Table of Content

You have loads of different credit cards available to choose from these days. They will carry their own respective rewards and perks. It is a good idea to do some research to see which Citi card could be the optimal fit for your needs.

This particular comparison will be looking at what the Citi Custom Cash℠ Card and the Citi® Double Cash Card have to offer. This includes highlighting the things they have in common and where they deviate from one another. You should then be able to see if one is better for you than the other.

General Comparison

|  | |

|---|---|---|

Citi® Double Cash Card | Citi Custom Cash℠ Card | |

Annual Fee | $0 | $0 |

Rewards | 2% cash back rewards rate – 1% every time you swipe and another 1% upon payment. | 5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter. |

Welcome bonus | $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening | $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back). |

0% Intro APR | 18 months on balance transfers, then 19.24% – 29.24% (Variable) APR | 15 months on purchases and balance transfers, then 19.24% – 29.24% (Variable)

APR |

Foreign Transaction Fee | 3% | 3% |

Purchase APR | 19.24% – 29.24% (Variable) | 19.24% – 29.24% (Variable)

|

Read Review | Read Review |

Simulation: Which Card Gives More Rewards?

You can get a good feeling for what types of rewards you can get with a card when you conduct a worked-out example.

Here is a look at a comparison between the rewards for these two cards:

|  | |

|---|---|---|

Spend Per Category | Citi® Double Cash Card | Citi Custom Cash℠ Card |

$10,000 – U.S Supermarkets | $200 | $340 |

$3,000 – Restaurants

| $60 | $30 |

$1,500 – Airline | $30 | $15 |

$1,500 – Hotels | $30 | $15 |

$4,000 – Gas | $80 | $40 |

Estimated Annual Value | $400 | $440 |

* The Citi Double Cash calculated according to 2% cash back - please keep in mind you'll get the additional 1% upon payment.

These two cards had very similar results when it came to the level of cashback you could get.

However, keep in mind to adjust the numbers to your regular spending categories, which may be different – so the exact calculation depends on your personal habits .

Compare Welcome Bonus And Fees

The Double Cash card offers $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening as well as 0% intro APR for 18 months on balance transfers. However, with the Custom Cash card you are able to get $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back).

Neither of these cards charges any annual fee and both have a 3% foreign transaction charge if you are not dealing in USD. The Citi Custom Cash Card has 0% intro APR for 15 months on purchases and balance transfers, with no such into APR being on offer with the Double Cash card. The APR thereafter for the Citi Custom Cash Card and for the Double Cash card is 19.24% – 29.24% (Variable).

Compare The Perks

There are going to be some areas that both of these cards have in common and other areas where they differ from one another. Here is a look at those commonalities and core differences:

Constant Customer Service: With both of these cards, you will get access to 24/7 customer service, including special lines for travel issues.

No Liability on Unauthorized Charges: If you notice any unauthorized charges on your statement, then you will not have to pay for them with either of these cards.

Digital Wallets: You are able to use digital wallets with both cards that speed up the online checkout process and allow you to unlock all of the great perks associated with these cards.

Citi Entertainment: With both of these cards you will get access to the Citi Entertainment program which allows you to avail of different types of music, sports coverage, and other types of perks.

Automatic Alerts: You will be able to set up alerts and get them sent to you automatically about your balance levels, due payments, and when you go past your credit limit.

Choose Payment Date: With this card, you are able to decide on what date you pay your bill.

