Table Of Content

Does Chase Charge Overdraft Fees?

- The standard overdraft fee at Chase Bank is $34. However, this fee is only charged if the transaction leads to an overdraft of more than $50.

- The overdraft fee can be charged a maximum of 3 times per business day. The maximum overdraft fee the bank can charge per business day is $102.

As the Chase bank website explains, an overdraft happens when there are no sufficient funds to cover a payment, check, or purchase. There are also a number of details to keep in mind.

- Approving Overdraft

It is important to remember that if you do not have sufficient funds to cover the transaction, there is no guarantee that the bank will always allow the overdraft transaction to proceed.

As Chase Bank explains, the bank may or may not decide to pay for an overdraft transaction. This decision is based on several factors, such as your deposits and transaction amount.

- Coverage

Overdraft at Chase Bank covers several types of transactions, such as automatic payments, recurring debit card purchases, and checks. However, one thing to keep in mind here is that the overdraft at Chase Bank does not cover cash withdrawals at ATMs.

Therefore, if you do not have sufficient funds to withdraw money at ATM, your transaction will be declined instead of your checking account going into an overdraft. In addition, overdraft at Chase does not cover regular purchases by cards, such as payment at a restaurant or gas station.

How Much Chase Overdraft Fee Compared to Other Banks?

Chase's overdraft fee is in line with other banks that still charge an overdraft fee.

For example, if we compare Chase and Bank Of America, we can see that Chase fee is a bit lower, but Chase charges a maximum of only 3 times per business day ($105 overall), while Bank Of America charges 4 times per day ($140 overall).

Many banks and especially online banks don't charge overdraft fees at all. Here are some of the banks that don't charge an overdraft fee:

- Capital One 360

- Ally

- Discover

- Axos Bank

- Citibank

- Chime

Most banks still charge an overdraft fee, but most of them offer a grace period and overdraft protection.

Bank/institution | Overdraft Fee | Max Per Day | ||

|---|---|---|---|---|

| Bank of America | $10 | 4 per day | Learn More |

| TD Bank | $35 | 3 per business day | Learn More |

| PNC Bank | $36 | 4 per 24 hours | Learn More |

| Wells Fargo | $34 | 3 per business day | Learn More |

| US Bank | $36 | 4 times per day | Learn More |

| Chase Total Checking® | $35 | 3 per business day | Learn More |

When Does Chase Charge Overdraft Fees?

According to Chase Bank, if you have overdrawn from your checking account by more than $50, it does not mean that you will be automatically charged an overdraft fee.

Instead, you need to make a deposit or transfer and bring the balance to being overdrawn by $50 or less until 11 PM by the end of the next business day.

For example, let us suppose that you had $100 on the account, and a $200 automatic payment was approved on Monday. In this case, your account will be overdrawn by $100. So, in this case, you have until 11 PM on Tuesday to make a deposit or transfer worth $50 or more to avoid overdraft fees.

Top Offers From Our Partners

![]()

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

How Can I Get Chase To Waive Or Refund Overdraft Fees?

If Chase Bank charges you an overdraft fee, there is still a chance to waive that fee or get a refund. There are two ways to go about this:

- Calling a customer support line – The first way to get the overdraft fee waived is to contact a customer support line at chase bank by calling 1-800-935-9935. Before speaking with the bank’s representative, it is important to have all the account information.

You have to explain your case, why you did not have enough funds for the transaction and why this fee should be removed. This does not guarantee a 100% success rate, but in many cases, the bank representative might agree to waive the overdraft fee. If you pay a monthly fee on your Chase account, you can use it as an argument.

