By their technical nature, savings accounts are akin to time deposits. Technically, the bank can require the depositor to notify the bank before withdrawing the funds or charge a penalty when the account holder withdraws the money before a specified date.

While banks do not usually exercise this right, some institutions restrict the number of transactions that a depositor can make in and out of a savings account per month. They also charge fees that depend on the average balance an account holder keeps in his account. Banks do not provide checks for a savings account as a general practice.

It is relatively easy to transfer funds to and from a savings account but a depositor must observe the federal limits on the number and types of withdrawals he can make per statement cycle.

While deposits are without limits (you can make as many as you wish), the law restricts some types of telephone and electronic withdrawals (exclusive of ATM withdrawals) and transfers to only six per statement cycle.

Here are The Smart Investor Select’s picks for savings account:

Bank/institution | APY Savings | Min Deposit | Monthly Fee |

|---|---|---|---|

Marcus | 4.40% | $0 | $0 |

Capital One | 4.35% | $0 | $0 |

Discover | 4.25% | $0 | $0 |

American Express Savings | 4.30% | $0 | $0 |

Ally Bank Online Savings | 4.25% | $0 | $0 |

Chime | 2.00% | $0 | $0 |

Varo Bank Savings | 3.00% – 5.00% | $0 | $0 |

Bank/institution | APY Savings | Min Deposit | Monthly Fee | |

|---|---|---|---|---|

| Marcus Savings Account | 4.40% | $0 | $0 |

| Capital One 360 Performance Savings | 4.35% | $0 | $0 |

| Discover Bank Online Savings Account | 4.25% | $0 | $0 |

| American Express High Yield Savings | 4.30% | $0 | $0 |

| Ally Bank Online Savings | 4.25% | $0 | $0 |

| CIT Bank Savings Connect | 4.45% | $100 | $0 |

| Citi Accelerate Savings | 4.45% | $0 | $4.50/$10 per month

Can be waived if you maintain an average combined monthly balance of $500/$1,500 in your eligible accounts, make one enhanced direct deposit or one qualifying bill payment per statement period

|

Marcus Online Savings Account

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

Marcus' savings account offers an impressive 4.40% APY with no minimum deposit or fees. You can also make same-day transfers to and from other banks of up to $100,000. This makes it an excellent option for storing funds while deciding whether or not to invest in a long-term strategy.

Marcus is a subsidiary of Goldman Sachs, which is reflected in its banking products. Marcus provides high-yielding savings and CDs, as well as investment options and a variety of loans. This does not, however, include a checking account.

So, obviously, the bank's goal is for newbie investors who want to start managing their money and taking their first steps into investing. The Marcus app is rated 4.9/5 on the Apple Store and 4 out of 5 on Google.

- Can I open a Marcus savings account online?

It is possible to open a savings account online. You’ll need to provide some basic personal and financial information. The Marcus team will then review your application and contact you with your approval details.

- Does Marcus work for Joint accounts?

It is possible to open up a Marcus savings account with two account holders. This means that both parties can enjoy co-ownership of the account and make decisions independently. So, if one account holder informs the bank of an action, Marcus will not check with the other party to confirm the action.

However, you need to open a new joint account, as it is not possible to convert a sole account into a joint account.

- Is Marcus worth for Millenials?

The general trend with millennials is to show interest in non traditional banks. Marcus has a specialized product line that could help customers to become familiar with investments and very competitive APY. The bank has a great app that can help you to manage your money on the go.

However, if you need an account to manage your day to day transactions, this is not the bank for you, as there is no checking account option.

- Is Marcus worth it if I have bad credit?

Marcus has a great savings account that is suitable for anyone, but if you want a lending product, you may need to work on your credit score. Marcus does not disclose the minimum credit score requirements, but it is likely that you will need a score of 660 or more to qualify for a loan.

- Do Marcus Offers Car Loans?

While it does not offer specific car loans, the bank does offer personal loans. These are fixed rate, no fee loans for $3,500 to $40,000, which you can use for any purpose. The specific rate will depend on your creditworthiness with a term of up to six years.

- Can you close Marcus bank account over the phone/online?

You can close your Marcus account by calling the bank’s helpline or by sending an email to the bank. The phone method is likely to be the easiest, as the Marcus team will guide you through the closure process.

