Wells Fargo Way2Save Savings

APY Savings

Minimum Deposit

Our Rating

Fees

Wells Fargo Way2Save Savings

APY Savings

Minimum Deposit

Our Rating

Fees

Wells Fargo is one of the most well established banks in the U.S with a history dating back over 170 years.

The Wells Fargo Way2Save may not offer the best savings rates, but you do have access to a large branch network for in person support.

The automated savings tools are not unique to Wells Fargo, but they can make it easier to boost your savings balance. With interest that compounds daily, you can slowly work towards your savings goals.

Unfortunately, the account works best if you have a linked Wells Fargo checking account. So, if you’re looking for the best rates and don’t want to open a new checking account, you may be better suited with another bank or financial institution.

Pros | Cons |

|---|---|

Save As You Go Transfers | Minimum Opening Deposit |

Auto Transfers | Monthly Service Fee |

Overdraft Protection | Low Rate |

Wells Fargo App | |

Access to Wells Fargo ATM Network | |

Access to Wells Fargo Branches |

What Does The Wells Fargo Way2Save Savings Offer?

Here are the main features you can expect when opening a Wells Fargo Way2Save savings account:

- Save As You Go Transfers: This feature automatically transfers $1 from your linked checking account to your Way2Save account each time you use your debit card or complete a bill payment via online banking.

- Auto Transfers: You can also set up automatic regular transfers from your linked Wells Fargo checking account. You can save daily from $1 or monthly from $25.

- Wells Fargo App: You can manage your account via the Wells Fargo Mobile app, so you can track your progress towards your savings goals.

- Overdraft Protection: You can opt to use your Way2Save account as protection for your linked Wells Fargo checking account to avoid going overdrawn and incurring overdraft fees.

- Access to Wells Fargo ATM Network: The Way2Save account is offered with an ATM card and you can use this with Wells Fargo ATMs. The Wells Fargo ATM network currently has over 12,000 machines, so you are sure to be able to find one near where you live or work. However, you are limited to six withdrawals in any month.

- Access to Wells Fargo Branches: You can also access in person support at one of the Wells Fargo branches. The Wells Fargo branch network includes over 4,700 locations around the country.

Sign Up for

Our Newsletter

Low Interest Rates Is The Main Drawback

The Wells Fargo Way2Save Savings account has some major drawbacks:

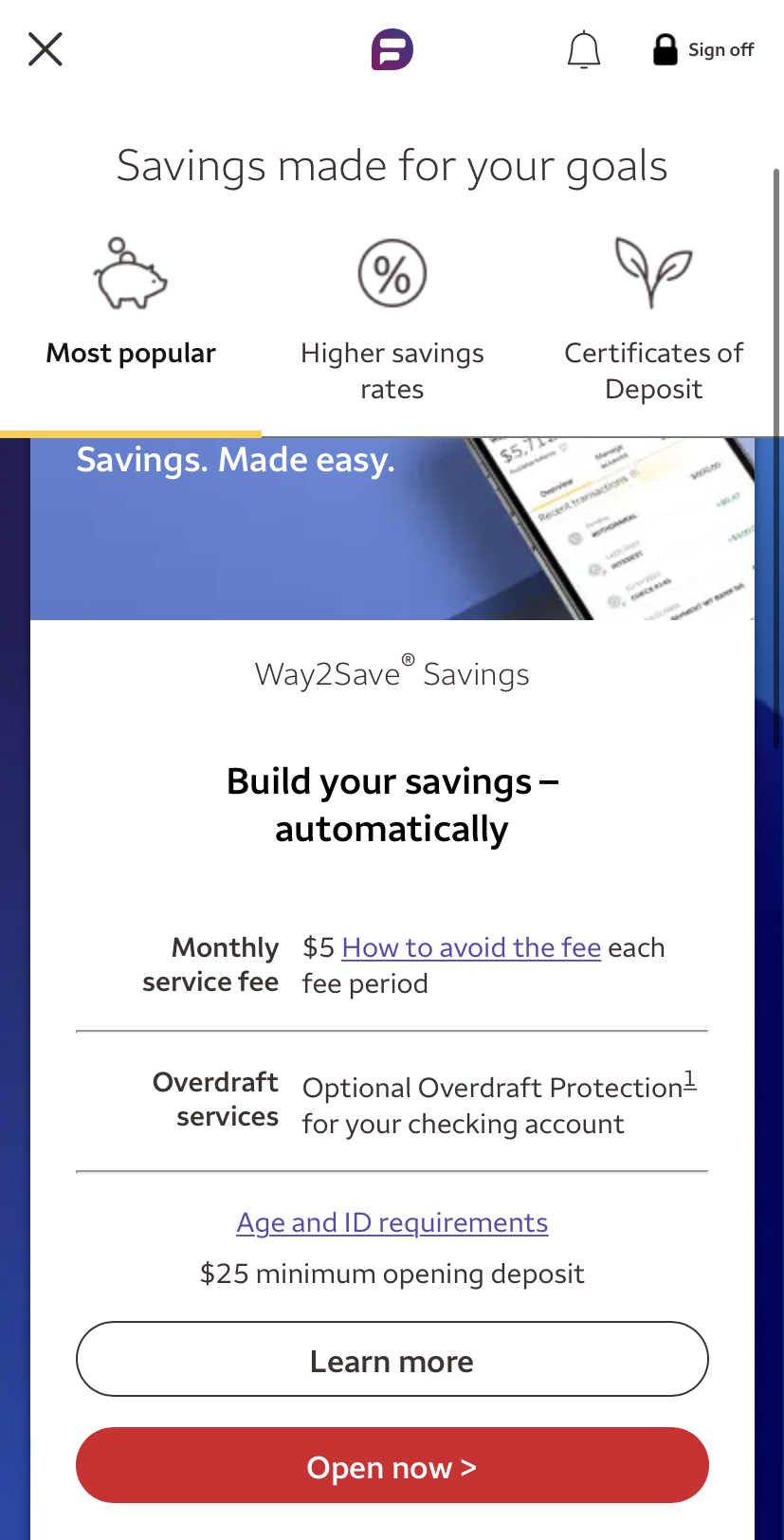

- Minimum Opening Deposit: Unlike many savings accounts, you need to open this account with at least $25. While this is not an insurmountable amount, if you’re only looking to save a dollar or two per week, it is a little counterintuitive.

- Monthly Service Fee: The account has a $5 monthly service fee. While this can be waived with a minimum daily balance, one auto transfer or if you’re under the age of 24, this has the potential to eat into your savings.

- Low Rate: The Wells Fargo rate for this account is quite low and far below what you can expect to get with an the best savings account.

Wells Fargo Way2Save Vs. Chase Premier Savings

On the surface, these two accounts look almost identical, but there are some key differences that may be important when you're making a decision about which one is best for you.

The Similarities | The Differences |

|---|---|

Similar Rate | The Monthly Maintenance Fee |

Link to a Checking Account | Potential to Earn Relationship Rates |

Automatic Savings | |

Similar Size Networks |

- Similar Rate

As of May 2024, both the Chase Premier savings and the Wells Fargo Way2Save accounts have an identical rate.

- Link to a Checking Account

Both accounts perform best when they are linked to the appropriate checking account.

- Automatic Savings

Both accounts have automatic savings features to help you reach your savings goals.

- Similar Size Networks

When comparing Chase and Wells Fargo, they basically have similar size branch and ATM networks.

- The Monthly Maintenance Fee

While both accounts have a monthly maintenance fee, the Chase Premier Savings account is far higher and has more stringent waiver requirements.

- Potential to Earn Relationship Rates

Chase offers relationship rates on its Premier Savings account.

You can earn a higher rate if you link the account to a Chase Sapphire or Chase Premier Plus checking account and make at least five customer initiated transactions per month.

