All information about Hilton Honors American Express Aspire Card has been collected independently by The Smart Investor. AHilton Honors American Express Aspire Card is no longer available through The Smart Investor.

Rewards Plan

Welcome Bonus

Our Rating

0% Intro

N/A

Annual Fee

APR

- Elite Status

- Statement Credit

- Lower Point Values

- High Annual Fee

Rewards Plan

Welcome Bonus

Our Rating

PROS

- Elite Status

- Statement Credit

CONS

- Lower Point Values

- High Annual Fee

APR

20.99% - 29.99% variable

Annual Fee

$550

0% Intro

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

The Hilton Honors American Express Aspire Card is a premium travel credit card tailored for frequent Hilton hotel guests. While the point value may not be as generous as some other rewards programs, the Hilton Honors American Express Aspire card does offer some excellent value.

Earning points is made easy with the card, offering 14X Hilton Honors bonus points when you make eligible purchases on your card at participating hotels or resorts within the Hilton Portfolio, 7X Hilton Honors bonus points on eligible purchases on your card for: Flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and U.S. restaurants, 3X Hilton Honors bonus points on other eligible purchases .

The benefits include $400 in Hilton property credits, $200 in flight purchase credits, car rental elite status, and cellphone protection, justify the cost. The card offers annual fee night awards applicable at nearly any Hilton property, a unique feature not common among hotel credit cards.

With the Hilton Honors Diamond status cardholders earn complimentary room upgrades, access to executive lounges for complimentary breakfast and evening snacks, as well as guaranteed room availability with 48-hour notice.

However, unless you do stay at Hilton resorts and hotels at least a few times per year to fully benefit from this card and offset the annual fee. If you’re an infrequent visitor or only stay at Hilton locations once in a while, this is not the right card for you.

Does the card provide car rental insurance?

Unfortunately, this card does not provide car rental insurance even if you pay for your rental with your card.

What are card income requirements?

There are no official card income requirements for this card, but you do need to have good to excellent credit to qualify. While income is considered, it is not the only factor that determines whether your application will be successful.

Can I get pre-approved?

Yes, American Express does allow you to check if you qualify for the Hilton Honors Amex Aspire card without any impact to your credit. There is an apply button on the American Express website with reassurance that there will be no damage to your credit from simply applying.

In this Review

Estimating Your Rewards: A Practical Simulation

The following table is a simulation of rewards that showcases the potential benefits of using the Hilton Honors American Express Aspire Card. It provides an estimated breakdown of the rewards you could earn based on your typical spending habits in various categories.

While this table can help you understand the potential advantages of the card, it is important to keep in mind that the figures presented are only estimates, and your actual rewards may vary depending on your individual spending patterns and other factors.

| |

|---|---|

Spend Per Category | Hilton Honors American Express Aspire Card

|

$10,000 – U.S Supermarkets | 30,000 points |

$3,000 – Restaurants

| 21,000 points |

$4,000 – Airline | 28,000 points |

$4,000 – Hotels | 56,000 points |

$4,000 – Gas | 12,000 points |

Estimated Annual Points | 147,000 Points |

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

Pros and Cons

Just like any other credit card, the Hilton Aspire Card has some advantages and disadvantages:

Pros | Cons |

|---|---|

Hilton Honors Diamond Status | Low Points Value |

Hilton Resort Statement Credit | High Annual Fee |

Airline Fee Statement Credit | No Introductory APR |

Hilton on Property Credit | Variable Award Night Prices |

Reward Nights | Limited Transfer Partners |

Complimentary Priority Pass | Specific Enrollment Requirements |

- Hilton Honors Diamond Status

Providing your card account remains open, you will automatically qualify for Diamond Hilton Elite Status. This provides a number of benefits including free breakfast, room upgrades, bonus points and more.

- $200 Airline Fee Statement Credit

You can select an airline and you will then receive up to $200 of statement credit for airline incidentals each calendar year.

This includes spending by card authorized users. It can be applied to cancellation or change fees, lounge passes or checked bag fees.

- No Foreign Transaction Fees

When you make purchases outside the United States using your card, you won't be charged any foreign transaction fees.

- $400 Hilton Resort Statement Credit

You can receive up to $400 per calendar year in statement credit for any incidentals that are charged to your card when you’re staying at participating Hilton resorts.

