The fully online application process takes less than 10 minutes to complete and get a decision.

APR

Loan Amount

Term

Min score

The fully online application process takes less than 10 minutes to complete and get a decision.

APR

Loan Amount

Term

Min score

- Our Verdict

- Pros & Cons

- FAQ

Originally a mortgage refinancing and home equity line of credit issuer, Figure now offers personal loans in its list of loan products. If you are looking to consolidate your debts, pay for home improvement or make a large purchase, you can borrow up to $50,000 on Figure.

Figure uses blockchain and artificial intelligence to offer quick sign-up and funding processes, and you can get a quote for the rates and interest in minutes. The fully online application process takes less than 10 minutes to complete and get a decision. If you are comfortable with the quote, you can proceed with the application, sign loan documents digitally, and wait for the funds to be processed.

Figure is a good fit if you want to apply for a personal loan quickly and get access to your funds as soon as possible after approval. It also provides a discount for autopay and pre-qualification with a soft credit check.

- Quick application process

- Prequalification

- Competitive Interest Rates

- Quick funding

- Autopay discount

- Referral program

- Origination fees

- State availability

- Strong credit required

- Only two loan terms

- High starting amount

Does Figure personal loans verify income?

Figure does need to verify your employment status and income. However, retired applicants do not currently do not need to verify employment.

This verification may take the form of pay stubs or bank statements. However, there may be some flexibility if you don’t have this paperwork to support your application.

Can I negotiate with Figure?

Like most lenders, Figure does not explicitly state that it is open to negotiations, but this does not mean it is not worth a try.

Whether you want to negotiate your rate to match another quote when shopping for a loan or would like to negotiate a settlement figure, it is worth speaking to the Figure team.

Can I pay off a Figure loan early?

Figurehas no prepayment penalties, making it easier to repay your loan early if your financial circumstances change before the end of your loan term.

You can speak to the Figure team to obtain a settlement figure at any point during your loan term.

Does Figure offer more financial products besides personal loans?

Figure specializes in lending products, so for personal customers, the product line is primarily personal loans and mortgages.

However, Figure does also offer business services including Figure Pay for merchants, equity solutions, and digital fund services. This may be useful if you are setting up an enterprise and want to work with a company you’ve previously used for a personal loan.

Does Figure personal loans offer soft credit check?

Figure does offer the option to check your rate and prequalify for a personal loan. Figure will only use a soft credit inquiry to generate this initial quote.

This will not impact your credit score, as you may see it on your credit report, but it will only be visible to you. However, if you decide to submit a complete application and proceed with a loan, this will trigger a hard credit inquiry.

Can I add a cosigner to a FIGURE personal loan?

Unfortunately, Figure does not allow joint applications or co-signers on its loans. This means you must qualify for a loan based on your credit profile rather than relying on a co-signer with a better credit score to bolster your application.

In this Review..

Requirements & Repayment Options

Figure leverages the latest technology to offer a streamlined 100% online application process. You will provide your information, sign documents, and speak with an e-Notary without making a trip to the bank.

If you would like to compare rates with other personal loan lenders, prequalify for Figure personal loan to know how much you qualify for, loan terms, APR, and estimated monthly payments without getting a hard inquiry on your credit report.

Figure requires a FICO credit score of 680 or higher to be approved for a personal loan. If your credit score is below 680, you will have to work on improving your credit to qualify for the loan. Also, you must have a maximum DTI of 60% and a monthly cash flow of at least $1,000.

Compared to other excellent credit lenders, the required score is reasonable. For example, Discover loan required score is 660 .

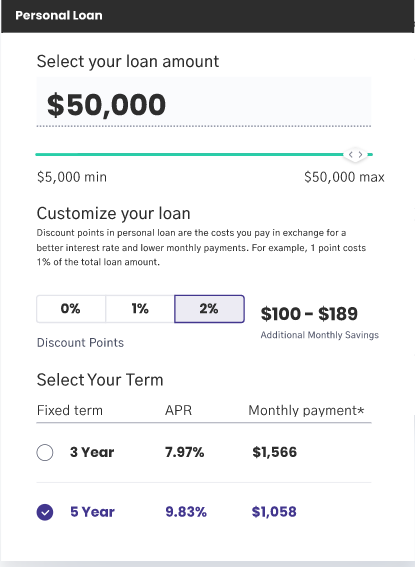

FIGURE only provides you with the option of a three-year or five-year repayment term. It does provide a 0.25% autopay discount, but you cannot choose or change the payment due date. Finally, FIGURE does not charge prepayment or late fees.

Benefits & Drawbacks

As we know, each lender has its own pros & cons – here are the relevant things we found for potential borrowers:

- Quick application process

Figure has a simple and streamlined application process that allows you to get a decision in less than 10 minutes.

