Live Oak Personal Savings

APY Savings

Minimum Deposit

Our Rating

Fees

Live Oak Personal Savings

APY Savings

Minimum Deposit

Our Rating

Fees

Live Oak offers a savings account for those looking for a solid APY and great ease of use. Interest is compounded daily on the account and there is a savings calculator, so you can watch projections of how your savings fund can grow.

However, you’ll need to be prepared for no cash deposits or withdrawals, no in person support and limited phone helpline hours. If you’re happy with these limitations, Live Oak is certainly worthy of consideration, as you won’t have to worry about monthly maintenance fees, account minimums or low transfer limits.

Live Oak Bank is an online financial institution offering a variety of loans and personal banking products including its savings account. So, here we’ll explore the Live Oak savings account in more detail.

Table Of Content

What Does The Live Oak Personal Savings Account Offer?

The Live Oak Bank Personal Savings Account typically offers features such as:

- Impressive Rate: Despite the Live Oak savings account not being classified as a high yield account, it does offer an impressive rate that compares favorably with typically high yield accounts. This means that you can enjoy the benefits of a great rate without being tied to the limitations associated with a high yield account.

- No Maintenance Fees: Although maintenance fees are becoming less common with savings accounts, they can still be an issue. In many cases, you can have maintenance fees waived by meeting at least one item of criteria, but this does add more complications to managing your account. Fortunately, with the Live Oak savings account, you don’t need to worry about any maintenance fees.

- No Minimum Balance Requirements: You don’t need to deposit a large sum to access the impressive APY on this account. The only requirement is that you need to have at least one cent in your account to earn interest.

- High Transfer Limit: You can transfer up to $250,000 out of your Live Oak savings account per day. This means that if you need to make a large purchase using a third party account, you don’t need to spread the transfer over multiple business days.

- Savings Tools: While the savings tools are not as comprehensive as you may find with best virtual banks, Live Oak does have a great savings calculator. This allows you to see how much interest you can earn on different savings balances, so you can see how much your savings fund can grow.

- Great User Interface: Live Oak is a fully online bank with a great website platform, but you can also use the app, which is available for Android and iOS users to manage your account. Regardless of which you choose, you can expect an intuitive interface that makes it easy to perform any transactions you need.

Benefits | Drawbacks |

|---|---|

Impressive Rate | No Cash Deposit Options |

No Maintenance Fees | No ATM Access |

High Transfer Limit

| Dormant Threshold |

No Minimum Balance Requirements | |

Savings Tools | |

Great User Interface |

Drawbacks

While there are many benefits, it's important to consider the drawbacks as well:

- No Cash Deposit Options: This is a fairly common issue with online banks, but it has the potential to be an important limitation for Live Oak customers. While Live Oak does offer a variety of deposit methods, cash deposits are not possible.

- Dormant Threshold: All banks will classify an account as dormant if it has not been used for an extended period of time, but Live Oak is a little more stringent. If your account has no activity for 24 months and the balance is less than $10, your account will be deemed dormant and you will not be able to access your account. Additionally a dormancy fee may be applied, which could be up to $10.

- No ATM Access: Live Oak does not operate its own ATM network and furthermore, this account is not supplied with an ATM card. If you have a business account, there is a free access to over 55,000 machines included in the allpoints network.

Live Oak Personal Savings vs Marcus Savings Account

Like Live Oak, Marcus is an online financial institution, so it is natural to make comparisons between the savings accounts offered by both. There are numerous similarities between the Live Oak savings account and the savings account offered by Marcus. This includes that neither account has maintenance fees or account minimums. Likewise, neither account is supplied with an ATM card.

However, there are also some key differences which may influence which is the better choice for you. One of the most immediately obvious differences is that currently Live Oak offers a higher APY on its savings account. But, this should not be the major factor in your decision, since rates are subject to change.

Marcus facilitates same day transfers of up to $100,000, which is less than the $250k daily cap offered by Live Oak, but transfers are processed more quickly with Marcus. Another important difference is that Marcus offers customer support 24/7 via its helpline, while Live Oak customer service is only available 8am to 8pm ET Monday through Friday.

Live Oak Personal Savings | Marcus Savings | |

|---|---|---|

APY | 4.40% | 4.40% |

Fees | $0 | $0 |

Minimum Deposit | $0 | $0 |

Live Oak Personal Savings vs Capital One Savings Account

Capital One also offers a savings account that offers a similar return. While the rates may be a little different, with Live Oak currently offering slightly more, there are some other similarities, such as no maintenance fees or account minimums. However, there are differences.

