Table of Content

American Express cards are some of the best credit cards you can take out if you want to be able to earn lucrative points and amazing perks. American Express cards even offer unique card designs to help you purchase things in style.

American Express cards are perfect for new credit cardholders and people who have several reward cards already. You can also use Amex Rewards for everyday things like U.S. supermarkets, dining out, and business expenses.

How to Use Amex Membership Rewards?

There are many different ways you can use Amex rewards. Here are some interesting, rewards ways to redeem your Amex points:

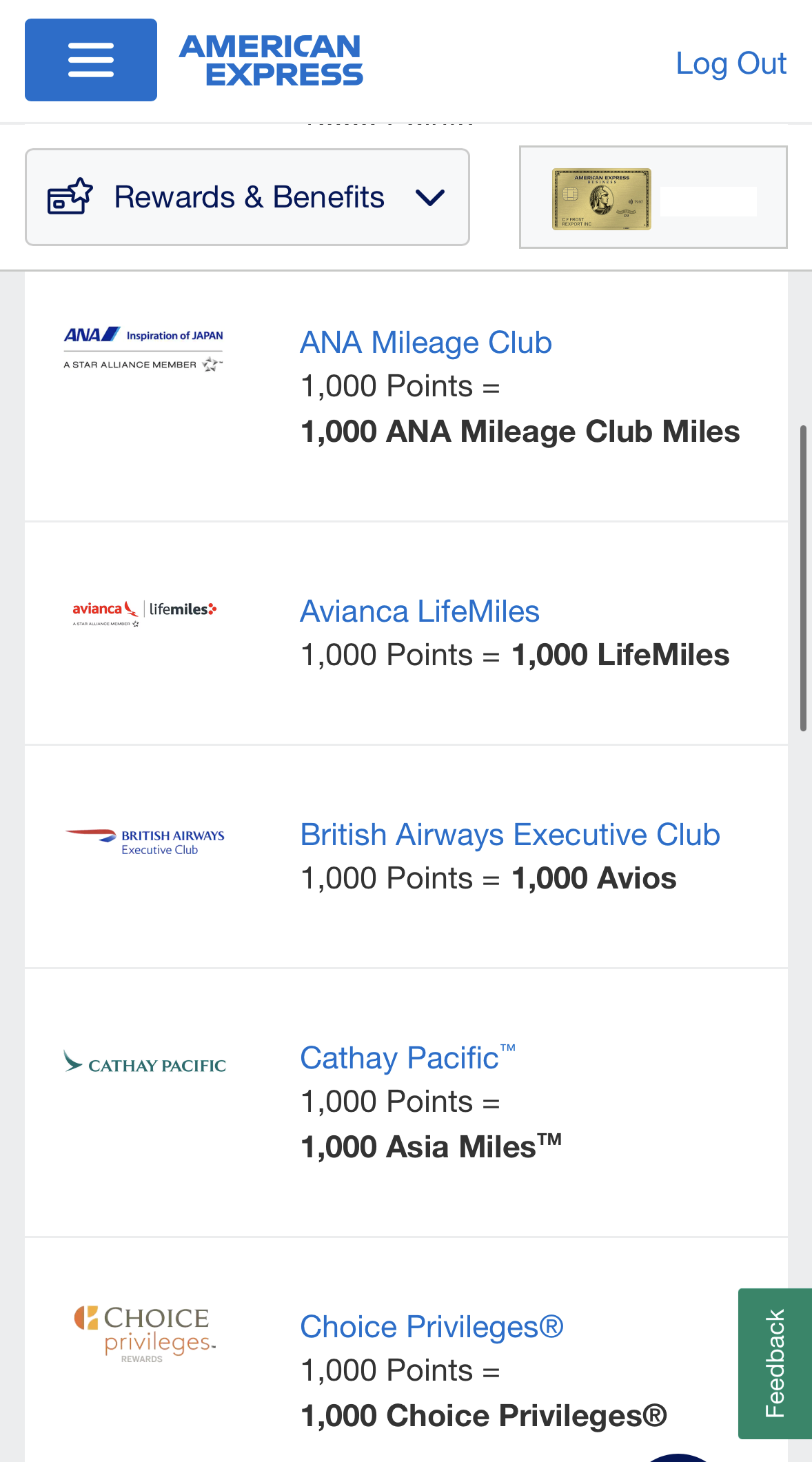

1. Use Them at Airline Transfer Partners

One of the best ways that people love using their Amex Membership Rewards is for transfer partners. These include 19 different airlines including popular ones like Delta, British Airways, and JetBlue. You can also transfer them to three different hotel options including Choice, Hilton, and Marriott.

This is one of the best ways to fly first class internationally without spending too much money. You can book your flights directly through the Amex travel page and use your points to buy flights.

Fly United or Alaska Airlines to Hawaii or take an Iberia flight to Madrid. If you don’t want to fly first class, you can use even fewer miles and fly economy or comfort depending on the airline’s options.

You can also use your reward points to fly round-trip or one way. By using your rewards and points, you will be able to pay little to no money for your next international trip.

2. Fly American Airlines Anywhere in the World

American Airlines is one of the only US carriers that offer a direct flight from Los Angeles to Hong Kong, and you can use your points to take this long-haul flight. For just 62,500 miles, you can also fly first class from Los Angeles to London, Miami to Sao Paulo, and Los Angeles to Tokyo.

On these extremely long-haul flights, you’ll love the ability to stretch out your legs and have full meals in a first-class seat. You can also book directly with American on one of their sister airlines to go even more places.

For example, book an Etihad flight to other destinations in the middle east and Africa through American airlines. This lets you use your rewards to reach even more destinations throughout the world.

You can even get great deals on international business tickets and first-class options when you are booking a flight from North America.

