Table Of Content

The Apple Card is the credit card introduced by the iPhone maker in 2019 as a part of their attempt to break into the fintech industry. The Apple Card is issued by Goldman Sachs Bank.

For avid Apple customers, the Apple Card offers another avenue to connect your life through Apple products. Let’s get into what the Apple Card offers and whether it’s a good fit for you!

What Are The Main Benefits Of The Apple Card?

The Apple card offers a number of benefits to its users that differentiate itself from the credit cards of the more legacy players.

- Seamlessly Track Your Spending

The integration of the Apple Card into the wallet app on the iPhone allows users to easily track their spending on a sleek and well-developed app.

For many, much of a person’s online presence is centered around the Apple technological ecosystem, and the Apple Card allows these customers to integrate their personal finance and spending into this system.

This simplicity and connectiveness streamlines keeping track of spending and is a major draw for loyal Apple customers.

- No Fees

Most credit cards utilize fees, both hidden and explicit to profit from irresponsible spending habits. The Apple card does not charge any annual, over-the-limit, foreign transaction, or late fees.

The lack of fees gives you more leeway to spend how you’d like, but also allows for mistakes to be made with no dramatic consequences when paying off balances.

Many other cards are riddled with fees meant to punish you, so the Apple card being fee free is a breath of fresh air in the industry, and makes it one of the top shopping cards out there.

- Apple Savings Access

Apple Savings, a high-yield savings account by Goldman Sachs Bank USA in partnership with Apple, is exclusively available to Apple Card® holders. Seamlessly integrated within the Wallet app on your iPhone, it offers a notable 4.15% APY.

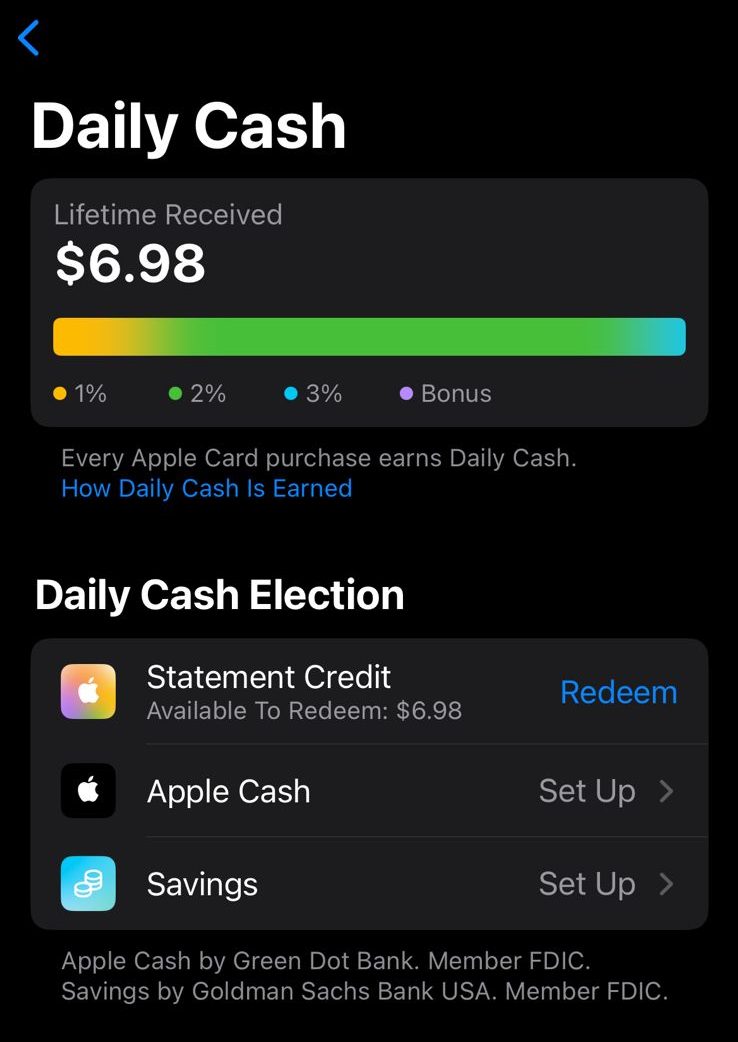

- Unlimited Daily Cash Back

One of the nicest features of the Apple card is unlimited cash back.

Unlike other cards that offer cash back in the form of points and expire or lose value, the Apple card returns cash directly into your account instantly.

There is also no limit on the amount of cash that you can take out per day. This allows you free reign over how you spend your cash.

- 3% Cash Back on Apple Purchases

If you are a frequent spender on Apple products, you could be rewarded with 3% cash back on every purchase! This includes all purchases of Apple products such as iPhones and Macs, as well as Apple services such as Apple Music and Apple TV.

This is one of my favorite features of the card, especially for customers who already spend a good chunk of income on Apple purchases.

If you can reap the benefits of this reward without having to change your spending habits, the Apple card may be for you!

- 2% Cash Back on Apple Pay purchases

I know I hate reaching into my wallet to grab my credit card to only put it back a second later.

If you are a fan of Apple Pay like I am, the Apple Card rewards you for all purchases made using Apple Pay. This perk applies to any purchases, giving you a lot of opportunities to get the most bang for your buck with the Apple Card.

Especially if you already use Apple Pay for many of your purchases, you could be getting rewarded for how you already spend your money!

