Capital One is one of the top online banks, while HSBC Bank focus on serving wealthier customers. Let's compare them side by side: checking account options, savings accounts, CDs, and loan options.

Checking Accounts

For the average consumer, Capital One is our winner. It offers free checking accounts, decent interest on balance, and other features to manage your money.

On the other hand, the HSBC Premier Checking Account is best suited for individuals who maintain a higher level of financial resources and prioritize international banking services.

-

Account Types

The HSBC Premier Checking Account is tailored for individuals seeking priority banking services and international accessibility.

To qualify, customers must maintain a balance of $75,000 across U.S. consumer and qualifying commercial accounts, or have monthly direct deposits of $5,000 or more, or maintain Private Bank status.

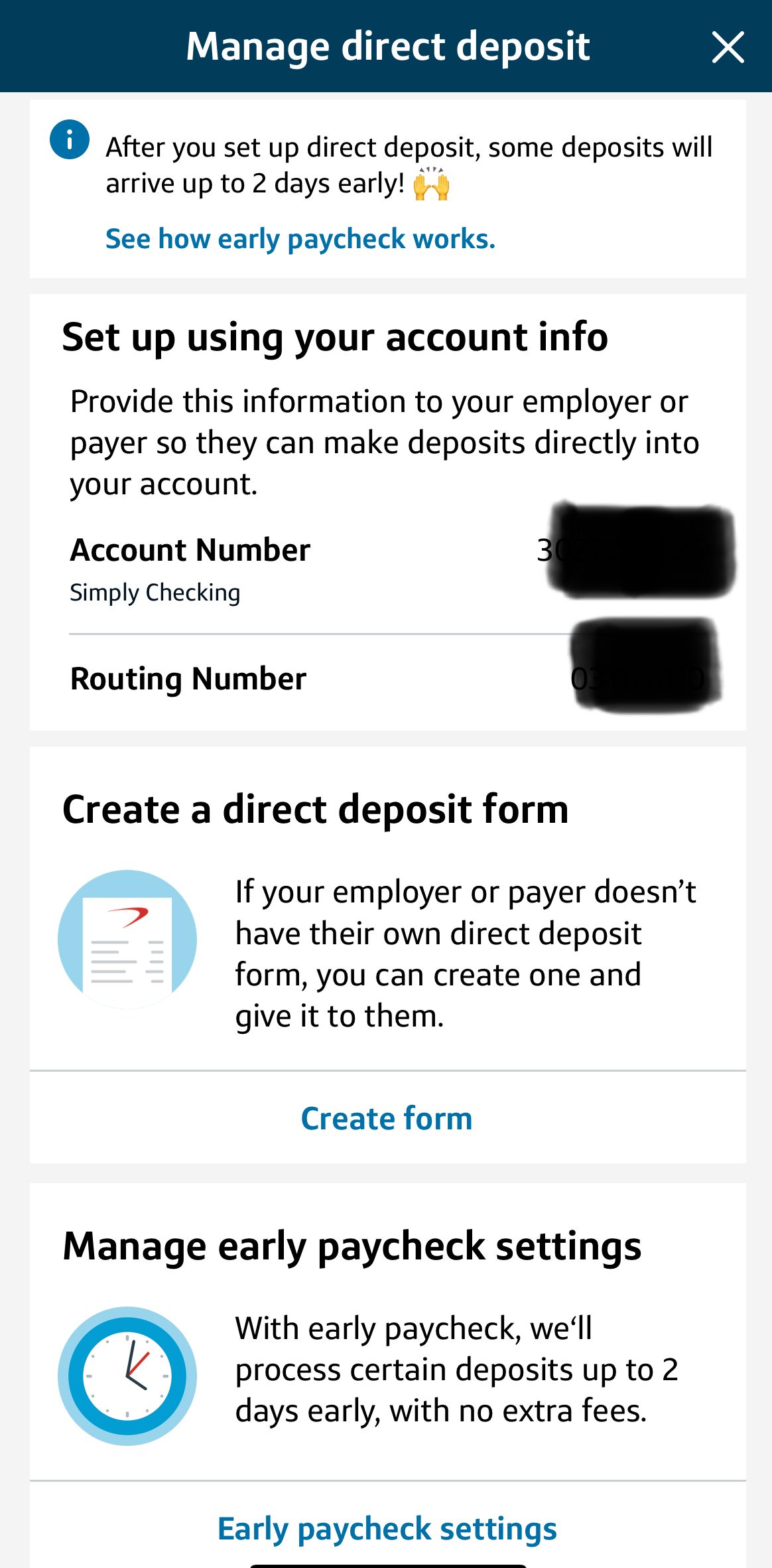

On the other hand, the Capital One 360 checking accounts are mainly used and operated online for your optimal convenience.

