Capital One's Venture card has long been a reliable navigator, offering travel rewards and flexibility. However, the Venture X has emerged as a sleeker, more sophisticated contender, promising premium perks and an elevated experience.

In this guide, we'll unravel the distinct features of both, helping you navigate the twists and turns of rewards, fees, and benefits

General Comparison: Capital One Venture vs. Venture X

The Venture X card, positioned as a luxury travel companion, outshines the Venture card with superior rewards and premium travel perks.

Tailored for avid globetrotters, the Venture X is ideal for those who can make the most of statement credits and robust rewards. On the flip side, the Venture card holds its ground as a reliable mid-level travel option.

While it may offer fewer rewards, its allure lies in a more budget-friendly annual fee, making it a sensible choice for those seeking a balance between benefits and affordability in their travel card experience.

|

| |

|---|---|---|

Capital One Venture X | Capital One Venture | |

Annual Fee | $395 | $95 |

Rewards | 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases | 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel |

Welcome bonus | 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening | 75,000 miles once they spend $4,000 on purchases within 3 months from account opening |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 19.99% – 29.99% (Variable) | 19.99% – 29.99% (Variable) |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Credit Card Points Battle: Venture vs. Venture X

Despite the difference in annual fees, the cards have no significance when it comes to point rewards earnings. As long as you spend more on everyday purchases, the difference becomes smaller.

The significant advantage of the Venture X card is the high ratio on flights and hotels, while the Venture card offers the same rewards ratio on other categories.

|

| |

|---|---|---|

Spend Per Category | Capital One Venture X | Capital One Venture |

$15,000 – U.S Supermarkets | 30,000 miles | 30,000 miles |

$5,000 – Restaurants

| 10,000 miles | 10,000 miles |

$5,000 – Airline | 25,000 miles | 10,000 miles |

$5,000 – Hotels | 50,000 miles | 25,000 miles |

$4,000 – Gas | 8,000 miles | 8,000 miles |

Estimated Annual Value | 123,000 miles (About $1,230) | 83,000 miles ( $830) |

Which Benefits Of You'll Get On Both Cards?

There are some additional types of perks that you will see with both of these cards:

- Capital One Dining and Entertainment: Enjoy exclusive reservations at award-winning restaurants and access to culinary experiences, as well as exclusive pre-sales, tickets, and more for music, sports, and dining events.

- Capital One Lounges: Cardholders can escape airport crowds by accessing all-inclusive Lounges with unlimited complimentary access for themselves and two guests per visit.

- Hertz Gold Plus Rewards President's Circle® status: Venture X cardholders are eligible for complimentary Hertz President’s Circle status, allowing them to skip the rental counter, choose from a wide selection of cars, and receive guaranteed upgrades.

- Global Entry or TSA PreCheck® Credit: Receive up to a $100 credit for Global Entry or TSA PreCheck®.

- Partner Lounge Network: Enjoy unlimited access for yourself and two guests to over 1,300 lounges worldwide from Priority Pass™ and Plaza Premium Group.

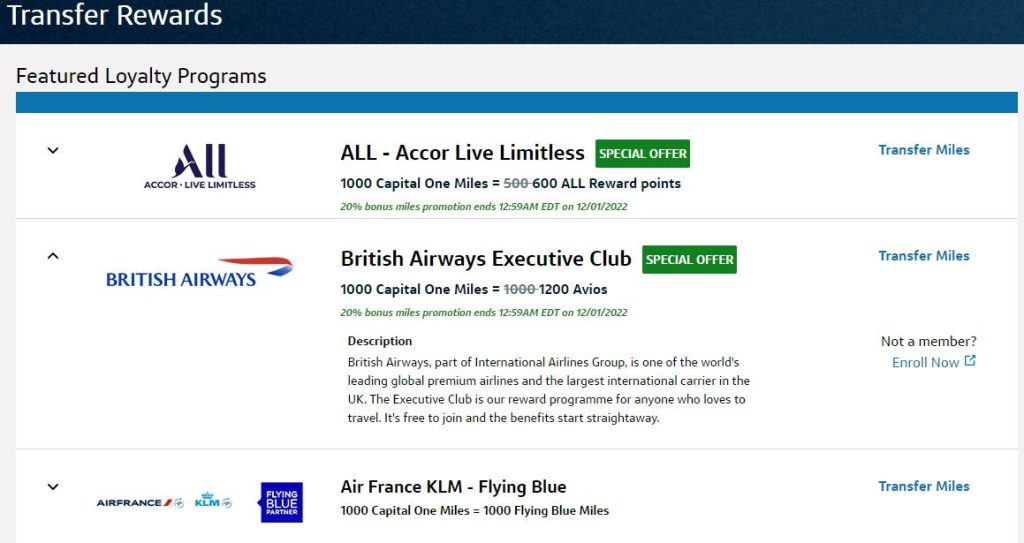

- Miles Redemption: Use your Capital One miles to cover various travel expenses, such as flights, hotels, rental cars, and transfer miles to a choice of 15+ travel loyalty programs.

