The World of Hyatt Credit Card and the Hilton Honors American Express Surpass Card are both hotel credit cards, each affiliated with a different hotel loyalty program.

Here's our full comparison to help you decide between the two:

General Comparison

The World of Hyatt Card is a premium credit card that caters to travelers who prefer Hyatt hotels, while cardholders earn bonus points on Hyatt purchases, as well as on other purchases.

On the other hand, the Hilton Honors American Express Surpass Card targets those who favor Hilton hotels. It often features a substantial welcome bonus with points redeemable for free stays at Hilton properties worldwide.

Here's a side-by-side comparison of the card's main features:

|

| |

|---|---|---|

World of Hyatt | Hilton Amex Surpass | |

Annual Fee | $95 | $150 ( See Rates and Fees. ) |

Rewards | 4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases. | Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases |

Welcome bonus | 30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening.*Opens offer details overlay Plus, up to 30,000 More Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Point, on up to $15,000 spent. | 130,000 Hilton Honors Bonus Points plus a Free Night Reward after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in the first 6 months of Card Membership |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0. ( See Rates and Fees. ) |

Purchase APR | 21.49%–28.49% variable | 20.99% – 29.99% variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Hilton Amex vs. Hilton Surpass: Point Rewards Analysis

When we analyze and compare the points rewards of the two cards, the Surpass card stands out as the superior choice, providing a notably higher number of points compared to the standard World of Hyatt Card.

But, it's essential to keep in mind that Hilton points are worth much less compared to Hyatt, and therefore, on the bottom line, the estimated annual value of both cards is quite similar.