Bank Account | Monthly Fee | APY On Balance |

|---|---|---|

Capital One 360 Checking Account | $0 | 0.10% |

HSBC Premier Checking Account | $50

Can be waived if you maintain $75,000 in qualifying balances OR having monthly recurring direct deposits

totaling at least $5,000 from a third party OR having a HSBC U.S. residential mortgage loan with an original loan amount of at least $500,000

| 0.01% |

-

Features

With the Capital One 360 Checking Account customers can quickly pay their bills, get their cash, make deposits, and transfer their money without the added stress of a monthly fee.

There are over 38,000 fee-free ATMs and over 2,000 Capital One ATMs, which will successfully meet your needs when accessing your money. Another great incentive Capital One 360 offers is a free debit card for all purchases.

Bank Account | Main Features |

|---|---|

Capital One 360 Checking Account | No overdraft fees, get paid early, pay bills online, send cash with Zelle, mobile deposit, account alerts |

HSBC Premier checking account holders enjoy benefits like global ATM access without HSBC fees, a fee-free HSBC Premier Debit World Mastercard for international transactions, and the convenience of fee-free transfers up to $200,000 per day to linked international HSBC accounts.

Additionally, the account offers online access to worldwide HSBC deposit accounts, overseas account opening support, and priority customer service, making it an appealing choice for frequent travelers and those with international financial needs.

Bank Account | Main Features |

|---|---|

HSBC Premier Checking Account | Access to wealth products, priority services, global support, transfer funds, no HSBC fees on everyday transactions, Debit World Mastercard

