Table Of Content

Choosing the best bank account for you should be a carefully thought-out process. The money in your savings and checking account are vital to maintaining your financial independence.

Avoiding paying fees on these accounts can help alleviate worries and keep as much money in your pocket as possible!

How Chase Monthly Maintenance Fees Work?

Due to the differences in what a savings versus a checking account offers, the fees associated with each of these types of accounts are distinct.

Chase Checking accounts are geared towards making everyday purchases, either with cash or a debit card, and moving money into and out of the account. As a result, fees associated with the accounts typically include, monthly service fees, overdraft fees, out-of-network ATM fees, and foreign transaction fees.

Chase Savings accounts are more focused on saving a large amount of money for a big purchase or retirement. With less activity in savings accounts, the main fees are monthly service fees and saving withdrawal limit fees

One of the most recurring fees that quickly adds up with checking accounts is the monthly servicing fee. Oftentimes, this fee can be avoided if specific guidelines are followed. While the rules differ based on the specific account type, there are a few tips that can help avoid fees in general.

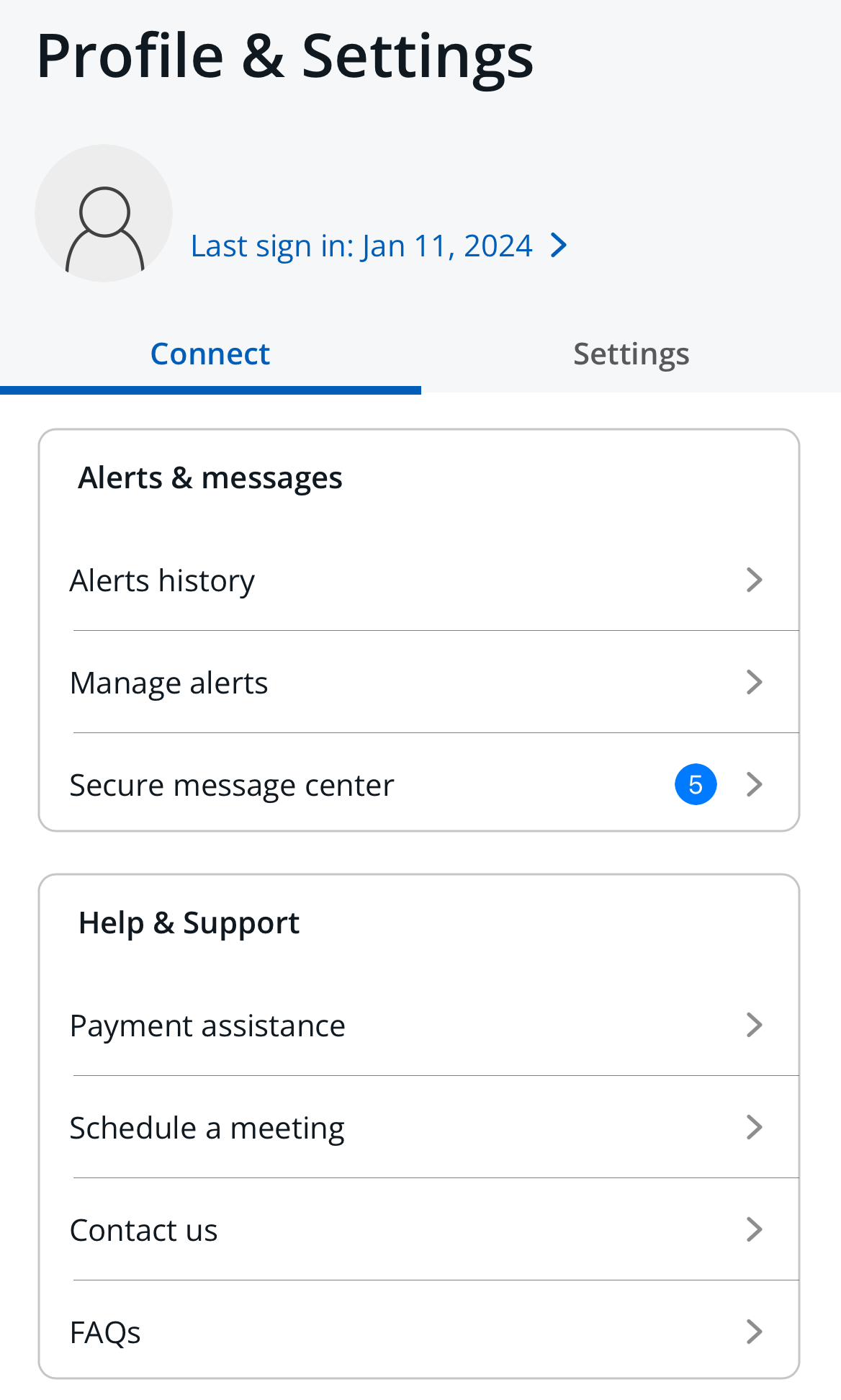

- Track your spending with the Chase Mobile App. To ensure that you are spending within your means, download the Chase Mobile App to check your account balance easily and quickly.

- Set up alerts. If you know checking your account balance often is difficult for you, set up notifications form the app. You can get alerted whenever your account reaches a certain level to not overspend.

How to Avoid Chase Checking Account Monthly Fees?

While good spending habits can lead to you avoiding fees, it is important to understand what exactly needs to be done for each checking account type. Each checking account has a slightly different set of criteria that needs to be met each month to avoid paying service fees.

Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Chase Total Checking | $12 | $1,500 |

Chase Premier Plus Checking | $25 | $15,000 |

Chase Sapphire Checking | $25 | $75,000 |

Chase College Checking | $12 | $1,500 |

Chase Private Client Checking | $30 | $150,000 |

Chase Business Complete Banking | $15 | $2,000 |

Chase Performance Business Checking | $30 | $35,000 |

Chase Platinum Business Checking | $95 | $100,000 |

- Chase Total Checking- At least one of the following needs to be met: Electronic deposits made into the account totaling $500 or more. Have a balance at the beginning of each day of $1,500 or more in the account. Have an average beginning day balance of $5,000 or more in any combination of the checking account and linked deposits or investments. If the fee is not avoided, it is $12 per month.

