Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Flat Rate Rewards

- 0% Intro APR

- No Intro 0% APR on Purchases

- Average Cash Back

Rewards Plan

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

Sign up Bonus

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening

Our Rating

PROS

- Flat Rate Rewards

- 0% Intro APR

CONS

- No Intro 0% APR on Purchases

- Average Cash Back

APR

19.24% – 29.24% (Variable)

Annual Fee

$0

0% Intro

18 months on balance transfers

Credit Requirements

Excellent, Good, Fair

- Our Verdict

- FAQ

The appeal of the Citi® Double Cash Card lies entirely in its simple easy-to-earn rewards plan: receive rewards from every dollar spent, and every dollar paid off.

The card’s combined 2% cash back rewards rate – 1% every time you swipe and another 1% upon payment. unlimited cash-back feature can boast a mass appeal to general consumers with solid credit scores (above 700). Also, unlike many cash-back cards – there is no annual fee.

Key features of the card include a limited-time offer for 5% cash back on specific travel-related expenses through the Citi Travel portal until December 31, 2024. The card also presents a welcome offer of $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. Additionally, it boasts a lengthy 0% intro APR on balance transfers for 18 months, making it an attractive option for those looking to manage existing high-interest debt.

But what the card offers in easy rewards, it sorely lacks excitement. The card cashback rate is 2%, which is low compared to category-specific credit cards.

How hard is it to get Citi Double Cash Credit Card?

It is not too hard to meet the eligibility requirements for this type of card. You are also able to get pre-approval so you can ensure that you are in with a good chance.

Can I get car rental insurance with Citi Double Cash Credit Card?

Yes, it offers rental insurance for cars if you pay for the full cost with this credit card and you decline the rental company’s insurance.

Does Citi Double Cash Credit Card ask for proof of income?

There are no out and out income requirements in place with this type of card and normally you will not have to provide proof of income.

What is the initial credit limit?

The initial credit limit of this card will normally be at least $500. The exact limit is going to be depending on your personal financial situation.

Should You Move to Citi Double Cash Credit Card?

If you like predictability and want an incentive to meet your payment commitments then this type of card could be a good fit for your needs.

Why did Citi Double Cash Credit Card deny me? What to Do Next?

Perhaps you did not meet all of the requirements. You can ask the customer service team what you need to do to get accepted or you can look at other card options

In This Review..

Pros & Cons

Let’s take a closer look at the pros and cons of the Citi Double Cash Card – and whether or not it’s right for your wallet.

Pros | Cons |

|---|---|

Simple Rewards Structure

| No Intro 0% APR on Purchases |

No Annual Fee | Balance And Foreign Transaction Fees |

Generous Intro APR on Balance Transfers | Reward Points Limitation |

Citi Entertainment Access | Limited Cardholder Perks |

Flexibility in Redemption |

- Simple Rewards Structure

The straightforward earn-as-you-pay rewards structure encourages responsible financial behavior, while it offers 2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

- Generous Intro APR on Balance Transfers

The card boasts a lengthy period of 0% fees on all balance transfers.

After this period each transfer requires paying a variable APR between 19.24% – 29.24% (Variable). That’s a fair range among general-spending cards.

- No Annual Fee

Another highly competitive benefit is the card’s $0 annual fee, meaning you don’t have to worry about swiping your card enough to cover a fixed yearly payment.

This is an enormous and unique benefit, as most cash back credit card fee sits near $100.