|

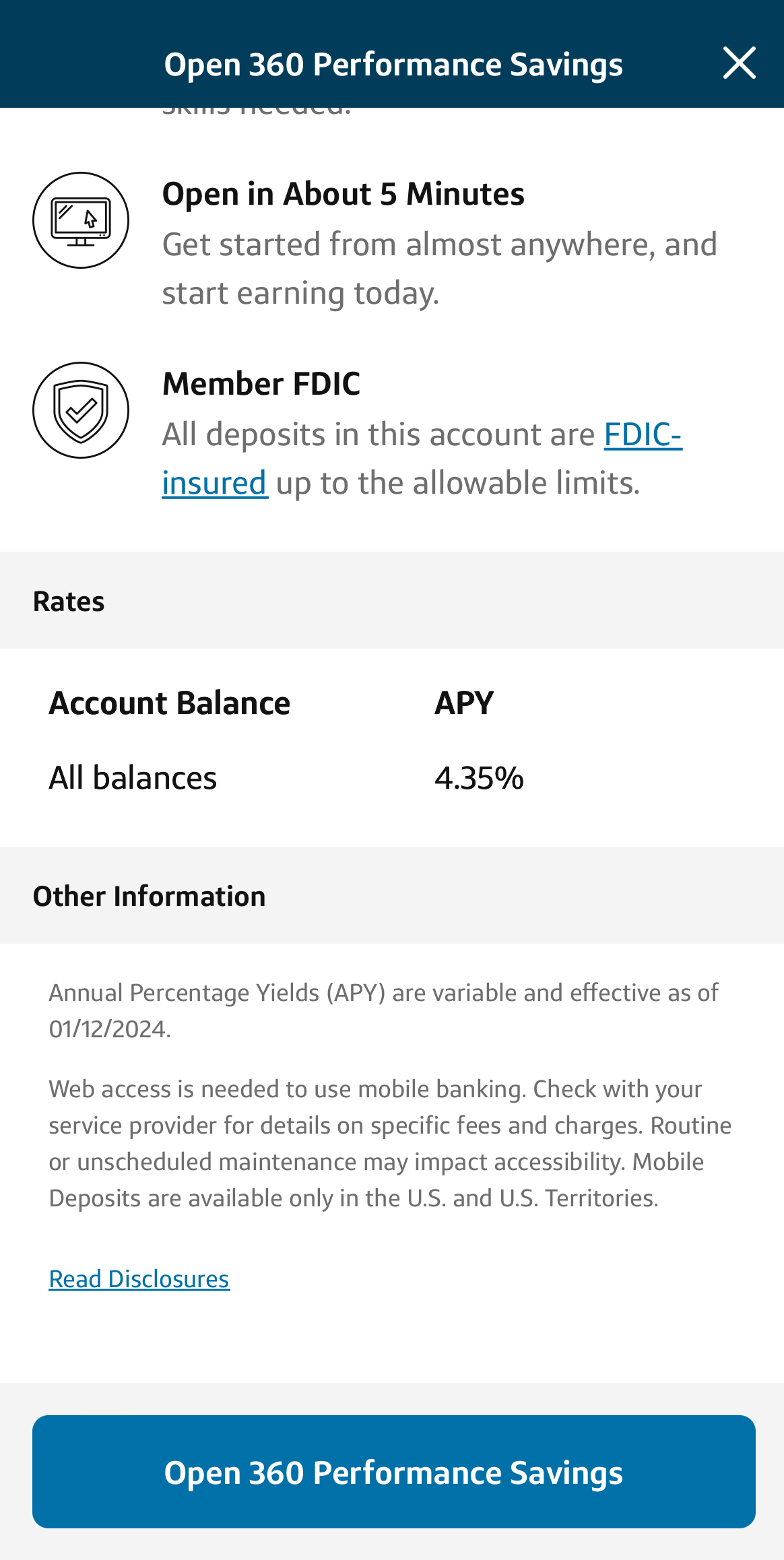

Savings Accounts

HSBC Bank edges ahead in savings accounts by offering a slightly better rate than Capital One, though the gap is small.

With the HSBC Premier Relationship Savings account, you can get a higher rate when linked to an eligible Premier checking account, meeting extra criteria.

Both banks provide competitive rates, easy online banking with bill pay, and FDIC insurance for your deposited money. It's worth noting that neither bank offers money market accounts.

HSBC Premier Relationship Savings | 360 Performance Savings | |

|---|---|---|

Savings Rate | 0.01% – 4.50% | 4.25% |

Minimum Deposit | $0 | $0 |

Fees | $0

Customers must maintain $75,000 in qualifying balances OR having monthly recurring direct deposits

totaling at least $5,000 from a third party OR having a HSBC U.S. residential mortgage loan with an original loan amount of at least $500,000

| $0 |

Certificate Of Deposits (CDs)

When it comes to CDs, Capital One is our winner.

Unlike HSBC Bank, which offers high rates on specific terms, Capital One provides consistently high rates across almost every term. This means customers have the opportunity to earn good returns on their money, regardless of the duration they choose for the CD.

Moreover, Capital One allows for flexible CD investing strategies, like CD laddering and combining short and long-term CDs. This flexibility gives customers more control over their investments and the ability to tailor their CD approach based on their financial goals.

-

HSBC Bank CD Rates

CD Term | APY |

|---|---|

6 Months | 4.00% |

12 Months | 4.80% |

24 Months | 4.10% |

-

Capital One CD Rates

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

6 Months | 4.25% | 3 months interest |

9 Months | 4.25% | 3 months interest |

12 Months | 5.00% | 3 months interest |

18 Months | 4.45%

| 6 months interest |

24 Months | 4.00% | 6 months interest |

30 Months | 4.00% | 6 months interest |

36 Months | 4.00% | 6 months interest |

48 Months | 3.95% | 6 months interest |

60 Months | 3.90% | 6 months interest |

Top Offers From Our Partners

![]()

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

Credit Cards

When it comes to credit cards, Capital One is a clear winner with much better options, rewards, and redemption options than HSBC cards.

The Capital One Savor Rewards Credit Card is tailored for individuals who want a high cashback rewards ratio on everyday spending categories. For those who want a flat rate cashback, The Capital One Quicksilver offers unlimited 1.5% cash back on every purchase, making it straightforward and rewarding.

