Table Of Content

What Is A Savings Account?

A savings account is a basic bank deposit product that allows the customer to deposit money, keep it safe, and withdraw funds while the account earns interest. The savings accounts you will find in banks, credit unions, and other financial institutions have FDIC insurance coverage and usually pays interest on the deposits.

The interest rates have gone down over the years. Most of the time in the last 15 years, the maximum you could get is 0.5%.

But now, when inflation is rising – the interest rate is rising. therefore, you can expect much higher rates on your savings. Here are the Fed rate for July 2024:

How Does Savings Account Work?

By their technical nature, savings accounts are akin to time deposits. Technically, the bank can require the depositor to notify the bank before withdrawing the funds or charge a penalty when the account holder withdraws the money before a specified date.

While banks do not usually exercise this right, some institutions restrict the number of transactions that a depositor can make in and out of a savings account per month. They also charge fees that depend on the average balance an account holder keeps in his account. In addition, banks do not provide checks for a savings account as a general practice.

It is relatively easy to transfer funds to and from a savings account, but a depositor must observe the federal limits on the number and types of withdrawals he can make per statement cycle.

While deposits are without limits (you can make as many as you wish), the law restricts some types of telephone and electronic withdrawals (exclusive of ATM withdrawals) and transfers to only six per statement cycle.

What Is The Purpose Of A Savings Account?

Savings accounts are a type of deposit account that are designed to hold funds that you have no immediate plans to spend. This differs from a checking account, which is meant for your everyday spending, so you can write checks or use a debit card to pay for purchases.

Banks anticipate that customers will leave money in their savings account for the short to medium term, so you’re rewarded with interest on the funds. However, unlike most investments, you don’t need to tie your money up for a set amount of time. So, when you need access to the funds, you can simply withdraw them via ATM, transfer or even at the teller in your local branch.

How Does Interest Work On A Savings Account?

Interest can be paid on savings accounts in one of two ways. Simple interest is not common with savings accounts, as it refers to getting a rate on your deposit only. For example, if the simple interest rate is 5% and you deposit $100,000, you would just receive $5,000 after one year. The most attractive savings accounts offer about 3-4% APY, as of July 2024.

The more common form of interest on savings accounts is compound interest. Interest can compound daily, monthly or quarterly, but it allows you to earn interest on the interest that you’ve earned up to that point. You can grow your savings more quickly when interest is added to your balance more frequently.

For example, if you have $100,000 and interest compounds every day, the amount earning interest grows by 1/365 each day. So, if the interest rate is 5%, you’ll grow your account balance to $5,126 by the end of year one. However, if the interest compounds quarterly, you will only earn $5,094 in interest over the same year.

Here's what you can get if you deposit $100,000 with 5% APY. You can see the difference between daily, quarterly, and annually compounded interest.

Term | Daily | Monthly | Annually |

|---|---|---|---|

1 Year | $105,126 | $105,094 | $105,000 |

2 Year | $110,516 | $110,448 | $110,250 |

3 Year | $116,182 | $116,075 | $115,762 |

4 Year | $122,138 | $121,988 | $121,550 |

5 Year | $128,400 | $128,203 | $127,628 |

How Much Interest Does A Savings Account Earn?

In essence, the bank computes interest on your running balance so it’s constantly changing. If you will let your money stay in your account, the interest will continue to compound, and your money will grow quicker.

When you compare it with certificates of deposit and other interest-bearing bank products, a savings account will earn a lower interest rate.

You should shop for the best savings account rates, although the highest savings rate you may find would probably still be lower than that of other types of accounts.

So, if you’re willing to keep your money in the bank for a prolonged period – from a few months to a few years – you will earn more if you place them in a Certificate of Deposit.

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

Top Offers From Our Partners

![]()

Benefits And Limitations

A savings account offers automatic savings tools, liquidity, and most important – the option to grow your money. However, it has some limitations to consider before putting your money. Here are the main things you should know:

Pros | Cons |

|---|---|

Grow Your Money | Fees And Requirements |

Joint Accounts | Withdrawal Limits |

Liquidity | Insurance Limits |

Automatic Savings Plan | No Tax Savings

|

Safety

|

- Grow Your Money

Savings accounts let you earn interest on money that you leave in your account. In effect, your bank will make small additions to your money, usually every month.

The interest rate is generally quite low and may even pale in comparison to the inflation rate.

