CIT Bank Savings Connect

APY

Minimum Deposit

Our Rating

Fees

CIT Bank Savings Connect

APY Savings

Minimum Deposit

Our Rating

Fees

The CIT Savings Connect is a solid choice for maximizing returns without restricting access. Interest is compounded daily and added to your account monthly, and you can initiate a withdrawal at any point. However, you need to be prepared for no branch access and not being able to deposit or withdraw cash.

If you’re happy with the limitations of the account, CIT Savings Connect is certainly worthy of consideration for your savings plans or emergency fund.

CIT Bank has been around for over 100 years, but this online bank has an interesting array of products including loans, CDs, e-checking and savings accounts. Here we’ll explore the Savings Connect in more detail to help you decide if it is the right account for you.

Table Of Content

What Does The CIT Savings Connect Offer?

Here are the main features CIT savings account offers:

- Highly Competitive Rate: Currently, CIT Savings Connect is a HYSA account that offers one of the highest savings rates on the market with its Savings Connect account. This rate is approximately 12 times the national average savings rate, but it is highly generous even compared to other online banks.

- No Monthly Maintenance Fees: Unlike many well established banks, CIT does not impose monthly maintenance fees on the Savings Connect account. This means that you don’t need to worry about fee waiver criteria or other qualifications to ensure you don’t pay money out of your savings fund for account services.

- Remote Check Deposit: With online banks, it can be a little tricky when depositing funds into your account. However, CIT has anticipated this and included a remote check deposit feature into its app. This means that you can not only manage your account on the go, but quickly deposit checks into your account.

- Convenient Access: According to CIT, this account can be opened in just five minutes and you can access online banking to make transfers, manage account alerts, create banking reports, view and download activity. This means that you can manage your account 24/7 from the comfort of your couch.

- FDIC Insured: You don’t need to worry about the funds in your Savings Connect account, since CIT is FDIC insured. This means that should the bank fail, you’ll be covered for up to $250,000 with federal insurance.

- Linked to e-Checking: This account provides the best user experience when linked with the CIT e-checking account, so you can enjoy the convenience of a checking account and the high APY of the Savings Connect.

Benefits | Drawbacks |

|---|---|

Highly Competitive Rate | No Physical Branches |

No Monthly Maintenance Fees

| Minimum Initial Deposit |

Convenient Access | No ATM Access |

Remote Check Deposit | No 24/7 Support |

FDIC Insured | |

Linked to e-Checking |

Limitaions To Know Before Applying

While the CIT savings account offers high rates and other benefits, it has some limitations to know before depositing:

- Minimum Initial Deposit: There is a $100 minimum deposit required to open the Savings Connect account. You must fund your account with at least $100 within 30 days of opening the account or the opening will not be completed and you’ll not be able to use your account.

- No Physical Branches: CIT is an online bank, so it does not maintain a physical branch network. This means that if you have a query or question, you’ll need to rely on the online resources or phone helpline to get a resolution.

- No ATM Access: The Savings Connect is not supplied with an ATM card, so there is no way to draw cash directly out of your account. If you do need cash, you will need to initiate a transfer into another account that has an ATM card or branch access, which may delay your plans.

- No 24/7 Support: While you can manage your account 24/7 via the online platform or app, if you run into an issue, you cannot access the customer support team around the clock. The helpline is only available 9 am to 9 pm on weekdays and 10 am to 6 pm on Saturdays.

- CIT Platinum Savings: If you're willing to deposit high deposits, you may want to check out CIT Platinum savings, as it offers even a higher yield than CIT Savings Connect.

CIT Bank Savings Connect vs Marcus Savings

Since Marcus is another online only financial institution, its savings account makes a natural comparison product to the CIT Bank Savings Connect. There are a number of similarities between these accounts including that neither has an ATM card, both banks have a well regarded app and there are no maintenance fees with either account.

However, there are some important differences which may influence which is better for you. The most obvious difference is that currently, CIT is offering a higher APY for its Savings Connect account, but this is subject to change. The other differences include that Marcus has no minimum deposit requirements and Marcus also offers 24/7 support.