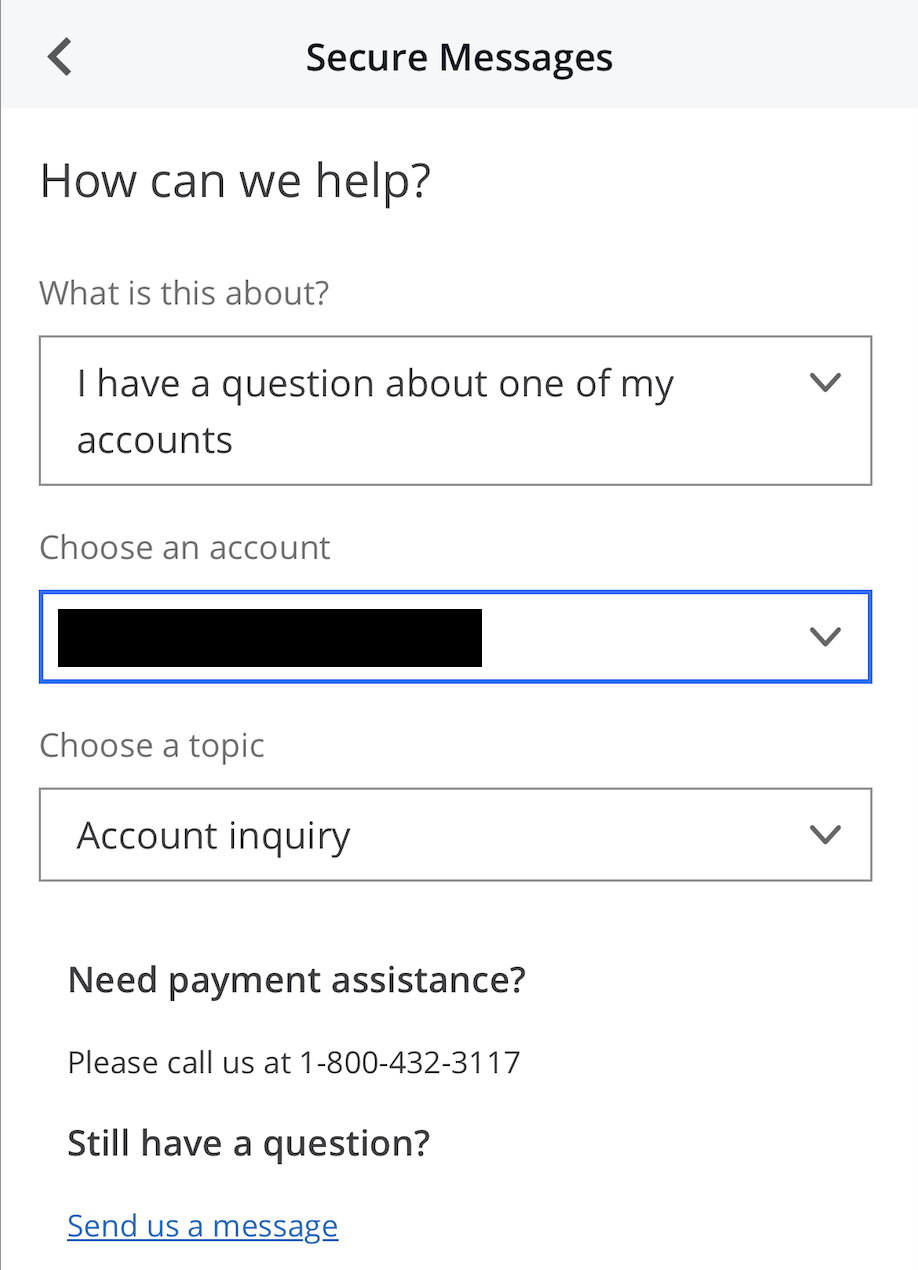

- Sending a secure message – Some people feel uncomfortable presenting and arguing their case over the phone. Fortunately, there is an alternative to that. All you need to do is to log into your online banking and send a secure message to Chase bank.

After some time, the bank representative will get in touch with you. They might ask you additional questions and, eventually, inform you about the bank’s decision on the matter.

Does Chase Offer 24 Hours Overdraft Fee Policy?

Chase Bank does not have a 24 hours overdraft fee policy.

Instead, by Chase Overdraft Assist, once your checking account is overdrawn, you will have until 11 PM (Eastern Time) the next business day to make a deposit or transfer to reduce your overdraft to $50 or lower.

How Does Chase Overdraft Assist Work?

So, what Chase Bank offers can be even better than a 24-hour overdraft policy. So, for example, if you have overdrawn your checking account at 11 AM, you will have 36 hours, instead of 24 hours, to address that before being charged overdraft fees.

