Rewards Plan

Sign up Bonus

Credit Rating

0% Intro

Annual Fee

APR

- Cash Back Rewards

- Build Credit History

- High Intro APR

- Refundable Deposit Is Required

Rewards Plan

Sign up Bonus

0% Intro

PROS

- Cash Back Rewards

- Build Credit History

CONS

- High Intro APR

- Refundable Deposit Is Required

APR

28.24% Variable

Annual Fee

$0

Balance Transfer Fee

5%

Credit Requirements

Good - Excellent

- Our Verdict

- Pros & Cons

- FAQ

The Discover it® Secured Credit Card is a great way to build your credit history while still earning cash back rewards like a normal credit card. This is a great credit card option for students as well as folks trying to repair their credit history.

Cardholders can earn 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and unlimited 1% cash back on all other purchases. Also, Discover also doubles all the cashback rewards earned in the first year.

Establish your credit line by providing a refundable security deposit from $200 – $2,500 after being approved. Bank information must be provided when submitting your deposit. Automatic reviews starting at 8 months to see if Discover can transition you to an unsecured line of credit and return your deposit.

- Build Credit History

- Discover Matches the Cash Back You Earn in Your First Year

- Refer a Friend for Cash Back

- Cash Back Rewards

- Flexible Redemption Options

- Get Extra Money Redeeming as a Gift Card

- Less Merchant Acceptance

- APR for Balance Transfers

- 5% Balance Transfer Fee

- You’ll Have to Put Down a Refundable Deposit

- High Purchase APR

How long does it take for card approval?

Discover offers pre-approval, which means that you can get an approval decision in a matter of minutes. If you decide to proceed, there should be a minimal delay and you can expect your new card in seven to 10 days.

What are the card income requirements?

There are no minimum income requirements. Discover it secured is suitable for those with poor credit, so your income is simply one factor the card issuer will assess to determine if you qualify for the card.

Can I get pre approved?

Discover has pre approval option for their cards. You can check if you qualify for the cards in a matter of minutes with a simple online form, without impacting your credit with a hard credit pull.

What are the top reasons not to get it?

The main reason not to get the Discover It Secured card is if you want to provide a lower deposit. There is no possibility of paying less to get the initial $200 limit, so you’ll need to be prepared to pay at least $200.

Does Discover report payments to all credit bureaus?

Yes, Discover will report your payment activity to all three of the major credit bureaus. Additionally, it provides a platform to monitor your credit score, so you can keep track of any changes as you use the card and work on other ways to improve your credit.

In This Review..

Benefits

The Discover It Secured has a couple of important benefits for those who need to improve and build their credit:

- Build Credit History

The main benefit of this credit card is building your credit history and raising your credit score!

You get access to the Discovers credit score tools so you can monitor how you’re doing and check your FICO score for FREE each month on your statement or online.

This isn’t a prepaid card or debit card. It’s a real credit card and you’re building credit with all three credit bureaus.

- Discover Matches the Cash Back You Earn in Your First Year

Whatever dollar amount of cash back rewards you earn in your first 12 months, Discover will match that amount helping you earn double.

The redemption option allows you to redeem your miles as cashback at a rate of 1 cent per mile. You can choose to redeem your miles towards travel or as a statement credit.

This is equivalent to earning 1.5% cash back since you are earning 1.5 points per dollar you spend.

- Refer a Friend for Cash Back

As a cardholder, you can earn cash back for referring friends to apply for Discover credit cards. You must send them the referral link you get from Discover, and they must use that link to apply.

If your friend is approved you will earn a cash back bonus. If your friend makes his first purchase within 3 months of opening the account, he will earn a cash back bonus too.

You can refer a maximum of 10 friends per year, and your account must not be late on payments or over the credit limit to qualify for this benefit.

- Cash Back Rewards

Get cash back at gas stations and restaurants on up to $1,000 in combined purchases every quarter, automatically.

Plus, earn unlimited 1% cash back on all other purchases. This is a much better deal than most secured credit cards which usually have no cash back rewards.

- Flexible Redemption Options

You can redeem $1 for every $1 in cash back you’ve earned and there are a variety of ways to redeem your credits.

You can have the credit applied towards your next statement to reduce your balance. You can have it deposited directly into your bank account.

You can also have it turned into a gift card or a donation towards a charity of choice or use it towards shopping money for select retailers like Amazon.

- Get Extra Money Redeeming as a Gift Card

Each gift card redemption will get at least $5 added for free, and more in some cases.

American Eagle, for example will give you $50 when you redeem $40 in cash back, thus you earn an extra $10 free.

There are many categories of retailers available, so you should be able to find one you can use

Drawbacks

Now, let’s review the things you should be aware of when choosing Discover It Secured Card

- Less Merchant Acceptance

Discover isn’t as widely accepted by merchants as other credit cards like Visa and Mastercard.