- Joint Accounts

You have the choice to open a savings account with your partner so you both can save together in a single account.

- Liquidity

Most banks and credit unions provide online access to your funds 24 hours a day, seven days a week.

Many institutions would also let you link your accounts together so that you can just transfer funds online and avoid paying withdrawal fees.

- Automatic Savings Plan

This feature automatically transfers a previously-specified amount from your paycheck into your savings account each time your employee pays you.

This applies the principle of “paying yourself first” and helps you develop a habit through force-saving.

- Safety

One main feature of a savings account is that it keeps your money safe – inside your bank's vault, credit union, or reserve bank.

Banks insure through FDIC, while credit unions are through NCUSIF.

- Fees And Requirements

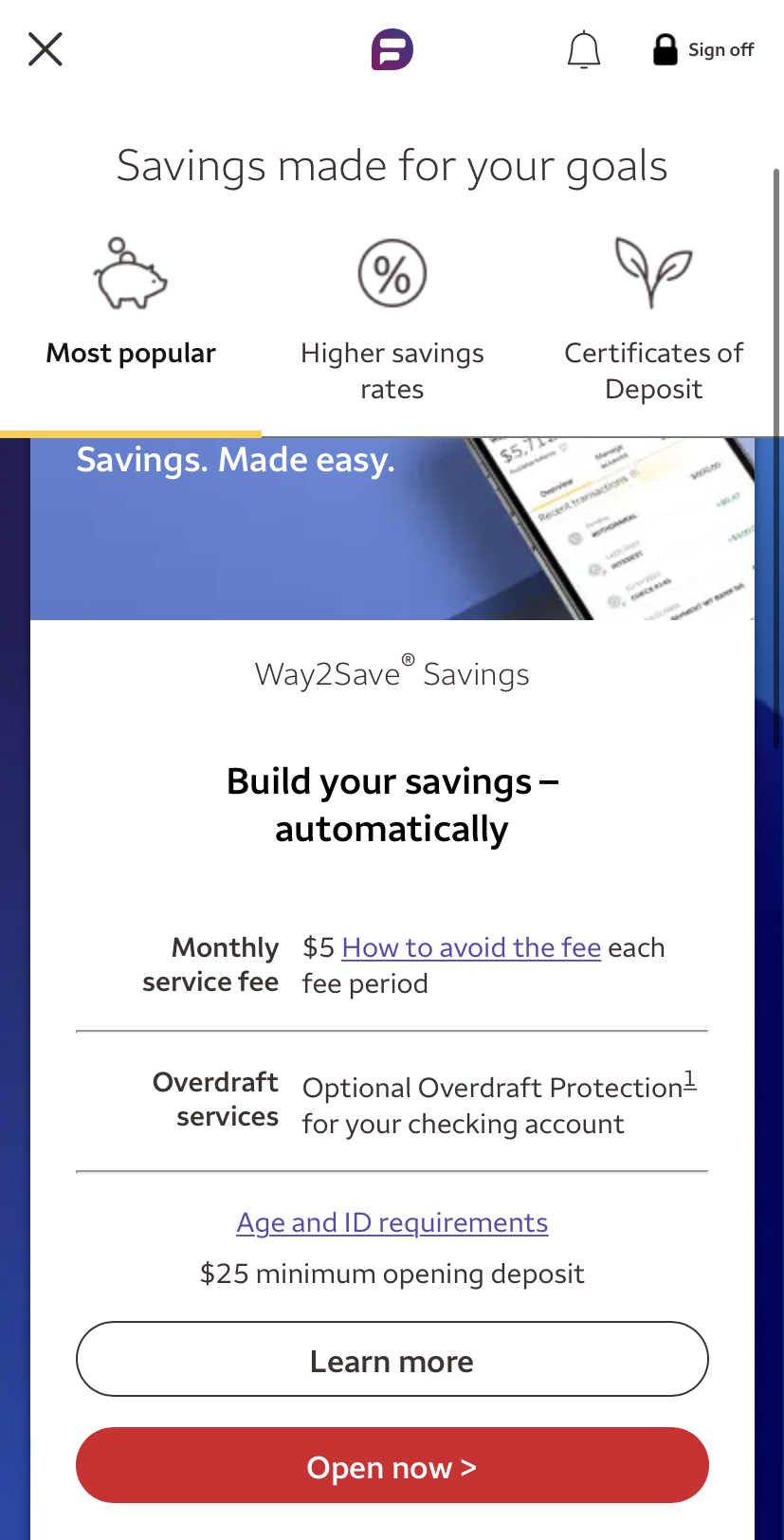

Some banks charge a monthly fee or have a minimum balance that you must maintain to avoid the monthly fee.

