Table Of Content

What Documents Do You Need?

You can open a checking account at Wells Fargo either individually or jointly. You will need basic information and documents to complete the process.

Here are the documents you need to open a savings or checking account at Wells Fargo:

- Driver's license

- Social security card

When opening a business account, the bank verifies your business and your association with the business. The documents required to open a business account at Wells Fargo depend on the business type.

How Much Do You Need to Open a Wells Fargo Bank Account?

You can open and operate different account types at Wells Fargo. For example, you can open a checking account to manage your daily financial needs with an opening deposit of $25.

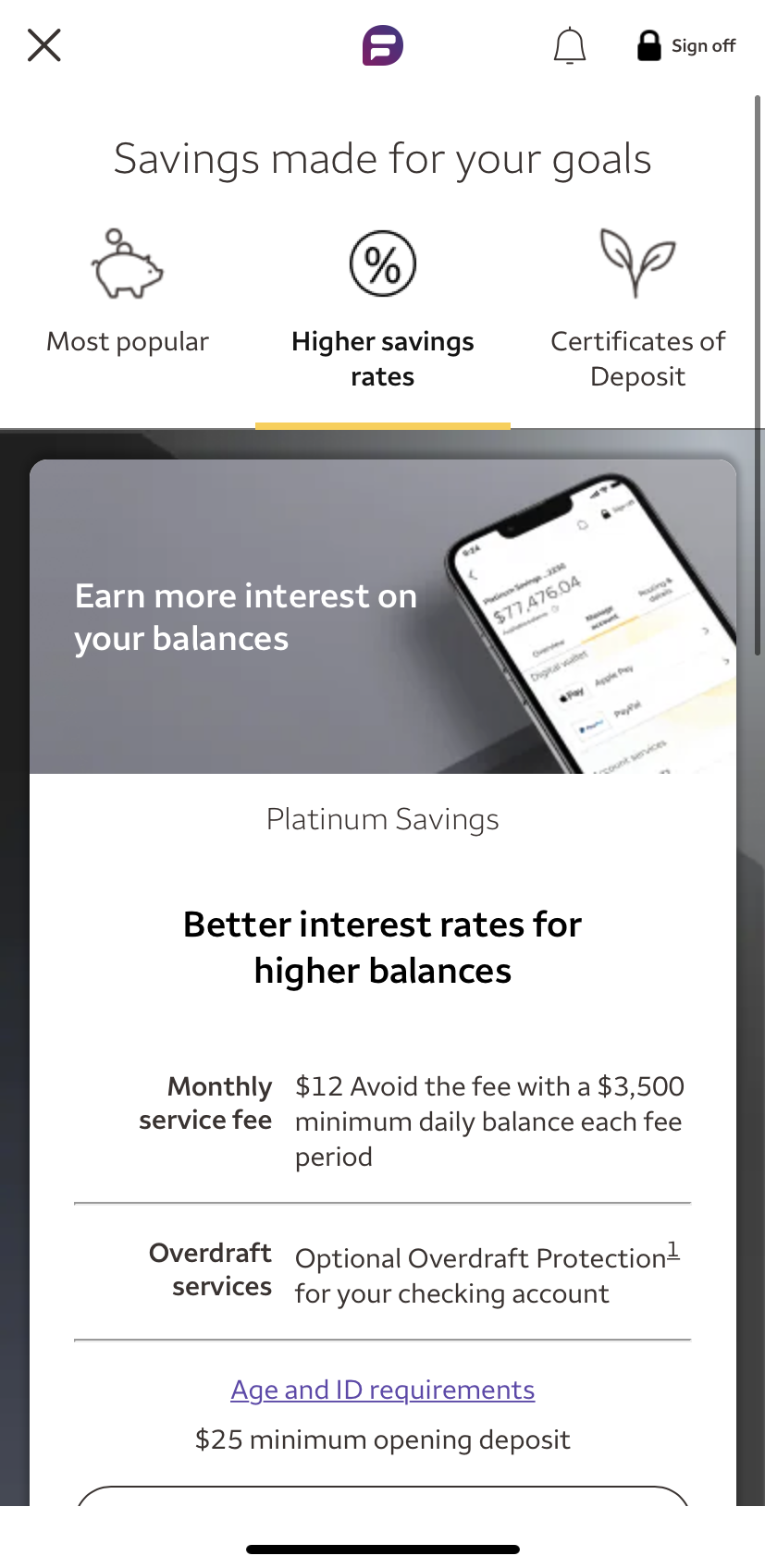

Moreover, the bank provides simple savings account solutions and time accounts. The minimum opening deposit is $25 for savings accounts such as platinum saving account.

