Table of Content

The United Club℠ Infinite Card and the Citi® / AAdvantage® Executive World Elite Mastercard® are luxury cards for frequent flyers.

In this comparison, we review them side by side in order to understand which of them offer more – and which one can be the best fit for your needs. Let's start.

General Comparison

|

| |

|---|---|---|

Citi® / AAdvantage® Executive | United Club℠ Infinite | |

Annual Fee | $525 | $525 |

Rewards | 10X AAdvantage® miles on eligible rental cars/hotels through aa.com, 4X miles on eligible American Airlines purchases and 1X on all other purchases | 4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases |

Welcome bonus | 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 in purchases within the first 3 months of account opening | 80,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.24% – 29.99% (Variable) | 21.99% – 28.99% variable |

Read Review | Read Review |

Simulation: Which Card Gives More Rewards?

Without a scenario comparison, it's difficult to understand the actual reward potential.

While cardholders earn above-average rewards on both cards, the benefits are not as valuable. The true value of the cards stems from the luxury perks they provide, such as global entry or TSA PreCheck, statement credit for in-flight purchases, trip delay reimbursement, and so on; more on this in the following section.

Remember that the figures should be adjusted to your regular spending categories, which may differ – so the exact calculation is dependent on your personal habits.

|

| |

|---|---|---|

Spend Per Category | Citi® / AAdvantage® Executive | United Club℠ Infinite |

$15,000 – U.S Supermarkets | 15,000 miles | 15,000 miles |

$5,000 – Restaurants

| 5,000 miles | 10,000 miles |

$5,000 – Airline | 10,000 miles | 20,000 miles |

$4,000 – Hotels | 4,000 miles | 8,000 miles |

$4,000 – Gas | 4,000 miles | 4,000 miles |

Total Miles/Points | 38,000 miles | 57,000 miles |

Estimated Redemption Value (Flights) | 1 mile = ~1.2 cents | 1 mile = ~1.5 cents |

Estimated Annual Value | $456 | $855 |

Compare The Perks

Citi® / AAdvantage® Executive World Elite

- Admirals Club Membership: Up to two guests or immediate family can accompany you into almost 50 Admirals Club lounges around the world.

- Free First Checked Bag: You and up to eight travel companions can receive their first checked bag free on domestic American Airlines flights.

- Enhanced Airport Experience: Cardholders and up to eight travel companions can enjoy priority check in, screening and boarding privileges where available.

- TSA PreCheck or Global Entry Reimbursement: You can receive up to $100 in statement credit every five years as reimbursement for your application fee.

- Inflight Food & Beverage Savings: You’ll receive 25% savings on your food and beverage purchases on American Airlines flights when you use your card.

- Dedicated Concierge: This provides access to a team of experts to help you with domestic and foreign travel, dining, household, entertainment and shopping needs.

- Citi Entertainment: This platform provides special access to purchase tickets for events and exclusive experiences.

United Club℠ Infinite

- Membership to United Club: This is a great feature for travelers as you’ll have somewhere to relax or work before you fly and you can enjoy complimentary beverages and snacks.

- Premier Access: You will also qualify for Premium Access Travel Services, which offer preferential airport treatment including priority security screening, check in, boarding and baggage handling, where available.

- Inflight Purchase Credit: You’ll receive 25% back in statement credit for the purchases you make on board United operated flights. This includes drinks, food, WiFi and other purchases.

- Free Check Bags: You and your travel companion using the same reservation will receive free first and second standard check bags.

- TSA PreCheck or Global Entry Fee Reimbursement: When you charge your TSA PreCheck or Global Entry fee to your card, you’ll get up to $100 statement credit as reimbursement every four years.

- Trip Cancellation/Interruption Coverage: Claim reimbursement for pre paid, non refundable travel expenses for up to $10,000 per person and up to $20,000 per trip.

- Trip Delay Cover: If you have a common carrier travel delay of 12 hours or more, you can claim for unreimbursed expenses such as accommodation and meals with a cap of $500 per ticket.

- Baggage Insurance: If your bags are delayed by your passenger carrier for more than six hours, you can claim reinbursement for essential purchases for up to three days at a maximum of $100 per day.

- IHG Rewards Platinum Elite: Primary cardmembers can qualify for elite status, which provides complimentary room upgrades, extended check out and other travel perks on IHG.

