You have a choice to get a card with an annual fee or one with a free annual fee. You might be asking: why would you get one where you have to pay something when there’s a free one available? After all, an annual fee can range from $49 to $550 for a credit card.

The annual fee will basically provide the cardholder more valuable purchase rewards and benefits than their ‘free’ counterparts. A good rule to follow your annual fee decision is how often you plan to use the card. If you will be paying $49 for the card, you should earn at least $49 in rewards to break even and maybe profit from the rewards. If you plan on using the card sporadically, a no-fee card is better.

Many cash back cards do not charge an annual fee. This makes them a good option as a second card or a primary card for the budget-conscious. Besides the no annual fee benefit, all of the cards below offer rewards on everyday purchases.

Here are The Smart Investor Select’s picks for the top no-annual fee credit cards:

Card | Rewards | Bonus | Annual Fee | Best For |

| 1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

| 10,000 points

10,000 points after you spend $1,000 in purchases on your new card within the first 3 months

| $0 | Everyday Purchases |

|---|---|---|---|---|---|

| None | None | $0 | Balance Transfer | |

| 1X – 4X

4x points at restaurants, take-outs & deliveries, 2x points at supermarkets, gas stations & streaming servicesm and 1 point for 1 dollar on all other purchases

| 20,000 points

20,000 bonus points when you spend $1,000 in eligible purchases within the first 90 days of account opening

| $0 | Rewards | |

| 1-3%

3% cash back rewards on trips booked through SoFi Travel. After that, earn 2% unlimited cash back on purchases when redeemed toward investing, saving, or paying down an eligible loan with SoFi

| N/A

N/A

| $0 | Flat Rate Cashback | |

| 1.5% – 5%

5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases

| $200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| $0 | Cashback on Travel | |

| 1% – 8%

Earn unlimited 3% cash back on dining, entertainment, popular streaming services and grocery store purchases (excluding superstores like Walmart® and Target®), 1 percent on all other purchases. 10% percent cash back on purchases made through Uber and Uber Eats. 8% cash back on Capital One Entertainment purchases. 5% cash back on hotels and rental cars booked using Capital One Travel.

| $200

$200 cash bonus once you spend $500 on purchases within the first 3 months from account opening

| $0 | Dining | |

| 1-3%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

| $200

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

| $0 | Rotating Categories |

Blue Cash Everyday® Card from American Express

Rates & Fees, Terms Apply

Blue Cash Everyday® Card from American Express

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

Rates & Fees, Terms Apply

- Overview

- Features

- Pros & Cons

- FAQ

The Blue Cash Everyday® Card from American Express is a no-annual-fee credit card that excels in providing rewards for everyday spending. With a focus on U.S. supermarkets, gas stations, and online retailers, it offers a competitive 3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%.

The card provides a $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months. Additionally, it features a 0% introductory APR for 15 months on purchases and balance transfers from the date of account opening , followed by a variable APR of 19.24% – 29.99% Variable. This card pairs this introductory APR with the Pay It Plan It program, allowing users to manage their payments efficiently.

While it stands out for its unique U.S. online retail reward category, it may not be the most lucrative option for those who spend heavily outside these specified areas.

- APR: 19.24% – 29.99% Variable

- Annual fee: $0

- Balance Transfer Fee: 3% or $5, whichever is greater

- Foreign Transaction Fee: 2.7%

- Rewards Plan: 3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%. Terms Apply.

- Welcome Bonus: $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers from the date of account opening

- Competitive Rewards And Welcome Bonus

- No Annual Fee

- 0% Intro APR

- Foreign Transaction Fee

- Spending Caps

Are there any restrictions on redeeming cash back for direct deposits or checks?

Yes, unlike some other cards, the Blue Cash Everyday card doesn't allow for direct deposit or check redemptions.

What is the Pay It Plan It program?

The Pay It Plan It program allows cardholders to manage payments effectively, offering upfront payment options for qualifying purchases.

Does the Blue Cash Everyday Card have any exclusive perks?

Yes, cardholders enjoy exclusive access to American Express Experiences, providing special ticket presale access and event invitations.

Does the card offer any travel-related benefits?

Yes, cardholders have access to the Global Assist Hotline for emergency assistance when traveling more than 100 miles from home.

How can I redeem the cash back rewards?

Cash back rewards, earned as Reward Dollars, can be redeemed for statement credits with no minimum redemption amount.

PayPal Cashback Mastercard

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The PayPal Cashback Mastercard, issued by Synchrony Bank, stands out as a no-annual-fee cash-back credit card, offering simplicity and strong rewards for users who frequently utilize PayPal. With a competitive 3% cashback when you shop with PayPal, 2% cashback on all other purchases, the card eliminates the hassle of category restrictions and annual earnings caps.

The card requires applicants to have a PayPal account, which is free to open, and a good to excellent credit score for approval. While lacking a welcome bonus or introductory APR offers, its cash rewards never expire, and there's no minimum redemption threshold. The redemption process is seamless, allowing users to transfer cash rewards directly to their PayPal balance.

