Table Of Content

Certificates of Deposit (CDs) are a popular investment option for customers looking for a safe and secure way to grow their money. Two of the largest banks in the United States, Chase and Bank of America, offer CDs with varying rates and terms.

In this article, we will compare the CD rates offered by Chase and Bank of America, as well as other important factors such as minimum deposit requirements, how their CDs work, and early withdrawal penalties.

By understanding the differences between these two banks' CD options, you can decide which bank and CD term best fits your needs.

Chase | Bank Of America | |

|---|---|---|

CD Range | 3.00% – 4.75% | 0.05% – 5.00% |

Minimum Deposit | $1000 | $1,000 |

Early Withdrawal Penalty | 90-365 days of interest | 90-365 days of interest |

Terms | 1 to 120 months | 1 – 120 months |

How Do CD Rates Compare?

For short-term CDs (6-12 months), Bank Of America generally offers higher rates than Bank of America. However, for long-term CDs (24-120 months), Chase CD rates are higher than BoFa for some terms.

Keep in mind that the Bank Of America higher rates is on their featured CDs – means a higher minimum deposit of at least $10,000.

In cases with a range of interest, the lower rate is available for those who deposit up to $100,000, and the higher rates are for those who deposit more than $100,000 (for both Chase and Bank Of America)

CD Term | Chase APY | Bank Of America APY |

|---|---|---|

3 Months | 4.25% – 4.25% | 4.50% |

6 Months | 3.00% | 5.00% (Featured, 7 months) |

9 Months | 4.00% – 4.50% | 0.03% |

12 Months | 2.00% | 5.00% (Featured, 13 months) |

18 Months | 2.50%

| 0.03% |

24 Months | 2.50% | 3.00% (Featured, 25 months) |

30 Months | 2.50% | 0.03% |

36 Months | 2.50% | 0.03% |

48 Months | 2.50% | 0.03% |

60 Months | 2.50% | 0.03% |

120 Months | 2.50% | 0.03% |

Top Offers From Our Partners

![]()

Bank of America CD Vs Chase CD: How They Work?

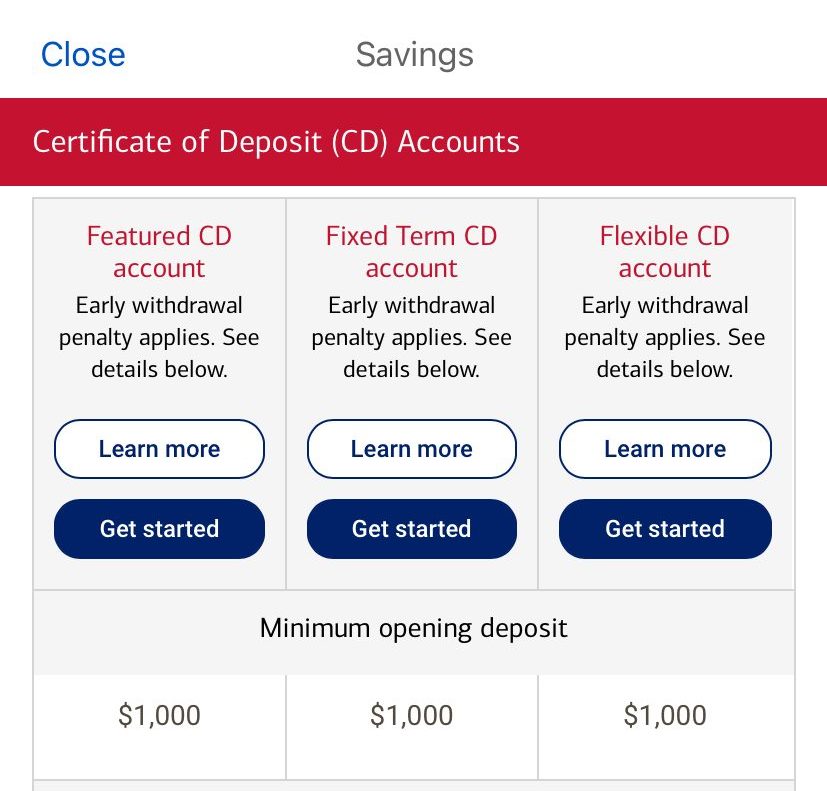

At present, Bank of America has two types of CD products on offer.

