Table Of Content

Chase Total Checking ®

Fees

Minimum Deposit

Promotion

Our Rating

Chase Total Checking ®

Fees

Minimum Deposit

Promotion

Our Rating

Chase is one of the largest banks in the U.S, providing consumers with a comprehensive line of products and services from credit cards and investments to savings accounts. Since it has a big presence throughout the U.S, Chase is a solid choice for your checking account.

Chase Total Checking is the most affordable checking account in the Chase product line with a modest monthly service fee, which is relatively easy to waive.

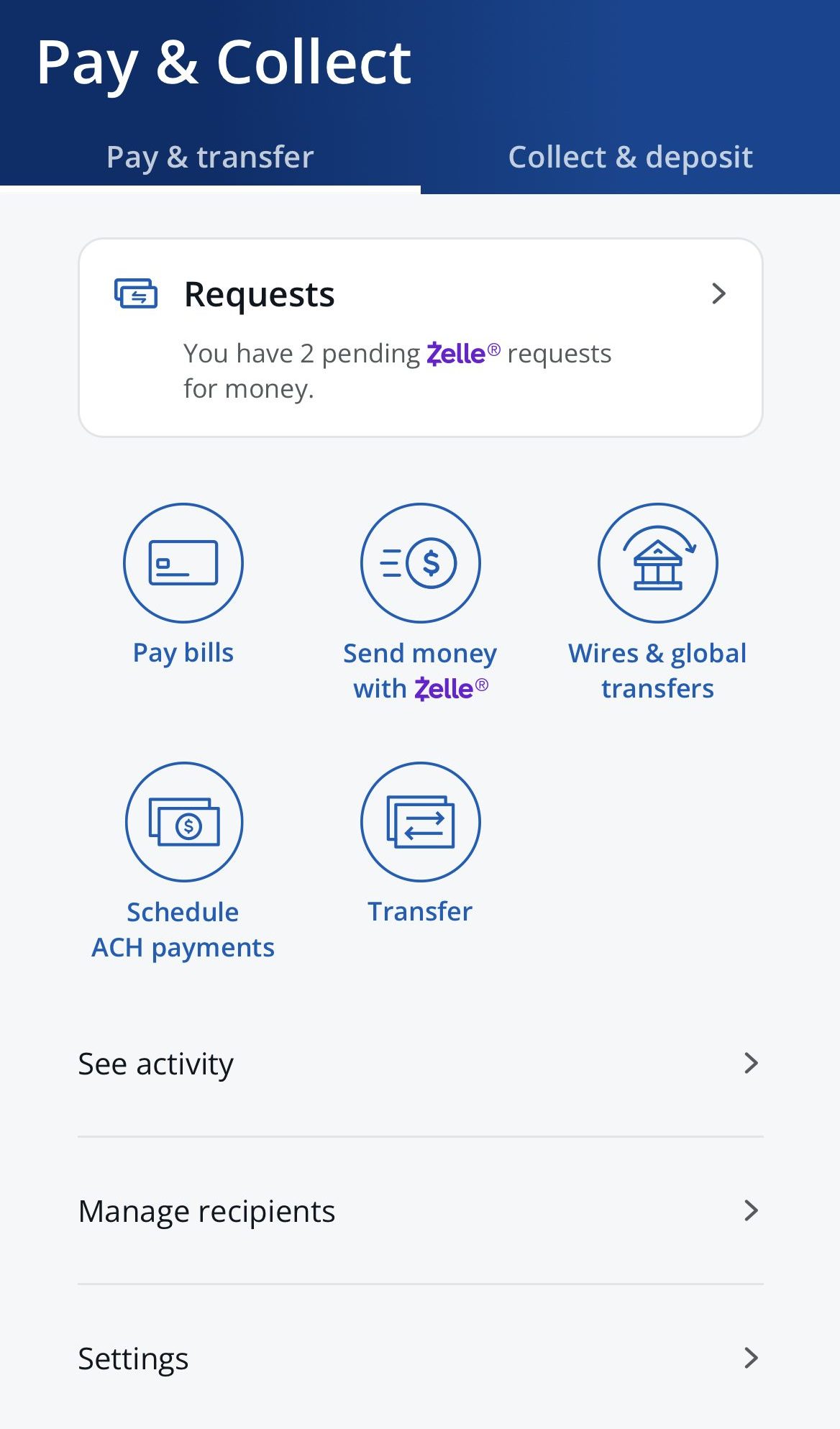

You can use the account for all your everyday banking needs, with zero liability protection for any unauthorized debit card transactions and an impressive mobile app, which allows you to pay bills, transfer money, deposit checks and all other aspects of managing your account.

Chase Total Checking: Best Features

Here are the main features to know about the Chase Total Checking account:

- Access to a Massive Branch Network: Chase is one of the largest banks in the U.S with a branch network of over 4,700 locations. This makes it easy to access in person support if you run into any issues or queries. You can also more than 15,000 ATMs in the Chase network, so you can deposit or withdraw funds for free.

- 24/7 Support: In addition to its branch team, Chase offers 24/7 support via its customer service helpline. So, you can still get immediate assistance if you have a query or concern outside of regular business hours.

- Chase Quickpay with Zelle: This service is free of charge and available through the Chase app or online banking platform. You can transfer up to $2,000 daily and up to $16,000 monthly to family or friends using just their phone number or email address. This makes it super easy to split a bill when you’re dining out or cover other costs and the recipient will receive the money directly into their bank account.

