Bank/institution | APY | Min Deposit | Monthly Fee | |

|---|---|---|---|---|

| LendingClub High-Yield Savings | 5.00% | $0 | $100 |

| SoFi Checking and Savings | up to 4.60% | $0 | $0 |

| Barclays Online Savings | 4.35% | $0 | $0 |

| Synchrony Bank Online Savings | 4.75% | $0 | $0 |

| UFB Preferred Savings Account | Up to 5.25% | $0 | $0 |

| Quontic Bank High Yield Savings | 4.50% | $100 | $0 |

| Bread Financial Savings | 5.15% | $100 | $0 |

Bank/institution | APY | Min Deposit | Monthly Fee |

|---|---|---|---|

LendingClub High-Yield Savings | 5.00% | $0 | $100 |

SoFi Checking and Savings | up to 4.60% | $0 | $0 |

Barclays Online Savings | 4.35% | $0 | $0 |

Synchrony Bank Online Savings | 4.75% | $0 | $0 |

UFB Preferred Savings Account | Up to 5.25% | $0 | $0 |

Quontic Bank High Yield Savings | 4.50% | $100 | $0 |

Bread Financial Savings | 5.15% | $100 | $0 |

UFB Preferred Savings

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

The UFB Preferred Savings account offers a much higher interest rate than most traditional banks. It also compares favorably with many online savings accounts.

With this account, UFB provides customers with a complimentary ATM card that makes accessing your money quick and easy. UFB Direct has an extensive ATM network with over 91,000 machines throughout the country that you can use without incurring any fees.

Managing your account is simple with the UFB Direct app. You can do everything from checking your transaction history to transferring money and even depositing checks remotely. Best of all, your UFB Preferred Savings account is FDIC-insured, so you can rest easy knowing that your money is protected just like it would be with a traditional bank account.

How do you close a UFB Preferred Savings account?

The easiest way to close your Preferred Online Savings account is to call the customer support line. An UFB representative can guide you through the closure process and activate your request.

How much can I withdraw from UFB Preferred Savings?

There are no limits to how much you can withdraw from your UFB Preferred Online Savings account.

Can I transfer my IRA to a UFB Preferred Online Savings?

Yes, you can transfer your IRA to a Preferred Online Savings account, but you should evaluate all of the tax implications before you make any decisions to move money around.

Can you direct deposit into a UFB Preferred savings account?

Yes, you can arrange to have your salary, pension or other payment direct deposited into your Preferred Savings account.

LendingClub Savings

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

The LendingClub High Yield savings account is an excellent option for individuals who want to earn a high Annual Percentage Yield (APY).

In comparison to many other financial institutions, this account offers an impressive APY that competes well with the competition. Interest is calculated daily and added to the account monthly, with compounding happening every statement cycle. One standout feature of this account is the availability of an ATM card, which is not commonly offered with this type of savings account.

However, there are some limitations to consider. This includes limited access to branches, a minimum deposit requirement, and high overdraft fees. If you're okay with these compromises, the LendingClub High Yield Savings account is certainly worth considering as a savings option.

Can you direct deposit into a LendingClub Savings?

Yes, it is possible to have your salary or other payments direct deposited into your LendingClub High Yield Savings account.

How do you close a LendingClub High Yield Savings?

The easiest way to close your LendingClub High Yield savings account is to call the customer service helpline. A representative can then guide you through the closure process.

How much can I withdraw?

There is a $500 daily ATM withdrawal limit and new customers may also have limits on the amount that they can transfer in the first 120 days.

SoFi Checking and Savings

APY

Fees

Minimum Deposit

Current Promotion

- Overview

- FAQ

SoFi has a hybrid savings and checking account that offers up to 4.60% APY, and this definitely one of the highest rates you can currently get in the US. SoFi savings has no minimum deposit and there are no account fees to worry about.

The SoFi hybrid account also has some good checking account features. This includes round up, so your debit card payments are rounded up and the difference is directed into one of your savings vaults.

There is also $50 of fee free overdraft protection, so you don’t need to worry about charges if your available balance drops too low. SoFi also offers new customers a $100 welcome bonus.

Are my deposits insured with SoFi?

Yes, your deposits are FDIC insured up to $250,000 per member ($500,000 for joint accounts).

How frequently are interest accruals and compounding made?

