Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Sign-Up Bonus

- Point Redemption

- Annual Fee

- Limited International Travel

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Sign-Up Bonus

- Point Redemption

CONS

- Annual Fee

- Limited International Travel

APR

21.49%–28.49% variable

Annual Fee

$69

0% Intro

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

The Southwest Rapid Rewards Plus Credit Card is a suitable option for Southwest Airlines enthusiasts seeking an entry-level credit card with a lower annual fee. While it offers fewer perks than higher-tier Southwest cards, it presents a solid welcome bonus and benefits that can offset the $69 annual fee.

In terms of rewards, cardholders earn 2X points on Southwest purchases, Southwesthotel and car rental partners, local transit and commuting (including ride-shares),internet, cable, phone and select streaming services, and 1X points on all other purchases. As a sign up bonus, the card offers 50,000 points after you spend $1,000 on purchases in the first 3 months from account opening.

However, the card has limitations. It doesn't excel in earning points for common spending categories like groceries or dining, and its 3% foreign transaction fee may deter international travelers. Additionally, its rewards rate may be less flexible compared to other travel cards, and its points' redemption value is lower on average.

In summary, the Southwest Rapid Rewards Plus Credit Card offers a cost-effective entry point for Southwest loyalists, but individuals with diverse spending habits or frequent international travel may find better alternatives among premium travel cards.

Are there blackout dates when redeeming points for Southwest flights?

No, Southwest does not have blackout dates for point redemption on flights.

How long does the Southwest Companion Pass last, and how can I earn it with this card?

The Companion Pass lasts for the year you earn it and the entire following year. Points from the welcome offer contribute toward earning the Companion Pass.

Can I earn points on everyday spending categories like groceries or gas?

The card does not earn bonus points in common categories like groceries, gas, or dining.

Can I redeem points for anything other than Southwest flights?

Yes, you can redeem points for gift cards, merchandise, experiences, hotels, and more through the More Rewards program.

What is the value of Rapid Rewards points compared to other airline rewards programs?

Rapid Rewards points are valued at 1.3 cents per point, making them among the most valuable compared to other airline programs.

How does the card's rewards rate compare to other travel cards in terms of flexibility and power?

The card's rewards rate may be less flexible than some general travel cards, and its points offer lower redemption value on average.

Pros & Cons

Let's explore the advantages and disadvantages of the Southwest Rapid Rewards Plus card to determine if it aligns with your wallet's preferences and needs.

Pros | Cons |

|---|---|

Potential For Companion Pass | Average Rewards Rate |

No Blackout Dates | Southwest Flights Only |

Cardholder Anniversary Gift | Limited International Travel |

Travel Insurance Perks | Annual And Foreign Transaction Fees |

No Change Fees | Not Ideal for Upgraded Boardings |

- Potential For Companion Pass

Points from the welcome offer count toward earning the coveted Southwest Companion Pass in addition to a boost of 10,000 Companion Pass qualifying points every year.

- No Blackout Dates

Because the Southwest Rapid Rewards Plus Credit Card is a travel rewards card, not having to worry about blackout dates causing a dilemma when scheduling trips is a huge benefit that many travel cards fail to offer to their customers.

On top of this, the Southwest Rapid Rewards Plus Credit Card offers no seat restrictions when you fly, meaning you don’t have to worry about only get the last open seats on an available flight.

- Cardholder Anniversary Gift

Every year a cardholder has an open account with the Southwest Rapid Rewards Plus Credit Card, they will receive 3,000 points as a loyalty perk for having the account.

While this isn’t a huge perk, this is still a nice little effort from Southwest to give people more of a reason to keep this card open.

- Travel Insurance Perks

The card offers valuable travel perks, including lost luggage reimbursement, baggage delay insurance, and no fees for flight changes, enhancing the overall travel experience.

- No Change Fees

Cardholders enjoy the benefit of no fees for flight changes, adding flexibility to their travel arrangements.

- Average Rewards Rate

If you're not a loyal customer of Southwest, the rewards rate is lower compared to what you can find on other travel cards such as the Chase Sapphire Preferred or the Capital One Venture.