- Online Bill Payment: You can pay your bills through the Total Checking account and schedule automatic payments for free. This can help you to keep on track of your financial obligations and avoid late fees.

- QuickDeposit: QuickDeposit is the mobile check deposit feature available on the Chase mobile app. This is a free service, which can save you from needing to visit an ATM or branch. However, there is a daily limit of $500 and $1,500 per month for the first six months of holding the account.

- Digital Financial Tools: Chase has a suite of digital financial tools, which are a great feature to help you to set goals and create budgets. So, if you want to take control of your finances, these tools can be a game changer.

Is Chase Total Checking Good?

No financial product is perfect and there are both positives and potential negatives associated with the Chase Total Checking account.

Pros | Cons |

|---|---|

Well Established Banking Brand | Monthly Maintenance Fee |

Fee Free ATM Network | Not Interest Bearing |

Excellent App | Out of Network ATM Fees |

No Minimum Deposit Requirement | |

Overdraft Assist |

- Well Established Banking Brand

Chase is one of the most recognizable banking brands, so you can have confidence that this isn’t a new and inexperienced financial institution.

There is FDIC protection and you can rely on the Chase team to have the knowledge to guide you through any issues.

- Fee Free ATM Network

One of the main Chase bank benefits is that it has its own network of over 15,000 ATMs, making it easy to make deposits or withdrawals without incurring any fees.

- Excellent App

The Chase banking app is highly rated and it allows you to manage virtually all aspects of your everyday account management.

- No Minimum Deposit Requirement

You don’t need to make an initial deposit to open this account, removing this potential barrier to entry.

