Chase Bank

Fees

Our Rating

Current Promotion

APY Savings

- Overview

- Pros & Cons

- FAQ

Chase Bank may have a modern, trendy image, but they’re one of the oldest banks in the US. While the past few decades have not been kind to most major banks, Chase is an exception to the rule. JP Morgan Chase was one of the big winners of the 2008 Wall Street collapse, taking ownership of most of Washington Mutual's remains.

Chase is the biggest bank in the nation and offers a variety of banking products for almost any purpose and age. However, its savings accounts and CD rates are lower than what you can find in other banks.

They’ve also been expanding their brick-and-mortar footprint. Over the last five years, they’ve built almost 200 new branches.

Chase Bank can be a perfect fit if:

- You can meet the requirements for account fee waivers

- The credit card partners and deals appeal to you.

- You want a welcome bonus

- Variety of banking products

- Chase credit cards and Chase Ultimate Rewards

- Promotions

- Top Notch Digital Experience

- Low Interest Deposit Rates

- Fees

Does Chase offer a free checking account?

All Chase checking accounts—with the exception of those for children and students—have some sort of monthly maintenance fee.

However, if you satisfy one of a number of account requirements, you might be eligible to have this cost eliminated. For instance, the $12 fee for Chase Total Checking is removed if you keep your account balance at $1,500 or receive at least $500 in direct deposits.

Why are Chase deposit rates low?

A more conventional bank, Chase has a sizable branch network. While this is practical if you require in-person customer service, it significantly raises the bank's operating expenses.

Chase's rates may appear excessively low when compared to banks that solely offer services online, but you must keep in mind that you are essentially paying for the option to call a branch and speak to a representative if you have a problem or question.

Can a Chase Checking Account application be Rejected?

Chase will need to review your account application, as do the majority of institutions, to determine your eligibility. This indicates that there is a chance your application will be rejected. Chase will often let you know if your application has been declined, but you might not be given a reason why.

Chase does, however, offer a straightforward checking account that they can suggest if you don't have the credit history to be approved for one of their more feature-rich accounts.

Can I invest in gold products through Chase?

Chase offers access to investment alternatives from its sibling companies as a member of the JP Morgan group. In order to trade stocks, ETFs, and options, you can either work with an advisor or go it alone.

This implies that you can buy gold equities on this site. Additionally, new users can take advantage of limitless commission-free online trades with certain products for zero dollars. However, Chase has a highly open pricing structure, allowing you to choose your investment strategy with confidence.

What’s the easiest way to close a Chase bank account?

Online closure of your Chase bank account is the simplest option. You should be able to send a message requesting account deletion by logging in to your dashboard and selecting the “Secure Message Center” link. You ought to get a message outlining any additional queries and the steps for closing the account within two business days.

Additionally, you can close your account by calling the toll-free customer service number for Chase or visiting your nearby location, where a Chase professional will walk you through the procedure.

Do Chase accounts that are joint work?

Co-ownership is permitted for numerous accounts at Chase. You have the option of opening a joint account or including a second party in your already-existing account. Naturally, Chase must confirm the parties' identities.

Therefore, both of you will need to provide your information if you are new to Chase. However, if you already have a Chase account, you should be able to open your side of the account first, after which your partner can complete the verification steps.

Chase Bank Review

Banking Services | Credit Options | ||

|---|---|---|---|

Savings Accounts | Mortgage | ||

Checking Accounts | Government Mortgage | ||

CDs | Credit Cards | ||

Money Market Account | Debit Card | ||

Investing Capabilities | Personal Loans |

Customer Experience

The customer service system at Chase is quite extensive. A comprehensive website with a help page is available, as well as customer service lines, Twitter and Facebook support from 7 a.m. to 11 p.m. ET Monday through Friday and 10 a.m. to 7 p.m. ET on weekends.

You can also make an appointment with an agent at your local branch. Chase even has special lines for military personnel and veterans, whether they are in the United States or abroad.

The Chase website has a clean design and is simple to use, providing a good user experience. You can thoroughly investigate and compare banking products to find the best one for you. This is especially useful if you're looking for the best credit card option. Chase's app has received 4.8/5 stars on the Apple App Store and 4.4 stars on Google Play.

