Finding a personal loan that meets your criteria and financial needs can be a challenge. There are often roadblocks and requirements for getting a personal loan.

APR

As low as 3.99% APR

Loan Amount

$1,000 – $100,000

Term

12-84 months

Min score

580

Finding a personal loan that meets your criteria and financial needs can be a challenge. There are often roadblocks and requirements for getting a personal loan.

APR

As low as 3.99% APR

Loan Amount

$1,000 – $100,000

Term

12-84 months

Min score

580

- Our Verdict

- Pros & Cons

- FAQ

LendingTree is a platform that compiles all of the data for a variety of different loan types, including personal loans. Whether you’ve been considering using LendingTree for your loan needs or you’re just curious to know more, we’ve got all the details you should know right here.

When you go to their website, you find several options. For a personal loan, you will select the “personal loan” box and then go through a simple series of questions. Once you’ve answered the questions, LendingTree uses that data to pair you with the best lenders for your needs. Then, you can shop and compare the lenders they provide you with.

As you search your options, you can compare them side-by-side and even have conversations with loan officers before you complete your official loan application with the lender of your choice.

- Up-Front View of Rates

- Online Application Process

- You Get a Choice

- Free & Simple to Use

- Information Sharing

- Repeat Information

- Higher Interest

- Waiting Period

How many lenders are available via LendingTree?

Lending Tree is an intermediary with a network of over 500 lenders, which offer personal loans, home loans, student loans, auto loans, lines of credit, and credit cards.

When you submit your application, it is unlikely that you will have access to all of these lenders as many of them specialize in particular lending areas. However, Lending Tree will match you with lenders who are best suited to meet your loan requirements.

Can I negotiate with LendingTree?

Since LendingTree is connecting you with lenders from its network, it is unlikely that there will be room for negotiation.

However, you will be presented with multiple loan deals that match your lending requirements, so you can compare them and proceed with the loan that represents the best deal for you.

Can I pay off a LendingTree loan early?

This will depend on the lender. Some of the LendingTree partners will not charge a prepayment penalty, while others will.

This makes it crucial that you read through the terms and conditions of each loan deal before you decide to proceed. The loan terms will detail any prepayment penalties so you can make an informed decision.

Can I add a cosigner to a LendingTree personal loan?

This will depend on the specific lender, but LendingTree has compiled a list of lenders in its network that will allow a cosigner. You can add this preference in your inquiry and LendingTree will connect you with appropriate loan deals.

In this Review..

LendingTree Personal Loan Pros & Cons

As we know, each lender has its own pros & cons – here are the relevant things we found for potential borrowers:

- Up-Front View of Rates

With LendingTree, you can easily see the rates that will be available to you right away. There is no question as to what your rate will be or what rate is available. When lenders are displayed to you, their associated rates are also displayed. When you complete the LendingTree questionnaire for a personal loan, you will quickly see how much you qualify for as well as the rates, and this part of the process will not affect your credit.

- Online Application Process

You get to go through a two-part process. The first part is to answer LendingTree’s questions so they can match you appropriately. Then, you shop lenders and compare. Once you choose a lender, you can typically complete the application for the chosen lender right there. You don’t have to go find a physical location to get your loan approved.

- You Get a Choice

One of the best things you will experience with using LendingTree is the ability to choose. They match you with multiple lenders on most occasions and you can compare and check out the details and find the match that you feel is best for you based on their recommendations. If you qualify, you will find multiple loan offers available for you to choose from.

- Free & Simple to Use

LendingTree is a free service that is available to you. It doesn’t cost anything to use their product to help you find the best match. You really can’t beat a free service that is intuitive and helpful, particularly when you are working with a money situation.

- Information Sharing

LendingTree is considered a market lead generator. This means that your information shared with them can be sold to third parties and you could end up getting a surplus of spam calls and emails because of this. It doesn’t matter whether you have an active loan or not, if you share your information they can sell it. This is a potential nuisance for the borrower.

- Repeat Information

You might feel like you have to supply a multitude of information more than once. LendingTree requests quite a bit of information so they can pre-qualify you for rate purposes with the lenders they match you with. Then when you apply, you have to re-submit all of that information again. Your results are accurate but it can be annoying to give all of your information for window shopping.

- Higher Interest

Since there is no required credit score, risky borrowers tend to get approved through LendingTree. This means that they typically have higher interest rate offerings than what you might find elsewhere.

- Waiting Period

You might find yourself waiting for loan funding, which could up to 7 days and sometimes takes even longer. If you’re in a pinch, you can typically find faster funding options.

Requirements

One of the nice things about LendingTree is they can accommodate a broad range of needs. If you have bad credit or a high debt-to-income ratio, they might be able to find you a solution. In order to apply, you will need to be at least 18 years of age and be a U.S. citizen or a permanent resident.

Be prepared to potentially provide documents like paystubs and an ID before you get alone. You also will be required to pass a credit check but these criteria may vary depending on the lender options found for you.