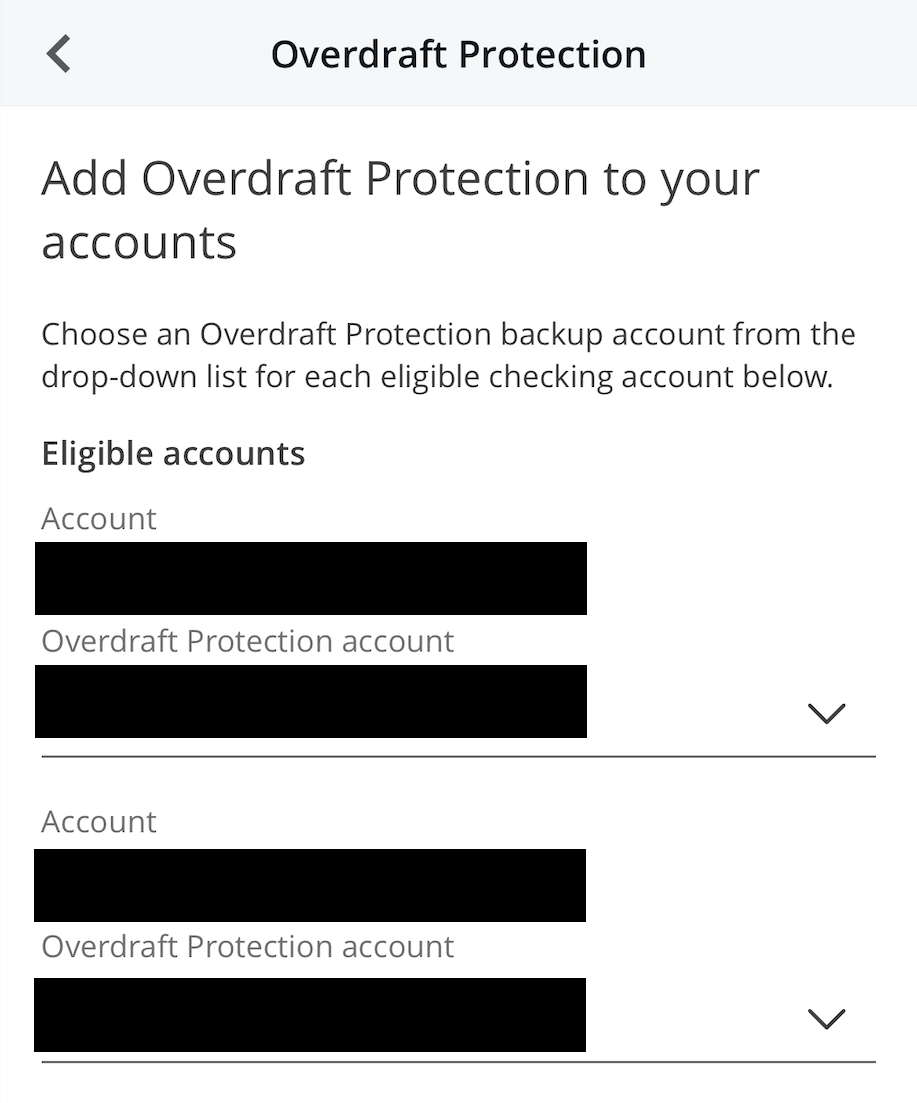

- Overdraft Assist

It can be easy to miscalculate payments or have a misstep which causes you to go overdrawn, but this account has Overdraft Assist, which means that there is no overdraft fee if you are overdrawn by $50 or less.

- Monthly Maintenance Fee

The account has a $12 monthly maintenance fee. You can waive Chase Total Checking monthly fees by having $500+ in electronic deposits per month, maintaining a balance of at least $1,500 or having a combined average balance across your qualifying Chase accounts of $5,000.

But, it does add another layer of complexity to managing your account.

- Not Interest Bearing

Unlike some of the other Chase checking accounts, Total Checking does not pay any interest on your balance.

- Out of Network ATM Fees

While Chase has a large ATM network, if you don’t have one in your local area, you could end up incurring out of network fees.

Unlike some of the other Chase checking accounts, you’ll not be reimbursed for these fees.

Which Type of Customer is Best Suited to the Chase Total Checking?

The Chase Total Checking is a solid account, but there may be some customers who find it is better suited to their circumstances. The types of customers who are likely to get the most from this account include:

- Those not looking for interest: If you simply want to use your checking account to manage your day to day expenses and don’t tend to carry a large balance, you’re not likely to be bothered about not earning interest on your account. In this scenario, you are more likely to have a linked savings account or use a Chase savings account, which allows you to transfer money into a separate savings fund.