Interest on your balance is accrued daily and compounded monthly. SoFi computes the interest earned on the last business day of each month and post it to your SoFi Checking and Savings account by the fifth business day of the following month. Your monthly statement includes the interest earned.

What is required to open a SoFi account?

Like the major banks, SoFi requires applicants to verify their identity and personal details to open an account. This will include your Social Security number, a valid home address, and contact details. All of these details are included in the application form, so be sure that you don’t leave any mandatory fields blank.

Is SoFi worth it if I have bad credit?

While SoFi does not have any specific bad credit products, it is reputed to have flexible requirements. There are many consumer reviews that suggest that it is possible to obtain SoFi products even if you have less than ideal credit.

Unlike many other banks, SoFi does not have a secured credit card. However, the only SoFi credit card option is designed to help you pay down debt, with greater rewards if you use them to pay down a loan.

Barclays Online Savings

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

Barclays offers high-interest rates that apply to all of its products that provide a great advantage compared to other competitive online banks. Barclays offers two different savings account options. The two options are the Barclays Online Savings Account and the Barclays Dream Account. Both earn 0.40% APY with no fees or minimum deposit.

The Dream account earns more interest over time. You can potentially earn a 5% bonus on earn interest every six months so long as you avoid any withdrawals and make one deposit a month. This is a great option for anyone that is smart with the savings and can keep themselves engaged with the overall process of long-term savings.

There is no other bonus offered to other savings accounts to any other online banking institution. The Dream Account does put a limit on your monthly deposits. You can only deposit $1,000 a month. If you make zero withdrawals and deposit the maximum $1,000 every month you still need to keep the same pattern for a full year for the benefits to kick into effect.

- Does Barclays offer a free checking account?

Although Barclays offers savings accounts, credit cards, and loans, its product line does not include a checking account. So, regardless of whether you’re prepared to pay checking account fees, this is not the bank for you if you need an account to manage your day to day transactions.

- Is Barclays a good bank for teens?

Unfortunately, Barclays no longer offers accounts for minors, which means that it is not a good bank for teens. Although the savings rates are great, your children will only be able to open an account after they turn 18.

- Is Barclays worth for Millenials?

Millennials tend to look for convenient and easy to use banking services. While Barclays does have some superb credit card options and a great savings rate, the lack of a checking account could create problems. Although the bank has a good interface and well regarded app, if you’re looking for a primary bank to manage your day to day transactions, you’re likely to find Barclays lacking.

However, if you want to start working towards your savings goals, Barclays does have some excellent products that could help you. You can link up to three accounts from other banks to make transfers easy and providing you make no more than 6 transfers out of the account, you’ll be able to access a great rate.

- Can you buy/invest in gold products via Barclays ?

Although the U.K arm of Barclays does offer investments, the US side of the bank does not currently offer investment products. This means that it is not possible to buy gold stocks or invest in gold products through Barclays.

Can you buy/invest in Crypto via Barclays ?

Barclays does not currently offer crypto investments, so if you are looking to create an investment strategy using cryptocurrencies, this may not be the bank for you. While you may be able to use Barclays for savings and credit cards, if

Bread Financial Savings

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

Bread Financial savings account offers some of the best interest rates on the market, making it a great choice for individuals who want to maximize their savings. However, it's important to note that the lack of a checking account in its product lineup means that Bread Financial cannot provide a full banking alternative to your current bank.

Since Bread Financial is an online-only operation, it's widely available to everyone. However, this does mean that there's no physical branch network or ATM network. Nonetheless, you can manage your account through the app, which has received mixed reviews.

What is required to open a Bread Financial savings account?

As with all US financial institutions, you will be required to verify your ID, which you can do by submitting a copy of your driver’s license, passport or state issued photo ID.

Is my money safe on Bread Financial?

Yes, Bread Financial is FDIC insured, which provides up to $250,000 of coverage per depositor in each ownership category. So, if you have a savings account and a CD, you’ll have $250,000 of coverage for each account.

Synchrony Bank Online Savings

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

Synchrony Bank is one of the highest APY in the market today. There is no minimum balance that customers have to maintain but you need a $5,000 to open an account.

Unlike other banks that would have several options in savings account alone, Synchrony Bank offers only one type of savings account. And don’t even bother to ask for a checking account because that one didn’t make it on their list for whatever reason. Customers can access their accounts online, via mobile app, or through the thousands of ATMs that carry the Visa Plus or Accel logos.

