Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Cashback Rewards

- Sign Up Bonus

- Cash Bonuses Cap

- High APR

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Cashback Rewards

- Sign Up Bonus

CONS

- Cash Bonuses Cap

- High APR

APR

20.49%–29.24% variable

Annual Fee

$0

0% Intro

15 months on purchases and balance transfers

Credit Requirements

Good – Excellent

- Our Verdict

- FAQ

The Chase Freedom Flex℠ Card does not come with an annual fee and offers 5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases.

The card offers a nice sign up bonus of $200 bonus after you spend $500 on purchases in the first 3 months from account opening. Lastly, you are eligible for a lengthy 0% intro APR for 15 months on purchases and balance transfers, then 20.49%–29.24% variable.

It also comes with valuable cardholder perks like Zero Liability Protection, Purchase Protection, Extended Warranty Protection, and more. However, there are cash back limits in its rotating bonus categories and cardholders should remember to enroll in quarterly categories might be a hassle.

The Chase Freedom Flex is one of the most popular cards for those who have good credit. However, if you want a card that does not have changing bonuses every quarter you may want to look for a card that offers higher cash back on all purchases.

Does Chase Freedom Flex offer pre approval?

Yes, you can get pre-approval. This provides you with a greater level of flexibility and you do not have to initially subject yourself to a hard credit check.

What are the top reasons NOT to get it?

If you make a lot of purchases not covered by the respective categories and will only get 1% cashback on them. You may also travel a lot and not want to pay the 3% foreign exchange transaction charge that comes with this card.

Should You Move to Chase Freedom Flex card?

This is a good fit for people who are looking for good cashback rates, as well as getting access to quarterly bonus categories for enhanced rates.