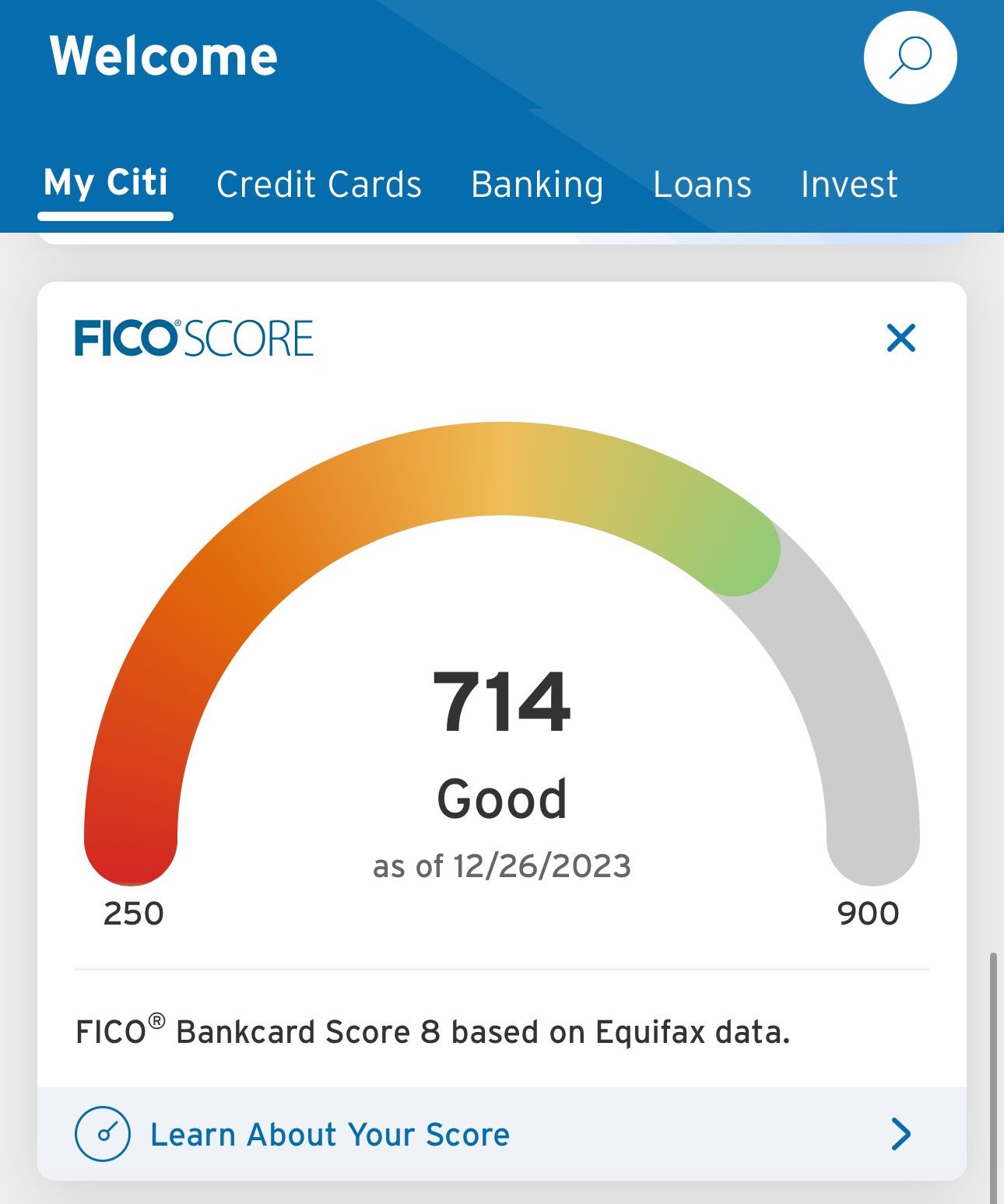

Free FICO Score: With this card, you will get free access to your FICO Score.

Compare The Drawbacks

There are no perfect financial products, so it is important to be aware of the potential drawbacks of a new credit card before you sign up.

Here we’ll highlight some of the possible negatives to help you make an informed decision.

Citi® Double Cash Card

- No Signup Offer

Unlike most other credit cards, you will not get any sort of signup offer with this credit card.

- Not the Biggest Rewards

You will never get more than 2% cashback on any spending category with this card.

Citi Custom Cash℠ Card

- Top Spend Cap

There is a cap on the higher cashback rate – 5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter.

- Single Bonus Category

You will only be able to get the bonus cashback on a single category of spending.

Compare Redemption Options

With the Citi Custom Cash Card, you will get 5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter. The following categories are: gas, restaurants, groceries, select travel, select transit, certain streaming services, home improvement stores, fitness clubs, live entertainment.

With the Double Cash card, you will initially get 1% cashback when you make any type of purchase, as well as getting another 1% cashback on your purchases when you make your minimum due payment on time.

Citi also has a number of reward redemption options that include:

- Checks: You can request a check. You can also take a credit towards your Citi savings or checking account.

- Statement Credit: You can redeem your rewards for a statement credit.

- Convert to ThankYou Points: If you have a minimum rewards balance of $1, you can convert your rewards to Citi ThankYou points.

- You can also use them in other ways, such as spending on gift cards, Amazon.com, and on travel.

Top Offers

Top Offers

Top Offers From Our Partners

How to Maximize Cards Benefits?

If you want to make the best use of your Citi Custom Cash, there are some tips to help you:

Use for Everyday Expenses: As this card offers dependability, you will know how much you will always earn in cashback when making everyday purchases, so it can be a handy day-to-day type of card.

Pay Your Minimums: In order to get the full 2% cashback on your purchases, you need to make sure that you meet the minimum due payment each billing cycle.

If you want to make the best use of your Citi Double Cash , there are some tips to help you:

Max Out the Bonus Category: It is a good idea to try to make sure that you take full advantage of the 5% premium cashback rate for your biggest spending category every billing cycle.

Utilize the Welcome Offer: The signup bonus is a very good offer and allows you to get $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back).