Sign Up for

Our Newsletter

and special member-only perks.

- Bundle Family Finances

Apple also offers a family card that allows you to easily track and manage your family’s finances.

Up to two managers can create credit lines for others on the card. For teens, this provides a way to learn about responsible spending and tracking spending habits in a way that is not foreign to them.

Users over 18 can build their own credit history and work directly with their families to sustain and improve their credit rating.

- 3% Cash Back on Purchases with Select Merchants

Apple has developed partnerships with a number of large retailers to give 3% cash back on any purchase made through them.

These companies include Exxon, Nike, Uber, Panera Bread, Walgreens, and others. If you are already a loyal customer of these companies, you could be rewarded a ton of cash back for your normal spending.

Even if not, these partnerships incentivize spending at these certain places, and you can adjust your spending to receive the same benefits at other places, while also receiving cash back!

Apple Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

How to Maximize Apple Card Benefits?

Knowing the ins and out of your card can help you maximize its benefits, save money and get more rewards. Here are the main things to keep in mind:

- Use Apple Pay wherever it is accepted: With 2% cash back on every purchase made with Apple Pay, to get the most out of this perk, use Apple Pay wherever it is accepted.

- Shop as much as possible at Apple Card partner retailers: The Apple Card offers 3% cash back on purchases made at select retailers. You should make an effort to make routine purchases at these locations.

For example, buy gas at Exxon or Mobil stations or buy pharmaceutical products from Walgreens or Duane Reade. Being targeted with your spending can yield you free cash benefits.

- Purchase Apple products for all tech needs: You receive 3% cash back on all purchases of Apple products or services. To maximize this benefit, you should rely on Apple to fulfil all of your technological needs.

If you already have use most of Apple’s product offerings and plan on continuing to do this, the Apple card could generate a lot of benefits for you.

If you are thinking about making the switch to Apple products, getting the Apple Card and then buying all the products with the card could get you a ton of cash back.

How to Redeem Apple Card Benefits

Redeeming your cash back with an Apple card is easy and quick. Here are the steps you should take and the options you have when redeeming:

- Find how much cash back you have

- Go to the wallet app

- Tap the more button

- Click on Daily Cash

- Locate how much you’ve earned for any period of time

- Set up Apple Cash to use your daily cash

- Open the settings app and find wallet and apple pay

- Turn Apple cash on and tap Apple cash under the payment card

- Click continue and follow the instructions

- What can you do with Apple Cash

- Add money from your bank account and receive daily cash back from Apple Card purchases

- Make purchases with Apple Pay or Apple Card using Apple Cash balance

- Send money through iMessage and Wallet

How To Get An Apple Card?

Applying for an Apple card is made extremely easy, and even possible right from your phone! Follow these simple steps and you can be approved for an Apple Card in no time!

1. Apply for an Apple Card

- Open the wallet app and select the add button.

- Select Apply for the Apple Card, select continue and fill out the application.

- Read, review, and agree to the Apple Card Terms and Conditions policy.

- Review and accept your offered credit limit and APR.

2. If your application is accepted

- Accept the offer within 30 days of receiving it.

- Request a titanium card if you’d like a physical card.

- Manage your account in the wallet app by setting up payment schedules and review balances.

- Begin using the card to make purchases!

3. If your application if rejected

- Review the eligibility policy to receive an Apple card and see what does or doesn’t apply to you.

- Call directly and inquire why your application was declined.

Top Offers

Top Offers From Our Partners

Top Offers

FAQs

- Open Wallet App and tap Apple Card.

- Tap More and then Card Details.

- Select the message button and send a message requesting a credit limit increase.

- Goldman Sachs will consider your payment history on the Apple card and other relevant credit information before deciding whether to grand an increase of credit limit. You will likely need six months of payment history to be approved.

- Once you’ve accepted your offer, you can begin using the Apple Card through Apple Pay immediately.

- If you’re requested a physical card, follow the instructions on the packaging of the titanium Apple Card to activate it.

- If you do not have the packaging, go to the wallet app, select apple card, tap more and then card details, and select the activate card button. Finally tap having trouble activating card and chose Do not have Card Packaging.

- Locate the 16 digit code on the back of the physical card. If the code is not obviously present on the card, you may need to peel or scratch label off of the card to see the code.

- Go to the App Store and select the account profile button.

- Tap the Redeem Gift Card or Code button and follow the instructions on screen to either take a picture of the code or input it manually.

- You can choose whether you want to use Apple Cash payments on Apple Card purchases through the Wallet app.

- Tap the Apple Credit Card and select pay.

- Select payment type and tap Pay Now.

- Tap on your bank account and choose whether you’d like Apple cash on or off.

- If you want to use Apple Cash for purchases, turn it on, but if not, turn it off.

There is no set minimum threshold to be accepted for an apple card, but generally, applicants with scores above 660 are considered favorable candidates.

A credit score is not the only factor looked at, as your credit history and income are also evaluated.

If your score is too low, try to improve it over time to increase your chances of being approved later.

- Just like with any other credit card, the Apple card builds your credit score over time.

- To improve your score, simply make regular on time payments on your card and keep your balance as low as possible.

- Building credit on the Apple card works in a very similar way to that of other cards.

Review Cash Back Credit Cards

Chase Freedom Flex