Rewards Plan

Welcome Bonus

Our Rating

Intro APR

Annual Fee

APR

- Welcome Bonus

- No Blackout Dates

- Annual Fee

- Low Merchandise Rewards

Rewards Plan

Welcome Bonus

Our Rating

PROS

- Welcome Bonus

- No Blackout Dates

CONS

- Annual Fee

- Low Merchandise Rewards

APR

21.24%–28.24% variable APR

Annual Fee

$95

0% Intro

N/A

Credit Requirements

Good – Excellent

- Our Verdict

- FAQ

The Chase Sapphire Preferred® Card is a travel rewards card issued by Chase Bank. This is a very popular travel rewards card because it offers a large sign-up bonus and the card is built around traveling. Many travel rewards cards have higher annual fees for the same kind of rewards.

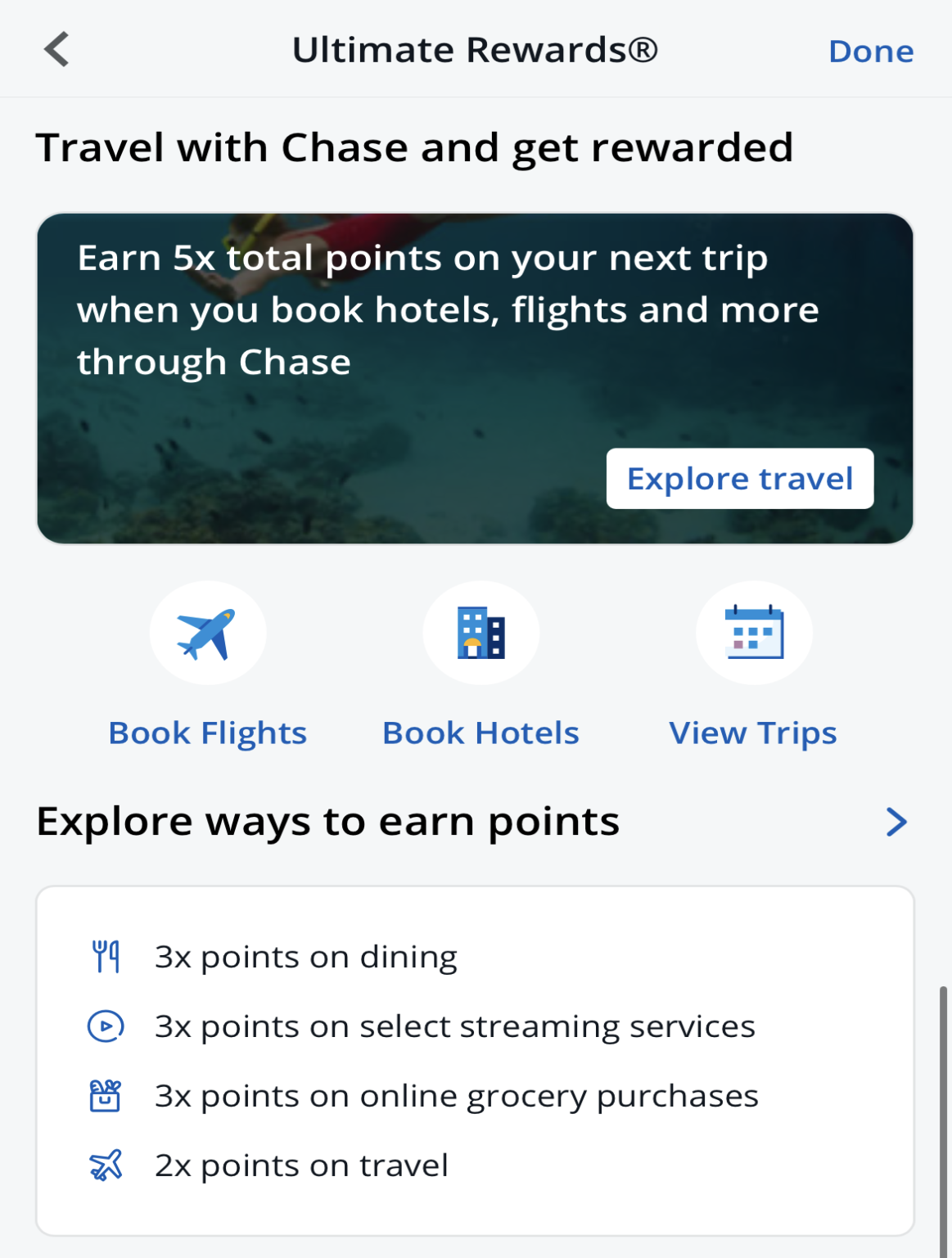

This card is on our top spot in regards to the best traveling and dining cards as they offer you more points compared to other cards. The card offers a welcome bonus of 60,000 points (upon spending requirements) and earn 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases. .

