Capital One is one of the largest US banks, and it is recognized for its technology-focused financial services. Some of its top products include credit cards, auto loans, savings accounts and commercial banking. Capital one was one of the pioneers of credit cards, and it has grown to be one of the five largest issuers of credit cards.

Whether you are looking flat-rate cash back credit card or travel rewards credit card, Capital One has a wide range of credit card options for your needs.

Card | Rewards | Bonus | Annual Fee |

| Capital One Venture Rewards Credit Card | 2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

| 75,000 miles

75,000 miles once they spend $4,000 on purchases within 3 months from account opening

| $95 |

|---|---|---|---|---|

| Capital One Quicksilver Cash Rewards Credit Card | 1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

| $200

$200 cash bonus once you spend $500 on purchases within 3 months from account opening

| $0 |

| Capital One Venture X Rewards Credit Card | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

| $395 |

| Capital One Savor Cash Rewards Credit Card |

1% – 4%

unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.

| $300

$300 cash bonus once you spend $3,000 on purchases within 3 months from account opening

| $95 |

| Capital One SavorOne Cash Rewards | 1% – 8%

Earn unlimited 3% cash back on dining, entertainment, popular streaming services and grocery store purchases (excluding superstores like Walmart® and Target®), 1 percent on all other purchases. 10% percent cash back on purchases made through Uber and Uber Eats. 8% cash back on Capital One Entertainment purchases. 5% cash back on hotels and rental cars booked using Capital One Travel. | $200

$200 cash bonus once you spend $500 on purchases within the first 3 months from account opening

| $0 |

| Capital One Walmart Rewards® Credit Card | 1-5%

5% cash back at Walmart.com (including pickup and delivery), 2% cash back in Walmart stores and gas stations, at restaurants and on travel plus 1% cash back everywhere else Mastercard is accepted

| 5%

5% cash back for the first 12 months when you use your card with Walmart Pay for in-store purchases, upon approval

| $0 |

| Capital One QuicksilverOne Cash Rewards | 1.5% – 5%

Unlimited 1.5% cash back on all purchases and unlimited 5% cash back on hotels and rental cars booked through Capital One Travel (terms apply)

| N/A | $39 |

| Capital One Secured Mastercard | N/A | N/A | $0 |

How's Capital One Rewards Program Work?

Capital One rewards program offers some of the most flexible rewards that travelers can redeem for travel purchases, gift cards, a statement credit, and other options. Capital One uses the term “miles” to refer to its reward points. This rewards program rewards you 2 miles for every $1 charged to your Capital Credit card.

You also earn miles through sign-up bonuses when you make payments up to a certain limit within 3 months from account opening.

Cardholders have an option to convert their miles into fixed-value rewards or transfer points to travel partners. One of the fixed value rewards involves using miles to cover purchases made in the last 90 days. Usually, this option offers 1 cent per mile.

You can also book new travel via Capital one Travel Center at the rate of 1 cent per mile, redeem for gift cards at 1 cent per mile, or redeem for cash back at 0.5 cents per mile. An alternative to fixed value rewards is to transfer miles to airline partners. This option may give you a higher value than one cent per mile.

Capital One Venture Rewards Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One Venture Rewards is a low-cost travel card that worth’s its value. It allows you to earn rewards and bonus points while traveling for business, leisure, or pleasure. However, it requires holders to have a credit score of between 680 and 850.

The rewards plan includes 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel . The card attracts no annual fees, and you can get a sign up bonus of 75,000 miles once they spend $4,000 on purchases within 3 months from account opening.

- APR: 19.99% – 29.99% (Variable)

- Annual fee: $95

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Rewards Plan: 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

- Sign Up bonus: 75,000 miles once they spend $4,000 on purchases within 3 months from account opening

- 0% APR Introductory Rate period: N/A

- Flexible Rewards Redemption

- Great Sign-Up Bonus

- No Blackout/Expiration Dates

- No Accumulation Limit on Miles

- High Variable APR

- Airline Partners Limitations

- $95 Annual Fee

- Redeem Points for a Statement Credit

- What are Capital One Venture card income requirements? Capital One often required monthly income to be at least $800. Sometimes, you will need to show some proof of income.

- Does rewards points expire? They do not expire.

- Can I get pre-approved on card Capital One Venture Card? Yes, you can get pre-approval.

- What is the initial credit limit ? The minimum credit limit is set at $5,000.

- How do I redeem cash back? You can do so in a number of ways, such as spending your accumulated miles directly on travel purchases, or redeem as cash, using at participating retailers, and so on.

- What purchases don't earn cash back with the Capital One Venture Card? Every purchase earns cashback.

- Should You Move to Capital One Venture Card? If you spent a decent amount of time and money on travel expenses.