- Rewards Plan: 3% cashback when you shop with PayPal, 2% cashback on all other purchases

- APR: 20.24% – 32.24%

- Annual fee: $0

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: 3%

- Sign Up bonus: N/A

- 0% APR Introductory Rate period: N/A

- Cash Rewards Never Expire

- Simplicity and Flexibility

- Cash Rewards Integration with PayPal

- No Minimum Redemption Threshold

- Requirement of a PayPal Account

- Limited Perks

- High APR

Does the card have an introductory APR offer?

No, the card does not offer introductory APR rates for purchases or balance transfers.

How can I redeem cash rewards from the PayPal Cashback Mastercard?

Cash rewards can be redeemed by transferring them to a PayPal account, where they can be used for PayPal purchases or transferred to a linked bank account.

Can authorized users earn the same cash back rates?

No, authorized users can earn up to 2% cash back on all purchases, less than the primary cardholder.

What credit score is required to apply for the card?

The card typically requires a good to excellent credit score for approval.

Can I redeem cash rewards for statement credits or gift cards?

No, the redemption options are limited to transferring cash rewards to a PayPal account or linked bank account.

Are there category restrictions for earning cash back?

No, the card eliminates category restrictions, offering a flat 2% cash back on all other purchases.

U.S. Bank Altitude® Go Visa Signature®

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

The U.S. Bank Altitude® Go Visa Signature® Card is extremely beneficial to both new and existing customers.

Cardholders can earn 4x points at restaurants, take-outs & deliveries, 2x points at supermarkets, gas stations & streaming servicesm and 1 point for 1 dollar on all other purchases These points have no expiration date and can be redeemed whenever the account is open. When you reach 2,500 points, you can either redeem them as statement credits or request that they be deposited into your account.

On purchases and balance transfers, there is a 0% introductory APR for 12 billing cycles on purchases and balance transfers, followed by a variable APR ranging from 18.24% – 29.24% (Variable). Finally, there are no annual fees or charges for shopping from international merchants because both are set at zero dollars.

- APR: 18.24% – 29.24% (Variable)

- Annual fee: $0

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: $0

- Rewards Plan: 4x points at restaurants, take-outs & deliveries, 2x points at supermarkets, gas stations & streaming servicesm and 1 point for 1 dollar on all other purchases

- Sign Up bonus: 20,000 bonus points when you spend $1,000 in eligible purchases within the first 90 days of account opening

- 0% APR Introductory Rate period: 12 billing cycles on purchases and balance transfers

- High Rewards Rate & Sign Up Bonus

- No Annual Fee

- 0% Intro

- No Points Expiration

- High Credit Needed

How much is 10,000 points worth?

Points are available on the Altitude Go, and they are typically worth 1.5 cents each. This means that depending on your redemption method, 10,000 points could be worth $150.

Is it good credit card?

Given that the card has no annual fee, it provides some decent rewards. They are worth serious consideration if you are looking for an everyday card without having to worry about hefty annual fees.

Does the altitude card offer pre approval?

Pre-approval is available at US Bank, but only for offers received via email or mail. Furthermore, if you are an existing customer, you may receive a pre-approved offer via your online account. There is no online tool for interested potential customers to use to check the status of their pre-approval. When you complete the online application form, you are submitting a complete application, which will include a hard credit pull.

What are the card income requirements?

The Altitude Go card requires excellent credit, but one of the most important factors for U.S Bank is your credit rating rather than your income status.

Do the reward points expire?

You don’t need to worry about expiry dates. U.S Bank clearly states that the points for the Altitude Go card never expire.

Chase Freedom Unlimited®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Chase Freedom Unlimited® card provides an enthralling combination of lavish rewards, including a 5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases. It offers a nice sign-up bonus of Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening..

Another beenfit worth mentioning is the long 0% intro APR – 15 months on purchases and balance transfers (20.24%–28.99% variable after that). Overall, Chase Freedom Unlimited is one of the best options in the market, especially for those who are looking to save the annual fee.

- APR: 20.24%–28.99% variable

- Annual fee: $0

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: 3%

- Rewards Plan: 5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases

- Sign Up bonus: Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- Cash Back Rewards + Sign Up Bonus

- 0% APR on Balance Transfers & Purchases

- No Annual Fee

- Protection & Free Credit Score

- Balance Transfer Fee

- Foreign Transaction Fee

- Less Relevant For Frequent Travelers

- Is there a limit to cashback rewards? There is no cap.

- Can I get car rental insurance with a Chase Freedom Unlimited card? Yes, when you rent the car and pay for all of it with this card and do not accept coverage from the rental company.

- Should You Move to Chase Freedom Unlimited card? This is a good fit for people who are looking for no annual fee card including good cashback rates that do not change.

