Take advantage of the discounts offered for having joint borrowers having over $40,000 in retirement savings.

APR

8.99% - 35.99%

Loan Amount

$5,000 -$50,000

Term

24 to 60 months

Min score

620

Take advantage of the discounts offered for having joint borrowers having over $40,000 in retirement savings.

APR

8.99% - 35.99%

Loan Amount

$5,000 -$50,000

Term

24 to 60 months

Min score

620

On Credible Website

Our Verdict

Achieve Personal Loans, formerly FreedomPlus, offer borrowers with fair to good credit scores an opportunity to consolidate debt or finance major expenses with competitive rates and flexible terms. With a minimum credit score requirement of 620 , Achieve provides loans ranging from $5,000 -$50,000 , accommodating various financial needs.

Borrowers can benefit from multiple rate discounts, including joint loan discounts, retirement savings discounts, and direct pay discounts for debt consolidation, potentially reducing their interest rates significantly. The approval and funding process is fast, and Achieve allows borrowers to pre-qualify with a soft credit pull.

While Achieve offers numerous advantages, including flexible payment options and competitive rates, it's important to note the origination fee ranges from 1.99% to 6.99%, depending on the borrower's profile and loan terms. Moreover, Achieve lacks a mobile app for loan management, which may inconvenience some borrowers who prefer mobile access.

What It Takes to Qualify?

To apply for an Achieve Personal Loan, applicants must meet specific requirements:

Credit Score Requirements: A minimum FICO Score of 620 is necessary to qualify for an Achieve Personal Loan. This score reflects a fair credit standing, making the loan accessible to a broader range of borrowers.

Income Requirements: Achieve evaluates applicants' debt-to-income (DTI) ratio, with a maximum DTI of 45% required for qualification. This ratio indicates the proportion of the borrower's gross monthly income dedicated to debt payments.

Co-signers and Co-applicants: Co-borrowers are permitted and can improve approval odds, especially for applicants with lower credit scores. However, all co-applicants are treated as co-borrowers, sharing equal responsibility for loan payments and meeting requirements.

In addition to these requirements, applicants need to provide certain documentation:

Identification: Valid forms of identification, such as a driver's license or passport, are necessary to verify the applicant's identity.

Income Verification: Documentation proving income, such as pay stubs or tax returns, is required to assess the applicant's ability to repay the loan.

Bank Statements: Applicants may need to submit recent bank statements to verify their financial stability and ensure sufficient funds for loan repayment.

Meeting these requirements and providing the necessary documentation is crucial for a successful application for an Achieve Personal Loan.

Understanding Achieve Repayment Options

Loan Repayment Options for Achieve Personal Loans include:

Payment Options: Borrowers can set up automatic ACH payments for convenience, ensuring timely repayment. Manual payments through customer service are also available, although they may incur an additional fee.

Missed Payments: If a payment is missed, Achieve typically charges a late fee of $15 or 5% of the amount due, whichever is greater. It's essential to communicate with the lender promptly to discuss options and avoid further consequences.

Rescheduling Payments: Achieve offers some flexibility for rescheduling payments. Borrowers can change their payment date twice in a calendar year or up to six times throughout the life of the loan, providing some relief for temporary financial difficulties.

Assistance for Difficulties: Borrowers experiencing financial difficulties should contact Achieve's loan servicing or customer service teams promptly. They may offer assistance or alternative repayment options to help borrowers manage their loans effectively and avoid default.

Achieve Personal Loan Pros & Cons

As we know, each lender has its own pros & cons – here are the relevant things we found for Achieve potential borrowers:

Pros | Cons |

|---|---|

Joint Borrowers | Origination Fee |

Soft Pull Inquiry | Not Available in All States |

Quick Turnaround Times | Higher Minimum Amount |

No Prepayment Penalty | Lack of Mobile App |

Competitive Interest Rates | Late Payment Fees |

Multiple Rate Discounts | Fixed Repayment Terms |

Loan Refinancing |

- Joint Borrowers

Achieve allows for joint borrowers on their personal loans. They even offer interest discounts for joint borrowers. It improves your chances of getting approved. Many loan providers do not allow joint borrowers.

- Soft Pull Inquiry

Achieve does an initial soft pull inquiry so the borrower can get an idea of the options for which they may qualify.

- Competitive Interest Rates

Achieve offers attractive rates for borrowers seeking affordable financing.

- Quick Turnaround Times

FreedomPlus has a quick and simple application process and the loan is usually funded in about 48 hours.

- Loan Refinancing

Option available to consolidate existing Achieve loans or third-party debts, potentially saving on interest and simplifying repayment.

- Discounts

Various discounts available, including joint loans, retirement savings, and direct pay discounts, enabling borrowers to lower their interest rates.