Chase Bank | |

|---|---|

App Rating (iOS)

| 4.8 |

App Rating (Android) | 4.4 |

BBB Rating (A-F) | B+ |

Contect Options | phone/social |

Availability | 7 AM – 11 PM

|

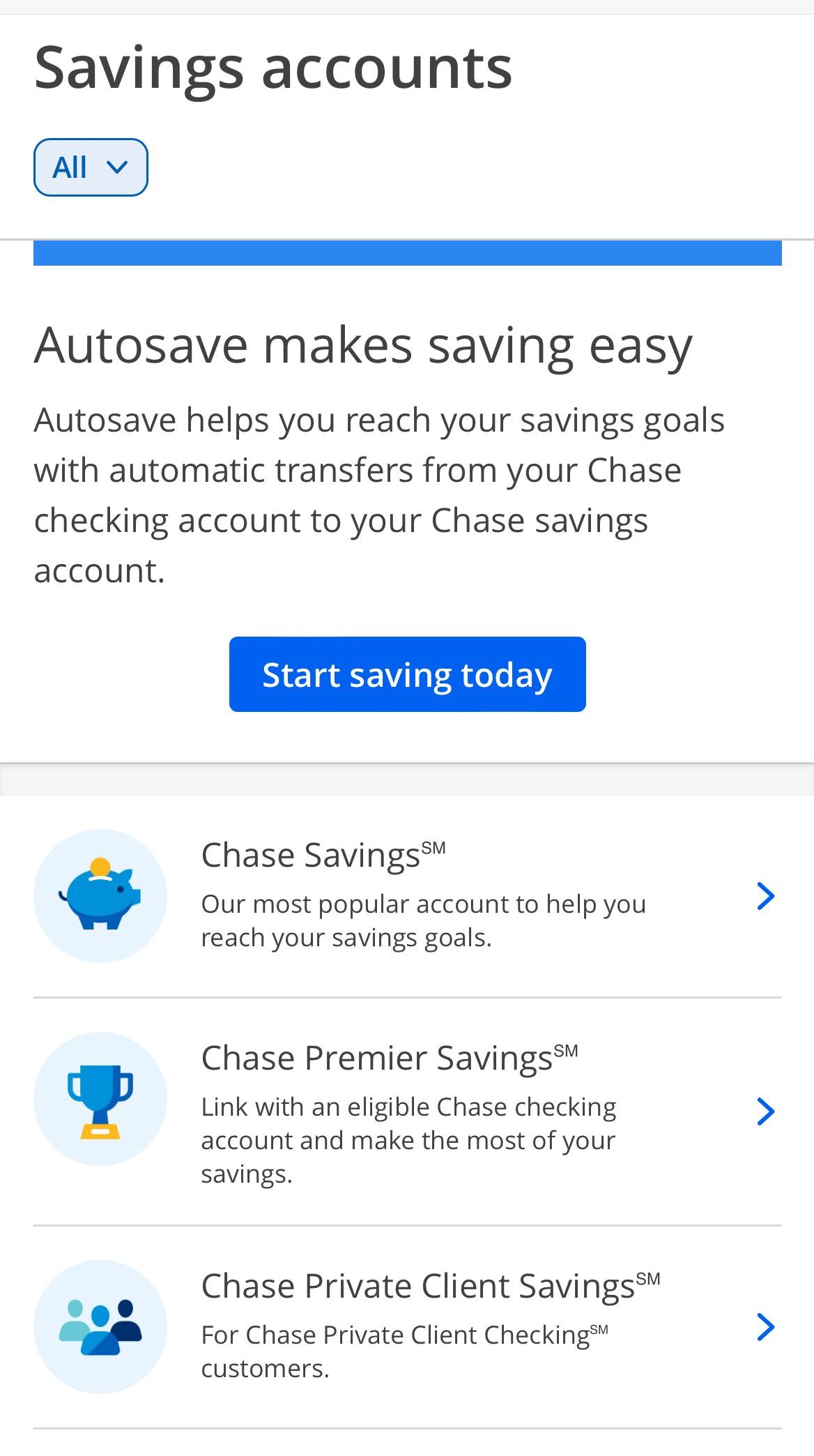

Chase Savings Account

APY Savings

Minimum Deposit

Promotion

Fees

Chase Savings Account

APY Savings

Minimum Deposit

Promotion

Fees

Chase’s most well-known savings account is the Chase Premier Savings account. This account earns below the national average APY, on a sliding scale that goes 0.01%.

Also, there are a couple of things to know. First, you’ll only earn an enhanced rate if you maintain – and use – a linked Chase Premier Checking or Chase Sapphire Checking account. When you make five register or PIN purchases monthly, you earn “relationship rates,” unlocking the higher APY. This has to be done monthly, so it’s only practical if you want a linked checking account.

A simpler alternative is to open a standard Chase Savings account. It only pays 0.01%, but there are no additional requirements. A Chase Savings account costs a $5 monthly fee to maintain, but the fee is waived if you have a balance of at least $300. It’s also waived for minors, making it a great savings option for kids.

