Bank of America Advantage Relationship Banking

Fees

Minimum Deposit

Our Rating

APY Checking

Bank of America Advantage Relationship Banking

Fees

Minimum Deposit

Our Rating

APY Checking

Bank of America is one of the largest banks in the U.S offering a variety of account options, including checking accounts.

The Advantage Relationship Banking account is the top tier checking account option designed for those who carry a larger balance in their account.

This account has the highest monthly maintenance fee of all Bank of America’s checking accounts, but it does offer more features and benefits which may provide greater value for you.

BoFa Advantage Relationship: Account Features

Bank of America Advantage Relationship comes with a variety of features and benefits that are designed to those who want to get more than the basic acocunts. In this section, we will explore these features:

-

Tiered APY

The Bank of America Advantage Relationship Banking account is an interest bearing checking account with a (low) tiered APY of 0.01% – 0.02%. The account is designed for those with a larger balance, so the lowest tier is up to $50,000.

-

Monthly Maintenance Fee

The account carries a $25 monthly maintenance fee, but this can be waived if you have a combined balance of at least $10,000 across your linked, eligible accounts or if you are enrolled in the Preferred Rewards scheme.

-

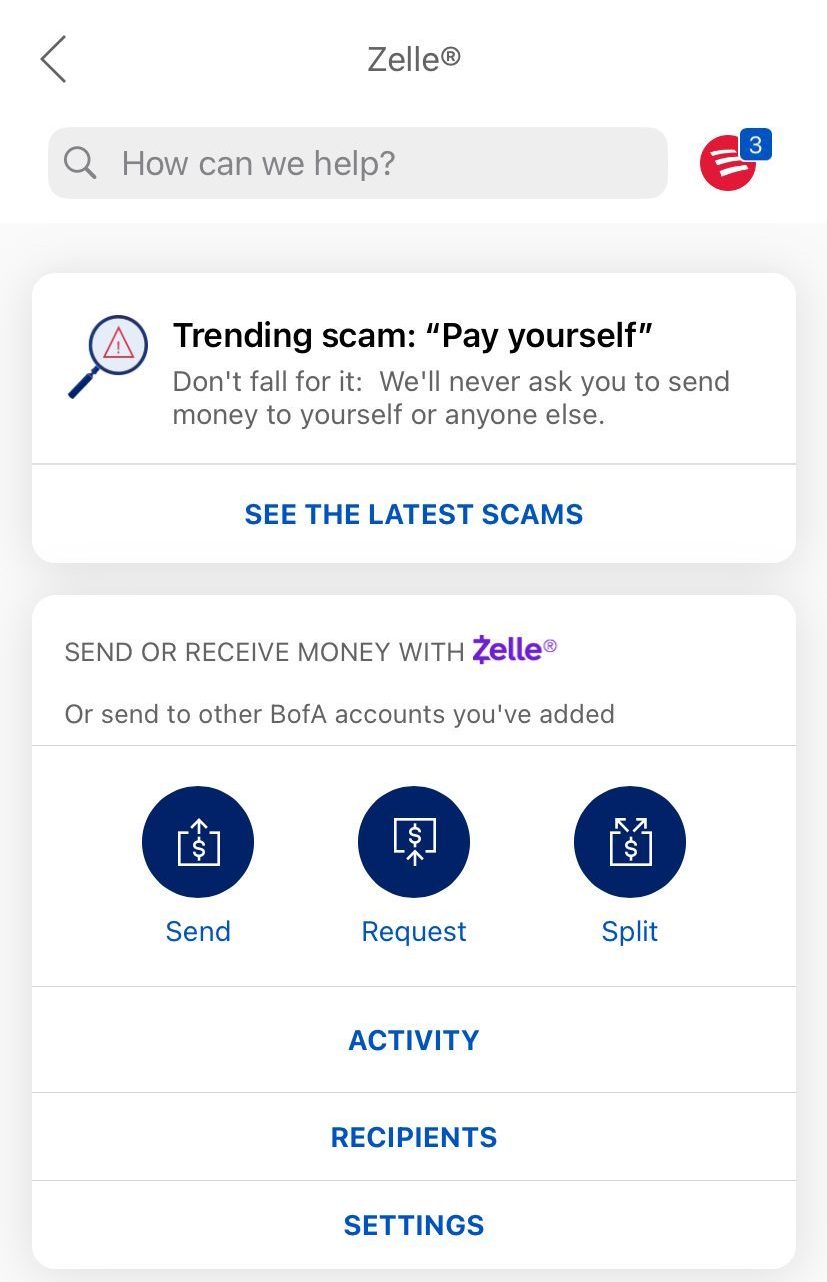

Mobile App with Zelle Integrated

The Bank of America app offers great ease of use to manage almost every aspect of your account using your smartphone. The app also has Zelle integrated into the platform, making it very easy to send or receive payments between family members or friends.