- Why did Capital One Venture Card deny me? What to Do Next? You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

Capital One Quicksilver Cash Rewards Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One Quicksilver Cash Rewards Credit Card is a good choice for individuals that either don’t like to spend too much in just one budget category or individuals that prefer one reward rate than multiple rates. The Capital One Quicksilver offers 5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.. This cashback rate is not the highest in the market, but card do not charge any annual fee, and it has a nice welcome bonus of $200 cash bonus once you spend $500 on purchases within 3 months from account opening.

Lastly, the card offers 0% intro APR for 15 months on balance transfers and purchases. Some of the benefits individuals can derive from using this card include; no foreign transaction fees, travel accident insurance, secondary car rental insurance and 24-hour travel assistance services.

- Rewards Plan: 5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

- APR: 19.99% – 29.99% variable

- Annual fee: $0

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: $0

- Sign Up bonus: $200 cash bonus once you spend $500 on purchases within 3 months from account opening

- 0% APR Introductory Rate period: 15 months on balance transfers and purchases

- Sign-Up Bonus

- Flat Cashback Rewards Rate

- No Annual Fee or Foreign Transaction fee

- Intro APR on Purchases & Balance Transfers

- No Bonus Rewards Categories

- Cashback Rate Could Be Better

- Requires Good/Excellent Credit

- Can I get car rental insurance with Quicksilver Card? Yes, once you refuse the insurance offered by the rental company you will automatically get coverage if you fund the entire purchase through this card.

- What are Quicksilver Card income requirements? Capital One often required monthly income to be at least $800. Sometimes, you will need to show some proof of income.

- Can I get pre-approved? Yes, you can get pre-approval.

- What is the initial credit limit? You will normally get a credit limit of at least $5,000.

- How do I redeem cash back? For the Quicksilver cashback rewards, you are able to get a check, as statement credit, or redeem them with certain retailers.

- What purchases don't earn cash back? All purchases are covered.

- Should You Move to Quicksilver Card? If you want consistency across all types of purchases or need to fill some gaps thrown up by other cards.

- How to Use Quicksilver card Benefits? Use it to fill the gap where your other credit cards fall short. If you want to have ultimate ease of use thanks to the consistency across all types of purchases.

- What are the top Reasons NOT to get the Quicksilver Card? If you are looking to get higher cashback rewards for certain categories.

Capital One Venture X Rewards Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One Venture X Rewards Credit Card is a premium travel card that can be a good fit for travelers who want extra travel perks like airport lounge access, travel insurance protection, and special rental car privileges, in addition to better rewards rates. It has quite high annual fee ($395)

When booking hotels and rental cars through Capital One Travel, the Venture X earns 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases. In addition, new applicants can earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening, and there is no foreign transaction fee.

- Rewards Plan: 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

- APR: 19.99% – 29.99% (Variable)

- Annual fee: $395

- Balance Transfer Fee: 3% for promotional APR offers, none for balances transferred at regular APR

- Foreign Transaction Fee: $0

- Sign Up bonus: 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

- 0% APR Introductory Rate: N/A

- Statement Credit For Travel

- Better Rewards Rate, Sign-Up Bonus

- Capital One Travel Portal

- No Foreign Transaction Fee

- $395 Annual Fee

- No Upgrading or Elite Status

- Smaller Network

What are the income requirements?

Neither issuer specifies a minimum income, but you will need excellent credit for the Venture X. Your income will be a factor for consideration, but it will not be the sole factor. If proof of income is required to support your application, the card issuers will contact you with a list of acceptable documents.

Can you get pre approval?

Capital One requires that you complete a full application for the Venture X, which will involve a hard credit pull.

What is the initial credit limit?

You can expect an initial credit limit of $5,000 to $30,000 with the Capital One Venture X.

How much is 10,000 miles worth?

The average value of Capital One miles is one cent per mile. This means that 10,000 miles would be worth $100. However, it may be possible to get a higher redemption rate with partner programs.

How’s the card customer service availability?

Capital One has a customer service line that is available 24/7, so you can access help at any time of the day or night

How long does it take for approval?

Capital One aims to give an approval decision within a few minutes, unless additional information is required to support your application. In this case, it can take a further 7 to 10 days. After approval, you should receive your card within 10 days.

Capital One Savor Cash Rewards Credit Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One Savor Cash Rewards Credit Card offers unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.. Rewards don’t expire for the life of the account, and you can redeem cash back for any amount.

In addition, there is a significant sign up bonus of $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening, as well as no foreign transaction fee.

However, if you don’t spend enough on these types of activities then you won’t get ahead much on the rewards due to the $95 annual fee.

- Rewards Plan: unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.