Firstly, while neither account has an ATM card, Capital One does have some physical locations, so you can access in person support if needed. You can also use the physical locations to make deposits or withdrawals. However, the Capital One savings account works best if you link it to a Capital One checking account. This allows you to access the auto savings features and make quicker transfers.

Live Oak Personal Savings | Capital One Savings | |

|---|---|---|

APY | 4.40% | 4.25% |

Fees | $0 | $0 |

Minimum Deposit | $0 | $0 |

How to Deposit and Withdraw Money From Live Oak Savings Accounts

Since Live Oak Savings is an online account, you cannot simply pop into a branch if you want to make a deposit or withdrawal. To deposit money into your account, you can transfer funds electronically via an ACH transfer from a linked external bank account. This typically takes one or two business days to be processed. You can also perform a wire transfer, but you are likely to incur fees for this.

Alternatively, you can deposit a check by mailing it to Live Oak HQ or using the mobile check deposit feature within the app. However, this cannot be a third party check or a check drawn on a foreign bank.

To withdraw money from your account, you will need to initiate an ACH transfer. This can be done via the app and you should receive the funds in your external account within one or two business days, providing the transfer is initiated before 5pm ET.

Should I Open a Live Oak Savings Account?

As with any financial product, there are both positives and potential drawbacks to the Live Oak savings account, so should you open an account?

If you’re unsure if this account is the right choice for you, it's important to look at the savings account pros and cons and ask several questions you will need to ask yourself to make an informed decision.

- Do you deal in cash? If you tend to have cash on hand and need to pay it into your savings account, this may not be the right account for you. Live Oak does not accept cash deposits, so you would need to pay the cash into an external bank account and then make a transfer into your savings, adding another layer of complexity to managing your account.

- Do you need an ATM card? This follows on from the previous point, but if you prefer to deal in cash, you may need to look for an account that is supplied with an ATM card. This is not the case with Live Oak. As with deposits, you would need to use an external bank account to access cash, transferring the funds into the account and then withdrawing cash via ATM or counter service.

- Do you need in person or 24/7 customer support? While the Live Oak platform is highly intuitive, if you prefer to access in-person customer support or you may need help at any time of the day or night, Live Oak is not the right bank for you.

All in all, it's always a good idea to compare savings rates and other parameters before making a decision.

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

Top Offers From Our Partners

![]()

How to Open a Live Oak Savings Account

You can only open a Live Oak savings account online, but the bank has designed the process to be as painless as possible. There is a quick three step application, so you can complete the process in a matter of minutes.

- Click “Get Started”: On the Live Oak website, you’ll need to find the savings account page, via the top bar menu or by scrolling through the products. Once you’re on this page, you’ll need to click the “Get Started” button at the top of the button.