What Can a LendingTree Personal Loan Be Used For?

With LendingTree, you will find loans with a variety of interest rates. They can range anywhere from As low as 3.99% APR. This could depend on the lender and your credit details. The loan limits are flexible with a large range and there is no penalty to pay your loan off early.

You can expect an origination fee of 2-6% and terms that range is 12-84 months.

LendingTree has been accredited with the Better Business Bureau since 11/6/2019. Their ratings are not the best there, with a score of 2.21/5 based on customer reviews to the BBB. If you compare this to Trustpilot, they have a far better rating there with 4.5/5 stars based on customer reviews. Trustpilot has a much larger number of reviews to compile information from.

LendingTree Reputation

- A+ on BBB: BBB assigns ratings from A+ (highest) to F (lowest). BB ratings are based on information in BBB files with respect to factors such as the business's complaint history with BBB, type of business, time in business, transparent business practices, and more.

- 4/5 on Consumer Affairs (+700 reviews): Consumer Affairs reviews allow customers to post positive, negative, or neutral reviews about marketplace experiences.

- 4.5/5 on Trustpilot ( +8800 reviews): TrustScore is also an overall measurement of reviewer satisfaction, represented numerically from 1 to 5.

- J.D Power: We considered J.D. Power’s lending consumers satisfaction study. .J.D Power offers the most comprehensive and independent study of personal loans consumer satisfaction . The study aims to help consumers and issuers to understand user opinions and ratings of top lenders. It covers terms, benefits, services, communication, transparency and more. LendingTree wasn't rated in the 2020 research.

How to Get Rates on LendingTree Website?

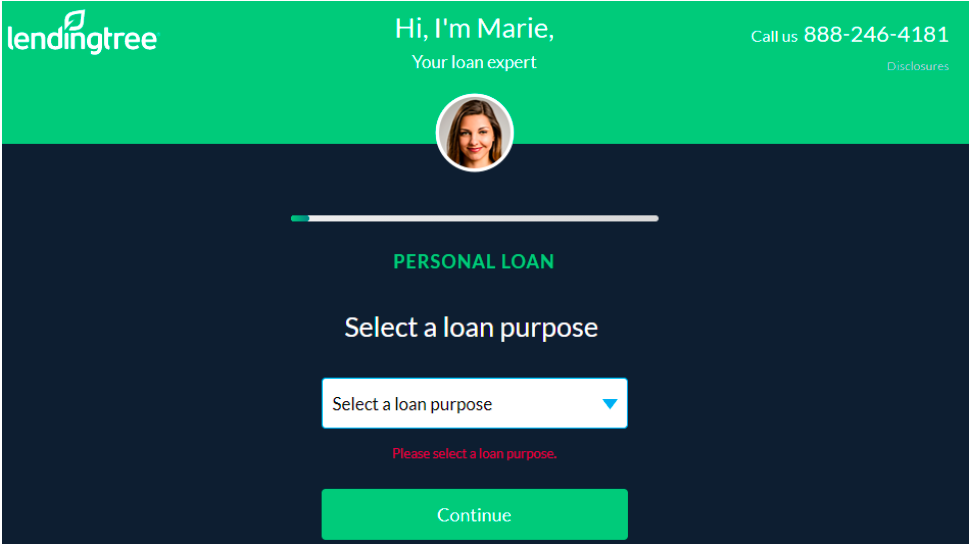

- 1.

You can choose from a drop-down list to explain why you need a personal loan. Options include major purchases, home improvement, debt consolidation, payoff credit cards, and more.

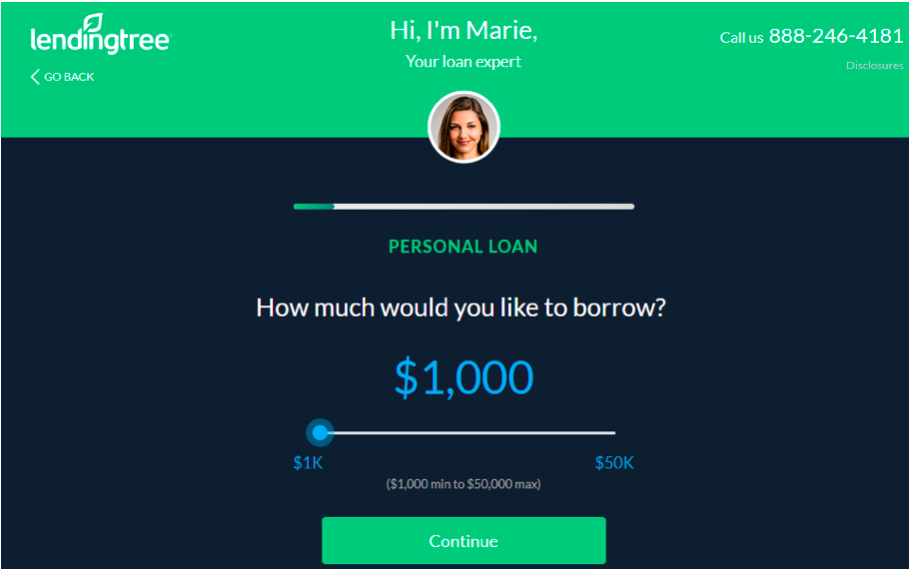

- 2.