Synchrony’s app is rated 4.8 out of 5 for both Apple and Google. In terms of customer service, Synchrony has a 24-hour automated phone service, but if you want to speak with an agent, the lines are only open from 8 a.m. to 10 p.m. on weekdays and 8 a.m. to 5 p.m. on weekends.

How's Synchrony Bank physical coverage?

Synchrony is a fully online bank, so it does not have any physical branch coverage. All your account maintenance is performed online through the online dashboard or accompanying app. However, there is a chat function on the website and helpline if you run into an issue you’re struggling to solve. The bank also has access to a large ATM network and you can use the ATM finder on the website or app to find a machine in your local area. So, if you are considering Synchrony, you will need to be comfortable with the idea of not having branch support.

Is Synchrony Bank ready/can fall for recession?

Synchrony has been operating since 2003 and the bank has maintained a solid track record. With its limited product line, the bank does have some protection against adverse economic times. Since the bank does not offer personal loans or mortgages, there is less risk of default if people start to struggle with their finances. So, Synchrony should be prepared for a recession and its customers still have the reassurance of FDIC insurance for up to $250,000 in deposits.

Does Synchrony Bank offer a free checking account?

Synchrony Bank does not currently have any checking account options in its product line up. This means that there is no possibility of opening a Synchrony checking account with or without a fee. So, if you do need a checking account and want your savings with the same bank, Synchrony is not the right bank for you.

Quontic Bank Savings

APY

Fees:

Minimum Deposit

Current Promotion

- Overview

- FAQ

Quontic Bank High Yield Savings offers one of the best rates you can get when shopping around for a savings account.

Quontic bank could be a wise decision if:

- You're comfortable using an online-only bank.

- You can open a savings account with at least $100,000.

- You might require a home equity loan or mortgage.

Online bank Quontic Bank has its main office in New York. The bank has been in business since 2009, and it serves online customers from all 50 states. Access to savings, checking, CD, and money market accounts is offered by this bank. Also, there are real estate goods for both residential and commercial properties.

Consumer review websites give this bank a high rating, and both current and former clients give high marks for the simplicity of account opening and the friendly staff.

Can I withdraw funds from a Quontic savings account?

Yes, this is possible. You can make a maximum of six withdrawals each month.

Quontic will contacte you in the event you exceed the transaction limitations and your account may be changed due to a transactional account.

How the Interest compounded?

Interest is compounded daily based on your posted account balance

How Does Quontic Mobile Banking Work?

Mobile banking gives you access to your accounts from your phine or app.

You can monitor account balances, look at recent account activity, transfer money across internal accounts, pay bills, and locate the closest ATM using both ways. Check deposits might be an option on the mobile banking app that you can download.

To open a Quontic checking account, what do I need?

When you open an account, to validate your identify we will ask for: your name address date of birth social security number.

Quontic may also ask for a valid U.S. government-issued ID. There is a minimum required amount to open an account. You will deposit money into your account with an internet transfer from a different bank account (during the online account opening process). To open an account, you must be a citizen of the United States and at least 18 years old.

How can I add money to my Quontic account?

Quontic offers three options for making your initial deposit: transferring funds from an existing Quontic account, sending funds via ACH from an external account, or using Plaid's technology.

Savings Accounts Reviews

Vio Bank Savings Review

Should I Put My Money in a Savings Account?

Saving is so important, but it is also so difficult for most people. Then, figure out how to put that extra cash to work for you. There are so many ways to use, grow, and save money these days, including good old-fashioned savings accounts.

Pros | Cons |

|---|---|

Interest Rate | Inflation |

Liquid | Low Rates Comparably |

Low Requirements | Fees and Requirements |

Secured | |

Easy Access |

- Interest Rate

Savings account interest rates have definitely taken a turn for the better compared to the last 15 years. They're currently at their highest levels since 2008, thanks to rising inflation and the Federal Reserve's interest rate hikes.

- Liquid

Savings accounts are cash-based, so you don't have to worry about selling investments or making other complicated moves to get your money. You can get your money in every time straight to your pocket.

- Low Requirements

Many savings accounts can be opened for as little as $25. Some financial institutions allow you to open a savings account for as little as $1, so you can start saving with a small amount.