CIT Bank Savings Connect | Marcus Savings | |

|---|---|---|

APY | Up to 5.00% | 4.40% |

Fees | $0 | $0 |

Minimum Deposit | $100 | $0 |

CIT Bank Savings Connect vs Citi Accelerate Savings

While both the CIT Savings Connect and Citi Accelerate are designed as accounts to work in concert with associated checking accounts, that is where the similarities end. The Citi Accelerate offers a low APY compared to the CIT Savings Connect. However, it does offer amenities that are not available with the Savings Connect.

Firstly, Citi Accelerate has auto savings tools and there are no opening deposit requirements. Additionally, you can access check writing abilities with this account and use the account for overdraft protection on your Citi checking account.

However, you do need to watch out for the monthly maintenance fee. Depending on the checking account package you open, the fee is up to $4.50 per month. It can be waived in a number of ways including meeting a balance requirement, but it does add further complexity to managing your account.

CIT Bank Savings Connect | Citi Accelerate Savings | |

|---|---|---|

APY | Up to 5.00% | 4.30% |

Fees | $0 | $4.50/$10 per month

Can be waived if you maintain an average combined monthly balance of $500/$1,500 in your eligible accounts, make one enhanced direct deposit or one qualifying bill payment per statement period

|

Minimum Deposit | $100 | $0 |

How to Deposit and Withdraw Money From CIT Savings?

Since CIT is an online bank, you cannot simply walk into a local branch to deposit or withdraw funds. Fortunately, CIT does offer several methods to deposit funds including wire transfer, ACH transfer from an external bank account or your CIT checking account.

However, funds may take up to two days to be processed and deposited into your account. Alternatively, you can mail a check to CIT Bank HQ or use the remote check deposit feature within the app.

When you want to withdraw funds from your account, you can initiate an ACH transfer between your Savings Connect account and another bank account. This is free of charge, but it can take up to two business days to appear in the other account.

You can also request a wire transfer, which is quicker, but it does incur a fee if your savings balance is less than $25,000. The final withdrawal method is to call the customer support line and request a check to be mailed to you. This is slower, but this service is offered for free.

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

Top Offers From Our Partners

![]()

Should I Open a CIT Bank Online Savings Account?

As we’ve demonstrated, there are both positives and potential negatives associated with the Savings Connect account. If you’re unsure if this is the right account for you, there are several questions you will need to ask yourself.

- Do you need to deposit or withdraw cash? Most of us have moved away from dealing in cash, but if this is still a part of your everyday finances, you will need to think carefully about opening a CIT Savings Connect. While it is possible to put these funds into or out of your account, you will need to do it via another bank account, which facilitates cash deposits and withdrawals.

- Are you comfortable with online account management? This is common for many online banks, but you will need to bear in mind that you won’t have the option to access in person support if you run into any issues with your account.

- Do you need 24/7 support? If you tend to be a night owl and complete all your banking activities in the middle of the night, you may find it frustrating that you will not be able to call the customer support line outside of 9am to 9pm ET during the week and 10am to 6pm on Saturdays.

- Do you have the minimum initial deposit? While $100 is a reasonable minimum deposit, you'll need to consider another account if you are on a more modest budget and want to start building your savings from nothing.

- Do you want the best rates? If you’re prepared to compromise on the above issues, it is important to note that CIT does offer one of the highest savings rates for an instant access product in the marketplace. So, is getting a higher rate worth it to you or would you prefer more account amenities?

How to Open a CIT Bank Savings Connect Account?

As CIT is an online bank, you can complete the CIT savings account opening process fully online. You can accomplish the entire process in a few straightforward steps.

- Visit the Product Page: You’ll need to head to the CIT Bank website and find the product page for the Savings Connect. You should be able to find this by clicking the “Bank” tab at the top of the page and then selecting “Savings Connect.”