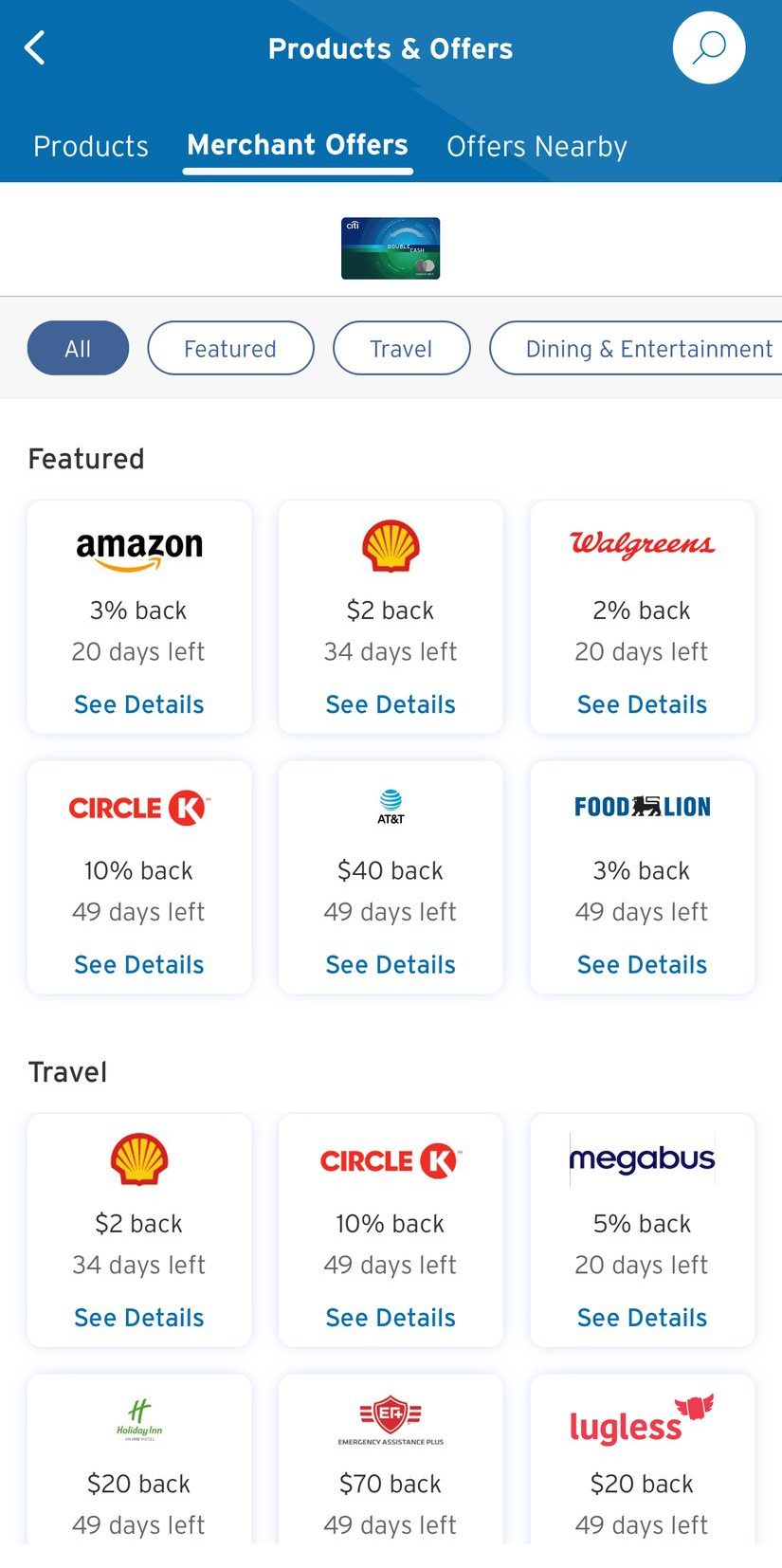

- Citi Entertainment Access

Cardholders gain access to Citi Entertainment, which offers presale tickets and exclusive event access, adding a layer of entertainment-related perks. You can also browse Citi products and special offers:

- Flexibility in Redemption

Cash back can be redeemed as a statement credit, direct deposit, or check, offering flexibility in how cardholders choose to use their earned rewards.

- No Intro 0% APR on Purchases

Despite an intro 0% APR on balance transfers, the Citi Double Cash Card doesn’t offer an intro 0% APR on actual purchases.

Instead, all purchases from the sign-up period onward endure the variable APR between 19.24% – 29.24% (Variable).

- Balance And Foreign Transaction Fees

The fee is incurred when you transfer debts from one or more credit cards to your Double Cash card. This fee is $5 or 5% of the transfer, and will be added to your debt load when transferred.

Citi Double Cash has a 3% fee for each transaction in another country. If you are traveling outside of the US you may want to leave this card at home.

- Reward Points Limitation

While the card advertises cash back, it actually earns ThankYou points, limiting redemption options as these are “basic” ThankYou points that cannot be transferred to Citi travel partners.

- Limited Cardholder Perks

While offering Citi Entertainment access and alternative installment payment plans, the card lacks some of the premium benefits provided by competing cards, such as travel insurance, travel benefits, purchase protections and partner perks with various services.