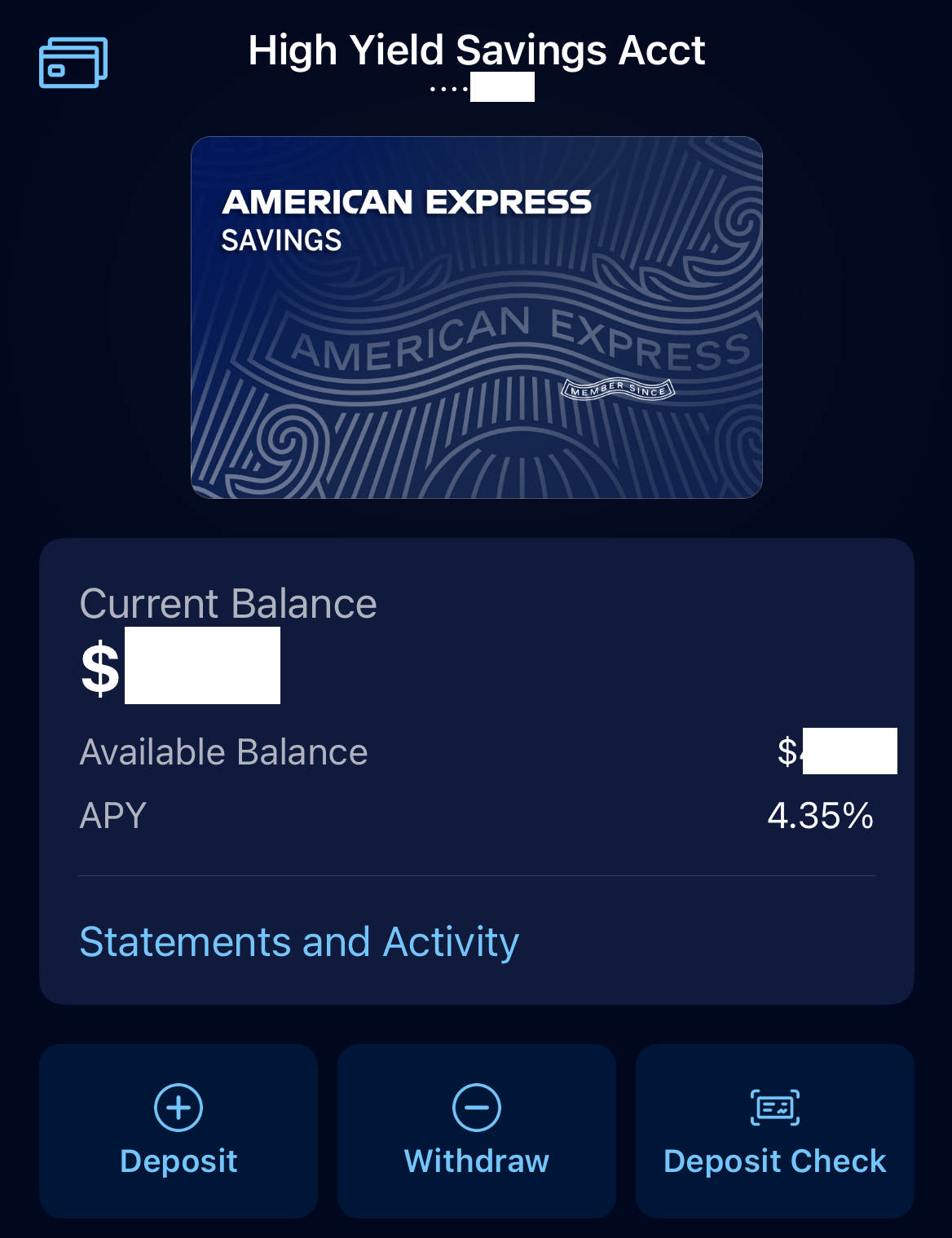

Capital One 360 Performance Savings

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

A Capital One 360 performance savings account can be opened with no minimum amount, no monthly fee, and a 4.35% APY. This is a top-rated mobile application that allows you to have access to your savings account 24/7 and track your progress and celebrating your savings. It has easy account transfers, which helps you access and move your money between any linked Capital One accounts.

Capital One began as a credit card company, but has developed its line of banking products to create a product line to rival a traditional bank. In addition to checking and saving accounts, you can access loan refinancing, auto finance, and kids’ accounts.

What Does Capital One Worth if I'm a Student?

While Capital One does not have an exclusive student checking account, the main 360 account is a great option for students as there are no account maintenance fees. However, where Capital One stands out is that it has several student credit card options.

The Savor Rewards for Students card offers up to 3% cash back on purchases, with 8% cash back if you purchase Vivid Seats tickets. The Quicksilver Rewards for Students offers an Unlimited 1.5% cash back on all purchases and unlimited 5% cash back on hotels and rental cars booked through Capital One Travel (terms apply) with no spending categories. There is also the Journey Rewards for Students, which offers earn 1% cash back and another 0.25% if you pay on time, so you can boost your cash back to a total of 1.25%.

- Can I open a Capital One checking account online?

Yes, in fact, the Capital One 360 checking account is an online account, which requires online access. Capital One states that you can open most of its accounts online and generally, the process takes less than five minutes. If you already have a Capital One account login, the process will be even quicker.

- Does Capital One offer a free checking account?

Yes, the Capital One 360 checking account is a fee free account. There are no account minimums or monthly maintenance fees. There is even a choice of overdraft options in case you inadvertently overspend, which includes Next Day Grace, so there are no fees if you can bring your account balance back up within one full business day.

- Is Capital One ready/can fall for recession?

Past recessions have been difficult for Capital One. During the 2001 recession, the stock price fell almost 70% and the bank had similar share issues in the 2007 recession.

However, Capital One does seem to be taking the prospect of another recession seriously.

The bank has a number of resources to help its customers, particularly small businesses get recession ready. After all, if its customers can remain financially strong during a recession, the bank should weather the storm well.

- Is my money safe on Capital One ?

While the share price may have fluctuated a great deal during turbulent financial times, Capital One has remained a safe bank for your funds. The bank is FDIC insured, so customers are protected for up to $250,000 in deposits.

Capital One did receive a $3.5 trillion federal bail out in 2008, but the bank has repaid these funds in full.

Discover Online Savings Account

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

For customers who want the familiarity of banking with a well-known financial institution and want to perform all their banking in one location, the Discover Online Savings Account is a suitable option.

It provides a very attractive APY of 4.25%. Both a minimum deposit and minimum balance are not necessary to start an account, and there is no monthly fee for the account. Also, from time to time Discover offers a promotion for new savings account.

In addition to having ATM access, users can receive cash back on their debit card transactions and have mobile access to their savings. Money transfers in and out of the account between your bank and Discover are quick and easy to complete.

What Discover products are inflation-proof?

Discover has a decent product lineup, but the products are not particularly inflation-proof. The only exception to this is the lending products. You can access personal and home loans with a fixed rate that can help you tackle increasing inflation and interest rates.

You can lock in your rate for the duration of your loan term, so you don’t need to worry about your monthly payments increasing along with all your other household expenses as higher inflation hits. Your monthly repayments will remain the same until the end of your loan.

How's Discover's physical coverage?

Discover is a purely online bank, so it does not have a physical branch network. You can manage your transactions online or using the Bank’s app. So, you will need to be comfortable with the concept of not having face-to-face support for managing your account.

What is required to open a Discover account?

Discover must comply with federal banking regulations, so you must verify your ID and address to open an account. When you complete your application, you will need to provide your full name, a valid postal address, and your Social Security number. You will also need a valid government ID, such as a passport, driver’s license, or state ID, to support your application.

Is Discover worth it if I'm a student?

Although Discover does not have a dedicated student checking account, the bank is exceptionally student-friendly. The bank has a fee-free checking account, so you won’t need to worry about a monthly maintenance fee or a minimum balance requirement.

However, where the bank excels is that it offers student loan options, and there are two student credit card options. The Student Cash Back card offers 5% cash back on activated rotating category purchases (up to $1,500 in purchases each quarter, then 1%) and 1% on all other purchases. While the Chrome for Students card offers 2% cashback at gas and restaurants (up to $1,000 every quarter) and 1% on groceries and other student related products. This makes Discover worthy of consideration if you’re a student.