Additional perks include a 25% bonus when redeeming points for travel through Chase Ultimate Rewards®, a $50 annual credit for hotel stays booked through Chase Ultimate Rewards®, and a 10% bonus on points at each card anniversary for renewing cardholders.

The card boasts strong travel and shopping protections, such as trip cancellation/interruption insurance, auto rental collision damage waiver, purchase protection, and extended warranty protection. The inclusion of a complimentary DashPass subscription and a 6-month Instacart+ subscription with statement credits adds further value.

However, with all of these rewards, you should note that the card has an annual fee of $95 but the benefits outweigh the cost, and most people use the card, regardless of the fee.

Can I get pre-approved?

Yes, you are able to pre-qualify for this card. This means that you know if you can get this card without having to go through a hard credit check initially.

What is the initial credit limit?

The minimum credit limit that you can get with this card type is usually $5,000. The exact credit limit will depend on what answers you provide in your application.

How do I redeem cash back?

You can redeem your points in a variety of ways through the Chase credit card reward portal. Some of the perks you can get include cash, travel credit, statement credit, and gift cards.

Should You Move to Chase Sapphire Preferred card?

If you travel frequently and do not want to pay a large annual fee, then this could be a good option for you to choose.

Why did the Chase Sapphire Preferred card deny me? What to Do Next?

You might not have met one of its requirements. You will usually find out where you fell short. You might be able to rectify the issue or you might have to look elsewhere.

How hard is it to get a Chase Sapphire Preferred card?

If you meet all of the outlined requirements, then it is relatively straightforward for you to get a Chase Sapphire Preferred card if you wish.

How to Use Chase Sapphire Preferred card Benefits?

You can redeem your points in a variety of ways through the Chase credit card reward portal. Some of the perks you can get include cash, travel credit, statement credit, and gift cards. Maximizing rewards see you using it for all dining and travel-related purchases.

When it's a good idea to skip?

You want bigger travel-related perks or you do not really travel much at all. These are aspects that are not ideally covered by this card.

In This Review..

Pros and Cons

Let’s take a look at the pros and cons of the Chase Sapphire Preferred card and see if it’s the right one for your wallet or not.

Pros | Cons |

|---|---|

Generous Welcome Bonus | Annual Fee |

No Foreign Transaction Fee | No Global Entry or TSA PreCheck Fee Credit |

Additional Benefits | No Lounge Access |

25% More through Ultimate Chase Rewards | Not Suitable for Cash Back |

Transferable Points | |

Travel and Shopping Protections |

- Generous Welcome Bonus

The Chase Sapphire Preferred® Card offers a substantial welcome bonus of 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening[/sc].

- 25% More Through Ultimate Chase Rewards

Your points go further when you book through Ultimate Chase Rewards.

This includes flights, hotels, cruise, and car rentals. You can also combine rewards from other Chase credit cards to boost your points.

- No Foreign Transaction Fee

Chase Sapphire Preferred has no transaction fees while traveling in another country.

Many other cards have fees when you make purchases outside of the United States.

- Additional Annual Benefits

Cardholders enjoy a $50 annual credit for hotel stays booked through Chase Ultimate Rewards® and a 10% anniversary bonus on points earned in the previous year, providing ongoing value for renewing cardmembers.

- Travel and Shopping Protections

The card provides robust travel and shopping protections, including trip cancellation/interruption insurance, auto rental collision damage waiver, purchase protection, and extended warranty protection, offering added security for purchases and travel plans.

- Transferable Points

Cardholders can transfer points at a 1:1 rate to over a dozen travel partners, including major airlines and hotel chains like United and Hyatt, offering diverse redemption options.