This includes room rates, taxes, spa treatments, activities, and dining. However, it cannot be applied to non refundable rates or advance purchases.

- Complimentary Priority Pass

You will also receive an unlimited Priority Pass which provides lounge access for yourself and up to two guests. If you have additional guests, they can enter the lounge with you for a fee, which is currently $32 per visit.

- $100 Hilton on Property Credit

When you book a minimum of a two night paid stay at Conrad or Waldorf Astoria property through the Hilton Honors website, you can receive up to a $100 property credit to cover incidentals that you incur during your stay.

- Free Night Reward

You can receive one reward night at almost any Hilton location after you open your account. You will also receive another reward night on your cardmember anniversary every year.

There is the option for a second reward night if you hit the spend minimum of $60,000 on your card during the calendar year.

- Lower Point Values

Although there is a generous points rewards rate, it is important to note that Hilton Honors points have a lower value compared to most other reward programs.

For example, Hilton Honors points have a typical value of 0.6 cent each compared to World of Hyatt points which have a value of 2.1 cents each depending on the redemption method.

- High Annual Fee

While the card does have some very nice benefits, it has a hefty annual fee (the highest among Hilton cards) which casual Hilton visitors may struggle to offset.

Additionally, there is no fee waiver for the first year, so you will need to pay it from the offset.

- Variable Award Night Prices

Hilton's variable award charts may result in uncertain point values for award nights, potentially affecting the perceived value of Hilton Honors points.

- Limited Transfer Partners

Unlike some other rewards programs, Hilton Honors has fewer transfer partners, potentially limiting flexibility in using points for non-hotel options.

- Specific Enrollment Requirements

Some benefits, such as Clear Plus membership and cellphone protection, require enrollment, adding an extra step for cardholders.

Hilton Aspire Additional Benefits

The Hilton Honors American Express Aspire Card offers a variety of additional benefits including travel protections:

Dispute Resolution: If faced with unrecognized charges or billing issues, American Express collaborates with you and the merchant to resolve the problem promptly.

ShopRunner: Enjoy complimentary membership with ShopRunner, providing free 2-day shipping on eligible items from a network of 100+ online stores, accessible by enrolling with your eligible Card at shoprunner.com/americanexpress.

- Concierge Service: Access a complimentary concierge service to assist with lifestyle needs, providing expertise on various matters such as restaurant recommendations and event ticket purchases.

- Car Rental Loss and Damage Insurance: When you reserve and pay for a rental vehicle with your Card, declining the rental counter's collision damage waiver, you can be protected against damage or theft in specific regions, subject to certain exclusions and limitations.

- $189 CLEAR® Plus Credit: Cover the cost of a CLEAR Plus Membership, enhancing airport security clearance with biometric verification, excluding any applicable taxes.

- Baggage Insurance Plan: When you purchase a common carrier vehicle ticket with your Eligible Card, you can receive coverage for lost, damaged, or stolen baggage.

- Trip Cancellation and Interruption Insurance: Buying a round-trip with your s Card can provide assistance in the event of trip cancellation or interruption, following the specified terms and conditions.

- Trip Delay Insurance: If your trip faces a delay of more than 6 hours due to a covered reason and you paid for the round-trip with your Eligible Card.

- Purchase Protection: Eligible purchases made with your card can be protected for up to 90 days from the purchase date, offering coverage for theft, accidental damage, or loss.

- Extended Warranty: When you use your card for eligible purchases, you can receive an extra year of warranty coverage for warranties lasting 5 years or less in the United States or its territories.

- Cell Phone Protection: This embedded benefit provides reimbursement for repair or replacement costs after cell phone damage or theft.