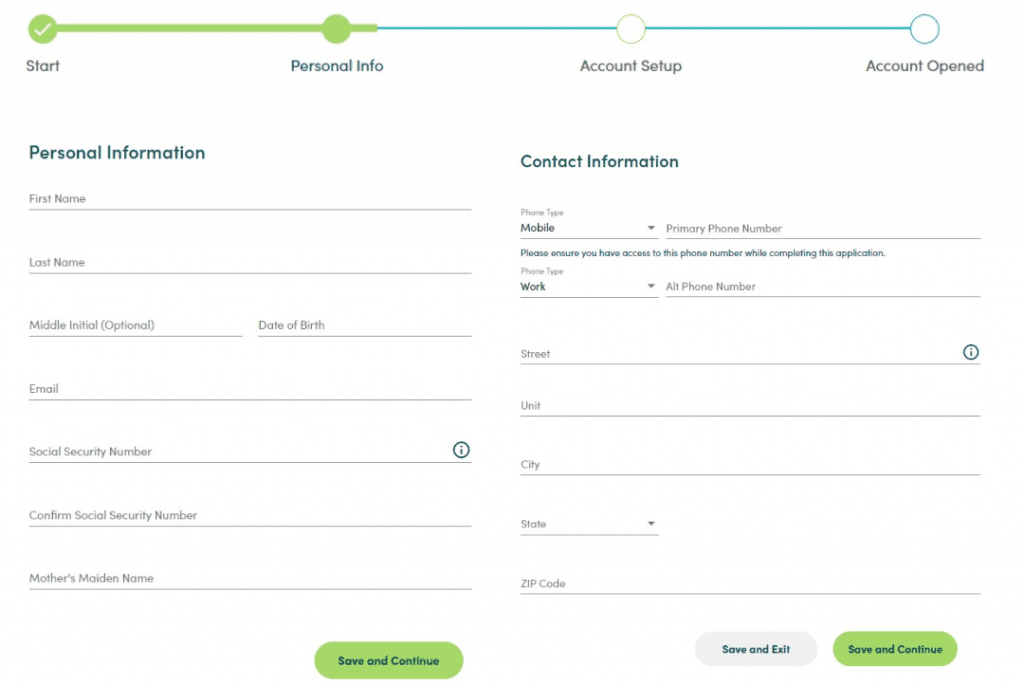

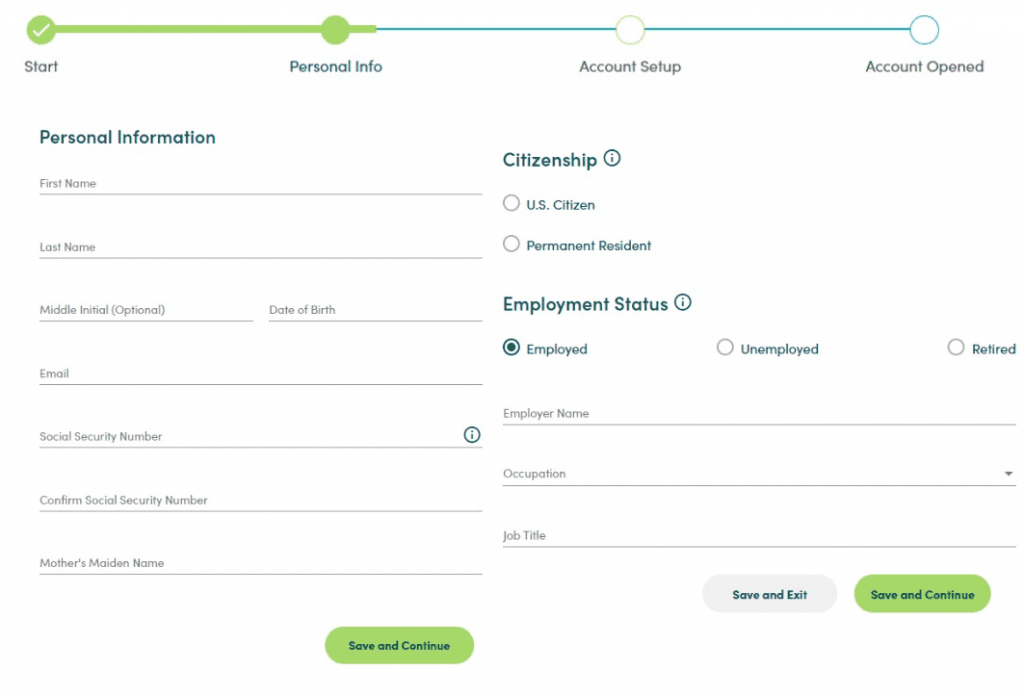

- Click “Open Account”: At the top of the Savings Connect Page, you should see a green “Open Account” button. When you click this, you’ll be directed to an application form, which you’ll need to complete with all your basic details including your full name, address, email address and Social Security Number.

- Verify Your ID: You will also need to provide your Driver’s License or another form of ID such as a valid, state issued photo ID.

- Fund Your Account: The final step of the opening process is to fund your new CIT Savings Connect account. There is a screen where you can provide the bank routing and account number for an external bank account or you will see details of how you can deposit a check.

Can I Open a CIT Bank Joint Savings Account?

Yes, it is possible to open a joint savings account with CIT. You’ll need to provide the same details we discussed above for the account co-owner. So, you’ll need to have their Social Security Number and a valid ID to hand during the account opening process.

Top Offers From Our Partners

![]()

FAQs

Is CIT Bank a Good Bank ?

CIT Bank is one of the best options if you're looking for an online bank account. In our CIT Bank review, you can read more about CIT Bank benefits and drawbacks.

How much can I withdraw from CIT Bank Online Savings ?

CIT Bank does not publish any withdrawal limits for its online savings accounts.

Can I transfer my IRA to a CIT Bank Online Savings?

Yes, it is possible to transfer your IRA to a CIT Bank savings account, but you should investigate all of the potential tax implications before you initiate a transfer.

How do you close a CIT Bank Online Savings account?

You’ll need to call the CIT Bank customer support line and a team member can guide you through the closure process.

Can you direct deposit into a CIT Bank savings account?

Yes, it is possible to have funds direct deposited into your new CIT Bank savings account.

Does CIT Bank offer a health savings account?

You can access HSAs via Citizen Bank.

Does CIT Bank offer an IRA savings account?

