Table Of Content

What Is An EFT Payment?

Electronic funds transfer (EFT) is a digital movement of money between individuals and banks. It is a digital transaction used in place of payment methods based on paper and a popular method of money transfer because it is simple and direct:

- Digital: The transfer of funds in EFT uses computer-based technology. It eliminates the need for paper transactions and does not require in-person interaction with bank employees.

- Fast: EFT transfers eliminate paper transactions making them quicker and more convenient. Also, the fast speed of money transfers is because there is no in-person interaction with bank tellers.

Different entities use EFT transfers, for example, friends to make bill payments and businesses to receive client payments. EFT has numerous uses making it a vital aspect of money transfers.

How Does EFT Work?

EFT payments need a sender, a payment network, and a receiver to work. After a sender commits to sending funds to the receiver, the payment goes through the different payment networks and moves money from the seller's account to the receiver's account.

The process begins after a sender initiates a money transfer through an electronic system. The sender can use different electronic systems, including:

- ATMs

- Remote banking programs

- Mobile phones

- Computers

Generally, EFT payments can be made from every location at any time as long as you have a computerized network. After initiating an EFT, it authorizes the financial institution to credit or debit the appropriate account for a specific amount of money.

For example, when buying groceries at the grocery store, you slide your debit card into the payment terminal to pay for the groceries. After entering your PIN, you approve the transaction and funds are moved from your account to the account of the grocery store owner.

What Money Tranfer Apps Use Electronic Payments?

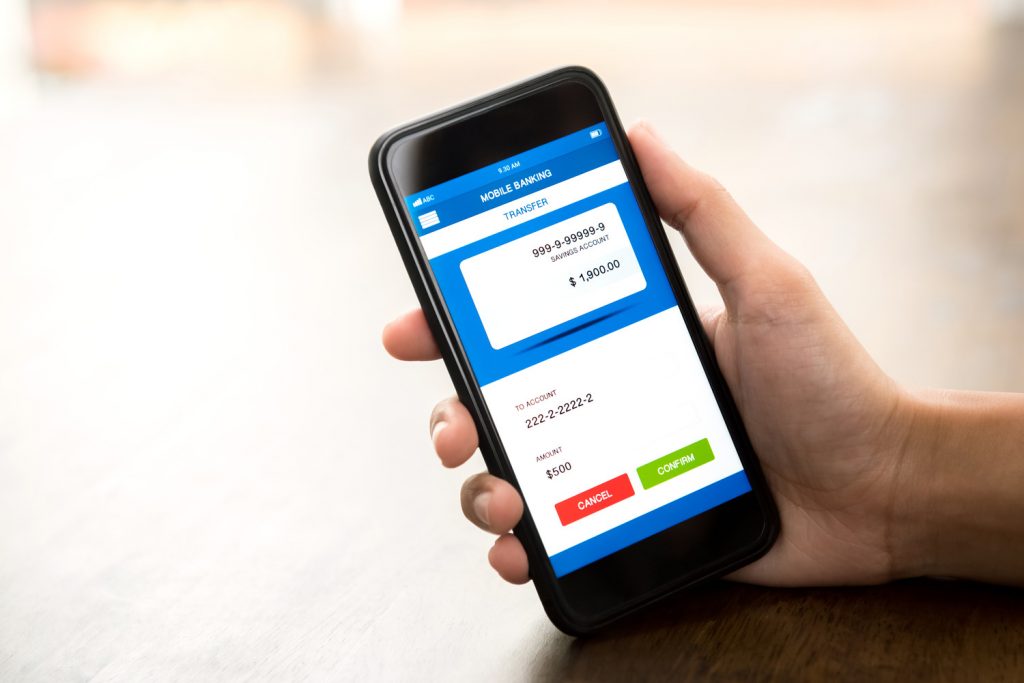

Money transfer apps or peer-to-peer (P2P) money transfer apps make it possible for you to move funds from one individual to another and from one entity to another.

The apps simplify payments and allow you to use digital wallets to link your bank account or credit card. The apps make it possible to make electronic payments with just a few taps on a mobile device.

The best money transfer apps allow you to move money safely and charge no hidden fees. Below are money transfer apps that you can use to make electronic transfers:

-

World Remit

You can use the World Remit app to send money to recipients within minutes. The transfers are complete within 24 hours and accept most prepaid, credit and debit cards. After downloading the World Remit app, you can send money to different recipients.

To send money, choose the country and the amount you intend to send. Enter the details of the recipient and bank information to send money. After completing the transaction, your recipient is notified of when they can access their funds.

-

PayPal

PayPal has different versions of its app, and it takes a few minutes to download. After downloading the app, you can transfer money to different recipients simultaneously.

The app has different features that make it easier and more secure to initiate transfers. For example, its invoice creation feature allows you to custom-make and track your invoices.

-

Cash App

This app allows you to send money instantly at a low cost. It is simple, easy to use and charges minimal fees.

It has unique options that are not common in other money transfer apps. For example, it has investment options and special savings. Sending a payment involves entering the recipient's $Cashtag, email address or phone number.

-

Venmo

Venmo offers an easy and quick way to send and receive money. You can send, spend or transfer money on your Venmo app to your bank account.

While using the app, you can make the experience more interactive by using animated stickers or emojis with your transactions.

-

Zelle

Zelle is a digital payment platform that allows users to send and receive money directly from their bank account.

