Table Of Content

What Is Chase Credit Journey?

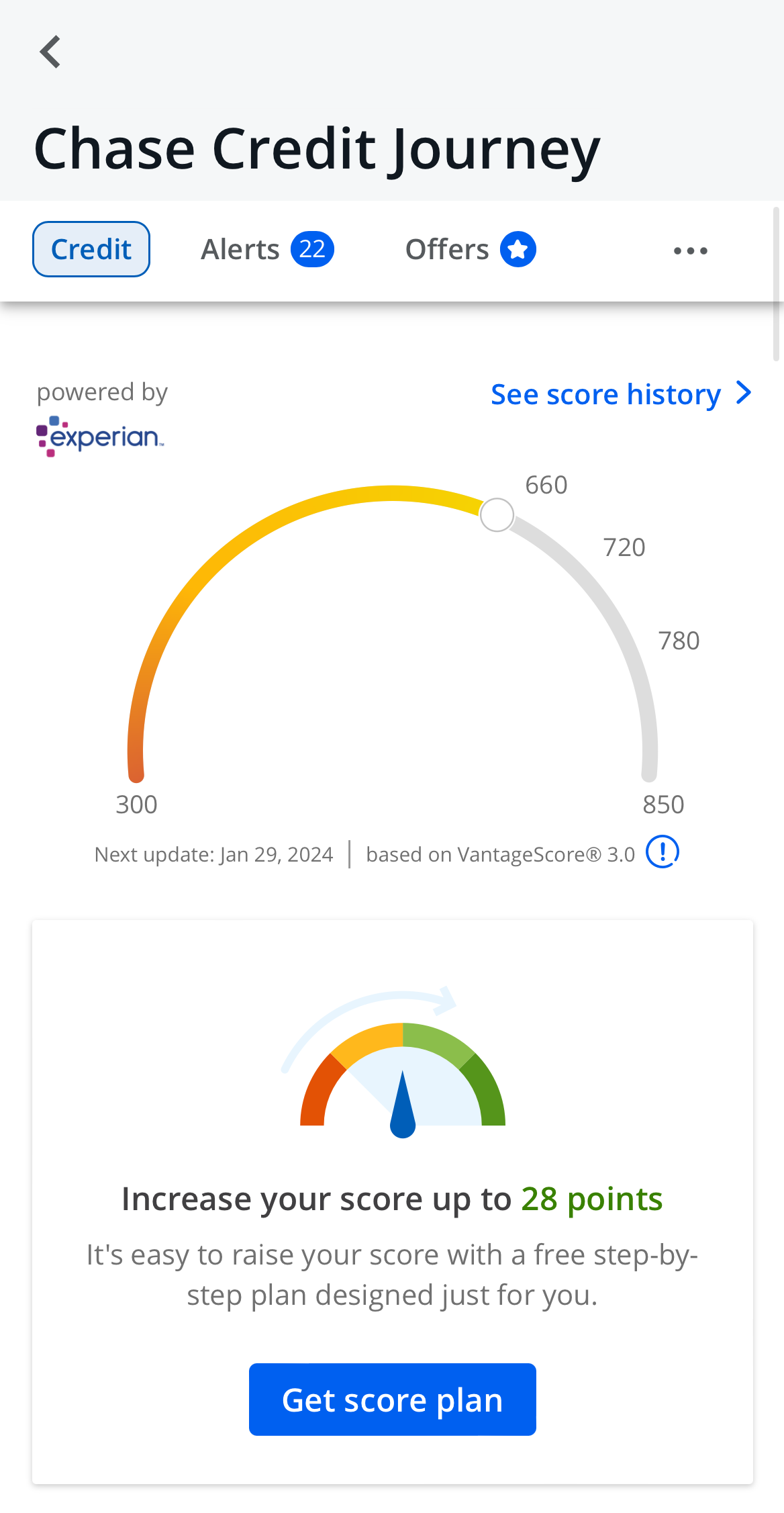

Chase released Chase Credit Journey in 2017. This is a tool that allows you to monitor and view your credit score and credit report. This free service collects your credit information from Experian, and you can log in to review your report, which is updated on a weekly basis.

Chase Credit Journey has several key features including:

- Access to your Credit Scores

You can view your Vantage 3.0 credit scores and all the factors that are used to calculate your credit score.

