Table Of Content

When Chase Bank Wins?

Both Chase and Wells Fargo offer a fairly comprehensive product line that rivals a conventional high street bank.

In addition to savings and checking, Chase allows access to home loans, home equity options, and auto loans, along with an impressive variety of credit card options.

Chase can be a better choice than Wells Fargo if:

You want better CD rates

You are not planning on making more than 6 savings withdrawals in a month

You want the best savings rates

You want access to a massive selection of credit card options

When Wells Fargo Bank Wins?

Wells Fargo’s banking product line is even more impressive. There is a choice of savings accounts, different checking accounts, and investment options including 401ks, IRAs and wealth management services.

The bank also offers a variety of mortgages and loans. This ensures that making the switch to Wells Fargo is easy, as you can access all the banking products you expect from your current bank.

Wells Fargo can be a better choice than Chase if:

You’re interested in low deposit mortgages

You want access to multiple loan options

You want access to 24/7 customer service

Chase Bank | Wells Fargo | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

The Chase and Wells Fargo basic savings accounts are practically identical. They both offer a low interest compared to national average and have a service fee that can be waived by maintaining account balance among other things.

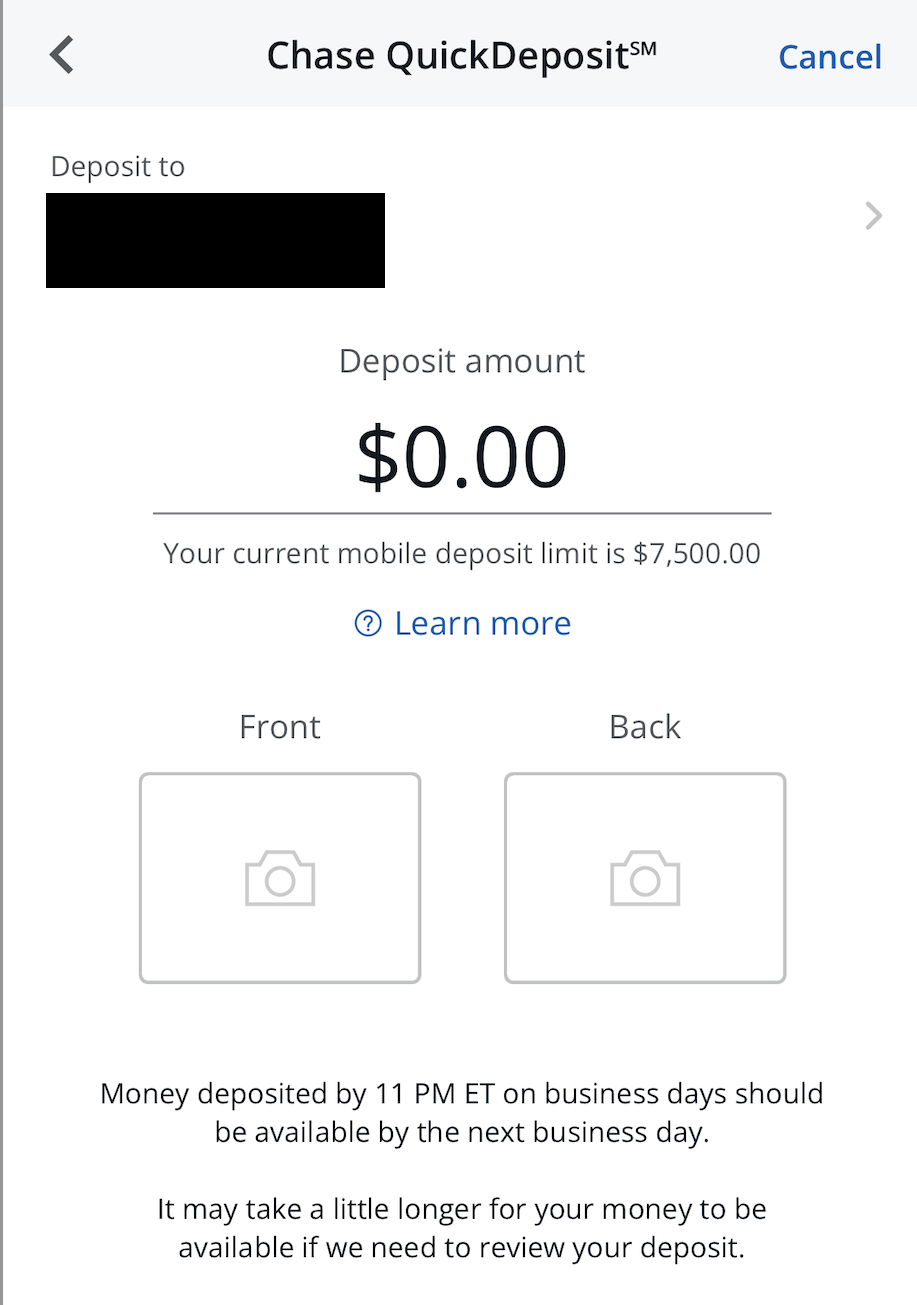

However, when you start to delve into the accounts, some differences do become clear. While both banks offer an auto save feature to assist you in your savings plans, and both banks allow you to manage your account via an app, Chase allows quick check deposits.

However, the crucial difference is that the Chase account does have some withdrawal restrictions. You’ll be charged a $5 withdrawal fee if you go over the six permitted withdrawals in any one month. Additionally, Wells Fargo does have a savings account upgrade, which offers further benefits including the potential to earn a bit higher rate.

Chase Bank | Wells Fargo | |

|---|---|---|

APY | 0.01% | 0.26% – 2.51% |

Fees | $5 per month

Can be waived if you carry $300 account balance at the start of the month, $25+ autosave or linking a Chase checking account

| $5

can be waived by maintaining a $300 minimum daily balance, one qualified automatic transfer, one or more Save as You Go transfers from your Wells Fargo checking account. Primary account owners age 24 or younger are exempt from the fees

|

Minimum Deposit | $25 | $25 |

Checking Needed? | No | No |

Main Benefits |

|

|

Checking Account

Both the Chase and Wells Fargo checking accounts offer no interest, but while Chase’s account has no minimum deposit, Wells Fargo requires $25 to open an account.

Both accounts carry a maintenance fee which can be waived with different requirements. For example, Wells Fargo requires a $500 minimum balance or $500+ in qualifying direct deposits, while Chase requires $500+ in electronic deposits or $1,500 account balance.