Wells Fargo Way2Save vs. Citi Accelerate Savings

Since the Citi Accelerate is a high yield savings account, there are some crucial differences between the accounts. However, there are also a couple of similarities.

The Similarities | The Differences |

|---|---|

Need for a Checking Account | Rates |

Limited Withdrawals | Minimum Deposit |

Monthly Fee | Loyalty Points |

- Need for a Checking Account

Like the Wells Fargo Way2Save, you’ll need a Citi Checking account to operate this account. In fact, you may not be able to open an Accelerate account without first opening a Citi Checking account.

- Limited Withdrawals

Both accounts have limitations on how many withdrawals or transfers out of the account you can make per statement period.

- Monthly Fee

With Citi And Wells Fargo accounts you’re likely to end up paying a monthly fee.

- Rates

The Citi Accelerate savings APY is much higher, 4.45%, which is more than you’ll get with Way2Save or most bricks-and-mortar banks.

- Minimum Deposit

There is no minimum deposit with the Citi Accelerate.

- Loyalty Points

The Citi Accelerate offers customers the ability to earn ThankYou points, which can be redeemed for statement credit, shopping and travel

How to Deposit and Withdraw Money From Wells Fargo Way2Save

Since Wells Fargo has a branch network and solid online platform with mobile app, there are numerous ways to deposit and withdraw funds for your Way2Save savings account.

Deposit | Withdrawl |

|---|---|

At Branches | In Person |

Visit an ATM | Visit an ATM |

Online transfers | Online transfers |

Wire Transfers | Wire Transfers |

Direct deposit | |

Mobile Check Deposit |

- Deposits

- At Branches: You can pay money into your account via the teller in your local branch.

- At ATMs: Some ATMs also allow you to deposit funds.

