Credit cards may seem like just a small, thin, piece of plastic with numbers on it, but they are actually pretty powerful pieces of plastic. These cards allow cardholders access to borrowed money to pay for things.

The key here is that the borrowed money is repaid in the form of monthly payments. Also, every time a purchase is made with a credit card, interest is accrued on the amount of money borrowed.

A good thing about credit cards is that when used properly, where monthly statements are paid on time, they can actually build up your good credit history. Good credit history is almost a necessity when it comes to purchasing homes, cars or large purchases.

However, if you go looking for the perfect credit card, the first thing you may find is that there seems to be an endless number of cards available. Each card also offers different perks, rates, and other terms which makes choosing one hard to do.

Here are The Smart Investor Select’s picks for the best credit cards of 2024:

Card | Rewards | Bonus | Annual Fee | Best For |

| Discover it® Cash Back | 1-5%

5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

| Cashback Match

All cash back earned at the end of the first 12 months is matched.

| $0 | Rotating Categories |

|---|---|---|---|---|---|

| U.S. Bank Cash+ Visa Signature | 1% – 5%

5% cash back on purchases in two categories of your choice (up to $2,000 in combined purchases per quarter, then 1 percent). 5% back on prepaid air, hotel, and car reservations through the Rewards Center. 2% cash back on one choice everyday category. 1% back on all other purchases

| $200

3 Free Nights (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months from your account opening

| $0 | Cashback and 0% Intro |

| Chase Freedom Unlimited® | 1.5% – 5%

5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases

| $200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| $0 | No Annual Fee |

| Blue Cash Preferred® Card from American Express | 1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases | $250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

| $95 ($0 intro for the first year) (Rates & Fees) | Everyday Spending |

| Amazon Prime Rewards Visa Signature Card | 1-5%

5% at Amazon.com, Amazon Fresh , Whole Foods Market and on Chase Travel purchases, 2% cash back on gas stations, restaurants and on local transit and commuting, 1% cash back on all other purchases

| $100

$100 | $0 ($139 Amazon Prime subscription required) | Amazon Shoppers |

| Chase Sapphire Preferred® Card | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases. | 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $95 | Value for Money |

| Citi® Double Cash Card | 1% – 5%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| $200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening

| $0 | Flat Rate Cashback |

| Capital One Savor Cash Rewards Credit Card< | 1% – 4%

unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.

| $300

$300 cash bonus once you spend $3,000 on purchases within 3 months from account opening

| $95 | Welcome Bonus |

Chase Sapphire Preferred® Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Chase Sapphire Preferred® Card, issued by Chase Bank, stands out as a highly sought-after travel rewards card. Its popularity is attributed to a substantial sign-up bonus and its primary focus on travel-related benefits. Despite being centered around travel, the card maintains a competitive edge by offering a generous sign-up bonus of 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

In the realm of travel and dining cards, the Chase Sapphire Preferred® Card secures the top spot by providing an elevated points structure compared to its counterparts, as reflected in 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases. .

If you Compare the Preferred vs the Reserve card, its travel rewards are fewer – but it make sense due to the difference in annual fee between the cards.

- Rewards Plan: 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

- APR: 21.24%–28.24% variable APR

- Annual fee: $95

- Balance Transfer Fee: 5% or $5, whichever is greater

- Foreign Transaction Fee: $0

- Sign Up bonus: 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

- 0% APR Introductory Rate: N/A

- Point Sign-Up Bonus

- Bonus Points

- No Blackout Dates

- 25% More through Ultimate Chase Rewards

- No Foreign Transaction Fee

- $95 Annual Fee

- Low Merchandise Rewards

- No Introductory 0%

- Balance Transfer Fee – 5% or $5, whichever is greater

- Does the travel rewards points expire? Your points won’t expire once you keep the credit card account open.

- Does card Chase Sapphire Preferred offer pre-approval? Yes, you are able to pre-qualify for this card.

- What is the initial credit limit? The minimum credit limit that you can get with this card type is usually $5,000.

- How do I redeem cash back? You can redeem your points in a variety of ways through the Chase credit card reward portal. Some of the perks you can get include cash, travel credit, statement credit, and gift cards.

- What purchases don't earn cash back? All purchases will earn cashback through this card.

- Should You Move to Chase Sapphire Preferred card? If you travel frequently and do not want to pay a large annual fee.

- Why did the Chase deny me? You might not have met one of its requirements. You will usually find out where you fell short. You might be able to rectify the issue or you might have to look elsewhere.

- How hard is it to get a Chase Sapphire Preferred card? If you meet all of the requirements, then it is relatively straightforward to get a Chase Sapphire Preferred card. The requirements are easier compared to Chase Sapphire Reserve card.

- Is there a limit to rewards/cash back on the Chase Sapphire Preferred card? No limit

- Can I get car rental insurance with a Chase Sapphire Preferred card? how? Yes, you can get car rental insurance with this card if you decline the collision cover of the rental company and pay for the entire cost of the rental car with this card.

Discover it® Cash Back

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Discover it® Cash Back is one of our favorites, mainly due to its high flexibility. This card offers a very high rewards rate on some categories that rotate every few months. The card gives a 5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases. This is one of the best cards for gas and groceries, and some of the categories include restaurant, online shopping and many more.

However, on all other purchases, excluding the ones in the category selected, you will only receive a 1% cashback. The Discover it® Cash Back also offers 15 months on purchases and balance transfers and a great sign up bonus. This card is best for individuals who understand their spending habits and want to leverage the high reward rate the card offers, or those who plan a big purchase in the next couple of months.