But, the rate of Chase savings is very low, so if you are looking for a place to deposit your money, you may want to take a look at other high-yield accounts. For example, the Amex savings account offers 4.25% APY on savings, while Discover savings account offers 4.25% APY on any amount you deposit on your savings account.

Top Offers From Our Partners

![]()

Chase Bank Checking Account

Fees

Minimum Deposit

Promotion

APY Checking

Chase Bank Checking Account

Fees

Minimum Deposit

Promotion

APY Checking

Chase offers three main types of checking accounts. Their “standard” account is Chase Total Checking. This is a standard checking account with a $12 monthly service fee. However, the monthly fee is waived if you maintain a balance of $1,500 or more in your Total Checking or a linked savings account. The Total checking is one of the best bank checking accounts available and one of the most popular ones in the nation.

If you tend to maintain a higher balance, you might prefer the Chase Premier Plus Checking Account. It costs a $25 monthly service fee, but it is waived if you maintain a balance of at least $15,000 in the Premier Plus or any linked accounts. The main benefit is that this kind of account pays None interest, so it’s worthwhile for larger accounts.

The third option is Chase Sapphire Checking. This type of account costs a $25 monthly fee, which is not waivable. That said, there’s no minimum balance. There are also no ATM fees, even on out-of-network ATMs. This makes the Sapphire Checking account ideal for frequent flyers and anyone who travels a lot.

Lastly, Chase offers a Private Client Checking account, where customers can enjoy personalized customer service, access to invitation-only events, business banking advice, JPMorgan private advisor, and private client banker. However, you'll need to maintain at least $150,000 in your account.

Chase Bank does not charge a fee for counter checks, money orders, cashier’s checks, and Chase design checks. The monthly fees are steep, and the $34 overdraft fee is also a bit high. Ultimately, you’ll get a lot better value if you carry a large balance than if you only keep a few hundred dollars in your checking account. Of course, you can close your checking account at any time.

Our Real Experiences With Chase

Curious about the usability of the features offered by Chase Bank? Join us as we closely examine them, providing a comprehensive assessment of their user-friendliness and functionality for daily use.

