Table Of Content

Chase has some of the best reward credit cards in the marketplace, but qualifying can be a little tricky. Most of Chase’s credit cards require good to excellent credit, but fortunately, there are a few ways to check if you are preapproved for a specific credit card.

Pre approval means that you don’t need to worry about hard pulls affecting your credit. Since pre approval only requires a soft credit pull, it has no impact on your credit score. A hard credit inquiry will only be initiated if you decide to proceed with the application.

Chase Pre Approval: Here Are Your Options

While pre approval is not a guarantee that you will be approved for the card, it does confirm your likely eligibility. There are a number of ways that you can get pre approved for Chase credit cards. This includes:

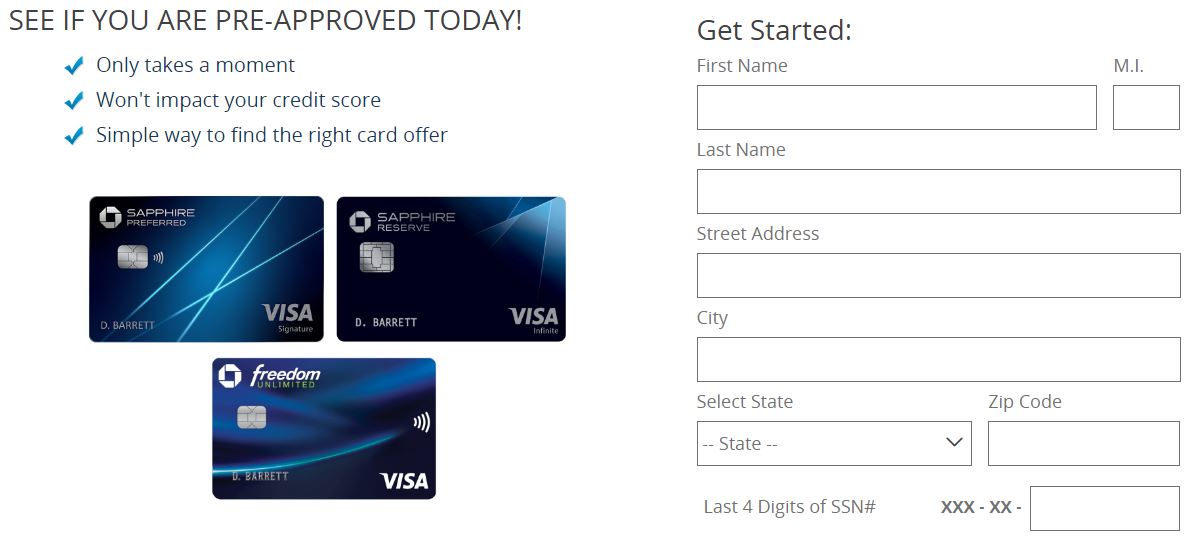

1. On the Chase Website

Chase credit card pre approval can be as simple as checking on the Chase website to see what cards you are eligible for.

To do this, you simply need to enter your basic personal details including your name, address and last four digits from your social security number. You can then click “Find My Offers” and the website will check to see if there are any cards that you are pre approved for.

Just be aware that Chase does remove the pre approval offers page periodically. This makes checking for offers a little more complicated, but if you are familiar with the main website, you should still be able to find your offers.