Via its parent company, Citizens Bank, you can access an IRA savings account.

How We Rate And Review Savings Account: Methodology

The Smart Investor team has conducted an in-depth analysis of savings accounts offered by banks and credit unions tailored to the needs of savers. Our review focused on four key categories, with specific considerations for savers, and here's how we rated them:

- Savings Rates and Terms (40%): We thoroughly examined the interest rates provided by financial institutions, along with any unique terms and conditions attached to their savings accounts. Higher scores were awarded to banks and credit unions, offering competitive rates, reasonable minimum deposit requirements, and minimal fees, ensuring savers get the best value for their money.

- Savings Account Features (30%): This category assessed the array of features designed to cater to savers' needs, including fees, minimum deposit requirements, mobile app functionality, ATM access, and withdrawal options. Financial institutions providing a diverse range of features and convenient banking solutions received higher ratings in this category, reflecting their commitment to meeting the specific needs savers.

- Customer Experience (20%): The ease of account opening, the responsiveness of customer service, the usability of mobile apps (thoroughly tested by our team), and the bank's policies for assisting customers were evaluated in this category. Banks and credit unions offering seamless account opening processes, efficient customer service, and user-friendly digital platforms were rated higher, ensuring a positive banking experience for savers.

- Bank Reputation (10%): We considered the reputation of each financial institution, incorporating ratings from trusted sources such as JD Power, TrustPilot, and local Better Business Bureau reviews. Higher scores were awarded to banks and credit unions with positive reputations and satisfied customers, reflecting their reliability and trustworthiness.

By weighing these categories appropriately and focusing on factors relevant to savers, our review provides valuable insights to help residents of the state make informed decisions when selecting a savings account.