Card | Rewards | Bonus | Annual Fee |

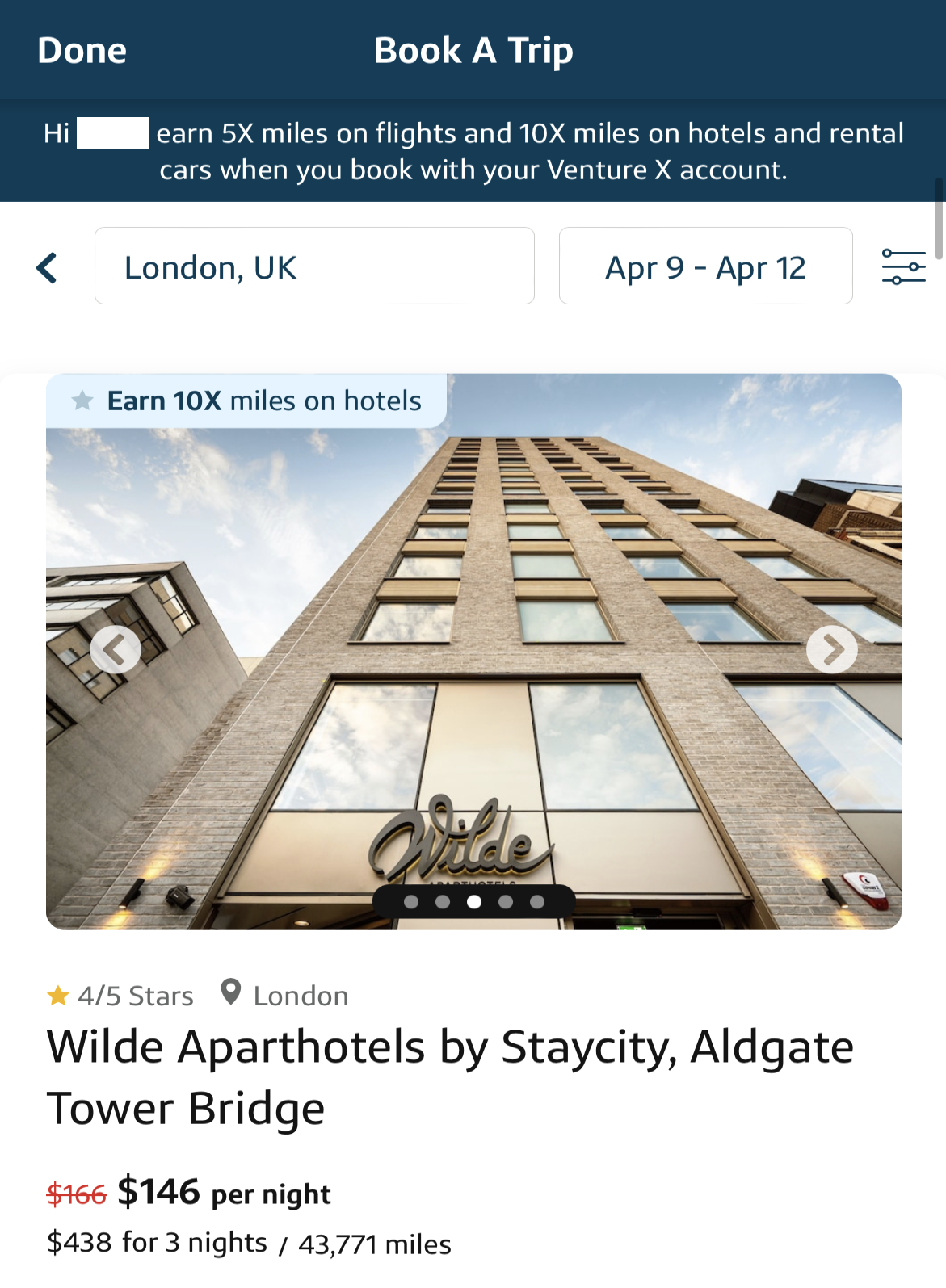

| 2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

| 75,000 miles

75,000 miles once they spend $4,000 on purchases within 3 months from account opening

| $95 |

|---|---|---|---|---|

| 1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

| $200

$200 cash bonus once you spend $500 on purchases within 3 months from account opening

| $0 | |

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

| $395 | |

|

1% – 4%

unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.

| $300

$300 cash bonus once you spend $3,000 on purchases within 3 months from account opening

| $95 | |

| N/A | N/A | $0 |

For travelers, the Capital One Venture Rewards Credit Card is great for travel enthusiasts, while the Venture X card offers premium travel benefits and annual credits.