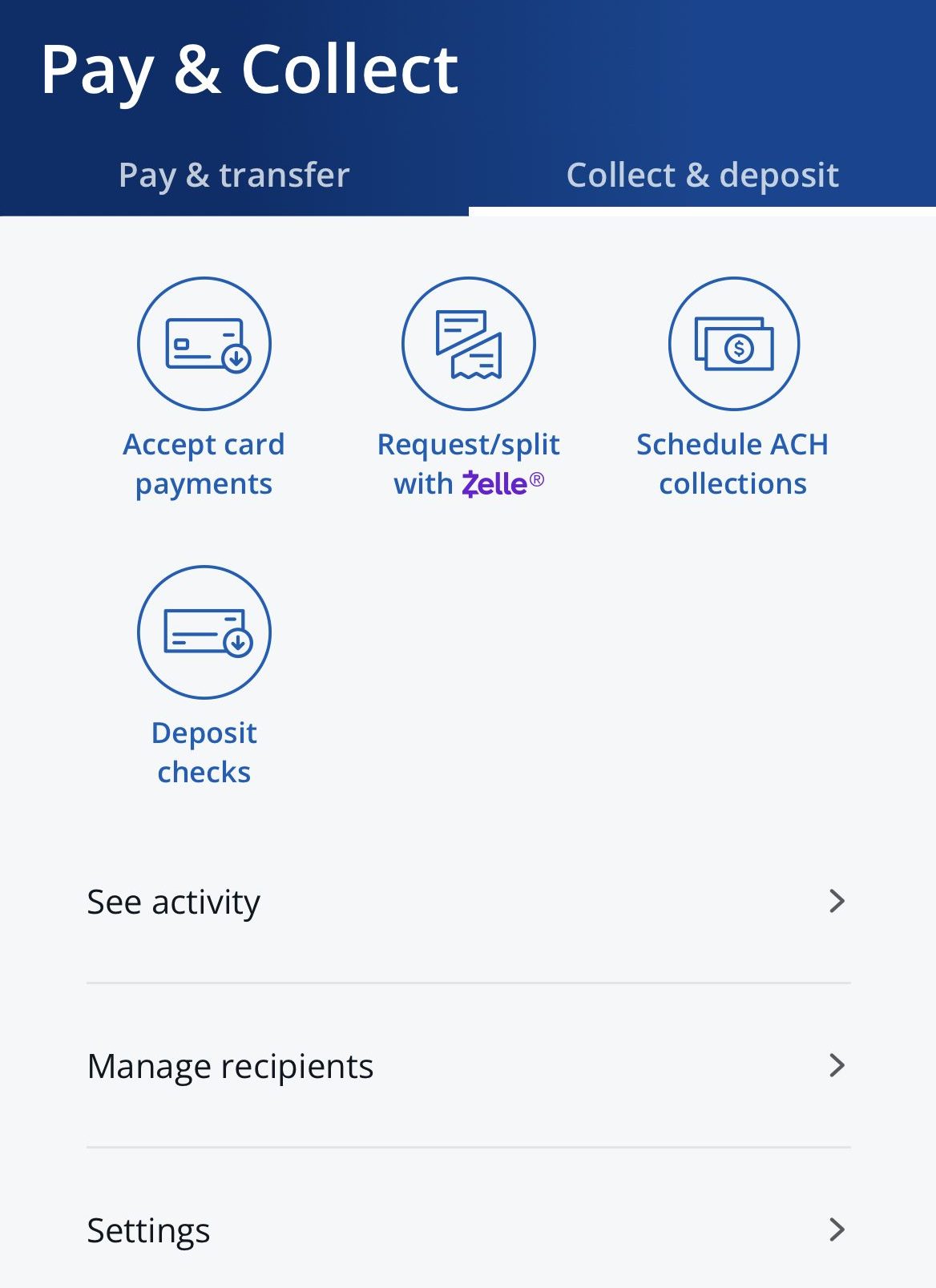

For those looking to expand their banking relationship, the app offers a gateway to explore additional products and services. Whether it's credit cards, loans, or investment options, users can discover and learn about a wide array of banking products.

The comprehensive set of payment options, including the ability to pay bills, transfer funds between Chase accounts, and even collect money from others, consolidates financial activities in one place.

The deposit options, coupled with QuickDeposit for checks, make the app a one-stop solution for various financial transactions.

Scheduling transfers between accounts or to external banks is a straightforward process. The app allows users to set up one-time or recurring transfers, providing flexibility and convenience in managing their finances.

