Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Two United Club Passes

- Free Checked Bag

- Not For Everyday Purchases

- Annual Fee

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Free Checked Bag

- Two United Club Passes

CONS

- Annual Fee

- Not For Everyday Purchases

APR

21.99% – 28.99% variable

Annual Fee

$95 ($0 first year)

0% Intro

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

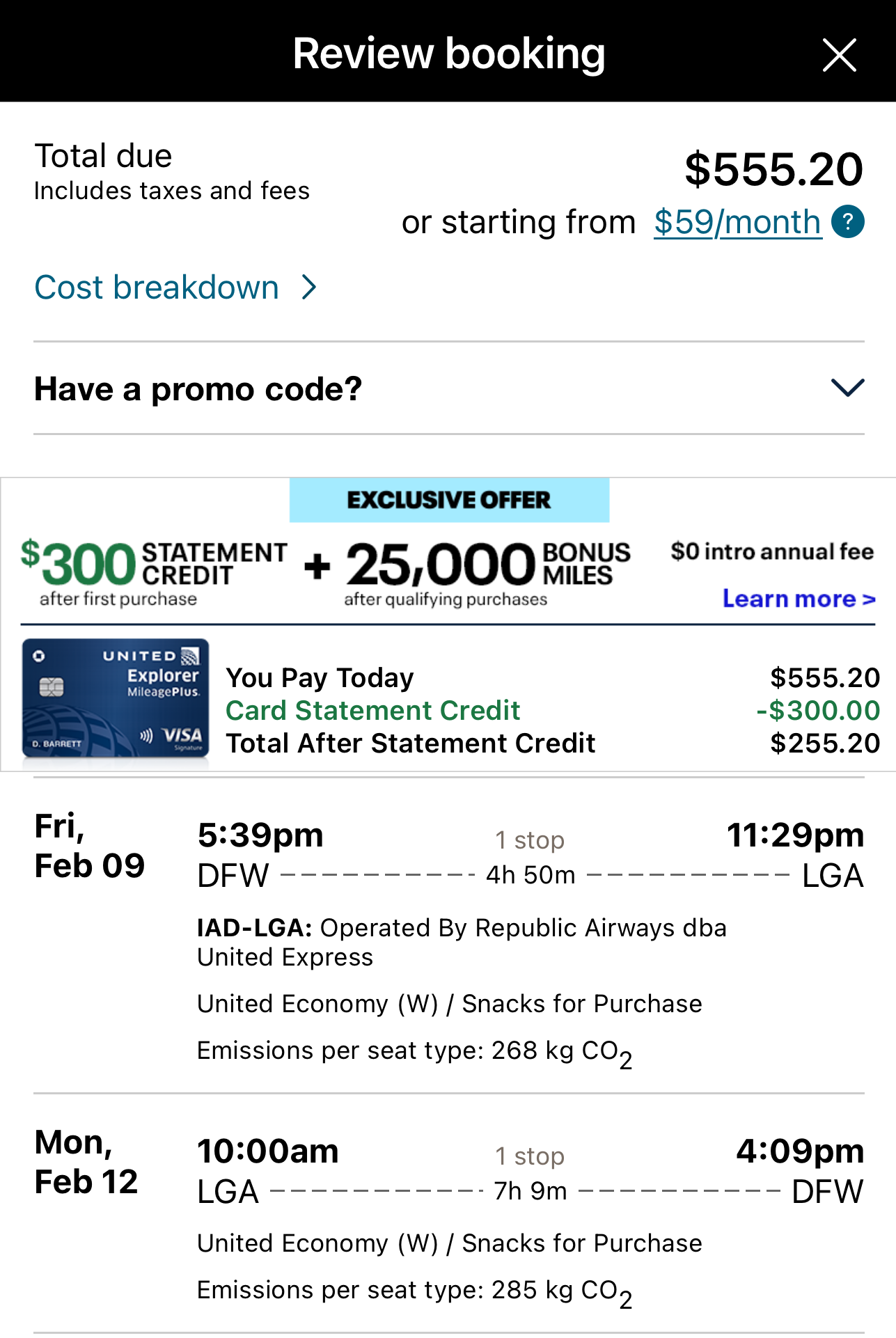

The United Explorer Card is a mid-tier option among United credit cards, offering a range of benefits that cater to frequent United flyers.