|

| |

|---|---|---|

Spend Per Category | World of Hyatt | Hilton Honors Amex Surpass |

$10,000 – U.S Supermarkets | 10,000 points | 60,000 points |

$4,000 – Restaurants

| 8,000 points | 24,000 points |

$4,000 – Airline | 8,000 points | 12,000 points |

$5,000 – Hotels | 20,000 points | 60,000 points |

$4,000 – Gas | 4,000 points | 24,000 points |

Total Points | 50,000 points | 180,000 points |

Redemption Value (Estimated) | 1 point = ~2.1 | 1 point = ~0.6 cent |

Estimated Annual Value | $1,050 | $1,080 |

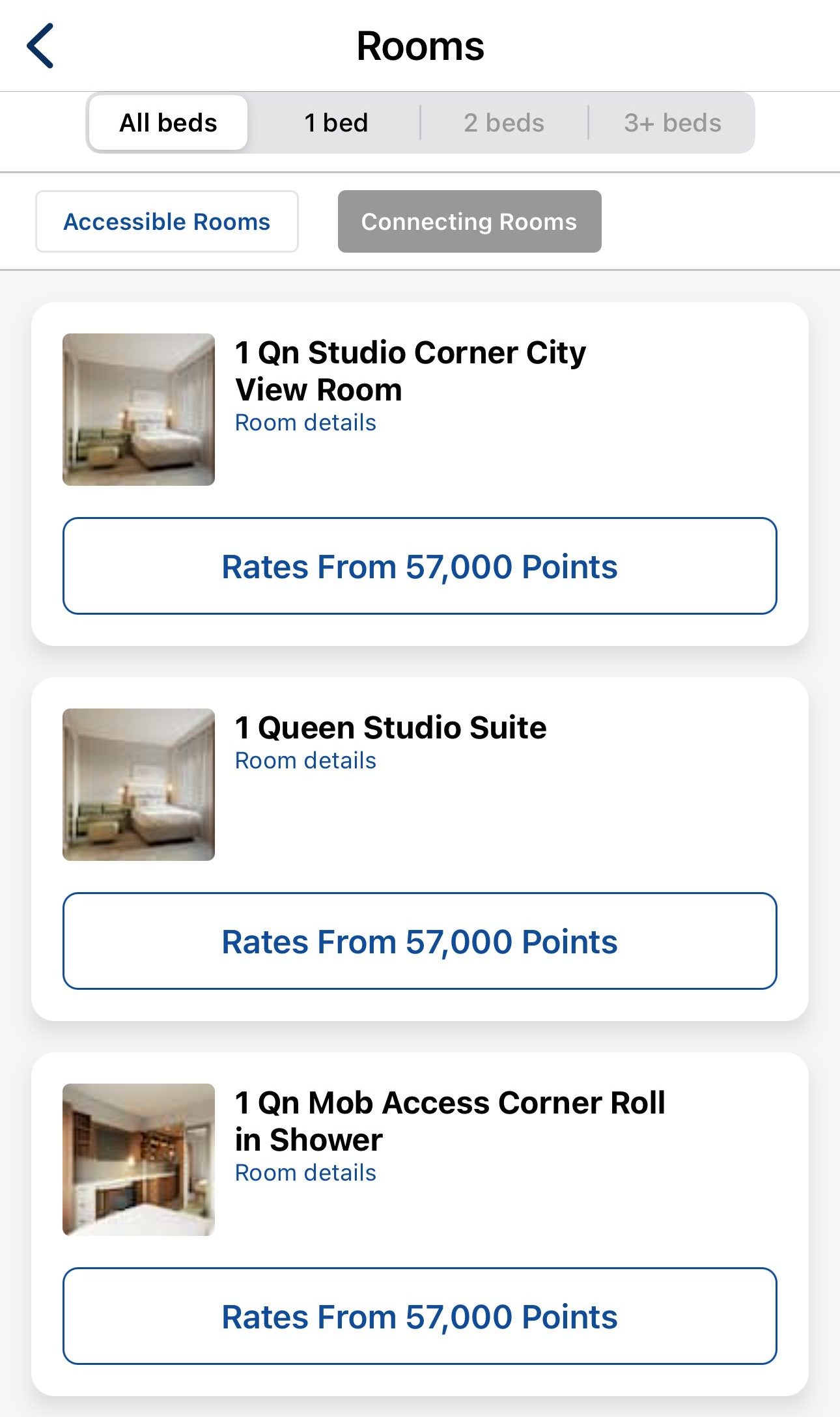

Hilton Surpass offers various ways for you to redeem points you earn through its loyalty program. You can use points to book free hotel stays, covering the cost of your room. Beyond hotel stays, you can also redeem points for experiences, travel, shopping, and more through the Hilton Honors program

World of Hyatt offers diverse redemption options for its members. You can use points for free hotel nights at various Hyatt properties, from budget-friendly to luxurious resorts worldwide. The program extends beyond hotels, allowing members to use points for car rentals, FIND experiences, and even credits with participating luxury brands.

Which Hotel Benefits You'll Get With Each Card?