Getting acceptance overseas may prove to be more difficult for the Discover It Secured card holders.

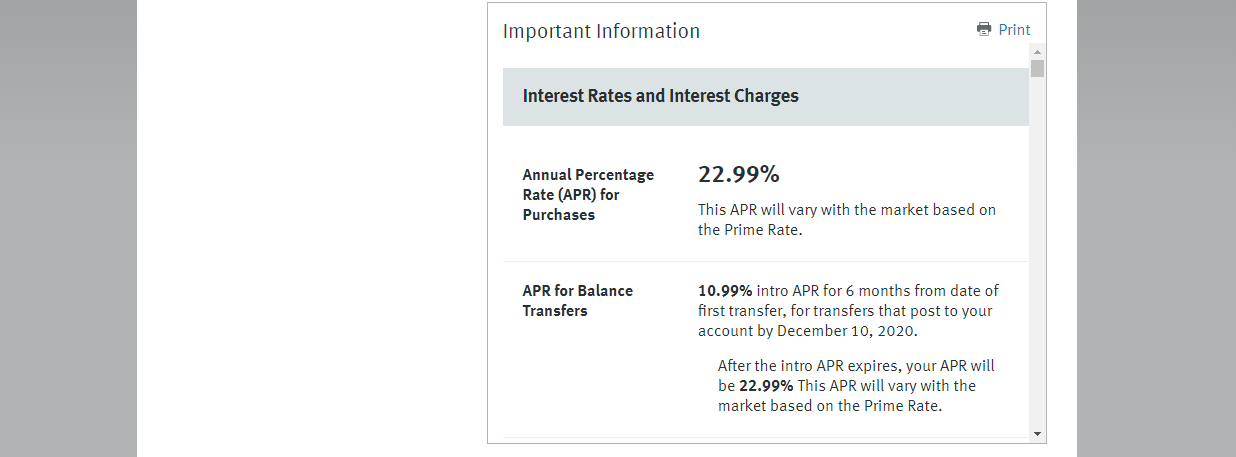

- APR for Balance Transfers

If you’re transferring a balance, you may not like that you have to pay 28.24% Variable APR when there are other balance transfer credit cards that offer 0% APR for long intro periods.

- 5% Balance Transfer Fee

You’ll also have a 5% balance transfer fee as well which can burn money from your pocket.

- You’ll Have to Put Down a Refundable Deposit

In order to use the Discover It Secured credit card, you’ll be required to open an account and put down a refundable deposit.

However, the larger deposit you put down, the larger your credit line limit will be up to the amount you are approved for.

- High Purchase APR

In addition to the high initial APR for balance transfers, 28.24% Variable standard variable purchase APR is another drawback you should be aware of when choosing Discover It Cash Back Card.

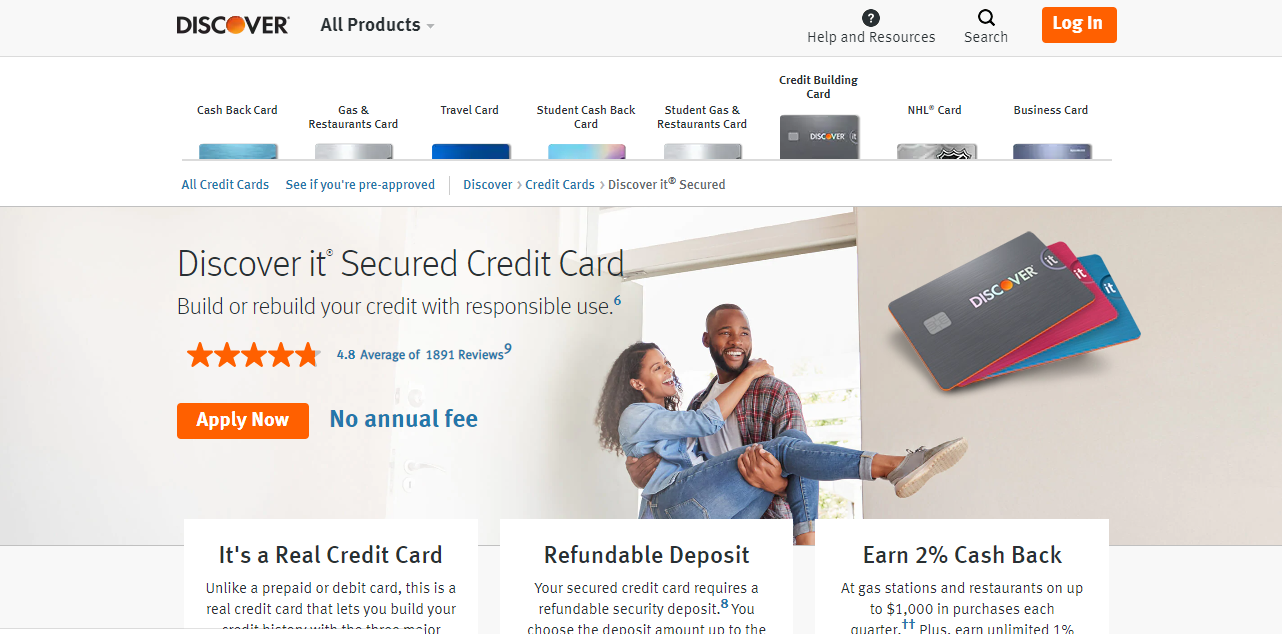

How To Apply For Discover It Secured Credit Card?

