Table Of Content

If you need to send money to someone, technology has moved far beyond writing out a check. There are a number of money transfer platforms, but one of the most frequently used is Zelle.

So, here we’ll present a Zelle complete guide to help you decide if it is the right transfer platform for you.

What is Zelle?

Zelle is a mobile payment app that facilitates peer-to-peer money transfers. The overall aim of the platform is to make it easier to move money without needing to visit the bank and to simplify paying for things, particularly if you need to split a bill.

For example, if you’re dining out with friends, when the bill comes, you don’t need to mess around with trying to pay with multiple cards. Instead, one person can pay the bill and everyone else can simply Zelle their portion of the bill to them.

Zelle was developed as a collaboration between over 30 major U.S banks and financial institutions. The platform is a stand alone app that you can install onto your smartphone, but it is also integrated into the mobile apps of participating banks, including major financial institutions such as Chase, Bank of America, Wells Fargo and Citi.

So, if you already have your bank’s mobile app, you may be able to immediately start using Zelle without needing to download anything else onto your phone or mobile device.

How Does Zelle Work?

Unlike some other money transfer platforms, Zelle moves money directly from one bank account to another. While standard bank transfers between different accounts require account numbers to perform the transaction, Zelle eliminates this need, making the funds transfer almost immediate, rather than needing several business days.

To initiate transfers, you only need the phone number or email address of the person you want to send money to. Zelle will then send the intended recipient an email or SMS to indicate that there is a payment waiting for them.

The message will include a link that the recipient needs to click to accept the payment. If the recipient’s bank account is held with a participating partner, the recipient simply needs to register for the services using the bank’s mobile app or website.

After they register, the recipient accepts the payment. First time users may need to wait up to three business days to receive the payment, but subsequent transfers will be quicker.

If the recipient’s bank is not a participating Zelle member, they can still receive Zelle transfer funds. All they need to do is download the Zelle app and register with the phone number or email. They will need to enter a debit card into the account settings to be able to receive the funds.

What Banks Use Zelle?

Zelle is compatible with almost all of the major banks, with many having the service integrated into their own mobile banking apps. However, as we discussed above, if your bank does not facilitate Zelle, you will need to download the Zelle app, which you can use with your bank debit card, even if your bank is not a Zelle partner.

Providing you have a valid Mastercard or Visa debit card, you can use the Zelle app to send money. But, if your bank is already a Zelle partner, you’ll be directed to the bank’s mobile app.

Zelle is owned by seven of the largest banks in the U.S; Capital One, Bank of America, U.S Bank, Wells Fargo, JPMorgan Chase, Truist, and PNC Bank.

Zelle has over 1,000 banks and financial institutions that are partnered with them to provide payment services. Some of the popular banks include Discover Bank, Ally Bank, Citizens Bank, and TIAA Bank, while some of the popular credit unions include VYStar Credit Union, Bethpage Federal Credit Union and SchoolsFirst Federal Credit Union.

You can use the Zelle online database to check if your financial institution is partnered with Zelle. However, bear in mind that you can still link Zelle to your bank account by downloading the app separately.

How to Set Up Zelle?

There are two ways to set up Zelle, depending on whether you’re using it through your financial institution or directly.

- Your Bank App: If you’re using Zelle through your financial institution, you simply need to install your bank’s app or use the online banking platform. When you log in, you just need to follow the prompts to enroll with Zelle. Depending on your bank, you may even be able to use your banking user name and password with the Zelle app.

- Zelle App: If your bank does not offer Zelle payments, you will need to download the Zelle app. Zelle is compatible with both Android and iOS devices and you just need to follow the prompts to set up an account. You will need to create a password and username, but you won’t need to provide any of your sensitive banking details.

Once your account is set up, you’re ready to start sending or receiving funds. We’ll delve into how to send money later in this guide, but if you are anticipating receiving funds, you’ll just need to click on the link in an email or SMS from Zelle and follow the instructions.

How Much Money Can You Send Through Zelle?

This will depend on your bank. If you’re using the Zelle app separately, there is a weekly limit of $500. If you are using Zelle via your bank, you may be able to access higher spending limits.

For example, Ally Bank has set a maximum daily limit of $5,000 with a monthly limit of $10,000. Chase Private Client and Business Checking, and Citibank Citigold, Citi Priority and Citi Private Bank account holders can also access a similar daily limit.

However, many of the major banks have lower daily limits of $1,000 or $2,500, such as Bank of America with $2,500 and PNC Bank with $1,000.

In these cases, you would need to spread the transfers across two or more days to be able to send the full $5,000 amount. While these measures may seem annoying, they are put in place for your security. If funds are sent to the wrong person or place, it is difficult to recoup the money.

