Citibank

Fees

Our Rating

Current Promotion

APY Savings

- Overview

- Pros & Cons

- FAQ

Citibank is a global financial service that serves over 100 million customers in 98 countries worldwide. Citibank is a decent option if you are looking for reliable financial assistance to safely and securely open a checking and savings account with no minimum deposit. From time to time you can get a nice sign-up bonus if you're a new customer.

This is a great way to organize your finances and access your funds due to the more than 60,000 ATMs that are available for you to use to access your money. You can also quickly obtain a Citi credit card, a great tool to increase your credit rating organically.

Along with many supportive tools to increase your financial gains, you should also be aware of some setbacks within the Citibank system. Citibank rates are quite low compared to other banks. Also, Citibank requires you to meet specific benchmarks to waive their monthly fees on checking accounts. This may be a disservice to users that are not in a financially stable position yet. You are also charged when you use another bank’s ATM.

Citibank can be a perfect fit if:

- You want a credit card that favors your preferred brands or spending habits.

- You live in a place with many Citibank branches

- You want a one-stop shop to manage your finance

- Variety of banking products

- Citi credit cards and Citi ThankYou Portal

- Promotions

- Low Interest Deposit Rates

- Fees

What are the requirements to open a Citi account?

Citi requires applicants to prove their identity before opening an account, as do the majority of banks. A genuine home address, name, and Social Security number must be provided. A legitimate government ID, such as a passport, driver's license, or state ID, is also required.

Naturally, if you already have an account with Citi, you can open a new one without having to go through the ID verification procedure once more.

Can I open a Citi checking account online?

It's true that opening a Citi checking account online is among the simplest processes. Citi has developed a six-step application procedure that, from start to finish, should barely take a few minutes.

You will have to set up your online access, submit your personal information, validate your ID, and confirm your employment information. Following that, you will be shown your finance and documentation options.

Is there a free checking account offered by Citi?

Despite the fact that Citi offers a variety of checking account choices, each one includes a monthly maintenance charge. If you meet the requirements for the fee waiver, though, you might be able to avoid paying it.

For instance, the $10 charge for the Access Account package is removed if you keep your balance at $1,500 or make one eligible deposit or bill payment per statement period.

Can Citi fail during a recession?

Despite having a long history, Citi has a history of experiencing difficulties during lean economic times. After the financial crisis of 2007–2008, the federal government provided Citi with a sizable $517 billion bailout loan.

The government didn't sell the final bailout bonds from this fund until 2013. Naturally, Citi is FDIC insured, so even if the bank experiences financial difficulties, customer deposits up to $250,000 are safeguarded.

Can I Open a Joint Checking Account with Citi?

Citi does permit shared account ownership. You and your friend can open a joint account or you can add a second person to your current Citibank account.

Although Citi must verify the identity of both parties, if you are already a customer, you simply need to go through the process for the other party. This can be done in person or online at a nearby branch.

