Wells Fargo Platinum Savings

APY Savings

Minimum Deposit

Our Rating

Fees

Wells Fargo Platinum Savings

APY Savings

Minimum Deposit

Our Rating

Fees

Although the Wells Fargo Platinum Savings account has interest that compounds daily, this cannot offset the difference between the rates offered by Wells Fargo and savings accounts with high rates.

If you prefer a traditional bank and do like Wells Fargo or need an account that can be used for overdraft protection, the Way2Save may be a better option. This offers an APY which is lower than the highest possible Platinum Savings rate, but the standard rate is more than you would get if you have less than $100,000 in your account.

If you are looking to get the best possible rates, numerous financial institutions offer several times higher rates, particularly if you don’t have a large balance. Additionally, many of these accounts don’t have a monthly maintenance fee to worry about.

So think carefully about what you’re looking for in your savings account and whether you may be better with a different account.

Pros | Cons |

|---|---|

Check Writing Facilities | Monthly Fees |

Savings Tools | Low Rate |

Access to Physical Branches | Tiered Interest Rate |

Can be Used for Overdraft Protection | |

Bonus APYs Available |

What Does The Wells Fargo Platinum Savings Offer?

Here are the main features you can expect when opening a Wells Fargo Platinum savings account:

- Can be Used for Overdraft Protection: If you have a Wells Fargo checking account, you can use this account as overdraft protection to prevent incurring fees if you slip into the red on your main account.

- Access to Physical Branches: Wells Fargo has a branch network with 4,900 locations throughout the country. So, if you prefer to manage your account with face to face customer support, this is a fantastic benefit.

