Marriott Bonvoy Brilliant® American Express® Card and the Marriott Bonvoy Bevy™ American Express® Card are two premium credit card offerings that cater to travelers and individuals seeking an array of exclusive perks and benefits.

In this comparison, we'll delve into the unique features of both cards, helping you decide which one best suits your preferences and lifestyle.

General Comparison: Marriott Bonvoy Brilliant vs. Bevy

The Marriot Brilliant card carries a higher price tag compared to the Bevy card, but the majority of the cost discrepancy can be attributed to its extra travel benefits such as Platinum elite status, statements credits, and more.

In terms of points rewards and welcome bonuses, both cards present fairly comparable terms and benefits.

|

| |

|---|---|---|

Marriott Bonvoy Bevy | Marriott Bonvoy Brilliant | |

Annual Fee | $250 See Rates and Fees. | $650. See Rates and Fees. |

Rewards | 6X points on purchases at hotels participating in Marriott Bonvoy, 4X points at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets (up to $15,000 in combined purchases per year, then 2X points), 2X points on all other purchases. Terms Apply. | 6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases |

Welcome bonus | 85,000 Marriott Bonvoy bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership | 95,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | ||

Purchase APR | 20.99% – 29.99% Variable | 20.99% – 29.99% Variable

|

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Compare Rewards: Marriott Bonvoy Brilliant vs. Bevy

While the Marriot Brilliant card comes with a higher annual fee compared to the Bevy card, the average consumer might find that they can accumulate more Marriott points with the Bevy card.

This is primarily due to the more favorable rewards ratio offered by the Bevy card for supermarket spending, which makes a significant difference in points accrual.

|

| |

|---|---|---|

Spend Per Category | Marriott Bonvoy Bevy | Marriott Bonvoy Brilliant |

$10,000 – U.S Supermarkets | 40,000 points | 20,000 points |

$5,000 – Restaurants | 20,000 points | 15,000 points |

$6,000 – Hotels | 36,000 points | 36,000 points |

$8,000 – Airline

| 16,000 points | 24,000 points |

$4,000 – Gas | 8,000 points | 8,000 points |

Total Points | 120,000 points | 103,000 points |

With the Marriott cards, you earn and redeem points for free nights at Marriott hotels, travel experiences, and exclusive events. Also, you can transfer points to airline or use it to pay for car rentals, merchandise or book an experience with Marriot Moments.

Which Travel Benefits You'll Get On Both Cards?

Both cards offer additional benefits including:

- 15/25 Elite Night Credits: With the Marriot Bevy card, you can earn 15 elite night credits each calendar year, while the Brilliant card offers 25 elite night credits, helping you progress in Marriott Bonvoy Elite status.

- 1 Free Night Award: The Bevy card provides 1 free night award after spending $15,000 in a calendar year, whereas the Brilliant card offers an annual free night award upon Card renewal.

- Amex Offers: Access Amex Offers to earn rewards on qualifying purchases directly through the AmericanExpress® App.

- Free Premium Wi-Fi: Enjoy complimentary in-room, premium Wi-Fi at participating Marriott Bonvoy hotels.

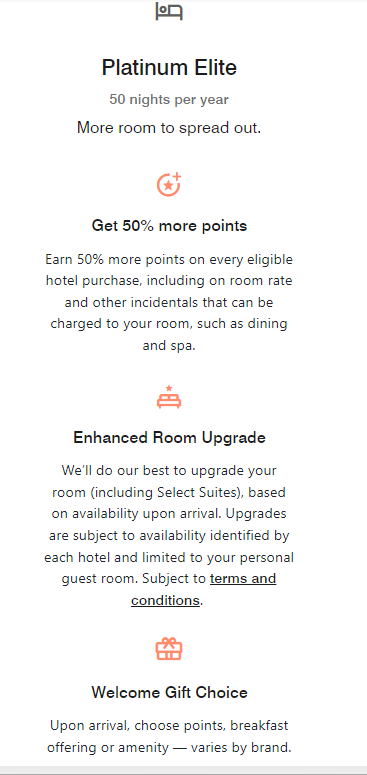

- Marriott Bonvoy Gold/Platinum Elite: The Bevy card grants Gold Elite status, while the Brilliant card offers Platinum Elite status.

Which Insurance Benefits You'll Get On Both Cards?

- Car Rental Loss and Damage Insurance: When you reserve and pay for a rental vehicle with your Eligible Card, declining the rental counter's collision damage waiver, you can be protected against damage or theft in specific regions, subject to certain exclusions and limitations.

- Baggage Insurance Plan: When you purchase a common carrier vehicle ticket with your Eligible Card, you can receive coverage for lost, damaged, or stolen baggage.

- Trip Cancellation and Interruption Insurance: Buying a round-trip with your Marriott Bonvoy Brilliant American Express Card can provide assistance in the event of trip cancellation or interruption, following the specified terms and conditions.