-

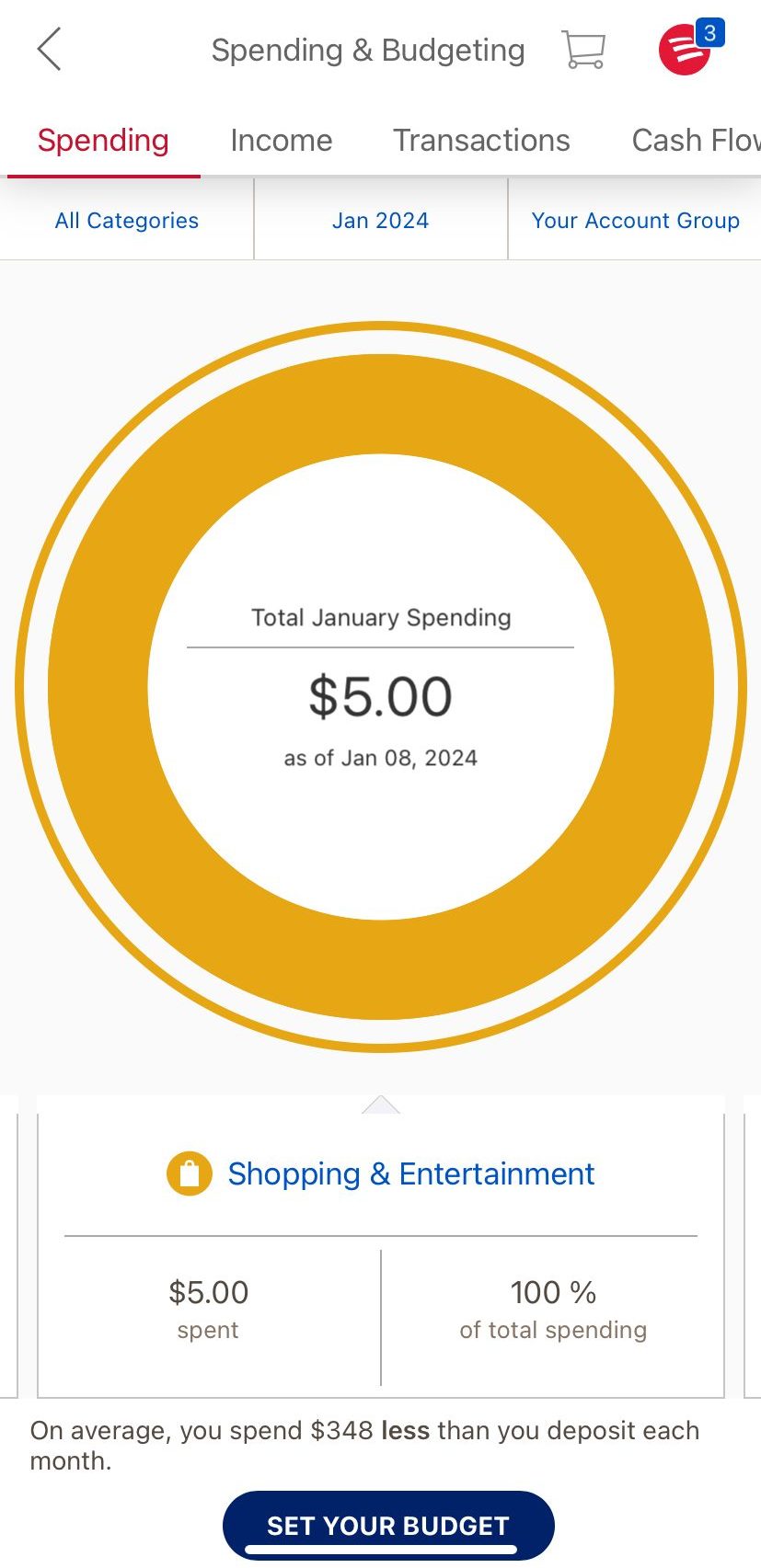

Smart Money Management Tools

The Bank of America platform features smart money management tools which Advantage Relationship Banking customers can access. This includes the ability to set custom alerts and savings goals, which make it easier to take control of your finances and work towards your financial goals.