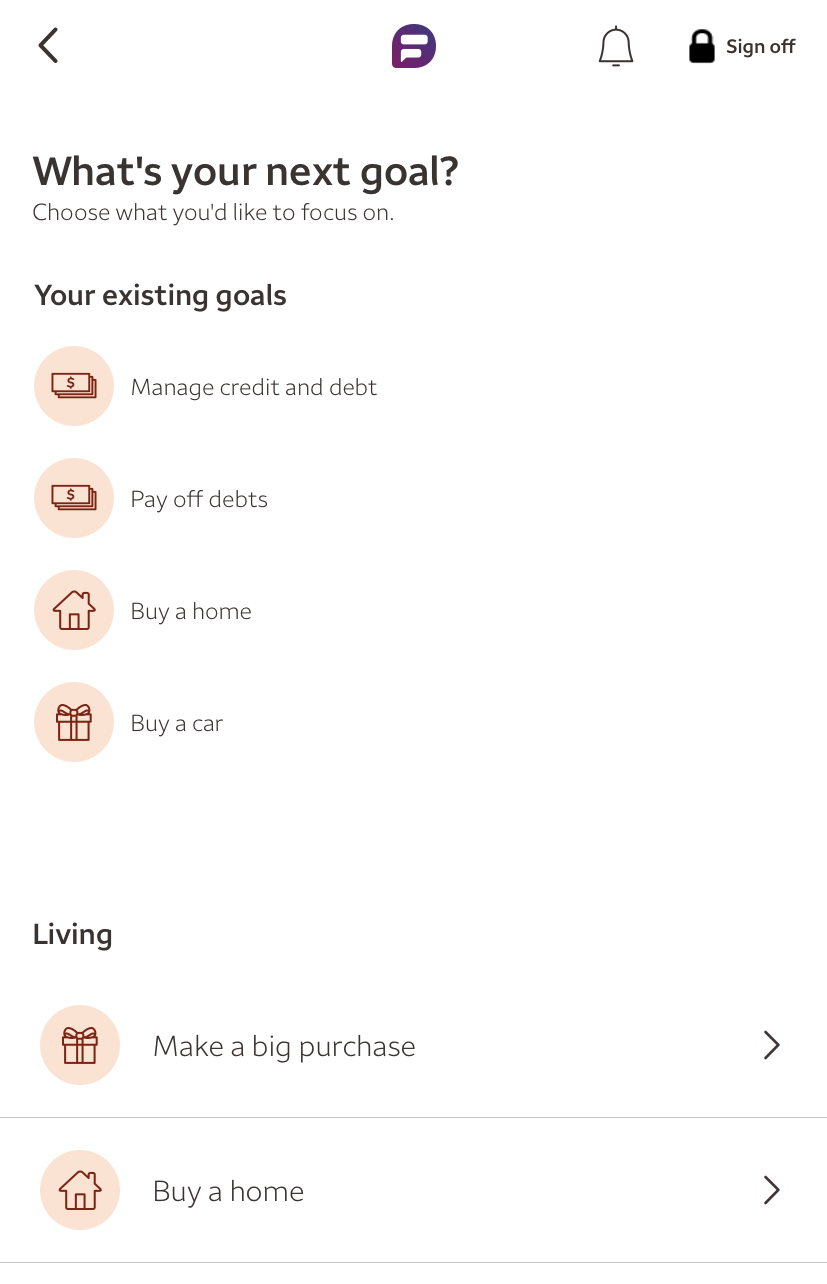

- Savings Tools: The Platinum Savings account has a number of savings tools including My Savings Plan, which can help you to set, track, and reach your specific savings goals.

- Check Writing Facilities: While the account does not have a debit card, you can write checks to gain easy access to your cash.

- Bonus APYs Available: You can access higher rates if you meet the relationship bonus criteria such as linking a Wells Fargo Portfolio.

- No Balance Requirements to Earn Interest: Although the account APY tiers favor higher balances, you don’t need to have a minimum amount in the account to earn interest on your balance.

- Interest Compounds Daily: The interest you earn on your savings fund compounds daily to maximize your returns.

The Main Limitation: Tiered Interest Rates

The Wells Fargo Platinum Savings account has some major drawbacks:

Monthly Charges: There is a monthly service fee of $12. While this can be waived, you will need to maintain a daily balance of at least $3,500 to accomplish this.

Initial Deposit Required: While it is low at $25, you will still need to have some cash on hand to open this account.

Tiered Interest Rate: While there is no minimum to earn interest on your funds, the APYs are tiered to reward higher balances. Unfortunately, the lowest earning bracket is up to $99,999.99, which puts the higher rates out of the reach of most savers.

Low Rates: Although it is quite common for traditional banks to typically offer lower rates since they need to cover the cost of maintaining a branch network, Wells Fargo rates for this account are particularly low. Currently, even if you have $1 million in your account, you’ll receive lower rates than if you deposit even a small amount in a high-yield savings account. If you are willing to lock your money for a period, you can also consider checking Wells Fargo CD options.

Wells Fargo Platinum Savings vs Wells Fargo Way2Save

Way2Save is another Wells Fargo savings account, which has some similarities and key differences.

The Similarities | The Differences |

|---|---|

Both accounts require a $25 minimum deposit to open the account. | While both accounts have a monthly maintenance fee, the fee for the Way2Save is lower and the waiver criteria is more easily achievable. |

Both Platinum Savings and Way2Save can be used for overdraft protection on your checking account. | The Way2Save account has a set APY regardless of your balance. While this is lower than the maximum rate on the Platinum Savings, it is higher than the base Platinum Savings rate |

Both accounts have an ATM card to access your funds. |

Wells Fargo Platinum Savings vs Bank of America Advantage Savings

Bank of America is a natural competitor to Wells Fargo, so it is logical to compare the savings offerings for both banks.

The Similarities | The Differences |

|---|---|

Relationship Rates Available | The Monthly Maintenance Fee |

Access to a Branch Network | APY Tiers |

Rates |

- Relationship Rates Available

Both banks offer more advantageous rates via their relationship rates.

- Access to a Branch Network

If you compare Wells Fargo and Bank of America accounts, they both offer access to a branch network, so you can access in-person support if you have an issue.

- Monthly Maintenance Fees

Although both accounts have a monthly maintenance fee, the Bank of America fee is lower and the waiver criteria is more flexible.

- APY Tiers

Bank of America has a flat rate regardless of your balance, compared to the tiered structure offered with Wells Fargo.

- Rates

However, Bank of America’s rate of 0.01% – 0.04% is far lower than even the base rate offered with the Wells Fargo Platinum Savings account.

- Initial Deposit

Bank of America requires a higher initial deposit of $100, compared to the $25 needed for Wells Fargo.

Should I Open a Wells Fargo Platinum Savings Account?

If you’re wondering whether a Wells Fargo Platinum Savings Account is the right choice for you, there are several questions you should ask yourself.

