TD Bank

Fees

Our Rating

Current Promotion

TD Bank offers a welcome bonus for new account – you can get Up to $300 bonus if you open a new checking account $200/$300. There is a minimum deposit required of $500 or $2,500, depending on account, within 60 days.

. Expired on N/AAPY Savings

- Overview

- Pros & Cons

- FAQ

TD Bank provides a wide range of services and products. Aside from checking and savings accounts, you can also get home equity loans, mortgages, personal loans, investments, and credit cards.

In terms of size, TD Bank bank is one of the 10 largest banks in the United States. This speaks well of their stability when it comes to assets to back up their deposit liabilities. Employing around 27,000 personnel, this is a huge organization.

Today, the bank focuses on delivering award-winning customer service and hassle-free products to customers. TD Bank is still a traditional brick-and-mortar bank in many of its locations. They are present in more than 1,200 sites all over the East Coast. However, they have already made online and mobile banking available to their customers.

TD Bank may be a good option for you if:

- You want a credit card that rewards you for your favorite brands or spending habits.

- You require personal loans.

- You want a little bit higher savings account interest rates than national average.

- Varied Products

- 24/7 Customer Service

- Special Accounts For Students / Seniors

- Promotions

- Low Interest Rates

- Fees

- High Minimum Deposits

How to Find TD Bank ATMs Near Me?

The bank has hundreds of ATMs spread across different parts of the country. You can find the ATM nearest you by using the ATM locator tool.

The tool is a convenient way of locating ATMs in different parts of the country.

Can I Open a TD Bank Account Without SSN?

Yes. If you do not have an SSN, you can still open a TD bank account using an individual Taxpayer Identification Number (ITIN).

The bank will ask you to provide other documents to verify your name, address, and date of birth.

Can I open a TD Bank checking account online?

Yes, TD Bank makes it easy to open a new checking account online. If you’re already a TD Bank customer, you can simply log in and open a new account from your dashboard.

New TD Bank customers can follow the product link on the official website. The application form is quite straightforward and will walk you through the process. You should be able to complete this and be able to start using your new account within a few minutes.

Is TD Bank is ready for recession?

The bank has been operating for 50 years, so it has a solid, consistent history. In fact, during the Great Recession, TD Bank was not only one of the few commercial banks to remain in the real estate market, but it did not need a government bailout.

While no one can predict the future, his should provide consumers with confidence that TD Bank is ready to handle tougher economic times, supporting its customers through a recession.

Can you buy/invest in gold products via TD Bank ?

TD Bank does have an investment arm, which allows customers to access shares, ETFs, bonds and stocks. This provides an avenue to buy or invest in gold stocks and products.

The bank has automated investment options and advisor guidance, so if you’re new to investing, TD Bank can help you to get started. The fees and charges for these services vary, but TD Bank aims to make investing as cost effective as possible.

Is TD Bank worth it for Joint?

TD Bank does offer the facility to open joint accounts for saving and your day to day transactions. Both parties will need to verify their ID and personal details, but once the account is opened, either party can action requests.

This makes it a great option for joint customers who want to co-own a variety of accounts.

TD Bank Bank Review

Customer Experience

TD Bank's website has a good contact us page with several options for contacting a member of its customer service team. This includes social media and instant messaging. There is, however, no obvious helpline number to call.

When it comes to customer satisfaction, TD bank has good ratings. According to the J.D. Power 2023 U.S. retail banking satisfaction study, TD bank gets high customer satisfaction in Florida, NY Tri-state, Pennsylvania, and about average ratings in Mid-Atlantic and New England.

Its website has a clean design and is simple to use, providing a good user experience. You can look over and compare products, as well as watch how-to videos and other support materials. The TD Bank app has received ratings of 4.8/5 on Apple and 4.4/5 on Google.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

TD Bank Savings Account

TD Bank Savings Account

Fees

Minimum Deposit

APY Savings

APY MMA

TD Bank offers two main savings account options: TD Simple Savings and TD Signature Savings.

The TD Simple Savings account features a low-interest rate and a small monthly fee. It offers the convenience of free automatic transfers from other accounts to help jump-start savings. Additionally, it provides the option to enroll in Savings Overdraft Protection for TD Checking accounts. This account is free for individuals aged 18 and under or 62 and older.

On the other hand, the TD Signature Savings account offers higher interest rates of 0.01% – 4.00%. There is a minimum balance requirement of $100,000 to get the highest rate. While the rate is good, it's below the best savings account interest rate.