- Access Your Credit Information

This includes details such as open or closed accounts, delinquencies, collections and inquiries. This is all the type of information that is typically available on your credit report and all of which influences your credit score.

Just bear in mind that your credit details are not displayed as they would be on a formal credit report.

- Email Alerts

You’ll receive an email or notification if there are any chances to your credit report, to not only help you improve your credit but also minimize the risk of identity theft.

For example, if an account is opened, there is a name or address change or a hard inquiry is made, you’ll be alerted.

These alerts can be helpful for credit safety, so you’ll be aware if a stranger is accessing your details or if there are any errors. You can personalize the alerts according to your preferences.

- Score Simulator Tool

This is an interesting feature that allows you to play around and see what would happen to your credit score if you make specific actions, such as paying off a balance, applying for a new credit card or you miss a payment.

There are misconceptions about credit scores, and this simulator calculates the potential impact and predicts your new score.

- Credit Resources

Chase offers a selection of credit resources that can help you on your financial journey.

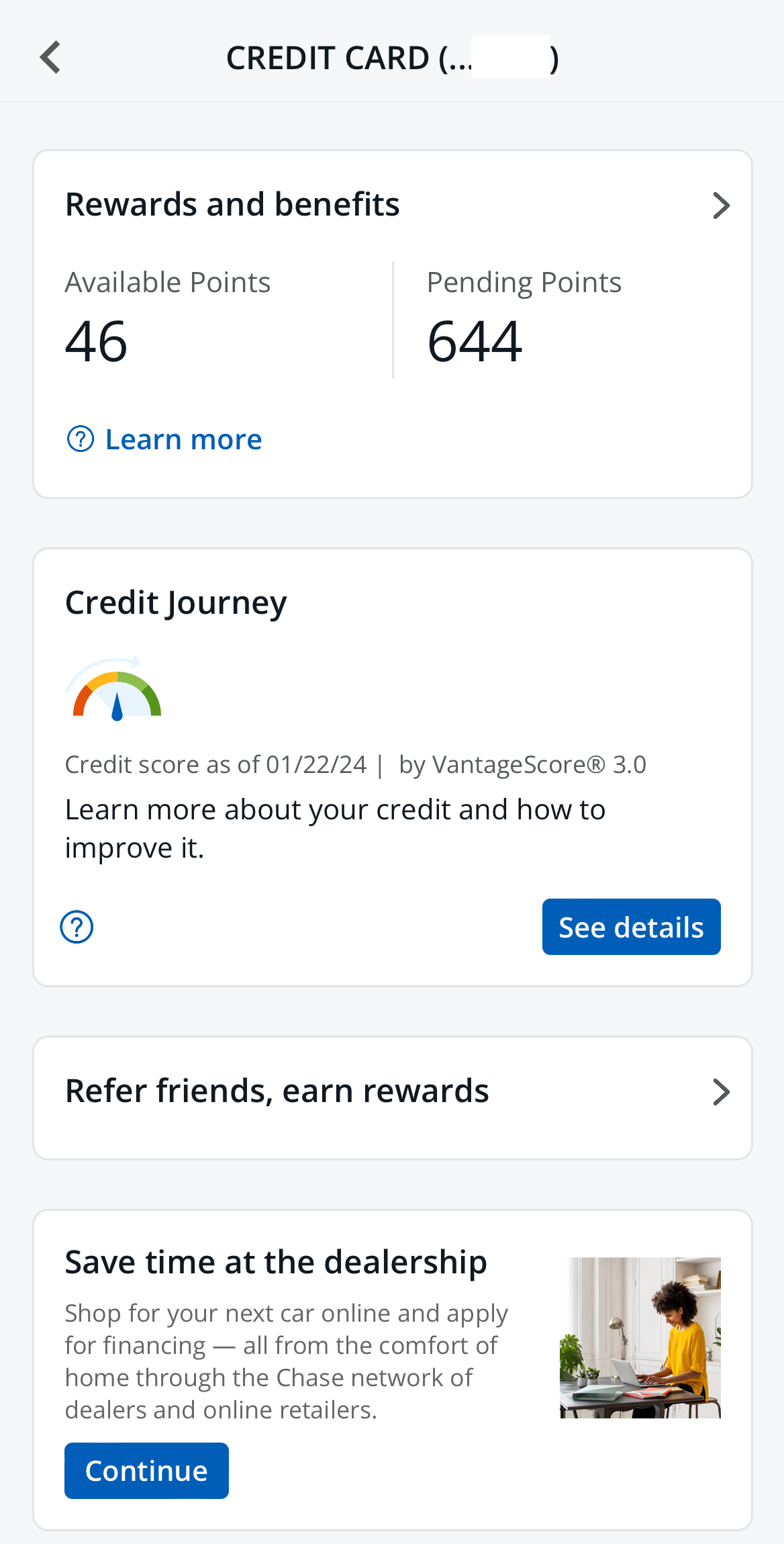

- Credit Card Suggestions

Chase will also provide suggestions for credit cards that could work well for your financial circumstances. However, these will be biased towards Chase products.

How to Enroll With Chase Credit Journey?

It's easy and quick to enroll the Chase credit journey. Here are the basic steps to take:

1. Visit Chase Website or App

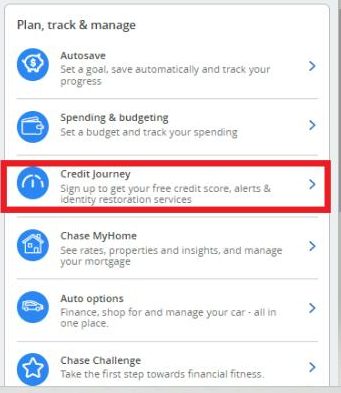

If you're a Chase customer, you should click on “Credit Journey” on the right menu in the main Chase dashboard:

Existing Chase customers may also find it easy to enroll using the Chase app. You just need to log in and you’ll find Credit Journey under the “Open Account” tab..

If you're not a Chase customer then you'll need to fill some details to join:

2. Verify your Identity And Enroll

If you're not a Chase customer, you’ll need to complete the identity verification to enroll. Existing Chase customers can do this via an SMS pin, but if you’re not currently a Chase customer, you will need to verify some information from your credit report.

If you’re not an existing Chase customer, you will need to create a log in.

How to Use It To Check And Improve Your Score?

Once you’re enrolled, there are a number of ways that you can use Chase Credit Journey. You’ll need to sign into the Chase app and tap “Credit Journey”. You can then complete a number of actions, including:

- Check Your Experian Report

You can view your Experian credit report via the Credit Journey service.

Simply tap “Access your report” or “See all accounts” and you can view your report details.

- Explore Credit Tools

This section is designed to help everyone improve their credit and financial circumstances, regardless of where they are in their own credit journey. The credit tools provide some excellent resources that can help you learn more about credit scores and how you can improve your credit.

All you need to do is swipe up and you’ll find “Explore our tools.” Tap the heading to access this valuable information.

- Simulate Your Score

As we touched on earlier, this is an interesting feature that allows you to experiment with how actions will impact your credit score.

For example, if you’re considering opening up a new credit card account, taking out a loan or clearing a debt, you can put this into the score simulator to see its potential effects.

You’ll need to swipe up and find the Score simulator section. Then Tap “Try it out.” You can then play around with the if and when circumstances to see how different choices will impact your score.