- Southwest Flights Only

The Southwest Rapid Rewards Plus Credit Card has some great flight options for Southwest airlines. However, because Southwest doesn’t have any partner airlines, cardholders who are looking to use these points to flight are limited to only flying Southwest.

While this card is designed for Southwest purchases and more specifically for Southwest loyalists, not having any flexibility is something that could deter potential cardholders from applying.

- Limited International Travel

Although there are a many options for domestic travel within the United States, traveling internationally is a different story.

There are very limited options when it comes to traveling abroad, so if international travel is something that a potential cardholder was hoping to benefit from, then they might want to look at other options.

- Annual And Foreign Transaction Fees

There is an annual fee of $69 for having the Southwest Rapid Rewards Plus Credit Card.

While this is lower than other cards that are both travel rewards based and not travel rewards based, there is also a 3% foreign transaction fee. The Southwest Rapid Rewards Plus Credit Card also have no intro APR for new cardholders, and the variable APR is 21.49%–28.49% variable.

- Not Ideal for Upgraded Boardings

It may not be the best choice for Southwest fans seeking upgraded boardings or a fast track to elite status, as these features are not prominent with this card.

Top Offers

Top Offers

Top Offers From Our Partners

Simulation: How Much Miles You Can Earn?

If you're a frequent traveler, there is no doubt you can leverage the Rapid Rewards Plus card to get a bunch of miles rewards, in addition to another benefits it offers. But how much exactly can you earn?

In order to understand that, we need to calculate the miles based on the card terms and spend per each category. However, everyone has its own habits, so it's important to adjust the according to your specific category breakdown.

| |

|---|---|

Spend Per Category | Southwest Rapid Rewards® Priority |

$12,000 – U.S Supermarkets | 12,000 points |

$4,000 – Restaurants | 4,000 points |

$3,000 – Airline | 6,000 points |

$3,000 – Hotels | 6,000 points |

$4,000 – Gas | 4,000 points |

Total Points | 33,000 miles |

Estimated Redemption Value | 1 point ~ 1.4 cent |

Estimated Annual Value | $460 |

How to Redeem Your Point Rewards?

Points that are earned using the Southwest Rapid Rewards Plus Credit Card can be redeemed for a number of things outside of just Southwest Airlines flights. You can use your points to book Southwest Airlines flights to over 90 destinations, car rentals and hotel stays, Rapid Rewards Access Events, gift cards, or merchandise.

Chase offers a rewards dashboard where you can track your points and double-check the benefits that come with your card. The Southwest Rapid Rewards Priority card has a tiered structure that awards three points for every dollar spent on Southwest products.

While the best rewards do come in the travel area, meaning the flights and hotel stays, it is nice to have the flexibility and options to look into other means of rewards. These points also don’t expire over time, just so long that the account stays open.