Does Discover offer a free checking account?

Discover’s checking account is free of monthly maintenance fees, and there are no minimum balance requirements. There are no charges if you have insufficient funds or have a deposit item returned.

What’s more, you’ll earn 1% cash back on debit card purchases, making it a desirable option for those who want the best value checking account.

Can you get denied by Discover?

All banks assess account applications to determine applicant suitability. Discover is quite flexible with its criteria for its checking account, but there is still the possibility that a red flag on your application may trigger a decline notification.

In this case, you may need to discuss your application with a member of the support team to find out if there is anything you can do to have your application reassessed.

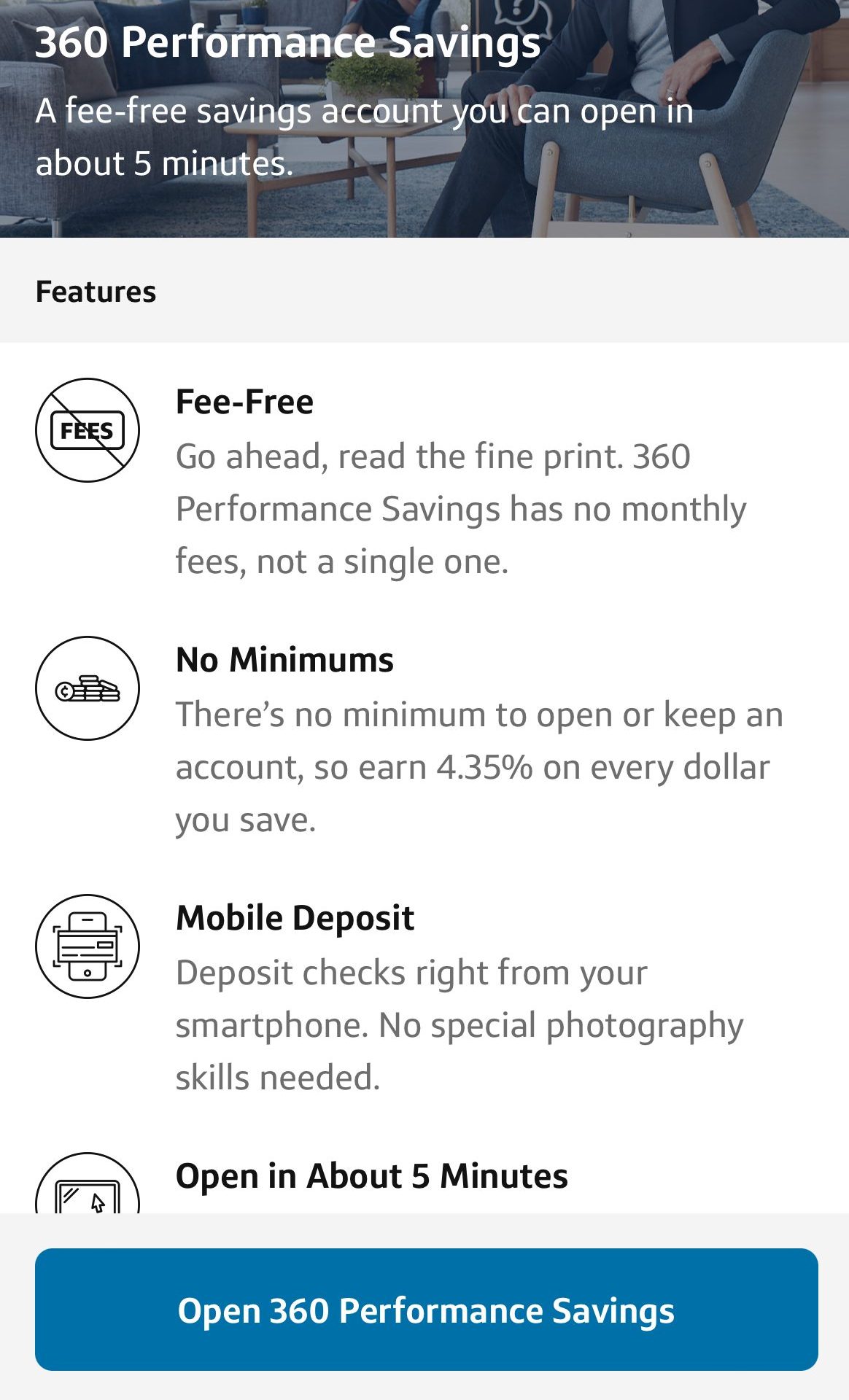

American Express Savings

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

American Express Personal Savings offers an online-only bank where you can store your savings at a competitive rate without any complicated features or maintenance fees. To use your savings account all you need to do is apply and once it is operational you can move your funds in and out through an electronic transfer.

You can link any major United States bank account to an American Express Personal Savings account using your account or routing numbers. There are no monthly service fees or minimum balance requirements to avoid a charge. Because there is no debit or ATM card, there are also no ATM or overdraft fees. The only fee you can accumulate is a five-dollar fee for a returned deposit.

The benefit of having a savings account through American Express is a simple way to open and maintain your savings account. It is easy to navigate and organize your savings plans that offer a high-end rate that is one of the highest available from both online and offline banks.

What are the requirements for opening a savings account?

To open an American Express account, no minimum balance is required. Simply go to the product page for the account you want to open and click the “Open Account” button.

You will be required to provide some personal information as well as financial information. After your application is approved, American Express will send you an email.

You can also apply by phone or downloading and mailing the application form.

Can you open a checking account with American Express?

Starting in 2022, American express bank is now offering also a checking account. You can get 1.00% APY on your account balance, as well as no monthly fees and advanced digital features.

How much time do I have to make the first deposit?

Your account will be closed if you do not fund your High Yield account within 60 days of receiving application approval.

To lock in your CD interest rate, you must fund your Certificate of Deposit account within 30 days of receiving application approval. Your CD account will be closed if you do not fund it within 60 days of receiving application approval.

Can I combine my savings account statement with my American Express Card statements?

American Express Savings statements are distinct from American Express Card account statements and will be delivered separately.

You can, however, link your American Express accounts to switch between your American Express Card and Savings accounts without having to log in and out each time. There will still be two sites with separate login credentials for your Card and Savings accounts, but once connected, you can easily navigate from one account to the other.