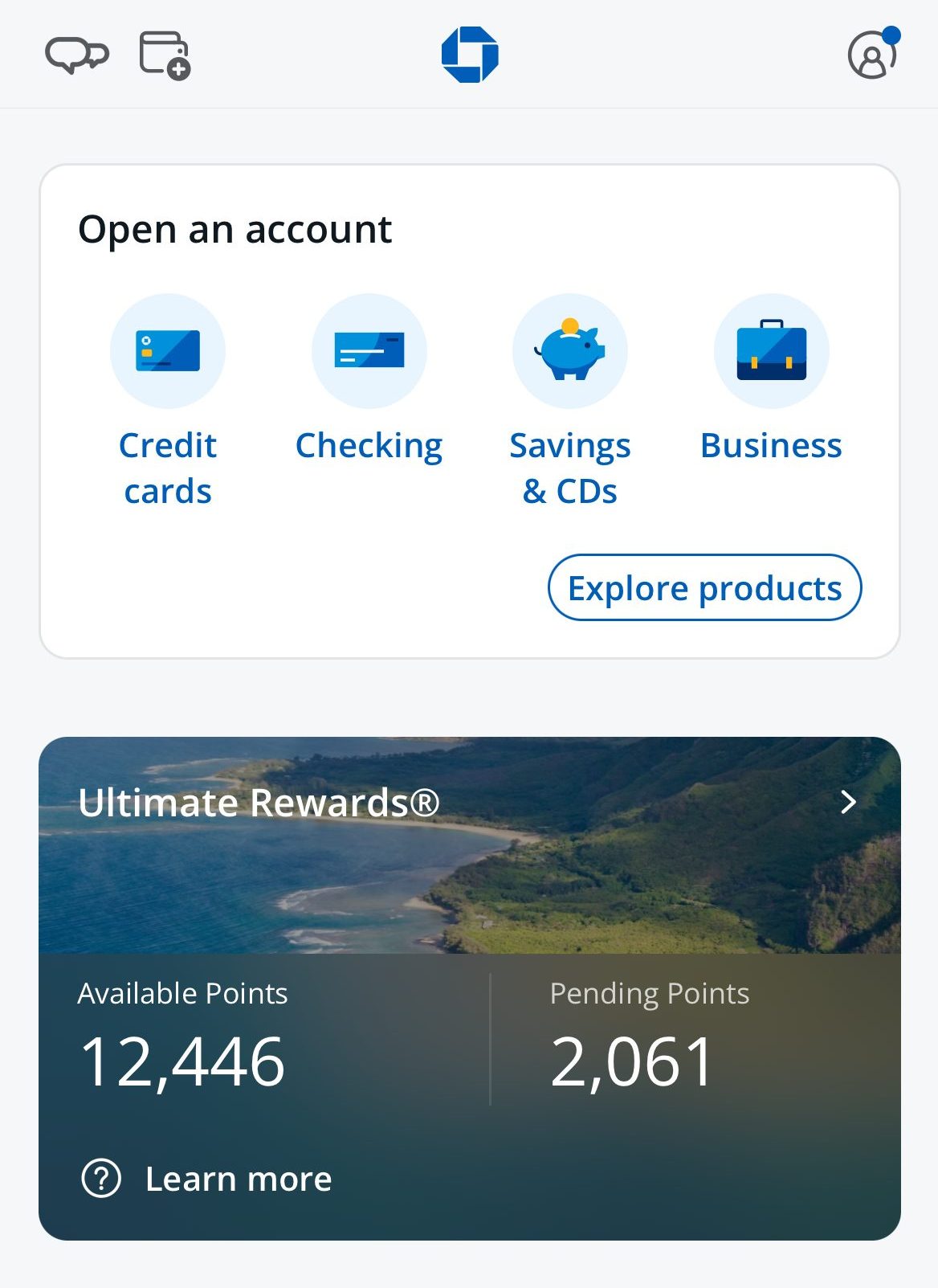

Existing Chase customers can explore and compare various checking account options within the app:

There are also some interesting differences in the account features.