3. Make the Most Out of Your Rewards with Virgin Atlantic

Flying Virgin Atlantic is another great way to use your rewards. It also gives you options to book with Delta and one of Delta’s many partner airlines to go to even more places around the world. While each partner airline from Virgin Atlantic has different rules, Delta and ANA give you the most freedom when it comes to choosing flights.

For Delta One business class, you can fly from the US to Europe for just 50,000 points. This is much fewer points than if you were to use Delta SkyMiles Gold or transfer Delta SkyMiles. This allows you to go anywhere in Europe for a fraction of the points.

ANA flights can give you up to a 50% discount if you are flying from the west coast to one of the airports in Tokyo. First-class tickets are only 110,000 miles round trip. Keep in mind that first-class tickets on ANA are sometimes $16,000 or more. This is a major discount when you choose to use your points instead.

Top Offers From Our Partners

Top Offers From Our Partners

4. Book Choice Hotels Anywhere in the World

Choice hotels might be lesser known than the other options with Amex like Hilton and Marriott. However, Choice hotels are found all over the world and are often much cheaper than their more well-known counterparts.

In cities around the United States, Choice hotels can be as low as 8,000 points a night. Choice hotels might not be the most luxurious option, but they still give you a nice place to stay if you’re on a budget and don’t want to spend too much time in your hotel room.

If you’re traveling abroad, you get even more options. Hotels abroad tend to be cheaper than domestic ones and they are even close to public transit options. If you want higher-end options, Choice hotels do have them for about 20,000 points a night or more.

If you carry a Citi credit card, you can also enjoy Choice Hotels via Citi ThankYou rewards program.

5. Fly Long Nonstop Flights in Comfort

New York to Singapore is the longest nonstop flight offered by any airline. Singapore Airlines offers this flight with no layovers. On this long flight, you definitely don’t want to be spending 18 hours in a small and cramped economy seat.

With a first-class seat, you can get amazing perks that other customers simply don’t have. You can lie fully down in the seat that becomes a bed or you can take advantage of the large entertainment selection. They also offer stellar food and unlimited drinks.