When I open a Savings account, do I receive an ATM card, a debit card, or checks?

Savings accounts are not intended for day-to-day spending. There are no ATM cards, debit cards, or checks available.

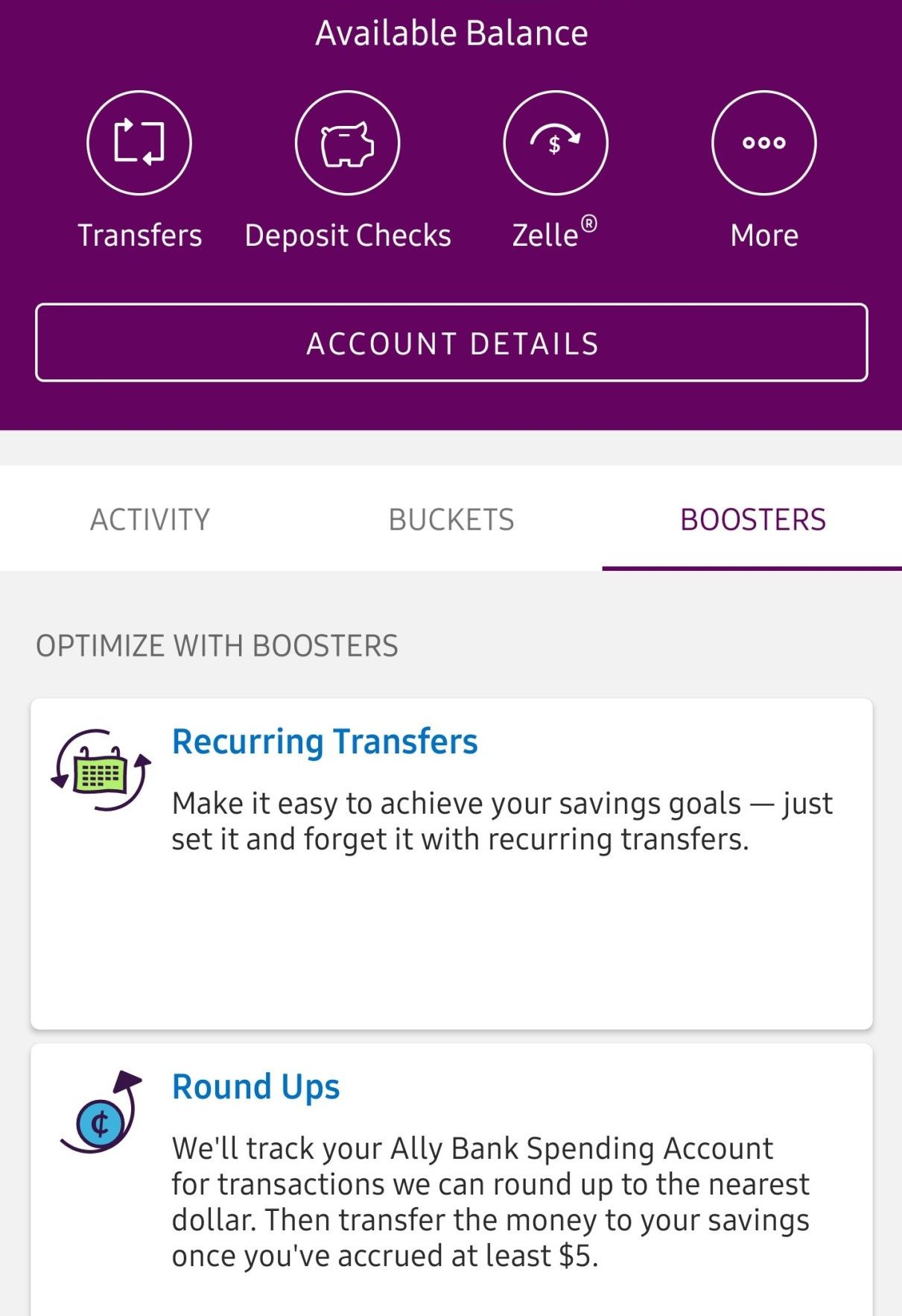

Ally Bank Online Savings

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

On its online savings account, Ally Bank offers an APY of 4.25%, which is more than ten times higher than the national average. Interest compounds daily. The account has no minimum balance requirement and no monthly maintenance cost.

There are no fees associated with online withdrawals or transfers up to six times a month for Ally account users. The account also stands out for its robust online and mobile management tools, as well as its integrated budgeting features that assist you in saving for your financial goals.

You can move money between your savings account and other Ally accounts or to outside bank accounts as well. You may also schedule transfers up to a year in advance. You can manage your savings account over the phone, online, or on a mobile device.

What is required to open an Ally account?

There is no minimum balance to open an Ally account. All you need to do is visit the product page for the account you would like to open and click on the “Open Account” button.

You’ll need to provide some personal details and financial information. Ally will send you an email after your application is approved.

Alternatively, you can apply by phone or download the application form and mail it in.

How Do Ally Savings Buckets Work?

Your Online Savings Account includes tools called buckets that allow you to categorize the savings in your account. Buckets are not independent accounts; even if you create up to 10 of them, the account will still receive interest on the entire balance.

What steps must I take to withdraw money from my online savings account?

Four methods of withdrawal are available:

- Transfer online

- Wire

- Telephone

- Check

Federal law permits a combined maximum of six of a particular sort of withdrawals and transfers from savings accounts every statement cycle. Each transaction that exceeds this cap is subject to a $10 excessive transaction fee.

How Do Ally Bank Roundups Work?

With Ally online savings account, one of the tools for saving is called a round up.

This booster automatically transfers funds from your Ally Bank Interest Checking account into your Online Savings Account once you have accumulated at least $5. It rounds up your purchases to the next dollar.

What types of CDs Ally Bank offers?

Ally Bank offers a variety of CD options to meet your needs:

- High Yield CD: terms range from 3 to 60 months.

- Raise Your Rate CD: 2- and 4-year terms available. Start with a great rate, plus have the opportunity to increase your rate once over the 2-year term or twice over the 4-year term if our rate for your term and balance tier goes up.