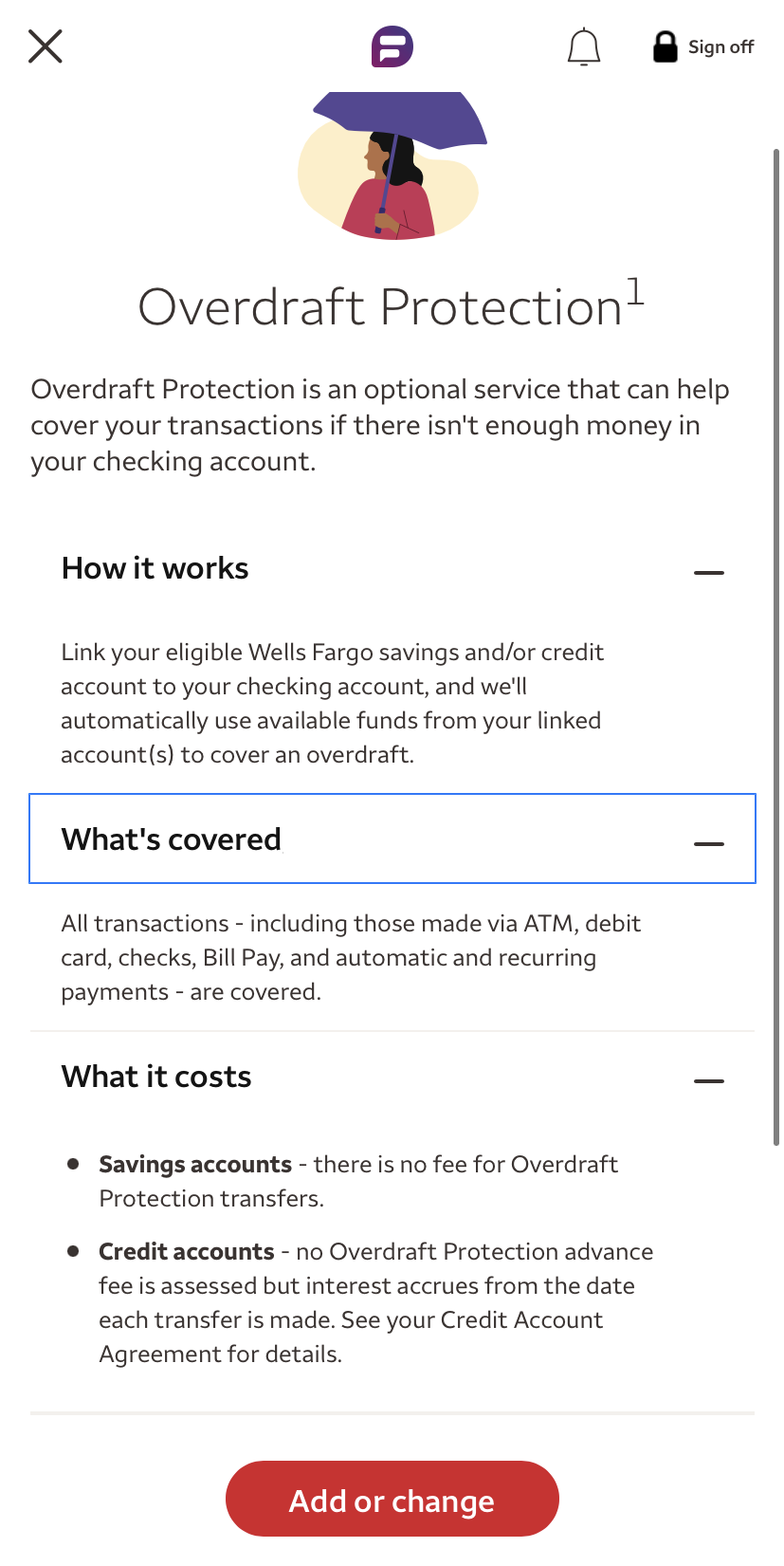

For example, Wells Fargo has several checking account options and an overdraft service is available. Chase also has several checking account options, but it offers a welcome bonus to new customers.

Chase Bank | Wells Fargo | |

|---|---|---|

APY | None | 0.05% – 0.10% |

Fees | $12

Can be waived if you maintain a $1,500 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $5,000 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

|

Minimum Deposit | $0 | $25 |

Main Benefits |

|

|

CDs

Both banks offer quite low CD rates compared to pther banks. In terms of minimum deposit needed – Chase threshold is lower.

Chase Bank | Wells Fargo | |

|---|---|---|

Minimum Deposit | $1000 | $2,500 |

APY Range | 3.00% – 4.75% | 4.24%- 4.75% |

Mortgage Options

Chase offers a variety of mortgage options. In addition to fixed rate and ARM loans, Chase also offers FHA and Jumbo loans. You can also get prequalified for your mortgage to speed up the home buying process. Chase allows customers to purchase discount points on their mortgage deal for both home purchases and refinance packages.

Wells Fargo offers an impressive choice of mortgage products including conventional fixed rate loans, VA loans, and FHA loans. However, what gives Wells Fargo the edge is the potential for paying a low down payment. You can secure a fixed rate loan from 3%, while the FHA loans require 3.5% or more.

