Table Of Content

What Is American Express’s MyCredit Guide?

One of the easiest ways to track your credit score is to use a platform that offers real time feedback on your score. There are lots of free platforms on the market, but one entry that is fairly recent is the American Express MyCredit Guide.

This is a free to use tool that is open to everyone, regardless of whether you hold an American Express credit card. This online platform provides a simplified credit report using TransUnion data, calculating your credit score with VantageScore 3.0. Although this is not a FICO score, it does provide a good proxy for most credit card companies and their requirements to qualify.

Estimate Credit Score Effect With MyCredit Guide Simulator

MyCredit Guide includes a credit score simulator. This innovative tool provides simulations of what could happen to your credit score if you take certain actions.

For example, if you open a new credit account, or make a late payment. This allows you to play around with potential scenarios to see if your credit score may be positively or adversely affected.

The other tools provided with MyCredit Guide also include Score Goals, which can encourage you to build positive habits that will support a healthy credit score and alerts for any changes in your TransUnion credit report.

How to Enroll For The Amex MyCredit Guide?

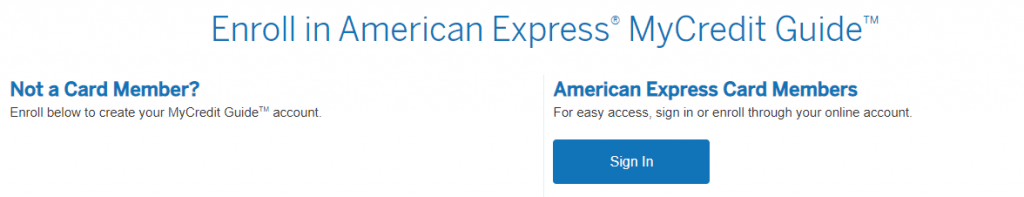

You can enroll with the Amex MyCredit Guide whether you’re an existing American Express customer or not.

If you already carry an American Express card, you can sign in via your Amex account using the dashboard.

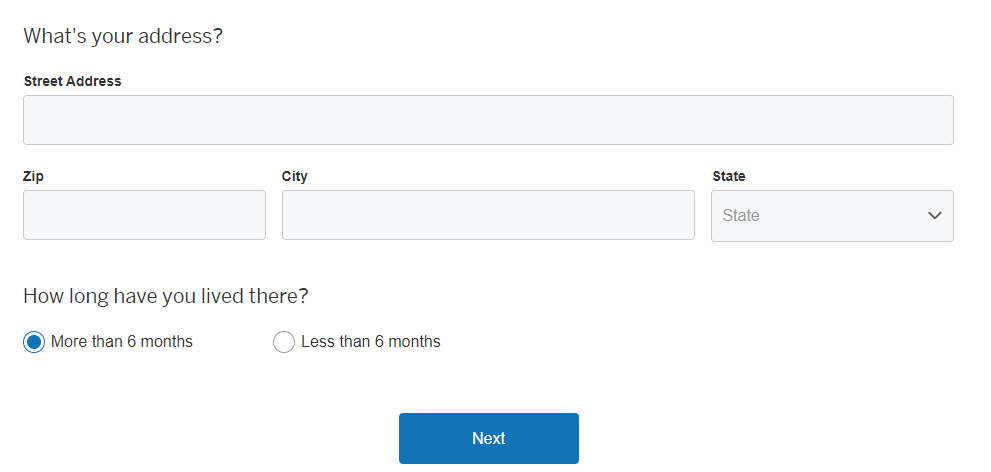

1. Add Personal Details

If you’re new to Amex, you’ll need to provide some of your personal information. This includes:

- Your full name

- Your date of birth

- Your postal address

- Your phone number

- Your email address

- Your Social Security Number

You will also see a prompt to create a password, which will be used with your email address as a log in for the platform.