- Prequalification

If you want to know how much you qualify for, and the rate and interest rate you will be charged, you can prequalify for Figure personal loans without affecting your credit score. A hard inquiry will only be made if you proceed with the application.

- Competitive Interest Rates

Figure has some of the most competitive rates in the personal loans segment.

- Quick funding

Once you’ve been approved for the loan, you can get your funds in as little as two business days, which is an ideal time if you want to pay for urgent expenses.

- Autopay discount

If you opt in to the autopay option, Figure will give you an auto-pay discount of 0.25%. This discount reduces your APR rate by a similar rate.

- Referral program

If you refer a friend or family member to Figure personal loans, both of you qualify to get a $150 gift card. However, the referred customer must get approved for a personal loan and receive the funds for you to get the reward.

- Origination fees

In addition to paying an interest rate on the loan, Figure charges origination fees of 0% to 5% of the loan amount. This increases the cost of borrowing.

- State availability

Figure has a presence in most US states. However, some states are not covered, and residents cannot access Figure personal loans.

- Strong credit required

Figure requires a minimum FICO score of 680 to qualify for its personal loans. An even higher credit score is required to qualify for a higher loan amount and low APR. A 680 credit score is out of reach for most personal loan borrowers.

- Only two loan terms

Figure personal loans are available in two terms i.e. 36 months (3 years) and 60 months (5 years). If you are looking for a loan term under 3 years or higher than 5 years, you may be forced to look elsewhere.

- High starting amount

When applying for a Figure personal loan, you can only borrow starting from $5,000. This means you may be forced to borrow more than you need.

Customer Experience

If you need help with your Figure personal loan, you can talk to customer support throughout the week from Monday to Sunday from 6 a.m. to 6 p.m., except on holidays.

There is financial education available on the website, as well the mobile app allowing you to manage your loan as you need.

Figure | |

|---|---|

iOS App Score | 3.5 |

Android App Score | 3.3 |

BBB Rating | F |

Contact Options | phone/mail |

Availability | 6am – 6pm (PT) |

What Can an Figure Personal Loan Be Used For?

Figure can be used to consolidate debt, build or improve businesses, pay for home improvements or for large purchases. It cannot be used for any post-secondary education expenses, investments, illegal activities, or gambling of any kind.

- Home Improvement – If you are planning to replace your roof, install custom stained glass windows, or repaint their exterior, a personal loan can help you cover these expenses.

- Debt Consolidation – If you are paying high interest for your debts, you can consolidate them into one loan at a lower rate.

- Medical expenses – If your emergency fund is insufficient to meet your increasing medical expenses, a personal loan can help you sort out the bill.

- Vacation – Upgrade allows personal loans to be used for business use. Many other lenders only allow this type of loan to be for personal use. The loan can be used to purchase inventory, payroll, or any other general business needs.

- Moving/Relocation – Getting a professional mover to transport your things to your new home can dent your wallet, and a personal loan can help you meet these urgent costs.

- Large Purchases – If you don't have the upfront cash to pay for expensive goods such as pieces of art, mattresses, jewelry, or a new laptop, a personal loan can help you with these purchases.

Application Process

Figure has a simple fully-automated personal loan application process. Here are the steps involved:

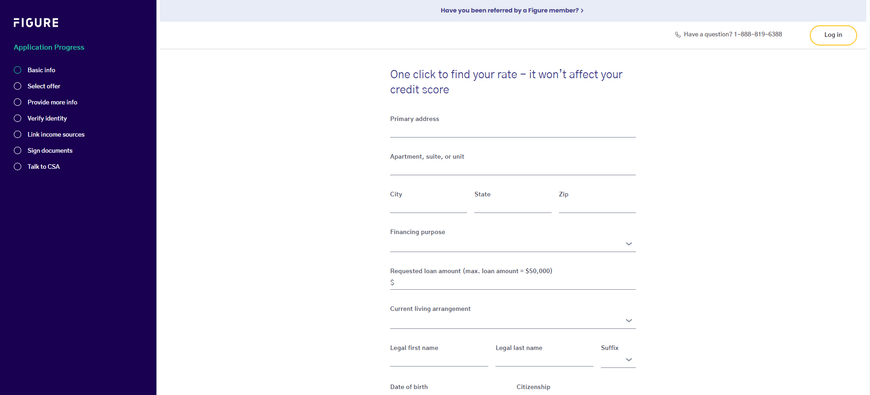

1. Select “Find My Rate”

On the Figure homepage, click “Find my Rate” in the Personal Loan option.

2. Fill out the preliminary form

In this section, you will be required to provide your personal information and loan requirements. Here are some of the details required:

- Primary address

- Financing Purpose

- Amount of loan requested

- Current living arrangement

- Legal names

- Citizenship status

- Date of birth

- Annual gross income

- Source of income

- Contact information

3. Review quote

Once you submit the information and create an account, you will get a quote of the amount that you qualify to get, loan term options, APR, and estimated monthly payments.