- Why did Chase Freedom Unlimited card deny me? You might not have met one of the requirements for this card. You can talk with a member of the customer support team to see what the issue is and how you might be able to rectify it.

- How hard is it to get a Chase Freedom Unlimited card? It is not very hard to get this type of card once you meet all of the straightforward requirements.

- How to maximize rewards on the Chase Freedom Unlimited card?

- You can choose between the options as to how you utilize the rewards. To maximize rewards, you should make the most of the signup bonus and also be aware of which of your credit cards have the best cashback for a particular type of purchase.

- Top reasons NOT to get the Chase Freedom Unlimited card? If you are looking for higher flat cashback rates. You may also travel a lot and not want to pay the 3% foreign exchange transaction charge that comes with this card.

- Does Chase ask for proof of income? There is no specific income requirements and it does not usually ask for proof of income requirements.

- Does the card offer pre-approval? Yes, you can get pre-approval.

- What is the initial credit limit? The initial credit limit varies, but can often be between $1,000 and $5,000.

- How do I redeem cashback? Go to the Ultimate Rewards section that Chase offers and you can choose between the options as to how you utilize the rewards.

- What purchases don't earn cashback with the Freedom Unlimited card? All purchases earn cashback with this card.

Upgrade Cash Rewards

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Cash Rewards card by Upgrade offers unlimited 1.5% cash back on every purchase, providing a straightforward and rewarding experience.

Additionally, users can earn a $200 bonus by opening a Rewards Checking Plus account and completing three debit card transactions. This card boasts a lack of annual fees, offering credit lines ranging from $500 to $25,000.

The Upgrade Card combines the flexibility of a cash back rewards credit card with the predictability of a personal loan. Users can make purchases anywhere Visa is accepted, with the convenience of various payment methods, including swipe, tap, insert, or online transactions.

- APR: 14.99% – 29.99%

- Annual fee: $0

- Balance Transfer Fee: Up to 5%

- Foreign Transaction Fee: Up to 3%

- Rewards Plan: 1.5% cash back on payments

- Sign Up bonus: Earn a $200 bonus after you open & fund a Rewards Checking Plus account & make 3 debit card transactions within 60 days. If you previously opened a checking account through Upgrade or do not do so as part of this process, you are not eligible. Payout made within 60 days of meeting the conditions.

- 0% APR Introductory Rate period: N/A

- Cash Back Rewards

- Balance Transfer Alternative

- No Deposit Required

- Inflexible Payments

- No Grace Period

- Balance Transfer and Foreign Transaction Fees

Can I check if I qualify before applying?

Upgrade has a pre-approval feature on its website. You can enter some basic info to see if you qualify for Upgrade cards. It won't affect your credit, and you'll get a decision in minutes.

When can I reach Upgrade customer service?

Upgrade's customer service is available by phone on weekdays from 6 am to 6 pm and on weekends from 6 am to 5 pm (Pacific Time). You can also email them, but responses may take some time.

Is Upgrade's digital experience good?

While Upgrade offers a good product, some users find its website interface less user-friendly. It needs improvement in the digital experience for customers.

How long does approval take?

With Upgrade's pre-approval option, you can get a response in minutes, speeding up the approval process. Once approved, you can expect to receive your card within ten business days.

How soon will my credit score improve?

The time it takes for your credit score to improve depends on your situation and financial habits. Upgrade provides free credit monitoring tools, helping you track improvements in your score.

Does the card report to all credit bureaus?

Yes, Upgrade reports your activity to the credit bureaus after you open your account.

Citi Custom Cash℠ Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

The Citi Custom Cash® Card stands out as a versatile cash back option, offering a unique rewards program that eliminates the need for tracking categories or activation periods.

With no annual fee, it provides 5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter. The card features a welcome offer of $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back).

The card's 0% APR for 15 months on purchases and balance transfers on purchases and balance transfers, whichadds to its appeal, though rates range from 19.24% – 29.24% (Variable)after the introductory period. While it lacks extensive additional perks, its World Elite Mastercard status offers some benefits.

However, it has limitations, such as a 5 percent bonus category spending cap, potential difficulty in tracking bonus categories, and a focus on a single category each billing cycle.

- APR: 19.24% – 29.24% (Variable)

- Annual fee: $0

- Balance Transfer Fee: $5 or 5% (the greater)

- Foreign Transaction Fee: 3%

- Rewards Plan: 5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

- Sign Up bonus: $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back)

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- High Cash Back Rate

- 0% Intro APR

- Sign-Up Bonus

- No Annual Fee

- Balance Transfer Fee

- Low Cap on Higher Cashback

- Foreign Transaction Fee

Can I get car rental insurance with Citi Custom Cash Card?

Yes, it offers rental insurance for cars if you pay for the full cost with this credit card and you decline the rental company’s insurance.

Is there a cash-back rewards limit?