- Secured

A savings account at an FDIC-insured bank (Federal Deposit Insurance Corporation) insures your money up to $250,000. If you use an NCUA-insured credit union, your account is also insured up to $250,000.

- Easy Access

Unlike long-term investment accounts, savings accounts are simple to open and allow you to withdraw and deposit funds at ATMs or through 24-hour online access at any time (within federal limits).

Many financial institutions will allow you to link your savings account to another account, such as a checking account, allowing you to avoid costly overdraft fees.

- Inflation

Inflation has risen in recent years at the highest pace since 1981, while the yearly inflation is much higher than the bank interest – which means the power of your money is getting down.

If your savings account does not offer a competitive interest rate, inflation may eat away at the value of your earned interest, leaving you with an account balance that is worth less in a year's time than it is today.

- Low Rates Comparably

Interest rates are lower than those found in other types of accounts or investments, such as certificates of deposit (CD) or treasury bonds. With the rising inflation, it's something to pay attention to.

- Fees and Requirements

Some savings accounts may have fees or minimum balance requirements. Failing to maintain the minimum balance or exceeding transaction limits may result in

Why is it Called High Yield Account?

A high-yield savings account is a type of savings account that pays at least 10 times the national average for a savings account. People have traditionally kept their savings account at the same bank where they keep their checking account, making transfers between the two simple and quick.

Also, with the advent of internet-only banks, as well as traditional banks that have opened their doors to customers across the country via online account opening, savings rate competition has skyrocketed, resulting in the creation of a new category of “high-yield savings accounts.”

Given the difference in rates between high-yield savings accounts and the national average, the earnings increase is significant. If you have $10,000 in savings and the national average APY is 0.05 percent, you would earn only $5 over the course of a year. If you instead invested the same $10,000 in a one-percentage-point-earnings account, you'd make $100.

With a high-yield savings account, you can withdraw or transfer funds (including electronic transfers, checks, and wire transfers) up to six times per month without incurring a penalty fee or risk having your account closed.

The value of personal savings in the US has soared since the 1960s to 2020, rising from $38 billion to $2.326 trillion in 2020.

How To Open High Yield Savings Account?

Opening a high-yield savings account is a straightforward process. Here's a step-by-step guide:

- Research and Compare Financial Institutions: Explore different banks, credit unions, and online financial institutions to find the one offering the best high-yield savings account. Compare interest rates, fees, and account features.

- Gather Necessary Documentation: Prepare identification documents, such as a government-issued ID (driver's license, passport), social security number, and proof of address (utility bill or lease agreement).

- Choose the High-Yield Savings Account: Select the specific high-yield savings account that aligns with your financial goals. Pay attention to interest rates, fees, and any account requirements.

- Visit a Local Branch or Apply Online: Depending on the institution, you can either visit a local branch or apply online. Many high-yield savings accounts are offered by online-only banks, so online applications are common.

- Complete the Application Form: Fill out the application form with accurate personal information. This may include your name, address, date of birth, employment details, and financial information.

- Provide Initial Deposit: Some high-yield savings accounts require an initial deposit. Ensure you have the necessary funds to meet any minimum deposit requirements.

By following these steps, you can open a high-yield savings account and start earning competitive interest on your savings.

What Documents Do I Need?

Bringing all the right documents with you to open an high-yield online savings account can ensure that the process is smooth, and you don’t get stuck not having everything you need. Many savings accounts can be opened online so you can easily get the documents you need while at home.

Every bank is a little different, but you will need some basic items no matter where you decide to the bank. You need a passport or driver’s license or some form of government ID. You also need to social security card, your date of birth, and proof of address.

You will usually need two forms of proof of address from two different sources. If you are funding your new account with an existing account, you will need the banking information to link them together.

How Much Money Do You Need to Open?

High yield online savings accounts usually don’t require a huge minimum deposit. They usually need about 25-100 dollars to open the account. However, you will need more to avoid the monthly fees. You will need at least a few hundred dollars in the account at all times to avoid a monthly fee.

