Bank of America Customized Cash Rewards and Chase Freedom Flex are two popular credit cards that offer cash back rewards and a range of benefits. We'll delve into their rewards structures, introductory offers, annual fees, and additional benefits.

General Comparison: BofA Cash Rewards vs. Chase Freedom Flex

While both cards don't charge an annual fee, the Freedom Flex offers a higher cashback rewards ratio for selected categories and also on additional categories.

Also when it comes to extra benefits, the Freedom Flex is a clear winner with more benefits in addition to cashback rewards.

|

| |

|---|---|---|

Chase Freedom Flex | BofA Customized Cash Rewards | |

Annual Fee | $0 | $0 |

Rewards | 3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%) | |

Welcome bonus | $200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening. | |

0% Intro APR | 15 months on purchases and balance transfers, then 20.49%–29.24% variable APR | 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account., then 18.24% – 28.24% Variable APR will apply. A 3% fee (min $0) applies to all balance transfers APR |

Foreign Transaction Fee | 3% | 3% |

Purchase APR | 20.49%–29.24% variable | 18.24% – 28.24% Variable APR will apply. A 3% fee (min $0) applies to all balance transfers |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Cashback Battle: A Side-by-Side Analysis

For those looking to maximize their cashback rewards, Chase Freedom Flex stands out, especially if you frequently make travel-related expenses through Chase Ultimate Rewards.

|

| |

|---|---|---|

Spend Per Category | Chase Freedom Flex | BofA Customized Cash Rewards |

$15,000 – U.S Supermarkets | $390 *** | $200 ** |

$5,000 – Restaurants

| $90 | $150 * |

$4,000 – Airline | $200 | $40 |

$3,000 – Hotels | $150 | $30 |

$4,000 – Gas | $40 | $40 |

Estimated Annual Value | $870 | $460 |

* 3% On Restaurants ** 2% On Supermarkets up to $5,000 *** 5% On Supermarkets up to $6,000

Which Extra Benefits You'll Get With Each Card?

Apart from the bonus points and welcome bonuses, both cards offer a host of supplementary benefits. In general, the additional perks of these cards are quite comparable, but it's worth noting that Chase Freedom Flex provides a wider range of protections and insurance benefits.

Chase Freedom Flex

- Credit Journey: Personalized insights to help build, monitor, and protect your credit health, with free weekly credit score access and score analysis.

- DashPass, Lyft, and Instacart Benefits: Complimentary DashPass, 5% cashback on Lyft rides, and Instacart+ membership with reduced fees and statement credits for eligible Instacart purchases, providing additional savings and convenience.

- Zero Liability Protection: Protection against unauthorized charges on your card or account.

- Purchase Protection: Covers new purchases against damage or theft for up to 120 days.

- Extended Warranty Protection: Extends U.S. manufacturer's warranties on eligible products by an additional year.

- Trip Cancellation/Interruption Insurance: Provides reimbursement for pre-paid, non-refundable passenger fares in case of trip cancellations or interruptions due to covered reasons.

- Cell Phone Protection: Up to $800 per claim and $1,000 per year for covered theft or damage on cell phones listed on your monthly bill.