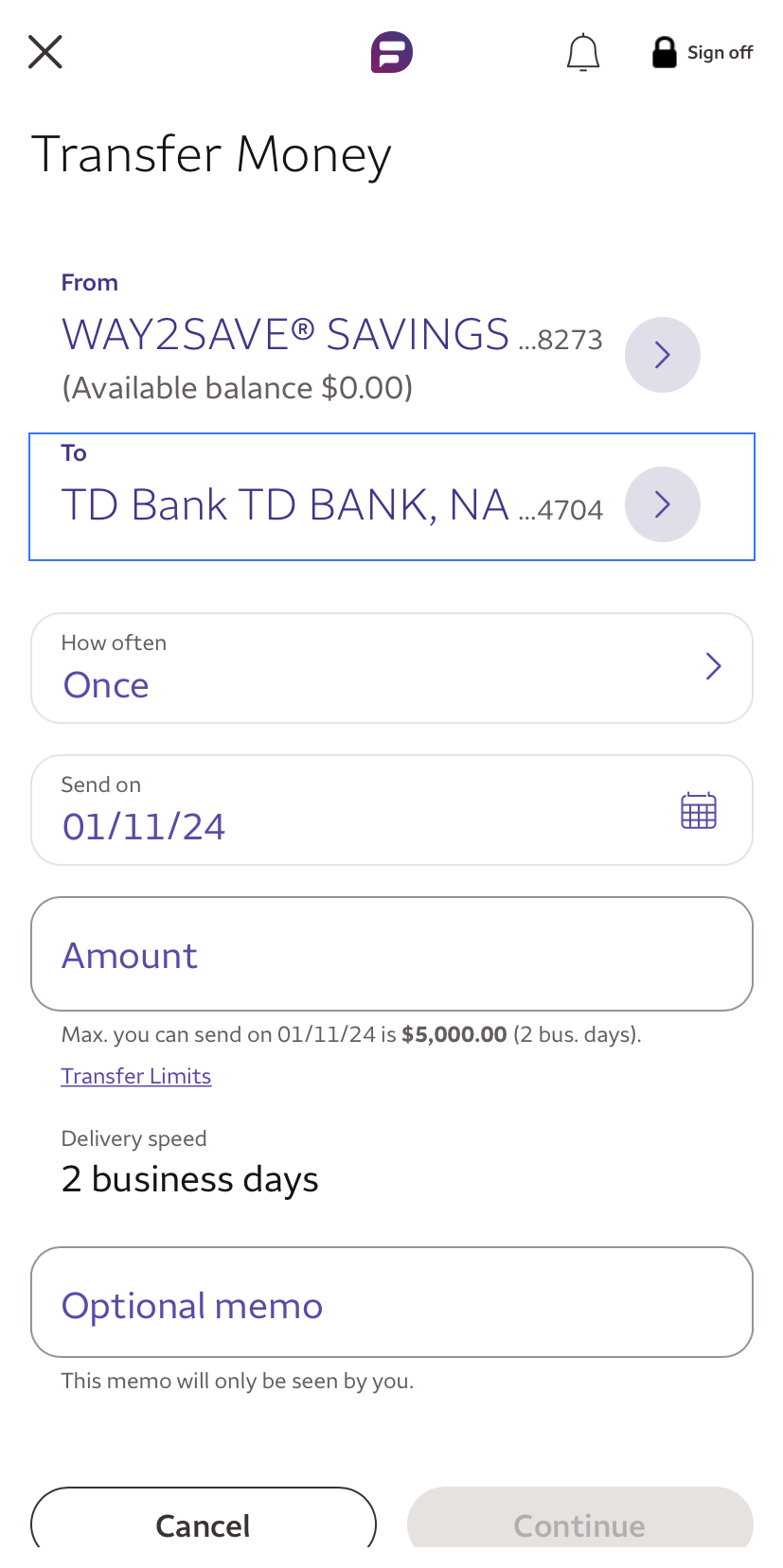

- Online Transfers: You can arrange an online transfer from your Wells Fargo checking account or third party account.

- Mobile Check Deposit: The Wells Fargo app allows you to take pictures of checks and submit them without needing to mail in the check or visit a branch.

- Direct Deposits: You can schedule to have your salary or other funds direct deposited into your account.

- Wire Transfers: Wire transfers into the account are possible, but you are likely to incur a fee from the sending bank.

- Withdrawals

While you are limited to six withdrawals per statement period, you can withdraw funds in a number of ways, including:

- In Person: You can visit a local branch, but you will need to bring proof of ID.

- ATM: The account is supplied with an ATM card, so you can easily withdraw funds. Just be wary of using a non network machine, as you will incur potentially hefty fees.

- Wire Transfers: You can also wire money from the account, but you will incur a fee.

- Online Transfers: You can also schedule an online transfer to your Wells Fargo or other bank accounts.

Should I Open a Wells Fargo Way2Save Account?

Whether a Way2Save account is the right option for you will depend on your preferences and circumstances. Before opening an account, there are several questions you should answer.

- Do You Have a Wells Fargo Checking Account? The automatic savings features only work if you have a Wells Fargo checking account. So, if this is an attractive feature for you, you must already have or intend to open a bank account with Wells Fargo.

- Are You Looking for the Maximum Interest? The Way2Save account does not offer a great rate, so if you’re looking to maximize your savings, you may want to consider a savings account that offers a higher APY. In most cases, you’ll be looking at online banks, but some of the Citi savings accounts offer solid returns.

- Do You Need Savings Tools? While the automated savings tools are in no way unique, the ability to set and forget your savings transfers can be a good way to boost your savings balance.

- Can You Meet the Waiver Criteria? Since there is a $5 monthly maintenance fee, it is important that you’ll be able to meet at least one of the waiver criteria requirements every month to avoid paying it.

- Do You Need Branch Support: While online banks typically offer better rates, they lack access to a branch network. So, if in person customer support is a must for you, Wells Fargo could be a good fit.

How to Open a Wells Fargo Way2Save Account?

You can open a Way2Save account in your local branch or online. The process to open the account is straightforward and can be completed in a few basic steps.