- Chase Premier Plus Checking- Either of the two criteria need to be met: An average beginning day balance of $15,000 or more in any combination of the checking account and linked deposits or investments. Have a linked qualifying Chase first mortgage enrolled in automatic payments from your checking account. Additionally, if you are a current or prior member of the military with a qualifying Military ID, you can avoid service fees. If the fee is not avoided, it is $25 per month.

- Chase Sapphire Checking- The fee is avoided if you have an average beginning balance of $75,000 or more in any combination of the checking account and linked deposits or investments. If the fee is not avoided, it is $25 per month.

- Chase College Checking– The fee can be avoided for the month if one of the three conditions are met: Up to five years in while in college. An electronic deposit is made into the account. An average ending day balance of $5,000 or more in the account. If the fee is not avoided, it is $6 per month.

- Chase Private Client Checking– The fee can be avoided if one of the two conditions is met: The Chase Private Client Checking account is linked to your Chase Platinum Business Checking account. An average beginning day balance of $150,000 or more in any combination of the checking account and linked deposits and investments. If the fee is not avoided, it is $30 per month.

- Chase Business Complete Banking- The fee can be avoided if you have above an average of $2,000 from minimum daily balance, deposits from Chase QuickAccept, or Chase Ink Business Card purchases. If the fee is not avoided, it is $15 per month.

- Chase Performance Business Checking- The fee can be avoided if you keep an average beginning day balance of above $35,000 between your accounts. If the fee is not avoided, it is $30 per month.

- Chase Platinum Business Checking- The fee can be avoided if you keep an average beginning day balance of above $100,000 between your accounts. If the fee is not avoided, it is $95 per month.

How to Avoid Chase Savings Account Monthly Service Fees

Similarly with the Chase Checking account, you can avoid paying monthly service fees by meeting a set of criteria each month. These rules differ based on the savings account type.

Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Chase Savings | $5 | $300 |

Chase Premier Savings | $25 | $15,000 |

- Chase Savings- Monthly fees can be avoided if one of the five criteria are met: A balance at the beginning of each day of $300 or more in the account. At least $25 in total autosave of other repeating automatic transfers from your personal Chase checking account. Chase college checking account linked to the account for overdraft protection. An account owner who is an individual younger than 18. A linked Chase Premier Plus Checking, Chase Sapphire Checking, or Chase Private Client Checking account. If none are met, you will pay a $5 monthly fee.