The HSBC Premier Credit Card doesn't have an annual fee or charges for foreign transactions. It also gives cardholders global Wi-Fi access with Boingo, up to $85 TSA Precheck credit, and exclusive Mastercard Travel Rewards. Points earned can be transferred to 11 airlines and two hotels.

The HSBC Elite Credit Card, with a $395 annual fee, offers up to $400 in annual travel credits for bookings through HSBC Travel. Cardholders get unlimited access to over 1,000 airport lounges via LoungeKey, a special Luxury Thank You Gift for hitting spending goals, and no foreign transaction fees.

However, HSBC redemption offers and rewards are limited compared to Capital One.

Card | Rewards | Bonus | Annual Fee |

| HSBC Premier Credit Card | 1x – 2x

2x points on travel (including airline, hotels, and car rental), 1× points on all other purchases

| 35,000 points

35,000 Bonus Points after spending $3,000 in the first 3 months from Account opening | $0 |

|---|---|---|---|---|

| HSBC Elite Credit Card | 1x – 3x

3× points on travel (including airline, hotels, and car rental), 2× on dining, 1× points on all other purchases | $50,000 points

50,000 Bonus Points after spending $4,000 from the first 3 months of Account opening | $395 |

Mortgage And Loans

HSBC Bank is our winner when it comes to lending options, as it offers more options for borrowers than Capital One.

While Capital One offers only auto loans, HSBC Bank provides mortgages for homebuyers, mortgage refinancing for improved terms, and home equity loans or lines of credit for leveraging property equity, all of which are not available through Capital One.

HSBC Bank also offers personal loans.

Which Bank Is Our Winner?

Capital One is our winner as it is a better fit for most consumers with a decent checking option, high savings rates, and a great selection of cards, while HSBC banking products are designed for affluent and high-net-worth individuals.

However, it's important to think about different things, especially the ones that matter most to you. This might include looking at banking services, help with overdrafts, how often you use ATMs, how close the bank is to where you live, and other things that are different for each person.

Top Offers From Our Partners

![]()

Top Offers From Our Partners

![]()

How We Compared Capital One and HSBC: Methodology

In our comprehensive banking comparison, The Smart Investor team meticulously reviewed and compared banks across five vital categories:

Checking Accounts (30%): We thoroughly examined features such as direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. Special offers available to customers were also taken into account.

Savings Accounts and CDs (20%): Our focus centered on critical factors including the Annual Percentage Yield (APY), minimum deposit requirements, account flexibility, FDIC insurance coverage, special savings offers, variety of CDs, automatic renewal options, and early withdrawal penalties.

Credit Cards (15%): We carefully analyzed rewards programs, annual fees, introductory bonuses, travel benefits, APR, and balance transfer options provided by each bank's credit cards to offer a comprehensive comparison of available features.

Lending Options (15%): We evaluated the variety of loan options offered, encompassing personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, providing valuable insights into the banks' lending capabilities.

Customer Experience and Bank Reputation (20%): Our assessment included an analysis of online banking and mobile app usability and ratings, accessibility of customer support, online reviews, JD Power research, Trustpilot ratings, and overall financial stability, delivering a holistic perspective on customer experience and reputation.

Compare Capital One With Other Banks

Discover Bank is a full-service online bank as well as a provider of payment services. Discover can be used for banking and retirement planning by individuals. Discover is best known for its credit cards with rewards, but it also provides personal, student, and home equity loans.

Capital One began as a credit card company, but it has grown to offer a diverse range of traditional banking services over the years. In addition to credit cards, it offers checking and savings accounts, loan refinancing, auto finance, and children's accounts. As a result, Capital One is more appealing to those seeking a traditional banking experience.

Read Full Comparison: Discover vs Capital One: Which Bank Account Wins?

Capital One is a premium online banking service that offers convenient, dependable service and physical locations to anyone looking for them. Capitol One 360, in addition to providing a trustworthy and dependable service, has no hidden fees or minimums, allowing you to continue earning interest on your daily money. There are over 38,000 fee-free ATMs and over 2,000 Capital One ATMs to meet your money access needs.

American Express is one of the world's most well-known credit card brand names. Customers can get a personal banking solution from American Express National Bank, which offers online savings and CD options. Personal savings accounts have a high potential yield. American Express National Bank is a respectable, secure banking option that does not offer any extra features but does offer the most important one.

Read Full Comparison: American Express vs Capital One: Which Bank Is Better For You?