Citibank Review

Banking Services | Credit Options | ||

|---|---|---|---|

Savings Accounts | Mortgage | ||

Checking Accounts | Government Mortgage | ||

CDs | Credit Cards | ||

Money Market Account | Debit Card | ||

Investing Capabilities | Personal Loans |

Citibank Savings Account

APY Savings

Minimum Deposit

Promotion

Fees

Citibank Savings Account

APY Savings

Minimum Deposit

Promotion

Fees

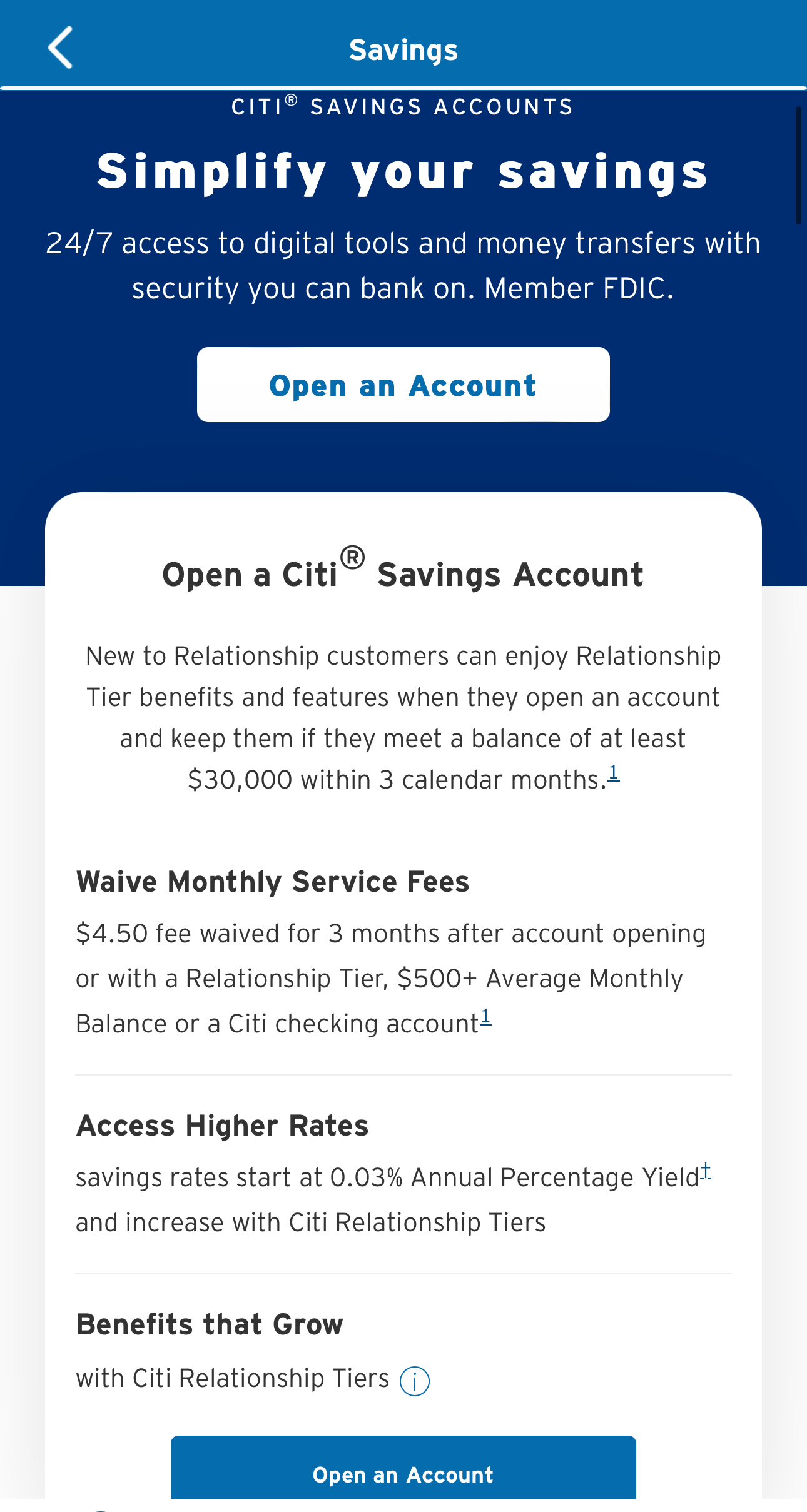

Citibank offers a savings account that is part of their banking package. Their savings account is the Citi Accelerate Savings account. It offers quite a high APY of 4.30% and one of the highest traditional bank savings rates.

There is no minimum deposit requirement to open a savings account, but you must maintain an average monthly balance of $500 to waive their $4.50 monthly service fee. This is not a high fee, but online banks and credit unions usually waive it.

Another feature of this savings account system is you can deposit your checks using their Citi mobile deposit service. This is quick and easy to use, which is an excellent addition for any technologically savvy user.

Lastly, you can earn Citi ThankYou points – when your savings account is linked to your eligible checking account. Enrolling in this program helps increase your credit and build a great foundation with this banking system.

Top Offers From Our Partners

![]()

Citibank Checking Account

Fees

Minimum Deposit

Promotion

APY Checking

Citibank Checking Account

Fees

Minimum Deposit

Promotion

APY Checking

Citibank checking accounts are reliable and offer many options you can use safely to deposit and access your money.