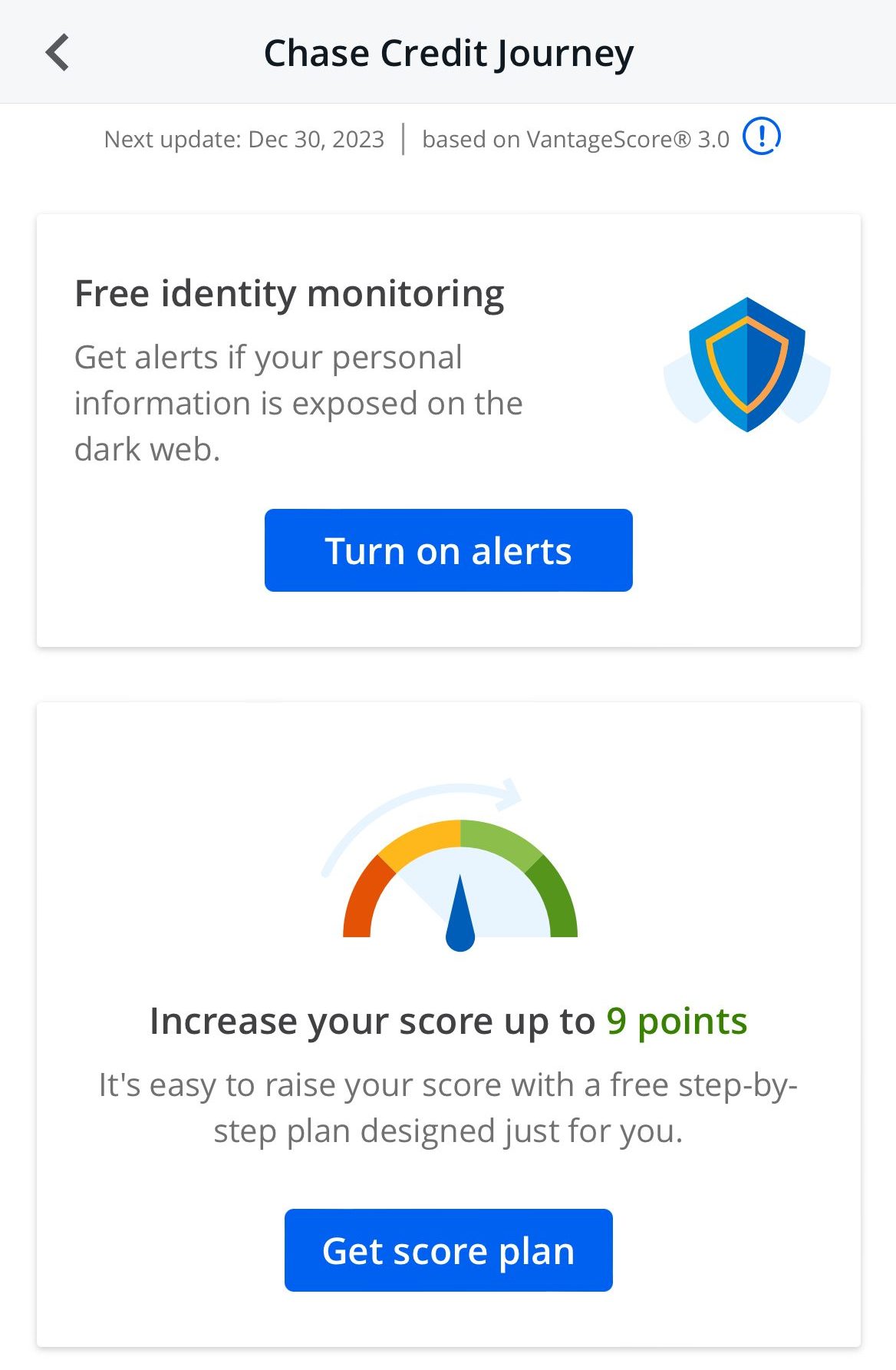

Credit Journey is an invaluable tool for those wanting to keep tabs on their credit health. The app provides users with their credit score, credit report details, and personalized tips for improving their score:

Lastly, the chatbot within the digital assistant brings a human touch to the app. It can assist with a range of inquiries, from transaction details to helping set up account alerts. However, it may not be helpful in some cases such as ordering checks:

Chase Bank CDs

APY Range

Minimum Deposit

Terms

Fees

Chase Bank CDs

APY Range

Minimum Deposit

Terms

Fees

Because of differences in state law, not all Chase CD offerings are available in all areas. To find out what’s available in your area, you’ll need to check their website and enter your location. Overall, Chase CD rates are quite low, but there are some promotional CDs, such as 6 months where customers can get quite a high rate.

What we can say for sure is that there is no minimum deposit for a Chase CD. However, you’ll only be able to get the best interest rates if you deposit at least $10,000. The APY can range is 3.00% – 4.75%. The more money you deposit and the longer the term, the higher interest you’ll earn.

Overall, Chase CDs offer lower rates than the highest CD rates you can find in the market.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 4.25% – 4.25% | 90 days of interest |

6 Months | 3.00% | 180 days of interest |

9 Months | 4.00% – 4.50% | 180 days of interest |

12 Months | 2.00% | 180 days of interest |

18 Months | 2.50%

| 180 days of interest |

24 Months | 2.50% | 365 days interest |

30 Months | 2.50% | 365 days interest |

36 Months | 2.50% | 365 days interest |

48 Months | 2.50% | 365 days interest |

60 Months | 2.50% | 365 days interest |

120 Months | 2.50% | 365 days interest |

Chase Credit Cards

Chase offers credit card options in addition to debit cards. There are seven hotel cards, seven business cards, and more than twenty travel cards. Chase even has partnerships with companies like Amazon, Starbucks, and Disney. This means you can select the card that offers the best rewards for your favorite brands and spending habits.

The majority of the best Chase cards have no annual fee, but there are a few exceptions, such as the Sapphire Preferred. While there is a $95 annual fee, it provides 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases. .

Card | Rewards | Bonus | Annual Fee |

| Chase Sapphire Preferred® Card | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $95

|

|---|---|---|---|---|

| Chase Freedom Flex℠ Card | 1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

| $200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

| $0 |

| Chase Freedom Unlimited® | 1.5% – 5%

5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases

| $200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| $0 |

| Chase Sapphire Reserve® | 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $550 |

| Marriott Bonvoy Boundless® Credit Card | 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 3 Free Nights

3 Free Nights (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months from your account opening

| $95 |

| United Explorer Card | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| 50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

| $95 ($0 first year) |

Chase also offers some co-branded travel credit cards, such as the United Explorer card or Marriot Bonvoy Boundless, where cardholders can earn 6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases..

Chase Money Market Funds

Chase Bank does not offer any money market accounts at this time. Because a money market account is more of an investment than a traditional bank account, that function remains on the JP Morgan side of the business. That said, there’s nothing stopping you from going to JP Morgan and opening a money market account.