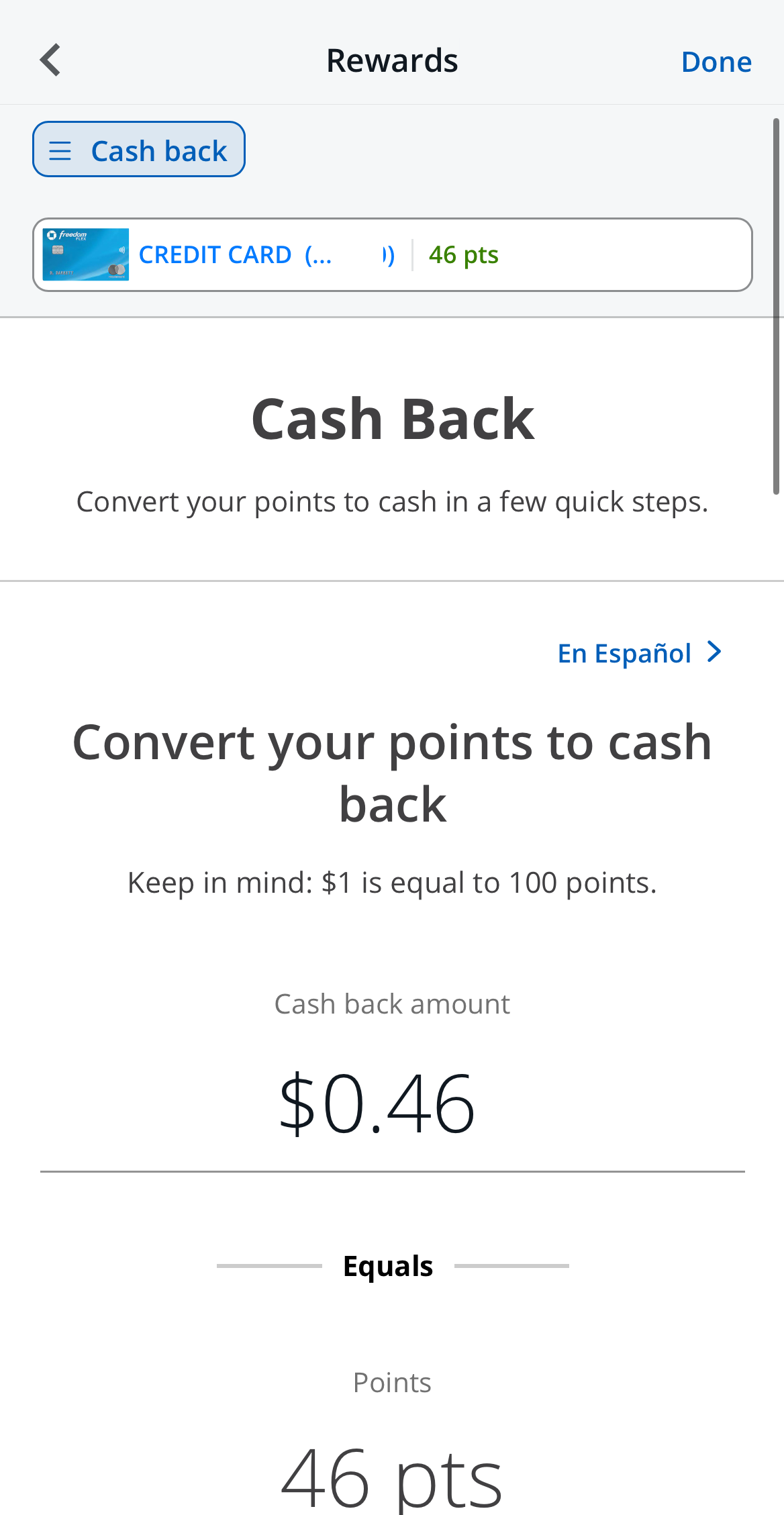

How do I redeem cashback on the Chase Freedom Flex card?

You go to the Ultimate Rewards section that Chase has on offer and you can choose between the options as to how you utilize the rewards.

In This Review..

Pros & Cons

Let's explore the advantages and disadvantages of the Chase Freedom Flex card to determine if it aligns with your wallet's preferences and needs.

Pros | Cons |

|---|---|

Cashback Rewards | Cash Back Limits |

No Annual Fee | Balance And Foreign Transaction Fees |

Sign Up Bonus | Travel Redemption Constraints |

0% Intro APR | Enrollment Hassle |

Cardholder Perks | |

Flexible Redemption Options |

- Cashback Rewards

Chase Freedom Flex offers 5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

- No Annual Fee

Many of the rewards cards that offer higher rewards than Chase Freedom Flex have annual fees which end up eating into the rewards.

The Chase Freedom Flex card does not have an annual fee.

- Sign Up Bonus

You can get a $200 bonus after you spend $500 on purchases in the first 3 months from account opening after signing up.

This bonus has a low threshold compared to other cards; in fact, many other credit cards have sign-up bonuses that require thousands to be spent in the first few months in order to get the bonus.

- 0% Intro APR

If you are looking to save money on interest, the Chase Freedom card Flex offers a 0% introductory rate for 15 months on purchases and balance transfers (then 20.49%–29.24% variable).

- Cardholder Perks

The card comes with valuable perks such as Zero Liability Protection, Purchase Protection, Extended Warranty Protection, Free Credit Score, Identity Restoration, Fraud Monitoring, and Auto Rental Collision Damage Waiver.

- Flexible Redemption Options

Rewards can be redeemed for cash back, statement credits, gift cards, or travel through Chase Ultimate Rewards®, providing flexibility in how cardholders use their earned rewards.

- Cash Back Limits

Chase Freedom Flex Rotating quarterly categories earn 5% rewards up to a combined quarterly of $1,500 maximum.

So if you are a big spender and looking to juice your bonuses, keep track of your spending in the bonus categories.

- Balance And Foreign Transaction Fees

There is a balance transfer fee required if you want to take advantage of the introductory 0% APR rate. Intro fee of either $5 or 3% of the amount of each transfer, whichever is greater, on transfers made within 60 days of account opening. After that, either $5 or 5% (the greater) of the amount of each transfer.

Chase Freedom Flex has a 3% fee for each transaction in another country. If you are traveling outside of the US you may want to leave this card at home.

- Travel Redemption Constraints

To earn 5% cash back on travel, purchases must be made through Chase Ultimate Rewards®, limiting flexibility compared to other travel reward programs.

- Enrollment Hassle

The need to enroll in rotating categories each quarter might be viewed as an additional task, potentially causing some cardholders to miss out on bonus rewards.

Simulate Your Rewards: How Much You Earn?

Let's explore the rewards structure of the Freedom Flex card and see how much cash back you expected to get based on the following spend:

| |

|---|---|

Spend Per Category | Chase Freedom Flex℠ Card |

$15,000 – U.S Supermarkets | $390 * |

$3,000 – Restaurants | $90 |

$1,500 – Airline | $75 |

$1,500 – Hotels | $75 |

$4,000 – Gas | $40 |

Estimated Annual Value | $670 |

* The card offers higher cash back on rotating categories up to $6,000/year. We assume full utilization, calculating the total amount under "U.S Supermarkets" category.