- Auto Rental Collision Damage Waiver: Enjoy primary coverage against theft and collision damage for most rental cars globally, provided you opt out of the rental company's insurance. Reimbursement extends up to the actual cash value of the vehicle.

- Purchase Protection: Safeguard your new purchases from damage or theft with comprehensive coverage.

- Extended Warranty Protection: Extend the existing U.S. manufacturer's warranty by an additional year for eligible warranties lasting three years or less.

- Cell Phone Protection: Simply pay your cell phone bill using your Venture card and receive reimbursement of up to $800 in case of theft or damage (subject to specific terms and conditions).

- Travel Accident Insurance: Automatically receive insurance coverage for eligible losses when you use your credit card to purchase your travel fare.

- 24-Hour Travel Assistance Services: In the event of a lost or stolen credit card, access emergency services such as an immediate replacement card and cash advance.

Which Benefits Of You'll Get Only With The Venture X?

The Venture X offers some unique, premium benefits for cardholders that you won't be able to get with the Venture card:

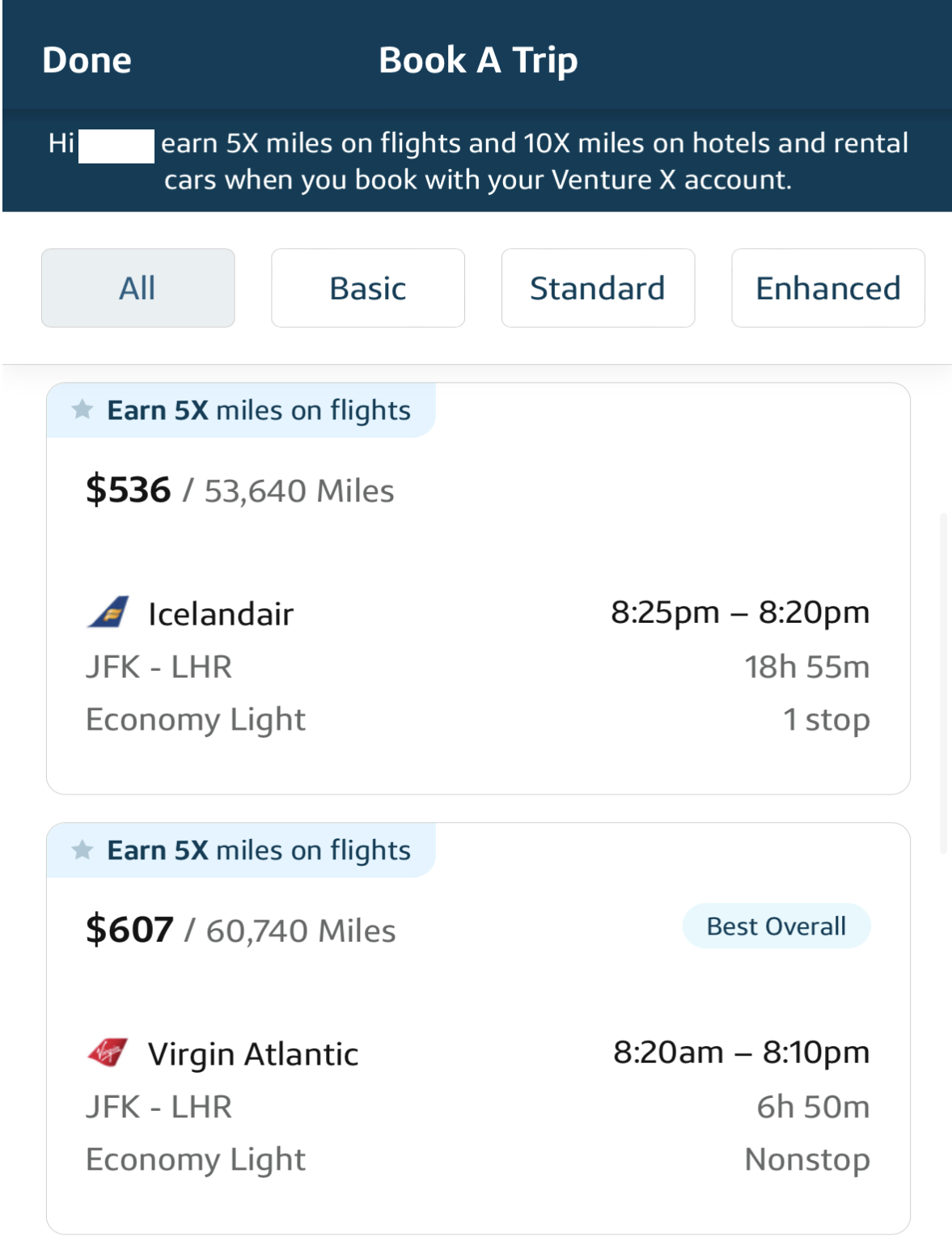

- Annual Travel Credit: Get a $300 annual credit for bookings through Capital One Travel, offering competitive prices on a wide range of travel options.