- Auto Rental Collision Damage Waiver: Similar to other rental car insurance cards, when you charge your entire car rental to your card and decline the collision cover offered by the rental company, you can benefit from your card’s collision damage and theft cove .

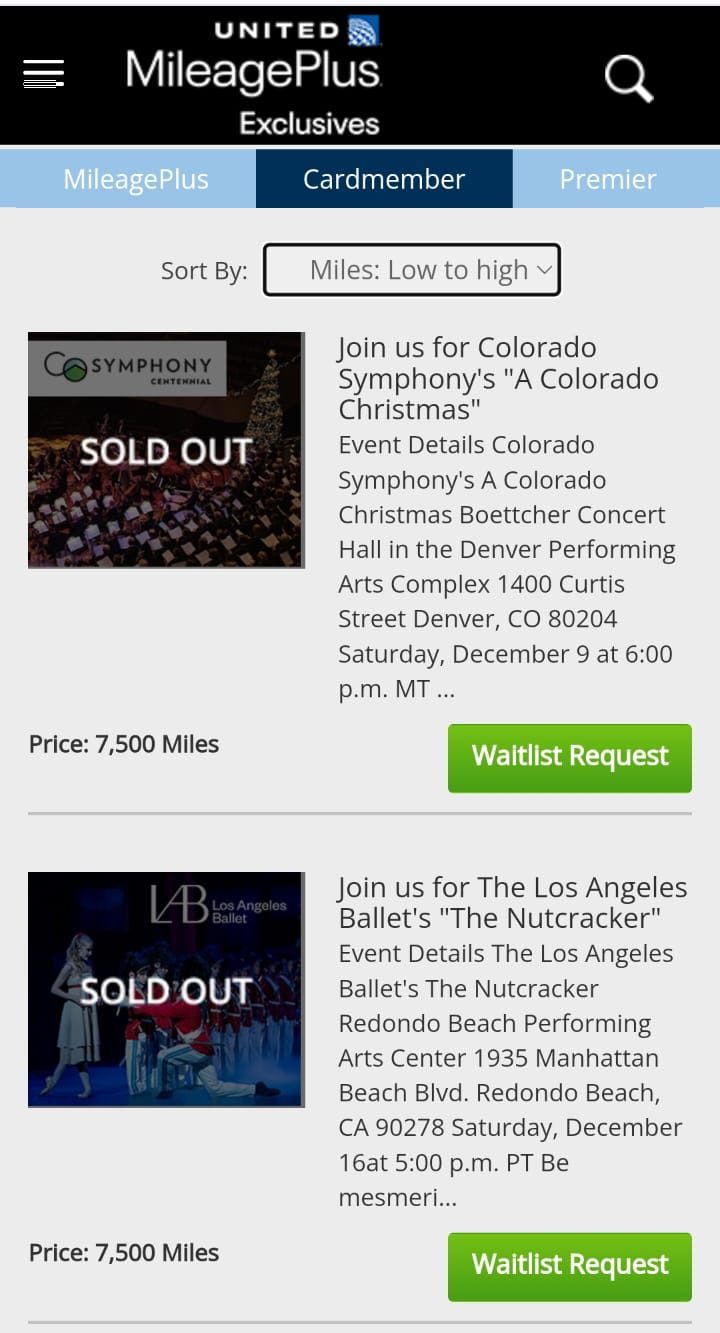

- Chase United Card Events: This portal allows you to purchase curated, private experiences from celebrity meet and greets to sporting events.

- Visa Infinite Concierge Services: You’ll have complimentary access to 24/7 concierge services to help make restaurant reservations, find tickets or help you to send gifts.

Top Offers

Top Offers

Top Offers From Our Partners

Compare The Drawbacks

Of course, the Citi® / AAdvantage® Executive and the United Club Infinite, like all credit cards, have potential drawbacks that may influence whether they are a good fit for you.

So, to help you make a smart decision, we'll highlight potential drawbacks here.

Citi® / AAdvantage® Executive World Elite

- Limited Non Flight Benefits

Not only will you earn fewer miles per dollar on flights, but there are only two reward tiers, so anything that is not an American Airlines purchase will only earn you one mile per dollar.

- No Insurance Coverage

Unlike the United Club Infinite, this card does not have trip interruption, trip delay or even baggage insurance, which is an obvious omission with a travel card.