- APR: 19.99% – 29.99% Variable

- Annual fee: $95

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: $0

- Sign Up bonus: $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening

- 0% APR Introductory Rate period: None

- Sign Up Bonus

- High Cash Back

- No Rotating Categories

- $95 Annual Fee

- Approval Can Be Strict

- No 0% Intro APR

- Can I get car rental insurance with Capital One Savor? Yes, once you refuse the insurance offered by the rental company you will automatically get coverage if you fund the entire purchase through this card.

- Does it have a cash-back rewards limit? There is no limit.

- Does Capital One ask for proof of income? No out and out request for proof of income and no transparent income requirements.

- Does Capital One Savor Card offer pre approval? Yes, you can get pre-approval.

- What is the initial credit limit? The minimum credit limit is set at $5,000.

- How do I redeem cash back? You can get them sent to you in the form of a check, as a statement credit, or get them given to you through gift cards.

- What purchases don't earn cash back? All types of purchases are eligible for cashback with this card.

- Should You Move to Capital One Savor Card? If you spend enough on the premium cashback categories to justify the annual fee.

- Why did Capital One Savor Card deny me? What to Do Next? You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

- How to maximize rewards on Capital One Savor Card? Make the most out of the signup offer and use this card for the premium cashback categories to get the best bang for your buck.

- Top reasons NOT to get the Capital One Savor Card? If you will not reap enough rewards to justify the $95 annual fee.

Capital One SavorOne Cash Rewards

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One SavorOne Cash Rewards credit card stands out as a no-annual-fee option catering to foodies, social explorers, and streaming enthusiasts. The sign up bonus include $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening.

The standard cash back rate is Earn unlimited 3% cash back on dining, entertainment, popular streaming services and grocery store purchases (excluding superstores like Walmart® and Target®), 1 percent on all other purchases. 10% percent cash back on purchases made through Uber and Uber Eats. 8% cash back on Capital One Entertainment purchases. 5% cash back on hotels and rental cars booked using Capital One Travel..

The card comes with a 0% APR on purchases and balance transfers for 15 months, making it attractive for those looking to avoid interest while paying down balances.

- Rewards Plan: Earn unlimited 3% cash back on dining, entertainment, popular streaming services and grocery store purchases (excluding superstores like Walmart® and Target®), 1 percent on all other purchases. 10% percent cash back on purchases made through Uber and Uber Eats. 8% cash back on Capital One Entertainment purchases. 5% cash back on hotels and rental cars booked using Capital One Travel.

- APR: 19.99% – 29.99% variable

- Annual fee: $0

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: $0

- Sign Up Bonus: $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- No Annual Fee

- Versatile Cash Back Categories

- Welcome Bonus

- Introductory 0% APR

- High Credit Requirement

- Balance Transfer Fee

- Not the Highest Rewards Rate

Are there foreign transaction fees associated with this card?

No, there are no foreign transaction fees, making it suitable for international use.

Can cash back rewards be redeemed at any time?

Yes, cash back rewards can be redeemed at any amount, at any time.

Which purchases earn the highest cash back rates?

The card offers boosted cash back rates on dining, entertainment, streaming services, and grocery store purchases.

Can rewards be transferred to other Capital One cards?

Yes, rewards earned on the SavorOne can be transferred to the Capital One Venture card at a 1:1 rate.

Capital One QuicksilverOne Cash Rewards

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

The Capital One Quicksilverone Cash Rewards card earns Unlimited 1.5% cash back on all purchases and unlimited 5% cash back on hotels and rental cars booked through Capital One Travel (terms apply), without requiring category activations while it's one of the few cash back credit cards that require a fair credit. However, make sure to pay on time since the variable APR is quite high.

QuicksilverOne Cash Rewards card charges an annual fee of $39 and can be a good choice if you are looking for a credit card for fair credit to earn cashback rewards across all purchase categories at a low annual cost.

- APR: 30.74% (Variable)

- Annual fee: $39

- Balance Transfer Fee: None

- Foreign Transaction Fee: 3%

- Rewards Plan: Unlimited 1.5% cash back on all purchases and unlimited 5% cash back on hotels and rental cars booked through Capital One Travel (terms apply)

- Sign Up bonus: None

- 0% APR Introductory Rate period: None

- 1.5% Cash Back

- Build Your Credit

- No Rewards Limits

- No Transfer Fees

- No-Cost Fraud Liability

- Annual Fee

- Redemption Limits

- Foreign Transaction Fee

- High APR

Is there a limit to cash back rewards?

There is no sort of limit in place as to how many rewards you are able to get when using the Capital One QuicksilverOne Card to make purchases.

Can I get car rental insurance with QuicksilverOne Card? how?

Yes, if you decline the insurance from the car rental company and pay for the entire rental with your Capital One QuicksilverOne Card you will be able to get coverage.

Does card QuicksilverOne Card travel rewards points expire?

Once you keep your account open, the rewards that you earn through making purchases with the Capital One QuicksilverOne Card will not expire.

What are QuicksilverOne Card income requirements?