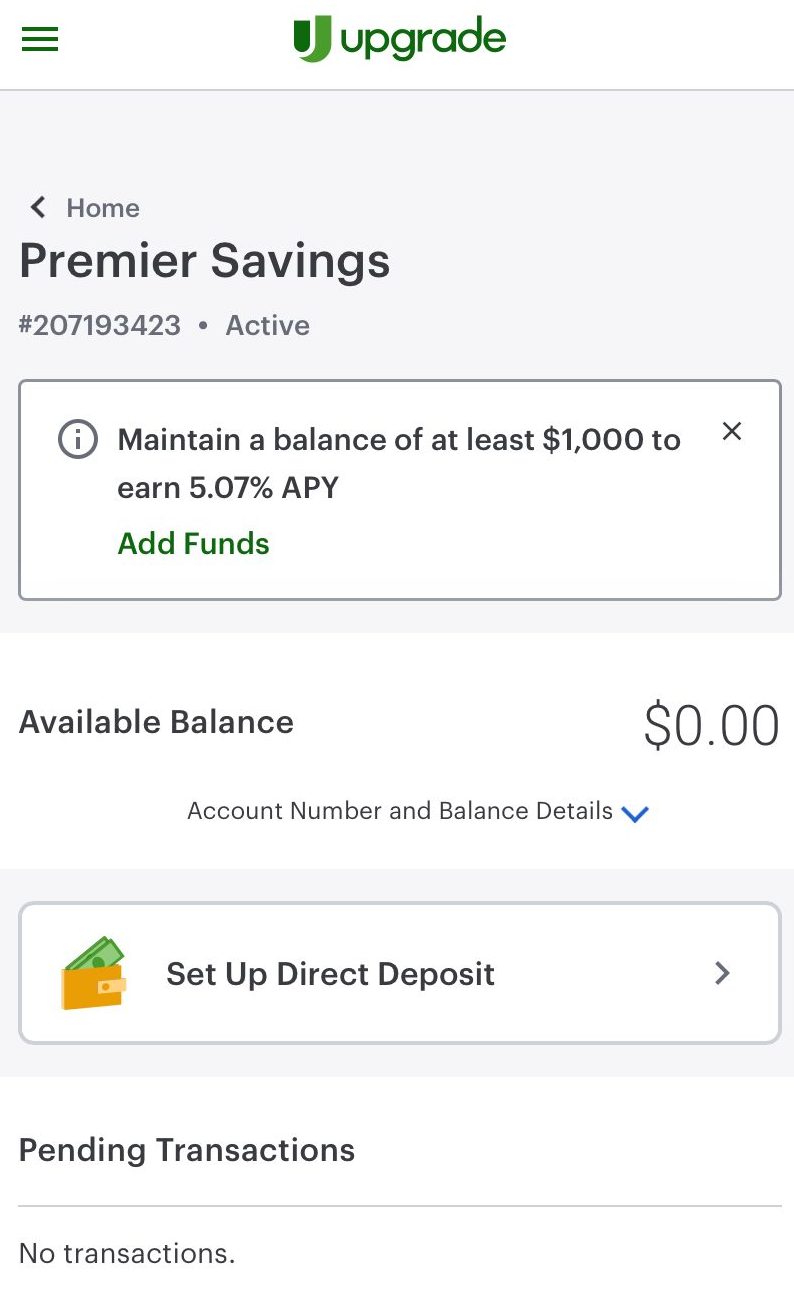

You also don’t need the money right when you open the account in many cases. This means you can open the account and then deposit the money a few days or weeks later. Also, after opening – there is no minimum balance so you can withdraw all money if needed, like we see in this case with Upgrade savings account:

How to Choose The Best High Yield Savings Account?

Choosing the best high-yield savings account requires careful consideration of various factors. Here's a guide to help you make an informed decision:

- Interest Rates: Compare the interest rates offered by different financial institutions. Look for a high-yield savings account with competitive rates to maximize your earnings.

- Fees: Check for fees associated with the high-yield savings account, including monthly maintenance fees, transaction fees, and any other charges. Ideally, choose an account with minimal or no fees.

- Online and Mobile Banking: Evaluate the online and mobile banking features. A user-friendly interface, mobile app availability, and convenient online services can enhance your overall banking experience.

- Customer Service: Assess the quality of customer service provided by the financial institution. Look for reviews or ratings that reflect positive customer experiences.

- Account Features: Examine additional features such as automatic transfers, linked accounts, and the ability to set savings goals. These features can contribute to effective money management.