United Club℠ Infinite

- Limited Non United Flying Redemptions

Although this card does offer some great reward options for United flyers, if you want more flexible rewards, you may find it a little lacking.

- No Anniversary Awards

While American Express does offer some awards on your card anniversary, this is not offered with the United Club Infinite.

Top Offers

Top Offers From Our Partners

Compare Redemption Options

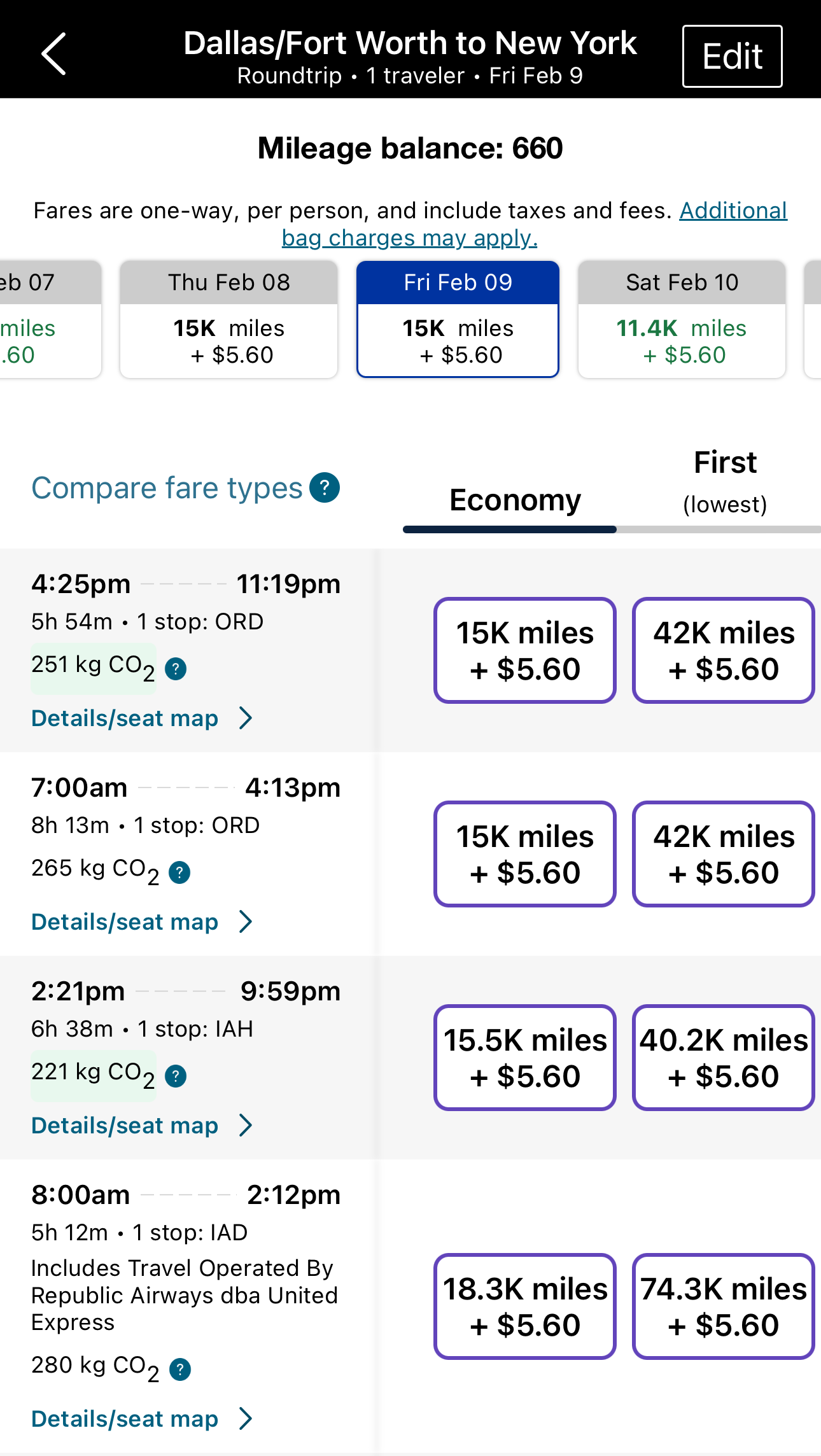

There are several ways that you can redeem the miles from this and other Chase cards. However, if you want to get the best redemption rates, you will need to book United Flights or flights operated by one of its 35 plus partner airlines.