This account comes with perks like waived TD ATM fees worldwide and ATM fee reimbursements with a $2,500 minimum daily balance. The interest rates are tiered, growing as your balance increases, and there's a bonus interest rate when linked with an eligible TD account.

The TD Signature Savings account also includes complimentary services like incoming wire transfers, official bank checks, money orders, and stop payments.

TD Bank Savings Account

TD Bank Checking Account

Fees

Minimum Deposit

APY

Promotion

TD Convenience Checking is all about easy everyday banking. You get a free contactless debit card and a fair monthly fee, which you can avoid by having $100 in your account every day or if you're between 17 and 23 years old.

TD Beyond Checking is even better, with the same contactless debit card and ways to pay. But that's not all – you'll also get overdraft fee refunds twice a year, free paper checks, and your fees for using ATMs not in our network will be given back if you meet the account balance needed.

TD Convenience Checking | TD Beyond Checking | |

|---|---|---|

Interest Bearing | No | Yes |

Checks | Discount on first order |

Free standard checks |

Monthly Maintenance Fees | $15

Can be waived if you Maintain a $100 minimum daily balance or if the Primary account holder is age 17 through 23

| $25

Can be waived if you send $5,000 in direct deposits per statement cycle or $2,500 minimum daily balance or $25,000 combined balance across eligible TD accounts

|

Fee Reimbursements | No | Two overdraft fees per year |

Freebies | None | Money orders, bank checks, stop payments and incoming wires |

There’s nothing really spectacular about this product except maybe the seasonal bonuses to attract new depositors. We noticed the big gap that separates the two types of TD checking accounts – one for the regular depositor and one for the high-end ones.

Certificate Of Deposits (CDs)

TD Bank’s CDs offer a variety of promotional CDs with quite high rates, especially for a big bank.

No matter how much you initially put in or how long you keep it, some TD Bank CDs give you a small interest. However, if you pick promotional CDs, you can get a much bigger interest. These CDs give you higher interest regardless of how much you start with, as long as you have TD checking account.

TD gives better rates than many regular banks. Even though the choices are not many, you can still get rates similar to online banks, which is not usual for regular banks.

CD Term | APY |

|---|---|

3 Months | 1.00% – 2.50% |

6 Months | 1.00% – 5.00% |

12 Months | 1.00% – 4.00% |

18 Months | 1.00% – 2.50% |

24 Months | 1.00% – 2.50% |

36 Months | 1.00% – 2.50% |

48 Months | 0.05% |

60 Months (Step Rate CD) | 1.00% – 2.50% |

Top Offers From Our Partners

In the Shoes of a Customer: A Visual Guide to TD Bank

From conducting transactions to examining credit scores, we thoroughly tested the features of the TD Bank App from the perspective of a user. Let's discover our opinions and insights on TD Bank main features.

Checking your account balance is a fundamental aspect of managing finances. TD Bank's app offers a clean and intuitive interface to view account balances. The home screen prominently displays your account balances, giving you an immediate snapshot of your financial standing and banking activities available.

Setting up direct deposit through the TD Bank app is a seamless process. The app guides you through entering your employer's information and your account details.