- Rewards Plan: 5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

- APR: 17.24% – 28.24% Variable

- Annual fee: $0

- Balance Transfer Fee: 5%

- Foreign Transaction Fee: $0

- Sign Up bonus: All cash back earned at the end of the first 12 months is matched.

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- 0% Intro APR Period

- High Cash Back for Select Spending Categories

- Matches Cash Back in the First 12 Months

- No Annual Fee

- Limit on Cash Back Spending Per Quarter

- Keeping Track of Bonus Categories

- Less Merchant Acceptance

- Balance Transfer Fee

- What are the cash-back rewards limit? There is a $1,500 cap on purchases each quarter that allows you to get the bonus cashback rates. Otherwise, no cap.

- Does Discover it Cash Back ask for proof of income? No out and out request for proof of income and no transparent income requirements.

- Does card rewards points expire? No expiry date for these points.

- Can I get pre-approved on card Discover it Cash Back? Yes, you can get pre-approval.

- What is the initial credit limit of card Discover it Cash Back Card? The minimum credit limit will be $300.

- How do I redeem cash back? You can get the rewards in the form of cash, statement credit, or gift cards.

- What purchases don't earn cash back ? All purchases will earn cashback.

- Should You Move to Discover it Cash Back Card? If you want to get good rewards from bonus categories and want access to a good signup offer.

- Why did Discover deny me? What to Do Next? You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

U.S. Bank Cash+ Visa Signature

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The U.S. Bank Cash+ Visa Signature Card is a Visa credit card provided by one of the largest banks in the United States.

By using the U.S. Bank Cash+ Visa Signature Card, you have the opportunity to accumulate 5% cash back on purchases in two categories of your choice (up to $2,000 in combined purchases per quarter, then 1 percent). 5% back on prepaid air, hotel, and car reservations through the Rewards Center. 2% cash back on one choice everyday category. 1% back on all other purchases.

Additionally, this card presents a generous sign-up bonus of $200 bonus after spending $1,000 in eligible purchases within the first 120 days of account opening.. Moreover, it offers a substantial 0% introductory rate for an extended period, and there is no annual fee associated with the card.

- APR: 19.49% – 29.74% (Variable)

- Annual fee: $0

- Balance Transfer Fee: $5 or 3%, the greater

- Foreign Transaction Fee: 3%

- Rewards Plan: 5% cash back on purchases in two categories of your choice (up to $2,000 in combined purchases per quarter, then 1 percent). 5% back on prepaid air, hotel, and car reservations through the Rewards Center. 2% cash back on one choice everyday category. 1% back on all other purchases

- Sign Up bonus: $200 bonus after spending $1,000 in eligible purchases within the first 120 days of account opening.

- 0% APR Introductory Rate period: 15 billing cycles on purchases and balance transfers

- Sign-Up Bonus

- Cash Back Rewards

- 0% APR Introductory

- No Minimums for Redemption

- Choose Spending Categories

- Restriction on Cash Bonuses

- Foreign Transaction Fee

- Balance Transfer Fee

- Opt in Every Quarter

- Visa Signature Card

What is the initial credit limit?

The starting credit limit for either of these cards can be as low as $1,000, but it is typically between $1,000 and $1,500 depending on a number of factors including your credit history, income and existing debt.

How much is 10,000 points worth?

The Cash+ reward system is easy to understand as you simply earn a percentage of your purchases as cash back.

What are the top reasons not to get the Cash+ card?

If you’re a keen traveler, you’re likely to be disappointed by the lack of travel rewards and redemption options. If you’re looking for a travel card, there are far better options, particularly if you have good to excellent credit.

What are the card income requirements?

You’ll need good to excellent credit for the Cash+. However, U.S Bank will consider your income when determining your initial credit limit upon approval.

Is there a cash back limit?

You can only earn 5% on $2,000 of combined purchases across the two categories each quarter. After this, the cash back rate will drop to the base 1%. However, there is no cap on the 2% category.

Chase Freedom Unlimited®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Chase Freedom Unlimited® card provides an enthralling combination of lavish rewards, including a 5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases. It offers a nice sign-up bonus of Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening..

Another beenfit worth mentioning is the long 0% intro APR – 15 months on purchases and balance transfers (20.24%–28.99% variable after that). Overall, Chase Freedom Unlimited is one of the best options in the market, especially for those who are looking to save the annual fee. The main difference betweeb the Freedon Unlimited and the Freedom Flex card is the rewards model.

- APR: 20.24%–28.99% variable

- Annual fee: $0

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: 3%

- Rewards Plan: 5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases

- Sign Up bonus: Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- Cash Back Rewards + Sign Up Bonus

- 0% APR on Balance Transfers & Purchases

- No Annual Fee

- Protection & Free Credit Score

- Balance Transfer Fee

- Foreign Transaction Fee

- Less Relevant For Frequent Travelers

- Is there a limit to cashback rewards? There is no cap.

- Can I get car rental insurance with a Chase Freedom Unlimited card? Yes, when you rent the car and pay for all of it with this card and do not accept coverage from the rental company.

- Should You Move to Chase Freedom Unlimited card? This is a good fit for people who are looking for no annual fee card including good cashback rates that do not change.

- Why did Chase Freedom Unlimited card deny me? You might not have met one of the requirements for this card. You can talk with a member of the customer support team to see what the issue is and how you might be able to rectify it.

- How hard is it to get a Chase Freedom Unlimited card? It is not very hard to get this type of card once you meet all of the straightforward requirements.

- How to maximize rewards on the Chase Freedom Unlimited card?

