Rewards Plan

Sign up Bonus

Credit Rating

0% Intro

Annual Fee

APR

- Insurance

- Grace Period

- High APR

- Credit Limit

Rewards Plan

Sign up Bonus

0% Intro

PROS

- Insurance

- Grace Period

CONS

- High APR

- Credit Limit

APR

22.49% Variable

Annual Fee

$0

Balance Transfer Fee

N/A

Credit Requirements

No Credit – Poor

- Our Verdict

- Pros & Cons

- FAQ

The Deserve® EDU Mastercard for Students is suitable for those who are beginning their credit journey. Compared to most sites, Deserve Edu allows international students and is ideal for overseas trips because it operates outside the US border. The benefits of using this product include; no annual fee, 1% cashback on every purchase, and mobile phone protection.

The main benefit – you are not required to be a US citizen or be a resident here for you to use the card. Also, Deserve Edu will not ask for a previous credit score or experience. International students can qualify for this product with their passports, student visa, and bank accounts.

There is the Amazon Prime Student Reward yearly membership for students. To qualify and receive the rebated fee, you must first make Purchases totaling $500 or more within the first three statements after card issuance.

- Exempted Charges

- International Students

- Extended Warranty Period

- Account Management

- Cashback Rewards

- No Credit Score

- Insurance

- No Balance Transfer or Cash Advances

- High APR

Do the cards report payments to all credit bureaus?

Deserve reports EDU payment activities to two of the major credit bureaus; Experian and Transunion.

How is the card customer service availability?

The Deserve customer service team is available on a toll free number 6 am to 6 pm Monday through Friday and 7 am to 12 pm on Saturdays (PT).

Can I add an authorized user?

Unfortunately no, the card issuer permits adding another user to your account.

Table of Contents

Advantages

Let’s take a look at the advantages of this card and see if it’s the right one for your wallet or not.

- Exempted Charges

Customers are exempted from paying annual fees and foreign transaction charges.

- International Students

Students will not be asked to show proof of US citizenship or provide a Social Security Number. Foreign students can sign-up for this product with their passports, student visas, and US bank account.

- Extended Warranty Period

In addition to the warranty given by a product’s manufacturer, paying with your Deserve Edu card can extend the warranty up to a year.

- Account Management

You can manage your account effectively with Deserve Edu. It is easy to track your spending and subscribe to the autopay feature. Automatic payments will free you from worries about late payments or incurring late fees.

- Cashback Rewards

Students are entitled to a 1% cashback on every purchase .

There is no expiry date for cash backs, which means you can redeem them anytime within the account's operational period. Clients enjoy discount shopping from top brands like Feather up to $100 for furniture rental, and a $10 statement credit for paying for coverage at Lemonade Insurance.

- No Credit Score

You do not need to have credit experience or a high score to qualify for a Deserve Edu card. The bank is more interested in your educational qualifications.

- Insurance

If you pay your cell phone debts with this product, you earn up to $600 insurance for theft and damages. You also get coverage for a car rental during a collision or theft. You can call for assistance during a roadside emergency like running out of gas or needing to tow the car.

Disadvantages

Let’s take a look at the disadvantages of this credit card and see if it’s the right one for your wallet or not.

- No Balance Transfer or Cash Advances

There is no option for cash advances or balance transfer with this product. Students usually don't use any of these features, but it is best to have the opportunity to transfer your balance or ask for a cash advance if the need arises.

- High APR

Deserve Edu is said to have a higher than average APR for student cards. The APR is 22.49% Variable and may be expensive to maintain since there is no introductory rate to ease into it.