-

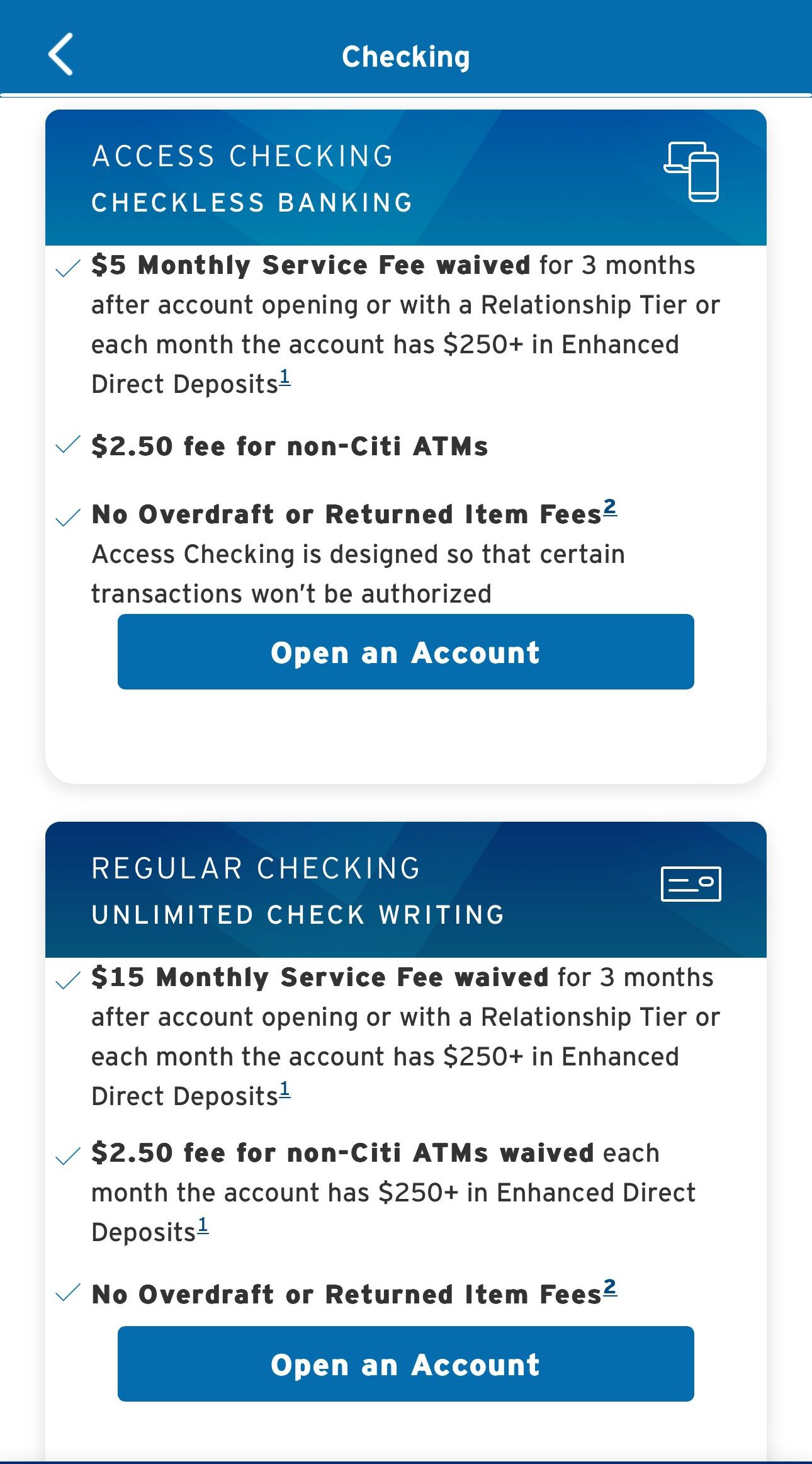

Citi Access Account

The Citi Access account represents Citibank's fundamental checking account choice, making it an ideal selection for individuals seeking streamlined banking. There is $5 monthly fee that can be waived with a Relationship Tier or each month the account has $250+ in Enhanced Direct Deposits.

-

Citi Regular Account

When contrasting the Citi Regular vs Citi Access accounts, the primary distinctions lie in the monthly charges and check writing availability. If you value the ability to write checks, opting for the Regular Banking account is necessary, as Citi Access does not include paper check services.

Furthermore, There is $15 monthly fee that can be waived with a Relationship Tier, or each month the account has $250+ in Enhanced Direct Deposits.

-

Citi Priority Account

For a combined average monthly balance of $30,000 to $199,999.99, the Citi Priority account offers preferred banking advantages with no monthly service fees. Additional benefits include waived fees for money orders and stop payments, along with complimentary financial check-ups from Citi Personal Wealth Management.

Higher limits for Zelle transfers, debit card purchases, and daily ATM withdrawals are also provided. However, many customers are not sure whether Citi Priority or Citigold is better, so we've summarized the main differences

-

CitiGold® Account

With a combined average monthly balance of $200,000 to $999,999.99, the CitiGold® account provides premium banking benefits, including waived transfer fees. Alongside Citi Priority benefits, customers enjoy unlimited reimbursement of Non-Citibank ATM fees worldwide.