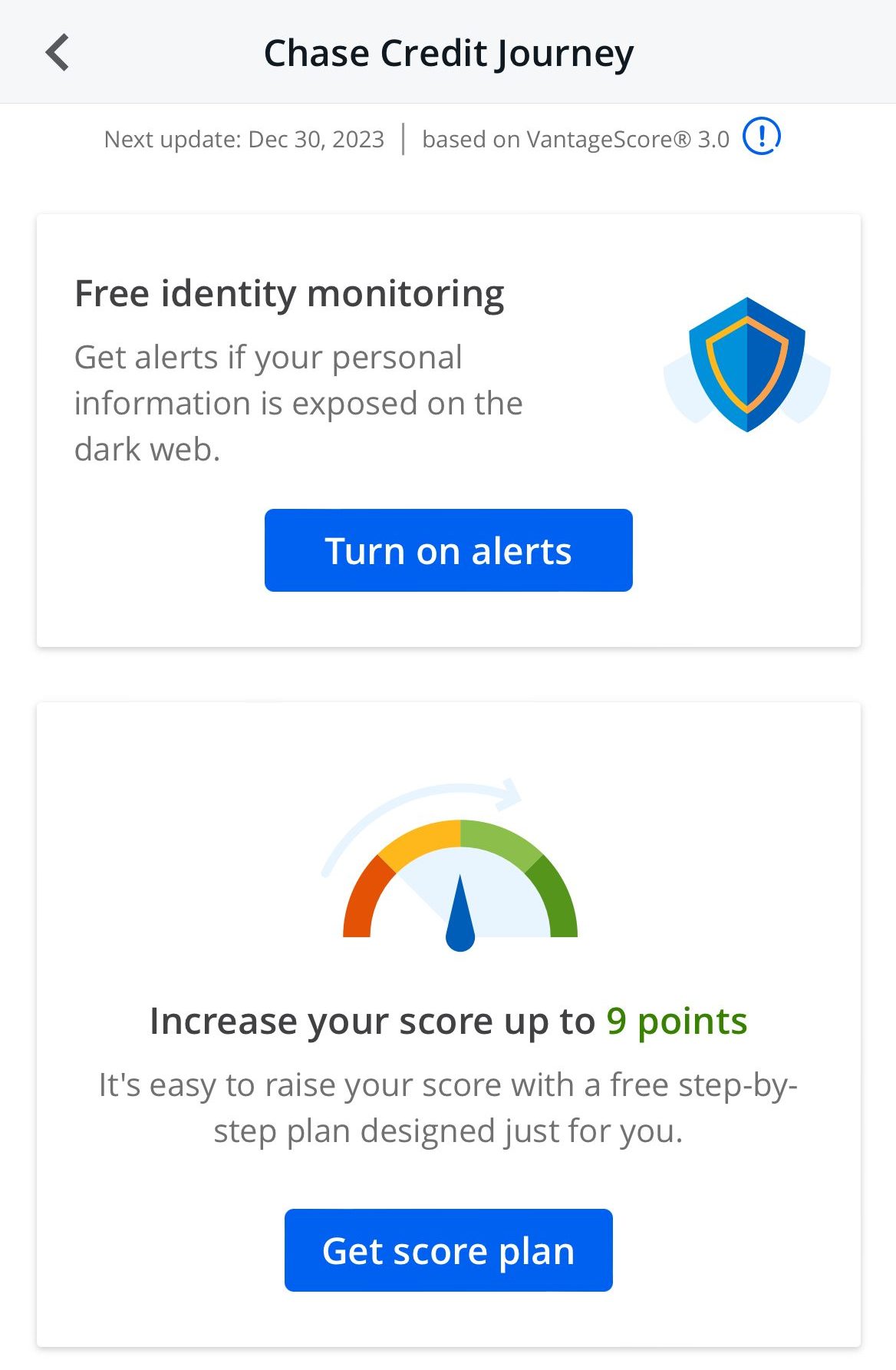

- Monitor Your Identity

This feature is designed to help protect you against identity theft and fraud. You simply need to tap on the Alerts Inbox or the Alerts icon.

You can look at the “Past Activity Scan” to check if any of your personal information has been exposed via a data breach.

Does Chase Credit Journey Affect Credit Scores?

One of the main reasons why many people are worried about checking their credit is because they are aware that credit inquiries will be logged on their credit report. However, this only occurs with hard credit inquiries. These are performed when you complete the application form for a new form of credit.

However, if you have a soft inquiry on your credit, it is not recorded. This type of credit pull occurs when you check for pre approval on a credit card offer.

Chase Credit Journey accesses your credit information using soft inquiries only. This means that although Chase updates your details every week, it will have no impact on your credit score.

According to Experian data, the average credit score for United States residents was 714 across all age groups. In the table below you can see a breakdown per age:

Is Chase Credit Journey Accurate?

Since this is a free service, you may be wondering if it is accurate. To answer this, you’ll need to have a greater understanding of how Credit Journey works.

For starters, Chase Credit Journey uses the Vantage 3.0 scoring model. Vantage is one of the two well-known scoring models. These companies use your credit information to calculate and create credit scores. Although Vantage and FICO are similar, they use different information to calculate your credit score.