- Those who can meet the waiver criteria easily: Monthly maintenance fees can quickly eat into your available cash, so it is best to avoid them wherever possible. While this account does have a monthly fee, there are several waiver options, which if you can easily meet will eliminate any risk of incurring charges.

Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Chase Total Checking | $12 | $1,500 |

Chase Premier Plus Checking | $25 | $15,000 |

Chase Sapphire Checking | $25 | $75,000 |

Chase College Checking | $12 | $1,500 |

Chase Private Client Checking | $30 | $150,000 |

Chase Business Complete Banking | $15 | $2,000 |

Chase Performance Business Checking | $30 | $35,000 |

Chase Platinum Business Checking | $95 | $100,000 |

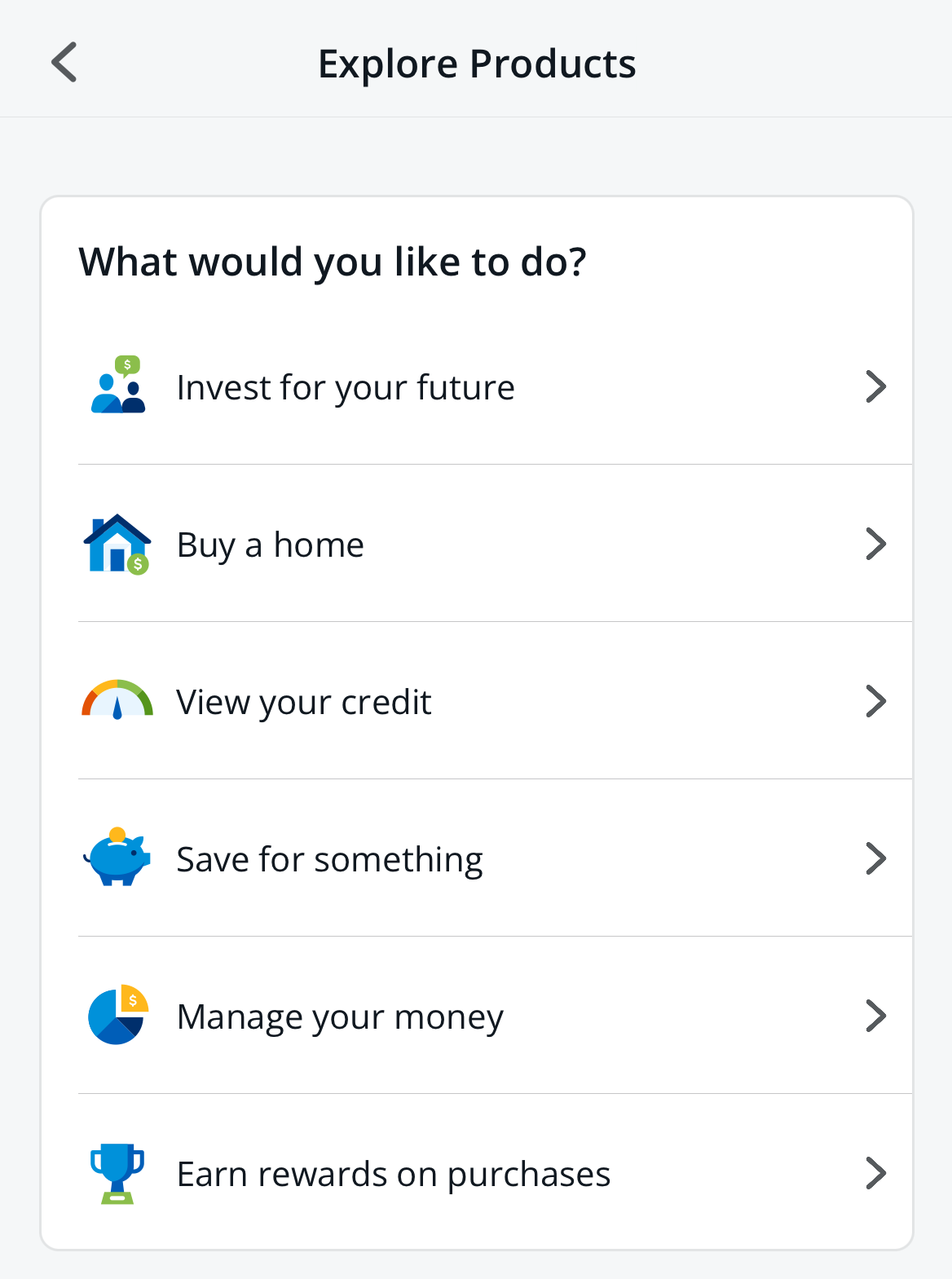

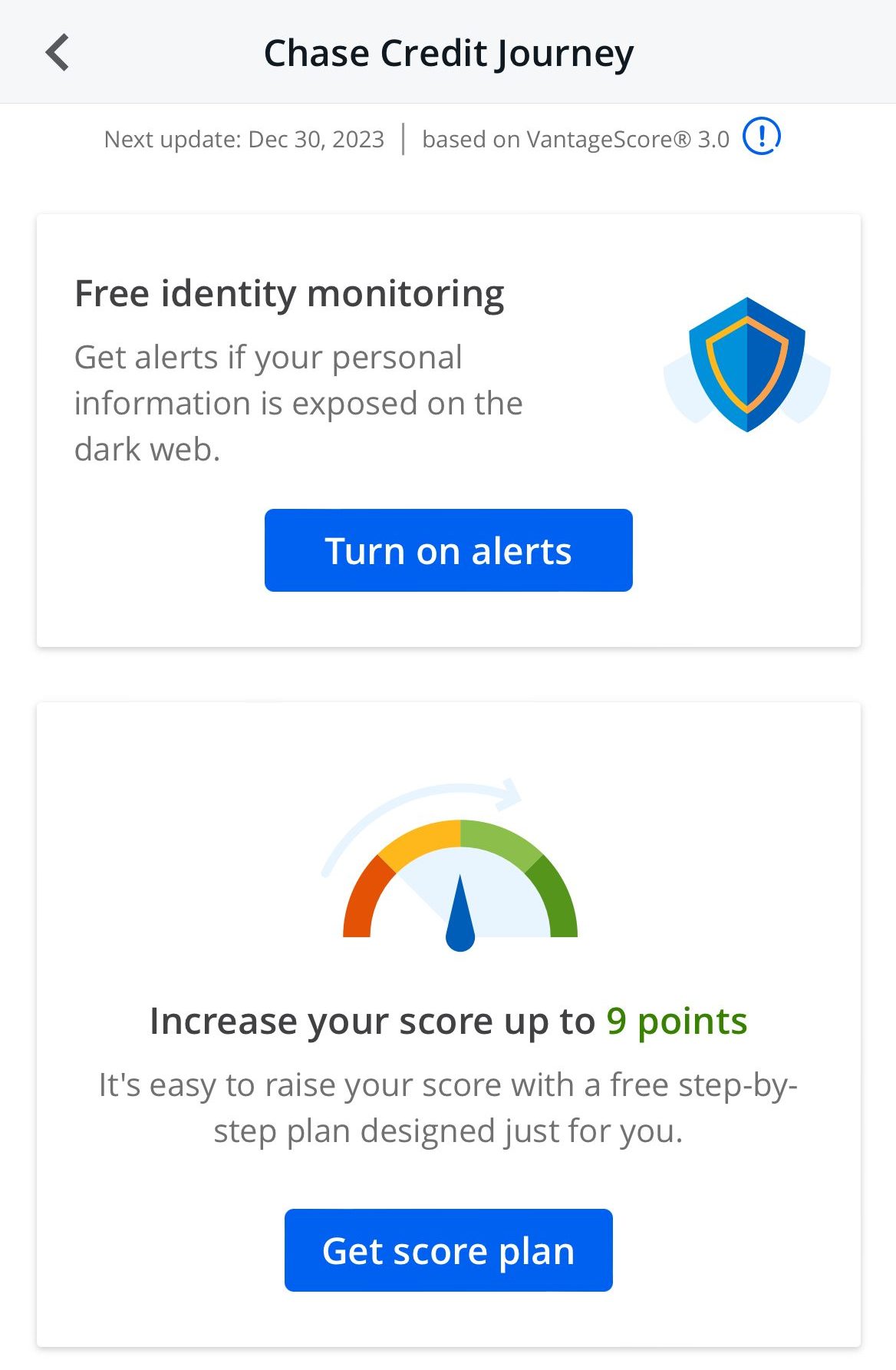

- Those who need access to money management and saving tools: If you’re looking to get your finances on track and work towards your financial goals, Chase Credit Journey can help you track your credit score.

Is Chase a Good Bank to Work With?

Chase has a poor reputation on Trustpilot, but this is fairly typical of traditional banks. On the other hand, the Chase app is quite well regarded on both Google Play and the Apple Store. This suggests that day to day, Chase is a decent bank to work with. Since Chase also offers 24/7 support, it could be a good option.

While Chase may not offer the best rates in the marketplace, it does have a comprehensive product line. So, if you want to keep all of your financial products under one roof, Chase is a good option. You can also access in-person support at a substantially sized branch network, and there is a large fee free ATM network.