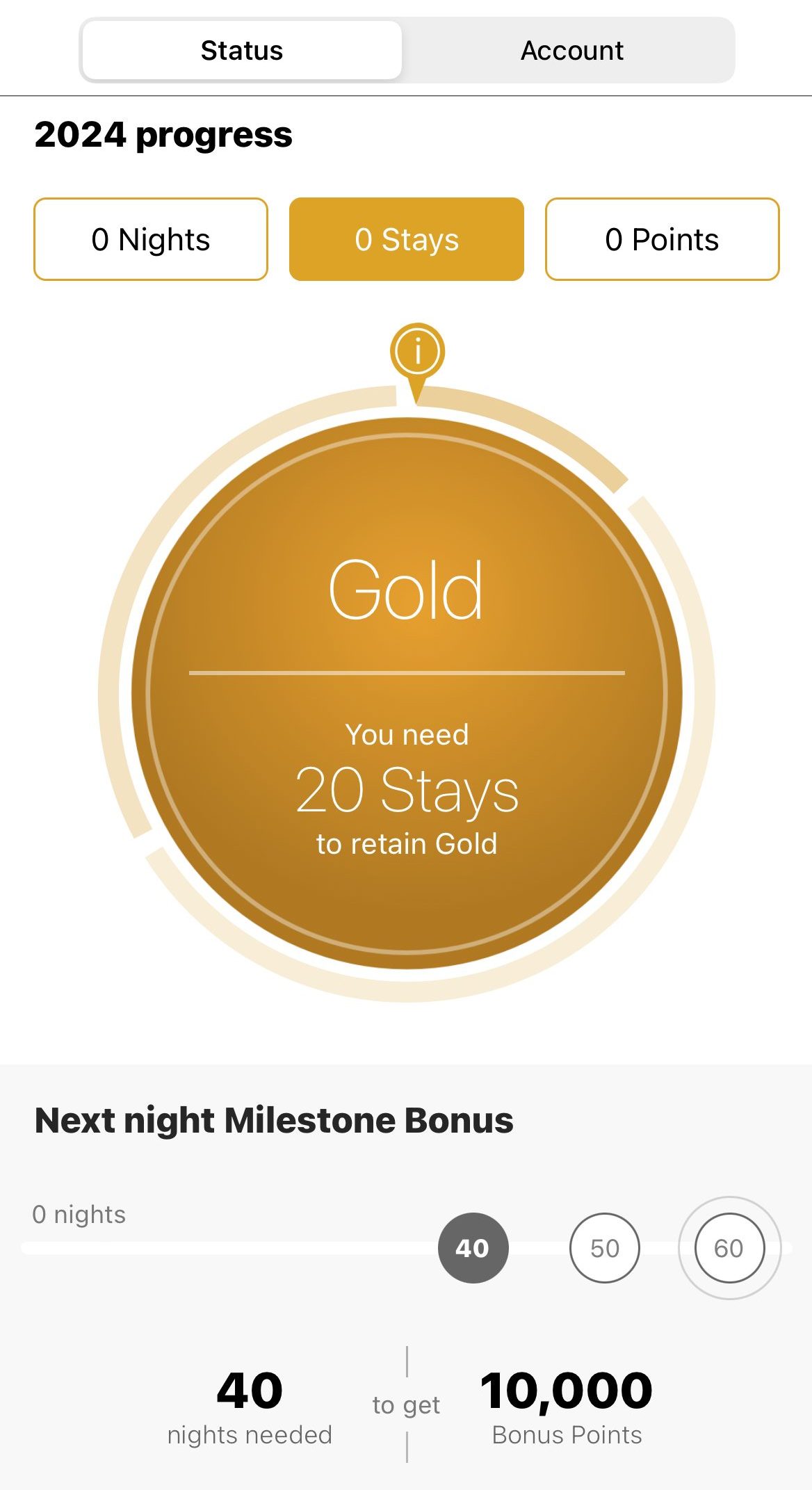

The Hilton Surpass's main extra benefits include an annual credit to Hilton and Hilton Honors Gold status. The World of Hyatt Card offers a Discoverist elite status and free night upon required spending.

World of Hyatt

- World of Hyatt Discoverist Status: Enjoy Discoverist status as long as your account is open, offering perks like room upgrades and late check-out.

- Free Night Benefit: Cardholders receive a complimentary night at any Category 1–4 Hyatt hotel or resort annually after their cardmember anniversary, with an additional free night for spending $15,000 in a calendar year.

- Qualifying Night Credits: Earn 5 qualifying night credits each year towards your next tier status, and an additional 2 credits for every $5,000 spent on the card.

DoorDash: Receive one year of complimentary DashPass, granting unlimited deliveries with $0 delivery fees and reduced service fees on eligible order

- Visa Concierge: Enjoy complimentary 24/7 Visa Signature® Concierge Service, providing assistance with various tasks, including finding event tickets, making restaurant reservations, and helping you select the perfect gift.

Hilton Amex Surpass Card

- $200 Hilton Credit: Enjoy up to $50 in statement credits per quarter, totaling $200 annually, for direct purchases with Hilton properties using your Hilton Honors American Express Surpass® Card.

- Hilton Honors™ Upgrade to Diamond Status: Achieve Hilton Honors Diamond status by spending $40,000 on eligible purchases in a calendar year, extending the status through the end of the next calendar year.

- Free Night Reward: Earn a Free Night Reward from Hilton Honors after spending $15,000 (Surpass) or $30,000 (Aspire) on eligible purchases on your Card in a calendar year.

ShopRunner: Enjoy complimentary membership with ShopRunner, providing free 2-day shipping on eligible items from a network of 100+ online stores, accessible by enrolling with your eligible Card at shoprunner.com/americanexpress.

- Hilton Honors Gold Status: Receive complimentary Gold Status, providing benefits such as a 5th night free on standard room stays of 5+ nights, and an 80% Bonus on all Base Points to accelerate your free night earnings.

- National Car Rental® Status: Surpass® Card Members can receive free National Car Rental® Emerald Club Executive® status. This includes benefits like access to the Executive Area (for full-size reservations and above) in the USA and Canada. Enrollment is required.

Terms apply to American Express benefits and offers.

Which Protections You'll Get With Each Card?

Each of these cards offers travel insurance and other protection. The Hilton Surpass card doesn't provide lost luggage reimbursement or trip cancellation as you can find on the World Of Hyatt card.

World of Hyatt

- Baggage Delay Insurance: Reimburses up to $100 per day for essential purchases like toiletries and clothing when your baggage is delayed by a passenger carrier for more than 6 hours, up to a total of 5 days.

- Lost Luggage Reimbursement: Provides coverage of up to $3,000 per passenger for damaged or lost luggage checked or carried on by you or an immediate family member when traveling.

- Purchase Protection: Safeguards your new purchases against damage or theft for 120 days, with coverage up to $500 per claim and a maximum of $50,000 per account.

- Trip Cancellation/Trip Interruption Insurance : Receive reimbursement, up to $5,000 per person and $10,000 per trip, for pre-paid, non-refundable travel expenses in case of trip cancellation or interruption due to covered situations like sickness or severe weather.

- Auto Rental Collision Damage Waiver : Decline the rental company's collision insurance and charge the entire rental cost to the card for coverage against theft and collision damage for most cars in the U.S. and abroad.

Hilton Amex Surpass Card

- Extended Warranty: Use your Eligible Card for Covered Purchases and benefit from an extended warranty, matching the Original Manufacturer's Warranty for up to one additional year on warranties of 5 years or less in the United States or its territories.

Car Rental Loss and Damage Insurance: When using your eligible Card to reserve and pay for a rental vehicle, and declining the collision damage waiver, you're covered for damage or theft in a covered territory. Exclusions apply, and the coverage is secondary without liability coverage.