Besides the cap on specific categories, there is no limit in place with this card on how many total rewards you can earn. Therefore, people who will be spending large sums on purchases can ideally take advantage of this offering.

What is the initial credit limit?

The initial credit limit will usually be $500 for this card. The exact limit that will be in place will depend on your financial situation (can be much higher).

Should You Move to Citi Custom Cash Card?

If you don't tend to spend more than $1,000 – $1,500 every month and you tend to spend them on specific categories, this card can be a perfect fit due to the high cashback on the your top category.

What purchases don't earn cash back?

All purchases earn cashback as a result of using this card. Therefore, you will be able to take a very flexible approach and know that you will always be able to earn reward no matter the type of purchase.

How to maximize rewards on Citi Custom Cash Card?

Make sure that you avail of the signup bonus and that you maximize the 5% cashback offering each cycle. This will allow you to get the best bang for your buck.

Capital One SavorOne Cash Reward

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One SavorOne Cash Rewards Credit Card is a noannual fee card that allows you to earn cash back rewards on everyday purchases. You can earn an unlimited Earn unlimited 3% cash back on dining, entertainment, popular streaming services and grocery store purchases (excluding superstores like Walmart® and Target®), 1 percent on all other purchases. 10% percent cash back on purchases made through Uber and Uber Eats. 8% cash back on Capital One Entertainment purchases. 5% cash back on hotels and rental cars booked using Capital One Travel..

In addition, you are eligible for 15 months on purchases and balance transfers to help you pay down an existing balance or pay off new purchases gradually (19.99% – 29.99% variable after that), as well as a $200 cash bonus if you spend $500 on purchases within the first three months of account opening.On the downside, this card requires good – excellent score and it charges a balance transfer fee of 3%.

- APR: 19.99% – 29.99% variable

- Annual fee: $0

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: [$0

- Rewards Plan: Earn unlimited 3% cash back on dining, entertainment, popular streaming services and grocery store purchases (excluding superstores like Walmart® and Target®), 1 percent on all other purchases. 10% percent cash back on purchases made through Uber and Uber Eats. 8% cash back on Capital One Entertainment purchases. 5% cash back on hotels and rental cars booked using Capital One Travel.

- Sign Up bonus: $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- Sign Up Bonus & Cash Back Rewards

- 0% Intro APR

- No Annual Fee

- Balance Transfer Fee

- Approval Can Be Strict

- No Travel Rewards

Can I get car rental insurance with SavorOne Card?

Yes, once you refuse the insurance offered by the rental company you will automatically get coverage if you fund the entire purchase through this card. Please review the terms and conditions before to make sure you're covered.

Does SavorOne Card ask for proof of income?

No out and out request for proof of income and no transparent income requirements.

Can I get pre-approved?

Yes, pre-approval is possible.

What is the initial credit limit?

The credit limit will be at least $500, and can be higher depends on your credit score.

How do I redeem cash back?

You can get them sent to you in the form of a check, as a statement credit, or get them given to you through gift cards.

Why did SavorOne Card deny me?

You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options

How to Use SavorOne card Benefits?

Use this card for the premium cashback types of purchases and maximize the signup offer.

What are top Reasons NOT to get the SavorOne Card?

If you can get better cashback rates elsewhere in equally as a cost-effective manner.

Bank of America® Customized Cash Rewards credit card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

If you are looking to have a bit more control over what categories in which you are going to be earning rewards, the Bank of America® Customized Cash Rewards could be for you. You are able to choose the category in which you get spending rewards.

You will be able to earn 3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%).

The signup offer allows you to get $200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening. Another great advantage of this card is that you do not have to pay an annual fee.

- APR: 18.24% – 28.24% Variable APR will apply. A 3% fee (min $0) applies to all balance transfers

- Annual fee: $0

- Balance Transfer Fee: 3% or $10

- Foreign Transaction Fee: 3%

- Rewards Plan: 3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

- Sign Up bonus: $200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

- 0% APR Introductory Rate period: 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account.

- Sign-Up Bonus

- 0% APR Intro

- No Annual Fee

- Bash Back Rewards

- Cap on Rewards

- Balance Transfer Fee

- Foreign Transaction Fee

- Is there a limit to cash back rewards? There is a quarterly limit on the 3% and 2% cashback each quarter, equalling a combined total of $2,500 worth of purchases.

- Can I get car rental insurance with Bank of America Cash Rewards Card? Yes, it offers rental insurance for cars if you pay for the full cost with this credit card and you decline the rental company’s insurance.

- Does Bank of America ask for proof of income? No out and out income requirements and normally you will not have to provide proof of income.

- Can I get pre-approved? Yes, you can get pre-approved.

- Should You Move to Bank of America Cash Rewards Credit Card? If you spend a lot on everyday purchases it can definitely be a good option.

- Why did Bank of America Cash Rewards Card deny me? Perhaps you did not meet all of the requirements. You can ask the customer service team what you need to do to get accepted or you can look at other card options.