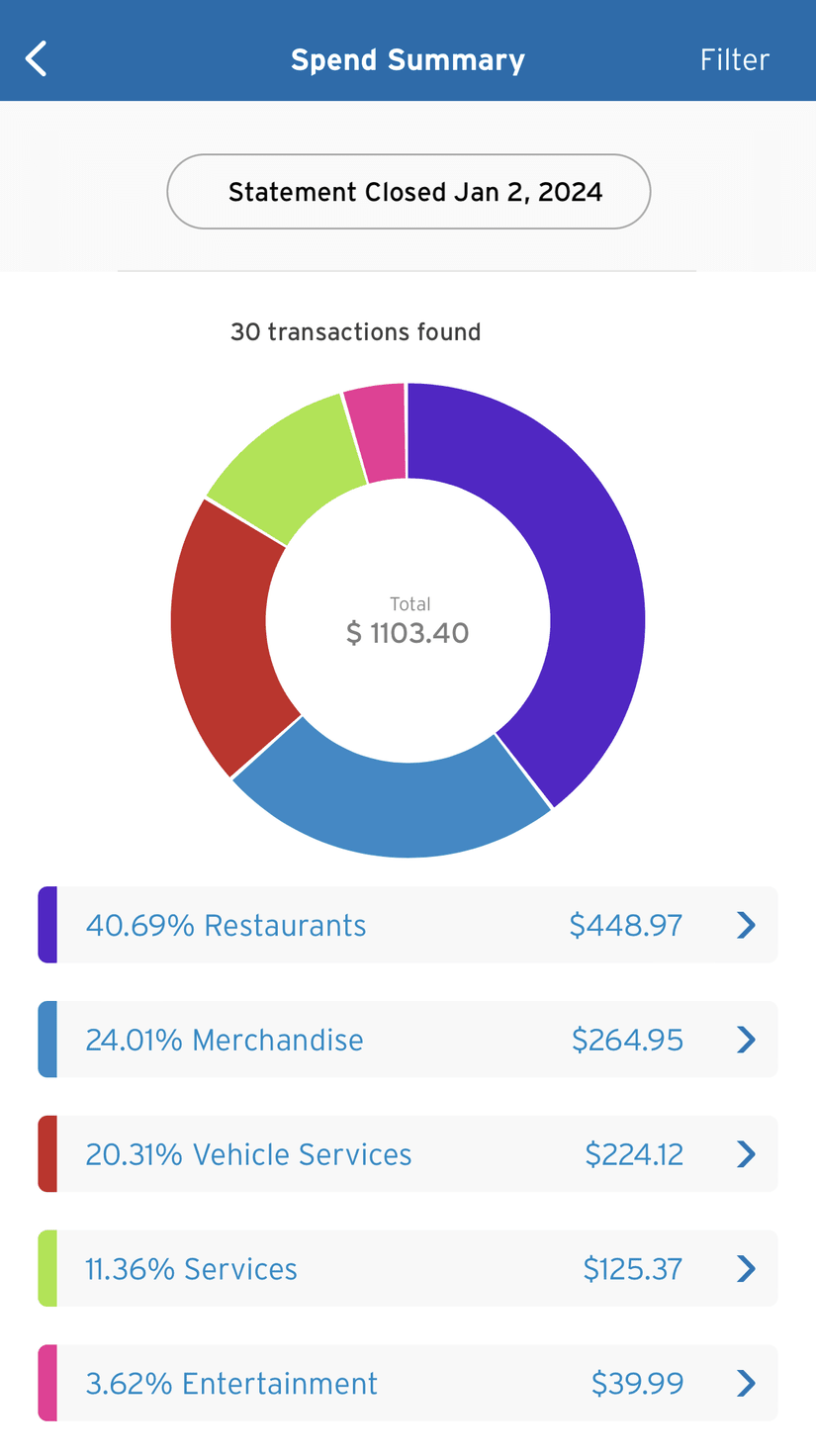

Rewards Simulation: How Much You Can Earn?

The best way to see if the Double Cash card is the right choice for your needs, is to calculate the amount of rewards and benefits you suppose to earn.

Keep in mind that this is a general breakdown of expenses, so make sure to adjust it to your own consumer preferences and spending habits.

| |

|---|---|

Spend Per Category | Citi® Double Cash Card |

$15,000 – U.S Supermarkets | $300 |

$3,000 – Restaurants

| $60 |

$1,500 – Airline | $30 |

$1,500 – Hotels | $30 |

$4,000 – Gas | $80 |

Estimated Annual Value | $500 |

* Calculated according to 2% cash back - please keep in mind you'll get the additional 1% upon payment.

Where to Redeem Your Rewards?

With the Citi Double cash card, cardholders earn 2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

Citi also has a number of reward redemption options that include:

- Checks: You can request a check. You can also take a credit towards your Citi savings or checking account.

- Convert to ThankYou Points: If you have a minimum rewards balance of $1, you can convert your rewards to Citi ThankYou points.

- Statement Credit: You can redeem your rewards for a statement credit.

Leverage Your Card Smartly

Here are some pointers to help you make the most of your Citi Double Cash:

- Leverage 0% Intro APR: Organize your balance transfers within the first six months. This will allow you to benefit from the lower balance transfer fee.