- FDIC or NCUA Insurance: Ensure that the high-yield savings account is insured by the Federal Deposit Insurance Corporation (FDIC) for banks or the National Credit Union Administration (NCUA) for credit unions. This protects your deposits up to a certain limit.

- Promotional Offers: Some institutions may offer promotional interest rates or sign-up bonuses. While these can be attractive, consider the long-term benefits beyond the initial promotion period.

- Withdrawal Limits: Be aware of any restrictions on the number of withdrawals or transfers allowed per month. Some high-yield savings accounts have limitations to maintain their higher interest rates.

By carefully evaluating these factors, you can choose the best high-yield savings account that aligns with your financial goals and preferences.

A survey conducted by IPSOS in February 2021 on the most valuable mobile banking features in the United States shows that 35% of the participants considered check deposit the most valuable mobile banking feature. At close range and above 30%, viewing statements and account balances, transferring funds between accounts, received 33% and 31% of the responses. 3% of the respondent did not have a bank account.

Can I Have Multiple Savings Accounts? Is It A Good Idea?

Yes, you can have multiple savings accounts, and it can be a good idea for various reasons. Having multiple savings accounts allows you to organize and allocate your funds for specific purposes, such as emergencies, short-term goals, or specific expenses.

It helps you track and manage savings more effectively, preventing the commingling of funds. Additionally, multiple accounts provide flexibility to take advantage of different banks' interest rates and promotions, maximizing your overall earnings.

However, it's crucial to avoid excessive accounts to prevent confusion and ensure you meet any minimum balance requirements. Evaluate your financial goals and consider multiple savings accounts if it aligns with your budgeting and savings strategy.

How Is Your Account Secured?

Security and protection are of paramount importance when we talk about online services and transactions. For a bank to verify your savings account, they need your identity information in order to protect themselves from fraud.

Some online banks, require from the account holder to choose a security question. In fact, this is a standard procedure when opening an account anywhere. Then you have to give the answer, which supposedly only you know. In case of a problem with your account, the bank might ask this question. Others will have your mother's maiden name as well as your previous address.

Also, if you want to have an online savings account you have to link it to a checking account. This is yet another verification and protection. This is great because you can transfer money between the two accounts if they are both active, of course.

Picking The Best High Yield Savings Account: Methodology

The Smart Investor team looked at lots of banks and credit unions to find the best high-yield savings accounts. We focused on important things like how much interest you can earn, the smallest amount of money you need to start saving, and any fees.

Here's how we rated them:

Rates And Terms (35%): We checked the interest rates, the smallest amount of money you need to start saving, and any fees. High-yield savings accounts with higher interest rates and lower fees got better scores.

Savings Account features (35%): We looked at all the different things the account offers, like ways to save money, transfer money, take out money, any special deals, and tools to help you save more. High yield savings accounts with lots of options got better scores.

Customer experience (20%): We checked how easy it is to open an account, talk to customer service, use the mobile app (our team tested this), and the bank's policies for helping customers. Banks and credit unions with easy-to-use apps and lots of ways to get help got better ratings.

Bank reputation (10%): We looked into how people feel about each bank, including ratings from JD Power, TrustPilot, and the Better Business Bureau. Banks with a good reputation got higher scores.

FAQs

Is your money stuck in a savings account?

This depends on the bank you use and the stipulations of your banking. Most of the time you can make 2-3 transfers out of the savings account each month. This means you can move the money freely. Some bank accounts have a minimum requirement, or you’ll end up facing fees. To avoid the fees, you might have a few hundred dollars stuck in the savings account at a given time.

If you want all your money, you might need to close the savings account.

How much interest will I get on $1,000 a year in a savings account?

It depends on the bank you use and how high your interest is. The higher your interest is, the more money you make on $1,000. If you have 0.01$ APY, you’ll end up with $1,000.10 after a year because your interest rate is on the lower end.

If you put the $1,000 in a high-yield savings account, you could $5 or more a year depending on how high your interest rate is. Putting your savings into a high-yield account will ensure you are making more money.

Does Chase have a high yield savings account?

Chase has a variety of savings accounts, but they typically have standard rates, rather than high-yield returns.

Does Citi have a high yield savings account?

Citi has several savings account options, but the Citi Accelerate is the bank’s high-yield savings account option, which offers lower interest than the best high-yield savings accounts.

Can you have more than one high yield online savings account?

Yes, you can open a high-yield online savings account with more than one financial institution.