Unfortunately, of the two, FICO is far more popular and tends to be used a lot more. If you apply for a credit product, the chances are the lender will use your FICO score to make an approval decision. In fact, FICO states that 90% of lenders use their scores rather than Vantage. So, since Credit Journey uses Vantage scores, it will lessen the accuracy.

However, Credit Journey does obtain the information for your credit report directly from Experian. This is a trusted credit bureau. So, you should feel reassured that all the details displayed on your Credit Journey portal are most certainly accurate.

Chase Credit Journey Limitations

Chase credit Journey has some limitations. While they are not a game changer, it's good to know them:

- VantageScore, Not FICO: As we’ve just discussed, one of the major limitations of this platform is that it uses VantageScore 3.0 rather than Fico. Although VantageScore is useful, potential lenders are likely to use Fico scores when making credit decisions.

- Experian Only: There are three major credit bureaus: Experian, Equifax and TransUnion. Chase only uses Experian data for Credit Journey. So, if you want a complete picture of your credit, you will need to subscribe to other services that track Equifax and TransUnion scores.

- Biased Offerings: While Credit Journey does recommend credit cards that may be a good fit for your circumstances, these are biased. You’ll only see recommendations for Chase’s own credit cards. This means that you may miss out on options that are better suited for you.

How to Access Credit Journey?

There are two ways that you can log in and access credit journey:

- Via the Chase Website: Credit Journey has its own dedicated section on the Chase website. You can log in as normal and then navigate to Credit Journey

- Using the Chase App: The Chase app is available for Android and iOS devices. Regardless of whether you hold a Chase bank account, once you’re enrolled with Chase Credit Journey, you can access the platform via the app. You’ll need to log in, then swipe up and you’ll see the Credit Journey section.

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

Should I Enroll in Chase Credit Journey?

Before deciding if you should enroll in Chase Credit Journey, you need to be aware that the platform has both pros and cons. When you’re aware of both the positives and potential negatives, you should be able to make an informed decision.

Pros | Cons |

|---|---|

It’s Free |

VantageScore Only |

Frequently Updated | Needs to be Used With Other Services |

Great User Experience |

Chase Card Offers Only |

Score Simulator |

- It’s Free

This is one of the best services to get a free credit score.

Like Capital One's CreditWise and American Express’s MyCredit Journey, Chase Credit Journey is free for consumers.

Overall, it's a free service, and you don’t need to hold any Chase accounts to use the platform. There are no hidden fees or charges, although Chase will recommend its products to you.

- Frequently Updated

Credit Journey updates report details and scores on a weekly basis. This makes it very easy to monitor any changes that occur on your credit profile.

- Great User Experience

This platform is highly intuitive and easy to use. You can easily navigate through the interactive content whether you’re using the mobile or desktop version.

- Score Simulator

This is arguably the most attractive feature of Credit Journey, since you don’t need to guess what impact your actions will have on your credit score.

You can play around with the tool to make the decisions that have the most significant impact on improving your score.

- VantageScore Only

We’ve already discussed this earlier, but the lack of a Fico score is a significant disadvantage.

- Needs to be Used With Other Services

: If you want a full picture of your credit, you will need to use other services that provide your Equifax and TransUnion details.

- Chase Card Offers Only

The card and product recommendations will only be Chase products such as Chase credit cards or Chase banking features, which may not be the right choice for you.