You can also access home equity finance deals, where you can borrow up to 80% of the value of your home less any outstanding secured loans, mortgages or liens. These packages are available from $25,000 to $500,000.

Loan Options

This comparison is a little more one sided. Wells Fargo has an impressive selection of loan products including auto loans, student loans, and personal loans. You can apply for personal loans up to $100,000 over a term of up to 84 months.

However, Wells Fargo also offers fixed interest rates and discounts for relationships with qualified customers, with no closing fees, prepayment penalties, or origination fees.

On the other hand, Chase does not offer personal loans. The only loans available are auto loans that allow you to finance a new or used vehicle.

Top Offers From Our Partners

![]()

Top Offers From Our Partners

![]()

Credit Cards

Chase has a superb selection of credit card options with more than 20 travel cards, 7 business cards and 7 hotel cards. The bank has partnered with Avios, Southwest, United, Hyatt, Disney, Amazon and Starbucks. This allows you to tailor your credit card to your preferred brand for the best rewards.

Most Chase cards have no annual fee, but there are exceptions like the Sapphire Reserve. This card has a $550 annual fee, but allows you to earn 5x points on flights and an impressive 10x points on car rentals and hotels.

There are also some unique cards such as the Slate Edge. This card allows you to lower your rate by as much as 2% each year. Even students can enjoy cash back with the no annual fee Freedom Student card.