Moreover, you can open a special fixed-rate Certificates of Deposit (CD) account and deposit a minimum of $5,000. The minimum opening deposit for a standard fixed-rate CD account is $2,500:

Can You Open a Wells Fargo Account Online?

Yes, you can open a Wells Fargo account online by visiting the bank's website.

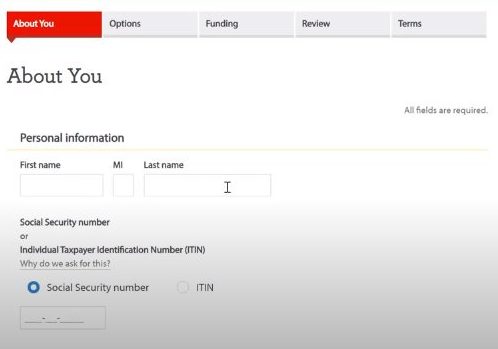

To open a checking account online, you must provide the following information to the bank.

- Name

- Taxpayer ID

- ID type

- Citizenship

- State

- Email address

- Mobile number

- Occupation

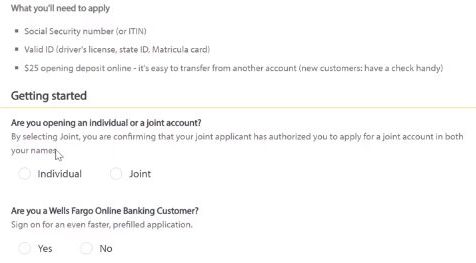

Also, it would be best if you had a Social Security Number or ITIN and the minimum opening balance for your chosen account type.

Before starting the process, you choose whether you are opening an individual or joint account and indicate whether you are an existing online client at the bank.

Steps to Open a Wells Fargo Checking Account

Opening a checking account at Wells Fargo is simple, and you can do it online. Here are the steps you follow when opening a Wells Fargo checking account.

1. Visit The Bank's Website

2. Choose Your Account

Under the ‘personal' tab, click on checking to view the list of all checking accounts. Wells Fargo offers different checking accounts, and they include the following:

- Clear access banking

- Everyday Checking

- Premier Checking

- Prime Checking

- Student or teen banking

If you choose clear access banking, click on the ‘Open now' tab. After clicking, you are taken to the next page comprising three steps: telling the bank about yourself, customizing your account, and making your opening deposit.

Also, you choose whether you are opening an individual or joint account and whether you are the bank's online client. Then, you continue to the next stage after reading the terms and conditions.

3. Fill In Your Personal Information

In this step, you will fill in your name, social security number or ITIN, and details of your driver's license or state ID.

Also, you fill in more information about yourself, such as:

- Date of birth

- Citizenship

- Phone number

- Email address

- Address

- Occupation

After filling in the details, you consent to continue with the application process. After filling in your details, complete the ‘Options' tab, deposit at least $25, and review your account details.

4. Review & Accept

Review and accept the bank's terms and conditions to complete the process of opening a Wells Fargo banking checking account.

If you choose clear access banking, you can use your account to manage your funds through checkless backing. Also, the account does not charge overdraft fees.

How To Open a Joint Bank Account With Wells Fargo?

You can choose different account types when you want to open a bank account. You can choose to open either an individual or joint account.

The difference between the accounts is the number of people operating either of them. A regular account has one account holder, while a joint account has two or more account holders.

You can open a joint checking account online by marking the ‘joint' option to confirm that you are a joint applicant.

You and the joint account holder provide information and identification in the joint account. Operating a joint account can help save, spend and share expenses.

Which Wells Fargo Checking Account Should You Open?

There are different checking account options that Wells Fargo offers. You should open a checking account that meets your needs and is the right for you.

Below are the checking account options at Wells Fargo.