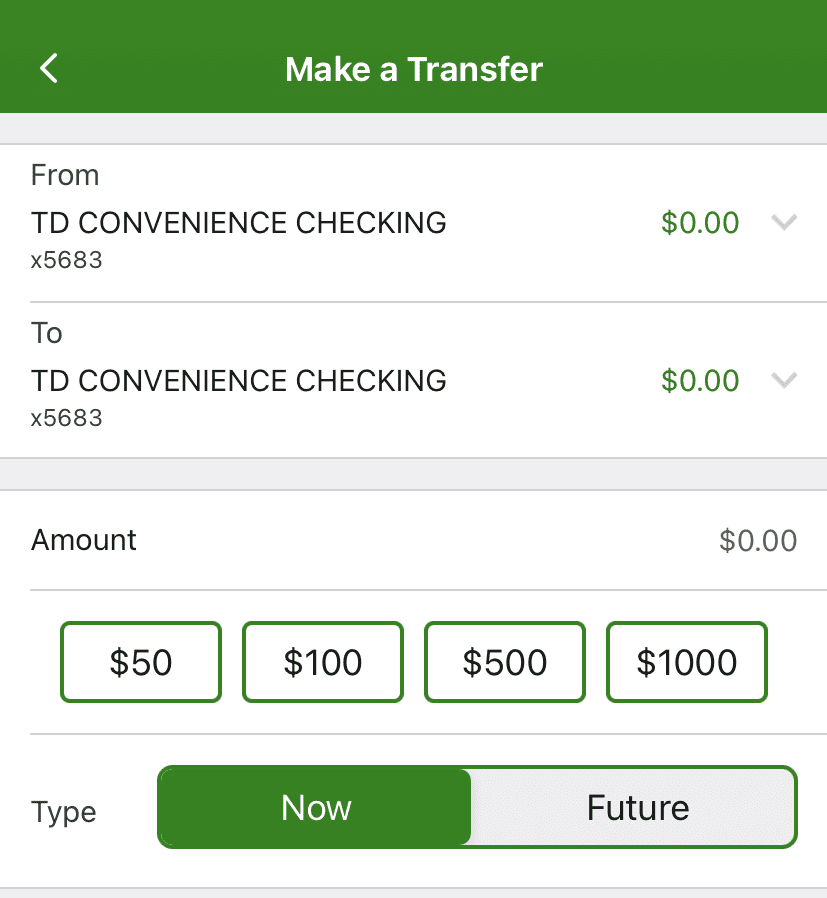

Transferring funds between accounts or to other TD Bank customers is simplified in the app. With a few taps, you can initiate a transfer, select the destination account, and specify the amount and whether to schedule it for now or in the future.

Zelle integration within the TD Bank app adds another layer of convenience for peer-to-peer transactions. Our experience highlighted the seamless experience of sending and receiving money using Zelle:

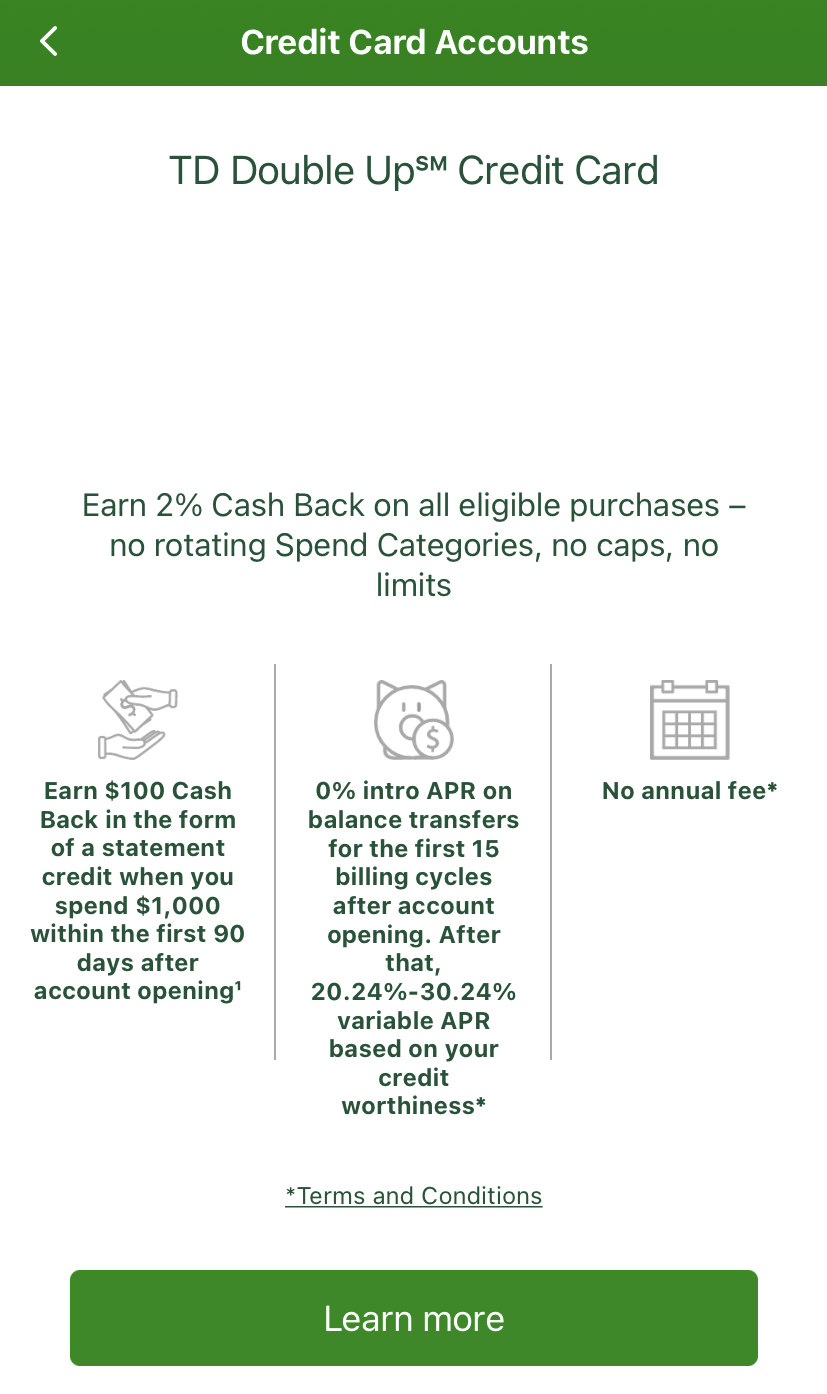

Lastly, applying for a TD Bank credit card is a straightforward process. The app prompts you to provide necessary personal and financial information.

Credit Cards

TD Bank offers a variety of credit cards.

This includes First Class card, which provides 3X First Class miles on travel and dining purchases and 1X First Class miles on all other purchases.

The TD Cash Card has a low introductory APR and a $200 Cash Back when you spend $500 within 90 days after account opening. It also offers nice cash back rate – 3% and 2% Cash Back on your choice of Spend Categories (you can switch your categories quarterly), and 1% Cash Back on all other purchases.

There is also a miles card and, for those looking to build credit, a secured card that uses your savings account as a security deposit and offers 1% cash back on purchases.

Mortgage & Loans

If you plan to purchase a home soon, TD Bank also provides fixed and adjustable rate mortgages, Jumbo loans, and government loans. Professional mortgage packages are also available.

Term lengths of up to 30 years are common, with down payments as low as 3%. Personal loans of up to $50,000 are available from TD Bank with no origination or application fees. Furthermore, you will receive a lending decision in as little as one business day.

TD Bank Pros And Cons

Certainly, no banking establishment achieves perfection, and TD Bank is not exempt from this reality. It's essential to weigh the advantages and disadvantages carefully before arriving at a conclusion regarding the decision to initiate an account.

Pros | Cons |

|---|---|

24/7 Customer Service | Low Interest Rates |

Special Accounts For Students / Seniors | Fees |

Promotions | High Minimum Deposits |

Varied Products |

- 24/7 Customer Service

Unlike many traditional banks, TD has around-the-clock live customer service available for customers.

When many banks are turning to automated responses or form responses, customers can still interact with customer service representatives through their 24/7 hotline.

- Special Accounts For Students / Seniors

Students from 17 through 23 can open their own checking accounts without any minimum opening deposit and minimum daily balance requirement.

The same offer is available for depositors who are 60 years of age or older. Plus, their money earns interest.

- Promotions

TD bank tend to offer promotions and bonuses for new accounts from time to time, so check out at the top of the page to see the current promotion. You can also take a look on our top banking promotions and bonuses guide which is updated for April 2024.

- Varied Products

The full range of common products and services is a big plus.

This means you don’t have to keep some of your money in a different bank. It’s a physical bank but you can also bank via mobile and online – that’s extra convenient for many.

- Low Interest Rates

If you want some returns for your money (especially the high minimum daily deposit you must maintain), TD Bank falls short in this area.

Many banks give much better rates for the same amount of money (or even less) that you keep in the bank, so comparing savings accounts is always a good idea.

- Fees

You can escape some of them, but once more it will require that you put so much money in your account. For example, many banks do not charge ATM fees but TD still does for non-TD ATMs.

If fees are important to you, take a look at banks that do not offer fees. There are online only banking accounts that waive most of these fees.

- High Minimum Deposits

This is the downside of banking with brick-and-mortar banks – they need a certain level of deposit liabilities to sustain the overhead.

For customers, it forces you to keep most of your money in accounts that don’t give so many benefits.

TD Bank FAQs

TD Bank has a history that dates back over 150 years. It is a subsidiary of Toronto Dominion Bank, but TD bank has a US headquarters in North Carolina. Additionally, deposits up to $250,000 are covered by FDIC insurance, so your funds are protected.

While primarily known for its outside of business hours branches, TD Bank does offer online banking facilities where you can pay bills, deposit checks, send money and manage other aspects of your account. TD Bank uses the latest technology to ensure security with Touch ID and single use security codes. This allows you to access your statements 24/7 and fully manage your account.