From New York to Singapore, you can get on this international flight with a first-class ticket for just 99,000 points. This is a small reward portion for such a long flight to an exotic destination. Singapore is also quickly becoming one of the most visited destinations in the world with amazing attractions, excellent hotels, and even better food.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

6. Air France or KLM Partners

Air France and KLM have a joint loyalty program called Flying Blue. They are also part of the Delta SkyTeam alliance program. They have a transfer ratio of 1:1 which allows you to get a mile for every dollar spent. They also often run promos or offers that might give you 2 or 3 miles for every dollar spent.

These promo rewards can save you up to 50% on the miles you would normally spend. If you regularly fly to destinations serviced by KLM or Air France this can be a great choice. Air France even flies to Dubai on their new planes.

With Capital One Travel, you'll also get 20% bonus when transferring miles to the Flying Blue program, which is also available through Chase Ultimate rewards.

7. Use your Rewards with Alitalia MilleMiglia

This is one of the major airlines flying out of Italy and they fly all over the world. They also have a SkyTeam Alliance with Delta Air Lines, Air France, and KLM.

With all the Delta Airlines, they have a transfer ratio of 1:1. This allows you to fly from the US to Italy for just 60,000 miles in economy class. A major perk of this is that you can then use points to fly to North Africa or other regions of the world once you’re in Europe.

On Alitalia, you can also fly one way to the Maldives from Italy for 100,000 miles on a business class ticket. The only major setback is you have to get to Italy first.

8. Explore Asia with Cathay Pacific

If Asia is on your bucket list, you can use your points and rewards to fly with Cathay Pacific to destinations like Beijing and Shanghai. You can also use your points to take short-haul flights throughout Asia once you get there.

To fly around China, you can get economy flights for just 7,500 miles. You can also take long-haul business class flights for just 65,000 miles around Asia.

9. Use Your Reward Points to Gain Avianca LifeMiles

Avianca is one of the biggest airlines of Columbia. They are also part of the Star Alliance program so you can use rewards to book flights on Air Canada, Air China, Air India, Ethiopian Airlines, and EgyptAir. You can also use the points to redeem flights from Europe to many different US destinations such as Dallas, New York, and Los Angeles.

This is a great way to fly on many different airlines to see destinations around the world. Promotional awards are also offered often for flights on partner airlines.

FAQ

How Much Are 50,000 Membership Rewards Points Worth?

This depends on your redemption method. The best redemption rates tend to be with travel purchases, where you could earn 1.15 cents per point or more. However, the typical redemption rate is 0.5 to 1 cent per point. At the typical rate, your 50,000 points would be worth $250 to $500.

Do American Express Membership Rewards Points Expire?

No, you don’t need to worry about your American Express Membership Rewards points expiring. However, your points can lapse if you fail to make the minimum payment due on your account on time.

American Express will provide you with a warning if your points are about to lapse and you can reinstate them, but fees may apply.

How Do You Earn Membership Rewards Points?

If you have an eligible American Express card, you’ll earn Membership Rewards points each time you make an eligible purchase. Most cards have a tiered structure that allows you to earn more points in one category compared to others.

However, this is calculated automatically for you. When you make a purchase, the appropriate number of points is added to your Rewards points balance, which you can check at any time by logging into your account.

