Table Of Content

What's The Minimum Age To Open Bank Account?

Having your own bank account is oftentimes the first step in achieving financial independence.

Opening your first account can be a daunting process, but starting early and becoming comfortable with banking certainly makes it easier. For most banks, the minimum age to open your own bank account is 18 years old.

While this pertains to opening a bank account in your own name, there are other ways to gain access to a bank account if you are below the minimum age with the help of an adult.

What Do You Need To Open A Bank Account For Child?

The documents and information required to open a bank account for a child is relatively similar to what is needed to open an account for yourself.

The information the bank needs is the same regardless of the customer's age. The main difference is they need information regarding the adult on the account to verify both identities and financial competency.

- Proof of your identity – This can be done in a few forms, with the most common being a drivers license or a passport. These documents are used to validate your identity.

- Your social security number – Banks use your social security number to further verify your identity as well as check your credit and banking history. Through this piece of information, banks can access your credit report and perform the necessary due diligence.

- Child’s social security number – The social security number of the child the bank account is for is used primarily for identification purposes. As they do not have a credit or banking history, this purpose is invalid.

- Child’s birth certificate – Similarly to the social security number, the child’s birth certificate is used to validate the identity of the child obtaining the bank account. Since most children do not have a government issued identification document, this largely serves this purpose.

- Proof of address – Just like opening your own bank account, you will need to submit proof of address, typically in the form of a utility bill. This is also done to further verity the applicant’s identity.

How Do Bank Accounts For Teenagers Work?

Banks have established accounts mean specifically for kids and teenagers to teach them how to manage their own money and start them on the road to financial independence.

These bank accounts have a few different features than normal bank accounts that are tailored towards minors

- Zero Or Low Minimum Opening Deposit

While many bank accounts require a sizeable initial deposit, bank accounts for minors typically don’t.

This incentivizes opening an account even if you do not have the capital right away. This demonstrates the use of these accounts as a learning opportunity.

- Little To No Fees

With banks creating these accounts to teach kids about banking, they do not want to penalize them for making mistakes. This means that they do not set up rules such as minimum daily balances leading to monthly maintenance fees.

Children can make mistakes with their money early on and not suffer the consequences, in hopes that they don’t make the same mistakes later on.

- High Interest Rate

Banks typically offer fairly high rates on these bank accounts to entice kids and parents to open these accounts. Bank accounts for minors can have higher APYs compared to the average checking account, usually up to a certain amount.

This allows kids to understand the power of interest and actually see their money grow.

- Kid Friendly Online Banking

Some banks have established a mobile and online banking platform that is specifically tailored towards kids.

This allows them to easily track their accounts in a way that is not overwhelming for them. This encourages and enables them to learn and understand their banking much easier.

Pros And Cons Of Having A Bank Account For A Minor

There are many factors to consider when deciding whether to open an account for a minor. Some as positive and some are negative, so lets get into the main points.

Pros | Cons |

|---|---|

Linking Child Account To Parent Account

| Limited Monthly Transaction |

View Only Access For Minors

| Few Financial Education Resources |

- Linking Child Account To Parent Account

One of the most enjoyed features of minor bank accounts is being able to link a parent and child account and seamlessly manage the accounts together.

This gives the parent control of their child’s money and makes transfers between accounts extremely easy.

- View Only Access For Minors

With financial education being one of the primary goals of these bank accounts, these accounts allow for kids to play around in their account and view everything, without making any possibly harmful transaction.

Allowing the kids to interact with the account themselves enables them to learn on their own.

- Limited Monthly Transaction

One of the downsides of these bank accounts is they often come with transaction limitations.

Minor bank accounts are tailored to saving, so banks want to limit the overall activity in these accounts. If you want your child to be able to spend and make frequent transfers from the account, you may be disappointed.

- Few Financial Education Resources

While these bank accounts aim to teach children how to manage their own banking, very few resources explicitly teach them how to do this.

Most banks rely on the parents explaining to them how everything works, and learning through experience. You will likely have to use a third-party resource if you want your child to get a more structured financial education about banking.

How To Open A Bank Account For A Teenager?

Here are the steps to take when opening a bank account as a minor:

- Select the type of account you want – Many of the banks that offer bank accounts for minors offer both checking and savings accounts. Decide what is the primary purpose of the account and how you want your child to utilize it. Based on your answer select the type of account most suited to yours and your child’s needs.

- Choose what bank to use – There are numerous banks that offer accounts for minors, so it is important that you do your research to select the one that best fits you. The main factors to consider when deciding on an account are the fees associated with it, the ease in online banking, and interest rate of the account.

- Submit an application – Once you’ve settled on a bank, its time to submit an application. This process is very similar to applying for a normal bank account, with the main difference being that you need information on the child as well. If you have all of the documents needed, this whole process can take as short as 15 minutes.

- Fund the account – After your application has been processed and approved, which can take a few days, all you need to do is fund the account. Transfer money from the parent account linked or another account, and once there is money in the minor account, its time to start banking!