The average value per mile for this redemption method is approximately 1.5 cents. However, if you prefer, you can use your miles for rental cars, hotel stays, tickets for events and shows, retail gift cards or merchandise.

Citi also offers similar redemption methods. You can use your miles for travel to more than 1,000 destinations around the world. There are flexible options for American Airlines awards. However, you can also use your miles for First Class or Business upgrades, hotel stays, car rentals or vacation packages.

Customer Reviews: Which Card Wins?

Citi® / AAdvantage® Executive World Elite Mastercard®

Satisfied borrowers report that the Admirals Club membership is a fantastic perk, with continuing improvements at the food and other amenities on offer in various locations around the world.

Negative comments seem to relate to the glaring omission of not including trip interruption or delay insurance. This used to be a feature with this card, but this service was cut. So, long term customers have complained that this is no longer offered.

United Club℠ Infinite

Satisfied borrowers report great happiness about the premium rewards package that accompanies this card. There are a variety of travel perks that can be a boon to frequent travelers.

Some negative reviews complain about the lack of opportunity for help to qualify for United Premier elite status.

Why You Might Want the Citi® / AAdvantage® Executive?

The Citi® / AAdvantage® Executive World Elite Mastercard® could be good if:

You tend to travel in a larger group: While both cards offer some great travel benefits, many of the United Club Infinite benefits are limited to the cardholder and one travel companion. On the other hand, up to eight travel companions can enjoy free first check bags and an enhanced airport experience if you carry the Citi AAdvantage® Executive.

You’re looking for lounge access: The AAdvantage Executive World Elite card allows you to add up to 10 authorized users to access Admiral Club lounges when you fly.

It is solely a travel card for you: The card does have some great travel benefits, but limited non travel benefits, so it might be a good choice if you only want the card for your travel purchases.

When You Might Want the United Club℠ Infinite?

The United Club℠ Infinite is a solid choice if:

You are looking for higher earning rates: The United Club Infinite pays up to four miles per dollar, which is higher than many other travel cards, but you can also earn two miles on dining and one mile elsewhere. So, you can boost your miles balance even outside of United.

You Use WiFi On Board Flights: While Citi offers discounts on on board purchases, The United Club card includes WiFi purchases in its offer, which could save you a great deal if you frequently fly and use the on board WiFi services.

You’re looking for premium travel benefits: The United Club Infinite card offers excellent insurance coverage including trip interruption, baggage insurance and trip delay coverage. So, if there are any unforeseen events that delay or interrupt your trip, you can be reimbursed.

Compare The Alternatives

If you're looking for an airline credit card with premium travel rewards – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare Citi/AAdvantage Executive World Elite

The Citi/AAdvantage Executive offers better cashback value and perks than the Platinum Select, but usually it doesn't worth the annual fee.

Citi/AAdvantage Executive World Elite vs. Citi/AAdvantage Platinum Select

The AAdvantage Executive card offers higher cashback value, but when it comes to premium travel perks, the Amex Platinum is the winner.

Citi/AAdvantage Executive World Elite vs. Amex Platinum Card: Compare Cards

The AAdvantage Executive is a clear winner when it comes to cashback value. But the Delta SkyMiles Reserve wins at premium airline perks.

Citi/AAdvantage Executive World Elite vs. Delta SkyMiles Reserve: Compare Cards

Both Citi/AAdvantage Executive and Chase Sapphire Reserve offer great cashback value, but the latter is our winner. Here's why.

Citi/AAdvantage Executive World Elite vs. Chase Sapphire Reserve: Compare Cards

Compare United Club Infinite Card

In this comparison, we will delve into the key features, benefits, and considerations of both the United Explorer and Infinite Card.

The United Infinite card offers luxury benefits that the Quest card doesn't, but for most consumers, it is not worth the higher annual fee.

These two are considered as one of the best exclusive airline cards out there. What are the differences between them and is it worth it?

United Club Infinite vs Delta SkyMiles® Reserve: Which Gives You More?

The Infinite Card is tailored for frequent United flyers, while the Amex Platinum offers a more lucrative, comprehensive rewards program.