There are no income requirements that you will need to meet when you are applying to get your hands on a Capital One QuicksilverOne Card.

What is the initial credit limit?

You will get at least $300 in credit limit straight away with the Capital One QuicksilverOne Card. Higher limits are possible and will depend on your personal financial situation.

How do I redeem cash back on QuicksilverOne Card?

You can redeem the rewards that you earn when using the Capital One QuicksilverOne Card for cash, statement credit, or for gift cards from certain retailers.

How hard is it to get QuicksilverOne Card?

You often need to have a credit score of at least 620 in order to get the Capital One QuicksilverOne Card. The rest of the requirements are quite straightforward.

Capital One Walmart Rewards® Credit Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

The Capital One Walmart Rewards® is the best card to have if you are a big Walmart shopper. You will get cashback on all purchases through Walmart.com whether it’s food, clothes, or other items. You also get other perks such as discounted delivery fees.

The points you earn on the card can be used to get statement credits or you can redeem them for travel. You can also get gift cards from Walmart and other qualifying retailers. There’s also not an annual fee, so you don’t have to worry about making that money back.

- APR: 17.99% – 28.99% (Variable)

- Annual fee: $0

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: Unknown

- Rewards Plan: 5% cash back at Walmart.com (including pickup and delivery), 2% cash back in Walmart stores and gas stations, at restaurants and on travel plus 1% cash back everywhere else Mastercard is accepted

- Sign Up bonus: 5% cash back for the first 12 months when you use your card with Walmart Pay for in-store purchases, upon approval

- 0% APR Introductory Rate period: N/A

- Cash Back Rewards

- No Annual Fee

- Fraud Protection

- Sign Up Bonus

- Free FICO Score

- Better Cashback Cards

- Foreign Transaction Fee

- Walmart Network Only

- High APR

Does Walmart limit the amount of rewards I can get?

There are no rewards limits on the Capital One Walmart Rewards card, so you don’t need to worry about monitoring how much you’re spending in each category.

What are the top reasons not to get the Walmart card?

The top reason not to get the Capital One Walmart Rewards is if you prefer to shop in store. The card prioritizes Walmart.com purchases. If this doesn’t apply to you, you may find other reward cards offering a high percentage on groceries will be better suited to your spending habits.

How much should I spend to cover the card fees?

The Walmart card doesn't charge an annual fee, so you don’t need to worry about spending a certain amount to cover the costs. In this case, unlike other store cards, you won't need any membership plan to enjoy benefits.

What’s the initial credit limit?

The initial credit limit for the Capital One Walmart Rewards card is $150, but it is more common to be offered a higher credit limit, depending on your credit.

What are the card income requirements?

You can qualify for the Capital One Walmart Rewards card with average to excellent credit, so this could be a little easier. However, the card issuers may require you to verify your income, so it could be a good idea to have a couple of pay slips on hand to support your application.

Capital One Secured Mastercard

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

Building your credit with a reliable, secured credit card may be a very smart move; however, not all secured credit cards are designed equal. Capital one secured Mastercard has some unique attributes that can win you over and make you trust them. Capital one secured card makes deposits less formidable, and this one of the unique qualities of capital one secured Mastercard.

Capital One Secured Card does not give any reward. However, using this card comes with some benefits: zero fees on a foreign transaction, travel accident insurance, secondary car rental insurance, extended warranty, and 24-hour travel assistance services. Some of the limitations of using this card are the relatively low initial credit limit and the no bonus offer program than other card issuers.

- APR: 30.74% (Variable)

- Annual fee: $0

- Balance Transfer Fee: None

- Foreign Transaction Fee: $0

- Rewards Plan: N/A

- Sign Up bonus: N/A

- 0% APR Introductory Rate period: N/A

- Build Your Credit

- No Annual Fee

- No Foreign Transaction / Balance Transfer Fee

- Flexible Security Deposit

- No Rewards

- High APR

- Put Down a Refundable Deposit

Can I add an authorized user?

Yes, the Capital One Secured allows you to add an authorized user to your account. This will allow a family member or friend to have their own card linked to your account.

Do the cards report payments to all credit bureaus?

Capital One will report your payment activity to all three of the major credit bureaus. Additionally, it provides a platform to monitor your credit score, so you can keep track of any changes as you use the card and work on other ways to improve your credit.

How long does it take for card approval?

The Capital One Secured offers pre approval, which means that you can get an approval decision in a matter of minutes. If you decide to proceed, there should be a minimal delay and you can expect your new card in seven to 10 days.

How long should I use the card to improve my credit score?

A good rule of thumb is three to six months. However, Capital One will review your account after six months to determine if your credit score has increased sufficiently to upgrade to an unsecured card. So, you should be looking at using the card for at least six or seven months.

What are the top reasons not to get this card?