Card | Rewards | Bonus | Annual Fee |

| Chase Sapphire Preferred® Card | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $95

|

|---|---|---|---|---|

| Chase Freedom Flex℠ Card | 1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

| $200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

| $0 |

| Chase Freedom Unlimited® | 1.5% – 5%

5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases

| $200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| $0 |

| Chase Sapphire Reserve® | 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $550 |

| Marriott Bonvoy Boundless® Credit Card | 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 3 Free Nights

3 Free Nights (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months from your account opening

| $95 |

| United Explorer Card | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| 50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

| $95 ($0 first year) |

On the other hand, Wells Fargo has fewer credit card options. Active Cash offers 2% cash back on unlimited purchases, with 0% APR for the first 15 months. You can also receive a $200 welcome bonus providing you spend $1,000 in the first three months.

Wells Fargo Reflect offers the bank’s longest and lowest intro APR terms. You’ll get a 0% rate for the first 18 months on both balance transfers and purchases. However, if you make the minimum payments on time, you can qualify for a three month extension to this introductory rate.

Card | Rewards | Bonus | Annual Fee |

| Wells Fargo Active Cash Card

| 2%

2% cash rewards on purchases (unlimited)

| $200

$200 cash rewards bonus when you spend $500 in purchases in the first 3 months

| $0 |

|---|---|---|---|---|

| Wells Fargo Autograph Card | 1X – 3X

3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

| 20,000 Points

20,000 bonus points when you spend $1,000 in purchases in the first 3 months | $0 |

| Wells Fargo Reflect Card | N/A | 0% Intro APR: 21 months on purchases and balance transfers | $0 |

| Wells Fargo Bilt Mastercard | 1x – 3x

3X points on dining, 2X points on travel and 1X points on rent payments without the transaction fees and other purchases

| N/A | $0 |

| Wells Fargo Choice Privileges Mastercard | 1x – 5x

5X points on stays at participating Choice Hotels plus on choice privileges point purchases properties, 3X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases | 40,000 points

40,000 bonus points when you spend $1,000 in purchases within the first 3 months7 – enough to redeem for up to 5 reward nights at select Choice Hotels® properties

| $0 |

| Wells Fargo Choice Privileges Select Mastercard | 1x – 10x

10X points on stays at participating Choice Hotels® properties plus on Choice Privileges point purchases, 5X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases | N/A | $95 |

Customer Service

Chase’s customer service system is fairly comprehensive. In addition to its in depth help website page, there are multiple customer service lines, Twitter and Facebook support 7 am to 11pm ET Monday to Friday and 10 am to 7 pm ET on the weekends.