- You can choose between the options as to how you utilize the rewards. To maximize rewards, you should make the most of the signup bonus and also be aware of which of your credit cards have the best cashback for a particular type of purchase.

- Top reasons NOT to get the Chase Freedom Unlimited card? If you are looking for higher flat cashback rates. You may also travel a lot and not want to pay the 3% foreign exchange transaction charge that comes with this card.

- Does Chase ask for proof of income? There is no specific income requirements and it does not usually ask for proof of income requirements.

- Does the card offer pre-approval? Yes, you can get pre-approval.

- What is the initial credit limit? The initial credit limit varies, but can often be between $1,000 and $5,000.

- How do I redeem cashback? Go to the Ultimate Rewards section that Chase offers and you can choose between the options as to how you utilize the rewards.

- What purchases don't earn cashback with the Freedom Unlimited card? All purchases earn cashback with this card.

U.S. Bank Shopper Cash Rewards

U.S. Bank Shopper Cash Rewards Review

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The U.S. Bank Shopper Cash Rewards Visa Signature Card offers an enticing rewards program for cardholders – 6% cash back on your first $1,500 in combined eligible purchases each quarter at two retailers you choose, 3% back on your first $1,500 in eligible purchases each quarter on your choice of one everyday category, 1.5% back on all other qualifying purchases. Also, 5.5% back on reservations for hotels and prepaid car rentals when you book through the U.S. Bank Rewards Center.

Also, this card provides a $250 bonus after you spend $2,000 in eligible purchases within the first 120 days of account opening. The first year comes with no annual fee.

The application process is swift, with decisions made in as little as 60 seconds. Flexible redemption options allow for cash back as a statement credit, rewards card, merchant gift cards, or direct deposits into U.S. Bank accounts.

- Rewards Plan: 6% cash back on your first $1,500 in combined eligible purchases each quarter at two retailers you choose, 3% back on your first $1,500 in eligible purchases each quarter on your choice of one everyday category, 1.5% back on all other qualifying purchases. Also, 5.5% back on reservations for hotels and prepaid car rentals when you book through the U.S. Bank Rewards Center.

- APR: 19.74% – 29.74%

- Annual fee: $95 ($0 on first year)

- Balance Transfer Fee: 3%, $5 minimum

- Foreign Transaction Fee: 3%

- Sign Up bonus: $250 bonus after you spend $2,000 in eligible purchases within the first 120 days of account opening

- 0% APR Introductory Rate period: 15 billing cycles if you transfer a balance in the first 60 days of opening your account

- High rewards rate

- High Welcome Bonus

- Bonus categories

- Annual fee

- Must enroll each quarter

- Foreign transaction fee

What are the eligible 6% bonus categories for this card?

The card offers 6% cash back at retailers like Apple, Amazon.com, Best Buy, Home Depot, Target, and more. The list is subject to change

How quickly can I get a decision on my card application?

You can receive a decision in as little as 60 seconds when applying for the U.S. Bank Shopper Cash Rewards Visa Signature Card.

What are some additional benefits of the U.S. Bank Shopper Cash Rewards Visa Signature Card?

Card benefits include purchase security, extended warranty protection, return protection, ID Navigator identity theft protections, and special guest status at 900+ Visa Signature Luxury Hotel properties worldwide.

Can cash back be redeemed for travel rewards with this card?

The redemption options are primarily cash-based, and travel transfer partners are not available.

Blue Cash Preferred® Card from American Express

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

Rates & Fees, Terms Apply

- Overview

- Features

- Pros & Cons

- FAQ

Considered as one of the best american express credit cards, The Blue Cash Preferred® Card from American Express offers an outstanding 6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit and U.S. gas stations, 1% cash back on other purchases , making it a suitable choice for commuters and a 2.70% fee on foreign transactions. Terms Apply.

However, warehouse clubs and superstores are not included. The American Blue Cash Preferred Card charges an annual fee of $95 ($0 intro for the first year), but you can justify this if you reach the higher cashback threshold in U.S. supermarkets. This makes the card suitable for individuals that buy or purchase their groceries at traditional supermarkets. New cardmembers can earn up to $250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months.

- Rewards Plan: 6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit and U.S. gas stations, 1% cash back on other purchases

- APR: 19.24% – 29.99% Variable

- Annual Fee: $95 ($0 intro for the first year)

- Balance Transfer Fee: $5 or 3%, whichever is greater

- Foreign Transaction Fee: 2.70%

- Welcome Bonus: $250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

- 0% APR Introductory Rate Months: 12 months on purchases and balance transfers

* Terms Apply

- Welcome Bonus

- Cash Back Rewards

- 0% APR Intro

- Redeeming Options

- Extended Warranty on Purchases

- $95 Annual Fee

- Short Introductory Rates

- Balance Transfer Fee

- Foreign Transaction Fee

- Minimum Redemption Amounts

- Is there a limit to rewards/cash back? You can get the premium cashback rate on groceries until you have annual purchases in this area of $6,000. The rate then goes to 1%.

- Can I get car rental insurance? how? Yes, you will get this insurance if you refuse the car rental company’s insurance coverage and you pay for the entire cost of the rental with this card.

- Does it have a cash-back/point rewards limit? You can get the premium cashback rate on groceries until you have annual purchases in this area of $6,000. The rate then goes to 1%. Otherwise, there are no restrictions.

- Do you need a proof of income? No transparent income requirements or proof of income requests.

- Does the rewards points expire? They do not expire once you keep your account open and meet a few basic conditions.

- Can I get pre-approved? Yes, you can get pre-approval.

