Best Egg has very high ratings with Consumer Affairs and the Better Business Bureau from many satisfied customers.

APR

8.99% – 35.99%

Loan Amount

$2,000 -$50,000

Term

36-60 months

Min score

640

Best Egg has very high ratings with Consumer Affairs and the Better Business Bureau from many satisfied customers.

APR

8.99% – 35.99%

Loan Amount

$2,000 -$50,000

Term

36-60 months

Min score

640

On Credible Website

Our Verdict

Eligible to borrowers with a credit score of at least 640 , Best Egg is a lending company that offers loans for just about every aspect of life. Whether you’re looking to consolidate debt, refinance your home, or adopt a child, Best Egg has something available. Best Egg is included on our best personal loans for fair credit in 2024.

Best Egg has a simple application process and only uses soft pull inquiries for applicants. They offer competitive rates with quick turnaround times and they don’t charge any penalty fees for prepayment. They offer fixed rates and their loan amounts range from $2,000 -$50,000 .

Despite this, there are a few downfalls to using this company. Best Egg isn’t available in every state and they charge an origination fee when signing on. They also give large amounts in short terms, have restrictions on investing, and don’t allow joint applications either.

What It Takes to Qualify?

To apply for a Best Egg personal loan, you'll need to meet specific criteria to qualify for funding. Here are the key requirements:

Credit Score Requirements: A minimum credit score of 640 is necessary to qualify for a Best Egg personal loan. However, applicants with higher credit scores may receive better rates.

Income Requirements: Borrowers should have a debt-to-income (DTI) ratio under 30%. This means monthly debt payments should not exceed 30% of gross monthly income.

Co-signers and Co-applicants: Best Egg only offers individual loans, so applicants must qualify based on their own credit score, income, and qualifications. Co-signers or co-applicants are not accepted.

In addition to these requirements, applicants need to provide certain documentation:

- Identity Verification: Applicants must provide documents such as a driver’s license or passport to verify their identity.

- Income Verification: Best Egg may require documentation to verify income sources, including employment, alimony, retirement, child support, or Social Security payments.

Understanding Best Egg Repayment Options

When it comes to repaying your Best Egg personal loan, the platform offers various options to help borrowers manage their payments effectively:

Payment Options: Borrowers can make payments through the online Account Portal, via phone, text, or online chat. Additionally, check or money order payments can be submitted via mail.

Missed Payments: If a payment is missed, a $15 returned payment fee may be charged if a check is returned or insufficient funds are available in the bank account. It's essential to contact Best Egg immediately if you anticipate difficulty making a payment to discuss potential solutions.

Rescheduling Payments: Best Egg may offer flexibility for rescheduling payments in certain situations. Borrowers experiencing financial difficulties should reach out to Best Egg's customer support to discuss options for modifying payment schedules.

Changing Payment Dates: Some borrowers may be eligible to change their payment due dates to better align with their monthly budgets. This can typically be arranged through phone, email, or online chat with Best Egg's customer service team.

Best Egg Personal Loan Pros & Cons

Like all lenders, Best Egg has its own set of advantages and drawbacks that potential borrowers should consider:

Pros | Cons |

|---|---|

Soft Pull Inquiry | No Mobile App |

Quick Turnaround Times and Simple Application Process | Origination Fee |

Direct Payment to Creditors | No Rate Discounts |

No Prepayment Penalty | No Joint Applicants |

Financial Health Tool | Limited Loan Term Options |

Option for Secured Loans |

- Soft Pull Inquiry

Best Egg allows for an initial soft pull inquiry so the borrower can get an idea of the options for which they may qualify.

- Quick Turnaround Times and Simple Application Process

Best Egg has a simple application process and one of the quickest turnaround times since the loan is usually funded in about 1 to 3 days.

- Direct Payments to Creditors

Ideal for debt consolidation, Best Egg can send payments directly to creditors, simplifying the repayment process for borrowers.

- No Prepayment Penalty

The borrower can pay off their loan early without any fees.

- Financial Health Tool

Best Egg provides access to a financial health tool, including credit reports, budgeting calculators, and credit score simulators, helping borrowers manage their finances effectively.