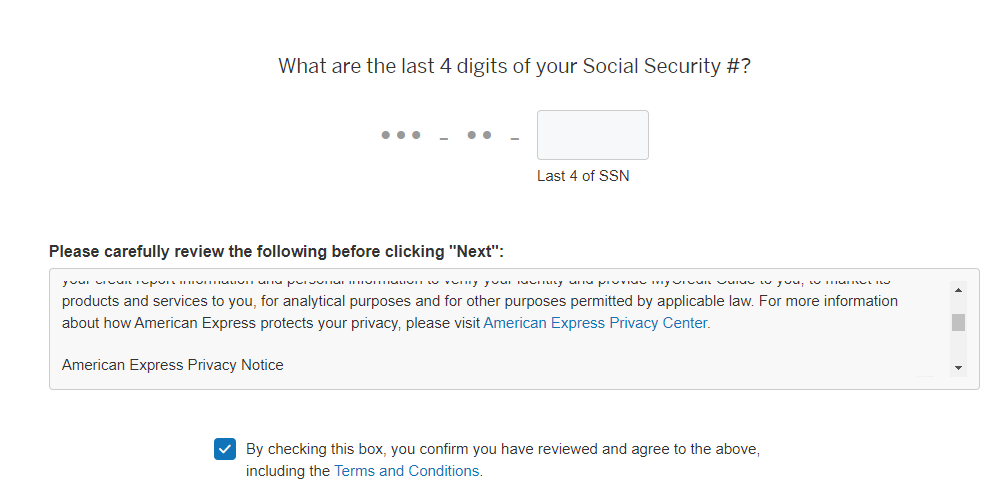

2. Verify Identity

The final stage of the enrollment is identity verification. This is essential for fraud protection and to ensure your privacy and data security.

The verification process requires answering questions about information contained in your credit report and other sources. Once your identity is confirmed, your MyCredit Guide will be available for you to view online.

How to Use It To Check And Build Score?

If you want to build your financial fitness, improving your credit score is likely to be at the top of your list of priorities. A solid credit score can not only allow you to access the best credit card offers, but also the best rates for loans and mortgages and even lower your insurance rates.

Once you have enrolled in MyCredit Guide, there are several ways that you can use the platform. You’ll need to sign in and then you can perform a number of different actions. These include:

- Access Your Free Credit Report

MyCredit Guide not only provides you with an estimated credit score, but you can also access your detailed TransUnion credit report. This means that you can access your report to check for any issues, errors or discrepancies.

- Score Goals

Score Goals allows you to set your desired credit score and then the platform will analyze your credit history and key factors to find where there are areas for improvement. It will then generate personalized recommendations to help you to achieve your credit score goal.

The recommendations typically fall into one of four categories; new/recent credit, debt/balances, percentage of credit used or payment activity.

For example, it may recommend paying down a specific dollar amount from your accounts or opening another credit account. The recommendations will also feature a suggested time frame to reach your target from six to 24 months.

- Credit Score Simulator

This is an interesting platform feature that will allow you to play around with how your actions impact your credit score. You’ll need to tap on “Simulator” on the top menu bar. You will then see a number of scenarios, which allow you to enter details.

For example, you could enter a dollar figure for the limit if you opened a new credit card account.

You can play around with these figures and the platform will provide you with an estimate of how your credit score will go up or down.

This feature is not unique to Amex. The other issuer's score monitoring tools, The Capital One CreditWise and the Chase Credit Journey, also provide their own simulator.

- Alerts

The MyCredit Guide platform will also alert you to any changes in your TransUnion credit report to help to detect identity theft. The alerts relate to new credit report inquiries, address updates, any new accounts that are opened and more.

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

Does Amex MyCredit Guide Affect Credit Scores?

No, using MyCredit Guide will not affect your credit score. Since MyCredit Guide uses soft inquiries, you can check your credit as frequently as you like and it will not lower your credit score.

When you pull a free credit report or you view your credit score using MyCredit Guide, you can monitor your credit history without initiating a hard inquiry. This means that you can keep an eye on your credit and correct any issues that may affect your credit report without worrying about causing potential damage to your score.

Should I Enroll in Amex MyCredit Guide?

Whether you should enroll in MyCredit Guide will depend on your requirements and preferences. But, there are both pros and cons to consider before you make a final decision.

Pros | Cons |

|---|---|

Available For Everyone | Vantage Score |

Free Credit Reports | One Credit Bureau Only |

Completely Free | |

Credit Score Simulation |

- Available For Everyone

Regardless of whether you are an American Express customer or not, you can access the MyCredit Guide and all its features.

This means that you don’t need to open an Amex account to be able to use this platform.

- Completely Free

There are no hidden fees or charges, so you can use MyCredit Guide without worrying about the cost. This platform is completely free of charge to access all the functions and features.