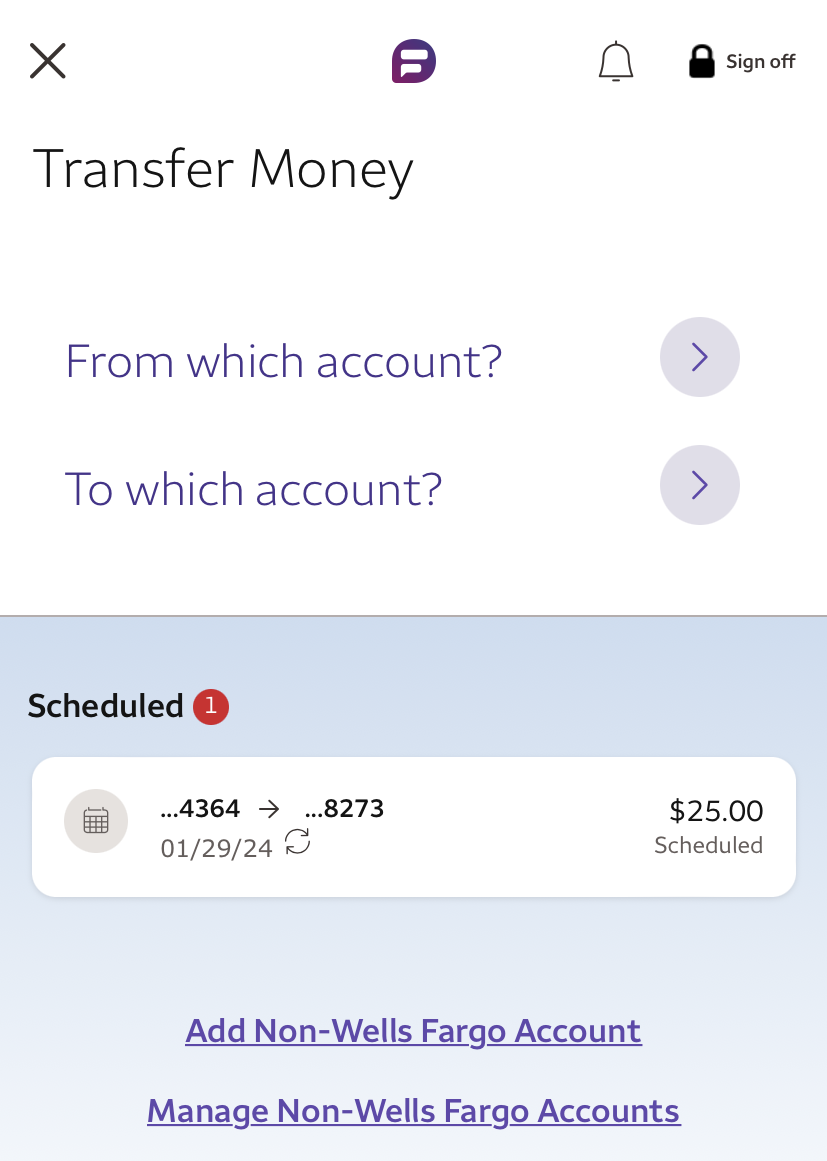

The inclusion of a Chase digital assistant within the app has made managing finances more interactive. However, it may not has a solution for all banking needs:

Wells Fargo also has a detailed support ‘page on its site, but there is also a 24/7 general banking helpline to speak to an agent.

Unfortunately, this level of service is not confirmed by consumer ratings. Chase has a poor rating of 1.3 out of 5 on Trustpilot, while Wells Fargo is only a little better with 2.3 out of 5.

Online/Digital Experience

Both Chase and Wells Fargo have an app for iOS and Android devices. Chase’s app has similar ratings with 4.8/5 on the Apple Store and 4.4 out of 5 on Google Play, while Wells Fargo’s app is rated 4.8/5 on both platforms.

Both sites have a clean design and are easy to use that offers a great user experience. You can fully explore and compare the products and access support materials.

Which Bank is The Winner?

Both Chase and Wells Fargo are large reputable financial institutions, so to summarize which bank is better, we’ll need to recap the both the positives and potential negatives.

At first glance, Chase and Wells Fargo appear to offer very similar products, so we need to look a little closer. There is little to separate the savings accounts and both banks offer a choice of checking accounts. However, while Chase’s account maintenance fee is a little higher, its account does have some more interesting features. Chase also has the edge in terms of CDs, but Wells Fargo is a better option if you’re looking for loans and mortgages.

APY Savings

The annual percentage yield (APY) is a percentage that represents the amount of money or interest earned on your savings account over the course of a year. The APY factored in compound interest. A savings calculator can help you quickly determine how much you'll earn with a given APY.

| 0.01% | 0.26% – 2.51%

| Up to 5.02%

|

Checking Fee

The monthly fee on checking account

| $12

Can be waived if you maintain a $1,500 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $5,000 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

| Compare Banking |

Mobile App Rating | 4.8/5 on iOS 4.3/5 on Android | 4.8/5 on iOS 4.6/5 on Android | Various Banks

|

Open Account

on Chase website | Open Account

on Wells Fargo website | Compare

on our website |

FAQs

Do Chase Offers Car Loans?

Chase offers vehicle financing for those with fair to excellent credit. The rates are fixed, so your monthly repayments will not change throughout the duration of the loan. The bank also allows its customers to get prequalified, so they can then start to shop for a vehicle.

Does Chase work for Joint accounts?

Chase allows co-ownership of many of its accounts. You can either open up a joint account together or add a second person to your existing account.

Of course, Chase needs to verify the identity of both parties. So, if you’re new to Chase, you will both need to present your details. However, if you are an existing Chase customer, you should be able to open up your side of the account and then your partner can go through the verification process.

Can you invest in gold via Wells Fargo ?

Wells Fargo allows customers to open a Wells Fargo Trade account, which is an online trading platform where you can invest in EFTs and stocks including gold stock. There is an annual fee for this service, but it is possible to have the fee waived if you meet one of a list of waiver criteria.