Select your preferred loan term to see the one-time origination fee. Prequalification will not affect your credit score.

4. Submit Application

Proceed with the application if you are satisfied with the terms provided.

You will be required to verify identity, link a bank account, and provide any additional information that may be required. Once approved, you will be required to e-sign the documents.

5. Speak with an e-Notary

Once you've signed the documents, you will speak to a customer service agent to walk you through the closing process and notarize your documents.

6. Funding

After closing, you can expect to receive funding in two business days or more.

FAQ

Is Figure a good place to get a loan?

Figure is a good option if need to apply for a debt consolidation loan. The company offers loans in long term. The rates are also lower than many other lenders.

Figure also has specific lending requirements. You need a good to excellent FICO score and a debt to income ratio of less than 40%.

Does Figure check your bank account?

Figure has a fully automated, paper-free application process. In order to determine your eligibility, Figure requires a copy of a valid government-issued ID, and income verification.

However, this can be done by providing copies of documentation such as tax returns or pay stubs. In most cases, Figure will not need to check your bank account and will rely on your credit report.

If you can't meet the minimum requirements, you can compare other personal loan lenders or check out personal loans alternatives.

Is Figure better than RocketLoans?

Rocket Loans offers similar maximum loan amounts, but the terms are typically shorter than Figure. The rates are typically higher than Figure, but you can qualify with a lower FICO score.

However, Rocket Loans do require that applicants have a minimum income of $24,000 per year and at least two years of credit history.

So, if you would like to clear your debt in less time or want to use your loan for a large purchase, Rocket is likely to be a better option. However, if you want to consolidate and bring down your monthly expenses, FIGURE could help.

Is Figure better than Citibank?

Like Figure, Citibank offers larger loans, but the typical rates are higher. Another key difference is that to qualify, you need to have an existing Citibank account. This established relationship helps Citibank to assess risk and determine approval.

So, unless you already have a Citibank account, Figure is likely to be a better option. You can borrow with flexible terms, making it a great option.

Is Discover better than Figure?

Figure offers larger sums for personal loans with far longer terms, making them a good choice for debt consolidation loans. The rates are also lower. Just bear in mind that if you take a loan with a longer term, even if the rate is lower, you will pay more in the long term.

Figure is also more flexible in terms of its lending requirements. You can qualify for a loan with a FICO score of 680, but you will need to have a debt to income ratio of less than 40%.

So, if you are in need of a debt consolidation loan, Figure does make a better option compared to Discover.

Is SoFi better than Figure?

Figure offers loans with a far lower maximum loan amount but potential longer terms and lower rates. While the rates are lower, they are obviously more designed for offering a debt consolidation solution rather than a basic personal loan. However, Figure also requires a FICO score of or more, so you will still need good credit. Figure also requires that applicants have a debt to income ratio of 40% or less.

If you’re looking for debt consolidation, Figure is a solid option, but if you’re looking for a loan for another purpose, SoFi is a more flexible option.

Alternatives For Low Interest Personal Loans

APR Range

The annual percentage rate (APR) is the total annual cost of borrowing money. This rate includes the interest rate as well as any additional finance charges. When you take out a personal loan, for example, you may be required to pay loan origination fees.

| 8.99% – 29.99%

| 6.99% – 25.49% (with autopay)

| |

Term

The term of your loan is the amount of time you have to repay it. For example, if you get a 24 months personal loan, the loan term is 24 months.

| 24-84 months

| Flexible

| |

Loan Amount | $5,000 – $100,000

| $5,000 – $100,000 | |

Minimum Score | 680

| 660

| |

Funding Time | Up to 7 days

| As soon as same day (conditions apply), within 30 days of approval (conditions apply)

| |

Review Personal Loan Top Lenders

Compare Alternative Lenders

FIGURE vs Universal Credit vs PenFED

Universal Credit is a lender that works with people who have bad or fair credit, and it is a subsidiary of Upgrade, another online lender. Figure is a major online lender that focuses on people with good credit and larger loan amounts. PenFED credit union is a well-known credit union in the United States, offering personal loans online. It is best suited for people looking for a small loan.

Read Full Comparison: Universal Credit Vs FIGURE Vs PenFED: Compare Personal Loan Providers

FIGURE vs SoFi vs Upstart

SoFi primarily serve people with good credit, whereas Upstart will serve people with poor or no credit. When it comes to providing quick access to funds, Upstart will be faster, while SoFi will offer autopay discounts.

Read Full Comparison: Upstart Vs SoFi: Which Personal Loan Is Best?

FIGURE vs SoFi vs Prosper

SoFi is widely regarded as the best option for people with excellent credit who require larger loan sizes while paying low fees. Prosper is best suited to people with low credit scores.

Read Full Comparison: SoFi Vs Prosper: Which Personal Loan Is Better?