With a United Explorer card, you can earn 2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases. The miles that you accumulate through using this card don’t expire, just so long as the account is active.

When you sign up for the United Explorer Card, the new cardholder will receive 50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.. The card comes with an annual fee of $95 ($0 first year) and the variable APR is 21.99% – 28.99% variable, based on your credit worthiness.

The card provides a free checked bag for the cardholder and a companion on the same United itinerary. Other perks include priority boarding, TSA Precheck/Global Entry fee reimbursement, and two one-time United Club passes annually.

While it provides valuable perks, the benefits may not justify the $95 ($0 first year) annual fee for those who don't frequently fly with United or prefer more versatile rewards programs.

Does the card offer any travel insurance benefits?

Yes, the card provides travel protections, including rental car insurance and trip delay reimbursement.

Are there blackout dates for using earned miles?

No, the United Explorer Card does not have blackout dates for redeeming miles.

Can I redeem miles for flights on other airlines?

The card is tailored for United loyalists, allowing redemption for flights within the United network and with Star Alliance partners.

Is the card subject to the Chase 5/24 rule?

Yes, the card is subject to the Chase 5/24 rule, limiting eligibility for those with five or more credit cards in the past two years.

Can I transfer miles to other loyalty programs?

Miles earned with the United Explorer Card are specific to the United MileagePlus program and cannot be freely transferred to other loyalty programs.

Is the card a good choice for infrequent travelers?

The card's value is optimized for regular United flyers who can benefit from perks like free checked bags, making it less ideal for infrequent travelers.

Pros & Cons

Let’s take a look at the pros and cons of the United Explorer card and see if it’s the right one for your wallet or not.

Pros | Cons |

|---|---|

Priority Boarding | Annual Fee |

No Foreign Transaction Fee | Balance Transfer Fee |

Travel Insurance | Limited Everyday Spending Rewards |

United Club Passes | Airline Loyalty Required |

Global Entry/ TSA PreCheck Credit | |

Baggage Insurance |

- Priority Boarding

The United Explorer Card offers a priority boarding onto your flight.

While these seem like less important perk, they are certainly subtle things that can make traveling much less stressful.

- No Foreign Transaction Fee

The card doesn't charge a foreign transaction fee – a great rewards if you're traveling abroad frequently.

- Travel Insurance

If your trip is cut short or canceled due to severe weather, sickness or other covered situations, you can be reimbursed up to $1,500 per person or $6,000 per trip for any non refundable, pre-paid passenger fares.

Also, if you charge your entire rental cost to your United card, you’ll receive auto rental collision damage coverage for most rental cars domestic and abroad.