- Pay your bills on time: In order to earn your cash back, you must pay at least the minimum due on time, so make sure you don't miss any payments. Set up an automatic payment with your checking account if you have trouble keeping track of your bills.

- Check Citi Entertainment first: If you enjoy concerts, sporting events, and other ticketed events, be sure to check Citi Entertainment first, as you may be able to obtain exclusive experiences and presale tickets.

How To Apply For Citi Double Cash Credit Card?

Visit the double cash credit card home page and then click “Apply Now”.

When the next page opens, fill in your personal information correctly.

Then, fill in your security number, date of birth and other important information requested.

Also fill in your financial information, and then take your time to read through the terms and conditions. After this, tick to agree and then click on “Agree and Submit.”

How It Compared To Other No Annual Fee Cash Back Cards?

When compared to other no annual fee cash back cards, the Citi Double Cash competes favorably. The Chase Freedom Unlimited® card, the Capital One Quicksilver card and the Amex Cash Magnet, for instance, offers 1.5% cash back on all purchases, falling slightly behind the Citi Double Cash's potential 2% cash back. The Wells Fargo Active Cash℠ Card also offer similar flat-rate cash back.

While the Discover it® Cash Back, BofA Customized Cash Rewards and Chase Freedom Flex card presents rotating bonus categories, the Citi Double Cash's consistent flat-rate structure may appeal to those seeking a hassle-free rewards system. However, these cards could be advantageous for individuals who frequently spend in specific bonus categories that align with the rotating calendar.

Lastly, there are Cashback cards with higher cash back rate, but for specific categories. For example, although the Blue Cash Everyday® Card from American Express offers strong cash back rates, it focuses on tiered rewards, and its supermarket and gas categories may not suit everyone's spending habits. This is also relevant for the CapitalOne SavorOPne card.

How It Compared To Other Citi Credit Cards?

When comparing the Citi Double Cash® Card to other Citi cards, several factors come into play, including rewards structure, annual fees, introductory offers, and additional perks.

The Citi Custom Cash℠ Card is another no annual fee cashback card and the main competitor of the Double Cash card. While the Citi Custom Cash℠ Card offers bonus cash back in categories where you spend the most, the Citi Double Cash provides consistent rewards without the need to track spending patterns.

One notable alternative is the Citi Premier® Card, which offers a diverse range of rewards, especially for travel enthusiasts. The Premier card provides bonus points on travel, dining, and entertainment, along with the ability to transfer points to Citi's travel partners. While it has an annual fee, its comprehensive rewards program may appeal to those seeking travel benefits.

On the other hand, the Citi Simplicity® Card is another Citi option that focuses on straightforwardness. It is renowned for its lengthy 0% introductory APR on both purchases and balance transfers, making it suitable for those prioritizing a temporary break from interest charges. However, it lacks a rewards program, making the Citi Double Cash a more rewarding choice for ongoing cash back.

Is the Citi Double Cash Card Right for You?

The Citi Double Cash card is a “boring” choice among a sea of competitors.

But for the average consumer who makes purchases across all categories, the Citi Double Cash Card can’t be beat.

The combined 1% on the front end and 1% on the backend add up to a strong 2% rewards system that not only offers a consistent stream of cash back, but also offers an incentive to build a strong credit score.

Compare The Alternatives

Several other credit cards provide similar rewards to the Citi Double Cash Card while also offering the enticing sign-up bonuses and intro APR periods on purchases that the Citi Double Cash Card lacks.

|

|

| |

|---|---|---|---|

Chase Freedom Flex℠ Card | Capital One Venture Rewards Credit Card | American Express EveryDay® Card | |

Annual Fee | $0

| $95

| $0

|

Rewards |

1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

|

1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

|

Welcome bonus |

$200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

|

75,000 miles

75,000 miles once they spend $4,000 on purchases within 3 months from account opening

|

10,000 points

10,000 points after you spend $1,000 in purchases on your new card within the first 3 months

|

Foreign Transaction Fee | 3%

| $0

| 2.7%

|

Purchase APR | 20.49%–29.24% variable

| 19.99% – 29.99% (Variable)

| 18.24% – 28.24% Variable

|

FAQ

There are no out and out income requirements in place with this type of card and normally you will not have to provide proof of income.

There is no limit in place with this card on how many total rewards you can earn. Therefore, people who will be spending large sums on purchases can ideally take advantage of this offering.

All purchases earn cashback with the Citi Double Cash card. This means that it is a great fit if you are looking for a good level of flexibility and coverage with one card.

If you want a higher cashback rate or a signup offer then you might be better off looking at other credit card options that will be able to support these needs.