- What is the initial credit limit? It will be at least $1,000 and usually greater.

- How do I redeem cash back? The rewards will be credited to you in the form of a statement credit.

Wells Fargo Autograph Card

Reward details

3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Wells Fargo Autograph Card offers a compelling option for those seeking a no-annual-fee rewards card with a diverse range of bonus categories

The card offers 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchasess. However, it lacks travel perks compared to traditional travel rewards cards, and its travel redemption options are limited.

Cellphone protection, My Wells Fargo Deals, and Auto Rental Collision Damage Waiver coverage are among the card's notable perks. Despite not offering transfer partners, the card's flexibility in redeeming points for cash rewards or travel, along with the ability to withdraw rewards from an ATM, adds to its appeal.

- Rewards Plan: 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

- APR: 21.49%–28.49% variable

- Annual fee: 20.24% – 29.99% variable

- Balance Transfer Fee: $5 or 3% (the greater)

- Foreign Transaction Fee: $0

- Sign Up bonus: 20,000 bonus points when you spend $1,000 in purchases in the first 3 months

- 0% APR Introductory Rate: 12 months on purchases

- Everyday & Travel Rewards

- My Wells Fargo Deals

- 0% Intro APR

- No Foreign Transaction Fee

- Wells Fargo Credit Close-Up

- Basic Card

- No Transfer Partners

- No 0% APR On Balance Transfer

What makes the Wells Fargo Autograph Card stand out?

The Autograph Card stands out with its broad range of reward categories, including restaurants, gas stations, transit, travel, and more, making it suitable for those with diverse spending patterns.

What perks come with the Autograph Card?

The card offers cellphone protection, My Wells Fargo Deals reward opportunities, auto rental collision damage waiver, and Visa Signature perks such as concierge service and Luxury Hotel Collection privileges.

Can you redeem Wells Fargo Autograph points for travel?

While the card offers various redemption options, including travel, the value of points for travel is limited to 1 cent per point.

Can I use the Autograph Card's points for cash back?

Yes, you can redeem your points for cash back as a statement credit or a deposit to your Wells Fargo savings, checking, or money market account at a value of 1 cent per point.

What makes the Autograph Card's redemption options flexible?

The card provides flexibility in redemption, allowing points to be redeemed for various options, including cash rewards, travel, or withdrawal from an ATM, making it convenient for cardholders with different preferences.

Citi® Double Cash Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

Looking for a credit card issuer that offers an unrivaled flat-rate cash back rewards on all your purchases with no annual fee and a straightforward reward structure, then look nowhere else; Citi Double Cash is the best for you. You can get up to 1% cashback when you use the card plus an additional 1% whenever you make a payment. The flexible redemption options of this card make it a potentially lucrative option for its users.

Some of the benefits you can get from using this card include an outstanding intro APR of 18 months on balance transfers as well as $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. If you're looking for a rotating category card of Citi, the Citi Custom Cash provide higher cash bacl rate – but it's capped, unlike the Double Cash card.

- Rewards Plan: 2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

- APR: 19.24% – 29.24% (Variable)

- Annual fee: $0

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: 3%

- Sign Up bonus: $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening

- 0% APR Introductory Rate period: 18 months on balance transfers

- Simple and Generous Rewards System

- 0% Intro APR

- Fee Waiver on First Late Payment

- No Annual Fee

- Average Cashback Rate

- Balance Transfer Fee

- Foreign Transaction Fee

- Is there a limit to cash back rewards? No limit in place

- Can I get car rental insurance with Citi Double Cash? Yes, it offers rental insurance for cars if you pay for the full cost with this credit card and you decline the rental company’s insurance.

- What are the income requirements? No out and out income requirements and normally you will not have to provide proof of income.

- Does cash back rewards expire? They don’t expire once you keep your account open.

- Does card Citi Double Cash Credit Card offer pre approval? Yes, pre-approval is a possibility.

- What is the initial credit limit? It will normally be at least $500.

- How do I redeem cash back? You will be able to redeem the cashback points through direct deposit, check, or as a statement credit. You can also use them in other ways, such as spending on gift cards, Amazon.com, and on travel.

- What purchases don't earn cash back? All purchases earn cashback

- Should You Move to Citi Double Cash Card? If you like predictability and want an incentive to meet your payment commitments.

- How to maximize rewards on Citi Double Cash ? Make sure that you make your minimum due payments.

- Top Reasons NOT to get the Citi Double Cash? If you want a higher cashback rate you may need to look for another card.

Hilton Honors Surpass American Express Card

Hilton Honors Surpass American Express Card

Reward details

Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Hilton Honors American Express Surpass® Card is a co-branded credit card tailored for regular Hilton guests seeking valuable perks without the high annual fee of the premium Aspire Card. The Surpadd card earns Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases.

The ongoing benefits include automatic Hilton Gold elite status, providing perks such as complimentary breakfast, increased points earnings, and space-available upgrades at Hilton properties. The annual fee of $150 is justified by these benefits, including up to $200 in Hilton statement credits, a free night reward for $15,000 in annual spending, and complimentary National Car Rental Emerald Club Executive status.

While the card has advantages like automatic Gold elite status and a solid earning rate, its drawbacks include the lower value of Hilton points, an annual fee, and limited travel protections.

- APR: 20.99% – 29.99% variable

- Annual fee: $150

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Rewards Plan: Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases

- Sign Up bonus: 130,000 Hilton Honors Bonus Points after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership

- 0% APR Introductory Rate period: N/A

- Automatic Hilton Gold Elite Status

- Statement Credits

- No Foreign Transaction Fees

- Hilton Points Value Is Low

- Annual Fee

- Low Ratio When Tranferring To Airline

Who is the ideal candidate for the Hilton Honors American Express Surpass Card?