- Annual Fee

There is an annual fee of $95 . If you don't plan to use the card regulary, make sure your spedning covers it.

- No Global Entry or TSA PreCheck Fee Credit

Unlike some premium travel cards, the Chase Sapphire Preferred® Card does not offer a credit for Global Entry or TSA PreCheck application fees, missing a valuable perk for frequent travelers.

- No Lounge Access

Unlike its premium counterpart, the Chase Sapphire Reserve®, this card does not provide access to airport lounges, which may be a consideration for those valuing luxury travel perks.

- Not Suitable for Cash Back

Individuals primarily interested in cash back rewards may find other cards more suitable, as the Chase Sapphire Preferred® Card's strength lies in its travel-focused rewards.

Top Offers

Top Offers From Our Partners

How Much Rewards You Can Earn? Calculation

The Sapphire Proffered card offers rewards on a variety of categories. However, in order to better understand the bottom line – it's always a good idea to calculate the expected rewards per category.

Don't forget to make the adjustments based on your own spending habits – and make sure it's, at least, covers the annual fee.

| |

|---|---|

Spend Per Category | Chase Sapphire Preferred® Card |

$15,000 – U.S Supermarkets | 45,000 points |

$5,000 – Restaurants | 15,000 points |

$2,000 – Airline | 10,000 points |

$2,000 – Hotels | 10,000 points |

$4,000 – Gas | 4,000 points |

Total Points | 84,000 points |

Estimated Redemption Value | 1 point = 1 – 1.5 cents |

Estimated Annual Value | $840 – $1,260 |

* Assuming all travel purchases are purchased through Chase Ultimate Rewards®.

Where to Redeem Your Rewards?

You should be aware that the redemption rates for these two cards differ.

While Chase offers a variety of redemption options, many of them are less lucrative than redeeming all of your credit for travel. For example, some redemption offers include receiving a statement credit or an automatic electronic deposit into your Chase checking account or any other eligible bank.

While this may appear to be a good option if you are short on cash or need to reduce your balance, it does not provide the same benefits as redeeming the same credit for travel.

You can transfer your Chase Ultimate Rewards points to one of Chase's airline or hotel partners. For example, if you find a $600 flight on Air France for 35,000 points, you can book the flight with the 35,000 points you have with Chase. This removes the need to accumulate points with multiple airlines in order to save money on flights.

Some of Chase's partner airlines include Air France/KLM, Iberia, Southwest, United, Emirates, Iberia, and Aer Lingus, as well as British Airways. Among the hotel options are Hyatt, Marriott Bonvoy, and Intercontinental Hotels Group.

Although having a gift card appears to be a good idea, you will not be able to earn enough money to travel or take a vacation.

Simply log into your credit card portal or card app and select the appropriate option to claim your rewards. There will be instructions to follow in order to finish the process.

Top Offers

Top Offers

Top Offers From Our Partners

How To Make The Most Of The Chase Preferred Card

Here are some pointers to help you make the most of your Chase Sapphire Preferred:

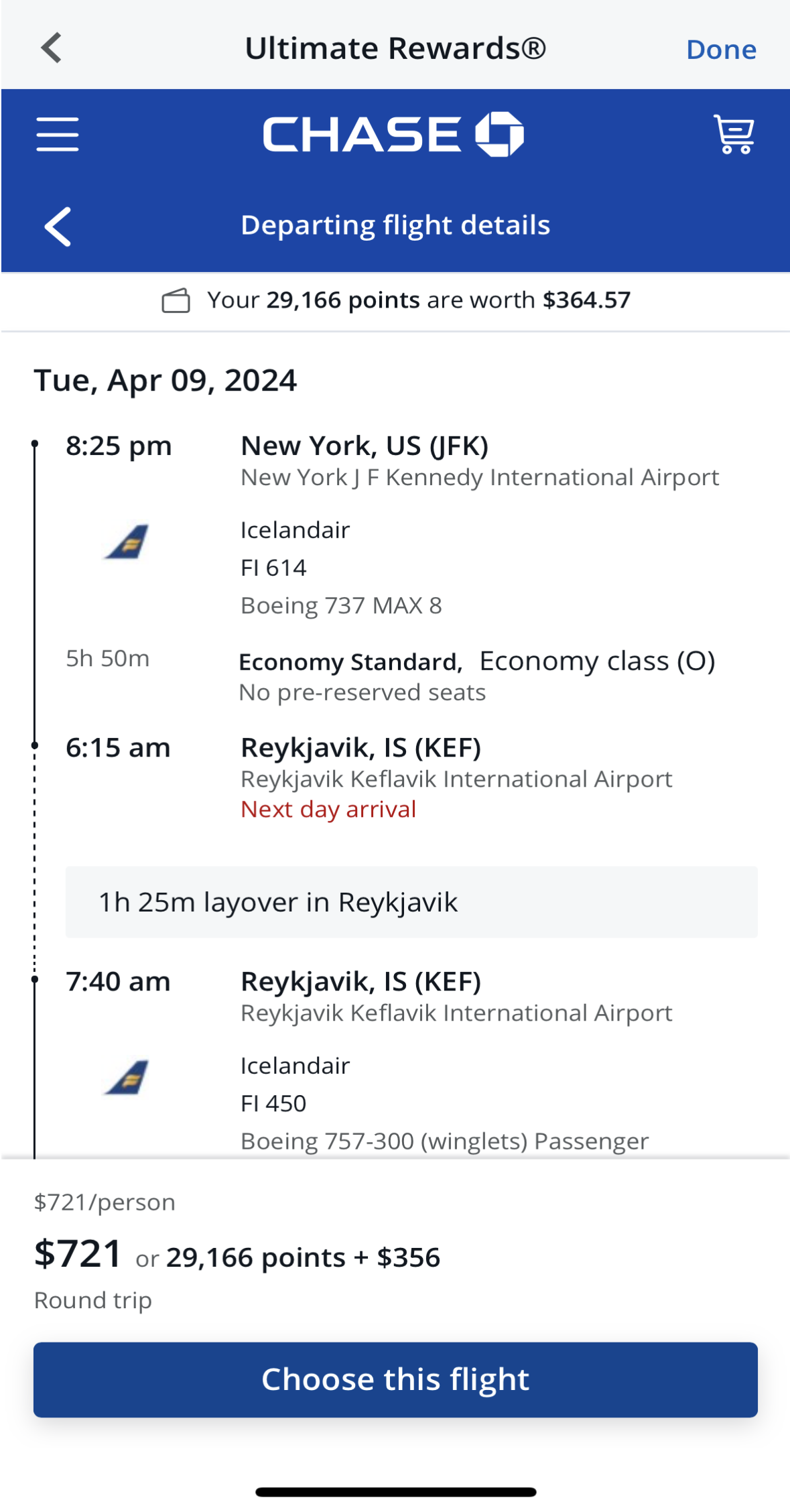

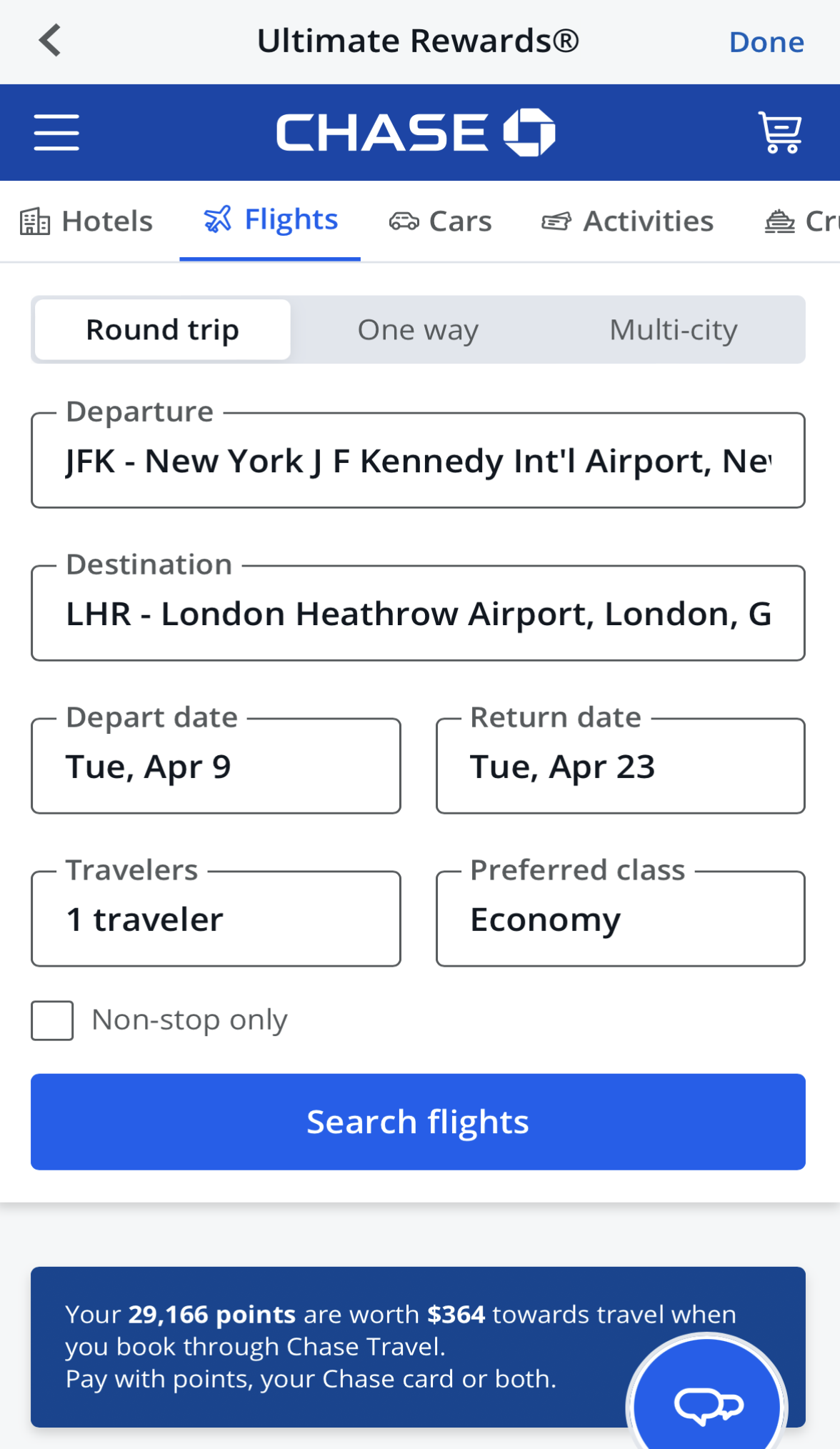

- Check out the Chase Ultimate Rewards platform: Don't assume that this platform is only for airfare; there are a variety of travel products available, and when you make purchases through Ultimate Rewards, you'll receive 5% instead of the usual 2%.

- Book Your Fares – When you use your card to book your travel, you will receive free insurance, which includes baggage delay and travel interruption/cancellation coverage.

- Buy New Items – When you use your card to buy new items, you'll get extended warranty protection and coverage against damage or theft.

- Add Family Members: You are able to add each member of your family as an extra user without incurring any extra cost. This can lead to you accumulating rewards at a much faster rate.

How To Apply For Chase Sapphire Preferred Card?

- 1.

Visit the Chase Sapphire Preferred Credit Card homepage and click “Apply as a guest.”

- 2.

A page appears to get you started, which includes your names, mailing address, date of birth, etc.

- 3.

Next, specify your statement and communication delivery preference. Now, take your time to read through the E-Sign Disclosure as well as the Pricing & terms.

- 4.

Lastly, agree to the certifications and click “Submit.”

How It Compared To Other Mid-Tier Travel Cards?

The Chase Sapphire Preferred® Card stands out among mid-tier travel cards with its compelling combination of rewards and benefits. When compared to other cards in this category, its versatility and generous welcome bonus make it a strong contender.

In the mid-tier segment, the Chase Sapphire Preferred® Card competes favorably with cards like the Capital One Venture Rewards Credit Card and the American Express Gold Card. While the Venture card offers straightforward rewards with a flat 2 miles per dollar on all purchases, the Sapphire Preferred excels in providing bonus categories, earning 5 points per dollar on travel through Chase Ultimate Rewards® and 3 points on dining, among others.