You do not have to pay an extra fee to activate the Chase Overdraft Assist service. Instead, this service comes with all Chase Bank accounts, but there are three exceptions:

- Chase First Checking

- Chase High School Checking

- Chase Secure Checking

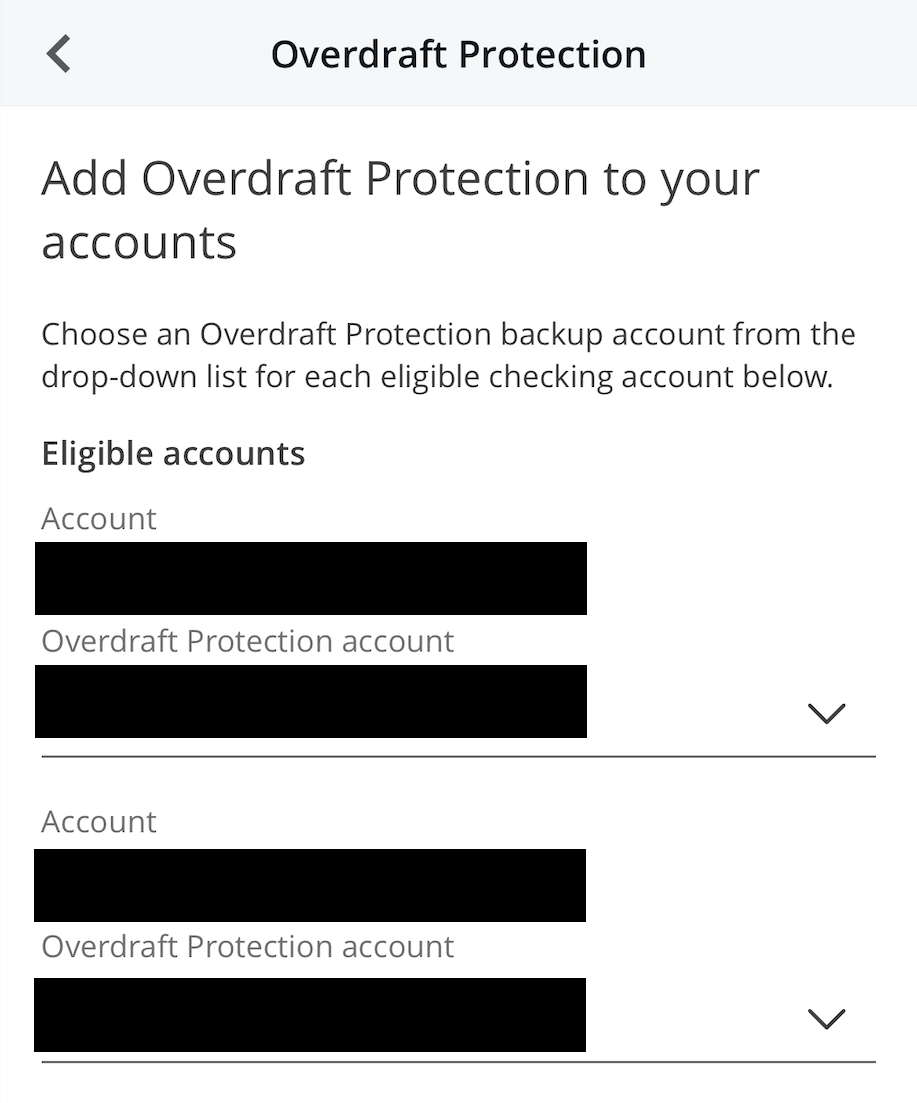

How Does Chase Overdraft Protection Work?

To avoid overdraft fee Chase Bank allows its customers to link their savings accounts to a checking account.

So if the checking account ends up with a negative balance due to the transaction, then the equivalent amount will be transferred from savings to a checking account.

As a result of this service, clients can avoid any overdraft fees. This is called overdraft protection. You can use overdraft protection with all Chase Bank accounts, except Chase Secure Checking℠ or Chase First Checking accounts.

For example, suppose that you have overdrawn from your checking account by $80 and have $3,000 in the linked savings account. In this case, $80 will be transferred from the savings account to your checking account. As a result, the balance in your checking account will be at zero, and $2,920 will be left in your savings account.