Wells Fargo Checking Account | Monthly Fee |

|---|---|

Clear Access Banking | $5 |

Everyday Checking | $10 |

Prime Checking

| $25 |

Premier Checking | $35 |

- Everyday Checking

This checking account can help you meet your day-to-day banking needs. It has an overdraft protection feature that you can either use or not.

It charges a monthly service fee of $10. However, there are different ways through which you can avoid paying the fee. For example, you can maintain a minimum of $500 every fee period and at least $500 in direct deposits.

The account requires at least $25, and anyone between 17 and 25 can open the account.

- Clear Access Banking

This checking account helps account holders in managing their finances. Students and teens can open an account because it does not charge overdraft fees.

After opening the account with at least $25, you can maintain lower balances. Clear access banking account charges a monthly service fee of $5 and is suitable for clients who don't need to write checks.

The holder of this account type can be at least 13 years old. You can avoid paying the monthly service fee if the primary account holder is between 13 and 24 years old.

- Prime Checking

This interest-bearing checking account is ideal for clients who want fee waivers or discounts for different banking services. The account is interest-bearing and has overdraft protection.

It is best for combined account balances of more than $20,000. The account's monthly service fee is $25, but you can avoid the fee every period when you have more than $20,000 in some linked balances.

You have to be 18 years or older to open the account. The minimum opening balance for the prime checking account is $25.

- Premier Checking

This checking account is right for clients needing premium benefits, discounts, and waivers for different services.

It is an interest-bearing account and has an overdraft protection feature. It is best for combined balances of more than $250,000.

It attracts a monthly service fee of $35. However, you can avoid paying the fee when you maintain a balance of $250,000 every fee period. The minimum opening balance is $25; you must be 18 years or older to open the account.

There is no fee for personal wallet checks. Moreover, holders of such accounts are given priority customer service by the bank.

Wells Fargo Savings Account

In addition to savings accounts, Wells Fargo offers two types of savings accounts: Wells Fargo Way2Save and Wells Fargo platinum savings.

Wells Fargo Savings Account | Monthly Fee |

|---|---|

Way2Save Savings | $5 |

Platinum Savings | $12 |

Why Can't I Open a Wells Fargo Bank Account?

There are instances when Wells Fargo may deny your application to open an account.

The bank may do so if your personal information cannot be verified. The details may not be verified because you listed incorrect information.

Also, you cannot open a Wells Fargo account if you have a history of overdrafts and negative balances. For example, you may have a record of unpaid overdraft fees.

You may have outstanding loans from old accounts and closure of past accounts due to suspected fraud.

What Can I Do if I Can't Open a Wells Fargo Account?

You can do the following if you are denied opening a bank account.

- Verify your information. The bank verifies your personal information when opening a bank account at Wells Fargo. Sometimes, you list incorrect information by mistake, denying a chance to open your account. You can check and correct the information and then reapply.

- Review your records. Wells Fargo may have verified your personal information but still denied opening a bank account for other reasons, such as outstanding loans. Reviewing the reports or files can help identify the outstanding balances and pay off or dispute existing errors.

- Explore alternatives. If you cannot open a Wells Fargo account, you can access banking services from other options. For example, you can open accounts at institutions providing second-chance checking and getting prepaid debit cards.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Factors to Consider When Opening a Wells Fargo Account

Checking accounts in different financial institutions offer convenience to clients. However, it can be difficult to choose from the numerous options.

Online banks, physical banks, and credit unions offer checking accounts that come with different elements. Below are the factors to consider when opening a checking account at Wells Fargo.

- Variety Of Products

Wells Fargo provides different checking accounts, for example, clear access banking, everyday checking, prime, and premier checking.

The many options broaden your choices, and you will likely find a checking account that meets your needs.

Checking accounts have different features, and you can choose the right one.

- Fees

Checking accounts charge fees for you to access different services on the account—for example, monthly service fees, balance inquiries, cashier checks, and wire transfer fees.

Checking accounts at Wells Fargo charges between $5-35 every month. There are ways through which you can avoid the fees every period.

For example, you can avoid paying the fees on a clear access banking checking account by ensuring the primary owner of the account is between 13 and 25 years old.

- Checking Account Type

Some of the Wells Fargo checking accounts are interest-bearing, while others are not. This gives you the freedom to choose based on your financial needs.