- Trip Delay Insurance: If your trip faces a delay of more than 6 hours due to a covered reason and you paid for the round-trip with your Eligible Card.

- Purchase Protection: Eligible purchases made with your card can be protected for up to 90 days from the purchase date, offering coverage for theft, accidental damage, or loss.

- Extended Warranty: When you use your Eligible Card for eligible purchases, you can receive an extra year of warranty coverage for warranties lasting 5 years or less in the United States or its territories.

- Cell Phone Protection: This embedded benefit provides reimbursement for repair or replacement costs after cell phone damage or theft.

Top Offers

Top Offers From Our Partners

Top Offers

Which Benefits You'll Get Only With The Brilliant Card?

The Marriot Brilliant credit card offers some unique, premium benefits for cardholders that you won't be able to get with the Marriot Bevy card:

- Earned Choice Award: After spending $60,000 on eligible purchases in a calendar year, you can choose an Earned Choice Award benefit such as getting Suite Night Awards™ (five) to redeem for upgrades to select premium rooms and suites, gift Marriott Bonvoy® Silver Elite Status to a family member or friend and more.

- $300 Brilliant Dining Credit: Get up to $300 in statement credits annually ($25 per month) for eligible restaurant purchases with the Brilliant card.

- $100 Marriott Bonvoy Property Credit: Get up to a $100 property credit for qualifying charges at The Ritz-Carlton or St. Regis hotels when booking a special rate for a minimum 2-night stay.

- Fee Credit for Global Entry or TSA Precheck: Receive a statement credit every 4 years for Global Entry or every 4.5 years for TSA PreCheck application fees when paid with your card.

- Priority Pass Select: Enjoy unlimited lounge visits for yourself and up to two guests at no extra charge with complimentary Priority Pass Select membership, offering access to over 1,200 airport lounges worldwide.

Which Benefits You'll Get Only With The Bevy Card?

- 1,000 Bonus Points: Earn 1,000 bonus points for each eligible stay booked directly with Marriott using both cards.

When You Might Want the Marriot Brilliant Card?

You might prefer the Marriott Brilliant card over the Marriott Bevy card if:

- You're A Frequent Traveler: If you travel extensively and stay at Marriott properties often, the Brilliant card's 25 Elite Night Credits can help you achieve higher Marriott Bonvoy Elite status more quickly, providing additional travel benefits and recognition.

- You want Premium Travel Benefits: The Brilliant card provides a $300 dining credit at Marriott restaurants as well as priority pass access and other premium perks.

- You want Platinum Elite Status: The Brilliant card grants Platinum Elite status, offering even more significant hotel perks and upgrades compared to the Gold Elite status provided by the Bevy card.

When You Might Want the Marriot Bevy Card?

You might prefer the Marriott Bevy card over the Marriott Brilliant card if:

- Versatile Lifestyle: If you're looking for a more versatile credit card that provides rewards and benefits beyond just travel, the Bevy card is a better choice. It offers a broader range of lifestyle perks, such as dining, entertainment, and cashback rewards.

- Lower Annual Fee: The Bevy card typically comes with a lower annual fee compared to the Brilliant card, making it a more cost-effective option if you want premium benefits without the higher cost.

- Focused on Earning Points: If your primary goal is to earn Marriott Bonvoy points for future travel without focusing on elite status, both cards offer similar points rewards and welcome bonuses. The Bevy card can be a more economical choice.

Compare The Alternatives

If you're looking for a travel rewards credit card– there are some excellent alternatives you may want to consider:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare Marriott Bonvoy Brilliant Card

While there is no big difference when it comes to points rewards, the Brilliant offers lounge access, credit statements, and Platinum status.

There is no real difference in annual cashback, despite the difference in annual fees. However, the Brilliant card offers premium hotel perks.

Marriott Bonvoy Bountiful vs Brilliant: : Which Card Is Best?

While the Amex Platinum offers extensive travel perks and redemption options, the Marriott Brilliant Card has better hotel-specific perks.

Amex Platinum Card vs. Marriott Bonvoy Brilliant Card: Which Luxury Travel Card Is Best?

While the Brilliant card focuses on benefits tailored to Marriott enthusiasts, the Chase Reserve focuses on general, luxury travel perks.

Marriott Bonvoy Brilliant vs. Chase Sapphire Reserve: Which Luxury Travel Card Is Best?

Surprisingly, while having a lower annual fee, the Hilton Amex Aspire's estimated cashback value is higher than the Marriot Brilliant's card.

Marriott Bonvoy Brilliant vs. Hilton Amex Aspire: : Which Luxury Hotel Card Is Best?

Compare Marriott Bonvoy Bevy Card

The Marriott Bonvoy Bevy is more expensive than the Boundless. Are the extra benefits worth the difference? We don't think so. Here's why.

Both Marriott Bonvoy Bountiful and Bevy offer the same cashback rates but different hotel and travel perks. How do you decide between them?