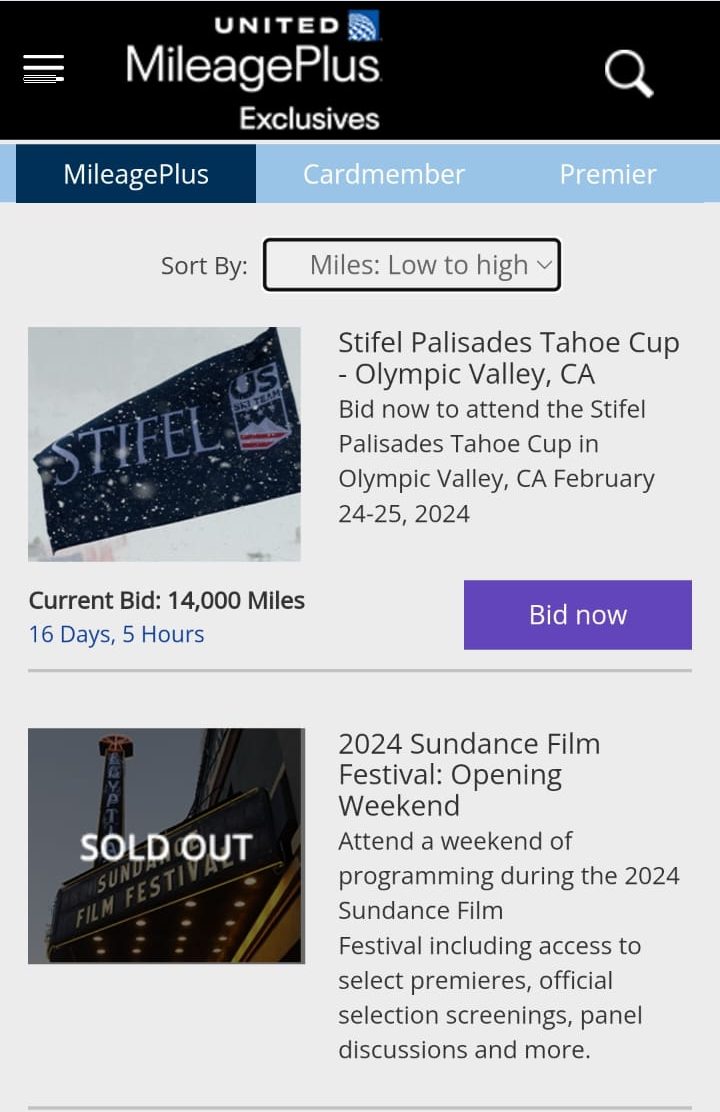

- United Club Passes

You can receive two United Club one times passes every year on your membership anniversary. In the United Club, you’ll enjoy complimentary snacks, beverages, WiFi and access to workspaces.

- Global Entry/ TSA PreCheck Credit

TSA Precheck has some great benefits for travelers, You can receive up to $100 in statement credit as reimbursement every four years for your application fee when you charge it to your card.

- Annual United Club Passes

When cardholders have an active United Explorer Card, they will receive two One-Time passes annually into United Club lounges. This is something that not to many airlines will give their cardholders for free.

If anything, they will be available for purchase at a discounted rate, or something not even that. United Club passes such as these can make long layovers much more enjoyable and relaxing

- Baggage Insurance

You can claim up to $100 per day for three days if your bags are delayed over six hours as reimbursement for essential purchases. If your check or carry on bags are damaged or lost by your carrier, you’ll also have up to $3,000 per passenger in coverage.

- Annual Fee

The United Explorer Card offers new card holders a waived annual fee for the first year. After this, the annual fee is $95 ($0 first year). This is average or higher than other travel cards in the industry.

However, with the rewards that are offered with obtained points, the United Explorer Card certainly has the potential to pay the cardholder back and make the annual fee worth it.

- Balance Transfer Fee

This fee is $5 or 5% of the transfer, whichever is bigger.

The fee is incurred when you transfer debts from one or more credit cards to your Wells Fargo Rewards Card. This fee is upfront and will be added to your debt load when transferred.

- Airline Loyalty Required

The card's benefits heavily favor United loyalists, potentially limiting its appeal for those who prefer airline flexibility.

- Limited Everyday Spending Rewards

Earning 1 mile per $1 on most non-bonus purchases is less competitive compared to other cards.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

Simulate Your Rewards: How Much You Earn?

Despite the fact that we've looked at a variety of card features, understanding the actual cash benefits can be difficult without a direct scenario comparison.

Because both of these cards are intended for everyday use, we'll examine typical monthly spending to see what rewards the cards provide, so you can see what rewards you could earn with similar spending.

However, keep in mind that the numbers should be adjusted to your regular spending categories, which may differ – so the exact calculation is dependent on your personal habits.

| |

|---|---|

Spend Per Category | United℠ Explorer Card |

$5,000 – U.S Supermarkets | 5,000 miles |

$3,000 – Restaurants

| 6,000 miles |

$3,000 – Airline | 6,000 miles |

$3,000 – Hotels | 6,000 miles |

$4,000 – Gas | 4,000 miles |

Estimated Total Points | $27,000 miles |

Estimated Annual Value | ~ $486 |

The redemption methods are the same regardless of which Chase United card you choose. You can use your miles to fly to over 1,300 destinations around the world via the Star Alliance network, which includes United and other well-known airlines.