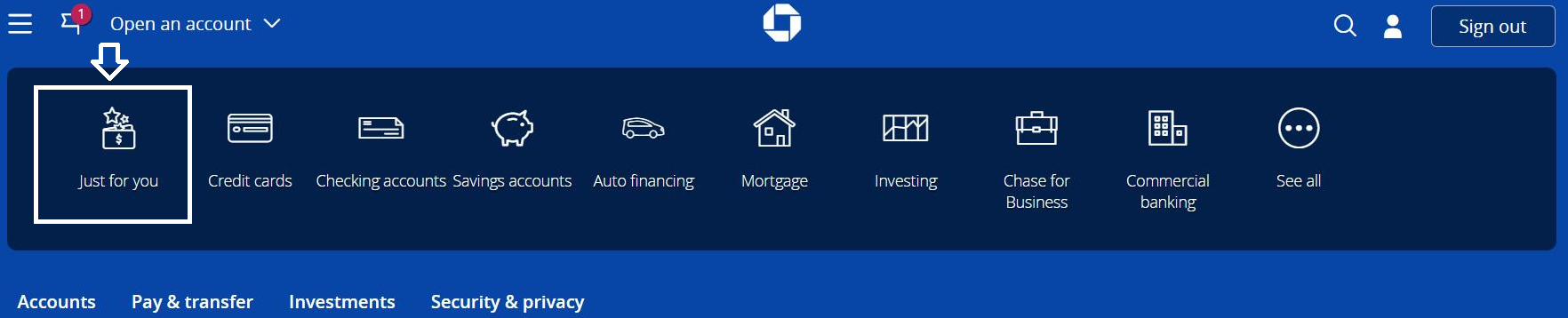

2. Via Your Chase Account

If you already have a Chase credit card, you can log into your account and check for pre approved card offers. There are a few steps to follow:

- Log In: You can log into your Chase account via the mobile app or the desktop platform.

- Find “Open an Account”: If you check the menu on your dashboard, you should be able to find the “Open an Account” tab.

- Click “Just for You”: This section is a curated selection of your current targeted Chase offers. This may include savings accounts and other products, so you’ll need to browse through for any pre approved credit card offers.

3. Through the Mail

In addition to providing offers in your Chase account dashboard, Chase also targets potential cardholders in the mail.

So, be on the lookout for any mailers that are promoting Chase cards and look for the pre approved wording.

Does Chase Pre Approval Affect Credit Scores?

No, since pre approval only requires a soft credit pull, it will not be logged on your credit report and will not affect your score. Soft credit pulls are simply inquiries used by financial institutions to assess your eligibility. You’ll only have a hard pull on your credit if you go ahead with an application.

This means you can check for pre-approval on several credit cards and then compare the best one for you without impacting your credit score.

In some cases, Chase may provide you with a pre-qualified offer in a mailer. In this scenario, Chase will have already assessed your approval status by checking your account history and a soft credit inquiry, so again, there will have been no effect on your credit score.

Chase 5/24 Rule

Typically, Chase requires good to excellent credit for its credit card approvals. However, there is also the 5/24 rule.

This is a major qualification consideration when assessing card applications. Essentially, this rule limits the number of new credit cards consumers can open over a period of time.

So, if you’ve opened five or more new credit cards from Chase or any issuer in the last 24 months, even if you have superb credit, you are unlikely to be approved for a new Chase credit card.

What Credit Score and Requirements Are Needed for Chase Cards?

While there are no guarantees for approval, there are some credit score and requirement guidelines for numerous Chase credit cards.

For all cards, Chase will need to verify that you have sufficient income to be able to pay the card and your income will be used to calculate your new card limit.

You also need a U.S address and social security number to receive approval. Bear in mind that your approval will also be influenced by the 5/24 rule.

The credit score requirements for various cards include:

- Chase Sapphire Preferred: The Chase Sapphire Preferred requires good to excellent credit or a score of over 690.

- Chase Sapphire Reserve: The Chase Sapphire Reserve requires excellent credit or a score of 720 or higher.

- Southwest Rapid Rewards Priority: You’ll need at least a score of 670 or good to excellent credit to qualify for the Rapid Rewards Priority.