- Find the Way2Save Product Page: Visit the Wells Fargo website and click on the link for savings accounts. You should be able to find the Way2Save product page. This will provide you with details of the account. If you’re happy to proceed, you can click the “Open Account” button.

- Complete the Basic Form: This is a simple form that asks if you’re already a Wells Fargo customer and if you want to open a sole account or a joint one. At the bottom of the screen, there is a box to click to confirm that you have read the disclaimer. You can then click “Continue.”

- Fill in the Account Application: This is a fairly standard form. You’ll need to fill in your full name, address, social security number and contact details.

- Provide Your ID: To comply with federal regulations, Wells Fargo needs to confirm the identity of all account applicants. You can do this by submitting a copy of your driver’s license, passport or state issued photo ID.

- Review the Account Terms: After you complete the application, there is an opportunity to review the account terms and confirm you’re happy to proceed.

- Fund Your Account: Since the account does require a minimum initial deposit of $25, you’ll need to complete the funding page. This will complete the account opening procedure.

Can I Open a Wells Fargo Way2Save Joint Account?

Wells Fargo does allow joint applications for its accounts. The opening procedure is exactly the same as described above, but you’ll need to provide all of those details for both account holders. You will also need to prove the identity of both parties.

Just bear in mind that both people will have full access to the account. This means that even if the auto transfers are coming from a sole Wells Fargo checking account, once the money is in the Way2Save account, it belongs to both of you. So, only open a joint account with someone you trust completely.

FAQs

Is Wells Fargo A Good Bank?

Wells Fargo is a good bank, especially if you need a checking account, mortgage, or various banking options. When it comes to deposit products, there are better options.

Does Wells Fargo offer an IRA savings account?

Yes, Wells Fargo offers IRA savings accounts.

Does Wells Fargo offer a health savings account?

Yes, the Wells Fargo product line also includes HSAs.

How do you close a Wells Fargo Way2Save account?

You can call the Wells Fargo customer support helpline or call into your local branch to close a Wells Fargo account. You can also send in your closure request by post, but this is far slower.

How much can I withdraw from my Wells Fargo Way2Save?

There are no restrictions on how much you can withdraw from your Way2Save, but you are restricted to no more than six withdrawals in any calendar month.

Can I transfer my IRA to a Wells Fargo Way2Save?

You can, but this may not be the right choice for you since Way2Save does not offer a very high APY.

How We Rate And Review Savings Account: Methodology

The Smart Investor team has conducted an in-depth analysis of savings accounts offered by banks and credit unions tailored to the needs of savers. Our review focused on four key categories, with specific considerations for savers, and here's how we rated them:

- Savings Rates and Terms (40%): We thoroughly examined the interest rates provided by financial institutions, along with any unique terms and conditions attached to their savings accounts. Higher scores were awarded to banks and credit unions, offering competitive rates, reasonable minimum deposit requirements, and minimal fees, ensuring savers get the best value for their money.

- Savings Account Features (30%): This category assessed the array of features designed to cater to savers' needs, including fees, minimum deposit requirements, mobile app functionality, ATM access, and withdrawal options. Financial institutions providing a diverse range of features and convenient banking solutions received higher ratings in this category, reflecting their commitment to meeting the specific needs savers.

- Customer Experience (20%): The ease of account opening, the responsiveness of customer service, the usability of mobile apps (thoroughly tested by our team), and the bank's policies for assisting customers were evaluated in this category. Banks and credit unions offering seamless account opening processes, efficient customer service, and user-friendly digital platforms were rated higher, ensuring a positive banking experience for savers.

- Bank Reputation (10%): We considered the reputation of each financial institution, incorporating ratings from trusted sources such as JD Power, TrustPilot, and local Better Business Bureau reviews. Higher scores were awarded to banks and credit unions with positive reputations and satisfied customers, reflecting their reliability and trustworthiness.

By weighing these categories appropriately and focusing on factors relevant to savers, our review provides valuable insights to help residents of the state make informed decisions when selecting a savings account.