Rewards Plan

Sign up Bonus

Credit Rating

0% Intro

Annual Fee

APR

- Annual Hotel Credit

- Versatile Earning Categories

- Annual Fee

- Limited U.S. Airline Partners

Rewards Plan

Sign up Bonus

75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com

Our Rating

PROS

- Annual Hotel Credit

- Versatile Earning Categories

CONS

- Annual Fee

- Limited U.S. Airline Partners

APR

21.24% - 29.24% (Variable)

Annual Fee

$95

0% Intro

None

Credit Requirements

Good - Excellent

- Our Verdict

- Pros & Cons

Citi Premier® Card is a mid-tier travel rewards card issued by Citibank that offers great benefits for travelers as well as general consumers.

With a $95 annual fee, it offers a competitive 10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases. Points can be redeemed for statement credits, cash rewards, gift cards, or transferred to one of Citi's 14 airline and four hotel transfer partners, providing various options for maximizing their value.

The card comes with several benefits, including a welcome bonus of 75,000 points upon meeting requirements, an annual hotel credit, extended warranty protection, no foreign transaction fee, damage and theft protection, and World Elite Mastercard perks

Despite its strong points-earning potential, the Citi Premier has an annual fee and it lacks some travel protection benefits found in competing cards, as well as premium travel perks .

- Point Sign-Up Bonus

- No Limits

- Thank You Points

- Citi Price Rewind, Protection & Free Credit Score

- Points on Travel , Gas, Restaurants, Entertainment & All Other Purchases

- No Foreign Transaction Fee

- No Annual Fee for the First Year

- Points Transfer,Citi Private Pass , Concierge Service

- Annual Fee

- No Rental Car Insurance

- Points Transfer Misses Some of the Bigger Airlines

- No Introductory 0% APR Balance Transfer Fee

- Complicated Rewards Structure and Redemption

In This Review..

Pros & Cons

Now, let's explore the pros and cons of the Citi Premier and to determine if it's a good fit for your wallet.

Pros | Cons |

|---|---|

Sign-Up Bonus

| Annual Fee |

No Foreign Transaction Fee | Limited Travel Perks |

Versatile Earning Categories | Limited U.S. Airline Partners |

Annual Hotel Credit | Lack of Travel Protections |

World Elite Mastercard Perks | |

Flexible Redemption Options |

- Sign-Up Bonus

You can earn 75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com.

- Versatile Earning Categories

With the Citi premier card, you'll earn 10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases.

- No Foreign Transaction Fee

Citi Premier Card has no transaction fees while traveling in another country.

Many other rewards cards and regular credit cards have fees when you make purchases outside of the United States.

- Annual Hotel Credit

Cardholders benefit from a $100 annual hotel credit, offering savings on single-stay hotel bookings of $500 or more made through the Citi travel portal, enhancing the card's overall value.

- World Elite Mastercard Perks

As a World Elite Mastercard, the Citi Premier comes with additional perks, including access to luxury hotels and resorts, and features like cellphone protection and Global Emergency Services.

- Flexible Redemption Options

The card provides flexibility in redeeming points, allowing for statement credits, cash rewards, gift cards, or transfer to Citi's extensive list of travel partners, offering a range of choices for maximizing the value of earned points.

- Annual Fee

Citi Premier Card does not require new cardholders to pay their annual fee for the first year, but beginning the second year there is a $95 annual fee. Many other credit cards do not have annual fees.

- Lack of Travel Protections

Unlike some competing cards, the Citi Premier falls short in providing travel protection benefits, such as trip delay, trip cancellation, or baggage coverage.

- Limited Travel Perks

The card offer basic travel perks and doesn't offer premium perks such as lounge access, variety of statement credits, elite status etc.

- Transfer Misses Bigger Airlines

Citi Premier Card point transfer partners where you can earn more points, is limited. They miss some of the bigger and popular airlines in the US market, including Delta, Southwest, and United Airlines.

How To Apply For Citi Premier Credit Card?

- 1.

Visit the Citi Premier Card home page and then click “Apply Now”.

- 2.

Next, fill in your personal details i.e. Title, Names, Phone number, email, and click continue.