A dedicated team and investment guidance from Citi Personal Wealth Management are included, along with potential annual cash back subscription rebates of up to $200.

-

CitiGold® Private Client

For a combined average monthly balance of $1,000,000 or more, the CitiGold® Private Client account offers premier banking advantages such as fee-free services and elevated money movement limits.

In addition to Citigold benefits, customers receive higher limits for Mobile Check Deposits, ATM cash withdrawals, and more. Advanced wealth planning and increased cash back subscription rebates of up to $400 annually are also part of the package.

Citibank CDs

APY Range

Minimum Deposit

Terms

Fees

Citibank CDs

APY Range

Minimum Deposit

Terms

Fees

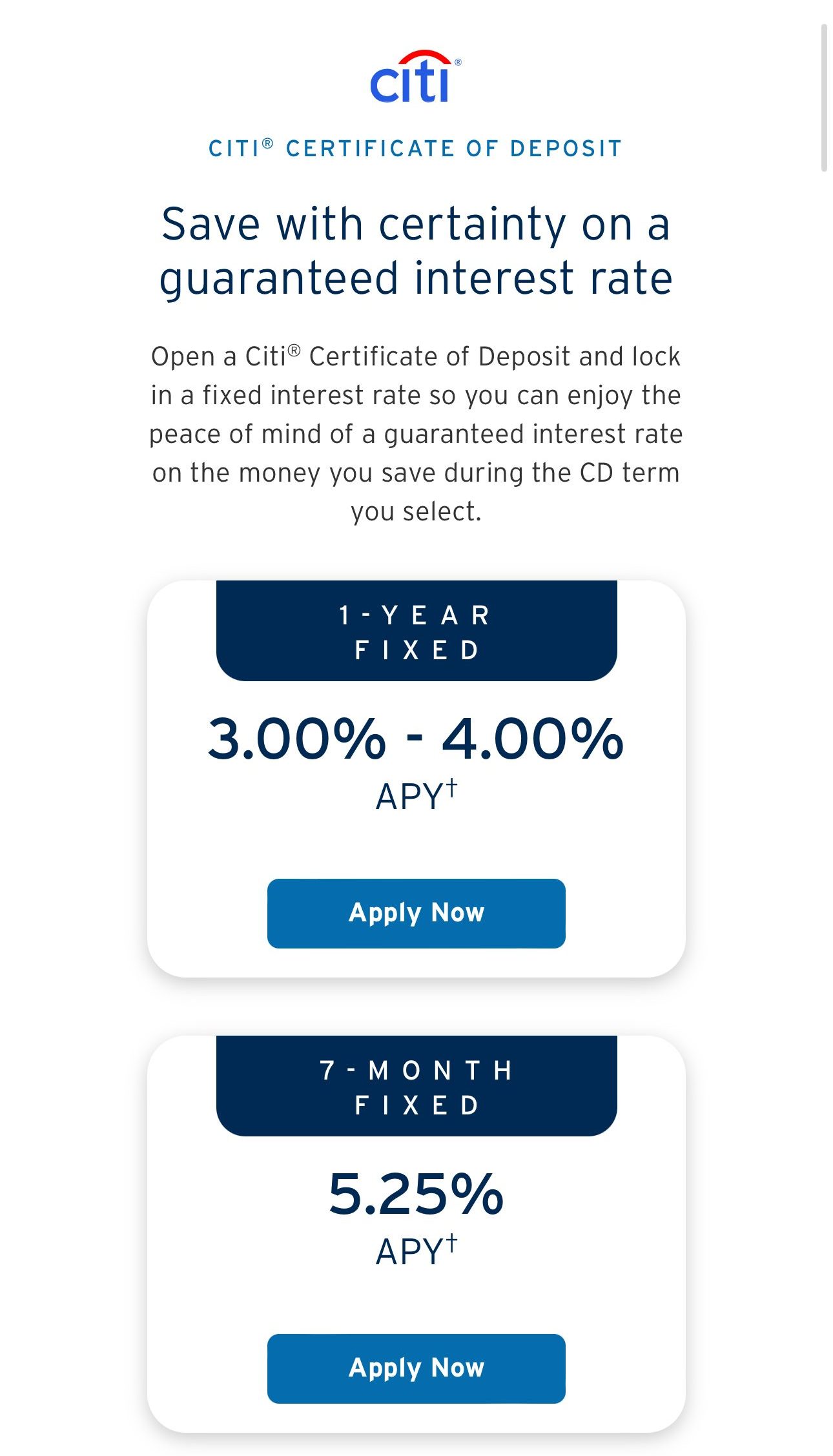

Citibank CD rates can be very appealing for specific terms. The various terms can alternate from a year or less or as long as 5 years. In most states, you will earn compound interest daily with a minimum deposit of $500. In California and Nevada, their CD rates require a $1,000 deposit. Maryland requires $2,500 for a minimum deposit.