- Credit Score Simulation

One of the best features of this platform is that you can test various scenarios to see how different actions will impact your credit score.

- Free Credit Reports

As with many credit monitoring platforms, you can get free copies of your TransUnion credit report, so you can monitor any changes and spot any issues or errors.

- One Credit Bureau Only

MyCredit Guide only uses TransUnion credit report information, so if you’re looking to get a complete picture of your credit and financial situation, you cannot rely solely on this platform.

- Vantage Score

Many lenders use FICO scores to determine your eligibility, so while having access to a Vantage score is handy, this is not the same as your FICO score.

Is Amex MyCredit Guide Accurate?

American Express MyCredit Guide primarily uses data from TransUnion. The details from your TransUnion credit report are used to calculate potential scores. However, since there are three credit bureaus, this means that MyCredit Guide scores cannot be guaranteed. Unless a platform uses all three bureaus; TransUnion, Equifax and Experian, it cannot be 100% accurate.

That being said, MyCredit Guide is a handy tool that provides good insight into how your actions can impact your credit score. Additionally, as the three platforms tend to use similar factors to calculate scores, the information you glean from MyCredit Guide can be beneficial.

The platform's tools are likely to help you work towards healthy financial habits and meet your credit score goals. So, although the platform may not be 100% accurate, it is certainly a great choice.

How to Access MyCredit Guide

You can access MyCredit Guide via the website and using your mobile device.

- Website: Many people rely on the MyCredit Guide website to access their credit reports. This is the simplest method for Amex customers since you can log into your dashboard and then navigate to MyCredit Guide. So, once you’ve checked your American Express credit card statement, you can then check your credit.

- The App: The MyCredit Guide app works with Android and iOS devices, so you can access the platform on your smartphone or tablet. You can still access all the MyCredit Guide features without needing to log into your desktop computer or laptop.

How to Reach Amex MyCredit Guide Customer Service

If you have a query or question about MyCredit Guide or your MyCredit Guide account, you can contact the customer service department via its helpline. The phone line is available Monday to Friday from 8 am to 9 pm ET. The phone line is not available on the weekend or during holidays.

Top Offers

Top Offers

Top Offers From Our Partners

FAQs

How do you opt out of Amex MyCredit Guide?

You can cancel your MyCredit Guide enrollment at any time via the MyCredit Guide website. There is the option to unenroll and the cancellation will be effective as soon as it has been processed.

What are the limitations using the Amex MyCredit Guide?

The American Express MyCredit Guide provides VantageScore 3.0 rather than FICO scores. While VantageScores are useful, potential lenders typically rely on FICO scores when they are making credit decisions.

MyCredit Guide only uses TransUnion data, which means that you are not getting a complete picture of your credit report.

Does Amex MyCredit Guide count as a credit check?

Since MyCredit Guide uses soft inquiries, it is not logged as a credit check. The only inquiries that are logged as a credit check on your credit report are hard inquiries.

Can I get a full credit report from Amex MyCredit Guide?

You can get a copy of your TransUnion credit report from MyCredit Guide, but this does not include Equifax or Experian data. So, if you want a full credit report, you will need one from each of the three credit bureaus.

What credit bureau does Amex MyCredit Guide use?

American Express uses TransUnion for the MyCredit Guide information.

How often does Amex MyCredit Guide update?

MyCredit Guide data is updated weekly, so any changes in your credit report can be quickly noted. You’ll also receive alerts as soon as your credit report is updated if there are any issues which may impact your score or relate to security issues.

Does MyCredit Guide can help you get pre approved for Amex cards?

No, the tool is a free credit monitoring tool. Getting pre-approved for Amex cards can be done via the Amex website.

Is Amex MyCredit Guide legitimate?

Yes, MyCredit Guide is a legitimate platform operated by American Express.

Can I access MyCredit on the Amex app?

Yes, if you’re an existing customer and use the Amex app, you can access MyCredit Guide. New users can also download the app and create a profile to enroll with MyCredit Guide.

Is Amex MyCredit Guide safe to use?

MyCredit Guide is a reputable platform that is operated by American Express. There is identity verification to prevent fraud and it can actually help to minimize the risk of identity theft, since you’ll be alerted to any changes on your credit report.