- No Penalty CD: 11-month term that allows you to withdraw all of your money any time after the first 6 days following the date you funded the account, and keep the interest earned with no penalties.

Chime

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- Banking Options

- FAQ

Chime offers a savings account feature that offers a high annual percentage yield of 2.00%. This is an optimal savings account program with its lack of monthly fees or minimum balance requirements. There is no cap on the amount of interest you can earn in your savings account as long as you have at least one penny in your account you are eligible to earn interest.

Another added benefit to opening a savings account is the lack of minimum deposit requirement for opening an account. To open a savings account you need to have at least one chime spending account to open a savings account. This promotes loyalty and using the added features within the Chime checking system.

Chime uses two optional programs to improve your ability to save money. The program is Save When You Spend. This program allows you to save small amounts when you make purchases. Whenever you make a Chime debit card purchase, Chime rounds the transaction up to the nearest dollar and transfers the difference to your savings account.

- Savings Accounts

- Checking Accounts

- Debit Card

- Credit Cards

- What Chime products are inflation proof?

Chime does not have a traditional product line of banking products as this bank specializes in products that help you to build your credit. For this reason, the Chime products are not particularly inflation proof.

The exception to this is that there are no hidden fees or charges, so even if your other expenses are increasing, you don’t need to worry about getting stung with banking fees.

- How's Chime physical coverage?

Chime is an online only bank, so it does not actually have any physical branches. This means that the coverage area of the bank is nationwide, but if you are looking for a bank where you can visit a local branch, this is not the bank for you.

- What is required to open a Chime account?

Since Chime is an online only account, the only way to open the account is on the Chime website. To start the process, you will need to complete a screen Captcha. The website will then walk you through the application process.

As with most banks, you will need to provide some basic personal information and financial details. This includes a valid home address, your Social Security number and confirmation that you are a U.S citizen or resident aged 18+. The entire application process should take approximately two minutes.

- Is Chime worth it if I'm a student?

One of the difficulties for students is a lack of credit history and this is where Chime excels. The entire Chime product line is designed to assist those who are looking to build or rebuild their credit.

Although Chime does not offer any loan products, you can enjoy a fee free checking account with up to a $200 fee free overdraft, a great savings rate and a secured credit card. This can be a great way to establish a credit history, which may make getting other finance products easier in the future.

- Is my money safe on Chime ?

Chime has FDIC insurance, so up to $250,000 deposit funds are federally protected. The bank also has two factor authentication and supports fingerprint authentication for your data protection.

The Chime debit cards are also protected with Visa Zero Liability. So, you don’t need to worry about unauthorized charges and can shop worry free with millions of merchants.

Citi Accelerate Savings

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

The Citi Accelerate Savings account is a popular choice for many people and is typically used as part of Citi's banking packages. These packages offer a comprehensive suite of banking, lending, and investing services, making it an all-in-one solution for those who need it.

Even if you don't want to use Citi for all your banking needs, the Accelerate Savings account still has great benefits, such as a competitive interest rate and relatively low fees. Therefore, it's definitely worth considering as an option to help you save and grow your money.

Can you direct deposit into a Citi savings account?

Yes, Citi allows its customers to set up direct deposits to their Accelerate Savings account. This is a great way to automate your savings.

Does Citi Accelerate offer promotions?

Citi offers $100 – $5,000 bonus if you open a savings account and deposit $10,000 – $1,000,000+. This specific promotion expired in $10,000 – $1,000,000+.

How much can I withdraw from Citi Accelerate Savings?

Citi does not place any limits on how much you can withdraw from your savings account. However, there is a daily limit on ATM withdrawals. The limit is $2,000 for people with the Citigold or Citi Priority account packages and $1,500 for everyone else.

Can I open a Citi Accelerate Savings joint account?

Yes, Citi allows customers to open joint savings accounts. It offers a fee waiver if one of the account holders is a minor or over 65.

How to close Citi Accelerate Savings account

To close any account at Citi, including an Accelerate Savings account, you’ll need to contact your account manager. As part of the process, you’ll need to fill out an account closure form and transfer all funds out of the account.

CIT Bank Savings Connect

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

The CIT Bank savings account offers a plethora of benefits and features that will make saving simple. CIT Bank has one of the highest interest rates in the country, offering customers 4.45%. You can also sit back and watch your money grow because there are no account opening or maintenance fees.

Even if you don't have enough money to earn the top interest rate right away, CIT Bank offers a variety of competitive interest rates to get you started. And, regardless of how much money you start with, they provide a great introductory interest rate for new customers.

CIT Bank's interest compounded daily to maximize your earning potential. You can easily deposit funds into your CIT Bank savings account using their mobile app, eliminating the need to visit the bank every time you want to deposit.

How's CIT Bank physical coverage?

CIT Bank is an online only bank, which means that it has no physical branches. This should not be confused with the CIT subsidiary CIT Bank NA, which has a regional branch network of 80 branches.

This means that if you want to use CIT Bank, you will need to be comfortable with performing all your account management online or using the phone helplines.

What is required to open a CIT Bank account?

As with all major banks, whether they are online or have a physical branch network, you will need to provide some personal details including a valid home address, your Social Security number, and contact information.

You will also need to verify your identity with a government ID, such as a passport, driver’s license, or state ID.

Can I open a CIT Bank checking account online?

As an online bank, opening an account online is your only option with CIT Bank. Fortunately, this is a very simple process that CIT has broken down into three simple steps.

When you click on the “Open Account” button on the product page, you will be directed to a form to provide your details. Next, you will need to fund your account for the appropriate minimum, and then CIT will send you a confirmation email to let you know the account is now active.

Savings Accounts Reviews

Vio Bank Savings Review

How Do Savings Accounts Work?

Before you start looking into starting a new savings account, you will want to be sure that you know exactly what they are for. Savings accounts are essentially a place for you to store your money and earn interest, safely.

A savings account is one of the many services offered by banks. They allow you to keep your funds safe and earn annual yields from interest. Some accounts can reach 1% in those yields.

Additionally, these accounts are federally insured up to $250,000. That means you will not lose your money if the banks fail.

Savings are a crucial part of financial stability. Whether you have an emergency fund or investment funds, savings can provide security against unforeseen events or situations. As you can see in this chart using FED Survey of Consumer Finances data, Americans are saving more.