Currently, JP Morgan offers six different money market funds, with investments in treasuries, private institutions, and other assets. Because of the nature of a money market fund, it’s impossible to say for sure what your yield will be. Like we said, it’s more of an investment than a standard account.

If you’re going to invest in a money market account, make sure you know what you’re doing. This would be a good time to talk to a financial advisor and learn more about your options.

Mortgage & Loan Options

Chase offers a variety of mortgages, including ARMs and fixed-rate loans, as well as Jumbo and FHA loans. Chase also allows prequalification, to help its customers speed up the home purchase process. The bank allows the purchase of discount points for both refinance and home purchase packages.

While Chase does not offer personal loans, it does offer auto loans to assist you in financing a new or used vehicle.

Top Offers From Our Partners

![]()

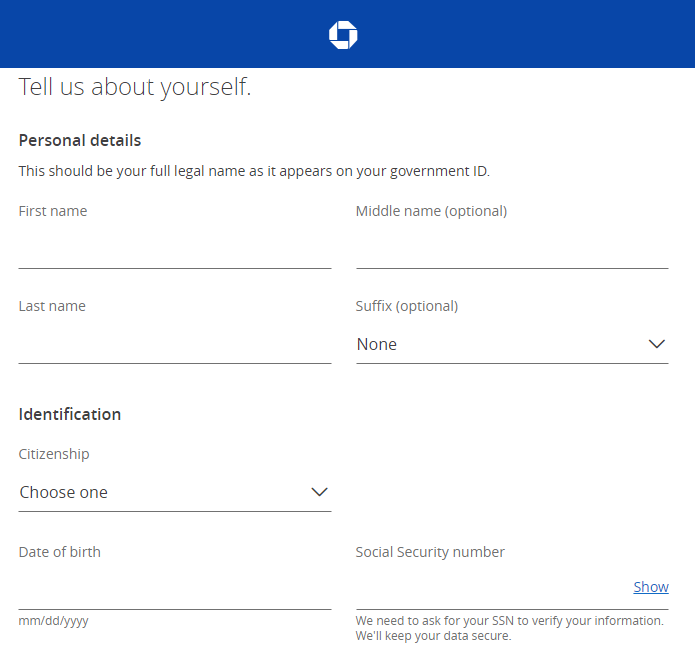

How to Open a Bank Account on Chase

Opening a Chase bank account can be done online. Here are the steps to take:

Step 1:

Visit the Chase Bank homepage. Some options will be provided to you; choose whichever you desire and click “Open now.”

Step 2:

Next, fill in your personal details and identification.Next, is your home address and contact info; fill in your street address, zip code, email address and phone number.

Step 3:

Next, go through the Consumer Report Authorization and then check the box to verify that the information you have provided is correct.

Lastly, you will get a notification if your application was successful or not.

Should You Consider Chase Bank?

As you can see, Chase Bank offers an array of account types that meet various needs. Whether you want a savings account or a revolving door checking account, you have an option.

Chase Bank isn’t perfect. The fees for out-of-network ATMs are a bit steep, and you’ll be using out-of-network ATMs a lot of you travel frequently. The interest rates on their CDs and savings accounts are also generally low. The exception is the Chase Premier Savings account, which offers competitive interest if you carry a large balance.

That said, there are plenty of locations, and the customer service is fast and friendly. You can also easily avoid monthly fees if you know how to use your account.

Chase Bank FAQs

What promotions do Chase offer?

As of July 2024, new Chase Total Checking customers can currently qualify for a $300 bonus. Chase also offers $100 if you set up a new Chase Secure Banking account and there are also offers for new credit card account holders.

All of these promotional offers do have qualification criteria, so it is important to check the small print, but these products can be a great way to get your hands on some free cash. Check out all Chase Bank promotions and bonuses.

Is Chase Bank trustworthy?

Chase Bank is a legit financial institution that is FDIC insured, so you have the reassurance of up to $250,000 of protection per depositor should the bank fail.

Additionally, Chase Bank has a number of safety measures to protect your data and financial details. These measures include multiple authentication, account activity monitoring and the latest in encryption technology.

Is Chase Bank good for online banking?

Chase Bank is a full service bank with a history dating back to 1799. While it has almost 4,900 branches, it also offers solid online banking services. The company has a solid digital footprint with its online banking platform and popular app.

The app is available for Android and iOS devices and offers 24/7 management for all your Chase accounts. This includes transfers, mobile check depositing, bill paying, account alerts, card lock and automated savings.

Is Chase Bank a good bank overall?