-

Fraud Protection

Bank of America offers a $0 Liability Guarantee, which means that if your card is lost or stolen, any fraudulent transactions made using the card will be credited back to your account in as little time as one business day.

-

Check Writing Ability

This is becoming a less common feature with checking accounts, but the Advantage Relationship Banking account has check writing abilities. In fact, checks are offered free of charge or at a discounted rate depending on your check preferences.

What Are the Main Differences Between This Account and SafeBalance or Advantage Plus?

SafeBalance and Advantage Plus are Bank of America’s lower-tier checking accounts. While there are some similarities between the accounts, some key differences may determine which account is the best choice for you.

The most obvious difference between the accounts is the monthly maintenance fees. Bank Of America SafeBalance is the most basic checking account with the lowest monthly fee, which is currently $4.95. Likewise, the Advantage Plus account has a lower fee compared to Advantage Relationship Banking. Additionally, the waiver criteria is different, with more easily met criteria with the lower tier accounts.

Another key difference is that while Advantage Relationship Banking is interest bearing, neither the SafeBalance or Advantage Plus accounts offer interest, regardless of your balance.

Some of the other main differences appear between the SafeBalance and the other two accounts. This includes that SafeBalance has a lower initial deposit requirement, but it does not have check writing capabilities or overdraft protection.

BaFa Advantage Relationship Banking: Pros And Cons

There is no simple answer to this question, as it will depend on your unique preferences and requirements. However, there are both pros and cons which could highlight if it is a good account for you.

Pros | Cons |

|---|---|

Access BankAmeriDeals | Balance Requirement for Fee Waiver |

Lock and Unlock Your Card | Minimum Opening Deposit |

Mobile Check Deposit | Low APY |

Access to a Large ATM Network | |

Overdraft Protection |

- Access BankAmeriDeals

With this account you can access exclusive offers at participating restaurants and stores.

