Table Of Content

What Is a Brokerage Account?

You can use your online brokerage account to purchase stocks and bonds, mutual funds, exchange-traded funds, index funds, options, futures, foreign currencies, real estate investment trusts, and all the other assets and instruments you can possibly invest your money in.

There’s an essential difference between the two. The bank takes out an insurance policy for your savings account with the FDIC up to $250,000 but there’s no insurance for your brokerage account.

So, in case your investments lose their value, you can also lose a lot of your hard-earned money in a blink of an eye.

Once your online account is up, you can start to buy and sell investments through your account. The type of flexibility your account can give will depend on the firm you pick to work with. But although the account is through a firm, it will still be the investor who will own the account’s assets.

1. First, Understand Your Needs

Spend some time identifying what is the most important element you want in your trading platform. Each investor might have a different preference because the answer would depend on each one’s investment goals and their knowledge about the art, science, and math of investments.

You should be honest to yourself about where you are in your investing journey and your ultimate destination. Do you want to put up your retirement fund and concentrate on passive investments that will give you tax-free income in an IRA or 401(k)?

Does the idea of spending your time doing day-trading appeal to you? Do you imagine yourself personally involving yourself in every detail of managing your portfolio or would you rather pay a professional to do it for you? What is your investment goal? What is your reason for investing? Why do you want to go this route?

Depending on the final path you want to follow, there will be many more questions that will come up. You’d want to answer each one of them as you gain investing experience and realign your goal from time to time.

But right now, it’s good to begin with just four considerations to help you decide which among the features we will discuss below will be most crucial for your investing need.

2. Compare The Most Important Factors

Transaction Fee

The brokerage firm will charge you a fee every time you buy or sell a stock regardless of whether you make money or not out of the transaction. It is normally a flat fee, but each firm charges a different amount.

The more active a trader you are, the more quickly these charges will pile up. They also apply to mutual funds.

Management Fee

If you opt to have the broker’s representatives to manage your account, you will have to pay them for this service. The fee will normally be a percentage of your total assets in the account.

The more involvement you want them to have in your account, the higher will be the fee.

Withdrawal Fee

Some brokers will collect a fee every time you make a withdrawal or will hold your withdrawal if your balance falls below the minimum. Still, some brokers will let you draw a check against your online account but they will often ask you to keep a higher balance.

Just make sure that you know the rules when it comes to taking money out of your account.

Important: Pay Attention To Hidden Costs And Fees

Watch out that you don’t fall victim to hidden costs and fees. Read the fine print because you don’t know how much the non-trading fees can accumulate over the years and affect your retirement portfolio. What’s worse, these fees can become more than the savings you generate from normal trading commissions.

For example, your broker may charge you an account transfer fee that you don’t know about when you try to cancel your online account. Many e-brokers put this charge in place to dissuade customers from moving their funds.

You might be liable to pay a fee if you don’t meet the minimum balance in your account, or an account maintenance fee to keep it running. Even when you don’t do anything, your broker may charge you an inactivity fee.

If you’re maintaining an Individual Retirement Account (IRA) with an e-broker, expect to pay maintenance fees and additional fees for closing the IRA. Normally, you can view statements for e-brokers online since it helps them reduce their overhead. It costs a lot of money to print statements on paper. When you open a margin account, ask about the interest you have to pay on broker loans.

Minimum Investment & Funding Options

When you’re starting out, it’s normal to start with just a small amount of money to invest. Although that’s not necessarily a problem with the brokerage companies but some of them choose to impose fat minimum balances. If you will not be able to meet the balance requirement, some brokers will assess an additional fee for the low balance or just disallow you to open an account altogether.

The common practice among brokers is to allow the use of checks and bank transfers but it’s a good idea to make sure that the broker you choose does. This is important if you foresee yourself making regular investments. Also, try to know how long it takes for deposits to clear and whether there are additional fees to pay for the other methods of depositing funds such as a wire transfer.

If you’re a techie and would want an automated system so that you can move your funds from your bank account directly to your investment account on a regular schedule, make sure your broker can accommodate this setup. An automatic transfer system to your investments is one of the best ways to keep your contributions coming into your savings.

In case you’re anticipating that someday, you’ll have to move over investments to or from another brokerage, you should also want to confirm that your brokerage will allow a broker-to-broker transfer so you won’t be forcing yourself to sell your securities.