- 1.

Visit the Discover It Secured Credit Card home page, and then click on “Apply Now.”

- 2.

It takes you to the next page where you can choose your card design.

- 3.

Select one and fill in your personal details like your Names, address, email, birth date, income, employment status, etc, then click “Next.” Discover runs a preliminary check to determine if you are creditworthy. If your file is clear, you will get an instant response within a few minutes.

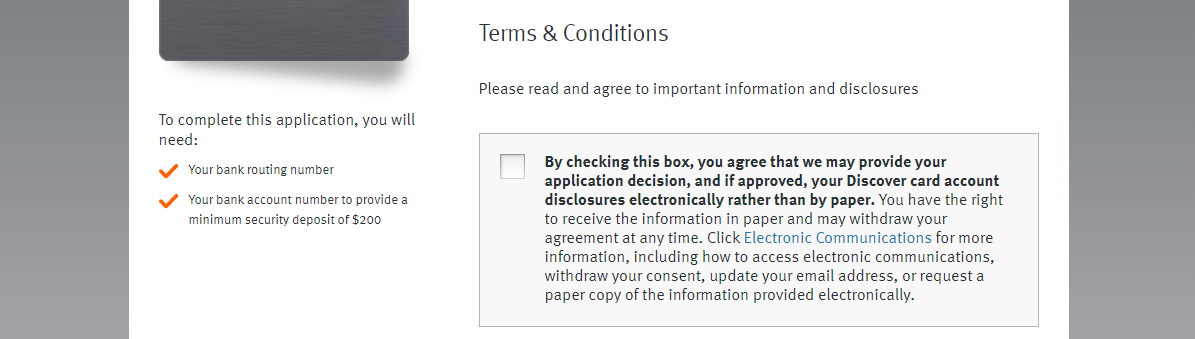

- 4.

Read the terms and conditions, check the two boxes to agree to the terms, and then click on “Submit.” Once approved, the card takes 5 to 7 days to arrive in your mail.

Is the Discover It Secured Card Right for You?

The Discover It Secured credit card is one of the best secured credit cards on the market. With most secured credit cards, there are no cash back rewards or 1% at best.

But with the Discover It Secured Credit Card, not only do you get 2% back on gas and at restaurants, all the cash back you earn in your first year will be doubled.

This makes it an ideal credit card solution for those with no credit or bad credit history that need time to repair their credit and can earn rewards in the mean time.

Compare The Alternatives

There are more cards to build credit with – here are some good alternatives to the Destiny card:

|

|

| |

|---|---|---|---|

Capital One Secured | Citi Secured | Discover It Secured | |

Annual Fee | $0

| $0

| $0

|

Rewards |

None

None

|

None

None

|

1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and unlimited 1% cash back on all other purchases

|

Welcome bonus |

None

None

|

None

None

|

Cashback Match™

Discover will match all the cash back you’ve earned at the end of your first year.

|

Foreign Transaction Fee | $0

| 3%

| 3%

|

Purchase APR | 30.74% (Variable)

| 21.24% – 29.24% (Variable)

| 28.24% Variable

|

FAQ

There is a minimum credit limit of $200, but your initial credit limit will depend on the amount of your deposit. Discover determines your credit limit by your deposit amount, setting the limit dollar for dollar with the amount of your deposit, up to $2,500

A good rule of thumb is three to six months. However, Discover will review your account after seven months to determine if your credit score has increased sufficiently to upgrade to an unsecured card. So, you should be looking at using the card for at least six or seven months.

Yes, it allows you to add an authorized user to your account. This will allow a family member or friend to have their own card linked to your account.

Discover has e a great app that will allow you to not only manage your account, but also monitor your credit limit. You can access your account via the app or on the main website, and both companies have a clear and easy to use platform that provides a good user experience.

Compare Discover It Secured Card

Unlike the Citi Secured card, the Discover it Secured offers rewards in addition to credit-building features, and therefore, it's our winner.

Discover it Secured vs Citi Secured Mastercard: How They Compare?

When it comes to secured cards, both Discover and Capital One offer decent cards to build and improve your credit. Which one is better?

Chime wins when it comes to no credit check and no foreign transaction fees, but Discover it Secured is our winner due to rewards and bonus.

Chime Credit Builder Secured Visa vs Discover it Secured: How They Compare?

Top Offers