Chase Bank is a solid option for those who want to access a variety of banking products. You will need to maintain the minimum balance required or complete qualifying activities so fees are waived, but you can earn cash back or valuable rewards.

This makes Chase Bank a good choice for most customers from students to military veterans, who can enjoy great service. From time to time, you could also find bonuses and promotions for new bank accounts.

Chase Bank or Bank of America?

Both Chase Bank and Bank of America are large national banks with solid reputations, so it can be tricky to see much distinction between them. Both organizations have thousands of ATMs and branches with a variety of product choices.

When it comes to financial stability, Chase seems to be in a better position. Also, Chase credit cards are more attractive. Therefore, our Bank Of America review rating is lower than Chase.

Is Chase Bank better than Citibank?

Citibank is another sizeable national banking institution. Like Chase Bank, you’ll find Citibank offers a wide variety of banking products with competitive rates. Since both are traditional-style banks, you will find that Chase and Citibank bank account fees are higher than online banks.

However, if you want to distinguish between the two, Chase is a better option if you wish for greater access to branches, as Chase has a more extensive network.

On the other hand, Citibank's benefits include higher deposit rates on CDs and savings, a more extensive ATM network. If you’re interested in CDs, you’ll find Citibank offers higher rates.

Which is better: TD Bank or Chase?

Both TD and Chase offer mobile features for checking, savings, and investment accounts.

Both bank savings rates can be better, and the variety of Chase checking accounts and credit cards makes Chase a better option for most cases.

One of TD Bank's benefits is the higher rates on savings and CDs, so if you are looking to maximize your yield, TD may a better option.

Which is better: Discover Bank or Chase?

Although Chase is one of the biggest banks in the USA, with over 4,700 branches, Discover Bank's reputation is excellent when it comes to customer service. Discover provides access to 24/7 customer support if you have any queries or issues.

Discover Bank and Chase have a variety of banking products; there are no service fees with Discover. Discover has a massive fee-free ATM network with over 60,000 machines. So, unless there is a specific Chase product that appeals to you, you are likely to find Discover Bank a better option.

Alternatives Banks

APY Savings

The annual percentage yield (APY) is a percentage that represents the amount of money or interest earned on your savings account over the course of a year. The APY factored in compound interest. A savings calculator can help you quickly determine how much you'll earn with a given APY.

| up to 4.60%

| Up to 5.00%

| 4.25% |

Checking Account Fee

The monthly fee on checking account

| $0 | $0 | $0 |

Checking Minimum Deposit | $0 | $100 | $50 |

Mobile App Rating | 4.8/5 on iOS, 4.2/5 on Android | 4.6/5 on iOS, 4.2/5 on Android | 4.8/5 on iOS, 4.7/5 on Android |

BBB Rating | A+ | B

| A

|

Compare Chase Versus Alternative Banks

Although Chase Bank has a modern, trendy image, it is one of the oldest banks in the United States. JP Morgan Chase's consumer division, Chase Bank, is one of the largest banks in the United States. Even though its interest rates aren't particularly competitive when compared to online banks and credit unions, loyal Chase customers who keep a significant amount of money with the bank can earn slightly better rates.

American Express is best known for its credit card business. The financial services firm, on the other hand, has a banking subsidiary that offers high-yield savings and CD accounts. For those looking to save money with a well-known financial institution, the American Express High Yield Savings Account is a popular option.

Read Full Comparison: American Express vs Chase Bank

Chase and Wells Fargo appear to offer very similar products at first glance, so we need to dig a little deeper. There is little to distinguish the savings accounts, and both banks provide a variety of checking accounts.

While Chase's account maintenance fee is slightly higher, it does have some more interesting features. Chase also has an advantage in terms of CDs, but Wells Fargo is a better option for loans and mortgages.

Read Full Comparison: Chase vs Wells Fargo: Where to Save Your Money?

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

The Discover checking account is more traditional. While the account does not pay interest, you can earn 1% cash back on debit card purchases. There are also no fees if you require a replacement debit card, have a deposit item returned, or have insufficient funds in your account.

Chase offers a wide range of banking products, including savings accounts, checking accounts, home loans, home equity options, auto loans, and a wide range of credit cards. In addition, Chase's customer service system is quite extensive.

Read Full Comparison: Discover vs Chase: Which Bank Account Suits You Best?

Chase has some great features including a massive selection of credit card options. Both banks also offer some great mortgage packages. PNC also has some innovative credit card options, and you can also access personal loans.

Read Full Comparison: Chase vs PNC Bank: Which Bank Account Is Better?