- How to maximize rewards on Bank? Make the most of the signup offer and max out the caps on quarterly purchases at the premium rates.

- What are top reasons NOT to get the Bank of America Cash Rewards Card? If you spend a considerable amount on relevant purchases each month.

- What is the initial credit limit of? It will usually be at least $500

- What purchases don't earn cash back? All purchases are covered

No Annual Fee Cards - Basics

What Does No Annual Fee Mean?

No Annual Fee credit cards are exactly what they sound like, credit cards that don’t have an annual fee for cardholders. That means that you can have these cards without any additional charges.

Credit card providers usually use annual fees for their cards to help cover the cost of the card’s rewards system. Fortunately, a lot of no annual fee credit cards still have great rewards systems, so you don’t have to pay for a premium card to get good benefits from your card.

About 74% of all credit cards have no annual fees.

When choosing a credit card, one of the things you need to consider is the free structure. In this chart compiled with creditcards.com data, we can see that late payment fees are the most common type of fee. This is followed by cash advance fees. At the other end of the scale, we can now see that over limit fees and annual fees are far less common. This highlights the importance of making payments on time, which can not only save on fees but help you to establish a solid credit history.

No annual fee cards are still able to charge other kinds of fees, like late fees and overcharge fees. So it's not that these cards are fee-free, just that you don’t have to pay an annual charge for having them. It’s important to pay attention to the other charges included with your no annual fees credit cards because some companies raise the cost of other fees to make up for the lack of an annual fee.

How To Compare No Annual Fees Cards?

Knowing how to compare no annual fees credit cards is critical for making sure you’re getting the right card for your needs. Here are some of the more important features you need to consider.

- Intro APR: Introductory APR (Annual Percentage Rate) is often used by financial institutions to make their credit cards more appealing for new clients. A low introductory APR is a good thing since it makes owning the credit card cheaper for the first few months. However, you should remember that low introductory rates can sometimes disguise higher rates and fees after the first 6 months to a year.

- Ongoing APR: The ongoing APR of your credit card reflects the real cost of the card. Many no annual fees credit cards have a comparatively high APR after the introductory rate has passed. So, it’s important to compare the ongoing APR of different options to find a more affordable and valuable credit card offer.

- Rewards Quality: Some no annual fees credit cards don't offer much in the way of a good rewards program, but there are a few cards that have solid rewards. Usually, these cards are some of the best options, but they may have very specific kinds of rewards. Look for programs that offer high cash back, fast points accrual, or that provide a significant discount at certain stores or for specific kinds of purchases.

- Sign Up Bonus: Not every credit card will offer a sign-up bonus, so it’s not a requirement to find a credit card that has a good one. Sign-up bonuses are often used to disguise unfavorable APR and high fees and to get customers to sign up because of the immediate benefits. Sign-up bonuses are great when they don’t hide unfavorable terms and conditions, but an overly generous signing bonus should make you look carefully at the other details of the card.

- Fees: Almost all credit cards have some fees associated with them, but you don’t want to get stuck with a card that will nickel and dime you for using it. Look for cards with low fees, especially low-interest rates, low overcharge fees, and low late payment fees.

- Does the Card Accept Balance Transfers? Balance transfers can be an important part of money management, especially if you already have credit card debt. Relatively few credit cards accept balance transfers, especially if you’re looking for low fees at the same time. You might not always need this feature, but it’s important to know whether it’s an option before you sign up.

- Source of the Credit Card: Most people get a lot of credit card offers, but those cards usually aren’t the best offer you’re eligible for. Pay attention to the bank or financial institution making the offer. Likely a banker or financial advisor will be able to choose a better credit card than a cold credit offer from a letter or email.

Drawbacks of No Annual Fees Cards

Of course, there are some drawbacks to the no annual fees credit card model. Financial institutions exist to make a profit, so even though they also want to offer high-quality products that help their customers.

- High APR

The main drawback of no annual fees cards is that they tend to have higher interest rates than other kinds of credit cards. The interest rate is where the financial institution makes most of its profit.

Higher interest rates aren’t the only drawback of no annual fees credit cards though.

- Fees

No annual fees credit cards also usually come with higher fees, which is why it’s so important to know what fees your credit card can charge and how to avoid them. It’s also common for no annual fees cards to charge more fees than other kinds of credit cards. That means that it will be harder for you to avoid your credit card fees entirely.

Similarly, no annual fees credit cards tend to have smaller sign-up bonuses and less valuable introductory rewards. That means that there is less incentive to sign up for these cards and can mean that they are less attractive options for balance transfers.

- Lower Rewards

It’s also worth noting that most no annual fees credit cards have less generous reward systems than credit cards with annual fees.

When To Consider a No Annual Fees Card?

No Annual Fees credit cards are almost certainly the cheapest option for consumers, at least at first. They are a good option for people who are looking for an affordable credit card that doesn’t cost a lot to use.