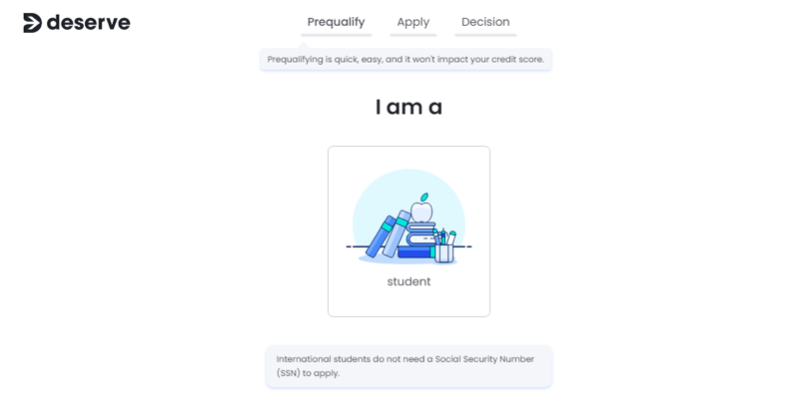

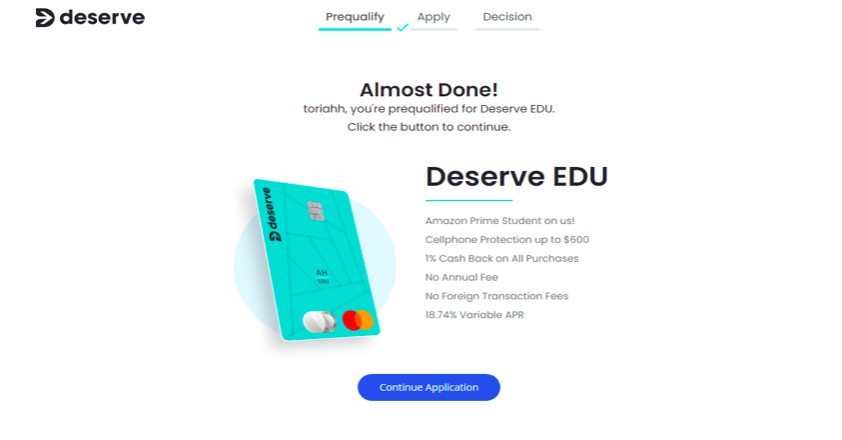

How To Apply For Deserve EDU Credit Card?

- 1.

Visit the Deserve Edu website and begin your prequalification process. Click in between the box that says “student.”

- 2.

After clicking, you'll see the option to identify as a US citizen or an international student. Select your answer to proceed.

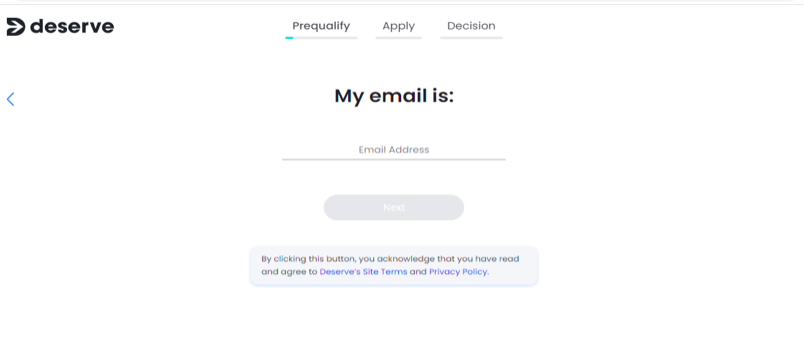

- 3.

Now, you have to fill in your email address. Click “next” to submit.

- 4.

Fill in your full name and click “Next” to proceed.

- 5.

Fill in your residential address by imputing your home details, zip code, city, and state. Click “Next” to proceed.

- 6.

Now, you have to fill in your date of birth. Click ‘Next” to submit.

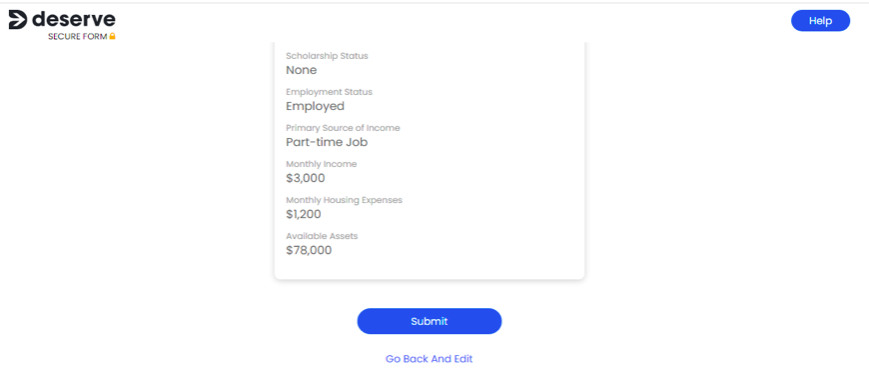

- 7.