- Chase Premier Savings – You can avoid paying the monthly service fee if you meet one of two requirements: A balance at the beginning of each day of at least $15,000 or a linked Premier Plus Checking of Chase Sapphire Checking account. If none are met, you will pay a $25 monthly fee.

Does Chase Offer An Account With No Monthly Fees At All?

Chase offers two accounts with no monthly service fees.

These options are the Chase First Banking and Chase High School Checking accounts. Both accounts are tailored to parents and children to teach minors good spending habits and allow for parents to have control over their child’s money.

While these accounts are similar, the Chase First Banking account gives more control over the account to the parent while the Chase High School Checking account encourages more freedom. Both accounts are nearly identical in terms of fee structure, and both require a parent co-owning the account.

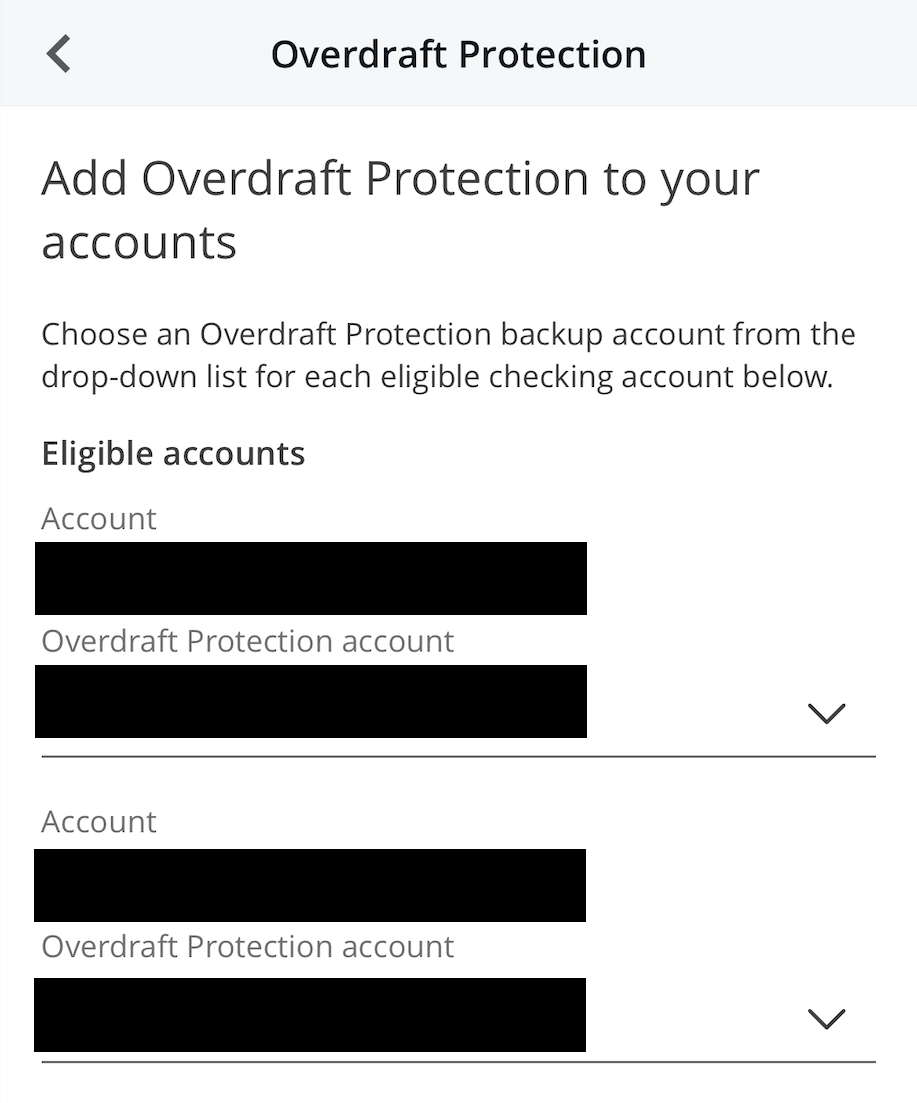

How to Avoid Chase Overdraft Fees

Overdraft fees occur when there isn’t enough money in your account to cover a payment, purchase, or a check written. These fees are some of the more sizeable fees levied by the bank, with them charging $34 for each occurrence.