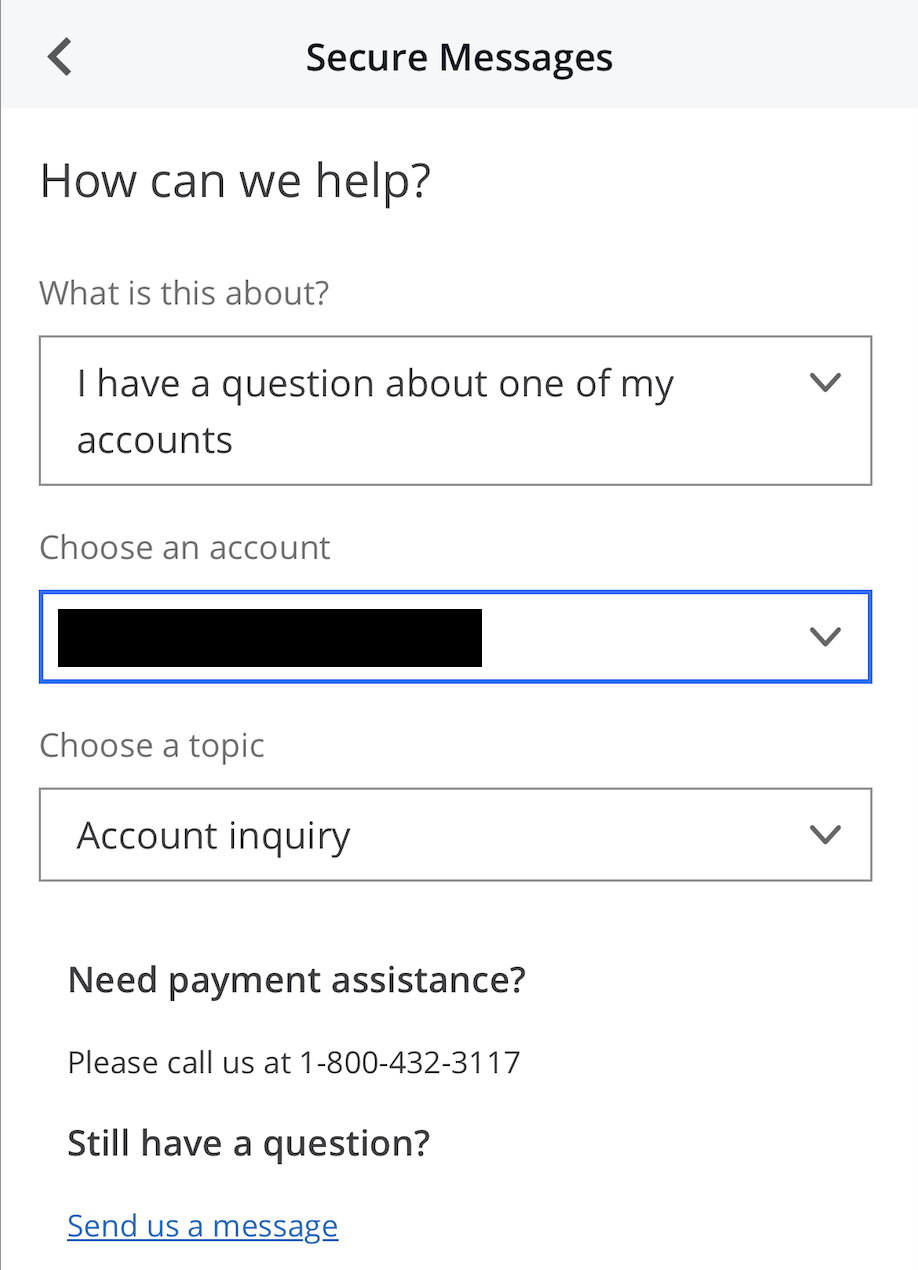

The responsive customer service team is helpful in addressing queries promptly, adding to the app's user-friendly appeal:

However, suppose you are looking for the highest possible rates and are willing to compromise on branch support and access to a large product line. In that case, you may prefer to look for other top rated checking accounts.

How to Open a Chase Total Checking Account

While you can visit a local branch, one of the easiest ways to open a Total Checking account is online. You can complete the process in a few simple steps.

- Find the Total Checking Product Page: You’ll need to visit the Chase website and click “Checking” on the top bar and select “Total Checking.” From this page, you can explore all the features of the account and if you want to proceed, you can click the green “Open Now” button.

- Complete the Basic Form: If you’re not an existing Chase customer, you will need to complete all the mandatory fields including your full name, date of birth, address, and Social Security Number.

- Confirm Your Citizenship: After you submit the basic form, you’ll be directed to a page to confirm your citizenship. The default is U.S, where you can click yes or no, but if you select no, there is a field to specify another country of citizenship.

- Fill in the Application Form: This is a fairly standard account application form, which you’ll need to fill in all the mandatory fields. After you click submit, Chase will process your application and send you an email to confirm when the account is opened.

FAQs

Does Chase Total Checking earn interest?

No, Chase Total Checking is not an interest bearing account.

Does Chase Total Checking offer a promotion?

There are occasionally promotions for new customers opening a Total Checking account. The current promotion is a $200 welcome bonus, but this is a limited time offer.