Moreover, you can write checks in some of the Wells Fargo checking accounts; in others, you can only deposit them, and you are not charged any check fees.

For example, In the Everyday checking account check prices vary.

- Promotion

From time to time, Wells Fargo offers promotions when opening savings it checking accounts. Check out if there are any promotions and how you can get it.

Tips to Maximize Your Wells Fargo Checking Account

You can get the best out of your Wells Fargo checking account if you have the right information. The right information can help you minimize the fees charged on checking accounts.

The following are the best tips that you can use to maximize your checking account.

- Go for the Right Account: The right account that meets your needs can help you avoid service fees. When choosing a checking account, go for one aligned with your needs. Given that there are circumstances under which you can avoid monthly service fees, you can get the most out of the account by exploring the options. For example, always ensure that you maintain a daily minimum account balance.

- Making Smart Choices: Smart service choices, such as low-cost alternatives, can help you get the most out of your checking account.

For example, when you are not near an ATM and need funds from your account, you can consider getting cash back from the transaction instead of paying higher withdrawal fees for using a non-Wells Fargo ATM. If you decide to use a non-Wells Fargo ATM, withdraw the full amount instead of several small withdrawals that will lead to more charges.

- Manage Your Account Properly: You can maximize your Wells Fargo account through its proper management. In this regard, you always need to ensure you have enough funds in your account to cover all transactions.

Proper management of your account helps in preventing cases whereby there is a negative balance in your account or overdrafts. When you avoid such cases, you avoid paying the associated fees. For example, you can avoid overdrafts by accurately recording your transactions and tracking all your deposits and withdrawals.

FAQs

Can a Non-US Citizen Open a Wells Fargo Bank Account?

Yes. Wells Fargo allows non-residents to open accounts using their Individual Taxpayer Identification Number (ITIN) and other documents.

As a non-resident, you can open a Wells Fargo account as long as you meet the requirements. The non-residents have to visit a branch in person to open an account.

How to Open a Savings Account With Wells Fargo?

The bank has different types of savings accounts. You can open a savings account by visiting any Wells Fargo branch or online. For example, you can open a platinum savings account or a Way2Save account.

Related: Should I Open A Savings Account In A Time Of Inflation?

How Long Does It Take to Open Wells Fargo Bank Account?

You can open your Wells Fargo in minutes.

However, the setup and verification for transfers to other financial institutions take 1-3 business days. Once you open and set up your Wells Fargo, you move closer to building a solid financial foundation.

Can I Open a Wells Fargo Bank Account Without SSN?

Yes. You can open a Wells Fargo account jointly or individually using your Individual Taxpayer Identification Number (ITIN) and driver's license.

Also, you will need your basic information and the minimum opening deposit. For example, you can use your ITIN to open a premier checking account and deposit at least $25.

What Is the Minimum Balance for Wells Fargo Checking Accounts?

Wells Fargo has different checking accounts, and you can choose one that is right for you in managing your financial needs. For the Everyday Checking account, the minimum daily balance is $500. The combined account balance for a Prime Checking account is $20,000 or more.

How to Find Wells Fargo Bank Branches Near Me?

You can use the ATM and branch locator to locate a branch or ATM near you. Also, select more choices on a Wells Fargo ATM, then ATM services and settings to view or print nearby ATMs.

Moreover, you can call the bank's official number to help locate a branch near you.

How to Find Wells Fargo Bank ATMs Near Me?

You can find a Wells Fargo bank ATM using the ATM and branch locator. The bank has more than 12,000 ATMs, and the locator will easily identify one near you.

Also, you can call the bank, and their representative will help you find ATMs near you.

How to Contact Wells Fargo Customer Service?

You can contact the bank's customer service by calling 1-800-869-3557 or 1-800-956-4442. Also, you can contact the Bank's customer service by using the bank's mailing addresses.

The bank has social care support available 24 hours every day of the week.

What Are Wells Fargo Bank Opening Hours?

The bank opens six days a week between 9:00 am and 5:00 pm. Most branches are open Monday to Friday from 9:00 am to 5:00 pm, and on Saturdays, the branches operate at adjusted hours.

The branches remain closed on Sundays except with a few exceptions.

Related Posts

Banking Reviews

Alliant Credit Union Review