The American Express Gold Card, on the other hand, focuses on dining and groceries, offering 4 points per dollar at restaurants and U.S. supermarkets. The Amex Gold also offers better travel perks,such as TSA PreCheck rreimbursementHowever, the Chase Sapphire Preferred® Card's broader range of travel bonus categoriese caters to a more travel-focused set of spending patterns than everyday spending.

One notable competitor is the Citi Premier® Card, which emphasizes travel and dining rewards. While it offers 3 points per dollar on these categories, the Chase Sapphire Preferred® Card's 5 points per dollar on travel through Chase Ultimate Rewards® and the option to transfer points to various partners provide additional flexibility.

Other than that, there are many co-branded cards for a specific airline or hotel network. When it comes to airlne, the Delta SkyMiles Gold American Express Card, the United Explorer and the American Airlines Platinum Select card offers priority boarding, free checked bagd and other airline – focused rewards. The same with basic hotel cards scuh as the Marriot Bonvoy Boundless or the Hilton Honors American Express card.

Is the Chase Sapphire Preferred Card Right for You?

Chase Sapphire Preferred is one of the best travel rewards cards for those with good to excellent credit. If you spend much of your time traveling and eating out, this is an excellent card offering some of the best travel rewards in the market.

Chase Sapphire Preferred offers a very large sign-up bonus as well as many other benefits designed for travelers. However, If you are looking for introductory APR, cash back, no annual fee, or points for merchandise, you should consider a different card.

Chase Sapphire Preferred also has a large transfer fee so it should only be considered for purchases. It is primarily for consumers who want to maximize their travel rewards.

Compare The Alternatives

There are other credit cards that do offer comparable cash back rewards – we’ve summarized the most popular cards which can use as an alternative to the Chase Sapphire Preferred Card:

|

|

| |

|---|---|---|---|

Bank of America® Travel Rewards credit card | Capital One Venture Rewards Credit Card | Chase Sapphire Preferred® Card | |

Annual Fee | $0 | $95 | $95 |

Rewards |

1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases. |

Welcome bonus |

25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

|

75,000 miles

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 18.24% – 28.24% Variable APR will apply. | 19.99% – 29.99% (Variable) | 21.24%–28.24% variable APR |

FAQ

There is no sort of limit in place how much cash back or rewards that you can earn when you are using this card over time.

Yes, you can get car rental insurance with this card if you decline the collision cover of the rental company and pay for the entire cost of the rental car with this card.

Please review the specific details before, to make sure you're covered as needed.

There are no transparent income requirements, but it usually is expected that your annual income is at least $50,000 and you may be asked for proof of income.

Your points won’t expire once you keep the credit card account open. Therefore, you will not be under pressure to use up points before they end up expiring.

Compare Chase Sapphire Preferred

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

When it comes to travel benefits, there is a clear winner. But what about if you're looking for rewards on everyday spending?

Amex Blue Cash Preferred vs Chase Sapphire Preferred: Which Card Is Best?

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison:

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

The Chase Sapphire Preferred offers better travel perks and protections, but unlike the Autograph card – you'll need to pay an annual fee.

Wells Fargo Autograph Vs. Chase Sapphire Preferred: Which Card Is Best?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Comparison

The Marriott Boundless offers great perks for Marriot lovers, while the Preferred card wins when it comes to general travel-related rewards.

Marriott Bonvoy Boundless vs. Chase Sapphire Preferred: Comparison

The Capital One Savor is better for everyday spending, but the Chase Preferred card is the winner when it comes to travel and protections.

Chase Preferred card is the clear winner as it offers better travel rewards than the BofA Premium Rewards and variety of travel protections

Bank of America Premium Rewards vs. Chase Sapphire Preferred: Which Card Wins

While the Chase Sapphire Preferred is our winner due to its various perks, the Aeroplan card offers high cashback value and airline perks.

Chase Sapphire Preferred vs. Air Canada Aeroplan Card: How They Compare?

The Chase Sapphire Preferred is our winner due to its higher annual cashback value and various redemption options compared to Alaska card

Chase Sapphire Preferred vs. Alaska Airlines Visa Signature Card: How They Compare?

While we really like both cards, the Chase Sapphire Preferred is our winner due to its diverse redemption options and high rewards rate.

Chase Sapphire Preferred vs. JetBlue Plus Card: Side By Side Comparison

Top Offers