Investment Options

You’ll find that you can typically invest in standard securities through most brokers so it’s easy to buy and sell stocks, bonds, and funds. However, not all brokers will let their customers delve into complex or riskier investments such as penny stocks, options, futures, and foreign currencies. If they would be part and parcel of your investment portfolio, be sure that your brokerage can handle these investments at a sensible cost.

One of the qualities that you should look for in a brokerage firm is if they have the capability to let you invest in a large number of assets such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate investment trusts, options, futures, certificates of deposits, and even U.S. government Treasury securities.

If, for now, you’re only setting your sights in ETFs, you should not confine your choice to a broker that handles only a limited range of products. Keep in mind that in the future, you might expand your horizons and venture into other forms of investments. So, it’s better to start off with a broker who will be ready to accommodate you when that time comes.

A report by Gallup shows that a majority of Americans consider real estate as their best long-term investment from a pool of several investment options. Real estate leads the list of preferred long-term investments by 35%, against stocks at 21%, gold at 16%, and Savings accounts at 17%.

Customer Experience

One important action you should do when assessing a brokerage firm is to check out their website. You want to see what it looks like and more importantly, how easy (or difficult) it is to navigate and do your transactions. For investors who may not be at all familiar with how online transaction works, good customer experience is important because it could also mean a good investing experience.

Many online brokers are exactly that – they only have online personalities and no facility for human interaction. To them, it’s about saving on costs that they can pass on to the customers. But for a customer, such savings should not be at the expense of excellent overall customer service.

The ideal customer service providers are the ones that offer all possible contact option such as phone, email, SMS, and live chat. That way, you’ll have several means to resolve issues and do it through a mode that is most convenient or accessible to you. Always look for a broker with a good customer service reputation. The broker should be reputable and a member of FINRA/SPIC at the very least.

Trading Platform & Educational Tools

You’d also want your trading platform to be easy to use. Whether you’re a novice trader or an old-timer, you would appreciate being able to use the broker’s website app as easily as you can.

Even for advanced traders who want the more sophisticated platforms, they want more easy-to-understand functions such as interactive charting, access to historical pricing and different technical indicators. So, before you sign up, request for a platform demo or try out a free trial for a short time.

Perhaps you’re into short-term trading and you’re comfortable doing the technical analysis – then, it’s logical that you’d want to have access to useful charting tools. When you have it, you can do your own technical analysis. See what charting tools and services are available on the broker’s website and check if they are the ones that you need.

If you’re a beginner in the investing game, you can learn a lot from research and educational tools that brokers provide. The wide line up of reports, tutorials and other information that are available on the website will help you make better investment decisions.

Sometimes, you’ll find a broker whose fees are higher because they provide more in-depth research and educational tools. If you’re a beginner who relies so much on these tools, you might find that it’s better to shell out an extra $2 per transaction as long as you can make use of these great features.