- No Prepayment Penalty

FreedomPlus does not have a prepayment penalty.

- Origination Fee

Charges ranging from 1.99% to 6.99% of the total loan amount may increase the overall cost of borrowing.

- Lack of Mobile App

Absence of a mobile app for loan management may inconvenience borrowers who prefer managing their loans on the go.

- Not Available in All States

Loans not offered in all states, restricting accessibility for certain borrowers.

- Late Payment Fees

Fees of $15 or 5% of the amount due (whichever is greater) may apply for missed payments, potentially increasing the loan cost.

- Higher Minimum Amount

The lowest personal loan amount you can get with FreedomPlus is $5,000.

- Fixed Repayment Terms

Limited flexibility in loan terms, with repayment terms ranging from two to five years, may not suit all borrowers' needs.

Customer Experience

- 4.7/5 on BBB customer reviews (+700 reviews): BB customer reviews allow customers to post positive, negative, or neutral reviews about marketplace experiences.

- 4.8/5 on Trustpilot ( 1800 reviews): TrustScore is also an overall measurement of reviewer satisfaction, represented numerically from 1 to 5.

Achieve | |

|---|---|

iOS App Score | 4.5 |

Android App Score | 3.3 |

BBB Rating | N/A |

Contact Options | phone |

Availability | 5 am – 5 pm (PT) |

To reach Achieve's customer service, borrowers can contact them via phone or email. The customer service team can provide assistance with loan inquiries, payment issues, or any other concerns.

What Else You Should Know?

Before applying for a personal loan with Achieve, it's important to understand additional factors that could impact your borrowing experience:

-

Is Achieve good for debt consolidation?

Achieve is a decent option if you’re looking for a debt consolidation loan. You can borrow $5,000 -$50,000 and the lender also offers direct payment to creditors. This means that you don’t need to wait for the loan funds to arrive.

Achieve will pay out to designated creditors on your behalf, and then provide the remainder of the funds to you. However, you do need to be prepared for a loan origination fee.

-

What is the funding time?

The funding time for Achieve Personal Loans is typically within three business days after approval. Once a borrower's loan application is approved, Achieve aims to disburse the funds to the borrower's designated bank account swiftly, ensuring quick access to the requested financing.

However, actual funding times may vary depending on factors such as the borrower's bank processing times and the complexity of the loan application.

-

Can I pay off a Achieve loan early?

Achieve does not have any prepayment fees, so it is possible to repay your loan early either in a lump sum or by making additional payments.

However, if you are thinking of switching to another lender, it is worth considering the origination fee that was paid at the start of your Achieve loan and factoring this into your calculations.

-

What Happens If I miss a payment?

If you miss a payment on your Achieve Personal Loan, you may incur a late fee.

Achieve typically charges a late fee of $15 or 5% of the amount due, whichever is greater, for payments that are at least 11 days late. It's essential to communicate with Achieve promptly if you anticipate difficulty making a payment.

Missing payments can also have negative consequences for your credit score and loan status, so it's crucial to address any issues promptly to avoid further financial implications.

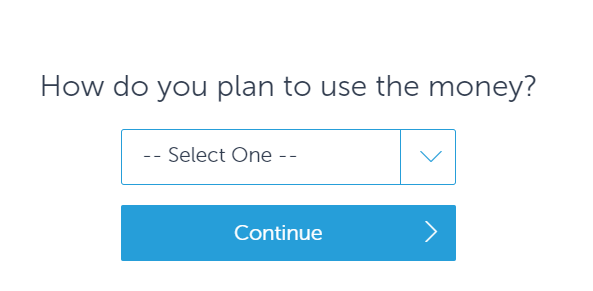

What Can a Achieve Personal Loan Be Used For?

An Achieve Personal Loan can be used for a variety of purposes, including:

- Debt Consolidation: Combining multiple debts into a single loan to simplify payments and potentially lower interest rates.

- Home Improvements: Financing renovations, repairs, or upgrades to your home.

- Weddings and Events: Covering expenses related to weddings, celebrations, or special occasions.

- Travel and Vacations: Funding travel expenses such as airfare, accommodations, and activities.

- Medical Expenses: Paying for medical bills, treatments, or procedures.

- Moving Expenses: Covering costs associated with relocation, including moving services and deposits.

- Other Personal Needs: Meeting unexpected expenses, making large purchases, or addressing financial emergencies.

Achieve Personal Loans offer flexibility in usage, allowing borrowers to address a range of financial needs and goals.