Hilton Aspire Redemption Options

The Hilton Honors American Express Aspire Card offers a variety of redemption options for the Hilton Honors points it earns. Here are some key ways to redeem points with this card:

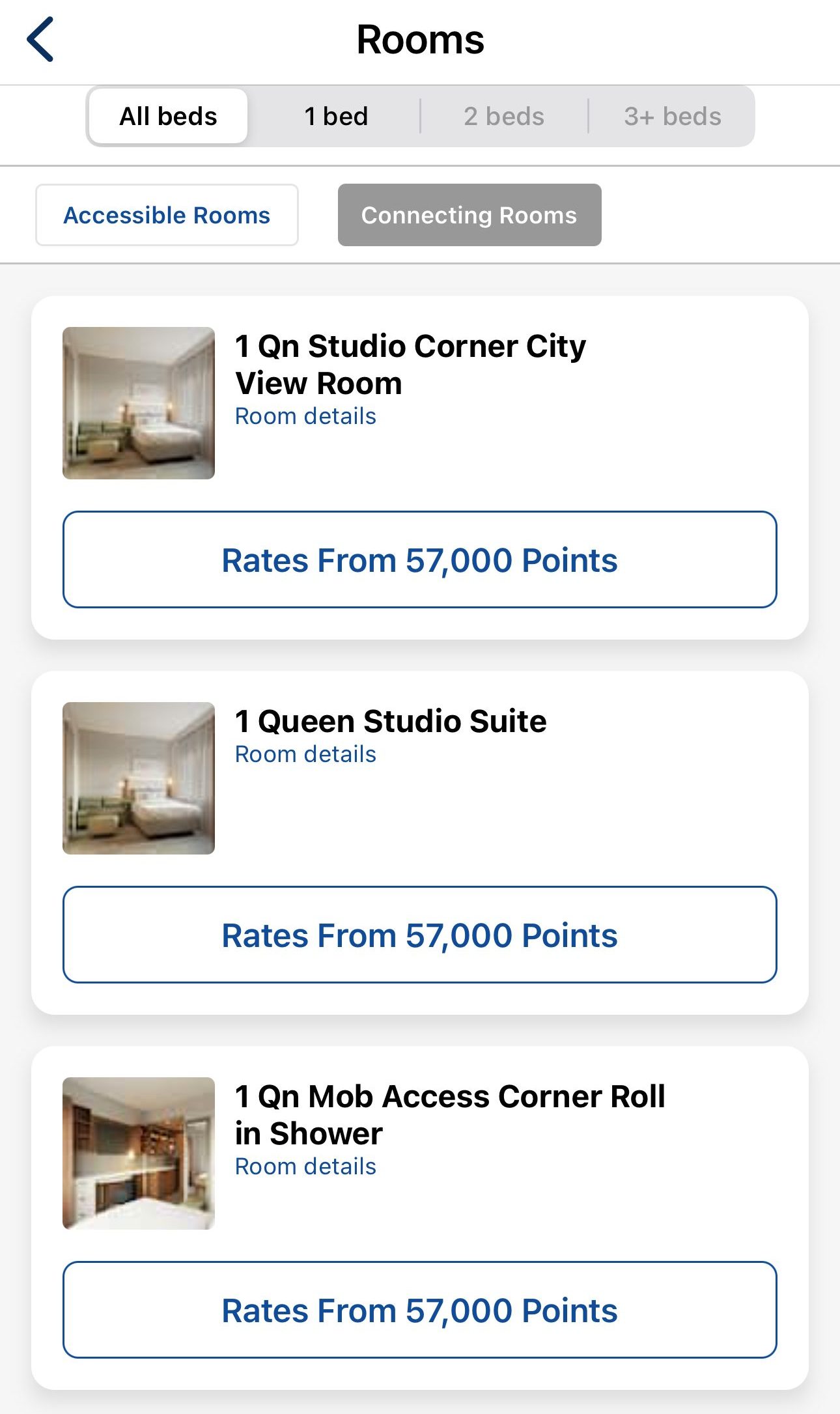

Standard Award Nights: Use your Hilton Honors points to book standard award nights at Hilton properties worldwide. The number of points required varies based on the hotel, room type, and dates.

Points & Money: Enjoy flexibility by combining points with cash for your hotel bookings. This option allows you to use fewer points and pay a portion of the room rate with cash.

Premium Room Rewards: Redeem points for premium room types, such as suites or rooms with special amenities, offering an enhanced and more luxurious experience.