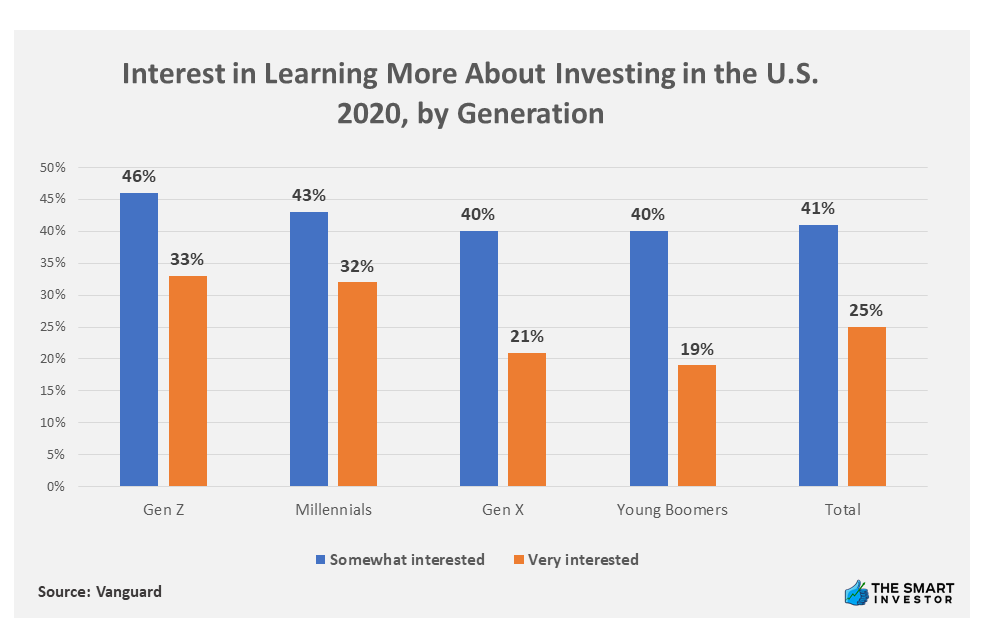

According to a survey conducted by

Types of Retirement Accounts Available

Just because the popular brokers offer many types of retirement accounts to invest in, don’t assume that all brokers offer the same things. You should confirm with your chosen broker.

If you’re investing for retirement, look for brokers that offer features that will help you set up and execute your retirement plan. You may pick one that makes available IRA or Roth IRA account with tax advantages. Some brokers offer commission-free ETFs and mutual funds that can give cheap but diversified market exposure. You may also look for a broker that offer special retirement tools such as retirement calculators.

Again, don’t just consider your present needs. You might be thinking that all you need now is a regular investment account, but there is a strong possibility that you might need an IRA or Roth IRA account in the future. Or perhaps, you’d need to open a custodial account for your children or a 529 account to fund their college education. Brokers who have robo-advising services or auto-trading features also fit in for retirement investments because you’d want to lessen your risk during market slumps.

If all these features are present before you finally sign up with a broker takes care of looking for them in the future when the need arises. Also, if this turns out to be an excellent broker, you might as well keep all your accounts with them because it’s quite difficult to keep track of your total portfolio if they are spread out to different brokers.

Additional Perks

There are larger brokerage firms that will give you some incentives if you sign up with them. Some will give cash bonuses for opening an account while others will grant you a limited number of free trades. These incentives are good especially if the firm can really support your investing requirements so you can use them as a tie-breaker when choosing between two or three equally good options.

However, don’t decide on a broker primarily because of their sign-up perks.

3. Final Step: Check Out Your Broker

If you’ve skipped this step, make sure you do it before you open an account with your broker. Do some background check on your broker or brokerage firm. Although you may not find anything negative about them – no registration or licensing problems, no disciplinary actions or bankruptcies – it is not a guarantee that it will remain that way forever.

Nevertheless, that’s better and more reassuring than knowing that the broker you’re thinking of picking has a problematic track record. Better to check beforehand and avoid problems later.

It's natural for each website to hype their company and post enticing materials on their pages, but the real information comes from unbiased reviews of real customers. You should pay particular attention to complaints about hidden fees and customer service.

Reputable brokers are always transparent when it comes to fees and commissions, and investors should be able to expect fast, convenient, and consistent access to customer service. You may run into one or two complaints (which is understandable and acceptable) but when you see a pattern of complaints, that’s a big warning sign.

Also, check if the phone numbers and addresses that your broker and brokerage firm gave in their “Contact Us” page are consistent with what Brokercheck has listed. Fraud operators usually steal identities of legitimate brokers and brokerage firms to dupe investors.

Bottom Line

You should consider a lot of factors when you’re picking your first broker. The broker you pick should be able to accommodate your investment style. You can be a trader or a buy-and-hold investor – you should take that into account when picking a brokerage firm.

Traders don’t keep their stocks for an extended time. They’re always looking for quick and fast gains, taking advantage of short-term price volatility so they may make numerous trade transactions in a short period. If this is you, you’ll want a broker with very low execution fees and not one that would charge so much that it would diminish your returns significantly.

Always remember that active trading takes experience, and records will show that inexperience and frequent trading would often have dismal results. A buy-and-hold investor, or a passive investor, buys stocks intending to hold them for a long time. One thing about buy-and-hold investors is that they don’t fret too much about the ups and downs of the market but are comfortable waiting for a stock’s long-term performance, just believing that their value will nevertheless increase over time.

Many investors will find themselves in between the two types for the meantime. And in that kind of scenario, they will have to look at all the other factors when they pick the broker that fits them to a tee.