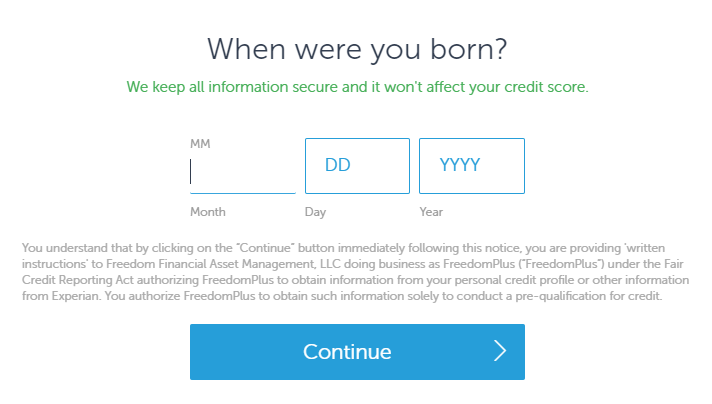

How to Apply For a Personal Loan With Achieve?

The Achieve application process is simple and quick, but you do have to speak with a representative about your loan. You first answer some questions about how much money you need and for what.

You then fill in some basic information about yourself.

Then, Achieve does a soft credit pull to see if you are eligible for a loan. A soft pull does not affect your credit. Then Achieve will call and discuss the loan with you and the things you should consider. They will also verify the information you put on your application.

They can also discuss with you customizing your loan to save you money and increase personal loan eligibility. For example, Achieve offers discounts for adding a co-applicant and paying off your creditors directly. There is also a retirement discount for those who have over $40,000 in a retirement account.

They will do a hard pull and let you know if you have been approved. You may still need to upload documents to verify your ID, income, or address. You then will sign loan documents and funds are usually in your account within 48 hours of applying..

Achieve FAQs

Is Achieves a good place to get a loan?

Achieve offers loans with a decent maximum amount and reasonable rates, depending on your circumstances. You do need a decent credit score to qualify, which may be a barrier to some. So, this does make Achieve a good option if you have fair credit.

Does Achieve check your bank account?

Achieve does require applicants to declare their income and employment status. You will also need to supply a valid ID as part of the loan application. Achieve will need to verify your income and may check your bank account.

However, in many cases, supplying supporting documentation such as pay stubs, bank statements or tax returns could negate the need to check your bank account.

If you can't meet the minimum requirements, you can compare other personal loan lenders. Keep in mind to pre-qualify so your credit score won't hurt. Also, there are alternatives to personal loans you may want to consider.

Is Achieve better than RocketLoans?

RocketLoans loan amount is slightly higher, but the lowest possible rate is higher. Additionally, RocketLoans requires a higher minimum FICO score, a minimum income and two years of credit history.

This means that in many cases, Achieve is likely to be the better option. You can qualify with a slightly lower credit score, and if you have good credit, you’ll qualify for a lower rate. So, unless you need that extra loan amount, opt for Achieve.

Is Achieve better than Discover?

Discover has a lower maximum loan amount and the starting APR is higher. However, at the top end of the scale, the rates are lower than Achieve. Discover also has more stringent applicant requirements. You need an excellent credit score to qualify.

The only advantage of Discover is the lender has a completely digital application process. This speeds up approval decisions and you can typically receive funds within one business day. So, unless you are in need of quick cash and can meet the credit score requirements, Achieve is likely to be a better choice.

Alternative Personal Loans Lenders

APR Range

The annual percentage rate (APR) is the total annual cost of borrowing money. This rate includes the interest rate as well as any additional finance charges. When you take out a personal loan, for example, you may be required to pay loan origination fees.

| 8.99% – 29.99%

| 9.11% – 29.99%

| 10.49% – 19.49% APR

|

Term

The term of your loan is the amount of time you have to repay it. For example, if you get a 24 months personal loan, the loan term is 24 months.

| 24-84 months

| 36-60 months

| 12-60 months

|

Loan Amount | $5,000 – $100,000

| $2,000 -$45,000

| $2,000 – $30,000

|

Minimum Score | 680

| 640

| 680

|

Funding Time | Up to 7 days

| As soon as same day

| Up to 5 days

|

Review Personal Loan Top Lenders

Compare Alternatives

Achieve vs Upstart vs Avant

Avant is best suited for people with bad credit, whereas Upstart offers small loans and quick funding. Finally, Achieve is appropriate if you require a large loan or a joint loan. When compared to one another, each of these lenders has advantages and disadvantages.

Read Full Comparison: Achieve Vs Upstart Vs Avant: Choose The Right Personal Loan

Achieve vs LendingPoint vs Avant

Achieve is an online lender that only works with relatively large loan amounts and also provides joint loans. Avant caters to people with low credit scores and focuses on providing quick access to funds.

Finally, LendingPoint is a similar option to Avant in many ways, such as its acceptance of lower credit scores and quick application process.

Read Full Comparison: LendingPoint vs Achieve vs Avant: Which Personal Loan Is Better?