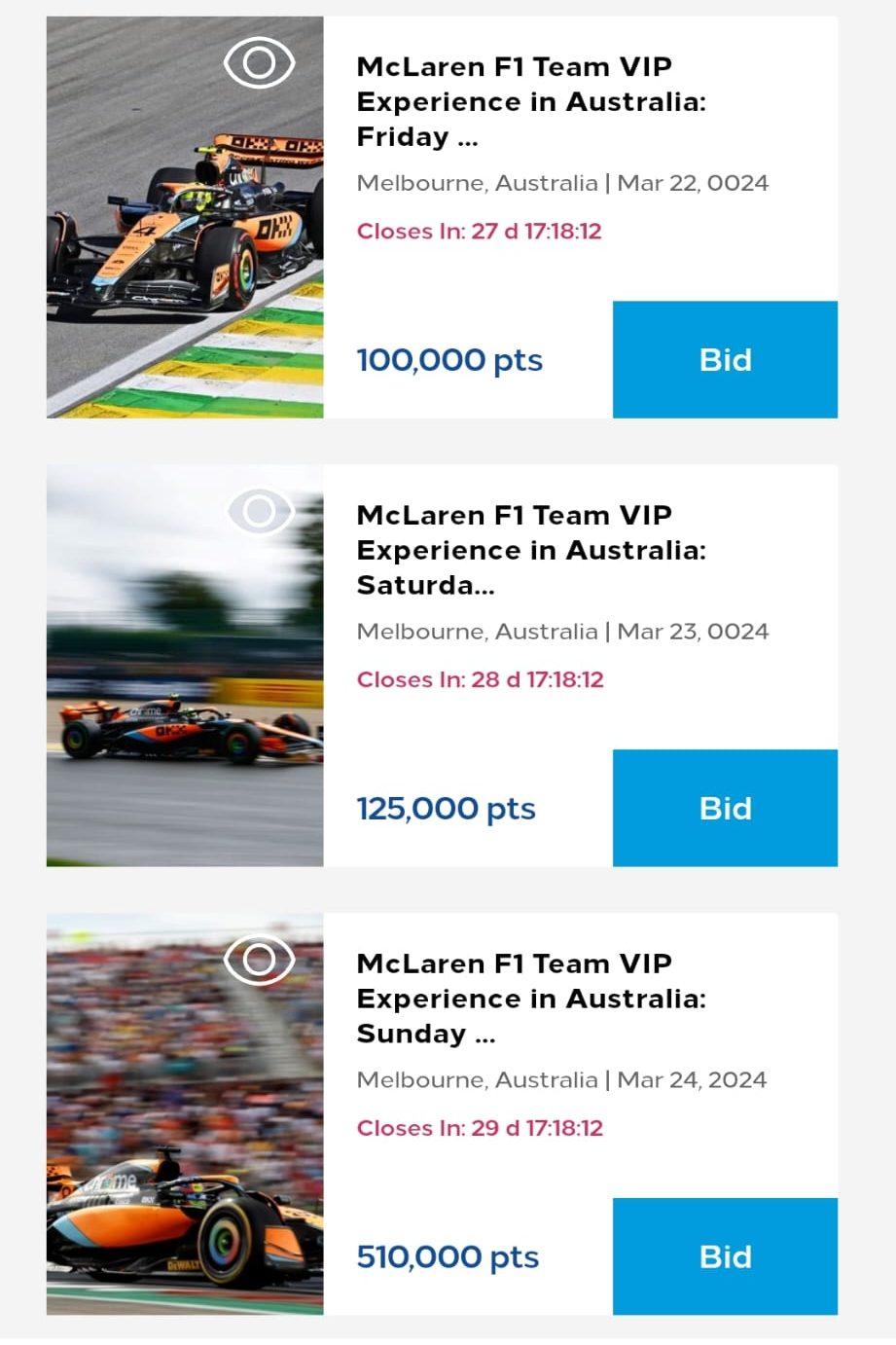

Experiences: Hilton Honors often provides opportunities to redeem points for unique experiences, including concerts, events, and exclusive access to various activities.

- Transfer Points: Hilton Honors points can be transferred to airline partners. While the transfer ratio varies, this option allows you to use points for flights with partner airlines.

Amazon Shop with Points: Link your Hilton Honors account to your Amazon account to use points for eligible purchases on Amazon.com.

Car Rentals: Redeem points for car rentals through Hilton's partners, allowing you to use points for travel-related expenses beyond hotel stays.

Donate Points: Hilton Honors allows you to donate your points to charitable organizations, contributing to causes you support.

It's important to note that the value of Hilton Honors points can vary, and it's advisable to consider the redemption options that align with your preferences and travel needs.