Many people use them as ways to set aside money, as it takes more steps to spend it than it would with a checking account. For example, you could use it to prepare funds for emergencies, a vacation, a big planned expense, and more.

- Open an Account and Make a Deposit

When you open a savings account at a bank, your next step would be to deposit some money into it. All funds in the account earn interest, which is added into the account by the bank.

Most banks allow you to transfer money between your checking and savings accounts as you please, as long as they are opened with the same bank.

Top Offers From Our Partners

- Save and Withdraw Later

Once you have saved enough money, you can withdraw it. This factor makes them very convenient for saving money for trips, tuition costs, and more.

The bank will also pay you back interest, as a way of saying thank you for working with them.

- Gain Interest

As of April 2024, you can get 3-4% if you put your money in one of the top savings accounts. This is a much higher rate compared to previous years and it happens recent increase in Fed rates, as you can see in the chart below:

What to Consider When Choosing a Savings Account?

When choosing a savings account, there are several factors you should consider to ensure that it meets your financial needs and goals. Here are some key factors to consider:

- Interest Rate: Look for a savings account with a competitive interest rate. A higher interest rate means your money will grow faster over time.

- Fees: Be aware of any fees associated with the savings account, such as monthly maintenance fees or transaction fees. Choose an account with minimal fees to maximize your savings.

- Accessibility: Consider how easy it is to access your funds. Look for a savings account that offers online and mobile banking options, as well as ATMs for withdrawals.

- Deposit Insurance: Ensure that the bank is insured by a government-backed agency. In the United States, deposits in FDIC-insured banks are backed by the federal government up to certain limits.

- Incentives and Bonuses: Some banks offer promotional incentives or bonuses for opening a new savings account. Consider these offers, but be sure to understand the terms and conditions.

- Financial Stability of the Bank: Consider the financial stability and reputation of the bank. Choose a bank that has a solid track record and is well-established.

- Goal Alignment: Consider how well the savings account aligns with your financial goals. Some accounts may offer specific features, such as goal tracking or automatic transfers, to help you save for specific purposes.

By carefully considering these factors, you can choose a savings account that best fits your needs and helps you achieve your financial objectives.

How's Inflation Impact Savings Account?

However, it is worth noting that inflation might have a negative impact on your savings account. When your interest amount does not keep up with inflation, the value of the money saved will slowly go down.

The reason this happens is because the price of goods tends to increase over time. A dollar you saved 30 years ago would not be as valuable as a dollar you saved yesterday. To combat this, banks tend to offer higher interest rates during times of inflation.

Still, that can take many years to happen. As long as you make sure that the bank offers a decent amount of money back in interest, your funds will not depreciate.

Is My Money Safe in an Online Savings Account?

Overall, your money is safe in an online savings account.

Where something bad to happen to the banks, your savings account is federally insured up to $250,000. That means that you can claim back the money you had saved, up to that covered limit.

Pros and Cons of a Savings Account

There are plenty of reasons that you may want to have a savings account. They make it easier to put money towards your goals.

However, it is important to consider both the pros and cons.

Pros | Cons |

|---|---|

FDIC Insurance | Minimum Balance Requirements |

Grow Your Money | Low Interest Rate Compares to CDs |

Automate Your Saving | Withdrawal Limitations |

Easy To Access |

FDIC Insurance is up to $250,000 |

- FDIC Insurance

First of all, your money is very safe in an FDIC insured account- which all legitimate banks are a part of. They will protect your account up to $250,000, so you will not need to worry about your money there.

- Grow Your Money

Besides safety and account options, savings account gives you the option to grow your money. Considering the expected FED interest rates increase, savings account provides a good alternative to other investing options.

- Automate Your Saving

Thanks to technological advancements, saving for the future has never been more convenient. Numerous savings accounts allow you to establish automatic transfers, enabling you to move a percentage of your paycheck directly into your savings account.

By automating the transfer process, you can build up your savings account without the constant stress of having to remember to move funds manually. This effortless approach to accumulating savings can make the process much less overwhelming.

- Easy to access

Many savings accounts are easy to access today. Your bank likely will offer a mobile app where you can easily transfer some of your funds to your checking account. Additionally, there are likely ATMs in your area that will allow you to withdraw cash when needed.

- Low Interest Rate Compares to other Account Types

If you want to make the most of your savings, CDs offer better options when it comes to yield. Their rates are lower than certificates of deposits (CDs) and money market accounts.

Lastly, those small interest rates are allowed to be changed by the bank at any moment, unlike CDs where you can lock your money for 1 year period and there are CDs even for 5 years that offer more than 5% APY.

- Minimum balance requirements

Most savings accounts also enforce minimum balance requirements. If your accounts fall below their limit, the bank will be able to charge your fees. Of course, when trying to save money, you will want to avoid this.

- Withdrawal Limitations

Due to Regulation D, you can only make up to six withdrawals per month from your savings account. Going over this limit may result in fees or even a change in account type to a checking account, which typically has a lower interest rate.

While savings accounts are intended for saving money and not frequent spending, this should not pose a significant issue. However, urgent cash needs could arise, causing potential problems if you have already reached your withdrawal limit.

- FDIC Insurance is up to $250,000

Accounts with balances exceeding $250,000 are only protected up to that amount by federal insurance. Any funds beyond that threshold are not covered.

To mitigate this risk, you could spread your money across multiple accounts. However, this can complicate the management of your savings and add extra steps to the process.

Top Offers From Our Partners

Do I Have to Pay Taxes on My Savings Account?

Yes, you may need to. All interest gathered by a savings account is taxable, even if it ends up being just a couple of dollars. Your bank will be required to send you a Form 1099-INT if you earned more than $10 in interest during the year.

Even if you earned less than that amount, you are still required to report the interest to the IRS and pay the taxes due on it. Luckily, this would not be much in those cases.

Interest earned in a savings account is taxed at a marginal rate. For example, if your income tax bracket puts you at 35%, the interest from your account will be taxed at that same rate.

Why It's Recommended to Have a Savings Account?

Savings account is more than a place to grow your money. It's important to maintain funds in a savings account for a variety of reasons:

- Preparation for Events – You should use one whenever you have a money goal you are trying to reach.