Financial Institution | Teen/Minor Account |

|---|---|

Capital One MONEY Teen Checking | |

Chase First Banking℠ | |

Copper | Copper Banking App |

Alliant Credit Union Teen Checking | |

Current Banking App | |

Connexus | Connexus Credit Union Teen Checking |

USAA

| USAA Youth Spending Account |

Axos Bank First Checking |

What Happens to a Bank Account When a Minor Turns 18?

If a child has a bank account in their name prior to turning 18, the account can be converted into a normal account following their 18th birthday.

Some banks have it established so that the account automatically converts into an adult bank account in their name. However, most of the times, you need to submit a request to change the account status.

You have the option to make the account solely in the child’s name or make it a joint account with both the child and the parent maintaining access.

Why Banking App Can Be Great For Minor?

Often times kids know more about technology than their parents do! With kids growing up in the digital age, kids are extremely comfortable with using apps, and as banking and technology become more interconnected, it is essential to learn how to manage accounts online.

Mobile banking apps are a great resource for children to access their bank account and learn how to manage it in a way that they are comfortable with. The more acclimated minors are to utilizing banking apps to manage their finances, the less daunting it will be when they are adults.

How To Manage A Bank Account As A Teenager?

Managing your first bank account can be challenging, but there are many sources you can keep learning, get advice, and manage your finance smartly. Here are some basic tips:

- Establish a budget – Creating a plan and sticking to it is the easiest way to ensure you are spending within your means. Talk with your parent about what is a reasonable limit to set for spending and how much you should save each month. Stick to your budget each month and be conservative with your spending.

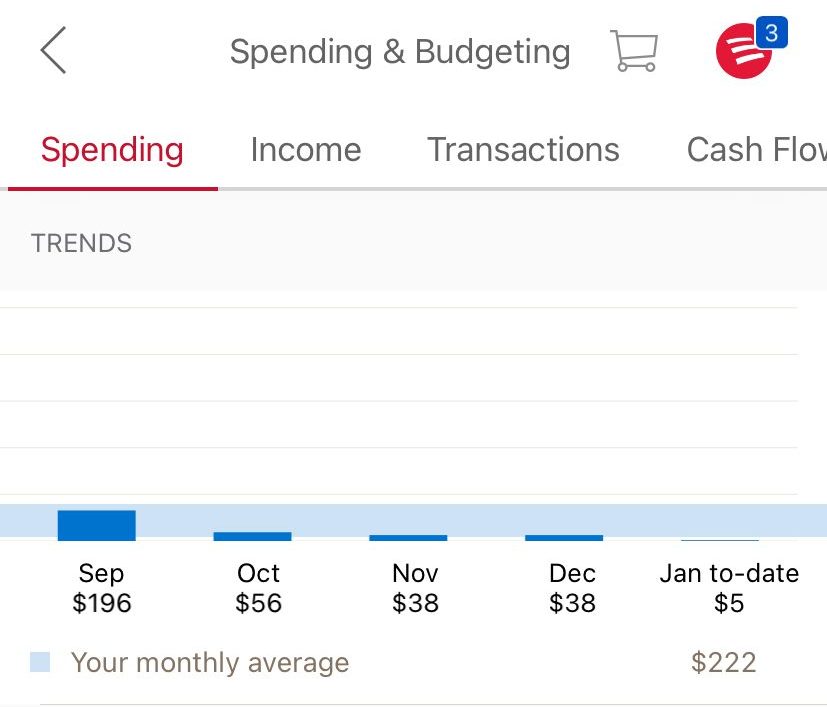

- Check your account often – The first time you have your own bank account, you can be surprised by how quickly it can be depleted. Get into the habit of checking your account often to get an understanding of what your spending looks like. With the aid of the kid-friendly mobile banking apps, this is easier than ever.

- Deposit into the account regularly – Along with setting a budget, you should get into the habit of depositing into the account in a structured manner. Whether you have a job and regular income or just gifts from family, add the money into your account right away. Especially when you get paid on a regular basis, have a plan for how much you are putting in checking or savings.

Top Offers From Our Partners

![]()

Top Offers From Our Partners

![]()

FAQs

Minors are able to be named a beneficiary on a bank account, but they do not have the authority to take control of the account until they are 18 or 21, depending on the bank and state laws.

Banks require you to have your own bank account to be able to cash a check. This can include a custodial account. If a minor does not have a bank account, an adult with their own account will have to cash the check for them.

The process of converting a minor bank account to a major account varies between banks. The best way to do this is to either visit the bank in person or speak with a representative on the phone.

There are many banks that offer bank accounts specifically tailored to minors. Many of these banks allow you to open the account directly online.

Some of the most well regarded bank accounts for minors include Chase First Banking, Capital One Money Teen Checking, and Wells Fargo Clear Access.

As a minor, you are able to open specific accounts that are meant for you, these are called custodial accounts. With the help of a parent or adult, you can set up one of these, or a joint account which is directly shared.

It is recommended that you open a savings account for your child as early as possible. Setting money aside for your child and teaching them the concept of saving is essential to get them on the path for financial independence.