The card is best suited for regular Hilton guests seeking a balance of benefits and rewards without the high annual fee of premium cards.

What is the spending requirement for earning Hilton Diamond status with this card?

Cardholders can achieve Hilton Diamond status by spending $40,000 on the Hilton Surpass card within a calendar year.

What is the primary drawback of the Hilton Surpass card?

The perceived lower value of Hilton Honors points compared to other loyalty programs is a notable drawback.

Can I pool Hilton Honors points with other members?

Yes, Hilton allows cardholders to pool points with up to 10 other members, providing flexibility for combining points for award stays.

How can I earn a free night reward with the Hilton Surpass card?

Spending $15,000 on eligible purchases in a calendar year qualifies cardholders for a free night reward that can be used at any Hilton property.

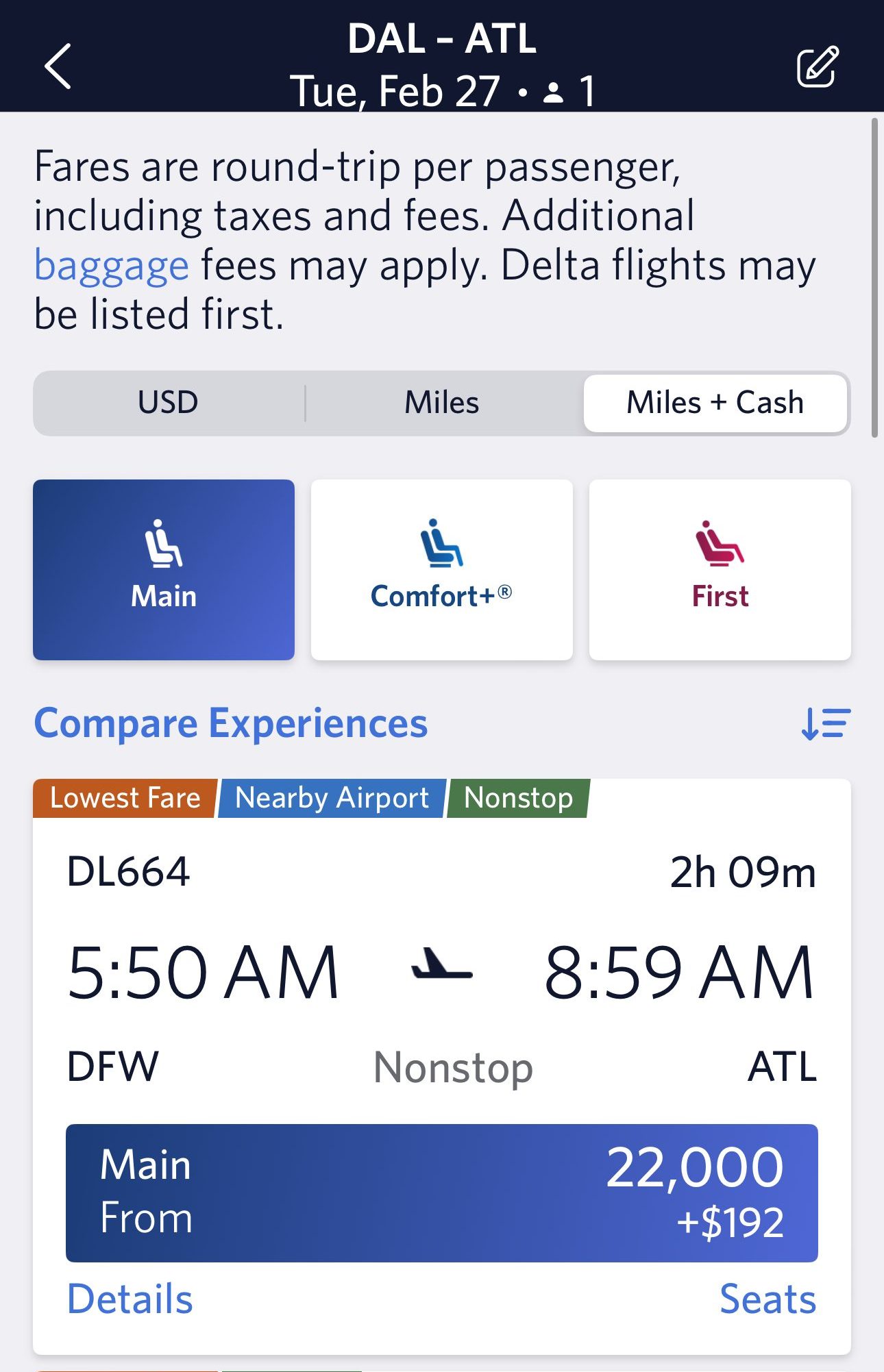

Delta SkyMiles® Platinum American Express Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

On Amex One Website, Terms Apply

- TSA Precheck & Additional Rewards

- Pros & Cons

The Delta SkyMiles® Platinum American Express Card offers one credit per four or 4.5 year period for either Global Entry or TSA PreCheck respectively. You’ll need to pay for your enrollment fee using your Delta SkyMiles Platinum card, and the credit will be automatically applied to your statement.

If you're looking to improve your Delta Medallion status, the card offers a welcome bonus of 50,000 bonus miles after you spend $3,000 in your first six months.

The card also provides a status boost if you hit the annual spending requirement; there is a first checked bag free for you and up to eight travel companions, priority boarding, and a companion certificate on your account anniversary.