The top reason not to get the Capital One Secured is if you’re looking for a card that offers rewards. This is a very basic secured credit card that aims to help you build or rebuild your credit, but there are no other major benefits.

What Are The Different Types of Capital One Credit Cards?

Capital One has really good rewards cards for everyone – whether you travel a lot, own a business, are a student, or want to improve your credit score.

They have credit cards for all kinds of credit scores – even if your credit is not so great or really excellent. What's cool is that Capital One doesn't charge extra fees when you use their cards in other countries. So, it's good for travelers.

If you want a credit card that gives you cash back or one that earns you travel rewards, Capital One has lots of options. Check out these top Capital One credit cards to find the one that suits you best.

Capital One Venture Rewards (Best for travel rewards)

The Venture Rewards credit card earns 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel . New sign-ups also get 75,000 miles once they spend $4,000 on purchases within 3 months from account opening.

The sign-up bonus is equivalent to $600. The accumulated rewards can be transferred to over 14 travel partner programs, or redeemed for statement credit. This card is a great fit if you are a regular traveler looking to collect miles on everyday purchases.

Capital One Quicksilver Cash Rewards (Best for cashback rewards)

This credit card earns a 5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.. There is also a one-time sign-up bonus of $200 cash bonus once you spend $500 on purchases within 3 months from account opening.

In addition, this is a good card for those who are looking to pay off credit card debt – it offers 0% intro APR for 15 months on balance transfers and purchases. You can earn as many cash backs with every purchase, and the cashbacks do not expire. Capital One Quicksilver is a good pick if you are looking for a low-cost credit card with flat-rate cashback rewards.

Capital One Savor Cash Rewards (Best for entertainment rewards)

The Savor Credit Card from Capital One is popular for dining and entertainment rewards. cardholders earn unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases..

Savor Cash rewards card sign-ups earn $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening. If you are looking to collect unlimited rewards on dining and entertainment purchases at minimal cost, Capital One Savor Cash Rewards Credit Card is a good pick.

Capital One Secured Mastercard (Best for bad credit)

This credit card is a good pick if you are looking for a no-annual-free credit card for credit building. Capital One reports your on-time payments and account credit card activity to credit bureaus to help you improve your credit scores.

You may also qualify for a higher credit line if use the Secured Mastercard responsibly for at least 6 months. Plus, this secured credit card gives you a higher credit limit than the security deposit. You will need to make a refundable security deposit of $49 to $200, which requires an authorized bank account to make the deposit.

Capital One Journey Student Rewards (Best for students)

The Capital One Journey Student Rewards card earns earn 1% cash back and another 0.25% if you pay on time, so you can boost your cash back to a total of 1.25%. The card doesn't charge an annual fee.

If you are a college student with little or no credit, this credit card is a good fit to help you build credit while earning cash backs on every purchase.

Capital One VentureOne Rewards (Best for no annual fee)

The Capital One VentureOne Rewards earns unlimited 5X miles on hotels and rental cars booked through Capital One Travel and 1.25X miles on all other purchases. Capital one also gives you a sign-up up bonus of 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening. The bonus is equal to $200 in travel purchases.

There are over 10 travel partners in the Capital One network that allow cardholders to redeem miles for airfare and hotel stays. If you are looking for the best first travel card, this credit card is a great pick considering its $0 annual fee and zero transaction fees.