Your interest is paid out monthly, but customers with a term of less than one year have interest paid at maturity. You will receive a penalty with each early withdrawal.

The penalties are standard rates. For a one-year CD, the penalty is 90 days of interest and for a five-year CD, the penalty is 180 days of interest. Citibank offers many great features for customers that include the ability to earn more interest with the larger balance, but the yields are low compared to what the best online banks can offer.

You should be aware that your grace period before automatic renewal is short. The grace period is only seven days compared to the usual ten days. Also, your CD must be funded from your linked Citibank account, which limits your ability to transfer money to other banking systems.

You should carefully consider all aspects of the CD savings system there are many benefits, but there are also limitations that may be too severe for some customers.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 0.05% | 90 days interest |

6 Months | 4.65% | 90 days interest |

7 Months (Featured) | 0.05% to 4.75% | 90 days interest |

9 Months | 3.75% | 90 days interest |

12 Months | 2.00% – 3.00% | 90 days interest |

12 Months – No Penalty | 0.05% | / |

18 Months | 3.75%

| 180 days interest |

24 Months | 2.00% | 180 days interest |

30 Months | 0.10% | 180 days interest |

36 Months | 2.00% | 180 days interest |

48 Months | 2.00% | 180 days interest |

60 Months | 2.00% | 180 days interest |

Money Market Account

Citibank offers money market accounts to customers through their Citibank Savings Plus Account and Citi Accelerate Savings Account. These two products are listed as savings accounts, but they operate like money market accounts. This advertising may appear confusing, but it is not intended to be.

The money market account requires a minimum deposit of $100 to begin the account and the APYs are very small. You can grow your interest with this savings account when it is linked to other accounts and maintain the minimum waiving account fees.

-

Credit Cards

Customers have a variety of Citi credit cards to choose from. The cards are divided into categories: Travel, Rewards, Balance Transfer, 0% introductory rate, and Cash Back. Many Citi cards have no annual fee and offer up to 5% cash back.

The Citi Double Cash card is one of the most popular Citi cards. This card has no annual fee and offers 1% cash back on purchases, plus an additional 1% when you pay for your purchases.

Card | Rewards | Bonus | Annual Fee |

| Citi® Double Cash Card | 1% – 2%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| N/A

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening

| $0 |

|---|---|---|---|---|

| Citi Premier® Card | 1X – 10X

10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases

| 75,000 points

75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com

| $95 |

| Citi® Diamond Preferred® Card |

None | None | $0 |

| Citi® Secured Mastercard® | None | None | $0 |

| Citi Custom Cash℠ Card | 1-5%

5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

| $200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back)

| $0 |

The Citi Custom Cash® Card stands out as a highly valuable, versatile, and hassle-free option within the issuer's card lineup. It boasts a 5% rewards rate on eligible purchases and charges no annual fee.

Tailored for Costco members who frequently spend on gas, dining, and travel, the Costco Anywhere Visa® Card by Citi is a logical choice. Its usability extends beyond Costco locations, making it a versatile option.

The Citi Premier Card goes beyond typical travel rewards, encompassing everyday expenses like dining, fuel, and groceries. For those seeking diverse opportunities to accumulate travel rewards, this card opens up new possibilities to enhance your travel experiences.

Citi has also partnered with American Airlines and offer a set of American Airlines cards for every purpose with different type of rewards, including premium airline cards. There are many more available cards so customers can pick up from a variety of cards.

-

Mortgage And Loan Options

Citi offers options for purchasing a home, refinancing, and accessing your home equity. You can also get pre-qualified for a mortgage. What distinguishes Citi is that it offers special pricing for its customers in order to secure a lower interest rate or a $500 credit towards closing costs.

Citi provides personal loans of up to $30k with fixed rates ranging from 10.49% – 19.49% APR and terms of up to 60 months.

With Citi's simple application process, you can get the funds quickly, as a check will be mailed to you within five business days of approval. If you sign up for Auto Deduct monthly payments and link your loan to an eligible checking account, you may be able to qualify for a lower rate.