How do you close a Chase Total Checking account?

You can initiate an account closure in one of two ways;calling the customer support helpline or visiting a local branch. In either case, the Chase representative can guide you through the closure process.

How We Review Checking Accounts: Our Methodology

The Smart Investor team has conducted a comprehensive review of checking accounts offered by various banks, taking into account several key factors to provide a thorough evaluation. Here's how we rated them across four important categories:

-

Checking Account Features (60%): We meticulously assessed the features and benefits associated with each bank's checking accounts. Factors considered include account fees, minimum balance requirements, ATM access, overdraft protection, online and mobile banking functionalities, and additional perks such as rewards programs. Higher ratings were awarded to banks offering a wide range of features and benefits that cater to diverse customer needs, ensuring convenience and flexibility in managing finances.

-

Customer Experience (20%): A positive customer experience is essential in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Diversity of Other Financial Products (10%): We also considered the diversity of other financial products offered by each bank, such as savings accounts, loans, credit cards, and investment options. Higher ratings were given to banks with a comprehensive suite of financial products, allowing customers to meet their various banking and financial needs in one place.

-

Bank Reputation (10%): The reputation of a bank is a crucial factor in decision-making. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were assigned to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories and assigning appropriate weights to each, our review aims to provide valuable insights to help individuals make informed decisions when selecting a checking account