Top Offers

Top Offers

Top Offers From Our Partners

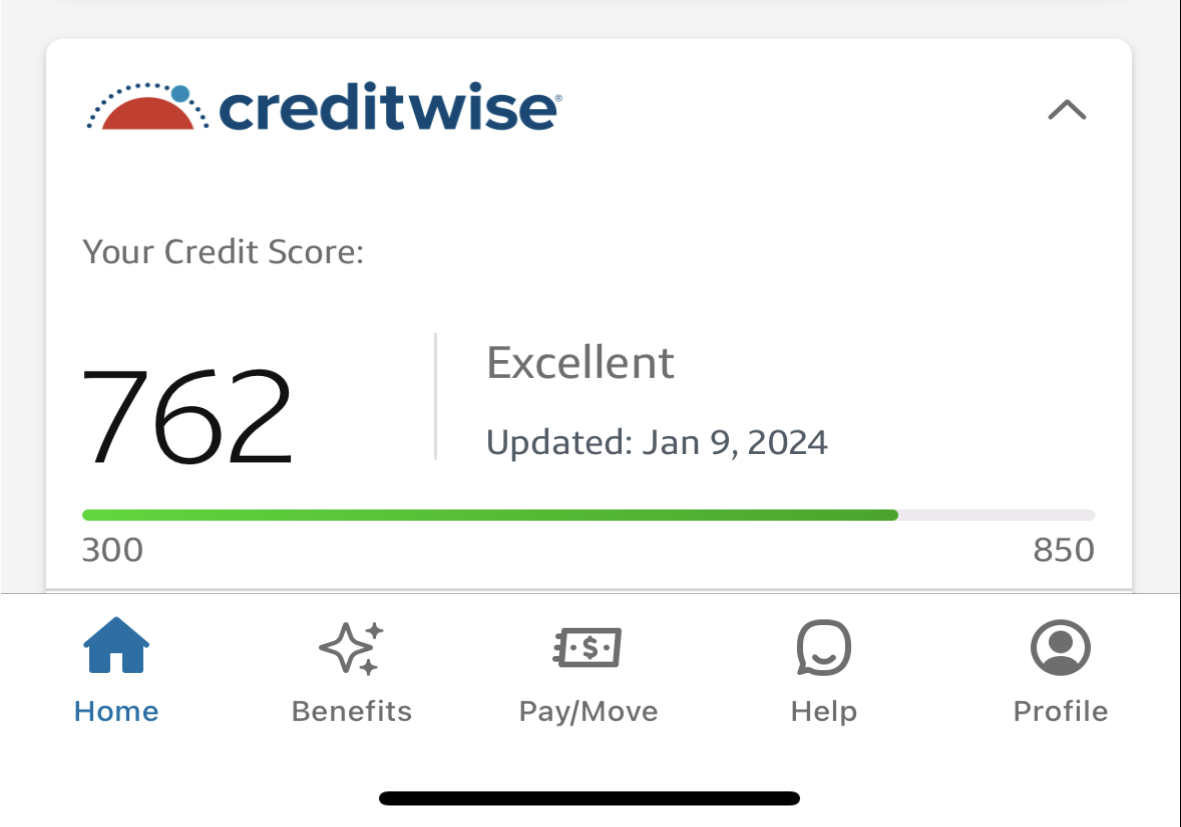

What Credit Score Will I Need in Order to be Approved?

Whether you have limited credit, fair credit, or excellent credit, there is a Capital One credit card for every credit score range. Here are the credit scores required for each credit card:

- Good to Excellent Credit Score: A credit score of 700 and above puts you in the good to excellent credit score, and you can get top-tier Capital One credit cards. Some of the Capital One credit cards available in this credit score level include Venture Rewards Card and Quicksilver Cash Rewards Card.

You will also get the most competitive rewards rates and interest rates in the good to excellent credit level.

- Fair credit score: With a credit score of 630 to 700, you can get a Capital One Quicksilverone Credit Card, Journey Student Rewards, and Capital One Platinum Credit Card.

These credit cards can help you build your credit into the good or excellent credit score range, as you earn rewards on your purchases.

- Bad credit score: A credit score of 629 and below puts you in the bad credit score range. This category comprises people with limited or no credit history and those rebuilding their credit after one or more defaults.

A bad credit score limits the options you have, but the Secured Mastercard from Capital One can help you build your credit score with its $0 annual fee. Capital one submits regular credit card information to the three credit bureaus to help you improve your credit.

How Capital One Cashback Offers Work?

The idea behind Capital One cashback offers is simple: every time you use your Capital One credit card to shop, you earn back a small percentage of the amount you spent.

Capital One cash backs are structured in the following two ways:

How It Works | Cards | |

|---|---|---|

Flat-rate cashback | A flat-rate cash back earns you the same percentage on every purchase you make. Some Capital One credit cards earn a flat rate cash back of 1.5% to 2% on the amount spent on purchases. | |

Tiered Cash Back | A tiered cashback structure earns a different percentage of cashback on different purchase categories. For example, dining and entertainment, purchases at grocery stores. | |

No Rotating Categories | Compared to other credit card companies, Capital One does not offer rotating category cash backs. Capital One credit card customers earn cash backs on all purchase categories. Other credit card issuers have purchase categories that change every quarter. |