Select an amount. The tool allows you to choose an amount between $1,000 and $50,000. Remember you will have to be approved for the amount.

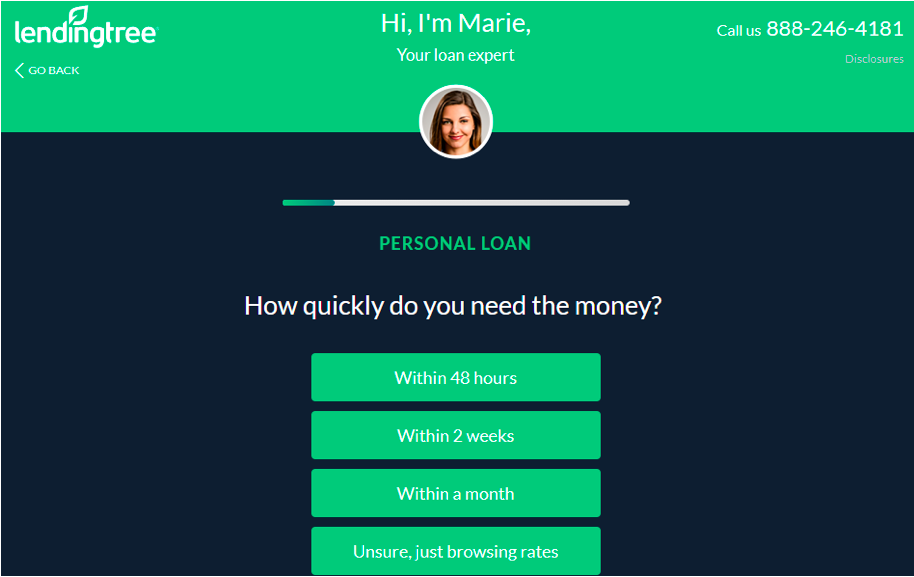

- 3.

Let them know just how quickly you need these funds

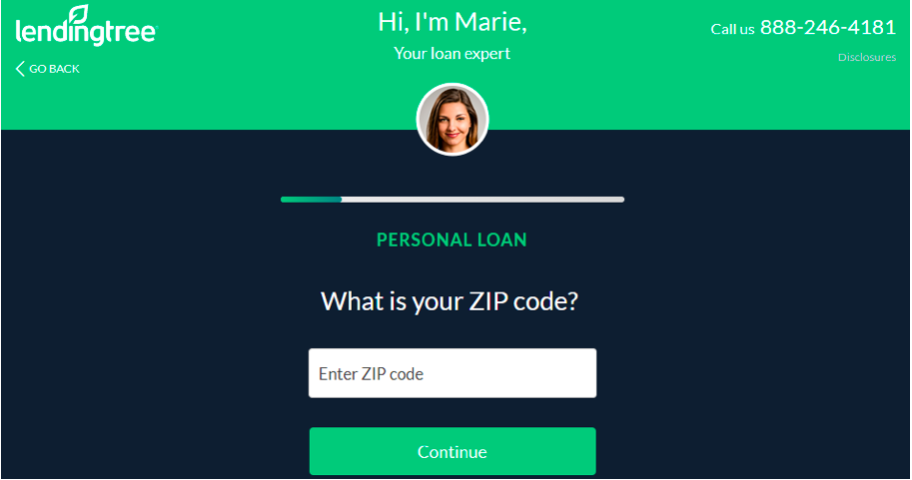

- 4.

Now it’s time to get personal and go through a series of questions that will ask for your personal information. They go through one step at a time to collect the information they need to qualify and match you.

- 5.

Once you make it through the personal details, you will be provided a list of matches. Shop and compare and then you can decide whether or not to apply with a specific recommended lender.

Should I use LendingTree?

LendingTree is a good resource for finding personal loan options, among other types of loans. They have a lot of valuable resources available for you and walking through the overall process is simple overall. This company has been around for about 20 years and have a primarily positive reputation.

We do feel as though LendingTree can be a valuable tool to find the right lender for you.

Alternative Personal Loans Online Marketplaces

| |||

|---|---|---|---|

APR Range

The annual percentage rate (APR) is the total annual cost of borrowing money. This rate includes the interest rate as well as any additional finance charges. When you take out a personal loan, for example, you may be required to pay loan origination fees.

| 6.99% – 35.99%

| 4.99% – %35.99

| 5.99% – 35.99%

|

Term

The term of your loan is the amount of time you have to repay it. For example, if you get a 24 months personal loan, the loan term is 24 months.

| 12-84 months | 6-84 months | 3-72 months |

Loan Amount | $600 – $200,000 | $1,000 – $100,000 | $1,000 – $35,000 |