Chase overdraft protection covers all transactions, including everyday purchases at restaurants, grocery stores, gas stations, etc.

Which Additional Tools Does Chase Offer To Prevent Overdrafts?

Another way to avoid overdraft fees besides using overdraft protection is to sign up for alerts. You can do so using online or mobile banking applications. With alerts, you will be informed about all of the transactions.

In addition to that, you can set the alerts in such a way, that you will get notified if the balance in your account drops below the indicated amount.

Chase Bank also offers Chase Secure Banking checking accounts to its customers. One of the advantages of this account is that it has no overdraft fees. This is because with this account you only spend what is available on the checking account.

So with this type of account, you do not have to worry about setting up alerts, or about being charged an overdraft fee. In this case, if there are no sufficient funds in the account, then the transaction will be simply rejected.

How Chase Debit Card Coverage Prevent Overdrafts?

Chase Debit Card Coverage gives you a choice of how the bank will handle your everyday transactions with your debit card when you have insufficient funds for the transaction.

If you accept Debit Card Coverage, then Chase bank may authorize everyday card transactions, such as when you spend money at gas stations or supermarkets, when there are insufficient funds in the account. The downside to this choice is that you will be charged with $34 fee per transaction, up to 3 times per day.

On the other hand, you can choose not to use Debit Card Coverage, in which case, those everyday transactions on your debit card will be automatically rejected if there are no sufficient funds available in your checking account. In this case, you can avoid that $34 fee.

So as we can see here, choosing a ‘No’ option with Debit Card Coverage can be helpful to avoid overdraft fees with your everyday purchases.

FAQs

Does Chase have a grace period for overdraft?

If a customer’s checking account ends up overdrawn by more than $50, the customer has until the next business day, 11 PM Eastern time to deposit or transfer funds to reduce the size of the overdraft to $50 or less.

Therefore, customers have some time to address the overdraft issue, before being charged a fee.

How many times will Chase let you use overdraft?

With Chase Bank, there is no hard limit on the number of times they will let you use an overdraft.

However, it is helpful to keep in mind that, for each business day Chase clients can only be charged with an overdraft fee maximum 3 times.

How many overdraft fees can be waived Chase?

There is no set limit on how many overdraft fees can be waived by Chase Bank. If you deposit or transfer funds by 11 PM the next day then you can avoid overdraft fees in every single case.

However, if you have missed this deadline, then you have to get in touch with Chase customer service, which will decide whether or not to waive fees.

How's overdraft fees work if I have a Chase credit card?

Chase credit cards charge your account on a specific day every month. If you don't have the right amount in your account, you can be charged an overdraft fee.

How much overdraft does Chase allow?

As the Chase website explains, there is no maximum limit on the size of an overdraft, which applies to all customers. Instead, the acceptable size of overdraft is different for every individual.

In this case, the bank takes into account the total amount of deposits in the account, cash balances on savings accounts, and some other factors.

Are Chase overdraft fees charged immediately?

With Chase Bank overdraft fees are not charged immediately. Instead, as explained above, a client has time until 11 PM the next business day to transfer or deposit funds to bring the size of the overdraft to $50 or less.

So this gives customers enough time to take steps in order to avoid unnecessary fees.

Will Chase forgive overdraft fees?

Chase bank automatically forgives overdraft fees, only if you bring the negative balance on your checking account back to $50 within 11 PM the next business day.

In addition to that, if you contact customer service, then they might agree to waive the overdraft fee in some cases.

Is Chase's overdraft fee daily?

The Chase Bank overdraft fee is a flat fee of $34 and a maximum of $102 in total every day.

You are charged with $34 for using an overdraft, up to 3 times per day.

Does Chase eliminate overdraft and monthly fee for new customers?

No. While Chase bank offers welcome bonuses for new customers, it doesn't waive an overdraft fee or monthly maintenance fee (unless you meet certain conditions).

What happens if my Chase account is negative for too long?

If you let the balance on your Chase checking account to remain negative for too long, then eventually the bank might decide to close your account.

This information will also be available to credit bureaus, therefore, this can also have a damaging effect on your credit history.