If you are receiving money via Zelle, there are no account limits to how much you are able to accept, regardless of who you bank with.

Does Zelle Charge Fees?

Generally, no, but it depends on how you use it. Fortunately, unlike many P2P transfer services, Zelle does not impose fees.

If you’re using a credit card to send money or you want to immediately deposit funds, you may expect to pay a fee of 1.5% to 3% of the transfer amounts. Obviously, if you’re regularly sending money or sending larger amounts, these fees can quickly add up.

How Should I Use Zelle?

Zelle is straightforward to use, but there are some tips that can make it easier.

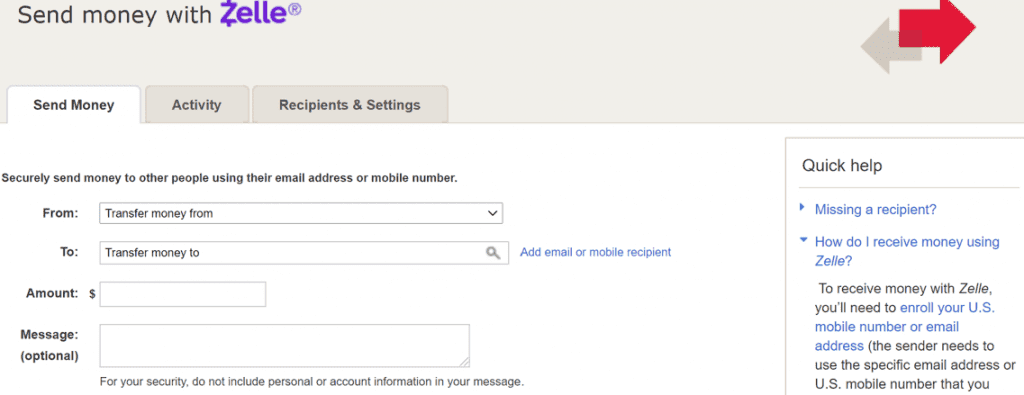

- Confirm the contact information for your recipient: You’ll need a correct email address or phone number to send a payment, so double check the information before you initiate a transfer. Here's an example from Bank Of America website:

You can add your recipient email or mobile as well as the amount you would like to transfer

- Understand the payment limitations: Zelle has no buyer protection, so make sure that you understand if a merchant does not deliver a product or service, you will not be able to claim a refund. Only use Zelle for people and businesses that you know and trust.

- Look out for payment scams: Zelle has no fraud protection, so be wary of any potential scams.

How to Send Money With Zelle?

After you set up your account, Zelle makes it very simple to send money to family, friends and other parties. You can complete the process in a few simple steps.

1. Add A Recipient Details

Zelle works best if you want to send funds to people that you know and can trust, such as family members or friends. For example, if you’re out to dinner with friends and you want to split the bill, you can pay your part of the bill with a Zelle payment.

You can also use Zelle for small business and certain service providers such as hairstylists, lawn care professionals and babysitters. Zelle transfers work for anyone with a U.S credit union or bank account. However, you don’t need to remember or write down complicated account details. All you will need is a U.S cell phone number or email address that is associated with their Zelle account.

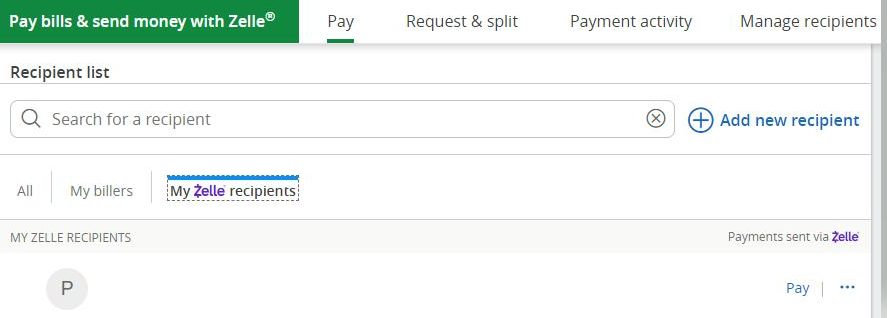

Here's another example from Chase bank:

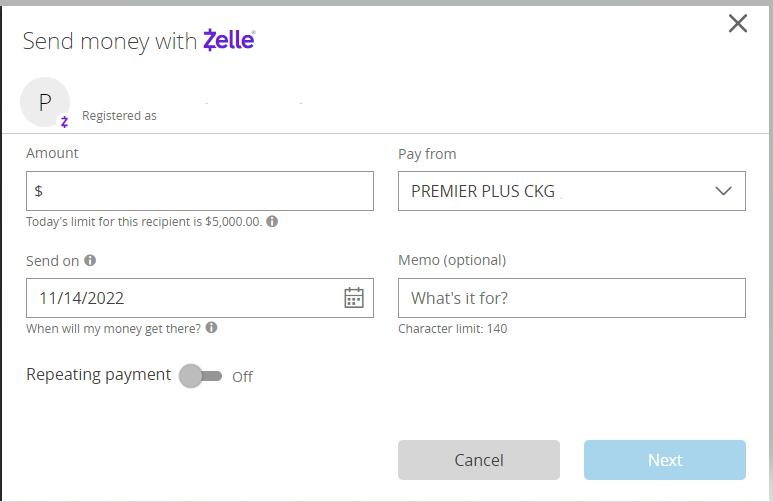

2. Enter the Transfer Amount, Account And Date

Next, you need to specify how much you want to send. You’ll need to enter the transfer amount, just bear in mind that it needs to be within the weekly and monthly spending limits appropriate for Zelle or your financial institution.

3. Review And Hit Send

When you press “send”, the payment is on its way. If your recipient already uses Zelle, the money will hit their bank account in a matter of minutes. However, if they are not already enrolled, there will be a delay. They will receive a message explaining how Zelle works and what they need to do to claim their payment.

How to Cancel a Zelle Payment?

As we touched on earlier, one of the reasons why Zelle is best for people you know and trust, and why there are sending limits, is that canceling a Zelle payment is tricky.

The only effective way to cancel a Zelle payment is if your recipient is not yet enrolled with the platform. If the recipient already uses Zelle, the payment will go directly into their bank account, so it can’t be canceled.

If you’ve changed your mind about payment, you’ll need to log into Zelle and check if it is eligible for payment cancellation. Check your account activity page, select the payment and see if there is an option to cancel

What are the Benefits And Drawbacks of Zelle?

Pros | Cons |

|---|---|

No Fees

| Payment Limits |

No Personal Details | Lack of Fraud Protection |

Quick Transfers | No Credit Card Transfers |

Banking App Integration | U.S Bank Accounts Only |

No Receiving Limits | Limited Payment Cancelation Facilities

|

- No Fees

Zelle is not only free to download, but there are no fees to send or receive money. Unlike a number of other payment apps, you won’t find a percentage taken from your transfer amount or any hidden fees.

However, you should check with your credit union or bank to ensure that there are no service fees that could apply to Zelle transactions.

- No Personal Details

One reason why many people are wary of transferring money is that they are concerned about sharing their personal information and banking details.

However, Zelle doesn’t require personal details for the sender or recipient. If you use Zelle via your bank app, your details are never visible to Zelle.

- Quick Transfers

Zelle is a good way to quickly send money. If the recipient is enrolled with Zelle, they can receive the money within minutes, much faster than a bank-to-bank wire transfer. This makes it convenient to deal with any personal finance needs.

There is no delay or pressure for one person to carry the cost of a larger purchase. In the scenario of splitting a restaurant bill, everyone can make their Zelle payments to one person, who can then pay for the meal with shared funds in minutes.

- Banking App Integration

Zelle is partnered with 1,000 or more financial institutions and many banks and credit unions have Zelle integrated into their apps. This makes it easy to make transfers without any fuss.

- No Receiving Limits

While there are sending limits, depending on whether you’re using the Zelle app or via your bank, there are no receiving limits.

- Payment Limits

Depending on how you’re using Zelle, your weekly sending limit could be as little as $500, which may be a problem if you’re dealing with larger sums regularly.

While there are some banks that allow sending as much as $5,000, you’ll need to check the policies of your specific bank.

- Lack of Fraud Protection

Unlike PayPal or some of the other payment transfer platforms such as Western Union or MoneyGram, Zelle has no fraud protection. So, if you’ve used Zelle to pay for an item or service and the seller does not deliver, you have no option for reimbursement.

For this reason, Zelle recommends only using its services to send money to those you know and trust.

- No Credit Card Transfers

Zelle only facilitates bank transfers, so if you typically use a credit card to send payments, this is not the right platform for you.

However, if you do use a credit card, you are likely to incur a fee for this transfer and your card issuer may regard it as a cash advance, so it is a costly way of sending money.

- U.S Bank Accounts Only

Zelle supports U.S bank and credit union accounts, so if you tend to send money internationally, Zelle won’t work for you.

- Limited Payment Cancelation Facilities

Since Zelle processes payments within minutes, there is no real facility to cancel a payment. The only way you can cancel a Zelle payment is when the recipient has not enrolled yet.