- Option for Secured Loans

Best Egg offers secured loan options, allowing borrowers to use collateral for potentially lower rates and larger loan amounts.

- No Mobile App

Best Egg lacks a mobile app for managing loans, which may be inconvenient for borrowers accustomed to mobile banking.

- Origination Fee

Best Egg deducts a one-time origination fee of 0.99% to 8.99% of your loan amount directly from your loan funds. This should be considered in the pricing of your loan when you apply. Take into consideration that there are other lenders who do not charge an origination fee.

- No Rate Discounts

Unlike some other lenders, Best Egg does not offer rate discounts for setting up automatic payments or paying off other creditors directly

- No Joint Applicants

The application is based on the applicant alone. Best Egg does not allow for joint applicants

- Limited Loan Term Options

Borrowers are limited to loan terms between 3 to 5 years, with no shorter or longer-term options available.

Customer Experience

Customer reviews for Best Egg are generally positive, with high ratings on platforms like Trustpilot and the Better Business Bureau. Borrowers appreciate the fast funding, competitive APRs, and efficient customer support provided by Best Egg.

However, some negative feedback pertains to the application and verification process, including occasional miscommunication regarding credit checks.

Best Egg Rating | |

|---|---|

Best Company | 4.9 |

TrustPilot | 4.7 |

BBB Rating | A+ |

WalletHub | 4.8 |

Contact Options | phone/mail |

Availability | 8 am – 10 pm (ET) |

To reach Best Egg's customer service, borrowers can contact them through various channels. They can reach out via phone, email, or online chat available on the Best Egg website.

What Else You Should Know?

Before applying for a personal loan with Best Egg, it's important to understand additional factors that could impact your borrowing experience:

-

Can I negotiate with Best Egg?

While negotiation with Best Egg may not be standard practice, borrowers can discuss potential options or solutions with customer service representatives if they encounter difficulties or have specific requests regarding their loan terms.

However, any changes or accommodations would ultimately depend on Best Egg's policies and the borrower's individual circumstances.

-

What is the funding time?

Best Egg typically offers quick funding, with funds potentially available as early as the next business day after loan approval. This fast funding can be beneficial for borrowers who need access to funds quickly to cover expenses or consolidate debt.

-

What Happens If I miss a payment?

If a borrower misses a payment with Best Egg, they may incur a returned payment fee, typically amounting to $15 for bounced checks or insufficient funds in the bank account.

Additionally, missed payments can negatively impact the borrower's credit score and may result in late payment penalties or collection efforts by Best Egg.

What Can a Best Egg Personal Loan Be Used For?

A Best Egg personal loan can be used for various purposes, including:

- Debt consolidation and credit card refinancing

- Home improvements

- Moving expenses

- Major purchases

- Special occasions and events

- Vacations

- Adoption

However, there are certain purposes for which a Best Egg personal loan cannot be used:

- Post-secondary educational expenses

- Purchasing or carrying any securities

- Illegal activity

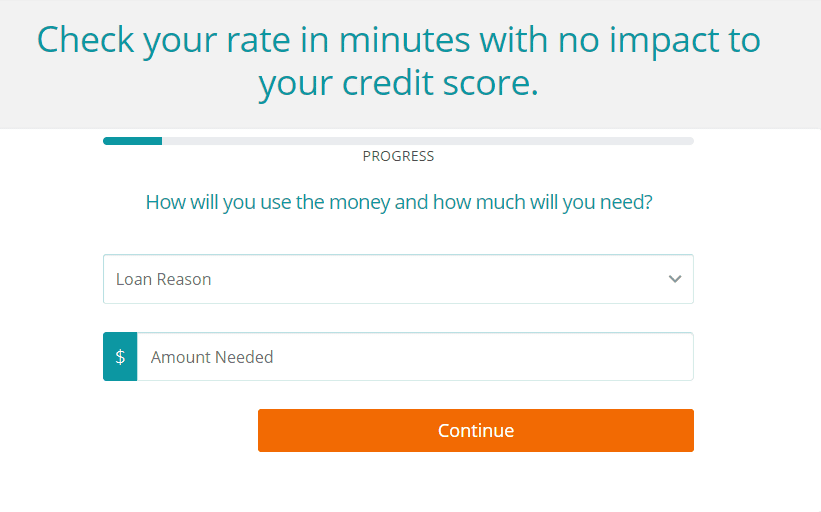

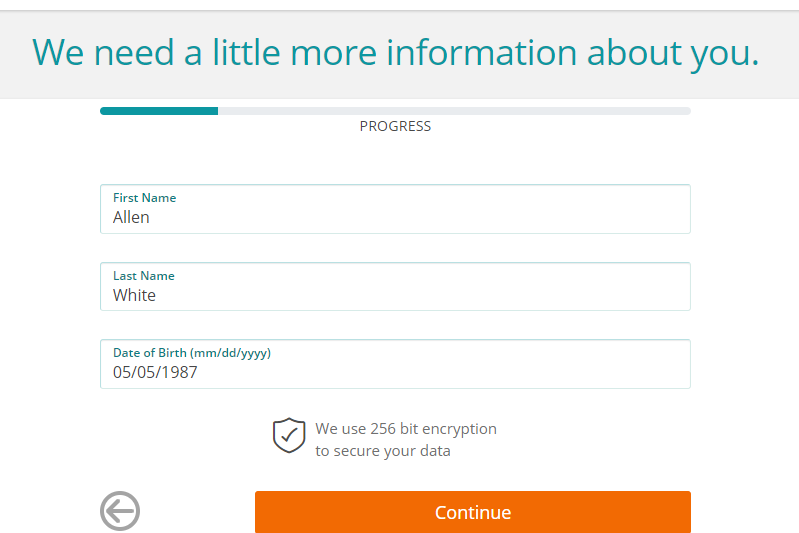

How to Apply For a Personal Loan With Best Egg

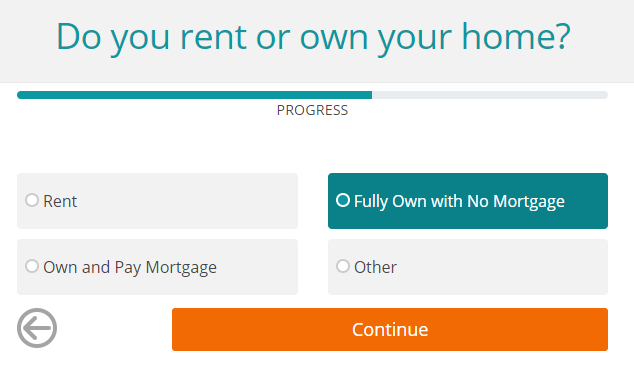

The Best Egg application process only takes a few minutes. You will fill out a short form with some basic questions about yourself, including your full name, contact information, date of birth, and income. You will need to consent to Credit Profile Authorization, allowing Best Egg to check your credit.

Then Best Egg does a soft credit pull and you’ll be presented with loan options for which you are pre-qualified. You can get an idea of how much you’ll be paying before they do a hard pull inquiry on your credit.

You may get a notification that the application has been declined. If you decide to move forward you will need to answer more verification questions, and allow a hard credit pull.

If Best Egg approves your credit application you will also need to provide verifiable banking information and possibly some documentation to verify your information.

The process is relatively quick – the average turnaround time for Best Egg is 1 to 3 days. Once the information has been verified you will need to sign loan documents.

Best Egg FAQs

Best Egg is an online lender offering personal loans to those with good or fair credit. You can borrow up to a decent maximum with reasonable rates and a term of three to five years.

However, you do need a fair or good FICO score. You can use the loan funds to refinance credit cards, consolidate debt or cover a large expense such as moving home or home improvements. If your score is higher, check out a personal loan for good credit.

The application process for a Best Egg loan does require you to provide some important financial details including your income, employment status, and your typical household expenses. You may also need to verify these details by providing bank statements, pay stubs, or a W-2.

Depending on how quickly you provide this supporting information, the approval process typically takes one to three days for approval and funding.