For instance, if you are putting money aside for your vacation, it can be handy to have. Long term goals also work great with these accounts, such as saving for a house down payment.

- Avoid Spending Money – Savings accounts are also great if you want to avoid spending money. They can help you resist the temptation to spend, since there are more steps involved to get the money back out.

If you are trying to change your financial habits, this can be a great place to start.

- Protecting Your Money – Money placed into your savings account is kept safe. If you have more than you need, you will want to protect it.

There are no risks involved like there is with investments, as your funds are insured. Plus, when you carry cash, there is always the risk of losing it somehow.

- Be Prepared – Finally, you want to have a savings account for emergencies. No one knows when they will get sick or injured. Plus, if something were to happen to your car, you would need funds for repairs. Savings accounts are a great way to keep yourself prepared for sudden situations.

How to Choose The Right Savings Account for Your Needs

The best way to choose the best savings account for yourself is to think about your needs. You will want to do all of the following.

- Check what accounts the bank offers

- Check for low fees and high interest rates

- Determine if you want a physical or online only bank

- Consider accessibility

- Look for hidden fees

1. Shop Around

First you will need to find out what accounts the bank offers. This can be done with a simple phone call or accessing their online page. You want to be certain they have savings accounts. If you are searching for checking, CDs, or money market accounts too, you can also ask about them.

Your bank should offer all the accounts you need, so you can do most of your banking in one place.

2. Compare Fees, Rates & Conditions

Savings accounts should have a decent interest rate to keep up with inflation. Most online-only banks can offer higher interest rates, since they do not have to pay to keep a branch open.

Plus, you will want to start an account without spending a ton of money. Fees add up fast. You will want to ensure either there are no minimum requirement fees or the fees are low. Best of all would be opening an account without any fees.

3. Physical or Online Bank?

You can do all of your banking online these days, if you want. Many people prefer to have physical banks that they can visit, but you do not need to. Online banks usually offer higher interest rates in their savings accounts.

Although, physical banks make it easier to carry cash on you- your preference is completely up to you.

How Do You Open a Savings Account?

Opening a savings account is a relatively straightforward process. Here are the general steps to guide you through the process:

- Research and Compare: Before choosing a bank or credit union, research and compare the savings account options they offer. Consider factors such as interest rates, fees, minimum balance requirements, and account features.

- Gather Required Documents: Different financial institutions may have varying document requirements, but generally, you will need to provide:

- Proof of identity (such as a driver's license, passport, or government-issued ID).

- Social Security number or other tax identification number.

- Proof of address (utility bill, lease agreement, etc.).

- Choose a Bank or Credit Union: Once you've decided on the institution and the specific savings account you want, visit the bank's website or go to a local branch to get more information or start the application process.

- Visit the Bank or Apply Online: You can open a savings account either by visiting a physical branch or by applying online, depending on the bank's policies. Many banks also allow you to start the application process online and complete it in person if necessary.

- Fill out the Application: Whether online or in person, you'll need to fill out an application form. This form typically includes personal information, contact details, and details about your financial situation.

- Review Terms and Conditions: Take the time to review the terms and conditions of the savings account. Understand the interest rates, fees, withdrawal restrictions, and any other important details.

- Deposit Initial Funds: Depending on the bank and the type of savings account, you may need to make an initial deposit. This can often be done through various methods, including cash, check, or electronic transfer.

Remember that specific steps may vary by institution, so it's always a good idea to check with the bank or credit union directly or review their website for detailed instructions on opening a savings account with them.

The Different Types of Savings Accounts

Here are the main types of saving accounts:

- Traditional savings accounts – These are likely the accounts you are most familiar with. They are a great way to save money and are offered by every traditional bank and credit union. They offer a small amount of interest as well.

- High yield savings accounts – These accounts can usually be found in online banks, as they offer higher interest rates than physical branches. If you want to manage all of your money online, these accounts are a great option.

- Money market accounts – These accounts provide more interest on your savings, while still having some options for you to access your money. You can think of them as a combination of traditional checking and savings accounts.

- Certificate of deposit (CD) – CDs are for long term savings. You need to leave the money there for a specified amount of time. When the CD has matured, you will be able to withdraw your money or move it to another CD. Online banks offer better interest rates here as well.

- Cash management account – These accounts let you invest in a taxable brokerage account or set aside money in a retirement account. They earn interest at higher rates than what you can find in many banks.

Each account can serve a different purpose. You can open more than one if needed. However, you will need to be familiar with what each account can do.

Can I Make Payments From a Savings Account?

Saving accounts are the best place to store your extra money, but they are not generally the best for making payments. You will need to withdraw some cash or transfer money to an account linked with your debit card.

Banks will not give you debit cards for your savings accounts. Plus, many will only allow you to write a select number of checks from your savings for payment.

Online Bank or Credit Union Savings Account?

Both banks and credit unions provide a platform to keep and grow your money. However, there are some key differences between them:

-

Online Bank

An online bank can provide you with a lot of advanced banking methods. Since everything is done online it is often convenient, as long as you do not need cash often. The online bank will offer a mobile app, allowing you to check on your accounts anywhere.

Banks also tend to offer more ATMs than credit unions do, so you will be less likely to pay fees to use the machines. Online options also have the added benefit of not having to pay to run physical branches- allowing them to offer better, higher interest rates with their accounts.

-

Credit Union

Credit Unions will usually have lower fees, although they have less features offered online and in apps. They are nonprofit organizations as well, meaning you will have plenty of options, without hidden fees or other charges. Additionally, they are known for offering better customer service.

Finally, not all Credit Unions are insured. When you open your savings account, you will want to know that your money is safe there. Be sure to look into whether or not the union is FDIC insured.

When it comes down to it, the choice is up to you and your personal preference. Both offer great services and are perfect for starting a savings account.

How Much Money Should I Keep in My Savings Account?

When planning your savings, there are a few general rules that you will want to follow. Although, the amount saved will vary from person to person.

The best way to figure out how much to save would be to look at your essential monthly payments. Add together your groceries, transportation costs, debt repayments, insurance costs, rent or mortgage, and other essential expenses.

If there is an emergency you want to be sure you have between three and six months of savings backed up. That way, you will not find yourself in debt and will still be able to buy groceries and essentials.