Use Along With Other Cards: The higher cashback rate is a great offer, but the 1% cashback on other purchases is not as good. This is why you are best served using the Citi Custom Cash Card alongside other cards that might have better rewards.

Customer Reviews: Which Card Wins?

The Citi Custom Cash Card tends to have a good range of reviews. In terms of the positives, people really like the signup bonus, as well as the higher cashback that is on offer for your highest spending category. The negative reviews give out about the low cap on the premium cashback rate.

For the Double Cash card, people enjoy the predictability that is associated with using the card. Users also like the Citi mobile app and its easy to use features.

When You Might Want the Citi® Double Cash?

The Citi Double Cash is a great option that could be good you're looking for:

Predictability: This card will allow you to get the same rewards across the board, meaning that you can predict the rewards that you get.

Simplicity: With this card, you do not have to worry about any sort of caps or get confused with varying cashback rates as it always stays the same.

Incentives: Some people enjoy having an incentive to pay their bill. You will get the full 2% cashback only if you make the minimum due payment for the billing cycle.

Top Offers

Top Offers From Our Partners

When You Might Want the Citi Custom Cash℠ Card?

The Citi Custom Cash Card is a solid choice if you're looking for:

Signup Offers: This card has one of the best signup offers around, giving you $200 in cash when you spend $750 in purchases in your first three months.

Meet the Spending Cap: In spite of the threshold is generally low – make sure to utilize it completely.

Plan a big purchase: There is no annual fee in place and there is 0% intro APR for the first 15 months.

Compare The Alternatives

Both of these cards have some key differences. The Citi Custom Cash Card offers you a premium cashback rate on your highest spending category and has a great signup bonus.

The Double Cash card is more predictable in terms of the rewards that you make and offers a good base level if you make your minimum due payment each billing cycle.

However, there are a couple of alternatives that you may want to take a look before applying:

|

|

| |

|---|---|---|---|

Chase Freedom Flex℠ Card | Capital One Venture Rewards Credit Card | American Express EveryDay® Card | |

Annual Fee | $0

| $95

| $0

|

Rewards |

1-5%

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

|

1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

|

Welcome bonus |

$200

|

75,000 miles

75,000 miles once they spend $4,000 on purchases within 3 months from account opening

|

10,000 points

10,000 points after you spend $1,000 in purchases on your new card within the first 3 months

|

Foreign Transaction Fee | 3%

| $0

| 2.7%

|

Purchase APR | 20.49%–29.24% variable

| 19.99% – 29.99% (Variable)

| 18.24% – 28.24% Variable

|

FAQ

The 5% cashback bonus that is on offer through this type of credit card only covers up to $500 in relevant purchases in that category for the billing cycle.

Yes, you are able to get pre-approval. This allows you to see if you can qualify for this card without then needing to subject yourself to a hard credit check.

You will be able to redeem the cashback points through direct deposit, check, or as statement credit. You can also use them in other ways, such as spending on gift cards, Amazon.com, and on travel.

Perhaps you did not meet all of the requirements. You can ask the customer service team what you need to do to get accepted or you can look at other card options.

It is not very hard in order to get this card. The eligibility requirement are very achievable for most people and pre-approval is also a possibility.

Compare Citi Double Cash Card

The flat rate cash back on Citi Double Cash Card is higher – but usually, it may not be the best option. Here's The Smart Investor analysis.

Citi Double Cash Card vs Chase Freedom Unlimited: Which Card Is Best?

When comparing rotating categories to flat-rate cash back rewards, need to analyze the categories & calculate – which card gives you more?

When both cards offer the same flat rate cashback, we should see beyond it. Which card is better? Here's The Smart Investor full analysis.

Citi Double Cash vs Wells Fargo Active Cash: Which Card Wins?

Top Offers

Top Offers

Top Offers From Our Partners

Compare Citi Custom Cash Card

The Citi Custom cash offers high cashback on your preferred category, but it's very limited in rewards compared to the Blue Cash Preferred

Amex Blue Cash Preferred vs. Citi Custom Cash Card: Which Card Is Best?

When it comes to cashback potential, the Chase Freedom Unlimited wins, especially for those who frequently engage in travel-related expenses

Chase Freedom Unlimited vs. Citi Custom Cash Card: Which Card Is Best?

Both cards provide comparable cashback terms, with Citi Custom Cash being more flexible as it autonomously selects your preferred category.

Unlike the Amex Blue Cash Everyday, Citi Custom Cash automatically adjusts its cashback categories based on your spending habits.

Citi Custom Cash vs. Amex Blue Cash Everyday: Which Card Is Best?

Citi Custom Cash Card and the BofA Customized Cash Rewards have similar reward structures but some significant differences. How they compare?

Citi Custom Cash Card vs. BofA Customized Cash Rewards: Which Card Is Best?