- Premier Collection: With the Capital One Venture X card, you can enjoy a $100 experience credit, daily breakfast for two, and premium benefits, along with earning 10X miles on hotel stays booked through Capital One Travel.

- Complimentary PRIOR Subscription: Cardholders receive a complimentary PRIOR Subscription worth $149, offering access to extraordinary travel experiences and destination guides.

- Free Additional Cardholders: Add cardholders to your account for free, allowing them to enjoy benefits while you earn rewards on their spending.

- 10,000 Miles Anniversary Bonus: Cardholders receive 10,000 bonus miles (equal to $100 towards travel) every year, starting on their first anniversary.

- Visa Infinite concierge: A Visa Infinite concierge will help make the reservation and more, like line up live stage shows, music or sporting event tickets.

- Referrals Bonus: Refer friends and family to apply for a Venture X card and earn up to 100,000 bonus miles when they're approved.

- Lifestyle Collection: Unlock premium benefits with every hotel stay, including a $50 experience credit, room upgrades when available, and earning 10X miles on hotel stays booked through Capital One Travel.

When You Might Want the Capital One Venture X?

If you're a frequent traveler with a taste for luxury, a desire for exclusive experiences, and an appreciation for ongoing rewards, the Venture X card stands out as the superior choice over the Venture card. Opt for the Venture X card over the Venture card if:

- Luxury Travel is Your Style: If you frequently indulge in premium travel experiences, the Venture X card's annual travel credit, Premier Collection perks, and other travel benefits make it the ideal companion.

- You're A Frequent Traveler: For avid travelers who frequently invest in flights and hotels, the Venture X card becomes the preferred choice, as its substantial mileage rewards easily offset the variance in annual fees.

- You Want An Authorized User: The inclusion of free additional cardholders makes the Venture X card a standout choice if you want to extend the premium benefits to your loved ones at no extra cost.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Capital One Venture?

Here are some situations where the Capital One Venture card may be a more suitable choice:

You Spend A Moderate Amount On Travel Each Year: If you find yourself spending a moderate amount on travel annually, the Capital One Venture card aligns perfectly with your lifestyle. Its competitive rewards system ensures that you earn valuable miles without the commitment of higher spending thresholds, making it an accessible and rewarding option for the average traveler.

Do Not Want To Pay A High Annual Fee: The Capital One Venture card caters to users who prioritize cost-effectiveness. With a reasonable annual fee, it provides a solid set of travel benefits without breaking the bank, making it an attractive option for those who want to maximize rewards without incurring high ongoing costs.

Compare The Alternatives

If you're looking for a travel rewards credit card– there are some excellent alternatives you may want to consider:

|

|

| |

|---|---|---|---|

Marriott Bonvoy Brilliant® American Express® Card

| Chase Sapphire Reserve® | Delta SkyMiles® Reserve American Express | |

Annual Fee | $650. See Rates & Fees | $550 | $650. See Rates & Fees |

Rewards | 2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 3X

3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases

|

Welcome bonus | 95,000 points

95,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 60,000 miles

Earn 60,000 bonus miles after you spend $5,000 in purchases on your new card in your first six months

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 20.99% – 29.99% Variable

| 22.49%–29.49% variable | 20.99%-29.99% Variable |

Compare Capital One Venture Card

If you're looking for travel rewards, it's an easy decision. But what about if you're looking to get rewards on everyday spending?

Capital One Venture vs Capital One Quicksilver: Which Card Wins?

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Venture card offers better travel perks and rewards ratio than the VentureOne, but lacks 0% intro APR. Here's our side-by-side comparison

The Capital One Venture is designed for avid travelers, while the Savor card caters to foodies and entertainment lovers. How do they compare?

The Capital One Venture offers a better points rewards ratio and travel benefits than the BofA Travel rewards. Is it worth the annual fee?

BofA Travel Rewards vs. Capital One Venture Card: How They Compare?

The Capital One Venture is a clear winner as it offers a better miles rewards ratio and extra travel benefits. But it charges an annual fee.

Discover it Miles vs. Capital One Venture Card: How They Compare?

The Capital One Venture is a clear winner as it offers higher annual cashback value and better travel perks than the Alaska Visa Signature

Alaska Visa Signature vs Capital One Venture: Side By Side Comparison

Compare Capital One Venture X Card

The Amex Platinum wins when it comes to redemption options and protections, but the Venture X is cheaper and offers great travel benefits.

Amex Platinum Card vs. Capital One Venture X: Which Card Is Best?

While Chase Sapphire Reserve offers better protections and redemption options, Venture X is cheaper and offers premium travel benefits.

Chase Sapphire Reserve vs. Capital One Venture X: Which Card Is Best?

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Which Card Is Best?

The Venture X offers better travel rewards than the Amex Gold but is less appealing if you're looking for everyday spending rewards.

Amex Gold Card vs. Capital One Venture X : How They Compare?

While having the similar annual fees, the Capital One Venture X offers more cashback for the same spend and better travel perks

U.S. Bank Altitude Reserve Visa Infinite vs. Capital One Venture X: How They Compare?