- The first is the fixed-term CD which is a conventional CD that offers terms ranging from 28 days to 10 years. Regardless of the term, a minimum balance of $1,000 is required to open an account, and the interest rates are determined by both the initial deposit and the term selected.

- The second CD product is Bank of America's Featured CD, which is tailored for customers who can afford a higher initial deposit. To open this account, you must deposit a minimum of $10,000, and you can choose from various term options ranging from 7 to 37 months.

Chase provides a wide range of CD terms, from as short as one month to as long as ten years. Chase CDs earn daily compounded interest, and depending on the term, you can choose to have the interest credited to your account on a monthly, quarterly, semi-annually, annually, or at maturity basis

Chase vs. BoFa: Compare CD Early Withdrawal Penalty

Remember that withdrawing funds before maturity will result in a penalty, and the penalty amount will differ based on the term of your CD.

When it comes to the early withdrawal penalty, Bank Of America seems to be more flexible than Chase. For most CD terms, you'll less with Bank Of America compared to the penalty Chase charges in case of an early withdrawal.

So, if you may need the money – Bank Of America may be a better option for you.

CD Term | Chase | Bank Of America |

|---|---|---|

3 Months | 90 days of interest | 90 days of interest |

6 Months | 180 days of interest | 90 days of interest |

9 Months | 180 days of interest | 90 days of interest |

12 Months | 180 days of interest | 180 days of interest |

18 Months | 180 days of interest | 180 days of interest

|

24 Months | 365 days interest | 180 days of interest |

30 Months | 365 days interest | 180 days of interest |

36 Months | 365 days interest | 180 days of interest |

48 Months | 365 days interest | 180 days of interest |

60 Months | 365 days interest | 365 days interest |

120 Months | 365 days interest | 365 days interest |

Which Is Better For 1-Year?

For 1 year CD, the rates are quite similar. If you have a relationship with Bank Of America, you may earn a bit higher interest than what you can get with Chase.

If you're looking for 1-year CD, you can take a look and compare CDs here.

About Chase Bank

Despite their modern and trendy image, Chase Bank is actually one of the oldest banks in the United States, dating back many decades.

As the consumer branch of JP Morgan Chase, one of the largest banks in the country, Chase has managed to weather the storm of financial upheaval that has affected many other major banks in recent years. In fact, JP Morgan Chase emerged as a winner during the 2008 Wall Street collapse, acquiring the remains of Washington Mutual.

Additionally, in recent years, Chase has been expanding its physical presence by building almost 200 new branches, with a particular focus on states in the eastern half of the country, such as Florida and Georgia.

About Bank Of America

Bank of America has a long history that dates back 240 years. Today, it has grown into a global financial services company and serves half of all households in America. The bank has approximately 67 million clients.

Bank of America offers unparalleled access to financial services with a vast network of approximately 3,900 branches and 16,000 ATMs. The bank provides low minimums to open checking or savings accounts, and offers higher rates and lending discounts through its Preferred Rewards program. However, there are some drawbacks to using Bank of America's services, including the absence of high-yield savings account options and no reimbursement of ATM fees.

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

Related Posts

How We Compare CDs: Methodology

In our comprehensive certificate of deposit (CD) comparison, The Smart Investor team meticulously evaluated various CDs across four key categories to assist you in selecting the most suitable option for your savings goals.

- CD Rates: We thoroughly examined the interest rates offered by each CD, considering their competitiveness in the market. Higher rates typically translate to greater returns on your investment over the CD's term. Additionally, we scrutinized any special promotional rates or conditions that might affect the overall value of the CD.

- CD Features: This category focuses on the unique features and terms associated with each CD. We assessed factors such as minimum deposit requirements, early withdrawal penalties, and the availability of flexible terms. Additionally, we considered any additional perks like interest compounding frequency or options for automatic renewal.

- Customer Experience: A positive customer experience is crucial in banking, and we evaluated each institution's performance in this regard. We looked into aspects such as the ease of opening a CD, the quality of customer service, and the availability of support channels. Reviews from reputable sources such as Trustpilot and JD Power rankings were also considered to gauge overall user satisfaction.

- Bank Reputation: The reputation of the bank is a significant factor in the decision-making process. We examined the bank's financial stability, regulatory compliance, and public perception to assess its overall trustworthiness and reliability as a CD provider.