The easiest way to avoid paying Chase overdraft fees is to monitor your account balance from the Chase Mobile App and set up alerts to notify you when your account gets below a certain level. The fee is also not charged if you’ve overdrawn your account by $50 or less.

How to Avoid Chase ATM Fees

To avoid paying ATM fees with a chase bank account, only use ATM’s that are within Chase’s network. On all transactions done in the US, Puerto Rico, and the US Virgin Islands that are done through a third-party ATM, Chase will charge $3.

Transactions done in other locations through a non-Chase ATM, will be charged $5. Whenever you use a Chase ATM to withdraw money from your account, you will not be charged at all.

How Chase’s Monthly Fees Compare To Traditional Banks?

Chase monthly fees are slightly higher than the average monthly fees across all banks.

The current average monthly fee is about $10, which is slightly below the Chase Total Checking fee and significantly lower than the more premium Chase checking accounts.

When compared to other large banks, the fees are about the same, with the basic checking accounts from Bank of America, Wells Fargo, and Citi charging $12, $10, and $12 respectively.

Here's a table summary of major financial institutions' monthly fee prices:

Bank/institution | Monthly Fee | Bank Type |

|---|---|---|

Bank of America Advantage Plus Checking | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

| Traditional |

Chase Total Checking® | $12

Can be waived if you maintain a $1,000 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $2,500 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| Traditional |

Citi Checking Account | $12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

| Traditional |

PNC Standard Checking | $7 – $25 per month

can be waived if you maintain $500+/$2,000/$5,000 direct deposit per month, $500+/$2,000/$5,000 monthly balance in savings or age 62+/$10,000 in all PNC consumer deposit accounts/$25,000 in all PNC consumer deposit accounts/

| Traditional |

U.S. Bank Checking | $6.95

Can be waived by maintaining an average account balance of $1,500, have $1,000+ in direct deposits per month or be aged 65+

| Traditional |

Wells Fargo Everyday Checking | $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

| Traditional |

Capital One 360 Checking | $0 | Online Only |

Amex Rewards Checking | $0 | Online Only |

SoFi Bank | $0 | Online Only |

How Chase’s Monthly Fees Compare To Online Banks?

Online banks typically charge lower fees on their customers than traditional brick-and-mortar banks, and this is the case with Chase as well. Many online banks offer accounts that do not charge any monthly service fees.

Ally Bank, Chime, and SoFi all offer checking accounts that do not charge a service fee. The lack of fees that come with online banks come with a tradeoff of less benefits than Chase bank.

FAQs

JPMorgan Chase is widely regarded as one of the best banks in the world, the largest bank in the US by assets, with a total of $2.87 Trillion.

If you open an account with Chase, losing your money due to the bank shutting down or widespread fraud is possible, but the chances are very low. All Chase accounts offer FDIC coverage.

Qualifying personal deposits include Chase First Checking accounts, personal Chase savings accounts, CDs, certain Chase Retirement CDs, and Certain Chase Money Market Accounts.

The savings accounts that are excluded from this list include Chase Premier Savings and Chase Private Client Savings.

Chase uses daily and combined balances to determine whether or not to levy fees on customers. Daily balances are calculated by looking at the beginning day balance on the account in question on that day. Combined balances are calculated by adding the daily average beginning balance across all linked accounts.

As of May 2024, new Chase total checking customers can currently qualify for a $300 bonus. You’ll need to open a Chase Total Checking account and set up at least one direct deposit to receive your bonus. Chase also offers $100 if you set up a new Chase Secure Banking account.

All of these promotional offers do have qualification criteria, so it is important to check the small print, but these products can be a great way to get your hands on some free cash.

The interest rate paid on Chase savings accounts is below the national average, but in line with the rates paid by other large national banks.

The current APY for a Chase savings account is 0.01% while the national average is 0.59%.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months