Top Offers

Top Offers From Our Partners

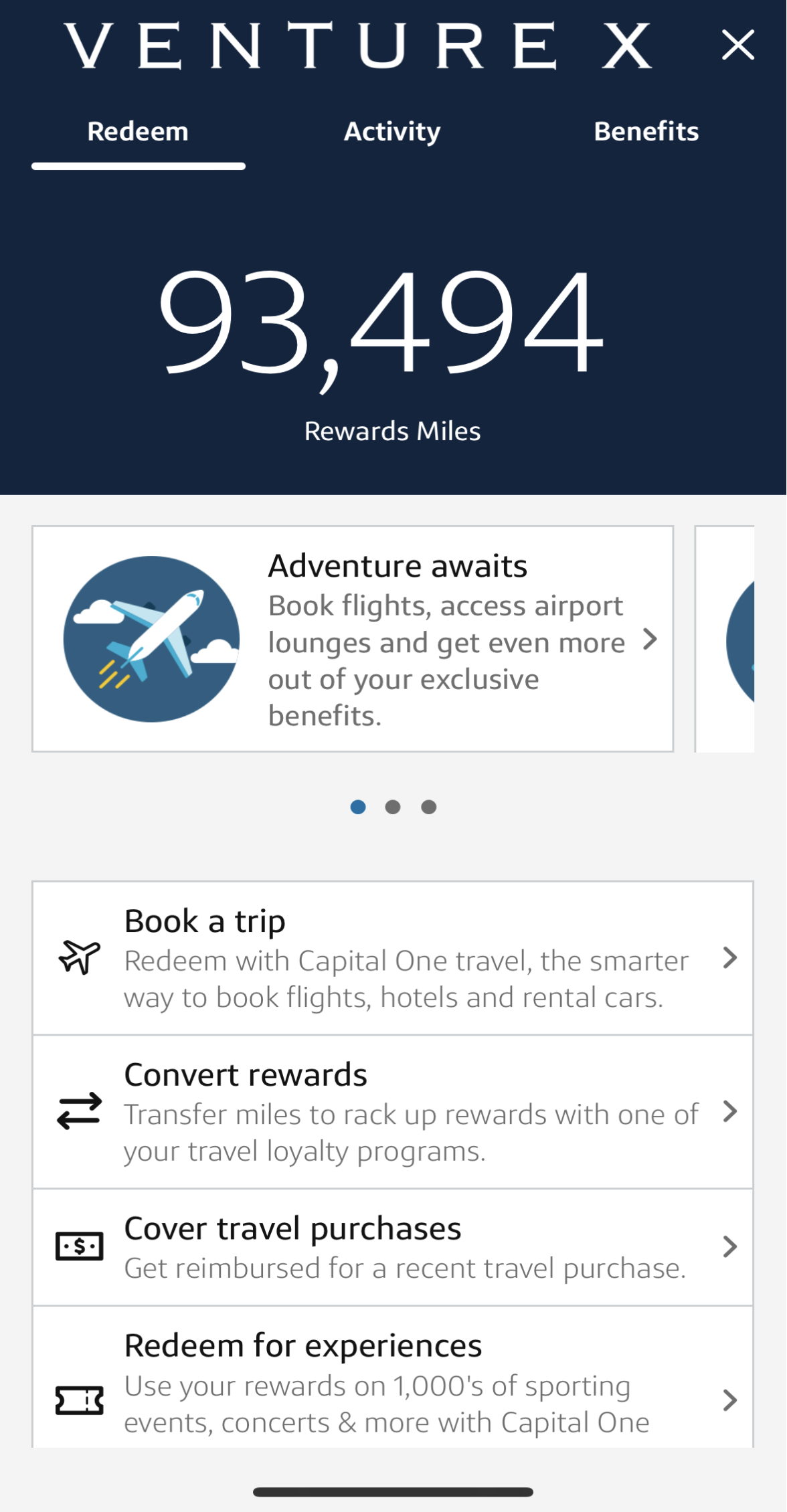

Capital One Redemption Options

Capital One allows customers to redeem their miles and cashback rewards for various purposes. To check the redemptions options available, logging into your credit account via the Capital One mobile app or website. The redemption options include:

- Cover Eligible Purchases

Capital One has a unique feature known as purchase eraser that allows customers to cover recent travel purchases incurred in the last 3 months. Examples of eligible purchases include rideshares, plane tickets, streaming services purchases, and restaurant delivery.

- Gift Card

If you prefer to use your points to shop at specific retailers, you can redeem your rewards for gift cards at a value of 1 cent per mile, subject to change.

- Cash

If you have a card that earns cashback, you can redeem the accumulated cashback for cash or check. You can choose to get the cash redeemed as statement credit or have the check sent to your address.

- Shop on Amazon

Capital One now allows cardholders to link their eligible cards with Amazon, and use their miles and cashback to pay for purchases on the retail store. This option offers a low value for your points, and you may get about 0.8 cents per mile.

- Book Travel

If you prefer to redeem your points for travel purchases, you can check the Capital One Travel website for available travel options. Customers can redeem their miles for travel booking, and use a mix of miles and cash to cover the payment.

- Transfer Points to a Travel Partner

Transferring your rewards to Capital One travel partners offers the best value. Capital One travel partners include airlines and hotels, and you can redeem your points for airline tickets or hotel stays.

For example, Emirates and Singapore Airlines have a transfer rate of 2:1, and 2 miles will get you 1.5 miles in one of these airlines.

How to Maximize Capital One Rewards?

Capital One credit cards earn rewards in form of miles and cashback, which can be redeemed for various uses such as travel purchases, gift cards, statement credit, and transfers to travel partners.

Here is how to make the most out of your Capital One rewards:

Use Purchase Eraser

The purchase eraser feature allows credit customers to make travel purchases directly, and then use the rewards to cover the eligible purchases from their bill.