So, if your monthly expenses are $2,000, you will need three months worth saved, which is $6,000. If you want to have six months saved, that would be $12,000. Of course, you do not need to throw all of that into your savings account at once. You can do so a little at a time.

Calculations You Should do Before Picking a Savings Account

Before you pick a savings account, think about how much you need to meet your goal. Are you building an emergency fund that is three months worth of money for essentials? Or are you saving for a down payment on a home?

You will want to calculate how much money you can set aside per week or per month. That way, you always can confidently set aside funds for your account.

The annual interest rate will add into how long it takes to reach that goal as well, so make sure you do some research into the banks first.

How Long It Will Take to Save?

Interest rates can assist you in getting to your goal a bit faster. If you are interested, use a special calculator to determine that amount of time. The sooner the goal is reached, the better for you.

Best Uses For a Savings Account

There are plenty of uses for a savings account. These are the best reasons to use one.

- Save for your goals

- Prepare for emergencies

- Cover large expenses

-

Saving For Your Goals

The most important use of a savings account is using it to reach your financial goals. If you are trying to save for a down payment on a house, you already know it is not cheap.

However, it is much easier to save in an account that is not your checking, which has funds constantly moving in and out of it.

Savings accounts are easier to put money into, without having to take it back out. It might help you avoid the temptation to spend your savings if you think of it like a piggy bank.

-

Prepare For Emergencies

Emergencies are sudden and not something that you can always plan for. If you do not have any savings, they can be very difficult to manage.

Savings accounts are great for setting aside extra funds, allowing you to build up an emergency stash. The more you can set aside, the better off you will be if something were to happen.

-

Cover Large Expenses

Savings accounts are great for covering other large expenses. For instance, you need to buy a new computer. You can save the funds in a short amount of time, meaning a savings account would be your best option.

No matter your reason for saving, these accounts make it much easier to do so. Only using a checking account or cash can be difficult, since you would be much more likely to spend your savings that way.

Common Savings Account Fees - How to Avoid Them?

When it comes to savings accounts, there are usually some fees associated with them. There are ways you can avoid them, however.

Overdraft or Non Sufficient Funds Fees are the most common ones. Many banks will charge you $35 per overdrawn item on your account. Some banks can charge less, but you will still want to avoid this fee, as it can become a slippery slope.

Your best bet will be to check your account often. If you notice an overdraft or realize that one is about to happen when an item goes through, you will want to take care of it right away. You can transfer money into your account from another account to keep your funds from dropping too low and charging you.

Overall, the best way to avoid these fees is to keep an eye on your account- even if it means checking it daily or more often.

How Many Savings Accounts Should I Have?

You can open as many savings accounts as you want- there are no limits and doing so does not hurt your credit score. However, that might not be wise, since you could not focus your money in one area.

If you choose savings accounts that do not charge fees or require minimum balances, they will not cost you much either. So, when is it a good idea to have multiple saving accounts?

If you want to reach a specific goal fast, you can open more than one. Many banks allow you to change the names of the accounts online too. You could have an account for vacation, then your normal savings.

Plus, they make automatic bill payments easier. For example, you could have an account just for your bills. If you keep the amount of the expense in that account and it comes out automatically, you would not need to worry about accidentally spending that needed money somewhere else.

Savings vs Checking Account

Here are the main differences between checking and savings account:

-

Checking

To summarize, a checking account lets you write checks from it. They are also linked with debit cards most of the time. These accounts are responsible for your daily transactions. Your checks from your job are deposited here as well.

Once you receive money into your checking account, you can deposit amounts into your savings account as you see fit.

-

Savings

You access your savings much less often. They are a safe place for you to store your money that you are not quite ready to spend just yet. You can store a lot of money here, since there is less coming out for expenses.

Plus, you can have as many savings accounts as you need. Many people have multiple for certain goals, emergency funds, or just as a place to grow their money. Checking does not offer interest either, while a savings account does.

What Else Should I Know About Savings Accounts?

For the most part, you want to be aware of their fees and interest rates. However, you should also know one more thing.

The interest rates are not great. But, if you have multiple accounts with the same bank, you may earn more interest.

This is because the bank will look at all of your accounts. If you have options open for your general savings, mortgage or rent payments, bills, and more- they will add all of those together to determine if you can earn higher interest rates.

As an example, suppose your bank currently has you at 0.03% interest. You can earn up to 0.06% if you qualify for their rewards. To do so, you need to reach a certain amount of money across your saving and checking accounts.

By reaching that amount, you will now receive a higher interest rate- making it even easier to continue saving.

So, do not hesitate to open multiple savings accounts with different purposes and goals behind them. The more you save, the more likely you are to get a better interest rate.

What Does My Bank do With My Money?

Banks use the money people deposit into them to make loans. They are essentially using the money to make more money, which is why they provide you with interest. It does not matter how you deposit the funds, they can all be used by the bank in this way.

Overall, banks are selling financial products to their customers. That is why they work with loans- so they can earn more through balancing other customers. However, that is why your account receives a fee when you take out too much or you withdraw more than six times a month.

Should You Open a Savings Account For Your Child?

This is a wonderful way to help teach your child about money and make them more financially responsible when they are adults. These accounts do not have checks or debit cards associated with them, so your child will not be able to take money from them without your permission.

Will you need to be present and have all of the needed documents ready to get started. We recommend calling the bank ahead of time to determine what you can do.

Picking The Best Savings Account: Methodology

The Smart Investor team looked at lots of banks and credit unions to find the best savings accounts. We focused on important things like how much interest you can earn, the smallest amount of money you need to start saving, and any fees.

Here's how we rated them:

Rates And Terms (35%): We checked the interest rates, the smallest amount of money you need to start saving, and any fees. Savings accounts with higher interest rates and lower fees got better scores.

Savings Account features (35%): We looked at all the different things the account offers, like ways to save money, transfer money, take out money, any special deals, and tools to help you save more. Savings accounts with lots of options got better scores.

Customer experience (20%): We checked how easy it is to open an account, talk to customer service, use the mobile app (our team tested this), and the bank's policies for helping customers. Banks and credit unions with easy-to-use apps and lots of ways to get help got better ratings.

Bank reputation (10%): We looked into how people feel about each bank, including ratings from JD Power, TrustPilot, and the Better Business Bureau. Banks with a good reputation got higher scores.