If you can't meet the minimum requirements, you can compare other personal loan lenders or check out alternatives to personal loans.

Upgrade minimum credit score requirement is higher, but you can borrow more compared to Best Egg. However, Upgrade is less flexible in regards to loan terms, as there is only the option of three years or five years. Additionally, the APR rates are generally higher than Best Egg.

So, unless you need the larger loan amount, Best Egg is likely to offer better rates and loan terms.

Achieve has a similar credit score requirement to Best Egg and similar rates. However, where Achieve differs from Best Egg is that you can borrow a smaller amount with Freedom – anywhere between $5,000 -$50,000 . So, if you’re looking to borrow that bit extra, Best Egg is a better option.

Also, Freedom Plus has a higher lowest loan amount.

Best Egg is a solid alternative to Marcus for your personal loan. This lender does have a higher maximum loan amount, you can also qualify with a lower credit score. However, the maximum loan term is five years, while Marcus loan term is 36-72 months .

However, what really makes Marcus better than Best Egg is the loan rates. While Best Egg has a lower starting rate, at the higher end of the scale, Marcus has a lower maximum rate.

Alternative Fair Credit Personal Loans

| |||

|---|---|---|---|

APR Range

The annual percentage rate (APR) is the total annual cost of borrowing money. This rate includes the interest rate as well as any additional finance charges. When you take out a personal loan, for example, you may be required to pay loan origination fees.

| 9.57% – 35.99%

| 5.20% – 35.99%

| 8.99% – 35.99%

|

Term

The term of your loan is the amount of time you have to repay it. For example, if you get a 24 months personal loan, the loan term is 24 months.

| 24 – 60 months

| 36-60 Months

| 36-60 months

|

Loan Amount | $1,000 – $40,000

| $1,000 – $50,000

| $2,000 -$50,000

|

Minimum Score | 600

| 300

| 640

|

Funding Time | Up to 7 days

| 1-2 Days

| N/A |

Review Personal Loan Top Lenders

Compare Alternative Lenders

Best Egg vs Prosper vs Marcus:

Prosper offers a wide range of repayment options and accepts lower credit scores, whereas Best Egg provides secured loans and preferable debt consolidation options.

Read Full Comparison: Best Egg Vs Prosper: Choose The Right Personal Loan For You

Best Egg vs Rocketloans vs Upgrade

Best Egg has been in operation since 2014 and has serviced over 785,000 loans in that time. It accepts low credit scores and secured loans, as well as a wide range of loan sizes. Rocket Loans is a well-known online lender that takes pride in providing customers with quick access to funds.

Finally, Upgrade has served over 500,000 customers and provided borrowings totaling more than $7 billion during its tenure in business. It offers a slew of great benefits, such as quick funding, substantial autopay discounts, and flexible repayment terms.

Read Full Comparison: Best Egg vs Rocketloans vs Upgrade: Which Personal Loan Is Best?

Best Egg vs SoFi

Upstart is one of the more notable online lenders because it employs artificial intelligence (AI) to guide the process of evaluating applications. As a result of this system, it frequently deals with people who have relatively low credit scores, or even those who do not yet have a credit score.

Best Egg is an online lender that has received numerous awards in recent years for its service, which includes quick approvals and competitive rates. Marcus, a Goldman Sachs offering, is one of the most reputable online lenders you will come across. It promises no-fee personal loans as well as a variety of loan types.

Read Full Comparison: Upstart vs Best Egg vs Marcus: Compare Personal Loan Lenders

Best Egg vs Upstart vs Marcus

Upstart is one of the more notable online lenders because it employs artificial intelligence (AI) to guide the process of evaluating applications. As a result of this system, it frequently deals with people who have relatively low credit scores, or even those who do not yet have a credit score.

Best Egg is an online lender that has received numerous awards in recent years for its service, which includes quick approvals and competitive rates. Marcus, a Goldman Sachs offering, is one of the most reputable online lenders you will come across. It promises no-fee personal loans as well as a variety of loan types.

Read Full Comparison: Upstart vs Best Egg vs Marcus: Compare Personal Loan Lenders