- You need to build credit

No annual fees credit cards are also usually a good option for people who are looking to build their credit scores. This isn’t the same as trying to recover bad credit. Consumers with bad credit scores likely aren’t eligible for no annual fees credit cards with other good features and terms of use.

But first-time credit card users and people with moderate credit scores usually quality for reasonable no annual fees credit cards.

- Your spend doesn't cover the annual fee

It’s also important to think about how much you’re likely to use your credit card. Consumers who are going to use their credit card a lot, especially with high balances, may be better off with a card that has annual fees compared to a no annual fee credit card.

That’s because high-use consumers will generally make back the cost of the annual fee in higher rewards returns. However, if you need a credit card for small purchases, minimal use, or to carry as an emergency-only credit card, a no annual fees credit card is likely a good option.

- Your don't need travel rewards

No annual fee credit cards are usually best for people who aren’t likely to travel very often since cards with annual fees almost always offer better travel bonuses and mileage rewards.

Travel cards are designed for users who are jetsetters and spend a lot of time traveling from place to place. They tend to make traveling cheaper and have travel-related rewards and discounts to help minimize your costs.

Best Travel Cards with No Annual Fees

Wells Fargo Autograph Card

The Wells Fargo Autograph Card is a no-annual-fee credit card offering rewards on everyday purchases, particularly in categories like restaurants, gas stations, transit, travel, and more. The card earns 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases.

Pros include its wide range of bonus categories, Visa Signature® status offering additional features, and a solid welcome bonus. On the downside, it lacks travel transfer partners and substantial travel benefits compared to other cards.The card is suitable for those who spend heavily on everyday purchases but may fall short for travelers seeking premium perks.

While the card is praised for its diverse bonus categories, including commuter transit, streaming services, and phone plans, it may not be the best fit for frequent travelers seeking premium benefits.

Bank of America Travel Rewards

The Bank of America® Travel Rewards card offers a similar rewards system, 1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points. However, unlike the Discover it® Miles card, the points system can be redeemed for a wide range of rewards.

There are some non-travel related rewards, but the big advantage for travelers is that the rewards can be redeemed for most travel-related expenses, including restaurants, hotel rental, baggage fees, and other travel costs.

Redeeming your points for travel rewards also gives you a higher cash value for your points than any other kind of reward. If you’re looking for a card with good travel rewards, but want to be able to redeem for other rewards too in case you only travel occasionally, this is a great option.

Good Cashback Credit Card With No Annual Fees

Cashback cards put a percentage of your spent money right back into your pocket. Usually you have to wait for a certain amount of money to build up, but this cards can help you keep up with bills or give you a little extra cash to add to your savings.

U.S. Bank Cash+ Visa Signature Card

The U.S. Bank Cash+ Visa Signature Card offers good value with an introductory 0% APR for the first year you have the card (19.49% – 29.74% (Variable) after that). Its cashback reward structure offers three levels of rewards, 5% cash back on purchases in two categories of your choice (up to $2,000 in combined purchases per quarter, then 1 percent). 5% back on prepaid air, hotel, and car reservations through the Rewards Center. 2% cash back on one choice everyday category. 1% back on all other purchases.

The biggest downside of this system is that you may have to change your rewards every quarter, and the card has no control over how merchants categorize different purchases. However, flexible cashback redemption gives you the power to control how your cashback rewards are delivered. This card also gives you 0% fraud liability, so you’re protected against unauthorized charges made to your account.

Overall, this card is perfect for everyday use and is a good option if you like to buy groceries and other domestic goods in bulk since you get bonus rewards on those purchases. It’s also a reasonable option for people who are looking for a good balance transfer credit card, though you might not get quite as much cashback if you’re using it that way.

Bank of America® Unlimited Cash Rewards credit card

The Bank of America® Unlimited Cash Rewards credit card provides users with a straightforward unlimited 1.5% cash back on all purchases, redeemable for statement credits or direct deposits.

While it offers a $200 welcome bonus and has no annual fee, its appeal is enhanced for Bank of America Preferred Rewards program members who can earn higher cash back rates. The card also features a 0 percent intro APR.

The card is particularly suitable for individuals who prefer a simple cash back structure without dealing with bonus categories. Redemption options are flexible, allowing users to apply rewards to statement credits, Bank of America accounts, or Merrill investment accounts.

For existing Bank of America or Merrill account holders, especially those in the Preferred Rewards program, the card becomes more attractive, offering increased cash back rates based on membership tiers.

Points rewards can give you a lot of variety but generally accumulate a little more slowly than other reward types. They are great for travel, gift cards, and even sometimes cashback and discount options depending on the card.

Points Rewards Cards With No Annual Fees

Wells Fargo Active Cash℠ Card

The Wells Fargo Active Cash℠ Card provides some of the most competitive rewards among no annual fee credit cards, featuring 2% cash rewards on purchases (unlimited).