Is my money safe on Wells Fargo ?

As one of the largest banks in the USA, you should feel reassured that your money is safe with Wells Fargo. Wells Fargo did receive a $25 billion federal bailout in 2008, but it paid off the loan at the end of 2009.

Today, Wells Fargo has over $1.7 trillion in assets, so it has sufficient funds to cover any defaults should the economic climate deteriorate. Additionally, the accounts are FDIC insured, so your deposits up to $250,000 are federally protected.

Chase vs Wells Fargo: Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked at Chase and Wells Fargo in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Chase Versus Alternative Banks

Although Chase Bank has a modern, trendy image, it is one of the oldest banks in the United States. JP Morgan Chase's consumer division, Chase Bank, is one of the largest banks in the United States. Even though its interest rates aren't particularly competitive when compared to online banks and credit unions, loyal Chase customers who keep a significant amount of money with the bank can earn slightly better rates.

American Express is best known for its credit card business. The financial services firm, on the other hand, has a banking subsidiary that offers high-yield savings and CD accounts. For those looking to save money with a well-known financial institution, the American Express High Yield Savings Account is a popular option.

Read Full Comparison: American Express vs Chase Bank

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

The Discover checking account is more traditional. While the account does not pay interest, you can earn 1% cash back on debit card purchases. There are also no fees if you require a replacement debit card, have a deposit item returned, or have insufficient funds in your account.

Chase offers a wide range of banking products, including savings accounts, checking accounts, home loans, home equity options, auto loans, and a wide range of credit cards. In addition, Chase's customer service system is quite extensive.

Read Full Comparison: Discover vs Chase: Which Bank Account Suits You Best?

Chase has some great features including a massive selection of credit card options. Both banks also offer some great mortgage packages. PNC also has some innovative credit card options, and you can also access personal loans.

Read Full Comparison: Chase vs PNC Bank: Which Bank Account Is Better?

Because both Chase and TD Bank provide a comprehensive range of products, we'll need to summarize the benefits and drawbacks to determine which bank is superior.

Chase offers some novel features, including the possibility of comparable CD rates without the TD Bank's minimum deposit. However, there is little to distinguish the checking accounts, as TD Bank's savings rate is twice that of Chase.

Although Chase has more credit card options, don't discount TD Bank, which has some interesting options.

Read Full Comparison: Chase vs TD Bank: Which Bank Suits You Best?

Chase and Capital One both have banking product lines that compete with traditional high street banks.

Capital One also has a competitive advantage in terms of checking accounts. The Capital One checking account is not only fee-free, but you can also earn interest on your account balance. Chase's checking account does not pay interest, and you must meet certain requirements to have the $12 monthly fee waived.

However, when you open a qualifying account, Chase will give you a welcome bonus, and its checking account has some nice features such as paperless statements for up to seven years and checking account upgrade options.

Read Full Comparison: Chase vs Capital One: Compare Banking Options

Both banks have account maintenance fees that can be waived by meeting one of several requirements. The rates are also quite similar, so which bank is best will come down to what products you’re looking for.

While Chase and U.S. Bank offer many banking services, Chase Bank is our winner in this competition. Here's why – and what else to know:

While Truist is a full service bank where you can find almost any financial product, Chase is our winner. Here's why – and what else to know:

We'll explore Chase and BMO Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison.

We believe Chase is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Chase vs. Fifth Third Bank

While Huntington Bank offers some better conditions when it comes to CDs and lending options, Chase is our winner. Here's why: Chase vs. Huntington Bank

Even though Regions Bank has better terms for CDs and loans, we're leaning towards Chase. Here's why, and our complete banking comparison: Chase vs. Regions Bank

Chase is the largest brick-and-mortar bank, while Ally Bank is among the best online banks. Here's our comparison and our winner: Chase vs. Ally Bank

Chase Bank is our winner, while Amex and Chase offer great banking services and credit card portfolios. Here's our side-by-side comparison: American Express Bank vs. Chase Bank

Chase is our winner as it is a better fit for most consumers than HSBC bank. But, there are important things to consider when comparing them: Chase Bank vs. HSBC Bank

Both Chase and Barclays offer a significant portfolio of banking services for US-based customers, but Chase is our winner. Here's why: Chase Bank vs. Barclays Bank

Chase Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

Top Offers From Our Partners

![]()

Compare Wells Fargo With Other Banks

Capital One began as a credit card company, but has expanded its line of banking products to rival a traditional bank. Aside from checking and savings accounts, you can also get loan refinancing, auto finance, and children's accounts.

