Rewards Plan

Welcome Bonus

Credit Rating

0% Intro

Annual Fee

APR

- 4th Night Free

- Statement Credit for TSA PreCheck

- Hotel Focused Card

- Low Rewards Redemption Ratio

Rewards Plan

Welcome Bonus

140,000 Bonus Points after spending $4,000 in the first 3 months from account opening.*Opens offer details overlay Plus, earn 35,000 Bonus Points after spending a total of $7,000 in the first 6 months from account opening

0% Intro

PROS

- 4th Night Free

- Statement Credit for TSA PreCheck

CONS

- Low Rewards Redemption Ratio

- Hotel Focused Card

APR

21.49%–28.49% variable

Annual Fee

$99

Balance Transfer Fee

$5 or 5%, whichever is greater

Credit Requirements

Good - Excellent

- Our Verdict

- Pros & Cons

- FAQ

If you like staying at IHG hotels when you travel, you might find the IHG Rewards Premier Business credit card useful for your business. It has a reasonable yearly fee and lets you earn Up to 26 points per dollar at IHG Hotels and Resorts, 5 points per dollar on dining, travel, gas stations and select business purchases, with 3 points per dollar on all other purchases. There are also nice benefits like free nights, travel coverage, and reimbursement for TSA PreCheck, Global Entry, or Nexus.

However, if you're not loyal to the IHG brand or don't stay at their hotels often, you might be better off with a general travel rewards credit card. Chase offers various business travel cards, some with no yearly fee, which could give you better value for your needs.

- 0% Introductory APR

- Anniversary Companion Certificate

- Free First Checked Bags

- Preferred Boarding

- No Foreign Transaction Fees

- Statement Credit for Inflight Purchases

- Travel Insurance

- High Annual Fee

- No Bonus Categories

- Low Rewards Rate

- High APR

What are card income requirements?

There are no official income requirements for the IHG Rewards Premier card, but you do need to have good to excellent credit. This means that while your income will be assessed, it is not the only factor considered when Chase is making an approval decision.

Can I get pre-approved?

Chase does not have a pre approval button on its website, but you may receive a mailer or other marketing material offering pre approval, particularly if you are signed into your Chase account and check on any available offers.