How to Receive Money From Zelle?

If you want to receive money via Zelle, all you’ll need is a Zelle account. If your bank or credit union account partners with Zelle, there is nothing more that you’ll need to do. Any payments that are sent to you via Zelle will deposit into your linked bank account automatically.

If your financial institution does not offer Zelle or you don’t already have an account, you’ll need to download the app and create an account. Just bear in mind that receiving your first payment will be a little slower, as Zelle needs to verify the account.

So, you could be waiting for up to three business days for the funds, but future payments will arrive in the account within minutes.

Can You Get Scammed on Zelle?

Unfortunately, scammers seem to access almost every area of personal finance and Zelle is no exception. Most of the common scams seem to involve misrepresentation to get people to authorize money transfers.

For example, you may receive a message to confirm a large, bogus Zelle payment. If you reply to let them know you didn’t authorize the payment, the scammer walks through dodgy instructions to gain access to your personal details. Scammers may also claim your account has been compromised and you need to take immediate action to resolve the issue.

Zelle Is Safe to Use, But Make Sure to Minimize Risk

Fortunately, there are some effective ways to minimize the risks of falling victim to a scam. Firstly, don’t respond to any unsolicited emails or messages. If you receive a spontaneous message, check with your bank first using your usual contact methods.

You should also be wary about any “urgent” requests or deadlines. Scammers rely on scare tactics to make the unsuspecting panic.

For example, you may receive a message that your power will be shut off in 30 minutes if you don’t make a payment. Again, don’t rely on these urgent messages. Instead contact the business directly.

Finally, be sure to only use Zelle with people or businesses that you are familiar with and trust. While Zelle is easy to use, you are unlikely to be able to recover any funds if you mistakenly authorize a payment.

Top Offers From Our Partners

![]()

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

Zelle Best Alternatives

While Zelle is a solid platform, if it doesn’t appeal to you, there are some decent alternatives. Some of the best include:

1. PayPal

This is one of the most commonly used payment service platforms, providing a convenient way to send money with or without a bank account around the world.

All you need is an email address and once you sign up for an account, you can add money using your debit card, credit card, bank account or other payment methods.

However, what makes PayPal particularly appealing is its security protections. It uses financial industry standard encryption and if there is an authorized transaction or the product fails to arrive, you can get a full refund. Just bear in mind that this comes at a cost. There is a service fee of 2.9% plus $0.30 per transaction.

2. Stripe

Stripe allows merchants to accept payments for online services. The platform has a straightforward and quick sign up process, with an easy to use dashboard and reasonable fees.

You don’t need to hold a business checking account to use this service and you can open an account with just an email address and password. You can send and receive money globally and Stripe even offers a test mode, so you can check how the service will work for you.

3. Venmo

Venmo is owned by PayPal, but it allows money transfers via a mobile phone app. You can transfer payments for shared things such as dinner, rent or concert tickets in a secure way.

You can fund the transfer using a bank account, credit card, debit card or your account balance. The platform does not charge fees higher than the standard electronic bank transactions, and the platform has a fun feel.

You can link with friends to create a social experience on the platform and even comment on other’s transactions when they are in the public mode.

FAQs

Zelle is a fintech from Early Warning Services LLC, which is owned by seven U.S banks: Capital One, JPMorgan Chase, Bank of America, PNC Bank, Truist, U.S Bank, and Wells Fargo.

Zelle doesn’t actually generate any revenue, it has been designed as a tool to aid banks and save transaction fees.

This depends on how you’re using Zelle. If you’re using the app directly, there is a $500 weekly limit, but your bank may have higher daily or weekly limits.

Unfortunately not. Since transfers arrive in the recipient’s bank account within minutes, it is very difficult to try to recoup any money from a scam transaction.

No, this is why Zelle is only recommended for people and businesses that you know and trust.

If this is your first payment received through Zelle, it can take up to three business days to arrive in your bank account, but subsequent payments will arrive in minutes.

You’ll need to adhere to the daily, weekly and monthly spending limits on Zelle.

Yes, if you know and trust the business, you can make Zelle payments. You may also use Zelle for your own small business, but clients may be wary of using it as there is no buyer protection.

Yes, you may be able to use Zelle via your bank’s internet banking platform.

Yes. You will be responsible for reporting any taxable payments made through Zelle.

Yes, Chime is partnered with Zelle, so you can use it via the Chime online banking portal or app.

Only if the recipient has not yet enrolled with Zelle. If the recipient is an existing user, the funds will arrive in minutes, so there is no way to cancel the payment.