Zelle is available in the mobile banking apps of more than 1,700 financial institutions. While there are some limits on the money you can send or receive, Zelle is free of cost.

Types of EFT Payments

EFT is a general term that includes different forms of electronic payments.

The Electronic Fund Transfer Act (EFTA) outlines protection of consumers around different types of electronic money transfers. It was passed to protect consumers from errors originating from electronic payments and the passage of the act led to the growth of EFTs.

Below are the different types of EFT payments protected by EFTA.

- Direct deposit: This is an electronic transfer whereby funds, especially payroll, are deposited into your bank account.

- Electronic checks: The payment type replaces paper checks and entails using your checking account details to create a virtual check and submit it to the bank for payment.

- ATM transactions: This EFT payment involves depositing or withdrawing funds from your account or moving money between accounts at the ATM.

- Phone payments: You can make bill payments by giving an entity your banking details to debit your bank an agreed amount.

- Credit card transactions: You can use EFT payments to make payments towards the balance on your credit card. Also, you can use EFT to move funds from one credit card to another.

- Direct debits: This type of EFT is a recurring payment set up to facilitate the automatic transfer of funds to the payee's account. It is commonly used in subscriptions and payment of bills.

How Do You Make an EFT Payment?

EFT payments are easy to make and require no effort to receive. To make an EFT payment, you must know the receiver’s bank information. Also, you must authorize the transfer for funds to be taken from your account and credited to the recipient’s account.

There are different steps for making different types of EFT payments. Below are the typical steps for initiating an EFT payment.

- The sender initiates the transfer: The sender initiates the transfer after agreeing with the recipient and gathering the necessary information. The sender has complete control over when EFT payment processing occurs.

- Connect to a payment gateway: To process EFT payments, you must connect to an EFT processor to eliminate the manual steps. The technology-driven platform also gives you complete visibility over your payment to the recipient.

- The recipient receives the funds: After confirming the recipient’s bank information, you initiate the transfer. Confirming your recipient’s bank information involves confirming the recipient’s name, account number, and routing number.

After waiting for sometimes, the funds are credited into the receiver’s account. The process can be in real-time, on the same day or within 48 hours.

You can send EFT payments to your vendors or suppliers. Also, your customers can pay their bills through EFT.

EFT Vs ACH Payment: Key Differences

EFT is a general term that describes different electronic payment methods. ACH transfers are commonly used to process electronic payments and can be used to send money from one person to another.

There are major differences between EFT and ACH, including:

- Scope. EFT payments involve the transfer of funds from one account to another and include different types of transactions. On the other hand, ACH is a type of EFT used to process common electronic payments. All ACH transactions qualify as EFT, while not all EFT transfers use the ACH system. Also, ACH payments can only be sent domestically, while other EFT payments, such as wire transfers, can be used to send money anywhere in the world.

- Speed: EFT payments are faster than ACH payments. In EFT payments, funds are released almost as soon as the payment is initiated.

- Security: In ACH, payments go through the Automated Clearing House, which adds an element of security to ACH payments.

- Cost: ACH payments are sent in batches, while EFT payments are sent as single payments. Given that EFT payments are sent as single transactions, you incur higher fees than ACH payments.

How to Track an EFT Payment

EFT payments are encrypted, and every transaction is assigned a unique number, making it easy to track the transactions.

Most banks offer end-to-end tracking as part of their services. Below are the different ways through which you can track an EFT payment.

- Banking service. You can check the status of an EFT payment through the use of a banking service. In this regard, you can log into your account and review the status of the EFT.

- Alerts: You can set up alerts that automatically notify you of the status of your EFT payments.

- DEFR reports. After the approval of an EFT payment, you can use the DEFR report to check the status of the payment.

EFT payments are processed fast, and you might be wondering why it is important to track them. Whether you are paying a bill or a supplier, it is important to ensure the payments are made promptly.

Tracking EFT payments makes it possible to fix delays and ensure payments are made promptly, which helps with cash flow.

FAQs

How Long Does Electronic Payment Take to Clear?

EFT transactions are not completed immediately. After the transaction is initiated, the verification takes 24-48 hours. The transaction is completed between 3-5 days if the sender has funds in their account.

After an EFT transfer is generated, the funds are debited within 24 hours, but it takes up to 3 days for the financial institution to release the funds.

Are EFT Payments Safe?

Yes. EFT payments are safe because all the payment details are encrypted and sent through secure communication channels. The information used in the process cannot be read, redirected or tampered with.

As much as there is potential for error and fraud, EFT transactions are considered safer than paper-based transactions.

Can You Reverse an EFT Payment?

Usually, yes. You can reverse an EFT payment with the consent of the parties involved.

After filing an EFT reversal request, the bank does not approve it without the receiver's consent. Only the sender can initiate an EFT reversal; after doing so, the bank reverses the funds within five days and informs the affected account holders.

Can You Make an EFT Payment With a Credit Card?

Yes. You can make an EFT payment with a credit card. There are different types of payments categorized as EFTs. For example, you can use your credit card to make EFT payments.

You can use your card to transfer funds from your account to purchase goods or services and pay bills.

Are EFT Payments Instant?

EFT payments are not instant. After initiating an EFT transfer, the funds are debited from your account within 24 hours. Mostly EFT payments are settled within one business day.

However, the transaction can take more than 24 hours if you make an international or high-value transfer. Moreover, the process can take longer if the transaction is initiated during a holiday or weekend.

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

Top Offers From Our Partners

![]()