This feature allows you to redeem miles for statement credit to cover purchases made within 90 days from the date of travel. You get 1 cent per mile, and there is no minimum redemption amount or blackout dates.

Any travel purchase coded as “travel” such as rideshare, travel agents, hotel stays, and airfare is eligible for redemption using the purchase eraser.

Transfer Miles to Partners

Transferring your Capital One miles to travel partners offers a higher value than redeeming your rewards for gift cards and statement credit. Capital One has partnerships with various airlines and hotels such as Emirate, JetBlue, and Air Canada.

Some of these partners offer a transfer rate of 2:1:5, which may be higher than the 1 cent per mile offered in other redemption options.

Book Travel through the Travel Center

The Capital One Travel Center allows you to book travel and pay using miles, or a combination of miles and cash. You can also book hotels, flights, and rental cars at the travel center, and pay additional costs such as taxes and surcharges using your reward points.

Share Rewards with a Family Member/Friend

If you have a family member with a miles-earning Capital One credit card, you can share your points with them. This can help them pool enough points to pay airfare or other major travel expenses.

TSA PreCheck or Global Entry

Some Capital One credit cards offer up to $100 in free credits to TSA PreCheck and Global Entry enrolment. These programs help you get through customs and airport security more quickly.

If you use your credit card to pay for membership fee to these programs, you will be reimbursed the fee once every four years. You can also use these credits to offset the annual credit card fee.

Other Benefits of Having a Capital One Card

Apart from earning cash backs and miles, the following are the other benefits of having a Capital One credit card:

- No foreign fees – Capital One is one of the few credit card companies to eliminate foreign transaction fees on all their credit cards. Most credit cards charge 3% to 5% in foreign transaction fees. When using your Capital One credit card to pay for purchases abroad, there are no foreign transaction fees, and this will save you money on your purchases.

- Balance transfers – If you want to consolidate your higher APR credit card debts, you can transfer your balances to a Capital One credit card. For example, the Capital One Quicksilver credit card offers a 0% APR for the first 15 months and an ongoing variable APR of 15.49% to 25.49% when the introductory period lapses.

- Auto rental collision damage waiver – Buying auto rental coverage may be pricey due to the add-ons included. If you want to save money on auto rental insurance, use a qualifying Capital One credit card to rent your car. This option may get covered for auto rental collision damage waiver and save you money in expensive rental insurance add-ons.

- Credit line reviews every 6 months – If you are using one of Capital One’s credit building credit cards such as the Journey Student Rewards and QuicksolverOne rewards card, you can get approved for a higher credit line within 6 months.

- Card lock – If your card is lost or stolen, you can quickly lock your card without having to call the bank. This can help prevent unauthorized credit card transactions in case the card gets in the wrong hands.

How Many Capital One Credit Cards Can I have at One Time?

Capital One limits the number of cards you can have to just two credit cards. The Capital One two-card rule started in 2011, and it applies to its list of consumer credit cards. However, some consumers may still apply and get approved for the Capital One Secured Mastercard, co-branded cards, and business cards that do not count towards the two-card rule.

Credit cardholders who had more than two credit cards before 2011 and those who held cards with banks that were acquired by Capital One were allowed to retain their cards and may have more than two cards.

How Do I Cancel a Capital One Credit Card?

You can cancel your Capital One credit card account in the following two ways:

- By Phone: Call Capital One Customer Support at 1-800-227-4825, provide your full credit card number, and ask them to close your credit card. The bank representative may ask you to keep the card open, and even offer a lower APR or higher rewards. Be sure why you want to close the account and stick with your decision.

- Online: Sign in to your Capital One credit card account and select “I want to” at the top of the page and choose “Close account”. Follow the steps provided to close your account.

Top Offers

Top Offers

Top Offers From Our Partners

Top Offers

How We Picked The Best Capital One Cards: Methodology

To select the best Capital One credit cards, our team thoroughly researched various offerings from Capital One, analyzing their features and benefits across two key categories:

Rewards Program (50%): We evaluate the rewards structure, including the type of rewards offered (points, cash back, or miles), earning rates per dollar spent, bonus categories for accelerated rewards, and flexibility in redemption options. Capital One cards with generous rewards rates, diverse redemption choices, and valuable sign-up bonuses receive higher scores in this category.

Card Features & Benefits (50%): This category assesses additional features that enhance the overall value of the card, such as introductory APR offers, absence of foreign transaction fees, complimentary airport lounge access, travel credits, purchase protection, and extended warranty coverage. Capital One cards offering a wide range of benefits without excessive fees earn higher scores.

This comprehensive evaluation ensures that the best Capital One credit cards offer valuable rewards, benefits, and a seamless user experience while maintaining a positive reputation, catering to the preferences of cardholders seeking Capital One products.