Top Offers From Our Partners

![]()

Customer Experience

Citi's customer service is a little trickier. According to your product, the bank has several phone lines through which you can contact the support team. So, if you have a question about a credit card, you'll need a different number than if you have a question about a savings account.

According to the J.D. Power 2023 U.S. retail banking satisfaction study, Citi customer satisfaction is controversial. While Citi bank gets high customer satisfaction in California, Florida, it gets lower than average in Illinois and NY Tri-state.

Citi has a comprehensive help page as well. You can use the website to send an inquiry and receive an answer, or you can message the customer service team. There is even a QR code within the phone app that you can scan to message the team.

You can fully explore and compare products on the Citi website to find the best one for you. This is especially useful if looking for the best credit card option. The Citi mobile app has received ratings of 4.9/5 on Apple and 4.7/5 on Google.

Citi Bank | |

|---|---|

App Rating (iOS)

| 4.9 |

App Rating (Android) | 4.7 |

BBB Rating (A-F) | F |

Contact Options | phone/chat |

Availability | 24/7 |

How to Open a Bank Account on Citibank

Opening a Citibank account can be done online or at the branch. Here are the main steps to take:

Step 1:

Visit the Citi bank homepage and indicate your location by inserting your zip code, then click “Submit.”

Step 2:

Next, get started by telling Citi bank about you by giving them information such as your names, security number, date of birth, etc.

Step 3:

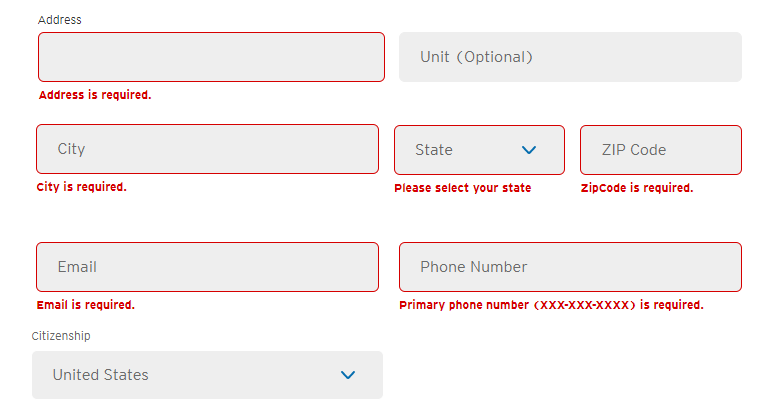

Next is your address, email, phone number, citizenship, state, and zip code.

Step 4:

Next, indicate how you intend to use the account; if you plan using it internationally to receive or send money.

After this, create a security word and click submit.

Bottom Line: Should You Consider Citi?

When you bank with Citibank they are many benefits. You have unlimited access to nation-wide ATMs and unlimited access to human customer service agents 24 hours a day, seven days a week.

Citibank offers many current and helpful banking app options that are easy to use and access your most up to date financial information. Other helpful tools help you manage and organize your spending habits that improve your financial standing.

Citibank is a great option for many customers, but it may not be the easiest choice if you struggle financially or are just starting. There are many fees you should be aware of before joining this banking service. Citibank is best suited for users that can manage daily balance and activity requirements

CitiBank Bank FAQs

Does Citibank Offers Promotions for New Accounts?

Yes, Citi offers a couple of banking promotions and welcome bonuses for new accounts. Currently, you can receive a bonus of $200 – $2,000 if you open an eligible checking account and meet the qualification criteria.

There is also a bonus of $100 – $5,000 if you open up a new eligible savings account and complete the required activities.

Is Citibank trustworthy?

Citibank takes security seriously. To safeguard your data when you use the online banking facilities, the information is encoded with 128 bit encryption.

Additionally, Citibank is FDIC insured, so your funds are protected up to the legal limits. Finally, you can sign up for the Citibank Safety Check. This automatically uses your savings account funds to help to cover any overdrafts on your checking account. So, Citibank is obviously not just in business to charge hefty overdraft fees.

Is CIT Bank the same as Citibank?

No CIT is a completely different organization to Citibank. While the names are similar, CIT has no relationship with Citibank.

In fact, the name CIT stands for Commercial Investment Trust and it has a history dating back to 1908. Like Citibank, CIT Bank offers a variety of banking products, including online banking, but it also offers a number of business services for small to medium businesses.

Our CIT Bank rating is a bit better than Citi, mainly due to the very high rates on deposits.

Is Citibank a good bank overall?

Citibank is a large, national bank, so it offers many of the perks you would expect from this type of organization. Citibank has a massive network of over 65,000 ATMs where you can access your funds fee free.