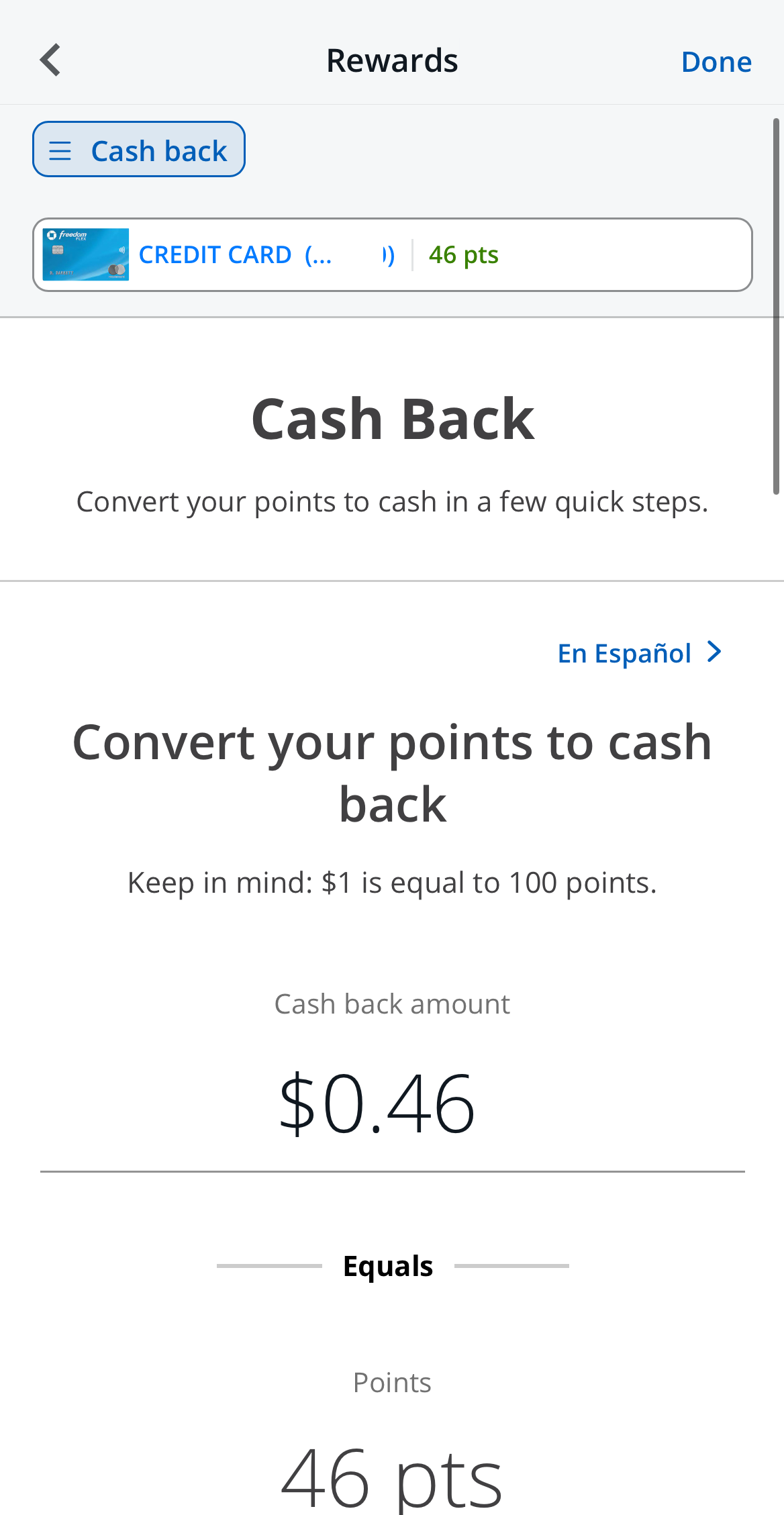

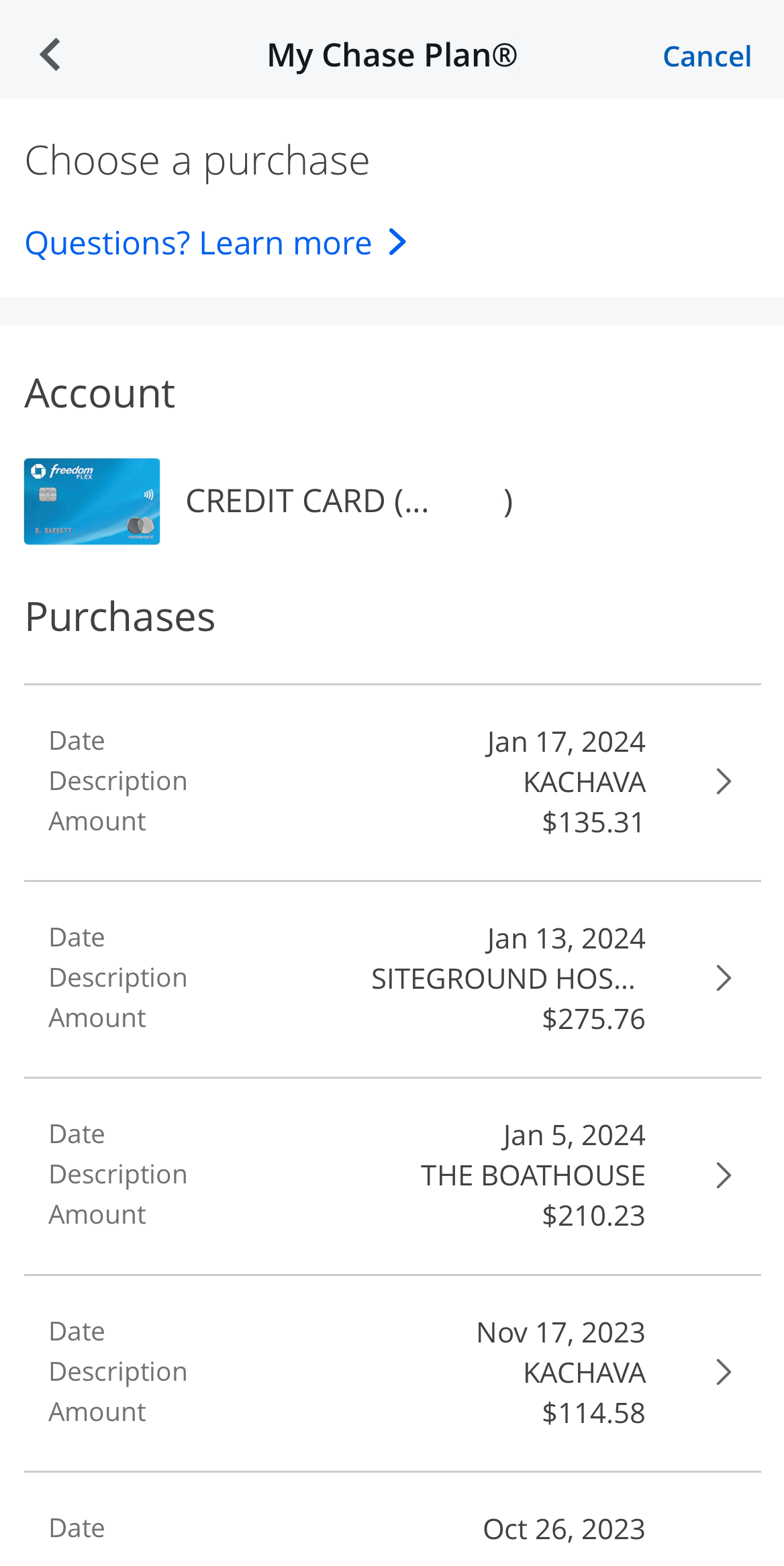

- My Chase Plan: Capitalize on the My Chase Plan option, enabling you to effortlessly settle eligible purchases of $100 or more through equal monthly payments, devoid of interest and accompanied by a fixed monthly fee.

- Auto Rental Collision Damage Waiver: Coverage for theft and collision damage when you charge the rental cost to your card.

- Travel and Emergency Assistance Services: Access to legal, medical referrals, and emergency assistance while away from home.