If you can’t keep your balance above the level that the bank requires, you may end up paying regularly to have your savings account open. Often, the monthly fee that you will pay will be more than the interest you might earn from your money.

- Insurance Limits

If your money in the bank is less than $5,000, you would probably ignore things like an insurance limit.

However, if you have a net worth of over $250,000, you should be conscious of where you will save your cash. Naturally, you want an option where they will have 100% insurance cover.

- Withdrawal Limits

The federal government has set a limit on the number and the types of withdrawals you can make per statement cycle.

Regulation D allows you a maximum of 6 transfers or withdrawals from each savings or money market account during a calendar month.

- No Tax Savings

The money that you put into a traditional savings account is often money that you’ve already paid income tax on.

Then, when you earn interest, the IRS will demand that you pay the full rate for them.

How Much Should I Have in My Savings Account?

There is no one size fits all answer to this question. How much you should have in your account will depend on your financial circumstances.

- If you’re in a low-income bracket or have financial uncertainty, it is a good idea to have at least three months of spending in your spending account as an emergency fund. For example, if your monthly bills, including your rent, utilities, and debt obligations, total $3,000 per month, you should aim to have $9,000 or more in your savings account.

- If you have an average financial life, where money is not particularly tight, but you don’t have a large income, you should aim to have six to 12 months of expenses in your savings account as your emergency fund.

In either scenario, once you have your emergency fund in place, you can then start to build up savings in another savings account to work towards your financial goals. Of course, if you have debt, such as credit card balances, you may want to prioritize paying off this debt rather than building up substantial savings.

- If you are in a very good financial position, you are likely to be looking at more long term investment strategies. While a savings account is great for emergency funds or money that you may use in the next year or so, if you have no plans for the money for several years, you may generate higher returns with other investment products.

Can I Take Money Out of a Savings Account?

One of the advantages of a savings account is that your funds are readily accessible. You can typically take money out of the account via ACH transfer, ATM or by visiting the teller at your local branch. However, you may have withdrawal limits on your account.

Most banks impose an ATM limit to minimize the risk of loss in the case of fraud or theft. For example, if you lose your ATM card or it is stolen, you don’t want a fraudster to clear out your account in the time it takes you to realize the card is gone.

There may also be limitations of how much you can withdraw at the teller. Banks don’t tend to carry unlimited cash, so if you want to withdraw a large amount, you will need to give your bank notice. Additionally, the bank may advise alternative methods rather than taking out cash, such as organizing a transfer or taking a cashier’s check.

High Yield vs. Traditional Savings Account

While we’ve covered the details of opening a savings account, it is important to differentiate between high-yield and traditional savings accounts.

There are three main differences between the two accounts:

- Traditional savings accounts rates are lower

- Minimum deposits required of high-yield savings accounts tend to be higher

- High-yield savings accounts are usually online only

- Other terms and conditions may not apply to basic, traditional savings accounts, such as higher maintenance fees.

However, the compensation for this is that you can earn a far higher rate than traditional savings. In many cases, you can expect to earn up to 10 times or more in interest on your account balance.

Bank/Institution | Savings APY |

|---|---|

American Express | 4.25% |

Capital One | 4.25% |

Upgrade | 5.21% |

Marcus | 4.40% |

Discover Bank |

4.25%

|

Lending Club | 5.00% |

Quontic | 4.50% |

UFB Direct | Up to 5.25% |

Alliant Credit Union | 3.06% – 3.10% |

Ally Bank | 4.20% |

SoFi | up to 4.60% |

How Many Savings Accounts Should I Have?

This is a purely personal decision and will be determined by how you like to manage your finances. Many people prefer to carry several savings accounts to allow them to have a different account for different financial goals.

For example, you may have a savings account for your emergency fund, another for vacation savings and one more for saving towards a new car. Having different accounts reduces the temptation to overspend in one area. So, you won’t dip into your emergency fund when you’re arranging your vacation.

The optimum number of savings accounts you should will depend on your specific plans, but you may want to have separate accounts for:

- Your emergency fund

- Vacation saving

- Child’s saving fund

- Home down payment

- Saving for a car or other large purchase

However, some savings accounts allow you to separate your money without needing to open separate savings accounts. These accounts have buckets or pods that you can designate for different financial goals. This may be preferable for you, if you don’t like the idea of managing multiple different accounts.