- First Class, Comfort+® or Main Cabin

- Free Global Entry or TSA PreCheck

- Upgrades

- No Foreign Transaction Fee

- Trip Delay Insurance

- Medallion Status Boost

- The Centurion® Lounge

- Free First Checked Bag

- Car Rental Damage and Loss Insurance

- $350 Annual Fee

- Rewards Rate Could Be Better

Capital One Savor Cash Rewards Credit Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One credit card is the Savor card, which offers unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.. Rewards don’t expire for the life of the account, and you can redeem cash back for any amount.

In addition, there is a significant sign up bonus of $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening, as well as no foreign transaction fee.

However, if you don’t spend enough on these types of activities then you won’t get ahead much on the rewards due to the $95 annual fee.

- Rewards Plan: unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.

- APR: 19.99% – 29.99% Variable

- Annual fee: $95

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: $0

- Sign Up bonus: $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening

- 0% APR Introductory Rate period: None

- Sign Up Bonus

- High Cash Back

- No Rotating Categories

- $95 Annual Fee

- Approval Can Be Strict

- No 0% Intro APR

- Can I get car rental insurance with Capital One Savor? Yes, once you refuse the insurance offered by the rental company you will automatically get coverage if you fund the entire purchase through this card.

- Does it have a cash-back rewards limit? There is no limit.

- Does Capital One ask for proof of income? No out and out request for proof of income and no transparent income requirements.

- Does Capital One Savor Card offer pre approval? Yes, you can get pre-approval.

- What is the initial credit limit? The minimum credit limit is set at $5,000.

- How do I redeem cash back? You can get them sent to you in the form of a check, as a statement credit, or get them given to you through gift cards.

- What purchases don't earn cash back? All types of purchases are eligible for cashback with this card.

- Should You Move to Capital One Savor Card? If you spend enough on the premium cashback categories to justify the annual fee.

- Why did Capital One Savor Card deny me? What to Do Next? You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

- How to maximize rewards on Capital One Savor Card? Make the most out of the signup offer and use this card for the premium cashback categories to get the best bang for your buck.

- Top reasons NOT to get the Capital One Savor Card? If you will not reap enough rewards to justify the $95 annual fee.

What Is The Best Credit Card Overall?

A lot of consumers naturally wonder which credit cards offer the best value for their money, and which credit cards can best help them manage their finances and plan for the future.

It would be incredible if there were a single credit card that could help everyone manage their finances, with ideal benefits for every situation.

There’s just one problem, no perfect credit card exists for every situation.

Credit cards are designed for different kinds of situations. That means that there probably is a good credit card for you, no matter your situation, but that the best credit card for you isn’t going to be the same and the best credit card for someone else.

Here are some things to consider when you’re choosing a credit card.

- Why do you want a credit card? Are you looking for a way to manage monthly bills? Do you need to build credit? Are you a college student looking to learn to manage your own finances and build a credit history? Are you a frequent traveler looking for a credit card that can make travel more affordable?

- What’s your current credit score? The best credit card for you might be influenced by your credit score. The better your credit the more likely you are to qualify for cards with better rewards programs and additional bonuses for cardholders.

- Do you have a family? If you have family members, especially kids, you might need a different kind of credit card than if you’re single or looking for a business-use card. Getting a card that offers benefits on groceries, home supplies, and other items can make your family expenses much more affordable.

There are a lot of other questions when you’re looking for a good credit card, including what kind of rewards program you want to get and whether you’re a high or low spender, but those three questions will help you narrow down the best options for you.

Now that we’ve talked a little about how to choose the best credit card for you let’s look at some of the best credit card options right now.

Best Store Cards To Build Credit With

Store credit cards are a great way to start building credit without a lot of risks since store credit cards tend to have a lower credit limit than other kinds of credit cards. Plus, since these cards often come with discounts at your favorite retailers, they can also help to lower your cost of living.

Capital One® Walmart Rewards® Mastercard®

This card is a great option for most college students and families since Walmart offers such a wide selection. This card gives you a fairly good discount on Walmart purchases, including 5% cashback on all online orders as 2% cashback in-store.

This is also a store card that you can use for other kinds of purchases as well. It’s accepted anywhere Mastercard is accepted and offers 1% cashback on non-Walmart purchases.

The introductory 5% cashback in Walmart stores for the first 12 months can also be a great way to use your card a little more often, build your credit, and get good cashback rates as well. That makes this a good card for people who haven't had a credit card before, since it will help incentivize you to use the card and monitor its credit limit and payments.

Amazon Prime Rewards Card

The Amazon Prime Store Card requires you to have an Amazon Prime account, but it's a good option for college students and most consumers. Families will benefit from the cashback offers on the card in addition to the other products and services that come with prime, but it’s also a great option for travelers, big and small spenders, and almost everyone else.

That’s because this card offers 5% cashback on all Amazon purchases (with a Prime account). That’s a powerful reward when you consider that Amazon offers such a wide variety of products, increasingly faster shipping services, and has several other services attached to Prime membership.

This card also gives you occasional bonus rewards between 5-15% of purchase value on some promotional items. That means that the Amazon Prime Store Card is one of the highest rewards store cards currently available.

Best No Annual Cards For Everyday Purchases

Free credit cards don’t have an annual fee, are usually relatively easy to qualify for, and have limited fees associated with card ownership. They aren’t truly free, you can still be fined if you miss a payment or go over your spending limit, but they are significantly more affordable than other alternatives.