- Global Assist® Hotline: As a Card Member, access the Global Assist® Hotline for travel assistance over 100 miles from home, providing services like lost passport replacement, translation, missing luggage, and emergency legal and medical referrals. Costs from third-party service providers are the Card Member's responsibility.

Dispute Resolution: If faced with unrecognized charges or billing issues, American Express collaborates with you and the merchant to resolve the problem promptly.

Purchase Protection: Covered Purchases made with your Eligible Card are protected for up to 90 days from the purchase date, covering theft or accidental damage, with limits of up to $1,000 per occurrence and $50,000 per calendar year.

When You Might Prefer The World of Hyatt Card?

You might prefer the World of Hyatt Card over the Hilton Amex Surpass card in the following situations:

Focused Travel on Hyatt Properties: If you frequently stay at Hyatt hotels, the World of Hyatt Card is a natural choice. It provides bonus points on Hyatt spending, an annual free night certificate at eligible properties, and automatic elite status, enhancing the overall value for loyal Hyatt guests.

You Want To Enjoy Hyatt Discoverist Status Benefits: The World of Hyatt Credit Card provides complimentary Discoverist status in the World of Hyatt program, which includes perks like late checkout and free breakfast.

You Prefer A Lower Annual Fee: The World of Hyatt Credit Card has a lower annual fee compared to the Hilton Honors Surpass card. If you're on a tighter budget, the World of Hyatt card may be a more affordable option.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Hilton Amex Surpass?

You might prefer the Hilton Amex Surpass card if:

You Need Global Presence and Diverse Properties: If you frequently travel internationally or prefer a broader range of hotel options, the Hilton Honors Surpass Card might be preferable. Hilton has a larger global footprint, offering a variety of properties from luxury to budget, making it suitable for a wider range of travel styles.

You Spend A Significant Amount On Dining, Gas, And Groceries: The Hilton Surpass Card could be a better choice if you spend heavily in categories beyond travel. With bonus points on dining, supermarkets, and gas stations, it caters to a more diverse set of expenses compared to the World of Hyatt Card, which focuses more on travel-related spending.

Easier Points Redemption Options: Hilton Honors is known for its straightforward points redemption system, and if you prefer a loyalty program with more flexibility and simplicity in redeeming points for hotel stays, the Hilton Surpass Card may be a better fit compared to the World of Hyatt, which has a more nuanced award chart.

Compare The Alternatives

If you're looking for a travel rewards credit card with hotel benefits – there are some excellent alternatives you may want to consider:

|

|

| |

|---|---|---|---|

Marriott Bonvoy Brilliant® American Express® Card

| The Platinum Card® from American Express | Hilton Honors American Express Card | |

Annual Fee | $650. See Rates & Fees | $695. See Rates & Fees | $0 |

Rewards | 2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

|

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

|

Welcome bonus | 95,000 points

95,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership

|

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

70,000 points

70,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

|

Foreign Transaction Fee | $0 | $0. See Rates & Fees | $0. See Rates and Fees. |

Purchase APR | 20.99% – 29.99% Variable

| 21.24% – 29.24% APR Variable | 20.99%-29.99% Variable

|

Compare Hilton Honors Amex Surpass Card

The Surpass card boasts a notably higher annual fee, justified by its superior rewards ratio and benefits compared to the Hilton Honors card.

If you can maximize your points, rewards, and benefits, the Hilton Aspire is our winner. But, if your spend is not so high – the Surpass wins.

Hilton Honors Surpass vs. Hilton Aspire Card: How They Compare?

The Hilton Amex Surpass is our winner as it offers higher estimated total cashback than the Marriot Boundless card and additional hotel perks.

Marriott Bonvoy Boundless vs. Hilton Amex Surpass: Side By Side Comparison

The Hilton Honors Surpass wins at estimated cashback, while the Amex Gold card is the winner for everyday spending and extra benefits.

Despite having a higher annual fee, the Hilton Surpass card is our winner with higher estimated annual cashback and better extra hotel perks.

IHG One Rewards Premier vs. Hilton Amex Surpass: Side By Side Comparison

Compare World of Hyatt Card

If you're looking for an hotel card, a good one can provide exclusive benefits. Which card offers more perks and what are the differences?

Amex Hilton Honors vs World of Hyatt: Which Hotel Card Wins?

The World of Hyatt Card is our winner – it offers a significantly higher annual cash back for the average consumer than Marriott Boundless.

World of Hyatt Card vs. Marriott Bonvoy Boundless: Side By Side Comparison

With this hotel rewards cards battle, the World of Hyatt Card is our winner as it offers a higher annual cash back for the average consumer

World of Hyatt Card vs IHG One Rewards Premier: Side By Side Comparison