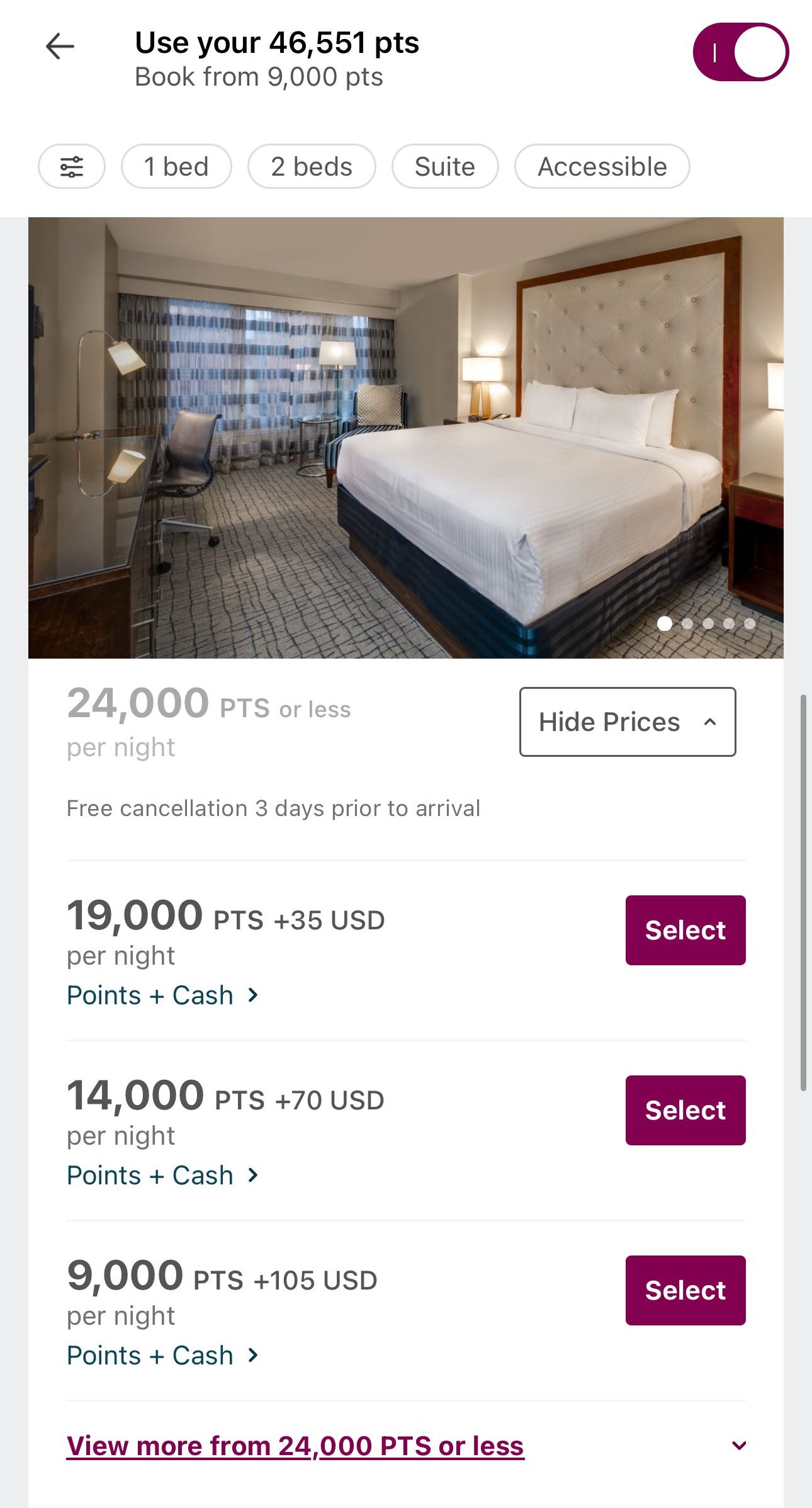

How do I redeem rewards?

When you want to redeem your points for a stay, you can use the search tool on the IHG website to look for hotels. When you find a stay you are interested in, select Points from the drop down menu under “Display Price.” You will then be able to see how many points the stay will cost. However, you can also use a combination of cash and points.

In this Review

Estimating Your Rewards: A Practical Simulation

Getting an accurate calculation of the rewards you'll earn with this card is not easy because it depends on how you actually use it. Whether it's your primary card or a secondary option, or if you reserve it for specific types of purchases, all these factors affect your rewards.

However, we've taken the time to crunch some numbers and provide you with an estimate of the rewards you could potentially receive from the IHG Rewards Premier Business card. By analyzing spending patterns in categories like supermarkets, travel, and dining, we've come up with an average estimation of the total rewards

| |

|---|---|

Spend Per Category | IHG Rewards Premier Business Credit Card

|

$10,000 – U.S Supermarkets | 30,000 points |

$3,000 – Restaurants

| 15,000 points |

$5,000 – Airline | 25,000 points |

$4,000 – Hotels | 104,000 points |

$4,000 – Gas | 20,000 miles |

Estimated Annual Points | 194,000 Points |

The card offers a range of flexible and rewarding redemption options, including free nights at InterContinental, Holiday Inn, and more. Cardholders can choose from various gift cards,shop for merchandise, book unique experiences or converted into airline miles.

Top Offers

Top Offers From Our Partners

Top Offers

Pros and Cons

As is the case with any regular credit card, the IHG Rewards Premier Business card has its own set of advantages and disadvantages:

Pros | Cons |

|---|---|

Free Anniversary Night | Hotel Focused Card |

4th Night Free | Low Rewards Redemption Ratio |

No Foreign Transaction Fees | High Spend Requirement for Bonus |

Statement Credit for TSA PreCheck | |

Trip Cancellation/Interruption Insurance | |

Platinum Elite Status | |

- Free Anniversary Night

You will receive a reward night certificate after every account anniversary year. This certificate can be used for one night’s stay at a property which charges up to 40,000 points per night.

Alternatively, you can combine with your points if you wish to redeem for a stay at a higher value property.

- 4th Night Free

When you redeem your points for four night consecutive stays at an IHG location, you will only pay for three nights. It's a great way to save money on IHG hotels.

- Purchase Protection

When you use your card to purchase new items, they will be covered for 120 days against theft or damage. There is a coverage limit of $10,000 per claim and a maximum of $50,000 per account.

- No Foreign Transaction Fees

You won't be charged any fees for making purchases abroad with this card.

- Option For Additional Bonus

In addition to the bonus points you can receive if you spend enough within three months of opening your account, you can earn $100 statement credit and a further 10,000 bonus points if you spend $20,000 each calendar year.

- Statement Credit for TSA PreCheck

If you pay the application fee for TSA PreCheck, Global Entry or Nexus with your card, you’ll receive a statement credit for up to $100 every four years to reimburse you for the cost

- Hotel Focused Card

If you don't tend to stay frequently at IHG hotels, the value of this card is limited.

- Low Rewards Redemption Ratio

Unlike many reward programs, on most redemptions the IHG Rewards are worth less than one penny each.

This means that you may have better redemptions with a general travel rewards card and transferring your rewards to IHG or booking your hotel via the credit card travel portal.

- High Spend Requirement for Bonus

While $3,000 in three months is not unreasonable, it is higher than the typical welcome bonus for co-branded credit cards.

- Trip Cancellation/Interruption Insurance

If you pay for your fares, hotels and other travel expenses with your card, if your trip is cut short or canceled due to severe weather, illness or other covered scenarios, you will be reimbursed for your non refundable, pre paid travel expenses. This coverage has a limit of $1,500 per person and up to $6,000 per trip.