Top Offers

Top Offers From Our Partners

Best Ways to Maximize Miles Rewards

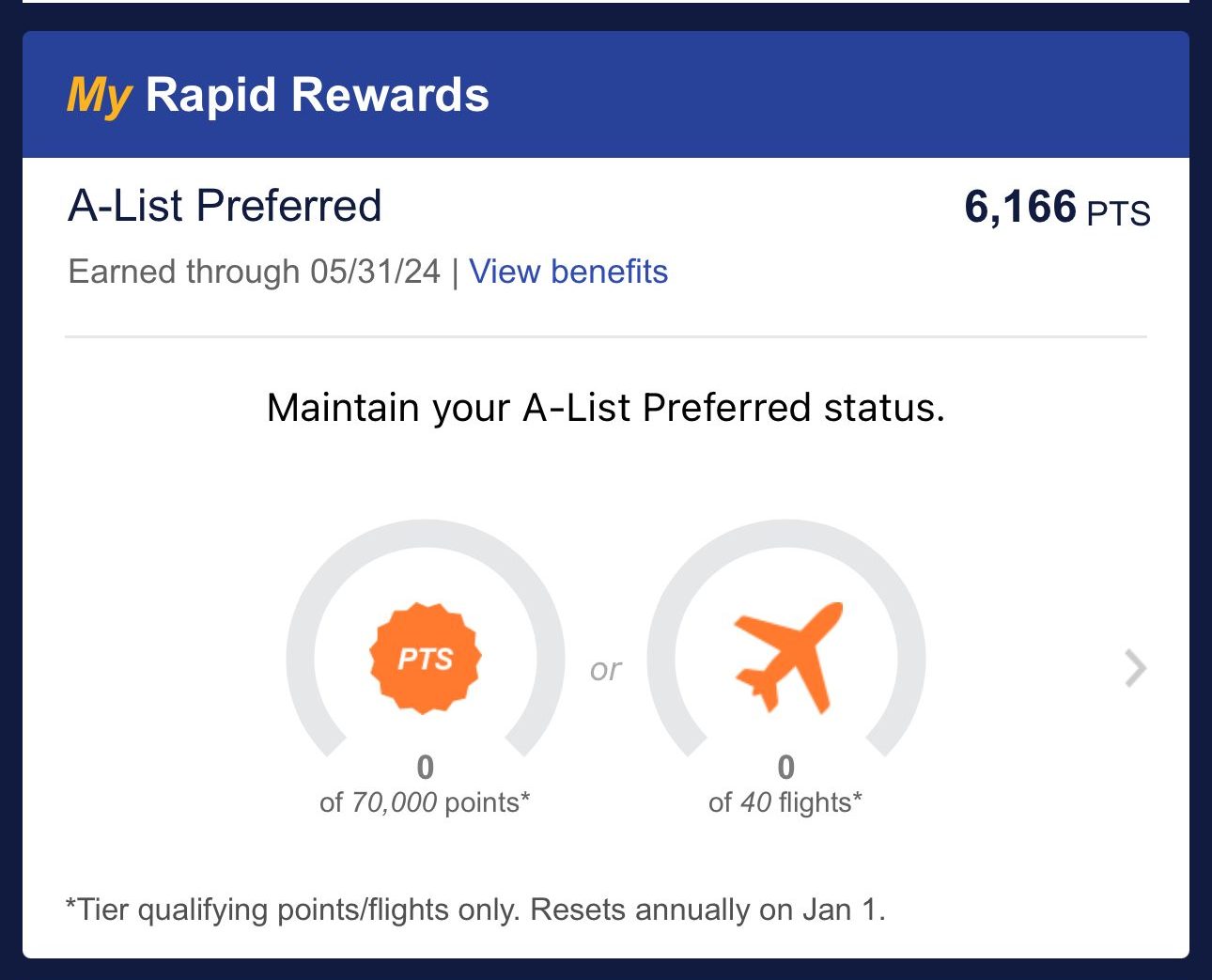

One of the best ways to maximize your rewards with the Southwest Rapid Rewards program is to achieve A List status.

A List Status requires at least 35,000 tier qualifying points or 25 qualifying one-way flights in a calendar year, but you'll get 1,500 points for every $10,000 you spend on your card. When you achieve A List status, you will not only receive airport perks, but you will also earn 25% more points for each flight.

You can also increase your point balance by participating in the refer a friend scheme. You can earn up to 100,000 bonus points per year, with 20,000 points awarded for each friend who obtains a Southwest Rapid Rewards card through your referral link.

How To Apply For Southwest Rapid Rewards Plus Card?

Applying for the Southwest card is quite simple process, here are the main steps:

Step 1:

Visit the Southwest Rapid Rewards Plus Credit Card and get started.

Step 2:

A page appears to get you started, which includes your names, mailing address, date of birth, etc.

Step 3:

Next, specify your statement and communication delivery preference. Then, take your time to read through the E-Sign Disclosure as well as the Pricing & terms.

Lastly, agree to the certifications and click “Submit.”

How It Compared To Other Southwest Cards?

In comparison to the Southwest Rapid Rewards Premier Credit Card and the Southwest Rapid Rewards Priority Credit Card, the Plus card offers a more economical alternative. The annual fee is notably lower than the Premier and Priority cards, making it an appealing option for cost-conscious travelers. However, it's essential to note that the higher-tier cards provide increased anniversary bonus points, potentially offsetting their higher fees for frequent Southwest flyers.