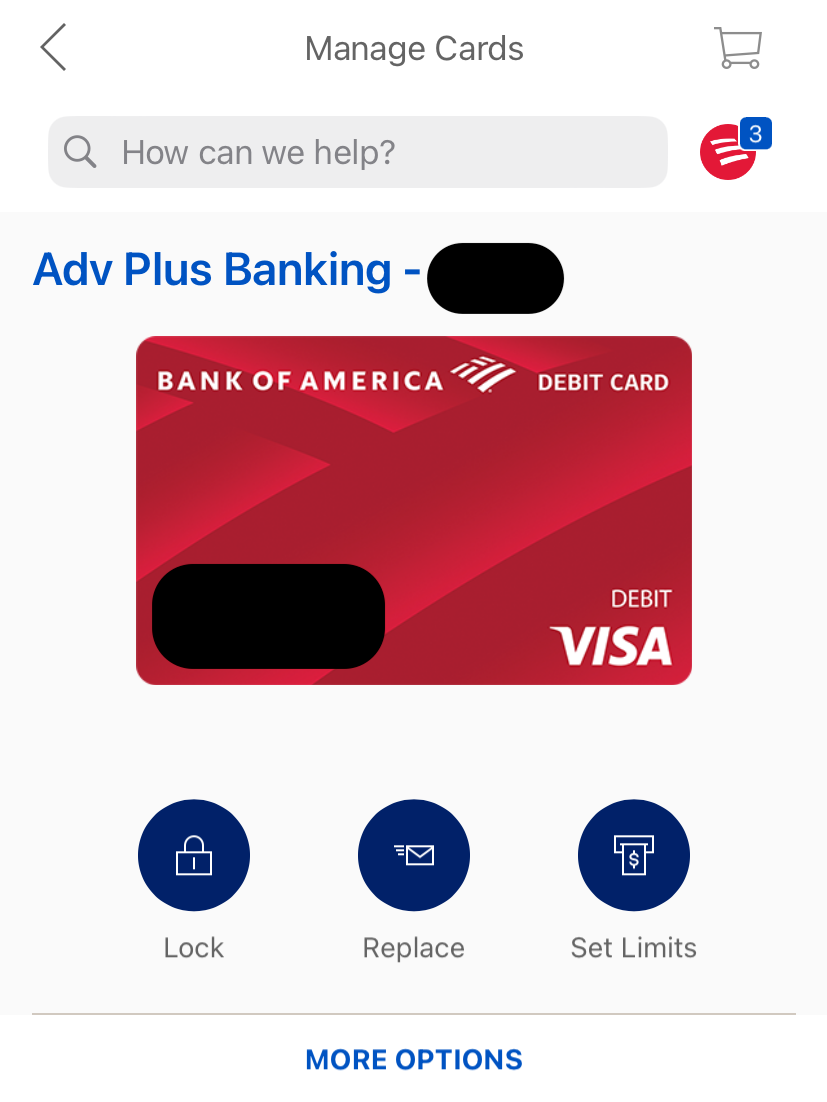

- Lock and Unlock Your Card

Within the Advantage Relationship Banking dashboard or app, you can lock and unlock your card as you need it.

If you misplace or lose your card, you can lock your card until you find it and any returns, autopay and credits will continue to be processed.

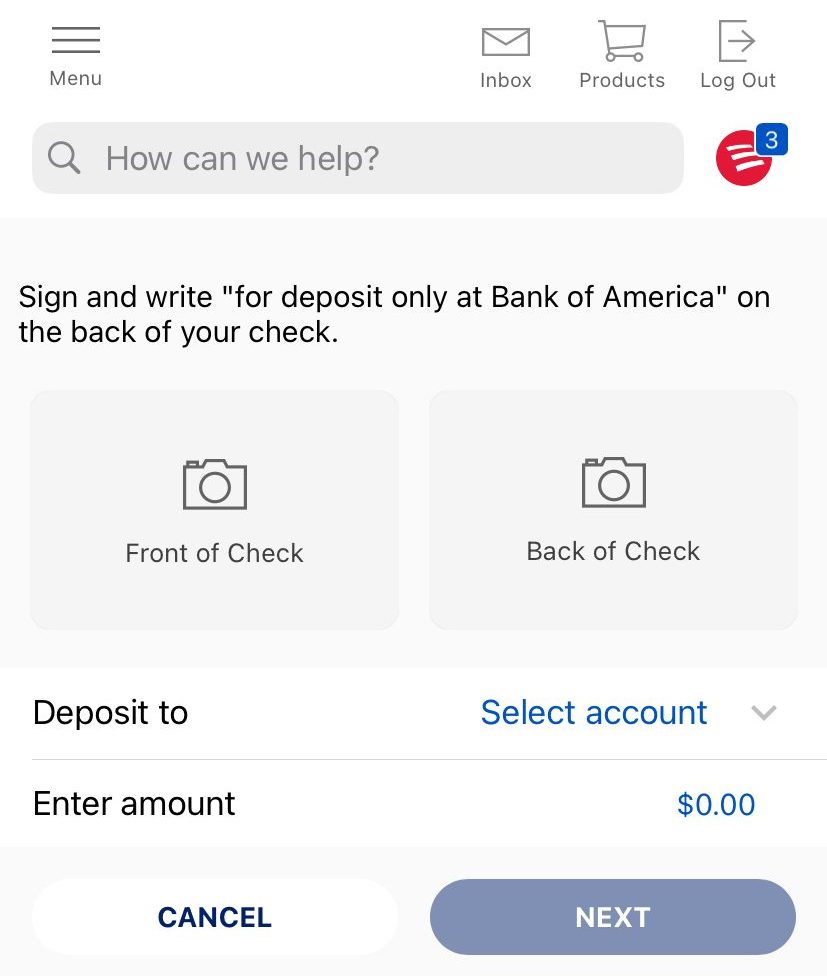

- Mobile Check Deposit

The Bank of America app allows you to deposit checks without needing to visit a branch or app.

You can simply enter a few details and take a photo of the check and Bank of America will process it.

- Access to a Large ATM Network

Bank of America has a large network of more than 16,000 fee free ATMs.