- Platinum Elite Status

You are upgraded to IHG One Rewards Platinum Elite status for as long as you remain a Premier Business cardmember

Who Should Consider The IHG Premier Business Card?

While it's not included on our top hotel card list, it can be a great card for those who are brand loyal to the IHG brand. If you tend to travel regularly for your business and prefer to stay in IHG locations, this card could be a good fit for you. You will not only accumulate IHG Rewards points, but you can get free nights and other perks.

This could also be a good card for those who want a business card that offers travel insurance. This card not only offers trip cancellation/interruption coverage, but also reimbursement for TSA PreCheck, Global Entry or Nexus application fees.

Card | Rewards | Bonus | Annual Fee | |

|---|---|---|---|---|

| 1x – 9x

Up to 9 points per dollar spent at Hyatt Hotels, 2 points per dollar in your top three spending categories each quarter and 1 point per dollar on all other purchases | 60,000 bonus points

60,000 points when you spend $5,000 within three months of opening your account | $199 | |

| 1% – 10%

1.5% cash back on all purchases10% Business Relationship Bonus. 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services. 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants. 1% cash back on all other purchases | $750

$350 when you spend $3,000 on purchases in the first 3 months*Opens offer details overlay and an additional $400 when you spend $6,000 on purchases in the first 6 months after account opening | $0 | |

| Hilton Honors American Express Business Card | 3X – 12X

12X points on hotels and resorts in Hilton portfolio, 6X points on select business (U.S. gas stations, U.S. cellphone service providers and U.S. shipping purchases) and travel purchases (U.S. restaurants, airfare booked through Amex Travel and select car rentals) with 3X points on all other purchases

| 175,000 points

12X points on hotels and resorts in Hilton portfolio, 6X points on select business (U.S. gas stations, U.S. cellphone service providers and U.S. shipping purchases) and travel purchases (U.S. restaurants, airfare booked through Amex Travel and select car rentals) with 3X points on all other purchases

| $95 (Rates & Fees) |

| Marriott Bonvoy Business® American Express® Card

| 1x – 6x

6x Marriott Bonvoy points on each dollar of eligible purchases at hotels participating in the Marriott Bonvoy® program,4x points for purchases made at restaurants worldwide, at U.S. gas stations, on wireless telephone services purchased directly from U.S. service providers and on U.S. purchases for shipping, 2x points on all other eligible purchases.

| Three Bonus Free Night Awards

Earn three bonus Free Night Awards after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership. Redemption level up to 50,000 Marriott Bonvoy® points for each bonus Free Night Award, at hotels participating in Marriott Bonvoy®. Certain hotels have resort fees.

| $125

|

| 3X – 10X

Up to 10X points from IHG® on stays for being an IHG One Rewards member. Up to 6X points from IHG® on stays with Platinum Elite Status. 5X total points on travel, dining, and at gas stations and 3X points per $1 spent on all other purchases.

| 140,000 Points

140,000 Bonus Points after spending $3,000 on purchases in the first 3 months from account opening

| $99 | |

| 3x – 10x

10X points from IHG® on stays for being an IHG One Rewards member. Plus up to 6X points from IHG® on stays with Platinum Elite Status, a benefit of this card. 5X total points on travel, dining, and at gas stations. 3X points per $1 spent on all other purchases.

| 140,000 points

140,000 Bonus Points after you spend $3,000 on purchases in the first 3 months from account opening.

| $0 |

IHG Business or Personal Card?

Chase also offers an IHG Rewards Premier card for personal customers. The cards have the same rewards structure, free anniversary night and four nights for three. The annual fee is also the same for both the business and personal cards.

The personal card offers IHG diamond elite status only if in each calendar year, you make purchases totaling $40,000 or more. However, you are upgraded to IHG One Rewards Platinum Elite status on both cards.

Another less obvious difference comes with travel insurance coverage. The business card offers trip cancellation/interruption, but with the personal card, you get additional coverage which also gets baggage delay insurance and lost luggage reimbursement.

Top Offers

Top Offers From Our Partners

Top Offers

FAQs

How hard is it to get an IHG Rewards Premier Business card?

You do need to have good to excellent credit, but the IHG Rewards Premier Business card is also subject to Chase’s 5/24 rule.

This means that if you’ve opened five or more new credit card accounts within the last 24 months, your application will be declined, even if you have excellent credit.

When it may not be a good idea?

This card is not a good idea if you don’t stay at IHG locations on a regular basis. The rewards are heavily weighted towards IHG and while other redemption methods may be available, you’ll get the best value for award stays.

So, if you don’t stay at an IHG at least every couple of months, you won’t get the most from this card. In this case, you may be better with a general business travel credit card that will offer you greater flexibility.

Does the card provide travel insurance?

Yes, the card offers trip cancelation/interruption coverage with a cap of $1,500 per person and $6,000 per trip.

If you need to cancel or cut short your trip due to severe weather conditions, illness or other covered scenarios, you can receive reimbursement for your non refundable, pre paid travel expenses including fares, hotels, and tours.