The Plus card's rewards structure is similar to its higher-tier counterparts, with 2X points on Southwest purchases and various other categories. However, the Premier and Priority cards may offer additional elite status point opportunities, more boarding upgrades, and a yearly travel credit.

Overall, for those prioritizing a lower annual fee and still desiring valuable travel perks, the Southwest Rapid Rewards Plus Credit Card stands out. However, frequent Southwest travelers looking for enhanced benefits and willing to pay a higher fee might find the Premier or Priority cards more appealing.

Is the Southwest Rapid Rewards Plus Card Right for You?

The Southwest Rapid Rewards Plus Credit Card is a strong credit card that is certainly designed for Southwest loyalists. The card has a great sign-up bonus, as well as many options for domestic traveling.

The travels perks, flexibility in point redemption, and its points rewards plan are all great reasons to consider this card. Combine this with a lower annual fee than competitor cards, and it makes sense as to why the Southwest Rapid Rewards Plus Card is a great option to consider adding to your wallet.

Compare The Alternatives

If you're looking for an airline credit card – the Southwest is definitely a good option. However, there are some good alternatives:

|

|

| |

|---|---|---|---|

United℠ Explorer Card | Delta SkyMiles® Gold American Express Card | Citi®/AAdvantage® Platinum Select® World Elite Mastercard® | |

Annual Fee | $95 ($0 first year) | $150, $0 intro first year. (See Rates and Fees.) | $99 (waived for the first 12 months) |

Rewards |

1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

|

1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus |

50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

|

40,000 Miles

40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months

|

50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0 | $0. See Rates and Fees. | $0 |

Purchase APR | 21.99% – 28.99% variable | 20.99%-29.99% Variable | 21.24% – 29.99% (Variable) |

FAQ

While the Southwest Rapid Rewards Priority card does have baggage delay insurance, this is only for if your baggage is lost or delayed by your carrier, it will not cover any expenses you incur as a result of your flight being canceled. You’ll need to cover any unreimbursed costs yourself.

Southwest does not allow you to transfer points to other airlines, but there is an Other Travel section within the Rapid Rewards catalog. Here you’ll find international flights on a variety of carriers that are priced in Rapid Reward points.

Chase typically has a full application form for its cards and this includes the Southwest Rapid Rewards Priority card. This means that you need to be prepared for a hard credit pull and whether it will impact your credit when you apply.

The Southwest Rapid Rewards allows you to earn unlimited rewards, so you don't have to worry about timing your purchases so that you don't exceed a rewards cap at the end of the year. In fact, the card encourages you to earn more rewards by providing you with additional benefits.

The Southwest Rapid Rewards Plus include rental car insurance. In most territories, if you decline the rental counter collision waiver coverage and pay for the rental with your card, you will have theft and damage protection. Please review the terms and conditions before to make sure you're covered.

As with most credit cards, Chase will consider your credit score when determining your approval status. The The Southwest Rapid Rewards necessitate a good to excellent credit score, which is only possible if you have a relatively low debt-to-income ratio. However, if you are approved, Chase will use your income to determine your credit limit.

Chase is quite discreet about initial credit limits for the Southwest Rapid Rewards Priority, but some customers have reported a credit limit of $2,000 or more initially.

Although there are other airline cards that offer more perks, these typically have a higher annual fee. If you want to keep your annual fees low and still enjoy some decent card benefits, the Southwest Rapid Rewards Priority fits the bill.

These are decent cards for travel and other spending, while offering some nice rewards, which can appeal to the less frequent traveler.

Compare Southwest Rapid Rewards Plus

If you're a frequent flyer, the Premier card has the edge so that you can cover the annual fee difference. If not, the Plus card is enough.

Southwest Rapid Rewards Plus vs Premier: Side By Side Comparison

Top Offers

Top Offers

Top Offers From Our Partners

Review Airline Credit Cards

Delta SkyMiles Blue American Express