Savings Vs. Checking Account: What's The Difference?

In a checking account, you wouldn’t have to worry of how many checks you can issue each month, but in a savings account, there may be a limit to the number of withdrawals you can make either from an ATM or from a live teller.

There are also set limits on the number of transfers you can make from your savings account to your checking account.

Generally, your bank will not allow you to make payments directly from your savings account because of Regulation D, a federal law that limits certain withdrawals.

A checking account is more efficient when it comes to taking money out of your account because you can just write a check, withdraw from an ATM, use your debit card, or pay electronically. So, if you need an account to service your disbursement needs, a checking account is more appropriate than a savings account.

How To Open A Savings Account?

Opening a savings account normally takes just a couple of minutes, whether online, over the phone, or in person. You can also make regular deposits and withdrawals (but within federal limits) at any time without having to think of any term length of the deposit or having to pay withdrawal penalties.

Online banking can provide the convenience of access to your funds 24/7 as long as you have an Internet connection. It also allows you to link your savings accounts to other accounts, like your checking and money market accounts so you can transfer funds seamlessly.

Saving Account Alternatives

In case you prefer a different investment option, there are a couple of good alternatives to a savings account. However, in most of them, the expected yield will be a little bit higher – and also the risk.

-

CDs (Certificate of Deposit)

By letting your money stay with them for longer, banks and credit unions will pay you a higher interest rate. The usual terms are from one month to 60 months. You can also consider special types of CDs such as no penalty CDs (very similar to savings accounts) or enjoy higher rates on Jumbo CDs.

The institution will issue you a Certificate of Deposit (CD) as evidence of your deposit, stating the interest they are willing to pay. Usually, this is more than the savings account average rate. In addition, your CD has insurance under the Federal Deposit Insurance Corporation for up to $250,000.

-

Money Market Account

A money market account is the same as a traditional savings account – except it has leveled up.

There are some additional limitations, primarily in the minimum balance you need to maintain and a ceiling in the number of withdrawals you can make each month.

The great thing about it is that the bank will pay you a higher interest rate if you meet these conditions.

-

Checking Account

If you can find a checking account that pays interest, you’d notice that the interest rate is even lower than that for a traditional savings account.

However, if you shop for a checking account, you can find a few financial institutions offering high-yield checking accounts with a slightly attractive interest rate.

The catch is that you must meet certain standards to earn a higher interest.

You’ll have to meet a higher minimum balance, make only a minimal number of transactions with the account, and link the account to your payroll through direct deposits. It’s a good option only if your existing saving and spending patterns jive with the criteria.

-

U.S. Government Bond Funds

Putting your money in bonds and other debt securities is a conservative but surefire way to receive stable income on your investments.

U.S. Government Bonds are risk-free and safe because the U.S. government’s resources fully back these debts. The only risk you have to contend with for these bonds is the interest rate fluctuation and the inflation gap.

-

Gold

If you compare gold with the other items in this list, you can conclude that this is not the safest alternative, but when you look at the current market conditions around the world, this has earned its place here.

Even if, historically, the price of gold has been unpredictable, it still could be an alternative to a savings account. If you have good timing, you can make a killing in your return on investment.

Can I transfer my IRA to a savings account?

Yes, your IRA can be transferred into a savings account, if you decide it is the best option for you.

What Is Health Savings Account?

In addition to the traditional savings account described here, the United States and other countries allow some people to open special savings accounts for specific purposes.

Examples of these are Health Savings Accounts and Coverdell Education Savings Accounts. Investors open these accounts to build funds they will use to pay for specific items, but these accounts have unique rules and specific tax provisions to govern them.

What is a share savings account?

Share savings accounts are a type of account that permit you to buy and sell shares or mutual funds tax free.

What are CD savings accounts?

CDs or certificates of deposit are a fixed term savings plan. You can take out the CD for a specified period, tying up the funds until the CD matures. If you need the funds earlier, you may incur an early repayment penalty.

Can you write checks from an online savings account?

Generally, no, you cannot write checks on an online savings account.

Can you direct deposit into a savings account?

Yes, you should have no problems direct depositing into your savings account.

Do savings accounts have routing numbers?

Yes, as with a checking account, you’ll have a routing number for your savings account.