Blue Cash Everyday® Card from American Express

The Blue Cash Everyday® Card from American Express is a great card for everyday purchases thanks to its higher cashback rates on essentials like groceries (3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%). There is also a welcome bonus of $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months. Terms Apply.

It’s a reasonable option for single people who are looking for a moderate rewards program but who can’t afford the annual fees of a better rewards card.

Capital One Quicksilver Cash Rewards Credit Card

The Capital One Quicksilver card is another option that’s affordable, practical, and incredibly easy to manage. The cashback rate is another flat-rate unlimited cashback offer, 5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday..

The real advantage of this card is that you can redeem rewards in a variety of ways. The card’s reward system also works with PayPal, which means you have the option o directly paying for things online with your cashback rewards as well.

Citi Custom Cash Card

The Citi custom cash is ideal for those who want to earn more money in specific categories. After you sign up for this card, Citi will give you $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back). Cardholders can also earn 5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter.

The Citi Custom Cash Card, like other Citi cards, includes additional benefits such as contactless payment, digital wallets, automatic account alerts, $0 liability on unauthorized charges, and free access to your FICO® Score.

Top Offers

Top Offers

Top Offers From Our Partners

Best Secured Cards With No Annual Fee

Secured credit cards require a deposit, but they make credit cards much more accessible to people with less than perfect credit. These offers are attractive whether you have a bad credit history and want to rebuild, don't have much credit history, to begin with, or just can’t quite qualify for a non-secured card.

Secured Mastercard® from Capital One

This card has a variable deposit depending on your credit history and the limit on the card. But that also means that people with almost any credit history can qualify for this card so long as you can afford the deposit on the card.

This card is also fairly widely accepted in the U.S., you can use it anywhere Mastercard is accepted.

Since it’s a card from Capital One it’s also a great option if you want to rebuild your credit before applying for a different Capital One credit card. Once you’ve established yourself as a reliable cardholder with a good payment history you’re much more likely to qualify for one of their other cards.

Chime Credit Builder

Chime is something a little different in a credit card. It’s a card that connects to the Chime app, which means that you get a lot of access to your account details. It’s one of the better options for younger users who are used to accessing everything digitally.

Since this card is a Visa, it’s a great option to help build your credit up faster because it’s accepted at most retailers. You may even be able to use this card internationally if you travel.

There is no credit check required to apply for this credit card. However, you will need to have a linked Chime Spending Account to use this credit card.

All in all, though, this is a fantastic secured credit card for younger and technically savvy users.

Best Secured Cards With Rewards

Secured credit cards don’t have to be limited, and they can still be wonderfully accessible. Getting some rewards on your secured credit card can help you make sure you’re getting the full benefit from your credit card.

Discover it® Secured

The Discover it® Secured is exactly the card most people think of when they want an accessible secured credit card. This card helps build your credit history and is reported to all three major credit history companies, it’s a great way to get on the fast track to credit recovery.

This credit card also comes with a serious bonus: the deposit on the card is refundable. If you close the account with a good credit history or prove that you're a trustworthy cardholder, you'll be able to get some or all of your initial deposit back.

It’s also a good option because this card offers solid rewards, 2% cashback.

This is a good option for anyone who is looking to maximize their income while also rebuilding credit.

Bank of America® Customized Cash Rewards Secured credit card

The Bank of America® Customized Cash Rewards Secured is a great option for those who want to build their credit while also receiving a lot of rewards. To open the account, cardholders should make a security deposit of $300-$4,900, and Bank Of America will review your account on a regular basis to see if you are eligible to have your security deposit returned.

The card offers the same rewards model as the original Bank of America® Customized Cash Rewards: You'll get 3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%).

Best Cashback Cards With No Annual Fee

Cashback cards help you make the most of your income, and cashback cards without annual fees even more so. These cards are great for moderate spenders who won’t get the full benefit of cards with annual fees, but who have good credit and use their credit cards moderately often.

Chase Freedom Unlimited

This card gives you a fairly generous cash back offer – 5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases. This is really a good card for people who want to maximize their rewards for the lowest possible cost.

The Chase Freedom card is generally easier to get for members of Chase bank, but it’s available to anyone with qualifying credit. Since this card offers generous rewards, it does require relatively good credit, very good to excellent is best.

Bank of America® Customized Cash Rewards credit card

Bank of America cash rewards card is a good option for people who want a little more customization in their finances. The card offers 3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%).

It can be a great card for families if you choose the right cashback benefits. No annual fee and a 0% introductory APR are both good reasons to consider opening a Bank Of America Cash Rewards card. The card does require fairly good credit, so it’s generally not a good option for a first credit card.

Does a Credit Card With Annual Fee Worth it?

For many consumers, a lack of an annual fee is an attractive feature of any credit card. Lenders have recognized this trend, and today, most cards do not have an annual fee. However, savvy consumers want more from their credit cards. In this chart created with US news data, you can see the percentage of no-annual fee cards by card type.

Best Cashback Cards With 0% Intro

0% introductory offers are a good way to save money and make sure you're getting the most from your income. Of course, these offers are only temporary, so you don't want to run up a huge balance or you’ll end up paying interest later on.

Citi® Diamond Preferred® Card

The Citi Diamond Preferred Card is highlighted for its impressive 0% introductory APR offer for 21 months on balance transfers and 12 months on purchases , and ongoing APR of 18.24% – 28.99% (Variable). This can be beneficial for individuals seeking to pay off existing high-interest debt.

Pros include the extended introductory APR periods, a potentially lower ongoing APR compared to the average, and no annual fee. Additionally, the card allows flexibility with payment due dates and provides a free FICO credit score online.