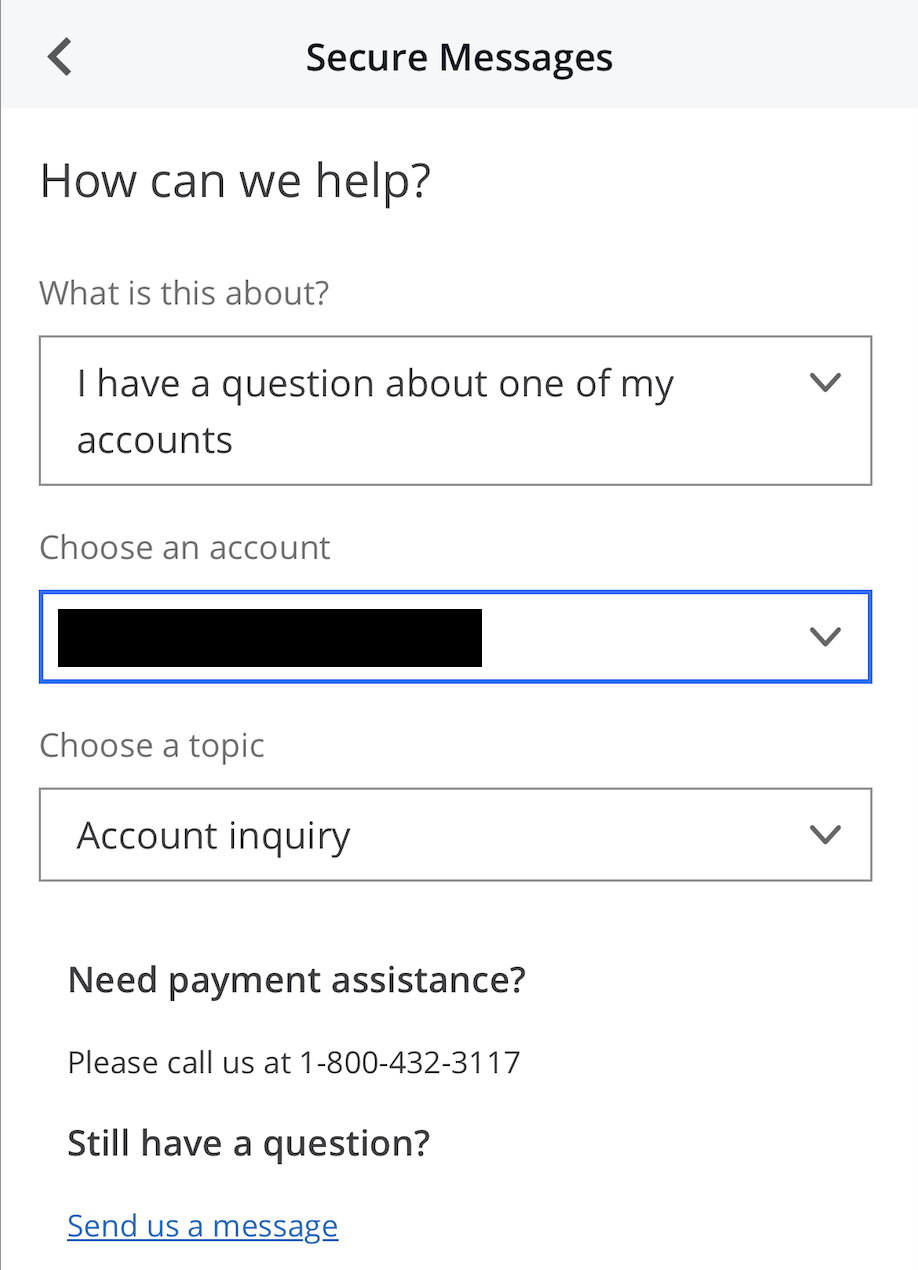

How to Reach Chase Credit Journey Customer Service

Chase has a number of helplines including one dedicated for personal banking customers that allow you to contact the support team. You can also message via the app or connect with the customer service team on Chase’s social media channels.

FAQs

How do you opt out of Chase Credit Journey?

You can unenroll from Chase Credit Journey on the website. The Chase team will process your request after which your cancellation will be effective.

Does Chase Credit Journey count as a credit check?

No Chase Credit Journey only uses soft credit pulls or inquiries to update your credit information. So, there is no credit check logged on your credit report.

Can I get a full credit report from Chase Credit Journey?

No, since Chase Credit Journey only uses Experian, you’ll not get a full credit report.

What credit bureau does Chase Credit Journey use?

Chase Credit Journey uses only one of the three credit bureaus: Experian

How often does Chase Credit Journey update?

Chase Credit Journey updates on a weekly basis.

Is Chase Credit Journey legitimate?

Yes, this is a legitimate platform owned and operated by Chase Bank.

Can I access Credit Journey on the Chase app?

Yes, you can access Credit Journey on the app and use all the platform features.

Is Chase Credit Journey safe to use?

Yes, it is a secure site and all users have their identity verified as part of the enrollment process.