Alongside these rewards, the card extends a $200 cash rewards bonus when you spend $500 in purchases in the first 3 months. Moreover, it offers a 0% APR rate for 12 billing cycles on purchases and balance transfers, with an 20.24% to 29.99% variable APR dependent on your credit score.

Notably, earned points on this card do not have an expiration date and remain redeemable as long as your Wells Fargo account is active. The redemption options are diverse, encompassing both travel and cashback rewards, providing flexibility for cardholders.

Store Cards With No Annual Fees

Store cards are usually store specific, but they can offer fantastic discounts at your chosen store. These cards are great if you find yourself shopping with specific retailers more than others.

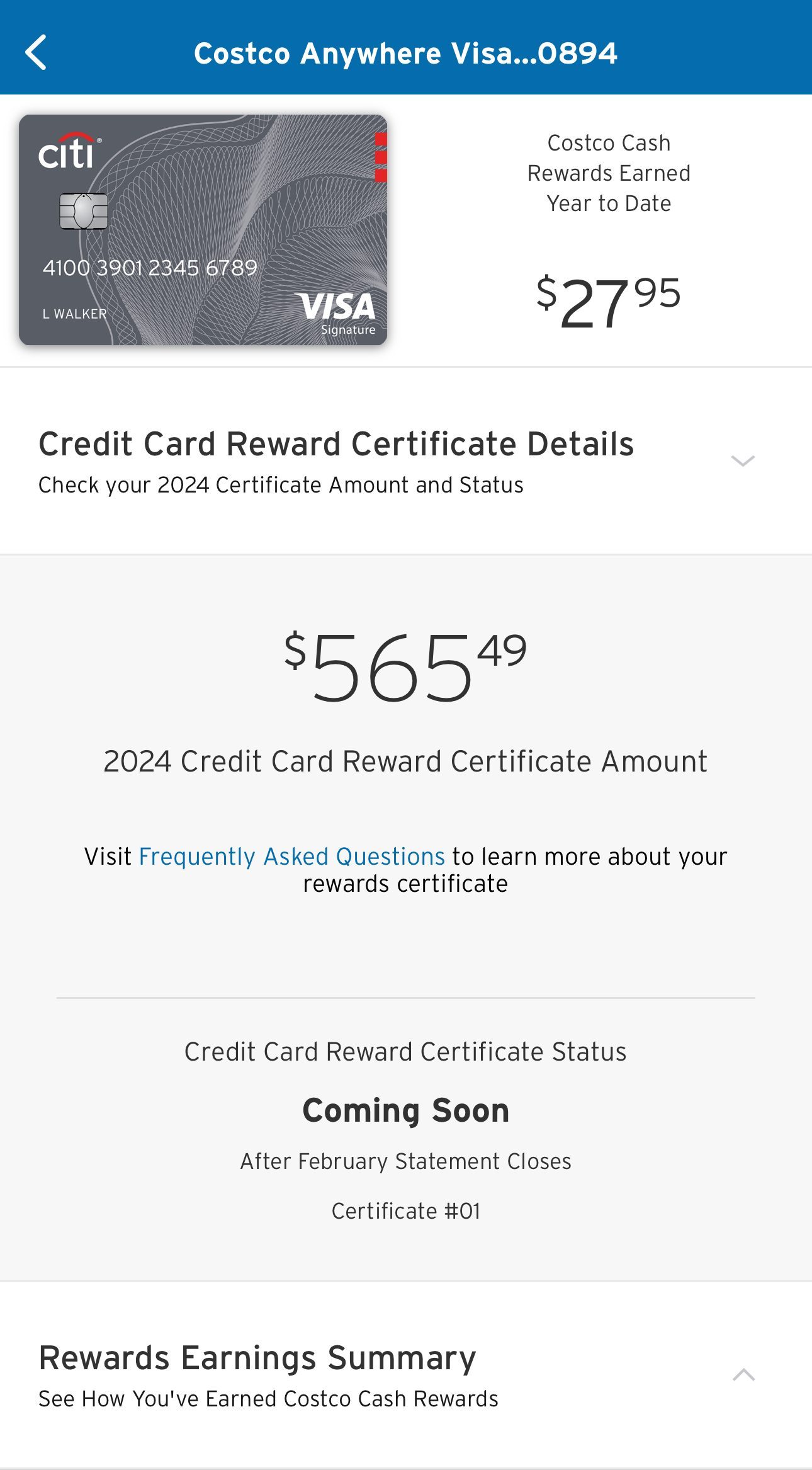

Costco Anywhere Visa Card by Citi

The Costco Anywhere Visa® Card by Citi is only available to Costco members, but it offers good rewards and is available to a wide range of credit scores. The card earns 4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases.

This card has a standard purchase APR of N/A, and a higher variable penalty APR rate, which penalizes customers for late payments. Costco members can pretty much universally benefit from this card since it makes all purchases a little more affordable, but you do need fairly good credit before you’ll be eligible for this card.