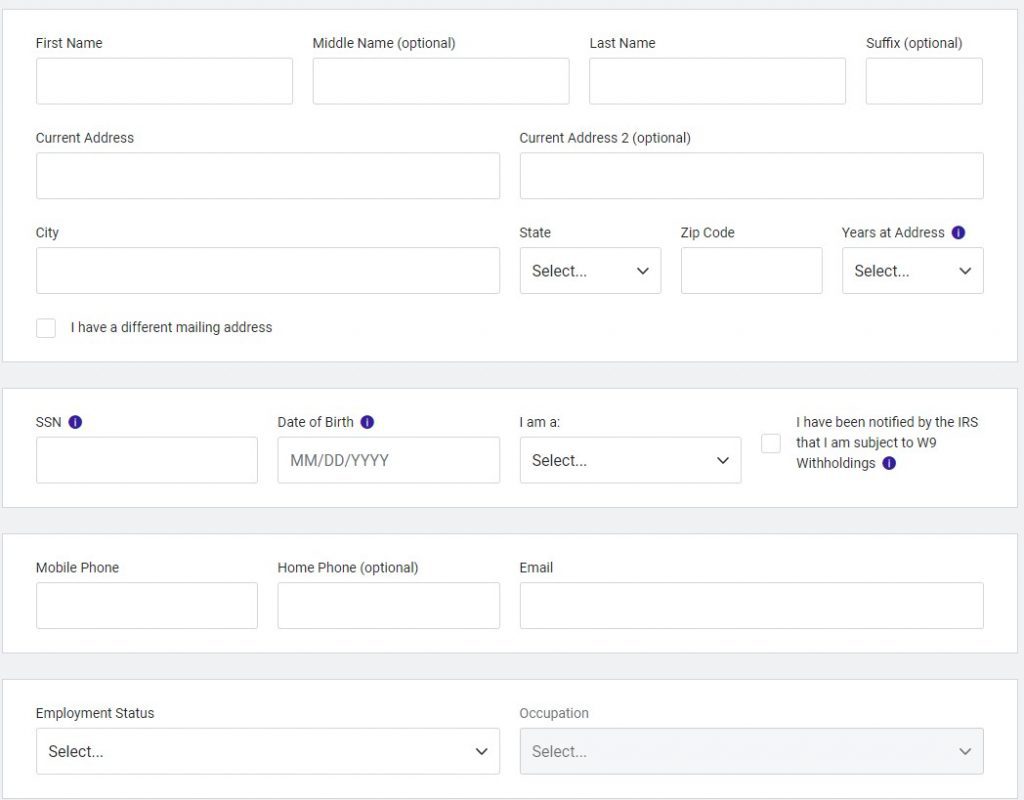

- Complete the Application Form: This is a fairly standard application that you’re likely to have encountered if you’ve already opened a savings account online. You’ll need to provide your personal details including your name, address, phone number, email and Social Security Number. Live Oak will verify your information electronically, but if additional verification is required, you may see a prompt to supply documentation.

- Fund the Account: The final step is to link an external bank account and fund your new Live Oak savings account. You can enter the amount of your initial deposit and Live Oak will guide you through setting up an ACH transfer. This opening deposit is held for five business days while Live Oak verifies your account details, but once it has been processed, your new account is up and running.

Can I Open a Live Oak Joint Savings Account?

Yes, you can add a co-owner to your account to create a joint account. This can be done after you’ve opened your account, but the easiest way is to set this up as you’re opening your account. After you’ve completed the three steps detailed above, you will have the option to add a co-owner.

You will need to provide the co-owner’s personal details, including name, contact information and Social Security Number. As with your own personal details, Live Oak will electronically verify the details, but they may require supporting documentation, such as a copy of a valid passport or driver’s license and proof of address.

Top Offers From Our Partners

![]()

FAQs

Is Live Oak A Good Bank?

If you're looking for an online bank, it is a good bank. Live Oak offers competitive deposit on savings accounts and a variety of other banking services. On our Live Oak bank review you can read more on Live Oak pros and cons.

Can you direct deposit into a Live Oak savings account?

Live Oak accepts ACH transfers, so you should not have any issues arranging to have your salary or other payments direct deposited into the account.

How do you close a Live Oak Savings account?

You will need to call the customer support team to initiate an account closure. A customer support manager can guide you through the closure process, but they are only available 8am to 8pm ET, Monday through Friday.

How much can I withdraw from Live Oak Savings?

Live Oak permits withdrawals up to a daily cap of $250,000 from its savings accounts.

Can I transfer my IRA to a Live Oak Savings account?

Live Oak does not offer IRAs, but you can transfer your IRA to a savings account, but it is important to check all the tax implications before initiating a transfer.

Does Live Oak offer an IRA savings account?

No, Live Oak does not offer retirement accounts including IRAs at this time.

Does Live Oak offer a health savings account?

Live Oak does not feature any HSAs on its website product line up.

How We Rate And Review Savings Account: Methodology

The Smart Investor team has conducted an in-depth analysis of savings accounts offered by banks and credit unions tailored to the needs of savers. Our review focused on four key categories, with specific considerations for savers, and here's how we rated them:

- Savings Rates and Terms (40%): We thoroughly examined the interest rates provided by financial institutions, along with any unique terms and conditions attached to their savings accounts. Higher scores were awarded to banks and credit unions, offering competitive rates, reasonable minimum deposit requirements, and minimal fees, ensuring savers get the best value for their money.

- Savings Account Features (30%): This category assessed the array of features designed to cater to savers' needs, including fees, minimum deposit requirements, mobile app functionality, ATM access, and withdrawal options. Financial institutions providing a diverse range of features and convenient banking solutions received higher ratings in this category, reflecting their commitment to meeting the specific needs savers.

- Customer Experience (20%): The ease of account opening, the responsiveness of customer service, the usability of mobile apps (thoroughly tested by our team), and the bank's policies for assisting customers were evaluated in this category. Banks and credit unions offering seamless account opening processes, efficient customer service, and user-friendly digital platforms were rated higher, ensuring a positive banking experience for savers.

- Bank Reputation (10%): We considered the reputation of each financial institution, incorporating ratings from trusted sources such as JD Power, TrustPilot, and local Better Business Bureau reviews. Higher scores were awarded to banks and credit unions with positive reputations and satisfied customers, reflecting their reliability and trustworthiness.

By weighing these categories appropriately and focusing on factors relevant to savers, our review provides valuable insights to help residents of the state make informed decisions when selecting a savings account.