BankAmericard® Credit Card

The BankAmericard® offers reasonable terms with relatively low APR, letting you keep more of your money and spend less on interest. These cards are great for people with good credit who are looking to develop great credit. The card has no penalty APR, no annual fees, and 0% APR for 21 billing cycles on purchases and balance transfers made within the first 60 days (16.24% – 26.24% Variable APR. after that).

The real advantage of this card is that it's a very secure and very monitorable card. That makes it a good choice for people who are concerned about identity theft, or who have already had identity theft affect their finances. Overdraft protection and mobile banking make this a good credit card for learning good credit card habits.

However, there really isn't much of a rewards program on this credit card, so its low-cost fee structure is the main reward of card membership.

Best Cashback Cards for Families

If you have a family you know how important every dollar can be, whether you're saving for presents, a family vacation, a treat for dinner, or expensive lessons and after-school clubs.

These cards give you cashback where it matters most and help families stretch their income to go further and do more.

Chase Sapphire Reserve®

The Chase Sapphire Reserve® can be a great fit for families who travel on a regular basis. It offers

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

. New applicants also earn a sign up bonus of 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.In addition to the basic rewards plan, there are a lot of special perks such as primary rental car coverage of up to $75,000 for theft and collision damage, complimentary priority pass select airport lounge membership, TSA PreCheck or Global Entry credit and multiple hotel and airline transfer partners. However, the $550 annual fee is quite high, so you need make sure your purchases cover it. Read more on our Chase Sapphire Reserve review.

Blue Cash Preferred® Card from American Express

The Blue Cash Preferred® Card from American Express might be the best card option for families with teenage boys since it helps the most with grocery bills. The card offers 6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit and U.S. gas stations, 1% cash back on other purchases . Terms Apply.

That means that you'll be able to keep your family well-fed and entertained at the same time. This card is really a good option that really covers all aspects of a family’s expenses.

Best Airline Cards For Frequent Flyers

Airline credit cards often offer some of the best travel benefits, especially for people who often fly with the airline offering the card. These are great for business people and frequent travelers since you need to fly a few times a year to get your money’s worth from this card.

Delta SkyMiles® Gold American Express Card

The Delta SkyMiles line of cards is actually three different American Express cards. That’s great because it lets consumers choose the credit card that best fits their travel habits and spending. The more often you travel the more premium a travel card you’ll likely want to get.

The Delta SkyMiles® Gold American Express Card offers 2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases (Terms Apply). There is a welcome bonus of 40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months.

Better yet, the card has it’s own matching system depending on how often you fly with Delta, which cabin you prefer to fly in, and other factors like your current credit rating. That matching system is great for making sure you get the right card for you.

That said, the annual fee is $150, $0 intro first year, so it’s likely only worth the cost for incredibly frequent flyers.

American Airlines AAdvantage MileUp℠ Card

The The American Airlines AAdvantage MileUp℠ Card is a Mastercard, which means it has wide acceptance inside of the United States but isn’t very commonly accepted internationally. It offers 2 AAdvantage miles per dollar on grocery stores and eligible American Airlines purchases, and 1 mile per dollar on other purchases, and a sign up bonus of 10,000 miles and $50 statement credit if you spend $500 in first 3 months.

The card helps balance that limitation by offering AAdvantage bonus miles on a lot of different kinds of purchases, including everyday purchases like groceries. American Airlines tickets also earn more points, and you’ll get a 25% discount on purchases onboard American Airlines flights.

This card is great for people who want to save up miles for a big trip as well since there are no limits on the number of miles you can earn while you have the account.

Best Electronic Store Cards

As more and more things run off electricity and the internet it’s gotten more and more important to get your electronic devices at a good price. Having an electronics store credit card is one great way to get discounts on electronic items.

These cards are especially good for people working in technical fields, who love gaming, or who need high-end computers and electronic devices for any reason.

My Best Buy® Visa® Card

My Best Buy® Visa® Card is one of the most ubiquitous electronics stores out there, and it’s a good all-purpose electronics store. You can buy everything from computers to gaming consoles to TVs, along with all the accessories here.

Best Buy's store card gives you 5% back in rewards on shopping at BestBuy, 3% back in rewards on gas purchases, 2% back in rewards on dining, takeout and grocery purchases, 1% back in rewards on everyday purchases.

How We Picked The Best Credit Cards: Methodology

To identify the best credit cards, our team conducted thorough research across various issuers, including major banks, credit unions, and fintech companies. Independently, our experts meticulously analyzed data to rate these cards based on four key categories:

- Rewards (40%): We evaluate the rewards structure, including cash back percentages, points, or miles earned per dollar spent, bonus categories, and redemption options. Cards offering higher rewards rates, versatile redemption choices, and valuable perks such as sign-up bonuses or statement credits score higher.

- Features (30%): This category assesses features crucial for cardholders, such as introductory APR offers, absence of foreign transaction fees, balance transfer options, and additional perks like travel insurance or purchase protection. Cards providing valuable benefits without excessive fees and competitive rates earn higher scores.

- User Experience (20%): We examine application simplicity, customer service quality, and online account management tools. Cards with user-friendly interfaces, responsive customer support, and convenient mobile apps or online portals receive higher ratings.

- Issuer Reputation (10%): We scrutinize each issuer's reputation, considering customer feedback, financial stability, and regulatory standing. Issuers with positive reviews from cardholders and a history of responsible lending practices receive higher ratings.

This comprehensive evaluation ensures that the best credit cards meet the diverse needs of consumers, offering valuable rewards, benefits, and a seamless user experience while maintaining a positive reputation in the industry.