TD Bank is a great option if you’re looking for banking services with solid customer support. TD offers options for checking accounts at different stages of your life.

However, the rates are quite low, so if you want to leave money in a savings account, you are likely to find more competitive rates elsewhere. You will also need to consider that many accounts have a minimum balance required to avoid paying management fees.

Both TD and Chase offer checking accounts, savings, investment accounts with mobile features. However, the bank fees differ according to several factors. TD does offer a discount to its fees if you sign up for online statements. You can also have the account fees waived if you meet the criteria.

One of the main Chase Bank benefits is the waivable account fees, but some fees, such as the out-of-network ATM fee, are less with Chase.

All in all, TD Bank and Chase are quite similar. You may find TD Bank appealing if you don’t mind monthly fees and limited access to branches. But, if you prefer access to a widespread network of branches and like the possibility of sign up bonuses, go with Chase.

Capital One offers competitive rates and a variety of banking products. While the rates are similar to TD Bank, a few differences will affect whether you consider TD better than Capital One.

One of the most obvious is the number of ATM locations, as Capital One has over 40,000. However, Capital One is online only, so you won’t have access to a branch as you could with TD Bank.

Another key difference is that TD Bank provides access to phone customer service 24/7.

So, if you’re happy with online transactions and don’t need access to a branch, Capital One is a good bank. However, if you like the idea of easy access to customer support, you may prefer TD Bank.

Account Alternatives

APY Savings

The annual percentage yield (APY) is a percentage that represents the amount of money or interest earned on your savings account over the course of a year. The APY factored in compound interest. A savings calculator can help you quickly determine how much you'll earn with a given APY.

| 4.25%

| 4.30%

| 4.40% |

Checking Account Fee

The monthly fee on checking account

| $0 | $0 | Not Available |

Checking Minimum Deposit | $0 | $0 | Not Available |

Mobile App Rating | 4.7/5 on iOS, 4.1/5 on Android | 4.9/5 on iOS, 4.2/5 on Android | 4.9/5 on iOS, 4.3/5 on Android |

BBB Rating | C | A+ | A+

|

How We Rate And Review Banks: Our Methodology

The Smart Investor team extensively reviewed hundreds of banks and credit unions. We assessed them based on four main categories, each with specific features:

-

Diversity of Products and Their Attractiveness (40%): We extensively analyzed the breadth and appeal of each bank's product offerings, including savings accounts, checking accounts, loans, investment options, and more. Higher ratings were assigned to banks with a diverse range of products that are attractive in terms of interest rates, fees, terms, and additional features. This category provides insights into the variety and value of the bank's offerings, crucial for meeting customers' diverse financial needs.

-

Account Features (30%): This category delves into the features and benefits accompanying each bank's accounts. We scrutinized factors such as promotions, deposit and withdrawal options, ATM accessibility, online and mobile banking functionalities, as well as additional perks like overdraft protection and rewards programs. Banks offering comprehensive and convenient features received higher ratings, reflecting the overall value of their accounts to customers.

-

Customer Experience (20%): A positive customer experience is paramount in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Bank Reputation (10%): The reputation of a bank is a critical consideration for customers. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were awarded to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories, individuals can make informed decisions that align with their financial needs and preferences, ensuring they choose a bank that offers competitive products, excellent features, a positive customer experience, and a solid reputation.

Compare TD Bank

Chase has some innovative features with the potential for comparable CD rates without TD Bank’s minimum deposit. However, there is little to separate the checking accounts, TD Bank’s savings rate is double that of Chase.

Chase does offer more credit card choices, but don’t rule out TD Bank, which has some interesting options.

We'll explore Bank Of America and TD Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner.

There is no clear winner when comparing Wells Fargo and TD bank, but if we have to pick, TD comes out ahead.

Citibank leads in credit cards, and TD Bank options for borrowers are broader. But what about the rest? Here's our comparison and winner:

TD Bank is our winner with better banking products compared to M&T, but there are cases when M&T wins. See our complete comparison

Both Truist and TD Bank are active in a variety of states, such as Florida, Georgia, North And South Carolina, and more. Here's our winner:

Capital One is our winner as it offers a full banking package, which is better than TD Bank, especially if you have deposit needs. Here's why.

While TD offers a better selection of checking accounts and credit cards, Ally is also a great option for those who want an online-only bank.

While TD offers a better selection of checking accounts and lending options, Amex is a great option for online banking. How do they compare?

Banking Reviews

Alliant Credit Union Review