Who Should Consider The Hilton Aspire Card?

As this is a co-branded credit card, the Hilton Honors Amex is best for those who have Hilton as their preferred hotel chain. If you have a few trips planned each year and will stay at Hilton properties, this card could be a good choice for you. With the automatic status, spending bonuses and statement credit, it could easily offset the fairly hefty annual fee.

The card could also be a good choice if you are struggling to achieve higher elite status simply with your Hilton stays. The card provides automatic Diamond status, which is the program’s top tier.

This level of status provides room guarantees, lounge access, premium WiFi, gifts, points bonus and room upgrades, which could provide great value if you’ve been lingering in silver or gold status in previous years.

If you do travel but still want to compare hotel cards, here's an overview:

Card | Rewards | Bonus | Annual Fee | |

|---|---|---|---|---|

| 1X – 4X

4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.

| Up to 60,000 Bonus Points

30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening.*Opens offer details overlay Plus, up to 30,000 More Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Point, on up to $15,000 spent.

| $95 | |

| 3X – 12X

Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases | 130,000 points

130,000 Hilton Honors Bonus Points plus a Free Night Reward after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in the first 6 months of Card Membership

| $150 | |

| 3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

| 70,000 points

70,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

| $0 (Rates & Fees) | |

| 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 3 Free Nights

3 Free Nights (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months from your account opening

| $95 | |

| 2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

| 95,000 points

95,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership

| $650 |

How To Maximize Card Benefits: Tips

The card offers many benefits and rewards, so make sure you take advantage of them. There are some tips that can help you to get the most from it including:

-

Assess Your Preferred Airline Carefully

This card allows you to designate one airline and receive statement credit for incidentals that you incur with that airline. So, while this isn’t an airline co-branded card, it is important to think about which is your preferred airline.

-

Make the Most of Your Hotel Perks

You can also receive statement credit for incidentals that you incur when you stay at participating Hilton locations.

So, when you’re planning your stay, think about making the most of your hotel perks, as you can receive up to $250 of statement credit per year against these charges on your card.

-

Book Your Airfare, Bus or Train Tickets With Your Card

Although this is a hotel co-branded credit card, it is a good idea to book your common carrier tickets with your Hilton Honors Amex, as you will automatically qualify for up to $3,000 of baggage insurance for checked and carry on bags.

Top Offers

Top Offers From Our Partners

Top Offers

FAQs

How do I redeem rewards?

There are a number of options to redeem Hilton Honors points including merchandise, gift cards and room redemptions. You can also transfer your points to airline rewards programs with a typical redemption rate of 10:1.

If you want to use your points for an award stay, you can use the Point Explorer tool to calculate how many points you will need for your desired property.

You can explore all of the available redemption options by logging into your account.

How hard is it to get a Hilton Honors American Express Aspire card?

You do need to have good to excellent credit for this card, but American Express does allow you to check if you are likely to qualify without impacting your credit, making the process easier.

When it may not be a good idea?

Since this is a co-branded card, it is only a good idea if you’re a regular visitor with the Hilton group. If you don’t have any brand loyalty to Hilton, there are other travel rewards cards that would offer greater value for you.

Compare Hilton Aspire Card

If you can maximize your points, rewards, and benefits, the Hilton Aspire is our winner. But, if your spend is not so high – the Surpass wins.

Hilton Honors Surpass vs. Hilton Aspire Card: How They Compare?

Surprisingly, while having a lower annual fee, the Hilton Amex Aspire's estimated cashback value is higher than the Marriot Brilliant's card.

Marriott Bonvoy Brilliant vs. Hilton Amex Aspire: Side By Side Comparison

The Hilton Aspire is surprising with its higher estimated annual cashback value, but the Platinum card wins at premium travel perks.

Amex Platinum Card vs. Hilton Amex Aspire: Side By Side Comparison

The Hilton Amex Aspire offers excellent value for hotel perks, while the Chase Reserve card is best for flexibility and redemption options.

Chase Sapphire Reserve vs. Hilton Amex Aspire: Side By Side Comparison

The Hilton Aspire is surprising with its higher estimated annual cashback value, but the Platinum card wins at premium travel perks.

Amex Platinum Card vs. Hilton Amex Aspire: Side By Side Comparison