Capital One Walmart Rewards Card

The Capital One® Walmart Rewards® Card, although not as rewarding as some, is accessible to individuals with fair or good credit scores. Its cashback benefits encompass 5% cash back at Walmart.com (including pickup and delivery), 2% cash back in Walmart stores and gas stations, at restaurants and on travel plus 1% cash back everywhere else Mastercard is accepted.

While this card caters specifically to those who predominantly shop at Walmart, this specialization is advantageous. It proves to be an excellent choice for families, Walmart employees, and individuals who frequently purchase clothing, groceries, and essential items from Walmart.

Best Gas Credit Card With No Annual Fees For Good Credit

Gas cards help make fuel a lot more affordable, which is especially important for anyone who loves road trips or classic cars.

Citi Rewards+ Card

The Citi Rewards+® Card offers good rewards for gas purchases, cardholders can earn Earn 5X points on rental car, hotel and attraction purchases booked through cititravel.com (ends 12/31/2025), 2X points at supermarkets and gas stations (on up to $6,000 in purchases per year, then 1X points) with 1X points on all other purchases. All rewards points are also rounded up to the nearest 10 points with every purchase. That helps maximize your rewards value.

The card also helps to maximize your points with 10% points back on the first 100,000 points redeemed every year. Points can be redeemed directly with certain retailers as well, including Amazon and Best Buy. This card has a 0% introductory APR for 15 months on purchases and balance transfers, with a 18.74% – 28.74% (Variable)APR depending on your credit score after that.

This card is a good option for people with long commutes or who go on at least 1-2 long road trips every year. It’s also a good investment for people who don’t drive as often, but who use premium gas since the reward points will add up faster with more expensive kinds of gas.

Discover it Chrome Gas & Restaurants Card

The Discover it® Chrome Gas & Restaurants Card offers cash back as well as a lengthy introductory 0% APR – 15 months on purchases and balance transfers. It's an excellent choice if you have a large credit card balance and need time to pay it off without incurring interest while also earning rewards.

In addition, you can earn2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all your other purchases. Lastly, Discover matching all cash back earned at the end of your first year. There is no annual fee with this card. If your expenses are high, you may prefer a different card with a higher rewards rate.

Best Balance Transfer Cards With No Annual Fees

If you have fair-good credit and you're looking to payoff debt without paying an annual fee, there are some cards to conbsider:

Citi Simplicity

The City Simplicity® card is currently offering one of the better introductory APR rates available, 0% for 12 months on purchases and 21 months on balance transfers. After that, the card has a 19.24% – 29.99% (Variable) APR, depending on your credit score.

This card has a big advantage in that there are no late fees, no annual fee, and no penalty interest rates to users. That means there is a consistent cost to the card, making it a lot more predictable than most credit cards that have fees and variable interest rates.

Overall, The Simplicity allows for Balance transfers as well as cash advances with a minimal fee. However, it’s only available for consumers with good or better credit scores. It’s also a good choice for anyone looking for a low APR card to replace the higher interest rates on other cards.

Capital One Quicksilver Cash Rewards

The Capital One Quicksilver Cash Rewards Credit Card offers consistent Cash Back rewards of 5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.. That makes it a good option for moderate spenders who want to use their credit card for a wide variety of transactions instead of having to focus on a specific kind of transaction.

This card can be good for balance transfers since it has an introductory 0% APR for 15 months on balance transfers and purchases. After that is has an APR from 19.99% – 29.99% variable. The card also no foreign transaction fees, and your rewards won't expire the entire time you keep your account open.

Overall, it can be a good balance transfer card and also offers fairly good cashback to help you maximize your earnings.

- All information about The Amex EveryDay® Credit Card has been collected independently by The Smart Investor. The Amex EveryDay® Credit Card is no longer available through The Smart Investor.

How We Picked The Best No Annual Fee Cards: Methodology

To identify top credit cards offering no annual fee credit cards, our team researched hundreds of cards, issued by major banks, credit unions, and fintech companies. Independently, our experts meticulously analyzed data to generate ratings and ranking based on four categories tailored for no annual fee cards:

Card Rewards (40%): We assess the rewards structure, including cash back percentage on purchases, bonus categories, and redemption options. Cards with higher rewards rates, flexible redemption choices, and enticing sign-up bonuses score higher.

Card Features (30%): This category evaluates features such as 0% intro APR offers, absence of foreign transaction fees, and additional perks like travel insurance or purchase protection. Cards offering valuable benefits without annual fees and competitive introductory rates earn higher scores.

Cardholder Experience (20%): We examine application ease, customer service quality, and online account management tools. Cards with responsive customer support, user-friendly mobile apps, and streamlined application processes receive higher ratings.

Issuer Reputation (10%): Each issuer's reputation is scrutinized, considering customer feedback, financial stability, and regulatory standing. Issuers with positive customer reviews and a history of responsible practices receive higher ratings.