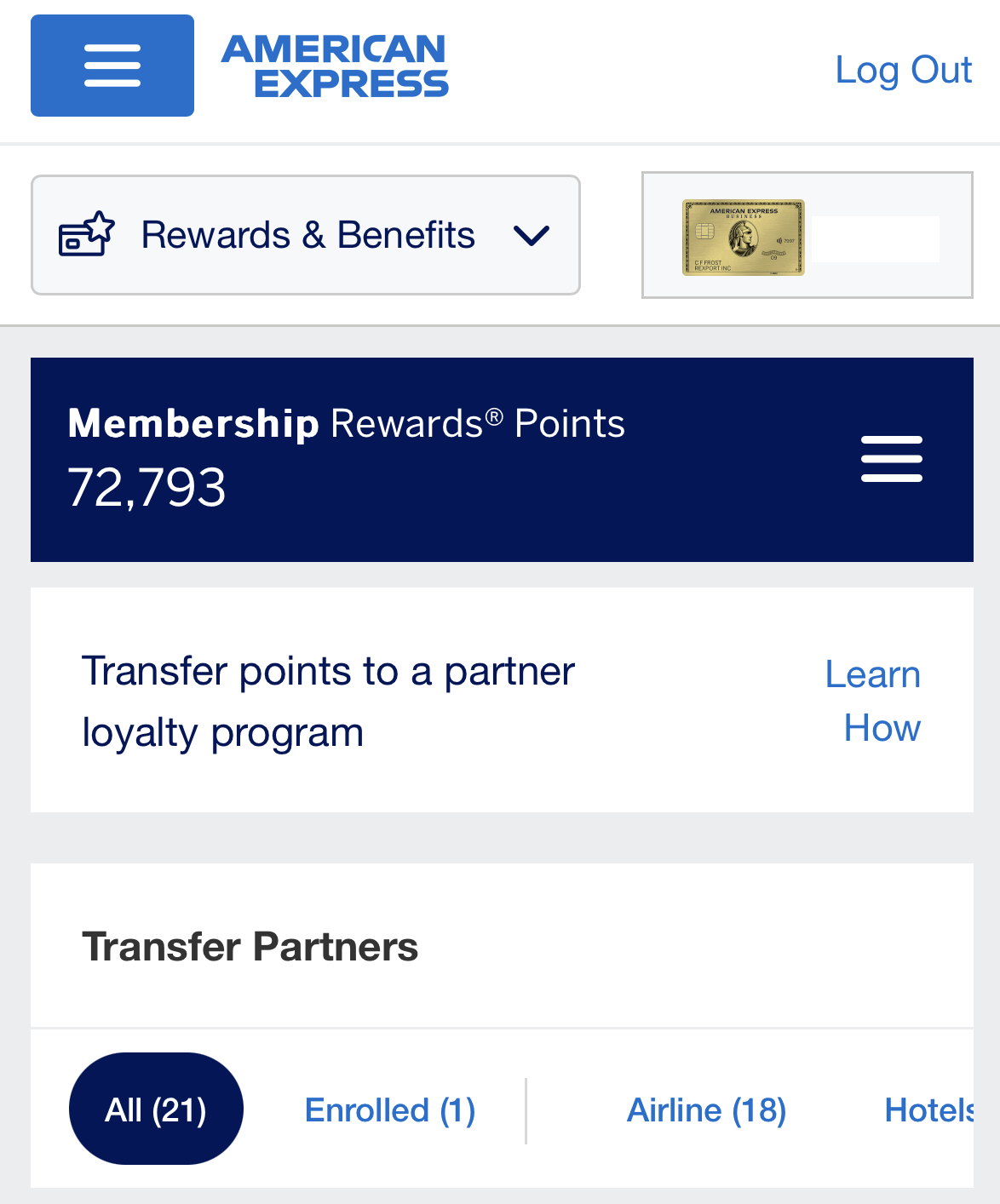

How Do You Check Amex Membership Rewards Points?

This is very simple to do. Just log into your American Express account and on the dashboard, you’ll see a Membership tab. This will allow you to check your balance or view your account activity.

This means that you can check if the points from your recent transactions have been added to your account and if you now have sufficient points for your preferred redemption method.

How Do You Cancel Amex Membership Rewards?

If you no longer want to be in the Membership Rewards program or want to cancel your card, you can voluntarily cancel your program enrollment. If you keep one open Amex card, you will have 30 days to use any accumulated points.

However, if you don’t have any open Amex card accounts, you’ll immediately forfeit any points. So, before you cancel, make sure to use all your points balance. To cancel, simply call the helpline and an Amex representative will guide you through the process.