Freedom Flex cash back rewards can be redeemed on Ultimate Rewards portal:

How It Compared To Other No Annual Fee Chase Cards?

When compared to other no annual fee Chase cards, the Chase Freedom Flex offers a competitive edge in its rotating cash back categories and welcome offer.

In the same league, the Chase Freedom Unlimited® is a notable counterpart. While both cards share no annual fee and offer cash back, the Freedom Flex's rotating bonus categories provide a more dynamic rewards structure, attracting users who appreciate variety in their spending incentives. The Freedom Unlimited, on the other hand, offers a flat-rate cash back on all purchases, catering to those who prefer simplicity over category management.

The Chase Slate Edge℠, another no-annual fee option, focuses on balance transfers with an introductory 0% APR period. It stands out for those seeking to consolidate debt rather than maximize cash back rewards.

Unlike the Sapphire cards that focus on premium travel rewards and carry an annual fee, the Freedom Flex is tailored for cash-back enthusiasts – but doesn't include premium perks.

Is the Chase Freedom Flex Right for You?

Chase Freedom Flex is a cashback card for those with good to excellent credit.

The 1% cash back is average but 5% quarterly bonuses increase your cash back. The 5% bonus does have a cap and if you are a bigger spender you may want to look to other cards that offer a higher cap for cash back on all purchases.

It does have a generous sign up bonus and introductory APR period, but beware of the transfer fee if wanting to take advantage of the 0% APR. You can schedule payments and see your balance and due date on Chase app:

If you travel overseas – this card should be left at home, with a 3% transaction fee outside of the United States that will eat up your cash back rewards.

However, if you want a card that does not have changing bonuses every quarter or if you do not max out on the bonus categories each quarter – you may want to look for a card that offers higher cash back on all purchases.

Top Offers

Top Offers From Our Partners

Compare The Alternatives

There are other credit cards that do offer comparable cash back rewards – we’ve summarized the most popular cards which can use as an alternative to the Chase Freedom Card:

|

|

| |

|---|---|---|---|

Wells Fargo Active Cash℠ Card | Chase Freedom Unlimited® | Bank of America® Customized Cash Rewards credit card | |

Annual Fee | $0 | $0 | $0 |

Rewards |

2%

2% cash rewards on purchases (unlimited)

|

1.5% – 5%

5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases

|

1% – 5%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

|

Welcome bonus |

$200

$200 cash rewards bonus when you spend $500 in purchases in the first 3 months

|

$200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

|

$200

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

|

Foreign Transaction Fee | 3% | 3% | 3% |

Purchase APR | 20.24% to 29.99% variable APR | 20.24%–28.99% variable | 18.24% – 28.24% Variable APR will apply. A 3% fee (min $0) applies to all balance transfers |

FAQ

Yes, when you rent the car and pay for all of its cost with this card and do not accept coverage from the rental company. Please review the terms and conditions before to make sure you're covered.

There are no specific income requirements outlined and you will usually not be asked to provide any type of proof of income in order to get one of these cards.

The points don’t expire as long as your account remains open. Therefore, you are able to build them up over time and not worry about having to use them straight away.

To maximize rewards, you should make sure that you take advantage of the bonus categories and leave the other types of purchases that are not covered by an enhanced rate to another card. This is because you will only get 1% cashback on non-covered purchases.

Compare Chase Freedom Flex

When comparing rotating categories to flat-rate cash back rewards, need to analyze the categories & calculate – which card gives you more?

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

If you're looking for rotating cash back rewards, it's time to analyze the categories of each to understand which card gives you more.

Chase Freedom Flex vs Discover it Cash Back: Which Is Better?

The BofA Customized Cash Rewards and the Chase Freedom Flex have many features in common, but there is a clear winner when comparing them.

BofA Customized Cash Rewards vs Chase Freedom Flex: Which Card Is Best?

The Capital One SavorOne cashback categories are fixed, while the Chase Freedom Flex has rotating categories. Which is worth more?

Capital One SavorOne vs Chase Freedom Flex: Side By Side Comparison

Review Cash Back Credit Cards

Chase Freedom Flex