You can also use your miles for car rentals and hotel reservations through the CarAwards and HotelAwards programs. If you prefer to shop, you can use your miles to buy home goods, electronics, and other items from your favorite brands at the MileagePlusAwards website.

Top Offers From Our Partners

Top Offers From Our Partners

How To Make The Most of Explorer Card?

These tips for maximizing your Explorer card rewards:

- Prioritize Travel: While you can redeem your United Explorer miles for shopping or other rewards, the best redemption rates are usually found with travel deals. So, try to prioritize travel, even if it means waiting to accumulate enough miles for your plans.

- Be Flexible With Your Travel Dates: If at all possible, try to be flexible with your travel dates and destinations. This will allow you to search through the various redemption options to find the best value for your miles. Try out a few different itineraries to see which one works best for you.

- Don't Assume Miles Are the Best Option: Even if you want to redeem your miles, don't automatically assume that doing so is the best option. For example, if you're looking at an economy cross-country flight, it's possible that you'll only get 1 cent per mile. You would be better off paying cash and saving your miles for a better deal in this case.

- Use Your Card On Board: When you pay with your card, you will receive a 25% rebate in the form of a statement credit for your in-flight purchases, which include WiFi, food, and beverages. If you fly frequently, this could amount to hundreds of dollars per year.

- Use the Referral Program: If you want to boost your mile balance, refer a few family members and friends. You will receive a 20,000 mile bonus for each referral who applies and is accepted. With this program, you can earn up to 100,000 miles per anniversary year.

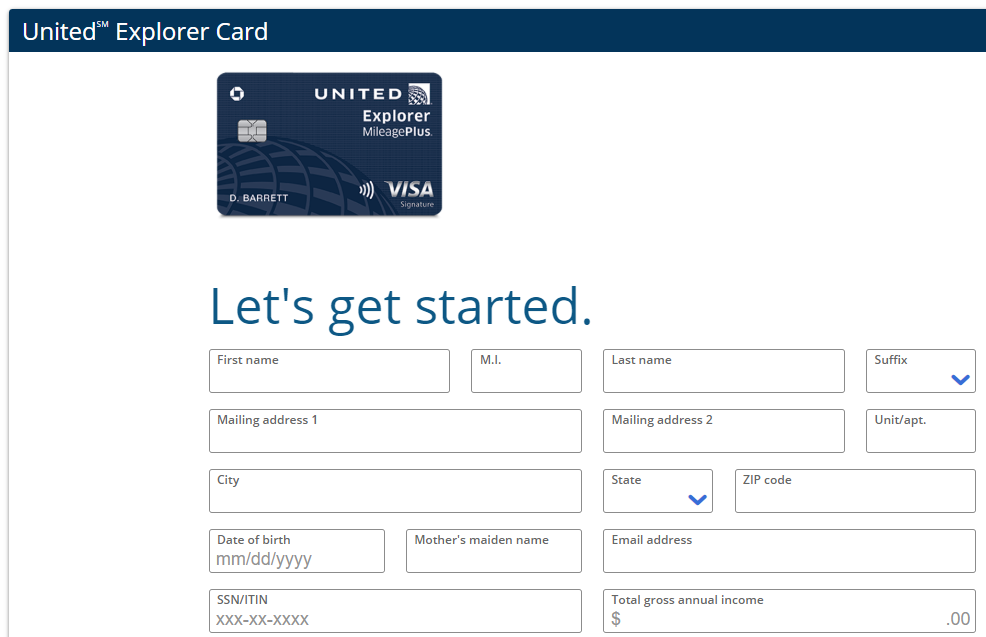

How To Apply For United Explorer Credit Card?

Visit the Chase Explorer Card homepage and click “Apply Now.”

A page appears to get you started, which includes your names, mailing address, date of birth, etc.. Next, specify your statement and communication delivery preference.

Now, take your time to read through the E-Sign Disclosure as well as the Pricing & terms. Lastly, agree to the certifications and click “Submit.”

How It Compared To Other United Cards?