Wells Fargo offers an even broader range of products. There are several checking accounts available, as well as two savings accounts and investment options such as IRAs and 401ks. You can also get loans and mortgages, as well as wealth management services. Wells Fargo is thus a highly comparable alternative to the traditional high street bank.

Read Full Comparison: Capital One vs Wells Fargo: Which Bank Wins?

Wells Fargo offers a diverse range of products, including checking accounts, savings accounts, loans, mortgages, and investments such as 401ks, IRAs, and wealth management options.

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Read Full Comparison: Wells Fargo vs US Bank: Which Bank Account Is Better?

Both Ally and Wells Fargo have a fairly impressive banking product lineup that would make switching from a traditional high street bank simple.

Ally offers CDs, auto loans, mortgages, investments, and retirement products in addition to checking and savings. The only glaring omission in the lineup is the absence of a credit card.

Wells Fargo's product lineup is even more impressive. Checking and savings accounts, mortgages, loans, and a variety of investment options such as IRAs, 401ks, and wealth management services are all available.

Read Full Comparison: Ally vs Wells Fargo: Which Bank Account Is Better For You?

Both banks offer a good selection of banking products, making it easier to switch from your current bank.

Citi offers CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and a variety of credit card options in addition to checking and savings accounts.

Wells Fargo provides savings and checking accounts, but it also provides mortgages, loans, and investment options such as IRAs, 401ks, and wealth management products.

Read Full Comparison: Citi vs Wells Fargo: Which Bank Account Is Better?

The Wells Fargo service is even more extensive. Checking accounts, various savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management solutions are all available.

PNC offers checking and savings accounts, home loans, mortgages, investments, student loan refinancing, and a variety of credit cards.

Read full comparison: Wells Fargo vs PNC: Which Bank Account Wins?

Wells Fargo offers a diverse range of banking services. Checking accounts, savings accounts, loans, mortgages, wealth management solutions, and investment options such as 401ks and IRAs are all available. Flagstar also offers a diverse product portfolio that includes a variety of checking and savings accounts, investments, home loans, and loans and investments.

It is important to note, however, that Flagstar does not operate in all states. This bank only operates in Michigan, California, Ohio, Indiana, and Wisconsin, where it has 150 branches. As a result, if you live outside of these areas, you may be unable to use Flagstar's banking services.

Read Full Comparison: Wells Fargo vs Flagstar: Which Bank Is Better For You?

Wells Fargo's product offering is even more extensive. This bank offers checking accounts, a variety of savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management services. This makes switching from another bank even easier because you'll have access to all of your favorite banking products.

Bank of America offers a diverse range of banking services. Checking and savings accounts, auto loans, home loans, credit cards, and investment options are all available.

Read Full Comparison: Bank of America vs Wells Fargo: Which Bank Is Better?

There is no clear winner when comparing Wells Fargo and TD bank, but if we have to pick, TD comes out ahead. Here's why.

Wells Fargo offers better savings rates than Truist Bank, more selection for checking accounts and better credit cards. Here's our comparison: Truist Bank vs. Wells Fargo Bank

While Wells Fargo Bank and Citizens Bank offer a range of banking services, Wells Fargo is our winner in this competition. Here's why.

Wells Fargo Bank vs. Citizens Bank : Which Bank Account Is Better?

Fifth Bank may be better than Wells Fargo when it comes to checking accounts, but is it enough? See our complete comparison, and our winner: Wells Fargo Bank vs. Fifth Third Bank

Let's compare savings accounts, checking accounts, CDs, credit cards, and lending products offered by Wells Fargo and M&T Bank.

Wells Fargo Bank vs. M&T Bank: Which Bank Account Is Better?

BMO has great options for checking accounts, and outshines Wells Fargo with higher savings rates. But is it our winner? See our comparison: Wells Fargo vs. BMO Bank

We'll explore Wells Fargo and Regions Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Wells Fargo vs. Regions Bank

There is no clear winner between SoFi and Wells Fargo as each bank excels in different areas – but Wells Fargo is our winner. Here's why.

Banking Reviews

Alliant Credit Union Review