It also offers solid mobile and online features with strong customer support. While the savings rates may be a little lower than other institutions, the product variety and service do compensate for this.

Which is better: Citibank or Bank of America?

Both Citibank and Bank of America are national banks that are known for convenience rather than higher savings rates. Both banks have a wide variety of banking products and top-shelf technology.

You can also gain access to a large ATM network, but Citibank does have a larger network. Additionally, Citibank offers access to live customer service, particularly during irregular hours. So, unless your priority is access to more physical branches, you are likely to find Citibank a better choice. Read our Bank of America review.

Is Citibank better than Discover Bank?

While Citibank offers a variety of accounts with low opening required amounts, Discover has no monthly fees or required balances. However, Discover does have fewer account choices with only personal deposit accounts available.

Another key difference is that Discover offers competitive rates across all of its accounts, while the competitive rates with Citibank have requirements you need to meet to access them. So, which one is best will depend on your priorities.

If you prefer access to a wider variety of banking products, you’ll likely prefer Citibank, but this will come at the cost of requirements to access the more competitive rates.

Is Chase Bank better than Citibank?

Like CitiBank, you’ll find Chase Bank offers a wide variety of banking products with competitive rates. Since both are traditional-style banks, you will find that both Chase and Citibank have higher fees compared to online banks.

However, if you want to distinguish between the two, Chase is a better option if you want greater access to branches, as Chase has a larger network. Also, Chase account overdraft protection is cheaper.

On the other hand, Citibank has a larger ATM network and if you’re interested in CDs, you’ll find Citibank offers higher rates.

Bank Account Alternatives

APY Savings

The annual percentage yield (APY) is a percentage that represents the amount of money or interest earned on your savings account over the course of a year. The APY factored in compound interest. A savings calculator can help you quickly determine how much you'll earn with a given APY.

| 4.50%

| 4.25%

| 0.01%

|

Checking Account Fee

The monthly fee on checking account

| $0 | $0 | $12

Can be waived if you maintain a $1,500 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $5,000 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

|

Checking Minimum Deposit | $100 | $0 | $0 |

Mobile App Rating | 4.5/5 on iOS, 3.4/5 on Android | 4.9/5 on iOS, 4.7/5 on Android | 4.8/5 on iOS, 4.3/5 on Android

|

BBB Rating | A+ | A+ | B- |

How We Rated Citibank: Review Methodology

The Smart Investor team extensively reviewed hundreds of banks and credit unions. We assessed them based on four main categories, each with specific features:

-

Diversity of Products and Their Attractiveness (40%): We extensively analyzed the breadth and appeal of each bank's product offerings, including savings accounts, checking accounts, loans, investment options, and more. Higher ratings were assigned to banks with a diverse range of products that are attractive in terms of interest rates, fees, terms, and additional features. This category provides insights into the variety and value of the bank's offerings, crucial for meeting customers' diverse financial needs.

-

Account Features (30%): This category delves into the features and benefits accompanying each bank's accounts. We scrutinized factors such as promotions, deposit and withdrawal options, ATM accessibility, online and mobile banking functionalities, as well as additional perks like overdraft protection and rewards programs. Banks offering comprehensive and convenient features received higher ratings, reflecting the overall value of their accounts to customers.

-

Customer Experience (20%): A positive customer experience is paramount in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Bank Reputation (10%): The reputation of a bank is a critical consideration for customers. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were awarded to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories, individuals can make informed decisions that align with their financial needs and preferences, ensuring they choose a bank that offers competitive products, excellent features, a positive customer experience, and a solid reputation.

Compare Citibank Versus Other Banks

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

Capital One began as a credit card company, but it has recently expanded its banking product line. Capital One offers checking and savings accounts, children's accounts, auto finance and refinancing, in addition to an impressive selection of credit cards.

Citi offers a diverse range of banking products, including checking and savings accounts, CDs, credit card options, mortgages, personal loans, wealth management plans, IRAs, and investment options.

Read Full Comparison: Citi vs Capital One: Which Bank is Best For You?

CIT Bank has a banking product line that rivals that of traditional banks. Savings accounts, CDs, an eChecking account, home loans, and mortgages are all available. The main shortfalls in this lineup are the lack of personal loans and a credit card option.

Citibank has a credit card background, but that doesn't mean it has a limited banking product line. Citi offers home loans, personal loans, lines of credit, wealth management options, and investments, as well as everyday and premium banking services.