- Are you looking for the highest rates? If you’re looking to obtain the maximum possible return on your savings, Wells Fargo is not the best choice. Although it does offer a higher rate compared to many traditional banks, this account only offers the highest rates if you have over $100,000. If you want the highest rates, you may need to consider online banks.

- Do you need branch support? If you prefer dealing with any issues face to face, Wells Fargo is a solid choice, as it has a decent branch network. There are approximately 4,900 branches throughout the US.

- Can you meet the waiver criteria? The account has a $12 monthly service fee, which can be waived if you maintain a daily balance of at least $3,500. You need to assess if you can comfortably meet this requirement or the fee could quickly start to erode your savings balance.

- Do you need flexible withdrawal methods? Most savings accounts offer an ATM card, but the check writing capabilities on the Platinum Savings account makes this account quite unusual.

Sign Up for

Our Newsletter

How to Open a Wells Fargo Platinum Savings Account

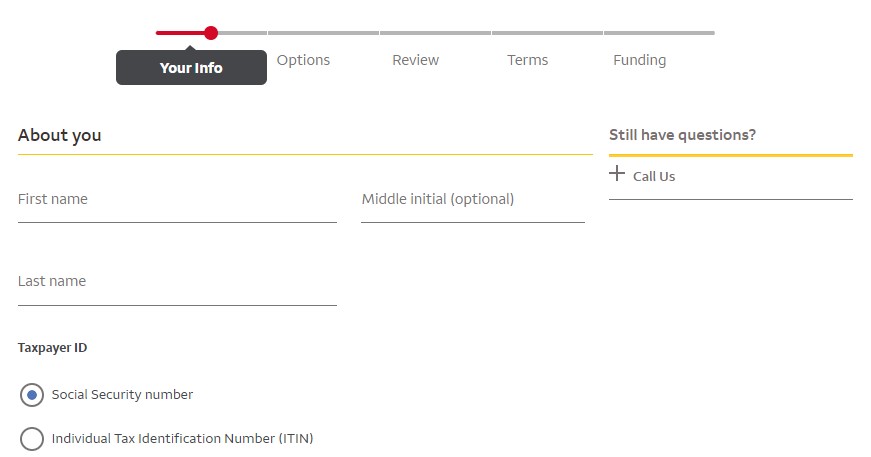

You can open a Wells Fargo Platinum Savings account online or in your local branch. If you choose the online application, you can complete the process in a few simple steps.

- Find the Product Page: The first thing you need to do is visit the Wells Fargo website and find the product page for the Platinum Savings account. You will be prompted to provide your zip code and you can then click the “Open Account” button.

- Confirm Your Customer Status: The first screen is a welcome screen which requires confirmation of whether you’re a new or existing customer. You will also see a disclaimer and if you want to open a sole or joint account.

- Complete the Application: This is a fairly standard application, and you’ll need to enter your full name, postal address, email, phone number and social security number. After you complete all the mandatory fields, you can review the account terms before you click submit.

- Fund Your Account: The final step of the process is making your initial deposit. You’ll see a funding page with various options to make the required initial deposit to finalize opening your account.

Who Is Eligible To Open a Platinum Savings Account?

The Wells Fargo Platinum Savings account is available to US residents and citizens over the age of 18. As per federal regulations, you will need to verify your identity to open an account if you are not currently a Wells Fargo customer.

However, this is easy to accomplish by submitting a copy of your driver’s license, passport or state issued photo ID.

FAQs

How do you close a Wells Fargo Platinum Savings account?

There is currently no online option to close a Wells Fargo savings account, so you’ll need to visit a local branch or speak to a representative via the helpline.

How much can I withdraw from a Wells Fargo Platinum Savings account?

There is no maximum on how much you can withdraw from your Platinum Savings account, but if you are planning on making a large cash withdrawal, you will need to speak to the branch beforehand, as most have daily limits without prior approval.

Can I transfer my IRA to a Wells Fargo Platinum Savings?

It is possible, but it may not be advisable. With a relatively low rate, you may be better transferring your IRA to an account that offers a higher APY.

Compare Wells Fargo

Wells Fargo vs Chase

Chase and Wells Fargo appear to offer very similar products at first glance, so we need to dig a little deeper. There is little to distinguish the savings accounts, and both banks provide a variety of checking accounts.

While Chase's account maintenance fee is slightly higher, it does have some more interesting features. Chase also has an advantage in terms of CDs, but Wells Fargo is a better option for loans and mortgages.