- Overdraft Protection

You can opt into Balance Connect, which is Bank of America’s overdraft protection. It allows you to link up to five Bank of America accounts that you can draw from if you overspend. This does incur a $12 fee, but this is lower than the $35 overdraft charge.

- Balance Requirement for Fee Waiver

It is possible to waive Bank Of America's monthly fee, but you do need to maintain a $10,000 balance across linked, eligible accounts.

- Minimum Opening Deposit

Although there are no ongoing balance requirements, you do need to open the account with at least $100, which may provide a barrier for some customers.

- Low APY

The APY for this account is tiered, but even the higher tiers offer a fairly low APY, which does not stand up to comparison with a number of online checking accounts that don’t have the same balance tiers.

Which Type of Customer is Best Suited To This Account?

This Bank of America Advantage Relationship Banking account is a premium checking account, so it is best suited to those who tend to carry a large balance in their checking account or would have a large combined balance across multiple accounts.

However, this account may appeal to those who want to have check writing abilities with no charge, overdraft protection and interest on your balance.

While you’ll earn the lowest APY if you have less than $50,000 in your account, you may appreciate this account, particularly if you already have other Bank of America accounts.

How to Open a BoFa Advantage Relationship Account?

You can open an Advantage Relationship Banking account at a local branch or using the Bank of America website.

- Navigate to the Advantage Relationship Banking Page: From the Bank of America homepage, you will find Advantage Relationship Banking under the “checking” tab on the top bar. You will then be presented with an overview of the account and if you’re ready to proceed, you can click on “open account.”

- Answer the Initial Questions: You’ll be redirected to an introduction screen with a few simple questions. This includes if you want to open a BoFa savings account with your Advantage Relationship Banking Account. You will also need to confirm if you are an existing Bank of America customer.

- Complete the Application Form: You’ll need to answer the mandatory questions including your full name, contact information, Social security Number, date of birth and some basic financial details.

- Add a Co-Owner: There is an option to add a co-owner to your new account. If you do want to create a joint account, you will need to indicate it in the box and then you’ll need to provide the full details for the second person.

- Complete Account Set Up: You can save your application at any point, but when you’re ready, you can complete the account setup including providing funding details for the initial deposit of at least $100. You can then review the terms and conditions, and submit your application. After opening, you can set up a BoFa direct deposit and use the rest of the features it offers.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

FAQs

Is Bank Of America A Good Bank?

It depends on your needs. In terms of checking options and variety of options, BoFa is one of the best banks in the nation. However, when it comes to deposit rates, there are better places to put your money. Here you can find the main pros and cons of Bank Of America.

Does The Advantage Relationship Banking® earn interest?

Yes, Advantage Relationship Banking does earn interest on your balance. The account has a tiered APY structure of 0.01% – 0.02%, but you’ll need at least $50,000 in the account to access the higher rates.

Does Bank of America offer a promotion in this account?

Bank of America does periodically offer promotions for new customers. You’ll need to look out for promo codes and be sure to enter the code on the first screen of the application form.

How do you close a Bank of America account?

The easiest way to close a Bank of America account is to either call into a branch or call the customer support line. A Bank of America representative can guide you through the closure process and initiate the account closure.

Related Posts

How We Review Checking Accounts: Our Methodology

The Smart Investor team has conducted a comprehensive review of checking accounts offered by various banks, taking into account several key factors to provide a thorough evaluation. Here's how we rated them across four important categories:

-

Checking Account Features (60%): We meticulously assessed the features and benefits associated with each bank's checking accounts. Factors considered include account fees, minimum balance requirements, ATM access, overdraft protection, online and mobile banking functionalities, and additional perks such as rewards programs. Higher ratings were awarded to banks offering a wide range of features and benefits that cater to diverse customer needs, ensuring convenience and flexibility in managing finances.

-

Customer Experience (20%): A positive customer experience is essential in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Diversity of Other Financial Products (10%): We also considered the diversity of other financial products offered by each bank, such as savings accounts, loans, credit cards, and investment options. Higher ratings were given to banks with a comprehensive suite of financial products, allowing customers to meet their various banking and financial needs in one place.

-

Bank Reputation (10%): The reputation of a bank is a crucial factor in decision-making. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were assigned to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories and assigning appropriate weights to each, our review aims to provide valuable insights to help individuals make informed decisions when selecting a checking account