Card | Credit Score | Rewards | Annual Fee |

| Chase Sapphire Preferred® Card | Good – Excellent | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| $95

|

|---|---|---|---|---|

| Chase Freedom Flex℠ Card | Good – Excellent | 1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

| $0 |

| Chase Freedom Unlimited® | Good – Excellent | 1.5% – 5%

5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases

| $0 |

| Chase Sapphire Reserve® | Excellent | 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | $550 |

| Amazon Prime Rewards Visa Signature

| Excellent | 1-5%

5% at Amazon.com, Amazon Fresh , Whole Foods Market and on Chase Travel purchases, 2% cash back on gas stations, restaurants and on local transit and commuting, 1% cash back on all other purchases

| $0 ($139 Amazon Prime subscription required) |

| Marriott Bonvoy Boundless® Credit Card | Good – Excellent | 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| $95 |

| United Explorer Card | Fair – Good | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| $95 ($0 first year) |

| United Club Infinite Credit Card | Good – Excellent |

Up to 4x miles

4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases

| $525 |

| Southwest Rapid Rewards Plus Credit Card | Good – Excellent |

1x – 2x

2X points on Southwest purchases, Southwesthotel and car rental partners, local transit and commuting (including ride-shares),internet, cable, phone and select streaming services, and 1X points on all other purchases

| $69 |

How to Improve Your Chase Cards Approval Chances

There are several things that you can do to increase your pre-qualification and approval chances for a Chase credit card.

- Check Your Latest Credit Score

Before you consider applying for any Chase credit card, it is a good idea to check your latest credit score. Generally, you’ll need to have good to excellent credit for most Chase cards.

If your score is below this range, you may still be able to qualify with good income, but it may be worth working on your credit before you apply.

- Watch Your Credit Utilization

Even if you have excellent credit, you can hurt your approval chances if your credit utilization ratio is too high. Ideally, your credit utilization should be less than 30%.

So, it may be worth paying down a couple of accounts before you apply.

- Consider Your Household Income

You can list your household income on your application for a Chase credit card.

This can be helpful if you are a spouse who only works part time or as a couple you have a side hustle that provides additional income.

- Remember the 5/24 Rule

While it is tempting to go for all attractive credit card offers, you need to remember Chase’s 5/24 rule. You don’t want to have too many credit cards in a short period of time.

If you have had five new cards over the last two years, you will need to wait a while before you should apply for a new Chase card.

How to Check Your Chase Pre Approval Status

You can check your application status by calling the Chase application status line. However, the easiest way to check your pre approval status on the Chase website.

You can log in and check for your offers or use the pre approval tool using your personal details to see if you are pre approved.

Why Did I Get Denied by Chase?

There are several reasons why your credit card application may have been denied. These include:

- You’ve opened too many new card accounts: If you’ve applied for too many new credit cards recently, your Chase application will be denied, regardless of your credit and income.

- You don’t have sufficient income: Chase will evaluate your income to determine that it is sufficient to support your new card. If Chase is wary that you don’t have a high enough income, it will deny your application.

- Your credit utilization is too high: This follows on from the previous point, but all credit card issuers are reluctant to approve new credit accounts if an applicant’s credit utilization is higher than 30%. There are some exceptions to this, but if your credit utilization is 30% or more, it could be the reason your application was denied.

FAQs

How long does Chase pre approval take?

In most cases, Chase will evaluate your application and provide a pre-approval decision within minutes. However, you may need to wait up to a day for your response, for there are cases you'll need to wait up to 2 weeks.

How long is Chase pre approval good for?

Each pre approval offer does have an expiry date, but generally you’ll need to proceed within 30 days.

What does pre approved mean for Chase credit card?

If you’re pre approved, it means that it is highly likely that your application for a Chase credit card will be successful.

What are the chances of getting denied after Chase pre approval?

Very low, but it can happen, particularly if your circumstances have changed or negative information has recently been reported on your credit.

What credit bureau does Chase use?

Chase uses Experian when they pull a credit report to check elgibility.

Which Chase credit card is the easiest to get?

The Chase Freedom Student card is the easiest Chase credit card to get, but this is only available to students. If you’re not a student, your best bet is likely to be the Chase Freedom Unlimited.

Does Chase offer welcome bonus?

Yes, Chase offers a sign-up bonus for most of its credit cards.