The United Explorer Card, positioned as a mid-tier option among United credit cards, has distinct features that set it apart. It offers more rewards than the United Gateway card, the lowest tier card in United series, that doesn't charge an annual fee.

Unlike the premium United Club℠ Infinite Card, which carries a higher $525 annual fee but offers enhanced benefits like United Club membership and elevated earnings on United purchases, the Explorer Card strikes a balance with valuable perks like free checked bags and priority boarding at a more affordable cost.

In comparison to the United Quest℠ Card, which have higher annual fee of $250, the Explorer Card focuses on providing practical benefits for regular United flyers without the Quest's higher-tier perks like additional anniversary award flight credits.

Is the United Explorer Credit Card Right for You?

Despite the fact that the United Explorer Card does have many great rewards and benefits, it still is limited to an extent due to the fact that the United Explorer Card is designed for United Flyer loyalists.

If you are a fan of United and use their airline often, or think you will be flying with United frequently in the future, then this is a great card for you and it could certainly make your experience flying with United Airlines much better.

However, if you are an infrequent flyer with United, or prefer other airlines, then the United Explorer Card might not be the best viable option for you.

Compare The Alternatives

There are several other travel-focused credit cards that offer higher travel reward rates and bonuses when signing up. Let’s take a look at them and see if one is better suited for you than the United Explorer card:

|

|

| |

|---|---|---|---|

United℠ Explorer Card | Delta SkyMiles® Gold American Express Card | Citi®/AAdvantage® Platinum Select® World Elite Mastercard® | |

Annual Fee | $95 ($0 first year) | $150, $0 intro first year. (See Rates and Fees.) | $99 (waived for the first 12 months)

|

Rewards |

1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

|

1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus |

50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

|

40,000 Miles

40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months

|

50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0 | $0. See Rates and Fees. | $0 |

Purchase APR | 21.99% – 28.99% variable | 20.99%-29.99% Variable | 21.24% – 29.99% (Variable) |

FAQ

The United Explorer card offers auto rental collision damage waiver protection.

If you charge the entire rental and decline the collision insurance from the rental company, you’ll enjoy primary coverage against collision damage or theft. Anyway, review the terms and conditions before to make sure you're covered.

One of the advantages of the Explorer card is that the miles don’t expire, so you can continue to accumulate them to save for a dream vacation or other rewards.

While Chase does occasionally send out pre approval letters for some of its cards, pre approval is not available, and you will need to submit an application and have Chase pull your credit.

This depends on how you redeem the miles. Typically, United flights will offer the best redemption deal and you can expect approximately 2 cents per mile. However, this can be as low as 1 cent per mile, depending on the specific flight or redemption deal.

Yes, the United Explorer card covers trip cancellation/interruption protection. So, if your trip is canceled by a covered situation, you can claim up to $6,000 per trip and up to $1,500 per person

Compare United Explorer Card

The United Gateway and Explorer are two co-branded credit cards offered by Chase in partnership with United Airlines. Here's our winner.

The Quest card has recently launched in order to provide a premium alternative to the old Explorer card. How they compared & is it worth it?

United℠ Explorer Card vs United Quest℠ Card: Which is Better?

In this comparison, we will delve into the key features, benefits, and considerations of both the United Explorer and Infinite Card.

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The United Explorer and the Southwest Premier card have numerous shared features. Let's explore the distinctive strengths of each card.

Southwest Rapid Rewards Premier vs. United Explorer: Comparison

While the AAdvantage Platinum Select and the United Explorer Card have many common features, the Explorer card is our winner. Here's why.

Citi/AAdvantage Platinum Select vs. United Explorer: How They Compare?

The Delta SkyMiles Gold and the United Explorer Card offer airline benefits and similar fees. The SkyMiles Gold is our winner – here's why.

United Explorer vs Delta SkyMiles Gold: Side By Side Comparison

The Alaska Visa offers higher annual cashback value than United Explorer, but the latter takes the lead when it comes to airline perks.

Alaska Visa Signature vs United Explorer: Side By Side Comparison

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

Review Airline Credit Cards

Delta SkyMiles Blue American Express