CIT Bank offers a variety of savings accounts. Savings Connect has two tiers, with the first offering a higher rate if you make qualifying deposits and link your checking account. Savings Builder, on the other hand, offers 3.99 percent if you keep a balance of $25,000 or make monthly deposits of at least $100. There are no account maintenance fees, but you can only make six transactions per statement cycle.

Capital One offers a high yield savings account with a slightly lower rate than CIT Bank's top rate. However, you are not required to jump through any hoops. The account allows six withdrawals per calendar month, but there is no minimum deposit or balance requirement to keep your account open.

Read Full Comparison: CIT Bank vs Capital One: Which Bank Account Is Better?

Chase and Capital One both have banking product lines that compete with traditional high street banks.

Capital One also has a competitive advantage in terms of checking accounts. The Capital One checking account is not only fee-free, but you can also earn interest on your account balance. Chase's checking account does not pay interest, and you must meet certain requirements to have the $12 monthly fee waived.

However, when you open a qualifying account, Chase will give you a welcome bonus, and its checking account has some nice features such as paperless statements for up to seven years and checking account upgrade options.

Read Full Comparison: Chase vs Capital One: Compare Banking Options

Capital One began as a credit card company, but has expanded its line of banking products to rival a traditional bank. Aside from checking and savings accounts, you can also get loan refinancing, auto finance, and children's accounts.

Wells Fargo offers an even broader range of products. There are several checking accounts available, as well as two savings accounts and investment options such as IRAs and 401ks. You can also get loans and mortgages, as well as wealth management services. Wells Fargo is thus a highly comparable alternative to the traditional high street bank.

Read Full Comparison: Capital One vs Wells Fargo: Which Bank Wins?

Capital One made its name as a credit card company, but in recent years, it has developed a decent banking product line that rivals that of a traditional bank. Capital One offers loan refinancing, kids' accounts, and auto finance in addition to checking and savings accounts.

Credit One remains primarily a credit card company, but it does offer a limited range of banking products, including CDs.

Read Full Comparison: Capital One vs Credit One: Which Bank Account Is Better?

Ally has a decent banking product lineup that would make switching from a traditional high street bank relatively simple. Checking, savings, CDs, auto loans, personal loans, mortgages, investments, and retirement products are among the products available. The only obvious omission from the Ally line is the absence of a credit card.

Capital One began as a credit card company, but it has since expanded into a variety of other banking services. You can access auto finance, loan refinancing, and children's accounts in addition to savings and checking accounts.

Read Full Comparison: Ally vs Capital One: Compare Banking Options

Capital One began as a credit card company, but it has recently expanded its banking product line. Capital One offers checking and savings accounts, children's accounts, auto finance and refinancing, in addition to an impressive selection of credit cards.

Citi offers a diverse range of banking products, including checking and savings accounts, CDs, credit card options, mortgages, personal loans, wealth management plans, IRAs, and investment options.

Read Full Comparison: Citi vs Capital One: Which Bank is Best For You?

Bank of America has an impressive product lineup, as one would expect from a large banking institution. There are various checking and savings accounts, as well as numerous credit card options, auto loans, home loans, and investments. This makes switching from your current bank a breeze.

Capital One began as a credit company, but it has recently expanded its product line. You can now access checking and savings accounts, auto finance, refinancing, and children's accounts in addition to an impressive selection of credit cards.

Read Full Comparison: Bank of America vs Capital One: Which Bank Wins?

Picking the right bank account can be confusing, especially when looking at big banks like U.S. Bank and Capital One. Here's our winner: U.S. Bank vs. Capital One

Capital One is our winner as it offers a full banking package. But if you have specific checking requirements, M&T Bank may win. Here's why.

Capital One is our winner as it offers a full banking package, which is better than TD Bank, especially if you have deposit needs. Here's why.

Regions Bank has physical branches you can visit, while Capital One operates mainly online. Let's compare their banking products: Regions Bank vs. Capital One

While PNC Bank is a brick-and-mortar bank, Capital One's presence is mainly online. Let's compare them and see which is our winner: Capital One vs. PNC Bank

Capital One is our winner for most consumers than Barclays bank. But, there are important things to consider when comparing them: Barclays Bank vs. Capital One

Capital One is our winner with a full banking package, including a decent checking option, high savings rates, and great credit cards.