Read Full Comparison: CIT Bank vs Citi: Which Bank Account Suits You Best?

The Citi checking account is a fairly standard product. The account does have a $12 monthly fee, but it is waived if you make a qualifying deposit or make a qualifying bill payment. Overdraft protection is also available, which automatically transfers funds from your savings account to avoid overdraft fees.

Because the American Express savings account has a high yield, the number of withdrawals or transfers you can make each month is limited to nine. It's also a nice touch that American Express allows you to choose paper statements if you prefer the old-fashioned way.

Read Full Comparison: American Express vs Citi: Where to Save Your Money?

Citi offers an excellent range of banking products that cover the majority of your financial needs.

Personal loans, mortgages, credit cards, investment options, IRAs, and wealth management plans are available in addition to savings and checking accounts. Barclays' product line is more streamlined. This bank offers credit cards, savings accounts, credit cards, and personal loans.

The most obvious product gap is the absence of a checking account. As a result, Barclays becomes more of a supplementary bank rather than your primary day-to-day financial institution.

Read Full Comparison: Citi vs Barclays: Which Bank Account Is Better?

Bank of America is a large banking institution, and its impressive banking product line reflects this. Aside from savings and checking accounts, there are home loans, auto loans, investment options, and a variety of credit cards. Citi also has a diverse product offering. Credit cards, CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and checking and savings accounts are all available.

As a result, if you want to switch from your current bank, either bank is a viable option because you won't have to make any compromises in terms of banking products.

Read Full Comparison: Bank of America vs Citi: Which Bank Suits You Best?

Discover began as a credit card company and has since expanded into banking services. As a result, it stands to reason that Discover would offer a diverse range of credit cards. Discover offers a simpler checking account. There are no account fees or minimum deposits, and you can earn 0.40 percent.

Citi offers home loans, personal loans, lines of credit, wealth management options, and investments, as well as everyday and premium banking services. This exemplifies Citi's viability as a viable alternative to the traditional high-street bank.

Read Full Comparison: Discover vs Citi: Compare Banking Options

Both banks offer a good selection of banking products, making it easier to switch from your current bank.

Citi offers CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and a variety of credit card options in addition to checking and savings accounts.

Wells Fargo provides savings and checking accounts, but it also provides mortgages, loans, and investment options such as IRAs, 401ks, and wealth management products.

Read Full Comparison: Citi vs Wells Fargo: Which Bank Account Is Better?

While U.S. Bank offers some better conditions when it comes to lending options, Citibank is our winner in this comparison. Here's why.

Citibank is our winner due to its checking account options, various credit cards, and better savings account rates than Truist Bank.

PNC Bank and Citibank are two big players in brick-and-mortar banking. Let's compare them side by side and see which is our winner: PNC Bank vs. Citibank

Citibank leads in credit cards, and TD Bank options for borrowers are broader. But what about the rest? Here's our comparison and winner: Citibank vs. TD Bank

We'll explore Citibank and M&T Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Citibank vs. M&T Bank

Citi is our winner for most consumers, but Ally is also a great option if you are willing to manage your account online. Here's why.

Banking Reviews

Alliant Credit Union Review

Compare Citibank Savings

While Citi Accelerate Savings account offers a slightly higher APY than Capital One 360 Performance Savings, it has drawbacks to consider.

Citi Accelerate Savings vs Capital One 360 Performance Savings: Which Is Better

Compare Citi Accelerate Savings and Ally Savings rates, features, benefits, and limitations to determine which one is the best option for you.

Citi Accelerate Savings vs Ally High-Yield Savings: Comparison

While Citi is a traditional bank, its savings rates are very competitive. How's the rates, features and tools compare – and who is the winner?

Marcus Online Savings Account vs Citi Accelerate Savings: Compare Side By Side

Compare Citibank Certificate Of Deposit (CDs)

Citi has better CD rates than Capital One for specific terms, but Capital One rates are higher on other terms. Here's a full comparison: Capital One CDs and Citibank CDs

Synchrony Bank offers higher CD rates than Citibank on most terms. Compare CD rates, minimum deposit and early withdrawal fees.

Citi Bank and Ally offer competitive CD rates, including no penalty CDs. Which one is the winner? Check out our full comparison: Ally CDs vs. Citibank CDs

While Citi Bank offers competitive CD rates on most terms, Wells Fargo offers high rates on specific terms. Compare rates and withdrawal fees.

While Citi Bank offers CD competitive rates on most terms, Bank Of America is the winner for specific terms. Citi also offers no penalty CD.