Bank of America Customized Cash Rewards

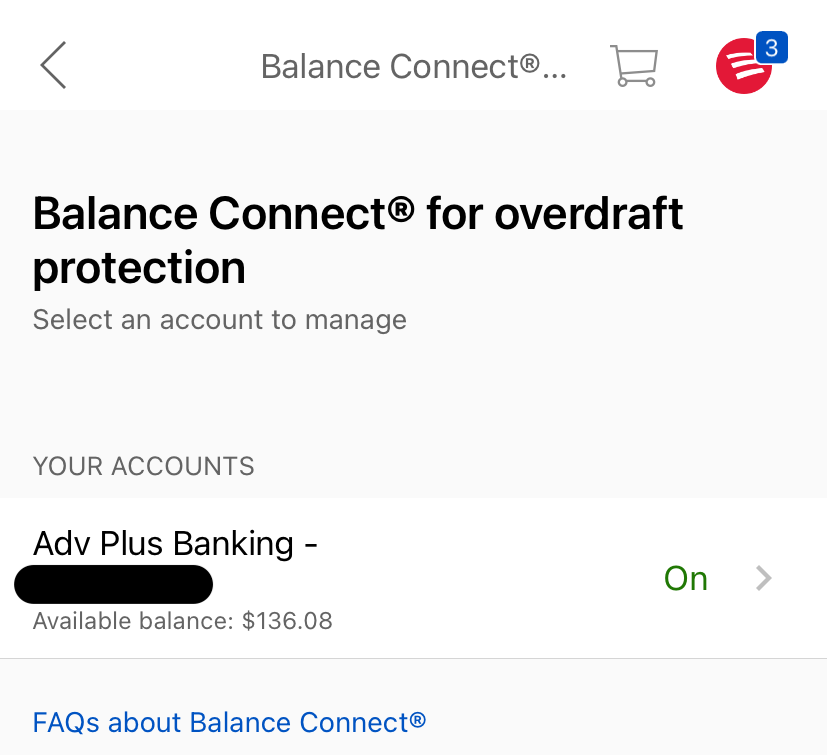

- Balance Connect® for overdraft protection: Link your Bank of America checking account to your credit card to prevent declined purchases and overdrafts, with no transfer fees, though other fees may apply.

- Account Alerts: Receive email or text alerts to stay informed about your balances and payment due dates, ensuring you never miss a payment.