Because both Chase and TD Bank provide a comprehensive range of products, we'll need to summarize the benefits and drawbacks to determine which bank is superior.

Chase offers some novel features, including the possibility of comparable CD rates without the TD Bank's minimum deposit. However, there is little to distinguish the checking accounts, as TD Bank's savings rate is twice that of Chase.

Although Chase has more credit card options, don't discount TD Bank, which has some interesting options.

Read Full Comparison: Chase vs TD Bank: Which Bank Suits You Best?

Chase and Capital One both have banking product lines that compete with traditional high street banks.

Capital One also has a competitive advantage in terms of checking accounts. The Capital One checking account is not only fee-free, but you can also earn interest on your account balance. Chase's checking account does not pay interest, and you must meet certain requirements to have the $12 monthly fee waived.

However, when you open a qualifying account, Chase will give you a welcome bonus, and its checking account has some nice features such as paperless statements for up to seven years and checking account upgrade options.

Read Full Comparison: Chase vs Capital One: Compare Banking Options

Both banks have account maintenance fees that can be waived by meeting one of several requirements. The rates are also quite similar, so which bank is best will come down to what products you’re looking for.

While Chase and U.S. Bank offer many banking services, Chase Bank is our winner in this competition. Here's why – and what else to know:

While Truist is a full service bank where you can find almost any financial product, Chase is our winner. Here's why – and what else to know:

We'll explore Chase and BMO Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison.

We believe Chase is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Chase vs. Fifth Third Bank

While Huntington Bank offers some better conditions when it comes to CDs and lending options, Chase is our winner. Here's why: Chase vs. Huntington Bank

Even though Regions Bank has better terms for CDs and loans, we're leaning towards Chase. Here's why, and our complete banking comparison: Chase vs. Regions Bank

Chase is the largest brick-and-mortar bank, while Ally Bank is among the best online banks. Here's our comparison and our winner: Chase vs. Ally Bank

Chase Bank is our winner, while Amex and Chase offer great banking services and credit card portfolios. Here's our side-by-side comparison: American Express Bank vs. Chase Bank

Chase is our winner as it is a better fit for most consumers than HSBC bank. But, there are important things to consider when comparing them: Chase Bank vs. HSBC Bank

Both Chase and Barclays offer a significant portfolio of banking services for US-based customers, but Chase is our winner. Here's why: Chase Bank vs. Barclays Bank

Chase Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.

Compare Chase Savings

There is no competition when it comes to savings rates – Discover wins Chase clearly. However, each of them has its own benefits and tools.

Chase Savings vs Discover Online Savings Account: Compare Side By Side

Ally Savings offers much higher savings rate compared to Chase Savings Premier. What other features and benefits they offer?

Chase Savings vs Ally Bank Savings Account: Compare Side By Side

Capital One Savings provides a significantly higher savings rate when compared to Chase. Let's explore the features and additional benefits.

Chase Savings vs Capital One 360 Performance Savings: Compare Side By Side

PNC offers much higher savings rate than Chase, but PNC states are very limited. Here's our full savings account comparison.

Compare Chase CDs

Chase and Wells Fargo offer competitive CD rates only on specific terms. Compare rates, minimum deposits, and early withdrawal penalties.

Overall, Capital One CD rates are higher than Chase. Compare CD rates, minimum deposit, early withdrawal fees, and alternatives.

How We Rated Chase Bank : Review Methodology

The Smart Investor team extensively reviewed hundreds of banks and credit unions. We assessed them based on four main categories, each with specific features:

-

Diversity of Products and Their Attractiveness (40%): We extensively analyzed the breadth and appeal of each bank's product offerings, including savings accounts, checking accounts, loans, investment options, and more. Higher ratings were assigned to banks with a diverse range of products that are attractive in terms of interest rates, fees, terms, and additional features. This category provides insights into the variety and value of the bank's offerings, crucial for meeting customers' diverse financial needs.

-

Account Features (30%): This category delves into the features and benefits accompanying each bank's accounts. We scrutinized factors such as promotions, deposit and withdrawal options, ATM accessibility, online and mobile banking functionalities, as well as additional perks like overdraft protection and rewards programs. Banks offering comprehensive and convenient features received higher ratings, reflecting the overall value of their accounts to customers.

-

Customer Experience (20%): A positive customer experience is paramount in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Bank Reputation (10%): The reputation of a bank is a critical consideration for customers. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were awarded to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories, individuals can make informed decisions that align with their financial needs and preferences, ensuring they choose a bank that offers competitive products, excellent features, a positive customer experience, and a solid reputation.

Banking Reviews

Alliant Credit Union Review