A review of the information you've provided will appear on your screen. Go through it one last time to avoid errors or misinformation. After confirming that there are no errors, scroll down to click “Submit.”

- 8.

Now that you are prequalified, click on “Continue Application” to proceed.

- 9.

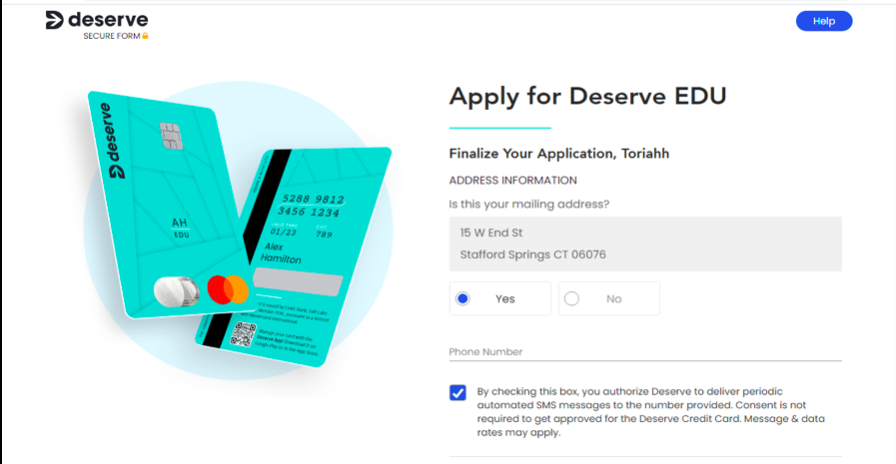

Finalize your application by agreeing to receive emails or text messages concerning your card. Tick the box to confirm.

- 10.

Now, scroll down to fill in financial and academic information, including; the level of study, school state, school name, major, scholarship, and employment status. Tick both boxes to show that you consent to the terms and conditions and click “Continue” to proceed.

- 11.

Now is the time to link your bank account to your bank. Identify your bank among the listed and select — double-tap on your bank logo to proceed.

- 12.

You have to fill in your account username and password to link your card. Click “Submit” to proceed once you have filled in your credentials and connected your bank with your card. You may proceed to make your final decision to get on board with Deserve Edu.

Compare The Alternatives

There are more cards for students – here are some good alternatives to the Deserve EDU card:

|

|

| |

|---|---|---|---|

Chime Credit Builder | Capital One Journey | Discover It Student Cash Back | |

Annual Fee | $0 | $0

| $0

|

Rewards |

None

None

|

Up to 1.25%

earn 1% cash back and another 0.25% if you pay on time, so you can boost your cash back to a total of 1.25%

|

1-5%

5% cash back on activated rotating category purchases (up to $1,500 in purchases each quarter, then 1%) and 1% on all other purchases

|

Welcome bonus |

None

None

|

None

$5 per month for 12 months on select streaming subscriptions when you pay on time

|

Match Bonus

Match Bonus for the first 12 months

|

Foreign Transaction Fee | 0%

| None

| $0

|

Purchase APR | N/A

| 29.99% (Variable)

| 18.24% – 27.24% Variable

|

FAQ

The Deserve EDU is a dedicated student card, so all you need to demonstrate is that you are a student with your student ID.

You can prequalify for the Deserve EDU in a matter of seconds without any impact on your credit score. There are only a couple more simple steps to complete your application after pre approval.

Deserve does not specify an initial credit limit, as each application is assessed and assigned a credit limit upon approval.

The top reason not to get the Deserve EDU is that it is a rather basic student card. If you already have some credit history, you may find that other student cards offer more benefits.

Top Offers From Our Partners

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.