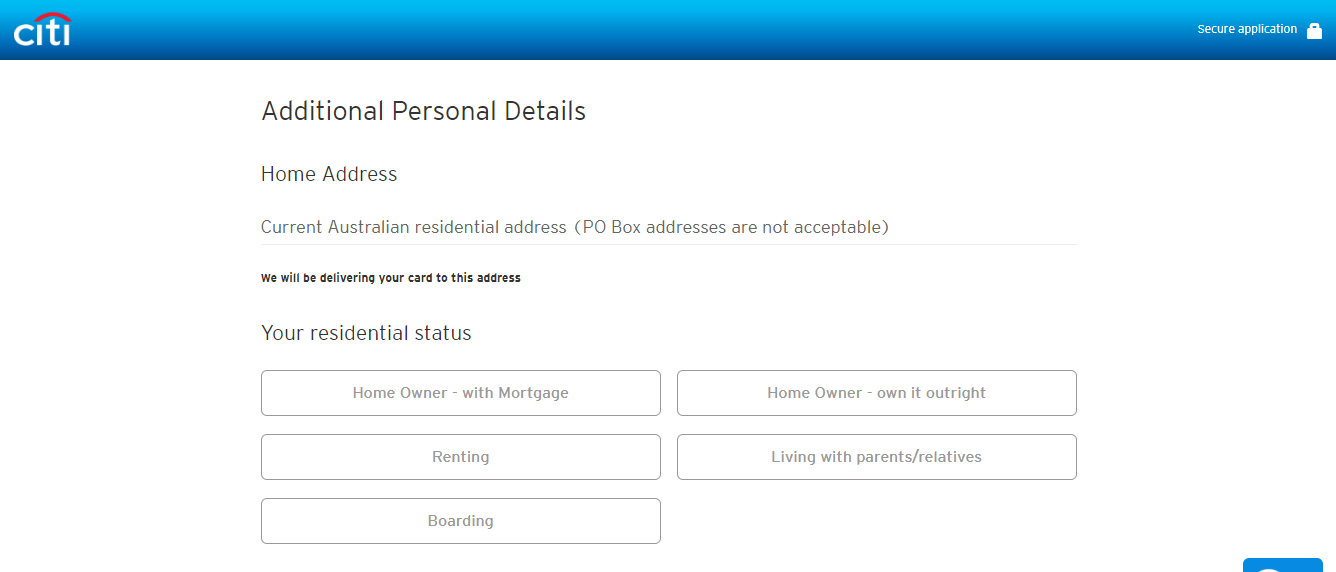

- 3.

Now, add more personal details like your home address and residential status. On the next page is your identification; fill in the correct details.

- 4.

Next, give some info about your employment, expenses and income.Lastly, double check then confirm.

How It Compared To Other Basic Travel Credit Cards?

Compared to some notable alternatives like the Chase Sapphire Preferred, United Explorer, Delta Gold Card, Bank of America Travel Rewards, and Discover Miles, the Citi Premier Card holds its ground in key areas.

Its main competitor is the Chase Sapphire Preferred, which offers higher points rewards ratio and more comprehensive travel benefits. The Citi Premier and Chase Sapphire Preferred both excel in providing flexible redemption options through transferable points. While the Citi Premier has 14 airline and four hotel transfer partners, the Chase Sapphire Preferred offers access to the valuable Chase Ultimate Rewards program with a broader set of airline and hotel partners.

The United Explorer and Delta Gold Card focus on specific airline-related rewards and charges similar annual fee.The United Explorer offers perks like free checked bags, and the Delta Gold Card provides priority boarding and a potential companion certificate.

The Bank of America Travel Rewards and Discover Miles cards focus on simplicity with no annual fee and straightforward rewards.

Is the Citi Premier® Card Right for You?

Citi Premier Card is one of the best travel rewards cards. If you spend much of your time traveling and eating out, this is an excellent card offering some of the best travel rewards in the market.

If you are looking for introductory APR, cash back, no annual fee, or points for merchandise, you should consider a different card.

One of the biggest benefits to any Citibank card is the Citi Price Rewind that should be used to the maximum benefit. It is almost like a cashback card too, with the Citi Price Rewind. Citi Premier Card is primarily for consumers who want to maximize their travel rewards on everyday purchases.

Compare The Alternatives

There are other credit cards that do offer comparable cash back rewards – we’ve summarized the most popular cards which can use as an alternative to the Citi Premier card:

|

|

| |

|---|---|---|---|

Bank of America® Travel Rewards credit card | Capital One Venture Rewards Credit Card | Chase Sapphire Preferred® Card | |

Annual Fee | $0 | $95 | $95

|

Rewards |

1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus |

25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

|

75,000 miles

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 18.24% – 28.24% Variable APR will apply. | 19.99% – 29.99% (Variable)

| 21.24%–28.24% variable APR

|