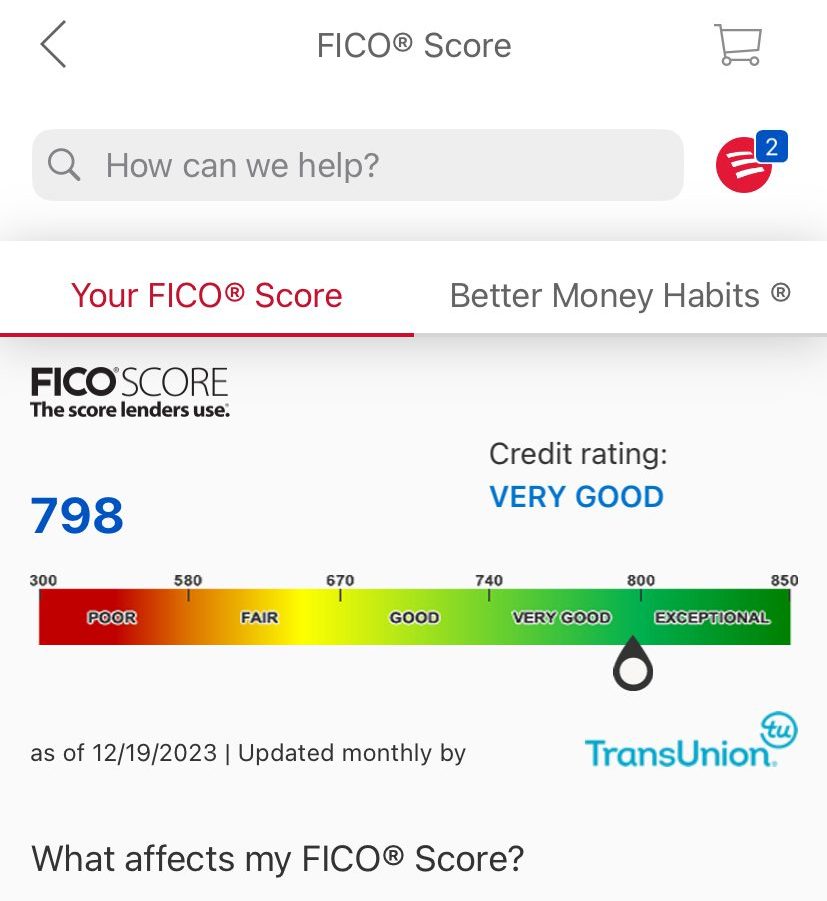

- FICO® Score: Opt-in to access your free monthly FICO® Score through your Mobile Banking app or Online Banking, helping you track your credit health.

When You Might Want the Chase Freedom Flex?

You might prefer the Chase Freedom Flex card over the Bank of America Customized Cash Rewards card in several scenarios:

- Higher Cashback Rate On Rotating Categories: Chase Freedom Flex higher rotating cash back rate than the Customized cards, in addition to much higher cashback rate on travel categories such as airline and hotels.

- You Spend On Travel: If you value travel rewards, the Chase Freedom Flex card not only rewards you more but allows you to transfer your cash back rewards to Chase Ultimate Rewards points, which can be more valuable for travel redemptions.

- Travel And Insurance Benefits: The Chase Freedom Flex provides travel-related perks, including trip cancellation/interruption insurance and an auto rental collision damage waiver, which can be valuable if you often travel or rent cars.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Customized Cash Rewards?

You might prefer the Bank of America Customized Cash Rewards card over the Chase Freedom Flex card in various situations:

- Lower credit Score: The Bank of America Customized Cash Rewards card may be a more accessible option if you have a lower credit score. Bank of America tends to be more lenient with credit score requirements for this card compared to some other premium credit cards.

- You Don't Want To Have To Keep Track Of Rotating Quarterly Bonus Categories: With the Bank of America Customized Cash Rewards Card, you can choose your own bonus category and earn higher cash back on all purchases in that category, regardless of the time of year.

Compare The Alternatives

It's always a good idea to be aware of other options before determining the most suitable choice for your needs.

|

|

| |

|---|---|---|---|

Capital One Quicksilver Cash Rewards Credit Card | Blue Cash Preferred® Card from American Express | Chase Sapphire Preferred® Card | |

Annual Fee | $0

| $95 ($0 intro for the first year)

| $95

|

Rewards |

1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

|

1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus |

$200

$200 cash bonus once you spend $500 on purchases within 3 months from account opening

|

$250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | 2.70% | $0

|

Purchase APR | 19.99% – 29.99% variable

| 19.24% – 29.99% Variable

| 21.24%–28.24% variable APR

|

Compare BofA Customized Cash Rewards

Both cards have no annual fee, but when it comes top redemption value – the Customized Cash Rewards gives you more. Here's our analysis.

Bank of America Travel Rewards vs Customized Cash Rewards Card

The BofA Customized Cash Rewards is more flexible, but the Chase Unlimited card will drive more rewards and benefits. Here's why.

Bank of America Customized Cash Rewards vs Chase Freedom Unlimited

Citi Custom Cash Card and the BofA Customized Cash Rewards have similar reward structures but some significant differences. How they compare?

Compare Chase Freedom Flex

When comparing rotating categories to flat-rate cash back rewards, need to analyze the categories & calculate – which card gives you more?

If you're looking for rotating cash back rewards, it's time to analyze the categories of each to understand which card gives you more.

Chase Freedom Flex vs Discover it Cash Back: Which Is Better?

The Capital One SavorOne cashback categories are fixed, while the Chase Freedom Flex has rotating categories. Which is worth more?

Capital One SavorOne vs Chase Freedom Flex: Side By Side Comparison