Read Full Comparison: Chase vs Wells Fargo: Where to Save Your Money?

Wells Fargo vs Flagstar

Wells Fargo offers a diverse range of banking services. Checking accounts, savings accounts, loans, mortgages, wealth management solutions, and investment options such as 401ks and IRAs are all available. Flagstar also offers a diverse product portfolio that includes a variety of checking and savings accounts, investments, home loans, and loans and investments.

It is important to note, however, that Flagstar does not operate in all states. This bank only operates in Michigan, California, Ohio, Indiana, and Wisconsin, where it has 150 branches. As a result, if you live outside of these areas, you may be unable to use Flagstar's banking services.

Read Full Comparison: Wells Fargo vs Flagstar: Which Bank Is Better For You?

Wells Fargo vs Citi

Both banks offer a good selection of banking products, making it easier to switch from your current bank.

Citi offers CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and a variety of credit card options in addition to checking and savings accounts.

Wells Fargo provides savings and checking accounts, but it also provides mortgages, loans, and investment options such as IRAs, 401ks, and wealth management products.

Read Full Comparison: Citi vs Wells Fargo: Which Bank Account Is Better?

Wells Fargo vs PNC Bank

The Wells Fargo service is even more extensive. Checking accounts, various savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management solutions are all available.

PNC offers checking and savings accounts, home loans, mortgages, investments, student loan refinancing, and a variety of credit cards.

Read full comparison: Wells Fargo vs PNC: Which Bank Account Wins?

Wells Fargo vs Bank of America

Wells Fargo's product offering is even more extensive. This bank offers checking accounts, a variety of savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management services. This makes switching from another bank even easier because you'll have access to all of your favorite banking products.

Bank of America offers a diverse range of banking services. Checking and savings accounts, auto loans, home loans, credit cards, and investment options are all available.

Read Full Comparison: Bank of America vs Wells Fargo: Which Bank Is Better?

Wells Fargo vs US Bank

Wells Fargo offers a diverse range of products, including checking accounts, savings accounts, loans, mortgages, and investments such as 401ks, IRAs, and wealth management options.

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Read Full Comparison: Wells Fargo vs US Bank: Which Bank Account Is Better?

Wells Fargo vs Capital One

Capital One began as a credit card company, but has expanded its line of banking products to rival a traditional bank. Aside from checking and savings accounts, you can also get loan refinancing, auto finance, and children's accounts.

Wells Fargo offers an even broader range of products. There are several checking accounts available, as well as two savings accounts and investment options such as IRAs and 401ks. You can also get loans and mortgages, as well as wealth management services. Wells Fargo is thus a highly comparable alternative to the traditional high street bank.

Read Full Comparison: Capital One vs Wells Fargo: Which Bank Wins?

How We Rate And Review Savings Account: Methodology

The Smart Investor team has conducted an in-depth analysis of savings accounts offered by banks and credit unions tailored to the needs of savers. Our review focused on four key categories, with specific considerations for savers, and here's how we rated them:

- Savings Rates and Terms (40%): We thoroughly examined the interest rates provided by financial institutions, along with any unique terms and conditions attached to their savings accounts. Higher scores were awarded to banks and credit unions, offering competitive rates, reasonable minimum deposit requirements, and minimal fees, ensuring savers get the best value for their money.

- Savings Account Features (30%): This category assessed the array of features designed to cater to savers' needs, including fees, minimum deposit requirements, mobile app functionality, ATM access, and withdrawal options. Financial institutions providing a diverse range of features and convenient banking solutions received higher ratings in this category, reflecting their commitment to meeting the specific needs savers.

- Customer Experience (20%): The ease of account opening, the responsiveness of customer service, the usability of mobile apps (thoroughly tested by our team), and the bank's policies for assisting customers were evaluated in this category. Banks and credit unions offering seamless account opening processes, efficient customer service, and user-friendly digital platforms were rated higher, ensuring a positive banking experience for savers.

- Bank Reputation (10%): We considered the reputation of each financial institution, incorporating ratings from trusted sources such as JD Power, TrustPilot, and local Better Business Bureau reviews. Higher scores were awarded to banks and credit unions with positive reputations and satisfied customers, reflecting their reliability and trustworthiness.

By weighing these categories appropriately and focusing on factors relevant to savers, our review provides valuable insights to help residents of the state make informed decisions when selecting a savings account.